Wind Turbine Rotor Blade Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Wind Turbine Rotor Blade Market is segmented By Location of Deployment (Onshore, Offshore), By Blade Material (Carbon Fiber, Glass Fiber, Others), By ....

Wind Turbine Rotor Blade Market Size

Market Size in USD Bn

CAGR9.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.1% |

| Market Concentration | Medium |

| Major Players | TPI Composites Inc., Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd, Nordex SE, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Limited and Among Others. |

please let us know !

Wind Turbine Rotor Blade Market Analysis

The wind turbine rotor blade market is estimated to be valued at USD 23.44 Bn in 2024 and is expected to reach USD 43.18 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2031. The wind turbine rotor blade market is expected to witness prominent growth with the rising demand for renewable sources of energy due to growing environmental concerns.

Wind Turbine Rotor Blade Market Trends

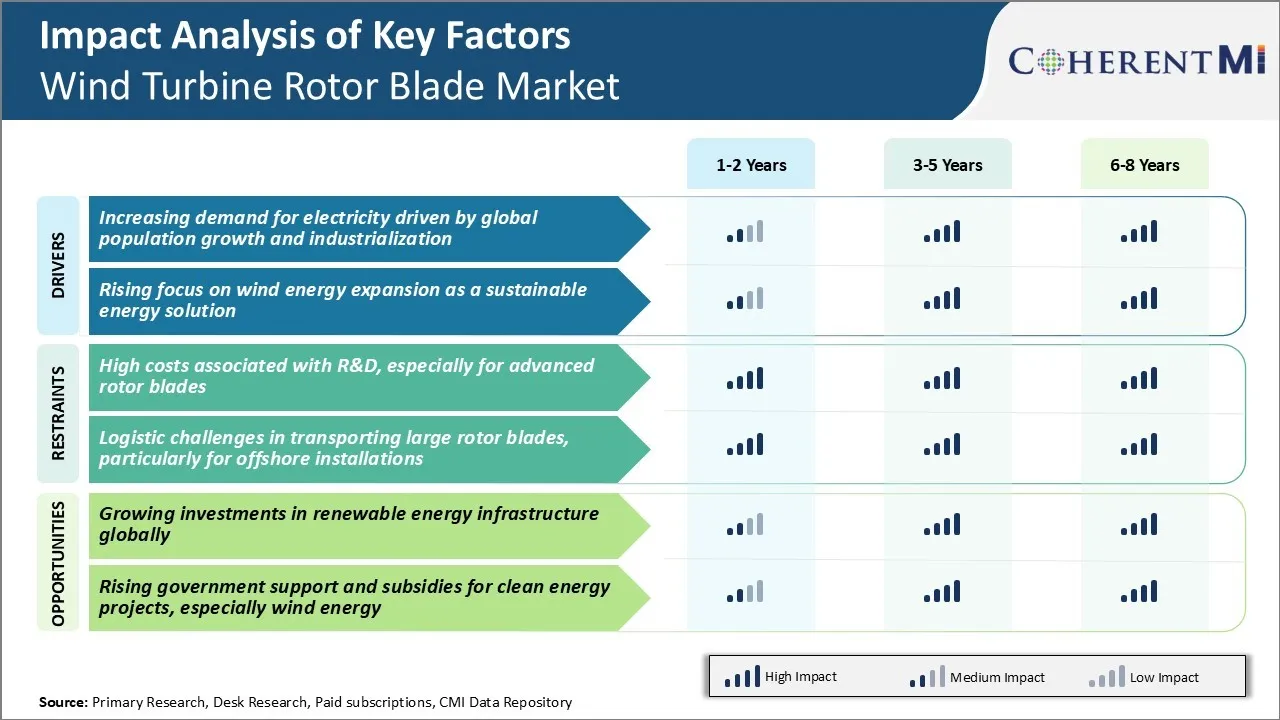

Market Driver - Increasing Demand for Electricity Driven by Global Population Growth and Industrialization

According to United Nations projections, the global population is expected to reach nearly 10 billion people by 2050. The numbers represent a sizeable increase from the current figure of over 7.7 billion.

This population boom, coupled with robust economic growth especially in Asia and Africa, is generating massive demand for electricity that needs to be fulfilled. To power their expanding cities, growing middle class with higher living standards, and flourishing manufacturing sectors requires tremendous amounts of grid power.

