Mercado de Wipes ANÁLISE DE TAMANHO E PARTICIPAÇÃO - TENDÊNCIAS DE CRESCIMENTO E PREVISÕES (2024 - 2031)

Perucas de bebê Mercado é segmentado por Produto (Wipes Wet (Scented, Unscented), Wipes Secos (Cloth-based, Paper-based)), Por Material (Synthetic (Po....

Mercado de Wipes Tamanho

Tamanho do mercado em USD Bn

CAGR5.2%

| Período de estudo | 2024 - 2031 |

| Ano base da estimativa | 2023 |

| CAGR | 5.2% |

| Concentração de Mercado | High |

| Principais jogadores | Procter & Gamble Co., Kimberly-Clark Corporation, Johnson & Johnson, Unicharm Corporation, A Companhia Honesta e entre outros |

por favor, avise-nos!

Mercado de Wipes Análise

Estima-se que o mercado de toalhetes de bebê seja avaliado em USD 5.47 Billion em 2024 e é esperado alcançar USD 7.8 Billion por 2031, crescimento em uma taxa de crescimento anual composto (CAGR) de 5,2% de 2024 a 2031. Maior conscientização sobre a higiene do bebê, juntamente com o aumento das rendas descartáveis dos pais, é esperado para impulsionar a demanda por toalhetes durante o período de previsão.

Mercado de Wipes Tendências

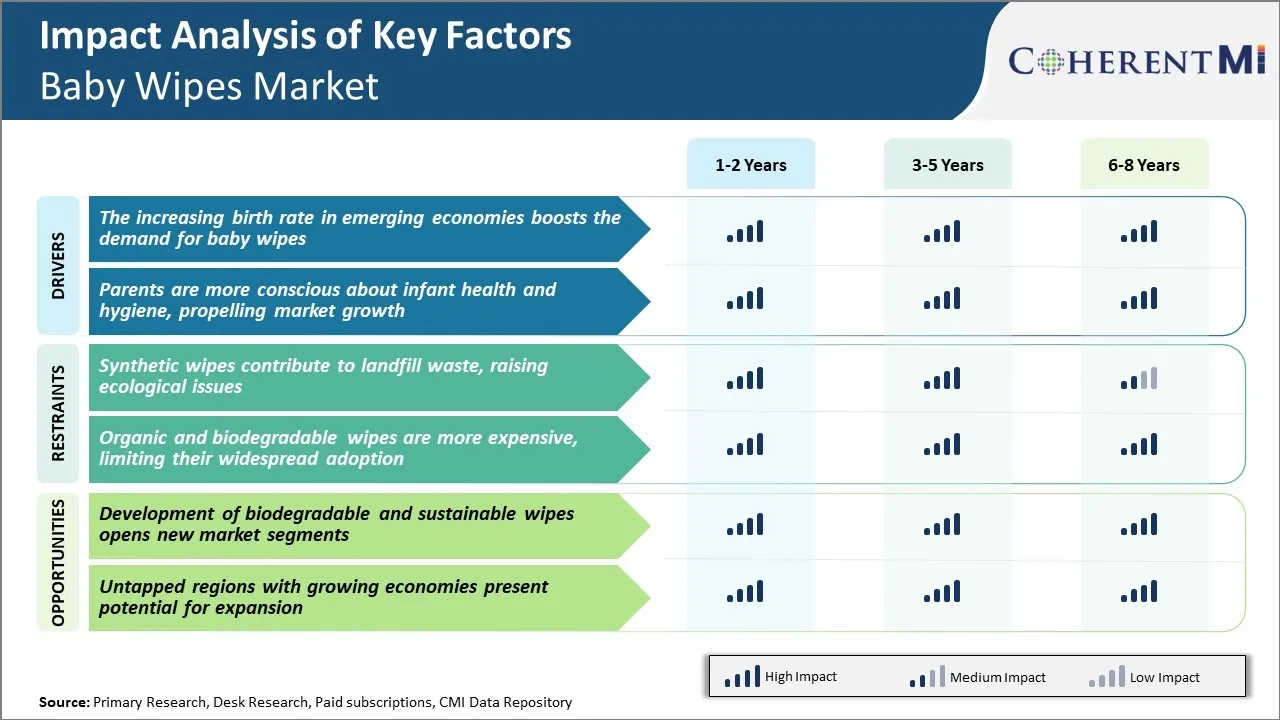

Driver de Mercado - A taxa de nascimento crescente em economias emergentes aumenta a demanda por Wipes bebê

