Газификация угля рынок АНАЛИЗ РАЗМЕРОВ И ДОЛЕЙ - ТЕНДЕНЦИИ РОСТА И ПРОГНОЗЫ (2024 - 2031)

Газификация угля Рынок сегментируется по газификаторам (фиксированная кровать, жидкая кровать, перевозимый поток), по применению (поколение электроэне....

Газификация угля рынок Размер

Размер рынка в долларах США Bn

CAGR11.4%

| Период исследования | 2024 - 2031 |

| Базовый год оценки | 2023 |

| CAGR | 11.4% |

| Концентрация рынка | Medium |

| Основные игроки | Synthesis Energy Systems Inc., Siemens AG, Sasol Ltd., Mitsubishi Heavy Industries Ltd., Air Products and Chemicals Inc. и среди других |

дайте нам знать!

Газификация угля рынок Анализ

Рынок газификации угля оценивается как USD 232,12 Bn в 2024 году Ожидается, что он достигнет 494,5 долларов США Bn к 2031 году, Растущий со сложным годовым темпом роста (CAGR) 11,4% с 2024 по 2031 год. Рынок газификации угля обусловлен строгими экологическими нормами в отношении выбросов от сжигания угля.

Газификация угля рынок Тенденции

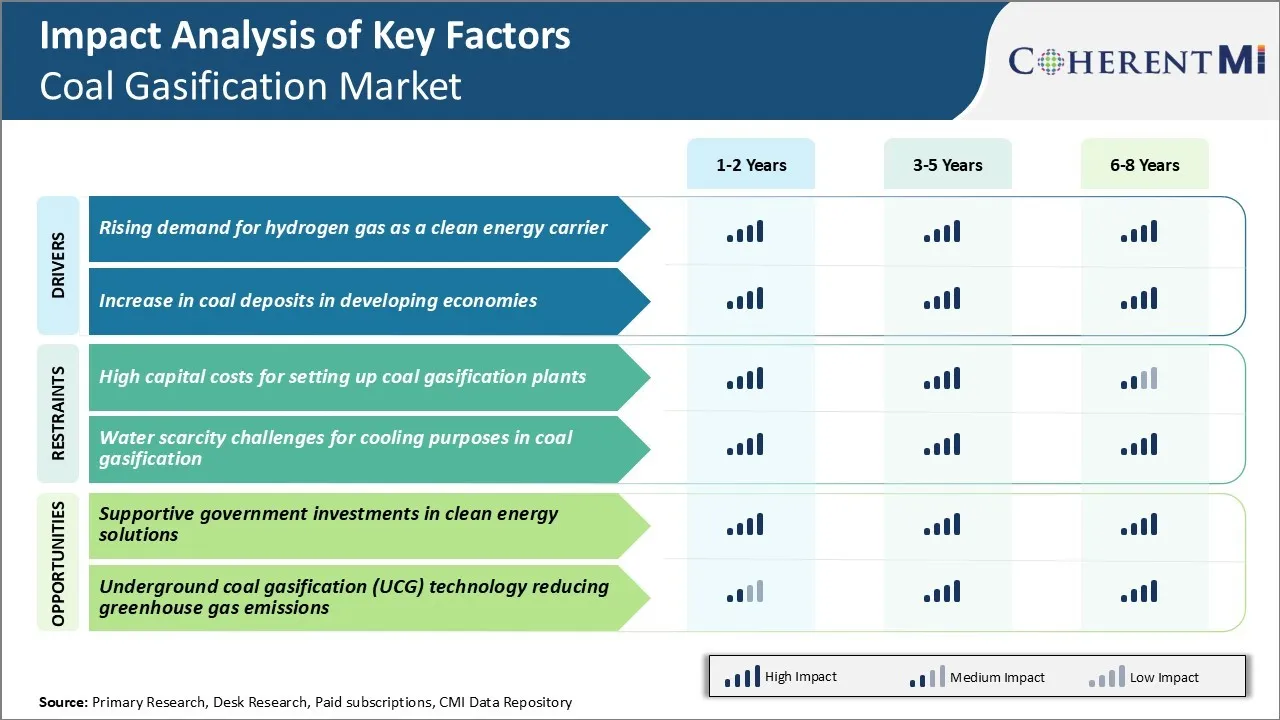

Рыночный драйвер - растущий спрос на водород как перевозчик чистой энергии

Поскольку проблемы изменения климата растут во всем мире, все больше внимания уделяется переходу на более чистые источники энергии. Водородный газ стал одним из самых перспективных энергоносителей будущего из-за его потенциала для декарбонизации отраслей и приложений, которые трудно электрифицировать.

Использование водорода в качестве топлива, по прогнозам, значительно вырастет в ближайшие десятилетия в различных приложениях, таких как смешивание его с природным газом, чтобы помочь уменьшить углеродный след. Заводы по газификации угля могут использовать существующую угольную инфраструктуру и наращивать поставки водорода для удовлетворения этого растущего спроса. Страны работают над развитием как частных, так и государственных водородных заправочных станций в ожидании взлета рынка FCEV в ближайшие годы.

В целом потенциал водородной экономики побуждает к оценке различных путей производства, включая газификацию угля. Чистые свойства и преимущества водорода для энергетической безопасности способствуют его появлению в качестве предпочтительного энергоносителя будущего для рынка газификации угля.

Рыночный драйвер - увеличение запасов угля в развивающихся странах

По оценкам, спрос на уголь может вырасти более чем на 25% в таких странах, как Индия, Индонезия и Вьетнам в течение следующих 20 лет. Газификация угля обеспечивает подход к использованию этих запасов для диверсифицированного применения при одновременном снижении интенсивности выбросов по сравнению с непосредственным сжиганием.