At the same time, greater awareness about climate change risks is motivating a transition to greener, low-carbon alternatives worldwide. Wind energy has increasingly emerged as one of the most viable renewable options to partly address this growing appetite for electricity from burgeoning populations and economies. This is expected to generate robust opportunities for manufacturers in the wind turbine rotor blade market.

Market Driver - Rising Focus on Wind Energy Expansion as a Sustainable Energy Solution

According to industry estimates, wind energy could account for up to 30% of global electricity needs by 2050 if deployment rates continue rising. This growing focus and confidence in wind power as a major sustainable solution would underpin strong demand for wind turbine components including rotor blades.

Meanwhile, national and local clean power targets also augur well for wind investments. Several countries have announced ambitious plans recently, such as achieving carbon neutrality by mid-century through large-scale renewables build-outs. Along with policy push, advances in utility-scale wind technology are making it an increasingly bankable source of baseload power.

Another significant catalyst is the falling cost of wind-derived electricity, which is now at parity or even lower than that from fossil fuel plants in many markets. Emerging offshore wind sector also holds immense promise with stable operations and adequate space for turbines despite higher setup costs currently. Such renewables-friendly trends bode well for the future prospects of growth in the wind turbine rotor blade market.

Market Challenge - High Costs Associated with R&D, Especially for Advanced Rotor Blades

The wind turbine rotor blade market faces significant challenges due to the high costs associated with research and development, especially for advanced rotor blades. Designing and developing advanced blades that can harness wind power more efficiently is critical for the industry.

However, it requires massive investments in testing different blade designs, materials, and aerodynamic technologies. The testing process is also lengthy and complex given the huge size of rotor blades. Manufacturing advanced carbon fiber or nanomaterial-based blades involves substantial costs.

Additionally, any design failures or flaws found during the testing process led to increased expenses. High upfront capital costs deter new players from entering the market. This concentration of R&D activities among major players limits innovations. Overall, the high costs of blade research and development pose a formidable challenge for the wind turbine rotor blade market by restricting technological breakthroughs.

Market Opportunity - Growing Investments in Renewable Energy Infrastructure Globally

The wind turbine rotor blade market has sizable opportunities arising from the growing investments in renewable energy infrastructure around the world. With rising concerns about climate change and energy security, many countries have ambitious targets to increase the share of renewables in their overall energy mix. Substantial financial commitments are being made to set up new wind and solar parks.

Major economies like China, USA, European nations have announced multi-billion dollar plans to transition to clean energy sources. This global push for renewables presents a massive market for wind turbine rotor blades. As more capacity is added, the demand for blades will increase substantially.

Growing infrastructure also calls for higher-capacity turbines requiring larger, more advanced blades that can harness energy more productively. Overall, the market players can leverage the widespread policy support for renewables to boost revenues in the coming years.

Key winning strategies adopted by key players of Wind Turbine Rotor Blade Market

Focus on innovation through R&D: Players have increasingly invested in R&D to develop more efficient and powerful rotor blades. For example, GE Renewable Energy invested over $400 million annually in wind R&D from 2015-2017. This helped GE launch its Haliade-X turbine with 107m diameter blades in 2018, one of the largest blades available.

Adopt modular blade manufacturing: Leading players like Vestas and Siemens Gamesa have adopted modular blade manufacturing approaches to standardize their blade production.

Scale up global manufacturing capacity: To tap into rising global demand, players have rapidly scaled up blade manufacturing capacity worldwide. For example, TPI Composites ramped up capacity from 200MW in 2010 to over 5GW currently by establishing production plants globally.

Focus on recycled/bio-based materials: Use of recycled and bio-based materials helps address sustainability. For example, Vestas launched recycled blade material products in 2006 and aims to produce only sustainable blades by 2040.

