Circuit Monitoring Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Circuit Monitoring Market is segmented By Type (Branch Circuit Monitoring, Multi-Circuit Monitoring), By End User (Data Centers, Residential, Commerci....

Circuit Monitoring Market Size

Market Size in USD Mn

CAGR4.72%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.72% |

| Market Concentration | High |

| Major Players | Schneider Electric, ABB Ltd., Eaton Corporation, Siemens AG, General Electric Company and Among Others. |

please let us know !

Circuit Monitoring Market Analysis

The circuit monitoring market is estimated to be valued at USD 694.29 Mn in 2024 and is expected to reach USD 959.15 Mn by 2031, growing at a compound annual growth rate (CAGR) of 4.72% from 2024 to 2031. The circuit monitoring market is expected to witness significant growth with growing investments towards enhancement of existing power infrastructure and expansion of transmission & distribution networks.

Circuit Monitoring Market Trends

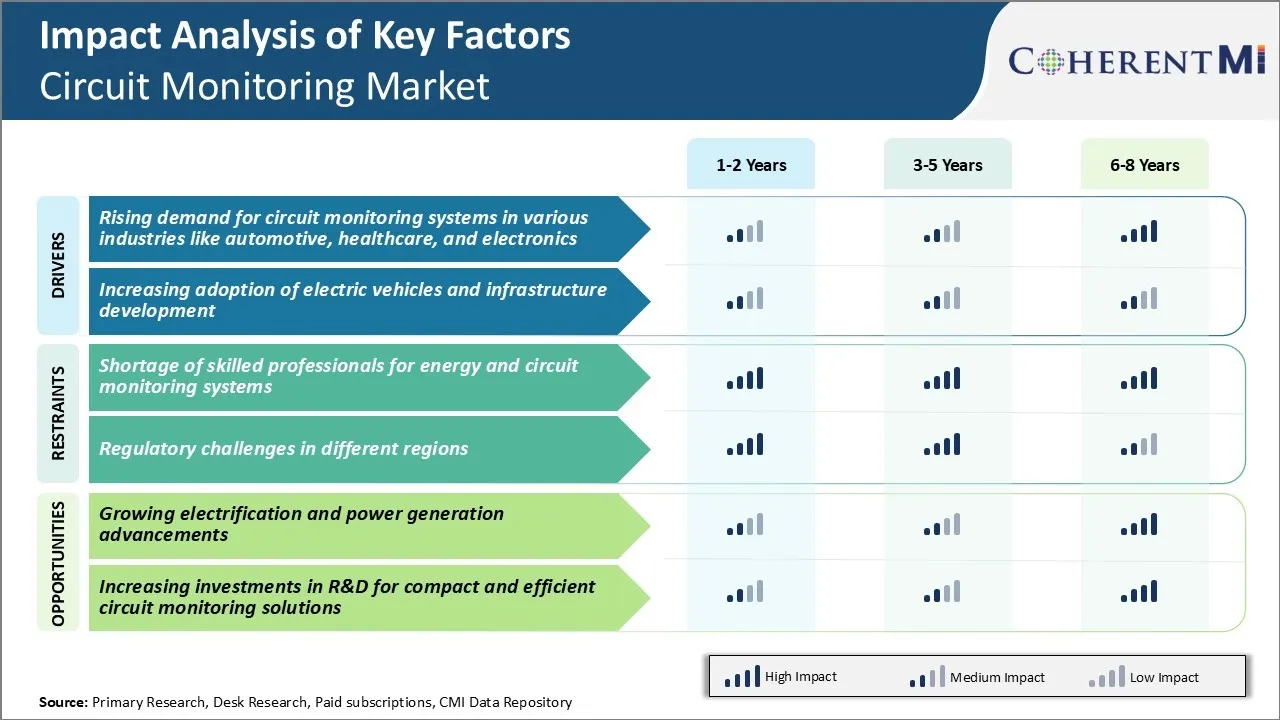

Market Driver - Rising Demand for Circuit Monitoring Systems in Various Industries

The circuit monitoring needs have been consistently rising across various industries in the past decade. With growing complexity and sensitivity of electronic circuits used in modern equipment, the requirement of continuous monitoring of these circuits has become imperative. Various industries like automotive, healthcare, and electronics rely heavily on intricate circuits for their products and any issues in these circuits can potentially disrupt operations or even cause safety hazards.