Заводы по газификации угля предлагают возможность производить не только электроэнергию, но и промышленные материалы, такие как водород, удобрения, жидкое топливо и химические вещества из того же угольного сырья. Это позволяет энергетическим активам быть многогранными и добавляет стратегическую ценность из имеющихся ресурсов.

Локализованное производство энергоносителей и сырья будет способствовать энергетической безопасности и устойчивости цепочки поставок для развивающихся стран. При наличии соответствующих политических механизмов газификация может помочь этим странам продвигаться по более экологически чистым путям развития, основанным на их природных ресурсах. Альтернативные результаты позволяют диверсифицироваться от более грязного сжигания угля, даже несмотря на то, что цели доступа к энергии выполняются для поддержки растущего населения и стимулирования индустриализации. Это продолжит поддерживать перспективы роста на рынке газификации угля.

Вызов рынка - высокие капитальные затраты на создание угольных газификационных заводов

Одной из основных проблем, с которыми сталкивается рынок газификации угля, являются высокие капитальные затраты, связанные с созданием установок газификации угля. Создание завода по газификации угля требует очень больших первоначальных инвестиций для установок и оборудования, таких как газификаторы, оборудование для обработки шлака, системы охлаждения и уплотнения и т. Д.

Оценки показывают, что установка газификации угля среднего размера мощностью 300 МВт потребует первоначальных капитальных вложений более 1 миллиарда долларов. Дальнейшее расширение или модернизация существующих заводов также требует значительных капитальных затрат. Подъем таких крупных объемов капитала из финансовых учреждений создает серьезные трудности для разработчиков проектов и операторов.

Высокие затраты влияют на осуществимость проекта и доходность. Это служит сдерживающим фактором для новых участников и планов расширения существующих игроков. В целом, высокие требования к капиталу для строительства инфраструктуры газификации угля остаются серьезной проблемой для более широкого внедрения технологий и роста рынка газификации угля.

Рыночная возможность: поддержка государственных инвестиций в экологически чистые энергетические решения

Одной из основных возможностей для рынка газификации угля является растущая поддержка инвестиций и политики правительств разных стран для более чистых энергетических решений. Благодаря строгим экологическим нормам и обязательствам по сокращению выбросов углерода многие правительства активно продвигают такие технологии, как газификация угля, которые обеспечивают более чистое использование угля.