Segmental Analysis of Wind Turbine Rotor Blade Market

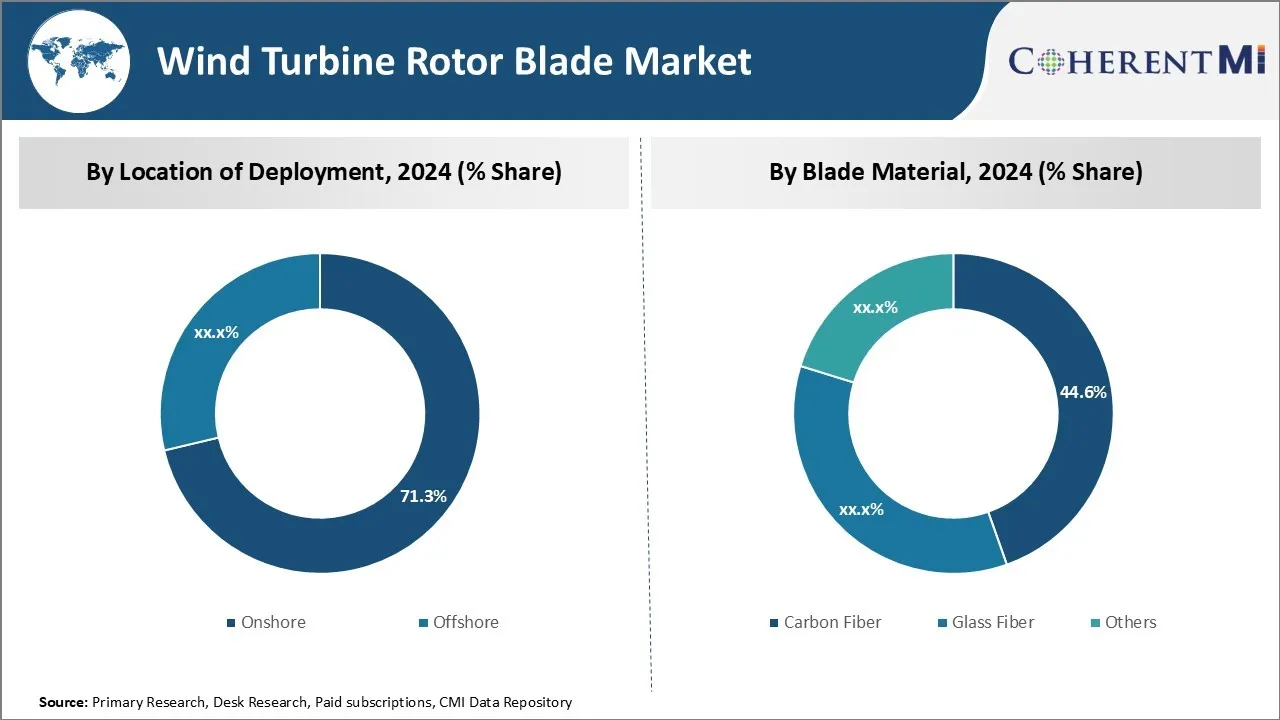

Insights, By Location of Deployment: Growing Demand and Cost Effectiveness Drive Onshore Segment Dominance

In terms of location of deployment, onshore deployment contributes 71.3% share of the wind turbine rotor blade market in 2024. This is due to growing demand and cost effectiveness. Onshore wind farms have increasingly become a critical source of renewable energy worldwide as concerns over climate change mount. The onshore segment benefits from easier installation and lower transportation costs compared to offshore locations.

Major factors driving the onshore segment include supportive government policies promoting renewable energy use, attractive incentives, and declining technology costs. Overall, the onshore segment is expected to remain the key driver of wind turbine rotor blade market growth globally.

Insights, By Blade Material: Superior Properties Make Carbon Fiber the Top Choice for Blades

In terms of blade material, carbon fiber contributes the highest share of the wind turbine rotor blade market owing to its superior mechanical properties. The high stiffness and strength of carbon fiber allow manufacturers to build longer and more slender blades for harvesting energy from lower wind speeds as well as installation in large wind turbines. Taller towers and longer blades have become critical to maximizing energy yields from modern multi-megawatt turbines.

Carbon fiber fulfills this need excellently by reducing self-weight. But it still providing enormous strength to wind turbine rotor blades that are 80-120 meters in length today. While carbon fiber is costlier than glass fiber initially, its advantages of longer operational life greatly outweigh higher material costs. Overall, superior mechanical characteristics along with declining costs are propelling carbon fiber as the material of choice for the growing utility-scale wind power rotor blade market.

Insights, By Blade Length: 45 to 60 Meter Blades Dominate as Standard for Latest Turbines

In terms of blade length, the 45-to-60-meter wind turbine rotor blades contributes the highest share of the wind turbine rotor blade market. Modern multi-megawatt turbines predominantly use standardized rotor diameters within this blade length range to optimize energy output. Wind turbine rotor blades spanning 45-60-meter wind turbine rotor blades represent the optimal balance between logistics, capacity and reliability considerations for the latest onshore and offshore wind farms.

