Рынок мотоциклов Adventure АНАЛИЗ РАЗМЕРОВ И ДОЛЕЙ - ТЕНДЕНЦИИ РОСТА И ПРОГНОЗЫ (2024 - 2031)

Мотоцикл Adventure Рынок сегментирован по мощности двигателя (500cc - 1000cc, ниже 500cc, выше 1000cc), по приложениям (туристические приключения, , с....

Рынок мотоциклов Adventure Размер

Размер рынка в долларах США Bn

CAGR5.7%

| Период исследования | 2024 - 2031 |

| Базовый год оценки | 2023 |

| CAGR | 5.7% |

| Концентрация рынка | High |

| Основные игроки | КТМ Спортмотоцикл Gmbh, BMW Group, Kawasaki Motors Corp., Бенелли К.Дж., YAMAHA Motor Pvt. Ltd. и среди других |

дайте нам знать!

Рынок мотоциклов Adventure Анализ

Рынок приключенческих мотоциклов оценивается как 15,3 долларов США Bn в 2024 году Ожидается, что он достигнет USD 22,55 Bn к 2031 году, растущие с совокупным годовым темпом роста (CAGR) 5,7% с 2024 по 2031 год. Рынок приключенческих мотоциклов в последние годы демонстрирует устойчивый рост, обусловленный растущей популярностью приключенческих видов спорта.

