Рынок перевозочного оборудования АНАЛИЗ РАЗМЕРОВ И ДОЛЕЙ - ТЕНДЕНЦИИ РОСТА И ПРОГНОЗЫ (2024 - 2031)

Рынок перевозочного оборудования сегментируется по типу (Belt, Roller, Pallet, Overhead, Chain Conveyors, Others), по продукту (Unit Handling, Bulk Ha....

Рынок перевозочного оборудования Размер

Размер рынка в долларах США Bn

CAGR3.8%

| Период исследования | 2024 - 2031 |

| Базовый год оценки | 2023 |

| CAGR | 3.8% |

| Концентрация рынка | High |

| Основные игроки | Daifuku Co., Ltd., Siemens AG, Honeywell Intelligent, Компания TGW Logistics Group, Группа BEUMER и среди других |

дайте нам знать!

Рынок перевозочного оборудования Анализ

Рынок транспортного оборудования оценивается в USD 52,12 Bn в 2024 году Ожидается, что он достигнет USD 67,66 Bn к 2031 году, растущие с совокупным годовым темпом роста (CAGR) 3,8% с 2024 по 2031 год. Этот устойчивый рост рынка конвейерного оборудования можно объяснить такими факторами, как увеличение автоматизации в различных отраслях промышленности и растущее внедрение передовых технологий транспортировки, которые повышают эффективность.

Рынок перевозочного оборудования Тенденции

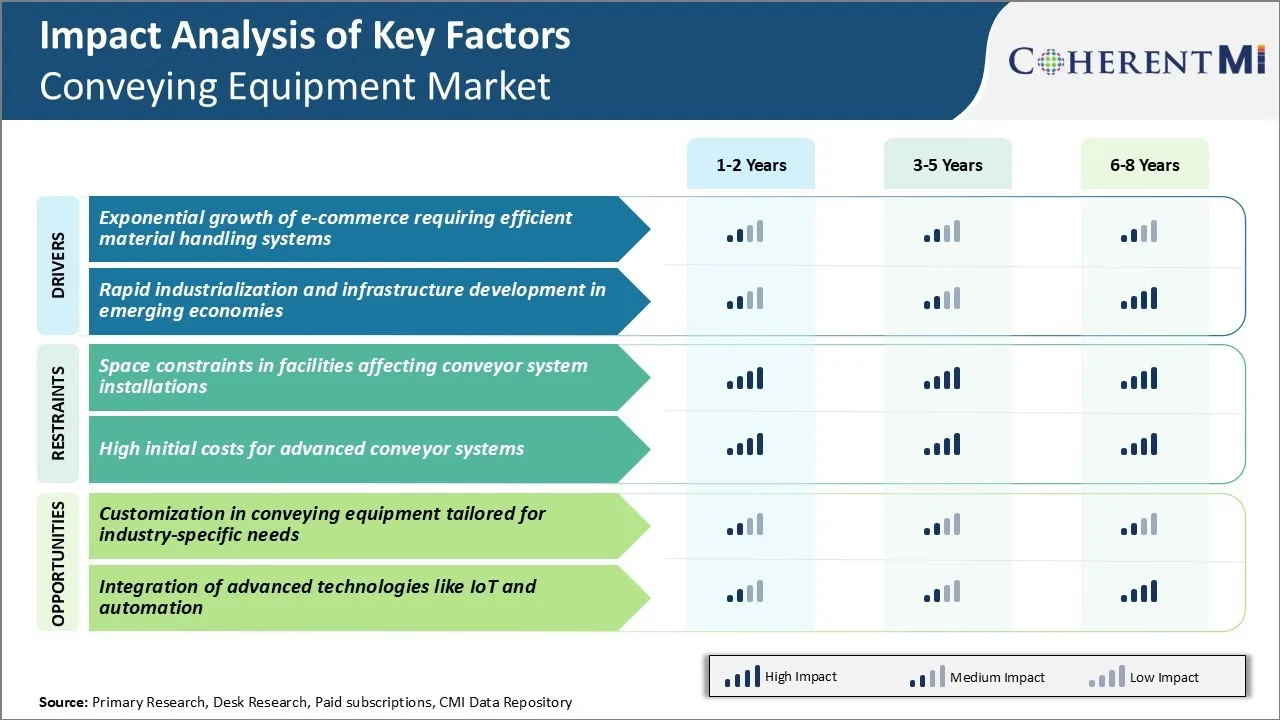

Рыночный драйвер - эффективная обработка материалов для роста электронной коммерции

Быстрое расширение электронной коммерции по всему миру оказало огромное давление на логистику и цепочки поставок. Экспоненциальный рост онлайн-ритейла подпитывает спрос на транспортное оборудование, которое может эффективно сортировать, маршрутизировать и транспортировать пакеты и продукты на объектах.