In automotive industry, vehicles now use dozens of electronic control units interconnected through various circuits to manage engine performance, transmission, safety, infotainment and more. Similarly, medical equipment also depend on sophisticated electronic circuits and even momentary glitches can compromise on patient care and safety.

Consumer electronics is another major area driving the circuit monitoring market. Advanced smartphones, laptops, home appliances have complex internal circuitry.

Overall, the demand for circuit monitoring systems is expected to steadily escalate across diverse industrial verticals worldwide.

Market Driver - Increasing Adoption of Electric Vehicles and Infrastructure Development

Rising environmental concerns and supportive government policies have triggered huge investments in electric vehicles across the globe in recent years. Establishing EV charging stations needs reliable low and high voltage circuit infrastructure to enable steady charging load.

Similar monitoring solutions are imperative at public charging points, commercial fleet terminals, residences and workplaces. This helps electricians easily locate hotspots, remotely diagnose faults and extend infrastructure life.

Continued upgrades of EV batteries and rise of charging hubs will also demand higher power circuits, switchgears with larger amp capacities. Hence circuit equipment of future will become extra sophisticated with growing complexity. This will open new opportunities in the circuit monitoring market.

Fossil fuels are progressively replaced with electricity across industries and transportation. So, robust circuit monitoring infrastructure will play a defining role in digital transformation of energy sector worldwide.

Market Challenge - Shortage of Skilled Professionals for Energy and Circuit Monitoring Systems

One of the main challenges being faced by the circuit monitoring market is the shortage of skilled professionals who can install, operate, and maintain these complex energy and circuit monitoring systems. Training and reskilling the existing workforce to gain proficiency in these new technologies is a lengthy and expensive process.

Moreover, attracting fresh talent with the requisite technical skills is also a daunting task for companies. This shortage of capable manpower means the circuit monitoring systems may not always be installed, configured and maintained properly, compromising their performance.

Further, with increasing focus on renewable energy resources that also need to be constantly monitored, the demand for skilled workers is surging rapidly while the supply remains limited. This mismatch between demand and supply of professional resources can negatively impact the growth targets for circuit monitoring market.

Market Opportunity - Growing Electrification and Power Generation Advancements

One of the key opportunities for circuit monitoring market expansion is the growing electrification and advancements in power generation technologies. With increasing urbanization and industrialization globally, the demand for electricity is continuously rising.

At the same time, the traditional electric power grids are also evolving into smart grids to facilitate better management of power supply and demand. These modernized grids heavily rely on real-time monitoring and protection provided by circuit monitoring systems.

Furthermore, the push for renewable energy adoption is also opening up avenues as renewable power assets like solar farms and wind farms have to constantly tracked through monitoring systems. Similarly, microgrids and offshore power stations also present opportunities.

Thus, as electrification grows and new power generation technologies emerge, worldwide deployments of advanced circuit monitoring systems will increase tremendously in the coming years. This presents a massive opportunity window for stakeholders in the circuit monitoring market to tap into this demand.

Key winning strategies adopted by key players of Circuit Monitoring Market

Focus on technological innovation: In 2020, Schneider Electric launched EcoStruxure Digital Monitoring System which uses cloud technology to monitor critical circuits and detect anomalies. This solution has helped the company expand its industrial automation portfolio.

Product portfolio expansion: Leading players have expanded their portfolio beyond traditional hardware to offer integrated software and services. For instance, in 2018, Eaton acquired Power Distribution Inc to enhance its power quality monitoring capabilities and offerings. This strategic acquisition enabled Eaton to provide end-to-end solutions.

Leveraging partnerships: In 2017, Littelfuse partnered with Phoenix Contact to integrate its circuit protection offerings with Phoenix's automation platforms. This partnership strengthened both companies' position in industrial sectors.

Focus on emerging sectors: In 2021, Siemens acquired Candura to expand its digital offerings for solar and wind applications. This move helped Siemens gain traction in the booming renewable industry.