Рынок мотоциклов Adventure Тенденции

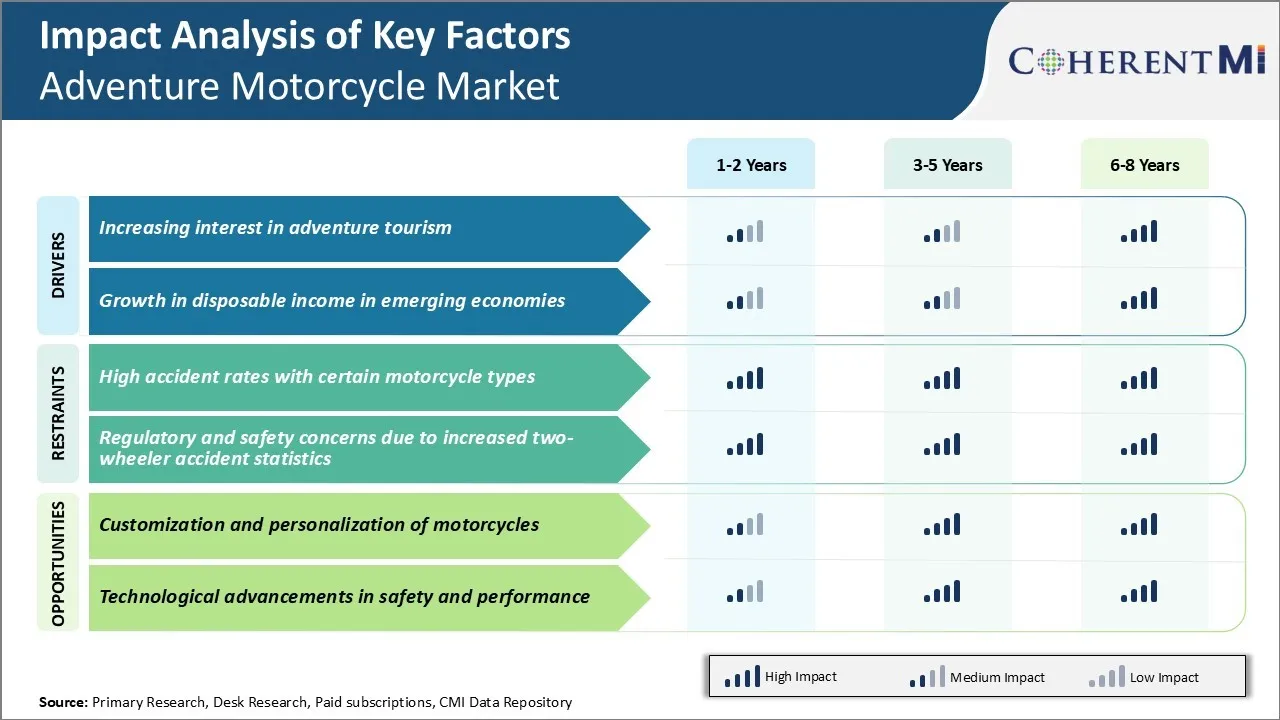

Рыночный драйвер: растущий интерес к приключенческому туризму

Поскольку люди становятся более опытными в путешествиях и предпочитают уникальные впечатления от путешествий по сравнению с обычными экскурсионными поездками, в последние годы наблюдается огромный всплеск приключенческого туризма. Приключенческий мотоцикл, в частности, стал одним из самых популярных подсегментов в индустрии приключенческих путешествий.

В настоящее время путешественники хотят исследовать непопулярные места, взаимодействовать с местными сообществами, проверять свои пределы и искать адреналин. Они ищут погружения в природу и культуры через такие мероприятия, как треккинг, скалолазание, рафтинг, езда на велосипеде и мотоциклетные тропы.

Езда на большом велосипеде по пересеченной местности, окруженной завораживающими пейзажами, обеспечивает идеальную эскападу, которую жаждут эти путешественники. Приключенческий велоспорт позволяет им ощутить различные ландшафты и почувствовать чувство достижения.

В большинстве направлений также есть специальные трассы для мотоциклов, курируемые местными сообществами, что еще больше повышает удобство. Исследователи отметили, что молодые путешественники-приключенцы более увлечены одиночными поездками на мотоцикле. Это дает им максимальную свободу и минимальную зависимость от групповых планов при изучении отдаленных районов. Ожидается, что это поддержит позитивные перспективы роста на рынке приключенческих мотоциклов в ближайшие годы.

Рыночный драйвер - растущая культура цифровых кочевников

Поскольку работа из любого места становится нормой, многие цифровые работники используют свои гибкие графики для длительных поездок на мотоциклах, охватывающих несколько стран. Социальные сети наводнены живописными изображениями и историями из своих путешествий, вдохновляя больше людей на то, чтобы удовлетворить свою страсть к путешествиям.

Несколько сообществ мотоциклетных туров появились в Интернете, чтобы поделиться маршрутами поездок, советами и обзорами, облегчая процесс планирования для новичков. Кроме того, знакомство с роскошным образом жизни знаменитостей и влиятельных людей также усилило стремление среди молодежи искать сложные виды деятельности, такие как приключенческий мотоцикл.

В то время как ранее приключенческий велосипед был преимущественно занятием для хардкорных энтузиастов мотоциклов, теперь он превращается в основной вариант путешествия. Производители на рынке приключенческих мотоциклов соответственно расширяют свои продуктовые линейки, проектируя велосипеды с более длинным запасом топлива, улучшенной подвеской и эргономикой, ориентированной на волнистую местность и тяжелый багаж.

Поставщики аксессуаров для вторичного рынка также выигрывают от этого растущего спроса. В конечном счете, приманка свободы и уникальный опыт среди миллениалов является основным фактором, способствующим росту мирового рынка мотоциклов для приключений.

Вызов рынка - высокие показатели аварийности с определенными типами мотоциклов

Одной из основных проблем, с которыми сталкивается рынок приключенческих мотоциклов, является высокий уровень аварийности, связанный с определенными типами мотоциклов. Приключенческие мотоциклы, как правило, тяжелее и имеют более мощные двигатели по сравнению с обычными спортивными велосипедами или крейсерами. Это позволяет им преодолевать более сложные местности, но также делает их менее проворными и более трудными в обращении, особенно для неопытных гонщиков.