Современные объекты используют конвейерное оборудование, такое как ленточные конвейеры, роликовые конвейеры, сланцевые конвейеры и напольные конвейеры, а также автоматизированные управляемые транспортные средства для равномерного распределения рабочей нагрузки. Это обеспечивает упорядоченное перемещение товаров прямо от приемных доков до сортировочных станций, складских полок и упаковочных площадок.

Рост онлайн-поставок продуктов и продуктов питания, в частности, ускоряет потребность в гигиеническом и адаптивном транспортировочном оборудовании. Варианты нержавеющей стали, способные легко интегрироваться с приложениями для сбора, широко используются. Кроме того, поскольку клиенты ожидают прозрачности в статусе заказа, производители встраивают датчики и включение IoT в эти машины. Это продолжит создавать новые возможности роста для игроков на рынке конвейерного оборудования.

Драйвер рынка - Инфраструктурный рост способствует промышленной автоматизации

Крупные экономики вкладывают значительные средства в расширение своей промышленной и логистической инфраструктуры для поддержания долгосрочного экономического роста. Это создает благоприятную среду для поставщиков конвейерных систем на рынке конвейерного оборудования.

Отрасли промышленности в таких сегментах, как автомобильная, электронная, фармацевтическая, химическая и тяжелая техника, автоматизируют свои заводы, включая автоматизированные управляемые транспортные средства и интегрированные конвейерные линии. Отрасли хотят увеличить пропускную способность, снизить требования к ручному труду и минимизировать эргономические риски за счет механизированного перемещения товаров и инструментов в пределах своих помещений. В то же время внедрение принципов Индустрии 4.0 повышает планку визуализации, подключения данных и настраиваемости этих систем.

В целом, увеличение производственных мощностей в сочетании с глобальным акцентом на оптимизацию цепочки поставок является основным фактором, способствующим внедрению различных типов продуктов на рынке конвейерного оборудования.

Рыночная проблема: космические ограничения в объектах, влияющих на установку конвейерных систем

Одной из основных проблем, с которыми сталкивается рынок конвейерного оборудования, является отсутствие свободных мест на производственных объектах и складах для установки конвейерных систем. По мере расширения операций и увеличения пропускной способности поиск места для добавления большего количества конвейеров становится проблемой для многих компаний.

Ограниченная компоновка оставляет мало места для ошибок при монтаже и вводе в эксплуатацию новых конвейерных сегментов. Специализированные конвейеры с низким уровнем очистки должны использоваться на объектах с ограничениями по высоте. Ограничения пространства также уменьшают варианты маршрутизации конвейеров и гибкость в дизайне макета. Это может субоптимально увеличить расстояния и время обработки.

Высокие затраты, связанные со структурными модификациями или новым строительством, сдерживают компании от масштабных модернизаций конвейерной системы. Это служит барьером для рынка конвейерного оборудования, чтобы извлечь выгоду из растущих потребностей в обработке материалов в существующих производственных зонах. Перед игроками рынка перевозочного оборудования стоит задача разработать компактные конструкции конвейера, которые максимизируют пропускную способность в пределах минимальных следов.

Рыночная возможность - кастомизация в перевозке оборудования, адаптированного для конкретной отрасли потребности

Основная возможность для рынка конвейерного оборудования заключается в настройке продуктов в соответствии с уникальными требованиями к обработке материалов конкретных отраслей. Нет двух одинаковых производственных или складских процессов, и универсальный подход редко бывает оптимальным.

Изготовление полупроводников требует сверхчистой транспортировки в контролируемых средах. Разработка модульных, настраиваемых конвейерных платформ, которые могут быть настроены в соответствии с отраслевым приложением, открывает новые потоки доходов. Партнерские отношения с системными интеграторами помогают внедрять готовые к установке индивидуальные конвейерные пакеты для клиентов по отраслевым вертикалям. Это обеспечивает идеальное соответствие существующему рабочему процессу клиента и оптимизированную производительность для конкретных типов материалов, потребностей в пропускной способности и условий окружающей среды.

Он также создает блокировку клиентов через бесшовно интегрированное индивидуальное решение, а не готовые детали. Акцент на кастомизации позволяет рынку конвейерного оборудования выйти за рамки товарных стандартных продуктов и командных премиальных цен, поддерживаемых специализированными ценностями.