O rápido crescimento da população infantil naturalmente gera maior consumo de produtos essenciais para o cuidado do bebê. E um item tão indispensável é toalhetes de bebê. Nestas regiões em desenvolvimento, onde o acesso a comodidades básicas como água corrente pode nem sempre ser confiável, os pais têm vindo a confiar no pacote conveniente de toalhetes para limpar e refrescar seus pequenos durante todo o dia. As máscaras são fáceis de transportar, podem ser usadas mesmo fora da casa e não exigem uma lavagem separada depois tornando-os muito práticos.

Além disso, como mais mulheres se juntam à força de trabalho em áreas urbanas, as famílias de renda dupla têm menos tempo para gastar em tarefas como dar banhos regulares para crianças. As máscaras reduziram significativamente o tempo gasto em rotinas de higiene do bebê. As mães trabalhadoras em particular procuram soluções que fazem cuidar das crianças sem complicações ainda eficazes.

Portanto, os fabricantes de toalhetes de bebê estão bem preparados para capturar a demanda de uma população jovem explosiva, bem como consumidores afluentes através de formulações superiores, desenhos bonitos e multi-pacotes. Em geral, a confluência de mudanças demográficas e econômicas em regiões em desenvolvimento significa imenso escopo para a expansão da indústria de limpadores de bebês em todo o mundo.

Driver de mercado - Os pais são mais conscientes sobre a saúde infantil e higiene, impulsionando o crescimento do mercado

Na era digital moderna, novos pais são constantemente alimentados informações sobre as melhores práticas de uma ampla variedade de fontes on-line e off-line. As mídias sociais, sites de parentalidade, revistas e pediatras enfatizam a importância da higiene e um ambiente limpo para o bem-estar geral do bebê.

Hoje Geração de mães e pais milenar extensivamente pesquisar produtos e ingredientes para garantir que apenas as opções mais seguras são usadas. Eles examinam rótulos verificando produtos químicos nocivos, alérgenos, certificações antes de comprar itens para bebês. Este alto foco na limpeza natural e orgânica traduz-se diretamente no aumento da demanda por características como toalhetes hipoalergênicos, livres de fragrâncias, feitos de materiais baseados em plantas em vez de sintéticos.

As marcas têm, portanto, renovadas ofertas catering para os pais conscientes da saúde. Perucas agora possuem texturas extra macias, extratos naturais como aloe vera, camomila para acalmar e hidratar o fundo do bebê após cada uso. Algumas variantes são enriquecidas com probióticos, vitaminas ou outros impulsionadores da imunidade. Tais inovações com formulações de promoção de bem-estar encontrar mais tomadores dispostos a pagar um prêmio por qualidade.

Os pais desejam fornecer a melhor rotina de higiene possível e cuidar do bem-estar do seu pequeno através de produtos certos. Em geral, a preocupação parental com o saneamento infantil e a segurança formam um sólido pilar impulsionando ganhos constantes para o segmento de limpeza do bebê.

Desafio de Mercado - Wipes sintéticas contribuem para resíduos de aterros, levantando questões ecológicas

Um dos principais desafios que enfrentam o mercado de limpas de bebê é o uso de materiais sintéticos que não são biodegradáveis. A maioria das toalhetes de bebê atualmente vendidos contêm plásticos como polietileno e polipropileno que não quebram em aterros durante longos períodos de tempo.

Como os limpa-vidros são destinados a ser produtos de uso único que são descartados após cada mudança de fralda, sua natureza não-biodegradável leva a uma enorme quantidade de resíduos plásticos que entram no fluxo de resíduos sólidos municipais todos os anos. As estatísticas mostram que mais de 100 bilhões de bebês são estimados para acabar em aterros anualmente em grandes mercados em todo o mundo.