Данные показывают, что модели приключенческих мотоциклов имеют непропорционально большее количество аварий по сравнению с другими категориями. Многие травмы и смертельные случаи происходят из-за потери контроля при сильном торможении или маневрировании острыми углами на высоких скоростях на дорогах. Приключенческий стиль езды, который включает в себя езду по грунтовым тропам, также подвергает гонщиков риску заноса или потери равновесия.

Это негативно влияет на рост рынка приключенческих мотоциклов, поскольку безопасность по-прежнему является основным фактором принятия решений для клиентов. Производителям необходимо будет сосредоточиться на электронных средствах защиты и функциях безопасности, чтобы уменьшить количество несчастных случаев и обеспечить безопасность клиентов.

Рыночная возможность - персонализация и персонализация мотоциклов

Одной из важных возможностей для рынка приключенческих мотоциклов является растущий спрос на настройку и персонализацию. Мотоциклы все чаще рассматриваются не только как средство передвижения, но и как образ жизни и способ выражения индивидуальности. Всадники хотят оснастить свои велосипеды в соответствии с их точными требованиями и стилем езды. Это открывает возможности для производителей запасных частей послепродажного обслуживания и услуг по настройке.

Производители также могут предложить гибкие программы настройки, позволяющие клиентам выбирать цвета, дополнения и аксессуары в соответствии с их предпочтениями. Наличие широкого спектра подлинных аксессуаров и возможность создавать уникальные проекты, удовлетворяющие разнообразные вкусы, могут помочь привлечь больше клиентов.

С растущими располагаемыми доходами многие мотоциклисты готовы платить больше за эксклюзивные, индивидуальные проекты и персонализированные штрихи. Этот персонализированный опыт может стать важным отличием на высококонкурентном рынке.

Ключевые выигрышные стратегии, принятые ключевыми игроками Рынок мотоциклов Adventure

Стратегия BMW MotorradВелосипеды, такие как BMW R1200GS и R1200GSA, стали эталоном в сегменте приключенческих туров. Их инновационный дизайн с мощными боксерскими двигателями, комфортной эргономикой, передовой электроникой и прочным шасси помог BMW доминировать на рынке приключенческих мотоциклов.

Эта стратегия была чрезвычайно успешной - к 2018 году BMW занимала более 25% рынка в сегменте приключенческих мотоциклов. Велосипеды GS установили новый эталон для дальних туристических возможностей на дороге и бездорожье.

Стратегия КТМKTM определила возможность нарушить рынок приключенческих мотоциклов, сосредоточившись на легких высокопроизводительных мотоциклах по доступным ценам. В 2008 году они выпустили 690 Enduro R, который стал популярным среди внедорожников и любителей приключений.

Затем KTM расширила свой ассортимент с 790, 890 и 1290 приключенческими велосипедами, которые предлагали высокое соотношение мощности к весу при меньших затратах, чем конкуренты. Их агрессивная ценовая стратегия в сочетании с гоночной ДНК сделали велосипеды KTM очень привлекательными.

Это помогло KTM утвердиться в качестве ведущего бренда в сегменте приключений средней мощности. К 2018 году он занял более 15% мирового рынка. KTM нарушил рынок приключенческих мотоциклов, изменив ожидания в отношении возможностей, производительности и цен на приключенческие мотоциклы.

Сегментарный анализ Рынок мотоциклов Adventure

Insights, по мощности двигателя: 500cc - 1000cc Двигатель подчеркивает мощность и производительность

С точки зрения мощности двигателя, сегмент 500cc - 1000cc вносит 46,5% доли рынка приключенческих мотоциклов в 2024 году. Это связано с его оптимальным балансом мощности и производительности этих двигателей. Мотоциклы в этом диапазоне двигателей достаточно мощные, чтобы обрабатывать внедорожные трассы и грунтовые поверхности. В то же время они легкие и достаточно проворные для высокого уровня маневренности. Двигатели мощностью 500-1000 куб.см обеспечивают гонщиков, ищущих острых ощущений, более чем адекватным ускорением и максимальной скоростью, чтобы наслаждаться динамичным опытом езды на разнообразной местности.