Значительные государственные средства вливаются через субсидии, налоговые льготы и модели государственно-частного партнерства, чтобы сделать проекты газификации угля более жизнеспособными и вознаградить низкоуглеродные инвестиции. Это создает благоприятную политическую среду и снижает риски для частных разработчиков. Такая политика может повысить темпы внедрения и привлечь больше инвестиций в создание газификационных установок.

Это также может стимулировать исследования более эффективных систем газификации. Таким образом, поддержка со стороны правительств открывает широкие возможности для более широкой коммерциализации и будущих перспектив роста глобального рынка газификации угля.

Ключевые выигрышные стратегии, принятые ключевыми игроками Газификация угля рынок

Технология комбинированного цикла интегрированной газификации (IGCC) IGCC является одной из наиболее успешных стратегий, принятых крупными игроками рынка газификации угля. Такие компании, как General Electric и Shell, успешно реализовали проекты IGCC. Например, завод GE IGCC в Тампа-Бей, штат Флорида, введенный в эксплуатацию в 1996 году, по-прежнему работает с низким уровнем выбросов.

Улавливание, использование и хранение углерода (CCUS) В 2018 году NRG Energy ввела в эксплуатацию крупнейший в мире проект по улавливанию углерода после сжигания на своем заводе по газификации угля WA Parish в Техасе. Это помогло компании сократить выбросы CO2 на 90% и получить одобрение регулирующих органов.

Развитие новых технологий газификации Инновационные технологии газификации обещают более высокую выходную мощность и энергоэффективность. Например, передовая технология K-Gas от KBR использует кислород и пар вместо воздуха, что обеспечивает большую конверсию углерода. Аналогичным образом, процесс газификации с включенным потоком обеспечивает тепловую эффективность более 40%, достигая успеха на таких рынках, как Китай.

Сосредоточьтесь на альтернативных кормах Диверсификация в сырье, такое как биомасса и отходы пластика в дополнение к углю, оказывается полезной. Такие компании, как Air Liquide, получили преимущество за счет разработки газификационных установок, способных обрабатывать несколько видов сырья.

