Flywheel Energy Storage Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Flywheel Energy Storage Market is segmented By Utility (Residential Utility, Commercial Utility, Industrial Utility), By Transportation (Personal Tran....

Flywheel Energy Storage Market Size

Market Size in USD Bn

CAGR2.84%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 2.84% |

| Market Concentration | High |

| Major Players | Langley Holdings plc, Amber Kinetics, Inc, VYCON, PUNCH Flybrid, OXTO Energy and Among Others. |

please let us know !

Flywheel Energy Storage Market Analysis

The flywheel energy storage market is estimated to be valued at USD 1.43 Billion in 2024 and is expected to reach USD 1.74 Billion by 2031, growing at a compound annual growth rate (CAGR) of 2.84% from 2024 to 2031. The flywheel energy storage market is set to witness substantial growth owing to increasing demand for grid-level energy storage.

Flywheel Energy Storage Market Trends

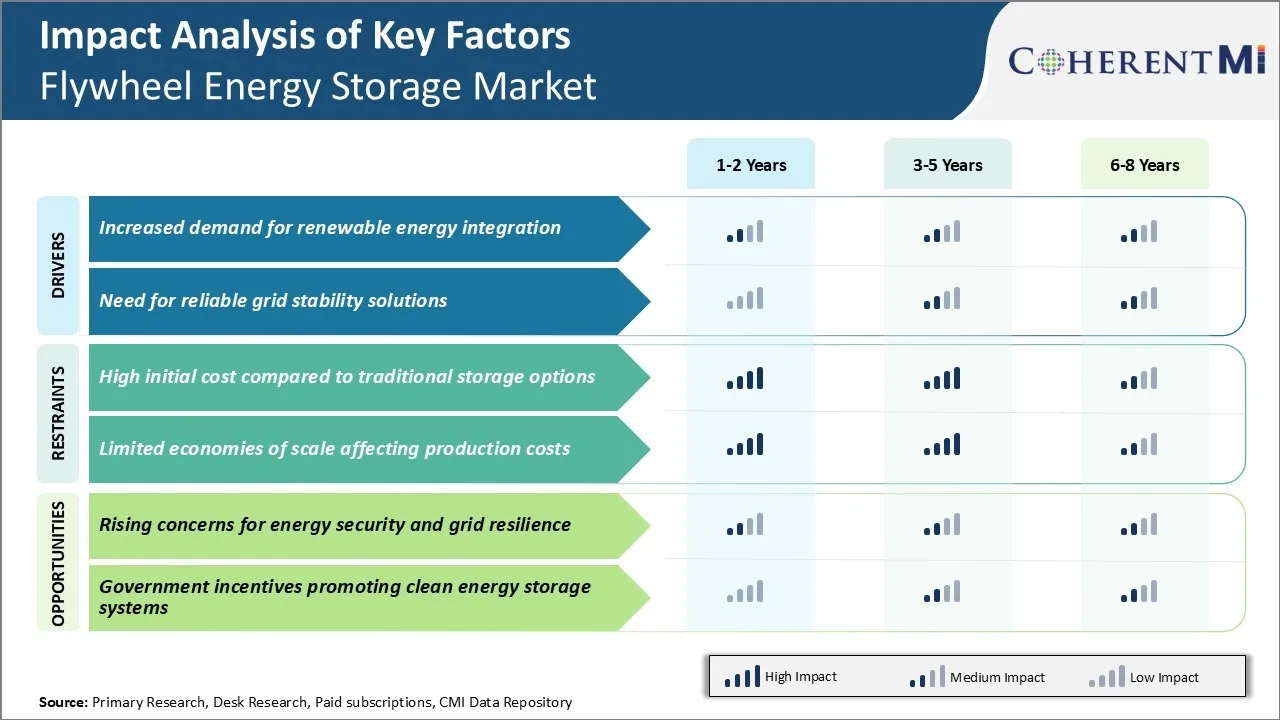

Market Driver - Increased Demand for Renewable Energy Integration

One of the key drivers for the growing flywheel energy storage market is the increased demand for integrating more renewable energy sources into the existing electric grid. Many countries have set ambitious targets to increase the share of energy generated from renewable sources in their overall energy mix in the coming decades. However, the intermittent and variable nature of these renewable sources poses major integration challenges for grid operators and utilities.