Тем не менее, они не слишком большие и тяжелые, как более 1000 кубических велосипедов, сохраняя спортивный характер, ценимый любителями приключений. Кроме того, техническое обслуживание и топливная экономичность, как правило, лучше, чем велосипеды меньшего объема, что добавляет привлекательности этой категории.

Insights, по применению: Универсальная функциональность мотоциклов Adventure поддерживает сегмент Touring Adventure

С точки зрения применения, сегмент туристических приключений вносит наибольшую долю благодаря универсальности удовлетворения различных потребностей в езде с одного мотоцикла. Эти велосипеды предлагают улучшенные туристические удобства, такие как защита от ветра, подвеска для дальних поездок и багажная вместимость, необходимая для длительных поездок по шоссе и асфальтированным дорогам.

Тем не менее, они также имеют высокий дорожный просвет и агрессивные рисунки протектора, необходимые для навигации по грунтовым тропам и легким внедорожным условиям. Приспособляемость к переключению между круизами по тротуару и случайным изучением грязи от одного и того же автомобиля широко привлекает любителей приключений.

Insights, by Distribution Channel: Hands-on Experience привлекает клиентов к оффлайн-каналам продаж

С точки зрения канала распространения, офлайн-продажи обеспечивают наибольшую долю, поскольку гонщики предпочитают практический опыт при оценке приключенческих мотоциклов. Возможность осматривать, сидеть и тестировать различные модели позволяет интуитивно понять эргономику каждого велосипеда, подачу мощности и динамическую обработку. Тактильный опыт тестовой езды неоценим для соответствия спецификаций физическим размерам и стилю езды.

Он также помогает сравнивать нюансы различий между аналогичными машинами перемещения. Кроме того, социальное взаимодействие с опытным персоналом по продажам и возможность вести переговоры напрямую с дилерами делают офлайн-маршрут привлекательным. В то время как онлайн-исследования проводятся, окончательная продажа закрывается только после подлинного ощущения различных вариантов, доступных на местном уровне.

Дополнительные идеи Рынок мотоциклов Adventure

- Азиатско-Тихоокеанский регион Доминирование: на Азиатско-Тихоокеанский регион приходится около 35,7% рынка приключенческих мотоциклов, что обусловлено большим населением и увеличением располагаемых доходов.

- Онлайн-каналы продаж выросли на 8,3%, что отражает изменение покупательского поведения потребителей.

- Сдвиг в сторону среднего размера Велосипеды: Растет предпочтение среднеразмерных приключенческих мотоциклов (500-800 куб. см) из-за их баланса мощности и маневренности.

- Спрос на кастомизацию: Всадники ищут персонализированные функции, побуждая производителей предлагать настраиваемые варианты.

Обзор конкурентов Рынок мотоциклов Adventure

Основными игроками, работающими на рынке приключенческих мотоциклов, являются KTM Sportmotorcycle Gmbh, BMW Group, Kawasaki Motors Corp., Benelli Q.J., YAMAHA Motor Pvt. Ltd, PIAGGIO & C SPA, Honda Motor Company, Triumph Motorcycles, Ducati Motor Holding S.p.A., Suzuki Motor Corporation, Royal Enfield (Eicher Motors Ltd.) и Harley-Davidson, Inc.

Рынок мотоциклов Adventure Лидеры

- КТМ Спортмотоцикл Gmbh

- BMW Group

- Kawasaki Motors Corp.

- Бенелли К.Дж.

- YAMAHA Motor Pvt. Ltd.

Рынок мотоциклов Adventure - Конкурентное соперничество

Рынок мотоциклов Adventure

(Доминируют крупные игроки)

(Высококонкурентный с большим количеством игроков.)