Ключевые выигрышные стратегии, принятые ключевыми игроками Рынок перевозочного оборудования

Продуктовые инновацииИнновации были ключевой стратегией для передачи оборудования игрокам, чтобы получить долю рынка. Например, в 2017 году Daifuku представила свой автоматический сортировщик колоночного типа, который может обрабатывать до 3000 посылок в час, что на 30% выше, чем у предыдущих моделей.

Стратегические приобретенияПриобретения позволили компаниям расширить свой портфель продуктов и географический охват. В 2019 году Swisslog приобрел GreyOrange, чтобы добавить возможности робототехники, искусственного интеллекта и автоматизации обработки материалов.

Фокус на нишевых сегментахВедущие игроки, такие как Murata Machinery, добились успеха, сосредоточившись на конкретных отраслевых нишах, таких как производство электроники. Они тесно сотрудничали с клиентами для создания прикладных решений.

Внедрение практики Индустрии 4.0Глобальные игроки на рынке передающего оборудования довольно рано внедрили передовые технологии, такие как IoT, аналитика данных и программное обеспечение для моделирования. Например, решение BoxLogiX WMS от BEUMER, запущенное в 2015 году, использует прогнозную аналитику для оптимизации производительности системы.

Сосредоточьтесь на качестве и обслуживанииКлючом к долгосрочному успеху является постоянное внимание к качеству продукта / услуги. Например, системы от Interroll пользуются высокой надежностью благодаря своей многолетней приверженности инженерному совершенству.

Сегментарный анализ Рынок перевозочного оборудования

Insights, по типу: конвейеры пояса получают лидерство в области транспортировки оборудования

По типу ремень занимает 35,5% рынка конвейерного оборудования благодаря своей обширной функциональной области. Поясные конвейеры эффективно транспортируют материалы как на большие, так и на короткие расстояния либо горизонтально, наклонно, либо вертикально. Они очень масштабируемы и адаптируются к бесчисленным промышленным потребностям, учитывая различные типы поясов, ширину и структуры. Производители широко настраивают ленточные конвейеры для конкретных уровней пропускной способности и требований к обработке полезной нагрузки.

Их эксплуатационная гибкость позволила ленточным конвейерам эффективно поддерживать крупномасштабные операции по обеспечению непрерывности в различных отраслях промышленности. Предприятия по производству продуктов питания и напитков широко используют их для плавного перемещения партий продуктов между линиями обработки и зонами хранения. Центры распределения полагаются на ленточные конвейеры для эффективной сортировки запасов и ускорения выполнения заказов. Аналогичным образом, их совместимость с автоматизацией увеличила поглощение на заводах электроники, где точность и пропускная способность имеют большое значение.

Функции самоконтроля минимизируют проблемы несоответствия, чтобы обеспечить надежную работу в течение длительных рабочих циклов. Вместе эти преимущества выдвинули ленточные конвейеры на передний план обработки различных материалов в различных отраслях промышленности.

Insights, by Product: решения для обработки блоков приводят пространство колесного оборудования на фоне динамической функциональности

Что касается продукта, то на рынке конвейерного оборудования, учитывая его динамичную функциональность, приходится 47,3%. В отличие от систем обработки сыпучих грузов, ориентированных на массовые нагрузки, обработчики блоков облегчают дискретное движение предметов с точностью. Они способны обеспечить диверсификацию упаковки, конфигурацию заказов и отслеживание потребностей секторов конечного использования.

Обработчики блоков используют гибкие решения для транспортировки, такие как ремень, ролик, накладные расходы и поддоны, для независимой транспортировки инвентаря в тотах, лотках и картонах. Перевозка оборудования, такого как лифты и поворотные столы, еще больше увеличивает трехмерное перемещение грузов в ограниченных пространствах.

Растущая деятельность в области электронной коммерции и персонализированные варианты продуктов усилили роль обработчиков единиц в быстром выполнении заказов. Объединение поставок облегчает автоматическое отслеживание и обновление запасов в режиме реального времени. Такая расширенная функциональность и совместимость с потребностями Индустрии 4.0 способствовали широкому признанию обработчиков устройств.

Инсайт, по применению: Сектор пищевой переработки стимулирует поглощение груш во главе с императивами безопасности и качества

Учитывая применение, продукты питания и напитки генерируют самый высокий спрос на рынке конвейерного оборудования из-за строгих отраслевых правил. Производство продуктов питания придерживается сложных стандартов безопасности, гигиены и прослеживаемости для обеспечения качества и укрепления доверия потребителей. Транспортное оборудование играет жизненно важную роль в поддержании этих императивов качества.