Customized solutions: In 2019, Bender launched railSense, a dedicated solution for railway applications. This helped Bender gain major railway projects globally and dominate the niche railway circuit monitoring market.

Segmental Analysis of Circuit Monitoring Market

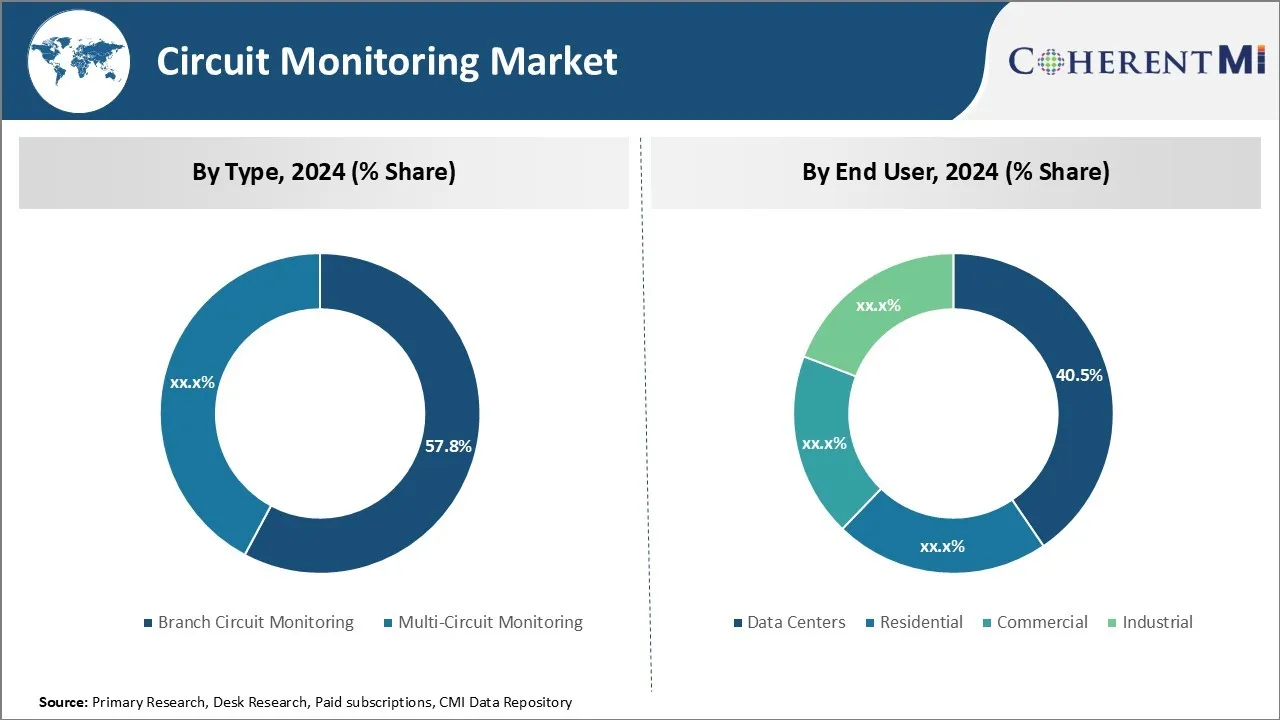

Insights, By Type: Branch Circuit Monitoring Contribute to Increased Need for Granular Power Monitoring

Branch circuit monitoring contributes to 57.8% share of the circuit monitoring market in 2024. circuit monitors provide visibility into individual circuits, rows, and racks rather than just aggregate power draws. This level of granularity allows issues to be pinpointed and waste to be eliminated.

As IT and building management systems grow more sophisticated and integrated, the need for detailed circuit-level insights has risen accordingly. Automatic load shedding and redundant power sources require up-to-the-second status updates on power distribution at a granular level. Addressing power capacity challenges and minimizing downtime pressures operators to carefully monitor capacity at the circuit level and redistribute loads proactively. Sensors that monitor each branch circuit in real time support these capabilities.

Sustainability initiatives have also boosted demand for branch circuit insights. Operators under pressure to shrink carbon footprints turn to circuit data to find inefficient hardware, optimize cooling needs, and implement targeted energy savings measures. Some adopters integrate circuit data with automation platforms to enact automated control based on monitored loads. This translates to long-term cost reductions through eco-friendly behavioral changes.