Последние разработки в Рынок мотоциклов Adventure

- В июле 2024 года QJ Motor представила SRT 550 X, приключенческий мотоцикл среднего размера, предназначенный для участия в сегменте приключенческих туров. SRT 550 X имеет прочную конструкцию с овальной формой фары, высоким ветровым стеклом, охраной костяшек и дополнительными колесами с поперечным спицем. Он оснащен 554-кубовым параллельным двухцилиндровым двигателем мощностью около 61 лошадиной силы, с отрегулированной 47-сильной версией, доступной для держателей лицензий A2 в Европе.

- В июле 2024 года Джава Йезди Мотоциклы представили обновленную версию Yezdi Adventure в Индии с новыми графическими и механическими улучшениями. Мотоцикл теперь поставляется в четырех новых цветовых вариантах: Ледник Белый DT, Magnite Maroon DT, Wolf Grey DT и Tornado Black.

- В октябре 2023 года Suzuki представила V-STROM 800, спортивный приключенческий турер, предназначенный для повышения комфорта и производительности на мощеных дорогах. Эта модель имеет 19-дюймовое переднее колесо, тормозные суппорты с радиальным креплением и бескамерные шины, все это способствует его дорожным возможностям.

- В сентябре 2023 года KTM представила 2024 890 Adventure R Rally, улучшенную версию своей линейки приключенческих мотоциклов. Эта модель оснащена передовыми компонентами подвески WP XPLOR PRO, включая вилки WP XPLOR PRO 7548 с технологией Cone Valve и моношок WP XPLOR PRO 6748, которые предлагают 270 мм проезда для улучшения внедорожных характеристик.

- В августе 2023 года Honda представила новый Africa Twin Adventure Sports ES, включающий передовую технологию подвески для повышения комфорта езды. Это может привлечь более широкую клиентскую базу в поисках комфорта и производительности.

Рынок мотоциклов Adventure Сегментация

- По мощности двигателя

- 500cc - 1000cc

- ниже 500 куб.см

- Выше 1000cc

- С помощью приложения

- Туристические приключения

- Спортивное приключение

- Двойное спортивное приключение

- Дистрибьюторский канал

- Оффлайн продажи

- Дилерские услуги

- Специализированные магазины

- Онлайн-продажи

Хотите изучить возможность покупкиотдельные разделы этого отчета?

Часто задаваемые вопросы :

Насколько велик рынок приключенческих мотоциклов?

Рынок приключенческих мотоциклов оценивается в 15,3 доллара США. Bn в 2024 году и, как ожидается, достигнет 22,55 млрд долларов США к 2031 году.

Каковы основные факторы, препятствующие росту рынка приключенческих мотоциклов?

Высокие показатели аварий с определенными типами мотоциклов, а также проблемы регулирования и безопасности из-за увеличения статистики несчастных случаев на двух колесах являются основными факторами, препятствующими росту рынка приключенческих мотоциклов.

Каковы основные факторы, влияющие на рост рынка приключенческих мотоциклов?

Увеличение интереса к приключенческому туризму и рост располагаемого дохода в развивающихся странах являются основными факторами, влияющими на рынок приключенческих мотоциклов.

Какой двигатель является лидером на рынке приключенческих мотоциклов?

Ведущий сегмент мощности двигателя - 500cc - 1000cc.

Какие основные игроки работают на рынке приключенческих мотоциклов?

КТМ Sportmotorcycle Gmbh, BMW Group, Kawasaki Motors Corp., Benelli Q.J., YAMAHA Motor Pvt. Ltd, PIAGGIO & C SPA, Honda Motor Company, Triumph Motorcycles, Ducati Motor Holding S.p.A., Suzuki Motor Corporation, Royal Enfield (Eicher Motors Ltd.) и Harley-Davidson, Inc. являются основными игроками.

Каким будет CAGR рынка приключенческих мотоциклов?

Прогнозируется, что CAGR рынка приключенческих мотоциклов составит 5,7% с 2024 по 31 год.