Сегментарный анализ Газификация угля рынок

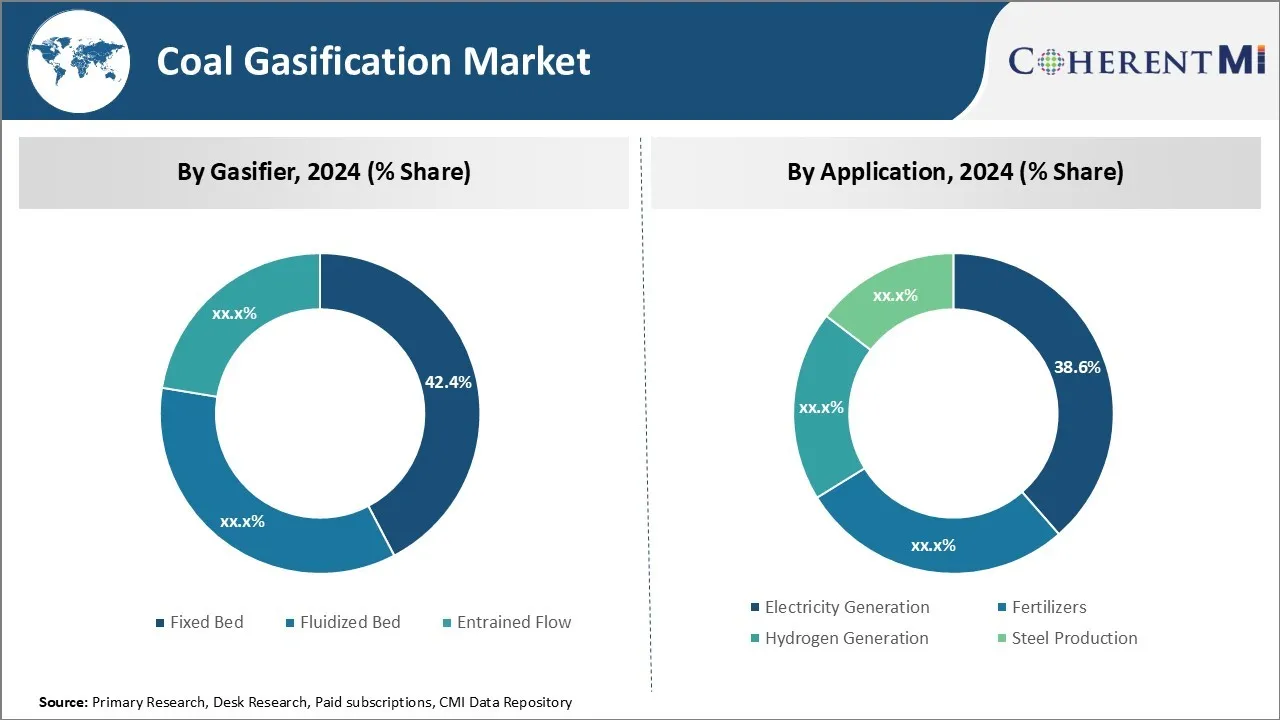

Insights, by Gasifier: благодаря их адаптивности, фиксированные кровяные газификаторы доминируют на рынке газификации угля

Газификаторы с фиксированной кроватью способствуют 42,4% доли рынка газификации угля в 2024 году, в связи с их высоким уровнем адаптивности. Эти газификаторы оснащены стационарной решеткой или кроватью, которая приостанавливает частицы угля, в то время как воздух или кислород продувается через дно. Эта простая конструкция позволяет стационарным газификаторам обрабатывать широкий спектр сырья для угля и биомассы с различными качествами. Их толерантность к изменениям исходного сырья делает стационарные газификаторы очень подходящими для небольших распределенных применений, которые могут полагаться на региональные источники топлива непоследовательного качества.

Еще одним преимуществом стационарных газификаторов является их прочная механическая конструкция. Без движущихся частей, кроме впускных и выпускных клапанов, стационарные газификаторы имеют более низкие требования к техническому обслуживанию, чем другие типы газификаторов. Эта надежность сделала технологию стационарных кроватей популярной для производства электроэнергии с базовой нагрузкой в меньших масштабах до нескольких мегаватт.

Гибкость стационарных газификаторов для модернизации существующей инфраструктуры еще больше расширяет их привлекательность и увеличивает долю рынка. В целом, технология стационарных кроватей остается предпочтительным типом газификатора для небольших, независимых применений благодаря своей экономичности, широкой адаптируемости топлива и надежной конструкции.

Инсайт: генерация электроэнергии занимает самую большую долю из-за растущего спроса на более чистую энергию

Сегмент производства электроэнергии в 2024 году занимает 38,6% рынка газификации угля. Поскольку опасения по поводу выбросов и изменения климата усиливаются, газификация предлагает способ более чистого и эффективного сжигания угля для производства электроэнергии. Интеграция газификации с электростанциями комбинированного цикла может обеспечить почти нулевые атмосферные выбросы за счет комбинированного использования технологии очистки синхронного газа, улавливания и хранения углерода. Некоторые проекты газификации также используют улавливаемый CO2 для повышения нефтеотдачи.

Растущий мировой спрос на электроэнергию, особенно со стороны развивающихся стран, также стимулирует рыночные возможности для газификации угля в производстве электроэнергии в коммунальном масштабе. Интегрированная технология комбинированного цикла газификации (IGCC) обеспечивает критическую стратегию перехода, поскольку регионы продолжают добавлять объемные мощности для поддержки экономического роста.

Крупные проекты, использующие газификацию для производства электроэнергии, в настоящее время активны или планируются по всему миру с многомиллиардными ценниками. Общие факторы, такие как соблюдение норм выбросов, повышение эффективности, растущие потребности в энергии и роль газификации в различных энергетических переходах, продолжают стимулировать доминирующее положение сегмента производства электроэнергии на рынке.