Solar power is only available during daylight hours and wind power fluctuates unexpectedly depending on weather conditions and wind speed. Flywheel energy storage systems can help address this problem by absorbing excess energy produced and discharging it to the grid when renewable energy production drops.

Additionally, flywheel energy storage provides other benefits like frequency regulation that help improve the stability, reliability and resilience of the power grid while integrating more renewable energy capacity. Going forward, the demand for cost-effective energy storage technologies is expected to grow significantly. This will boost growth of the flywheel energy storage market in the coming years.

Market Driver - Need for Reliable Grid Stability Solutions

Another important driver fueling the flywheel energy storage market is the pressing need across many countries and regions to strengthen grid stability and ensure reliable power supply. Ageing conventional power infrastructure, changing electricity usage patterns amid industrialization, and increasing penetration of intermittent renewable sources are posing major challenges to maintaining grid frequency and voltage levels. This increases the risk of blackouts and power quality issues that can severely impact businesses and livelihoods.

Flywheel energy storage systems have emerged as one of the most suitable technologies to address modern grid stability needs. They can autonomously and instantaneously inject or absorb energy from the grid within milliseconds to regulate frequency and help mitigate disturbances.

Many developing countries facing growing electricity demand are now increasingly turning to flywheel energy storage system for augmenting power system flexibility. This growing need for robust grid reliability solutions worldwide is expected to further boost global flywheel energy storage market in the coming years.

Market Challenge - High Initial Costs Compared to Traditional Storage Options

One of the main challenges currently faced by the flywheel energy storage market is the high initial capital costs associated with deploying flywheel energy storage systems. Estimates indicate the upfront capital expenditure for installing flywheel-based storage is around $1000-1500 per kWh of storage capacity, compared to $500-800 per kWh for lithium-ion batteries.

This high initial price point has limited widespread commercial and grid-scale adoption of the technology to date. System integrators and flywheel manufacturers will need to drive down costs through technological advancements, economies of scale and standardization to make the technology more cost competitive for different storage applications.

Market Opportunity - Rising Concerns for Energy Security and Grid Resilience

One major opportunity for the flywheel energy storage market lies in the increasing attention being placed on energy security and grid reliability issues by utilities and governments globally. As power grids integrate higher amounts of intermittent renewable energy like solar and wind power, there is a growing need for fast-acting energy storage technologies that can help balance short term fluctuations in supply and demand.

Additionally, the threats of cyber-attacks and extreme weather events on critical infrastructure have highlighted the requirement for storage solutions that can provide backup power during grid outages. Flywheels are ideally suited to address these needs due to their ability to discharge energy instantly at full power over very short time scales. This makes them valuable for frequency regulation services and temporary backup applications.

With policies and initiatives being developed around improving grid resilience, the demand is expected to rise substantially for technologies like flywheel energy storage systems.

Key winning strategies adopted by key players of Flywheel Energy Storage Market

One of the major strategies adopted by players like Amber Kinetics, Beacon Power, and Active Power has been developing modular and scalable flywheel energy storage systems. Companies like Amber Kinetics revolutionized the industry by developing modular units in 2017 that could easily be swapped in and out of operation.

Another winning strategy has been developing flywheel solutions tailored for specific applications like renewables firming. Renewables integration has been a major driver of the flywheel market and Beacon Power capitalized on this with their patented synthetic inertia product launched in 2013.

Developing utility scale pilot programs has also proven effective for gaining customer acceptance. For example, in 2015 Active Power partnered with AMSC to deploy a 2MW flywheel system at Bonneville Power Administration in the US as a pilot.

Segmental Analysis of Flywheel Energy Storage Market

Insights, By Utility: Residential Demand Spurs Growth in the Residential Utility Segment

The residential utility segment currently contributes 42.4% share of the overall flywheel energy storage market in 2024. This is primarily due to growing demand for reliable and inexpensive home battery solutions.

As power outages have become more frequent in recent years due to aging infrastructure and extreme weather events, homeowners are increasingly seeking ways to ensure uninterrupted access to electricity even during disruptions. Another major driver of growth in the residential segment is the push for more sustainable homes. With the rising popularity of solar panels, more homeowners are installing battery storage like flywheel energy storage systems.