Insights, By End User: Data Centers Drive Highest Share in End User Segment

In 2024, data centers account for 40.5% share of the circuit monitoring market. The exponential growth of data and focus on scalable digital infrastructure have transformed the data center sector into a booming industry. As cloud adoption rises across enterprises and consumers, there is tremendous pressure on data center operators to support capacity increases while improving efficiency. This makes power monitoring a strategic necessity.

Data centers consume massive amounts of energy for server operations and cooling. Even marginal improvements in power usage effectiveness translate to huge savings given data centers' gargantuan energy footprints and 24/7 uptime requirements.

Circuit monitoring provides hyper-detailed analytics to pinpoint inefficiencies, enabling rightsizing of power systems and streamlining of facilities management tasks. This supports greenfield capacity expansion plans as well as upgrades of aging facilities. Ultimately, this is expected to support upcoming trends in the circuit monitoring market.

Additional Insights of Circuit Monitoring Market

- The integration of circuit monitoring systems in smart cities has led to improved energy distribution and reduced blackouts.

- Healthcare facilities are increasingly adopting circuit monitoring to ensure uninterrupted power supply for critical equipment.

- Regional Growth: The Asia-Pacific region is anticipated to witness the highest growth rate of 8.2% in the global circuit monitoring market, attributed to rapid industrialization and infrastructure development.

- Product Demand: Branch circuit monitoring holds a larger market share due to its detailed energy usage insights, aiding in cost reduction strategies.

Competitive overview of Circuit Monitoring Market

The major players operating in the circuit monitoring market include Schneider Electric, ABB Ltd., Eaton Corporation, Siemens AG, General Electric Company, Legrand S.A., Mitsubishi Electric Corporation, Littelfuse, Inc., Socomec Group, and Bender GmbH & Co. KG.

Circuit Monitoring Market Leaders

- Schneider Electric

- ABB Ltd.

- Eaton Corporation

- Siemens AG

- General Electric Company

Circuit Monitoring Market - Competitive Rivalry, 2024

Circuit Monitoring Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Circuit Monitoring Market

- In July 2024, WAGO introduced a new line of slim multi-channel electronic circuit breakers (ECBs) designed to enhance monitoring capabilities and optimize space efficiency. These ECBs are notably compact, with an 8-channel unit measuring just 32 mm in width, making them the slimmest available on the circuit monitoring market.

- In March 2024, Emporia launched Vue 3 Energy Monitor with upgrades for home energy management, allowing better control of electricity usage.

- In February 2024, Aureon introduced a channel partner program aimed at independent telephone companies (ITCs) to enhance network solutions through strategic collaboration. The program's inaugural partnership with Butler-Bremer Communications led to the development of a customized international cloud WAN and meshed WAN solution.

Circuit Monitoring Market Segmentation

- By Type

- Branch Circuit Monitoring

- Multi-Circuit Monitoring

- By End User

- Data Centers

- Residential

- Commercial

- Industrial

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the circuit monitoring market?

The circuit monitoring market is estimated to be valued at USD 694.29 Mn in 2024 and is expected to reach USD 959.15 Mn by 2031.

What are the key factors hampering the growth of the circuit monitoring market?

Shortage of skilled professionals for energy and circuit monitoring systems and regulatory challenges in different regions are the major factors hampering the growth of the circuit monitoring market.

What are the major factors driving the circuit monitoring market growth?

Rising demand for circuit monitoring systems in various industries and increasing adoption of electric vehicles and infrastructure development are the major factors driving the Circuit monitoring market.

Which is the leading type in the circuit monitoring market?

The leading type segment is branch circuit monitoring.

Which are the major players operating in the circuit monitoring market?

Schneider Electric, ABB Ltd., Eaton Corporation, Siemens AG, General Electric Company, Legrand S.A., Mitsubishi Electric Corporation, Littelfuse, Inc., Socomec Group, and Bender GmbH & Co. KG are the major players.

What will be the CAGR of the circuit monitoring market?

The CAGR of the circuit monitoring market is projected to be 4.72% from 2024-2031.