The 45–60-meter wind turbine rotor blade Length has emerged as the standard for maximizing annual energy production from state-of-the-art turbines without excessive structural complexity or costs. Overall, effective load handling, mass production capabilities along with harmonizing turbine and farm designs have cemented this segment’s prominence in the wind turbine rotor blade market.

Additional Insights of Wind Turbine Rotor Blade Market

- In 2023, Asia Pacific led the wind turbine rotor blade market with 47% share, driven by rapid industrialization, government support, and increased adoption of wind energy. China aims for 33% renewable electricity by 2025, targeting 18% wind and solar power.

- The onshore segment held the largest share in wind turbine rotor blade market in 2023, benefiting from ease of installation and lower costs than offshore wind farms.

- Offshore wind is set for significant growth in the wind turbine rotor blade market globally, with technological advances enabling larger and more efficient installations in high-wind areas.

- The collaboration between GE Renewable Energy and LM Wind Power has led to the development of one of the world's longest wind turbine blades, measuring 107 meters, for the Haliade-X offshore turbine.

- TPI Composites, Inc. expanded its manufacturing facilities in Turkey to meet the growing demand for rotor blades in the European wind turbine rotor blade market.

Competitive overview of Wind Turbine Rotor Blade Market

The major players operating in the wind turbine rotor blade market include TPI Composites Inc., Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd, Nordex SE, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Limited, LM Wind Power, Vestas Wind Systems A/S, General Electric Company (GE Renewable Energy), Enercon GmbH, Acciona S.A., Avangrid Inc., Envision Group, Vestas Wind Systems A/S, TPI Composites, Inc., LM Wind Power (a GE Renewable Energy business), and Mingyang Smart Energy Group Co., Ltd..

Wind Turbine Rotor Blade Market Leaders

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- Nordex SE

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Energy Limited

Wind Turbine Rotor Blade Market - Competitive Rivalry, 2024

Wind Turbine Rotor Blade Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Wind Turbine Rotor Blade Market

- In December 2023, Suzlon launched a 3 MW series, targeting unviable sites and increasing energy yield. The S144 generator, one of India’s largest, is adaptable up to 3.15 MW depending on wind conditions.

- In October 2023, Mingyang Smart Energy introduced a 22MW offshore wind turbine, the MySE 22MW, with a 310-meter rotor, aimed at high-wind regions, improving offshore wind power capacity.

- In June 2023, Vestas Wind Systems A/S launched the V236-15.0 MW offshore wind turbine, featuring a 115.5-meter blade. This development aims to increase annual energy production and reduce the levelized cost of energy for offshore projects.

- In March 2023, Siemens Gamesa Renewable Energy introduced the Recyclable Blade for offshore wind turbines. This innovation allows for the recovery of wind turbine rotor blade materials at the end of their lifecycle, promoting sustainability in the wind energy sector.

Wind Turbine Rotor Blade Market Segmentation

- By Location of Deployment

- Onshore

- Offshore

- By Blade Material

- Carbon Fiber

- Glass Fiber

- Others

- By Blade Length

- 45 to 60 meters

- Less than 45 meters

- More than 60 meters

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the wind turbine rotor blade market?

The wind turbine rotor blade market is estimated to be valued at USD 23.44 Bn in 2024 and is expected to reach USD 43.18 Bn by 2031.

What are the key factors hampering the growth of the wind turbine rotor blade market?

High costs associated with R&D and logistic challenges in transporting large rotor blades are the major factors hampering the growth of the wind turbine rotor blade market.

What are the major factors driving the wind turbine rotor blade market growth?

Increasing demand for electricity, industrialization, and rising focus on wind energy expansion as a sustainable energy solution are the major factors driving the wind turbine rotor blade market.

Which is the leading location of deployment in the wind turbine rotor blade market?

The leading location of deployment segment is onshore.

Which are the major players operating in the wind turbine rotor blade market?

TPI Composites Inc., Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd, Nordex SE, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Limited, LM Wind Power, Vestas Wind Systems A/S, General Electric Company (GE Renewable Energy), Enercon GmbH, Acciona S.A., Avangrid Inc., Envision Group, Vestas Wind Systems A/S, TPI Composites, Inc., LM Wind Power (a GE Renewable Energy business), and Mingyang Smart Energy Group Co., Ltd. are the major players.

What will be the CAGR of the wind turbine rotor blade market?

The CAGR of the wind turbine rotor blade market is projected to be 9.1% from 2024-2031.