Este acúmulo de lixo plástico em aterros sobrecarregados é exacerbar questões ecológicas como a poluição microplásica. Químicos abundantes de limpas sintéticas podem leach em fontes de água subterrâneas ao longo de muitas décadas. Há também crescentes preocupações públicas sobre a pegada de carbono de processos de produção que criam plásticos não renováveis para toalhetes.

As agências ambientais na Europa e América do Norte expressaram preocupações sobre a falta de degradabilidade dos ingredientes comuns de limpeza do bebê. Isso adiciona pressão regulatória e reputacional sobre as marcas que se concentram em cumprir metas de sustentabilidade. Em geral, o uso de plásticos à base de petróleo representa um desafio significativo para as perspectivas de crescimento a longo prazo da indústria de limpadores de bebês a partir de uma perspectiva ambiental.

Oportunidade de mercado – Desenvolvimento de Wipes Biodegradáveis e Sustentáveis Abre Novos segmentos de mercado

Uma grande oportunidade para os jogadores no mercado de limpas de bebê é a crescente demanda por formulações de produtos mais ecológicas. Com o aumento da conscientização sobre questões como poluição plástica e mudanças climáticas, os consumidores estão procurando alternativas sustentáveis em categorias de cuidados pessoais, como o cuidado do bebê.

O desenvolvimento de toalhetes biodegradáveis feitos a partir de fibras à base de plantas como bambu, algodão orgânico e polpa de madeira apresenta uma enorme oportunidade para capturar esta mudança de consumidor para opções verdes. Tais materiais naturais permitem que os limpadores degradem completamente dentro de alguns meses de eliminação, reduzindo a pegada ambiental.

A pesquisa de mercado mostra que o segmento de limpezas biodegradáveis é esperado para se tornar uma das categorias de crescimento mais rápido, expandindo-se em um CAGR de mais de 8% nos próximos 5 anos. Isso abre oportunidades para lançar novas linhas de produtos posicionadas em torno da sustentabilidade.

Empresas líderes estão inovando receitas únicas combinando biopolímeros com essências antibacterianas naturais aprovadas para a pele do bebê. Há a possibilidade de comandar um prêmio para ofertas éticas e construir a marca de corte para causas como a redução de plástico do oceano. No geral, os limpadores biodegradáveis permitem ganhar vantagem de primeiro volume no setor de cuidados pessoais naturais com foco em bem-estar em expansão.

Principais estratégias vencedoras adotadas pelos principais participantes de Mercado de Wipes

- Foco na inovação do produto: Os jogadores sempre inovaram e expandiram suas linhas de produtos para atender às necessidades de consumidores em evolução. Por exemplo, em 2018, a P&G lançou os limpadores Pampers Pure Protection que são mais grossos, mais suaves e mais fortes do que os limpadores regulares. Eles também introduziram aromas e ingredientes naturais. Huggies em 2019 introduziu toalhetes Natural Care feitos com ingredientes baseados em plantas.

- Premiumização de linhas de produtos: Os principais jogadores como Pampers e Huggies lançaram toalhetes de nível premium feitos com ingredientes naturais / orgânicos para atingir o segmento high-end. Por exemplo, Pampers Aqua Os limpadores puros são comercializados como limpadores de limpeza diária premium feitos com água de 99%. Tais produtos premium possuem margens mais altas.

- Expansão através de níveis de preços: Os líderes de mercado oferecem toalhetes a vários pontos de preço - de marcas de varejo de mercado de massa para os premium. Isso permite que eles toquem em todos os segmentos de consumo. Por exemplo, as marcas P&G's Pampers, Always e Bounty têm um amplo portfólio. Esta gama de produtos expansivos contribuiu com 50% de market share para P&G.

- Marketing de mídia digital e social: As empresas estão promovendo suas marcas extensivamente on-line através de anúncios direcionados, marketing de influenciadores e páginas de mídia social dedicadas focadas na comunidade do bebê/pai. Por exemplo, a página do Facebook da Pampers tem mais de 32 milhões de curtidas globalmente.