All in all, the compelling value proposition of enhanced reliability and sustainability makes the residential utility segment dominant in the flywheel energy storage market.

Insights, By Transportation: Personal Transportation Drives Adoption in Transportation Segment

Personal transportation segment accounts for 54.6% share of flywheel energy storage market in 2024. Among transportation sub-segments, personal vehicles account for the highest share owing to various advantageous attributes of flywheels.

Flywheels are well-suited to meet the energy storage needs of personal electric vehicles including cars, motorcycles and light trucks. The ability to rapidly charge and discharge flywheel batteries enables much faster recharging times compared to lithium-ion alternatives. This addresses a key limitation of EV adoption and enhances electric drive range between charges.

Additionally, flywheels retain a high percentage of usable energy capacity even after thousands of charge cycles over the life of a vehicle. This positions the personal transportation sub-segment as the pivotal growth driver within the overall transportation flywheel energy storage market.

Additional Insights of Flywheel Energy Storage Market

- Europe: Leading with an 84% share in flywheel energy storage market in 2023, driven by public-private partnerships, government incentives, and a skilled workforce aiding in innovation.

- The EU targets a 42.5% renewable energy mix by 2030, pushing for 200 GW of storage by 2030 to support renewable integration.

- In Germany, battery storage installations reached 5.3 GW in May 2023, meeting approximately 8% of national demand.

- Asia-Pacific: Fastest-growing region in the flywheel energy storage market due to grid modernization and integration of renewables, with strong policy support, especially in South Korea.

Competitive overview of Flywheel Energy Storage Market

The major players operating in the flywheel energy storage market include Langley Holdings plc, Amber Kinetics, Inc, VYCON, PUNCH Flybrid, OXTO Energy, POWERTHRU (fka Pentadyne Power Corporation), STORNETIC GmbH, Adaptive Balancing Power GmbH, and Energiestro.

Flywheel Energy Storage Market Leaders

- Langley Holdings plc

- Amber Kinetics, Inc

- VYCON

- PUNCH Flybrid

- OXTO Energy

Flywheel Energy Storage Market - Competitive Rivalry, 2024

Flywheel Energy Storage Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Flywheel Energy Storage Market

- In July 2023, the Punjab State Power Corporation Limited (PSPCL) entered into a Power Purchase Agreement (PPA) with KAMMA Gear Flywheel Green Power Generation, a Hyderabad-based company. This collaboration aims to generate uninterrupted green electricity for Punjab using an innovative pulse-based flywheel mechanism.

- In June 2023, Key Energy installed an 8 kW/32 kWh flywheel energy storage system at a residence in Sawyers Valley, east of Perth, Western Australia. This installation involved a single flywheel capable of approximately 11,000 cycles without capacity degradation and a lifespan of 20 to 30 years.

Flywheel Energy Storage Market Segmentation

- By Utility

- Residential Utility

- Commercial Utility

- Industrial Utility

- By Transportation

- Personal Transportation

- Public Transportation

- Freight and Commercial Transportation

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the flywheel energy storage market?

The flywheel energy storage market is estimated to be valued at USD 1.43 Billion in 2024 and is expected to reach USD 1.74 Billion by 2031.

What are the key factors hampering the growth of the flywheel energy storage market?

High initial cost compared to traditional storage options and limited economies of scale affecting production costs are the major factors hampering the growth of the flywheel energy storage market.

What are the major factors driving the flywheel energy storage market growth?

Increased demand for renewable energy integration and need for reliable grid stability solutions are the major factors driving the flywheel energy storage market.

Which is the leading utility in the flywheel energy storage market?

The leading utility segment is residential utility.

Which are the major players operating in the flywheel energy storage market?

Langley Holdings plc, Amber Kinetics, Inc, VYCON, PUNCH Flybrid, OXTO Energy, POWERTHRU (fka Pentadyne Power Corporation), STORNETIC GmbH, Adaptive Balancing Power GmbH, and Energiestro are the major players.

What will be the CAGR of the flywheel energy storage market?

The CAGR of the flywheel energy storage market is projected to be 2.84% from 2024-2031.