Дополнительные идеи Газификация угля рынок

- Рынок газификации угля набирает обороты благодаря сильным государственным инвестициям, особенно в Азиатско-Тихоокеанском регионе, где такие страны, как Китай и Индия, активно внедряют технологии газификации для снижения выбросов углерода и перехода на более чистые источники энергии.

- Способность технологии сокращать выбросы парниковых газов по сравнению с обычными методами сжигания угля делает ее ключевым решением в достижении глобальных климатических целей.

- Ключевые инновации, такие как подземная газификация угля (UCG), обеспечивают альтернативу традиционной добыче и могут сыграть важную роль в будущем рынка газификации угля.

Обзор конкурентов Газификация угля рынок

Основными игроками, работающими на рынке газификации угля, являются Synthesis Energy Systems Inc., Siemens AG, Sasol Ltd., Mitsubishi Heavy Industries Ltd., McDermott International Ltd., Larsen and Toubro Ltd., KBR Inc., Johnson Matthey Plc, CNCEC и Basin Electric Power Cooperative.

Газификация угля рынок Лидеры

- Synthesis Energy Systems Inc.

- Siemens AG

- Sasol Ltd.

- Mitsubishi Heavy Industries Ltd.

- Air Products and Chemicals Inc.

Газификация угля рынок - Конкурентное соперничество

Газификация угля рынок

(Доминируют крупные игроки)

(Высококонкурентный с большим количеством игроков.)

Последние разработки в Газификация угля рынок

- В июне 2024 года Министерство угля и восточных угольных месторождений (ECL) инициировало первый в Индии пилотный проект UCG на угольном блоке Каста в Джаркханде. Проект направлен на производство синтетического газа, который может быть использован для синтетического природного газа, химических веществ и других промышленных применений к 2030 году.

- В ноябре 2023 года Mitsubishi Heavy Industries (MHI) в сотрудничестве с индонезийским институтом Teknologi Bandung (ITB) расширили свои совместные исследования по производству электроэнергии на основе аммиака. Партнерство направлено на сокращение выбросов путем продвижения более чистых топливных технологий и сосредоточения внимания на совместном сжигании аммиака в газовых турбинах.

Газификация угля рынок Сегментация

- с помощью Gasifier

- Неподвижная кровать

- Жидкая кровать

- Вовлеченный поток

- С помощью приложения

- Генерация электроэнергии

- Удобрения

- Генерация водорода

- Производство стали

Хотите изучить возможность покупкиотдельные разделы этого отчета?

Часто задаваемые вопросы :

Насколько велик рынок газификации угля?

Рынок газификации угля оценивается в $232,12 Bn в 2024 году и, как ожидается, достигнет 494,5 млрд долларов к 2031 году.

Какие ключевые факторы препятствуют росту рынка газификации угля?

Высокие капитальные затраты на создание установок по газификации угля и проблемы нехватки воды для охлаждения в целях газификации угля являются основными факторами, препятствующими росту рынка газификации угля.

Каковы основные факторы роста рынка газификации угля?

Рост спроса на газообразный водород в качестве носителя чистой энергии и увеличение запасов угля в развивающихся странах являются основными факторами, влияющими на рынок газификации угля.

Кто является ведущим газификатором на рынке газификации угля?

Ведущим сегментом газификатора является фиксированная кровать.

Какие основные игроки работают на рынке газификации угля?

Synthesis Energy Systems Inc., Siemens AG, Sasol Ltd., Mitsubishi Heavy Industries Ltd., McDermott International Ltd., Larsen and Toubro Ltd., KBR Inc., Johnson Matthey Plc, CNCEC и Basin Electric Power Cooperative являются основными игроками.

Каким будет CAGR рынка газификации угля?

Прогнозируется, что CAGR рынка газификации угля составит 11,4% с 2024-2031 гг.