Análise Segmental de Mercado de Wipes

Insights, por produto: Preferências do consumidor condução Wet Wipes Dominance

Em termos de produto, os toalhetes molhados contribuem para a maior parte do mercado devido às fortes preferências dos consumidores. Toalhetes molhados oferecem absorção superior e hidratação em comparação com outras variantes. Sua textura húmida imita de perto a sensação de um pano molhado, tornando-os mais eficazes e mais suaves para a limpeza do bebê.

A presença de umidade também ajuda a remover facilmente a sujeira, a sujeira e a bagunça sem irritação. Além disso, os limpadores molhados permitem a limpeza de uma mão e on-the-go sem exigir uma fonte de água separada. Essas conveniências ressoam fortemente com pais e cuidadores pressionados pelo tempo.

Toalhetes molhados também oferecem uma variedade de aromas e toalhetes personalizados para diferentes áreas de cuidado do bebê como rosto, fundo e mãos. Isso satisfaz múltiplas necessidades familiares e aumenta a ocasião de uso de limpas. Com sua experiência de usuário superior e aplicações versáteis, os limpa-vidros surgiram como a solução mais favorecida para rotinas de higiene do bebê.

Insights, Por Material: Synthetics Emerging as Preferred Material

Em termos de material, a sintética contribui para a maior parte do mercado devido à sua rentabilidade e consistência na qualidade. Tecidos sintéticos como poliéster e polipropileno oferecem propriedades que são consideradas ideais para toalhetes. Eles são altamente absorventes e secagem rápida, garantindo assim o melhor desempenho de limpeza com cada limpeza. Sua textura não tecida atinge o equilíbrio certo de força e suavidade sem ser abrasiva na pele sensível dos bebês.

Além disso, materiais sintéticos demonstram excelente durabilidade e não desintegrar ou triturar facilmente. Isso mantém a integridade de toalhetes molhados através de vários usos e sessões de limpeza. Sendo derivado do petróleo, os sintéticos também se beneficiam de um azedo confiável e produção em massa. Seu baixo custo de fabricação permite que as marcas a preços de bebê limpa concorrencialmente sem comprometer a qualidade do material.

Coletivamente, esses atributos levaram à crescente popularidade de limpas sintéticas sobre alternativas naturais.

Insights, por canal de distribuição: E-Commerce Transformando Canais Online

Em termos de canal de distribuição, os canais online contribuem para a maior parte do mercado impulsionado pelo crescimento explosivo do comércio eletrônico. A revolução digital permitiu que as plataformas on-line simplificassem a experiência de compra para os pais pressionados pelo tempo.

Sites e aplicativos de varejo dedicados oferecem disponibilidade 24x7, amplas seleções de produtos, facilidade de comparação, serviços de entrega por porta e ofertas lucrativas. Isso adiciona uma enorme conveniência para produtos de bebê que devem ser adquiridos durante as rotinas de parentalidade ocupadas. E-commerce também aumentou a descoberta de produtos através de anúncios direcionados, blogs, comunidades e comentários de outros clientes. O comércio social em particular influencia muitos pais milenar em suas decisões de compra.

Além disso, os jogadores online são adeptos na análise de dados que ajudam a personalizar recomendações, ofertas e programas de fidelidade para cada usuário. Estes fatores aumentaram acentuadamente a preferência por compras on-line entre pais de nova idade que procuram experiências rápidas e personalizadas.

À medida que os gastos digitais continuam aumentando, os canais de distribuição de e-commerce continuarão aumentando o crescimento do mercado de limpadores de bebê.

Informação adicional de Mercado de Wipes

- A mudança para toalhetes orgânicos e naturais está ganhando impulso como os pais procuram produtos mais seguros livres de produtos químicos e irritantes.

- As marcas de etiquetas privadas estão expandindo sua quota de mercado devido à sua rentabilidade e ao aumento da qualidade, colocando a concorrência às marcas estabelecidas.

- As vendas on-line de toalhetes de bebê aumentaram 15% anualmente, atribuído à conveniência das plataformas de e-commerce.

- A região Ásia-Pacífico está testemunhando o crescimento mais rápido, com um CAGR de 6,5%, devido ao aumento de rendas descartáveis e crescimento populacional.

Visão geral competitiva de Mercado de Wipes

Os principais jogadores que operam no Baby Wipes Market incluem Procter & Gamble Co., Kimberly-Clark Corporation, Johnson & Johnson, Unicharm Corporation, The Honest Company, Pigeon Corporation, Hengan International Group Company Limited, Svenska Cellulosa Aktiebolaget SCA, Huggies (uma marca de Kimberly-Clark), e WaterWipes UC.

Mercado de Wipes Líderes

- Procter & Gamble Co.

- Kimberly-Clark Corporation

- Johnson & Johnson

- Unicharm Corporation

- A Companhia Honesta

Mercado de Wipes - Rivalidade Competitiva

Mercado de Wipes

(Dominado por grandes players)

(Altamente competitivo com muitos jogadores.)

Desenvolvimentos recentes em Mercado de Wipes

- Em abril de 2023, a The Honest Company lançou uma nova linha de toalhetes biodegradáveis à base de plantas. Estes limpadores fazem parte de sua linha de produtos "Clean Conscious" e são feitos com mais de 99% de água. Eles são hipoalergênicos, livres de produtos químicos duros como parabenos, e são projetados para ser eco-friendly por ser compostável sob certas condições. Os toalhetes foram criados para atender aos consumidores eco-conscientes, oferecendo uma alternativa sustentável aos toalhetes tradicionais, enquanto ainda sendo suave na pele sensível.

- Agosto 2023: Kimberly-Clark Corporation anunciou a aquisição de uma startup de materiais sustentáveis, com o objetivo de integrar fibras mais naturais em seus produtos de limpeza Huggies.

Mercado de Wipes Segmentação

- Por produto

- Perucas molhadas

- Scented

- Descida

- Perucas secas

- Baseado em pano

- Baseado em papel

- Perucas molhadas

- Por Material

- Sintético

- Poliéster

- Polipropileno

- Natural

- Algodão

- Bambu

- Pulso de madeira

- Sintético

- Canal de distribuição

- Online

- Sites de e-commerce

- Portais de propriedade da empresa

- offline

- Supermercados e hipermercados

- Lojas de conveniência

- Farmácias

- Lojas de especialidade

- Online

Gostaria de explorar a opção de comprasecções individuais deste relatório?

Perguntas Frequentes :

Quão grande é o mercado de limpeza do bebê?

Estima-se que o mercado de limpezas de bebês seja avaliado em US$ 5.47 bilhões em 2024 e deverá chegar a US$ 7.8 bilhões em 2031.

Quais são os principais fatores que dificultam o crescimento do Mercado de Wipes de Bebé?

Os toalhetes sintéticos contribuem para o desperdício de aterros, aumentando as questões ecológicas e os toalhetes orgânicos e biodegradáveis são mais caros, limitando sua adoção generalizada são o principal fator que dificulta o crescimento do Mercado de Wipes do bebê.

Quais são os principais fatores que impulsionam o crescimento do Baby Wipes Market?

A crescente taxa de natalidade nas economias emergentes aumenta a demanda por limpas de bebê e os pais estão mais conscientes sobre a saúde e higiene infantil, impulsionando o crescimento do mercado são o principal fator que impulsiona o mercado de Wipes de bebê.

Qual é o produto líder no mercado de Wipes de bebê?

O segmento líder do produto é Wet Wipes.

Quais são os principais jogadores que operam no Baby Wipes Market?

Procter & Gamble Co., Kimberly-Clark Corporation, Johnson & Johnson, Unicharm Corporation, The Honest Company, Pigeon Corporation, Hengan International Group Company Limited, Svenska Cellulosa Aktiebolaget SCA, Huggies (uma marca de Kimberly-Clark), WaterWipes UC são os principais jogadores.

Qual será o CAGR do Mercado de Perucas de Bebé?

O CAGR do mercado de Wipes de bebê é projetado para ser 5,2% de 2024-2031.