Транспортное оборудование, разработанное с гигиенической отделкой, такой как полированные поверхности из нержавеющей стали, обеспечивает транспорт без загрязнения. Запечатанные двигатели и закрытые конструкции дополнительно предотвращают проникновение посторонних веществ. Некоторые варианты с модульной, чистой конструкцией поддерживают приложения Clean-In-Place.

В совокупности такие характеристики безопасности и качества увеличили приемку конвейера среди производителей продуктов питания, стремясь удовлетворить нормативные протоколы и гарантии клиентов. Их беспроблемное масштабирование также поддерживает расширение производственных мощностей и добавление новых продуктов.

Дополнительные идеи Рынок перевозочного оборудования

Азиатско-Тихоокеанский рынок В 2023 году Азиатско-Тихоокеанский регион занимал 42% рынка конвейерного оборудования, что связано с устойчивой индустриализацией, растущей производственной деятельностью и быстрым расширением электронной коммерции. В таких странах, как Китай и Индия, наблюдается значительный спрос на транспортные системы в различных отраслях промышленности, включая автомобилестроение, электронику и логистику.

Обзор конкурентов Рынок перевозочного оборудования

Основными игроками, работающими на рынке конвейерного оборудования, являются Daifuku Co., Ltd., Siemens AG, Honeywell Intelligrated, TGW Logistics Group, BEUMER Group, Vanderlande Industries, Murata Machinery, Ltd., Fives Group, Dematic, Swisslog Holding AG, Interroll Group, Viastore Systems GmbH, KNAPP AG, Hytrol Conveyor Company Inc. и Jervis B. Webb Company.

Рынок перевозочного оборудования Лидеры

- Daifuku Co., Ltd.

- Siemens AG

- Honeywell Intelligent

- Компания TGW Logistics Group

- Группа BEUMER

Рынок перевозочного оборудования - Конкурентное соперничество

Рынок перевозочного оборудования

(Доминируют крупные игроки)

(Высококонкурентный с большим количеством игроков.)

Последние разработки в Рынок перевозочного оборудования

- В июле 2023 года Jungheinrich AG объявила о планах построить полностью автоматизированный склад для Hawle Armaturen GmbH в своей штаб-квартире во Фрейласинге, Германия. Объект предназначен для включения передовых конвейерных систем, которые будут соединять производственные линии с местами хранения, обеспечивая эффективную и эргономичную выборку заказов.

- В июне 2023 года TGW Logistics Group объявила о разработке высокопроизводительной системы электронной коммерции для Skechers в Тайчане, Китай. Эта система оснащена 8-мильной (приблизительно 13-километровой) сетью энергосберегающих конвейеров KingDrive®, соединяющих различные области в пределах объекта и связывающих с существующим центром исполнения.

- В апреле 2023 года TGW Logistics Group представила FullPick, инновационную систему, предназначенную для полностью автоматизированного сбора смешанных поддонов. Это решение позволяет производителям продуктов питания, розничным торговцам и дистрибьюторам продуктов питания автоматически загружать как поддоны, так и клеточки.

- В октябре 2022 года Daifuku North America открыла новый завод в Бойн-Сити, штат Мичиган. Объект площадью 225 000 квадратных футов, представляющий собой инвестиции в размере 26 миллионов долларов, объединяет операции с предыдущих заводов в Бойн-Сити, Харбор-Спрингс и Пеллстон в одном месте.

Рынок перевозочного оборудования Сегментация

- По типу

- Пояс

- Ролик

- Паллета

- над головой

- Конвейеры цепей

- Другие

- По продукту

- Подразделение по обработке

- Обработка мусора

- Части и привязанности

- С помощью приложения

- Еда и напитки

- Склад и распределение

- автомобильный

- Аэропорт

- Минирование

- Электроника

- Другие

Хотите изучить возможность покупкиотдельные разделы этого отчета?

Часто задаваемые вопросы :

Насколько велик рынок транспортного оборудования?

Рынок конвейерного оборудования оценивается в 52,12 доллара США. Bn в 2024 году и, как ожидается, достигнет 67,66 Bn к 2031 году.

Каковы ключевые факторы, препятствующие росту рынка конвейерного оборудования?

Космические ограничения на объектах, влияющих на установки конвейерной системы, и высокие первоначальные затраты на передовые конвейерные системы являются основными факторами, препятствующими росту рынка конвейерного оборудования.

Каковы основные факторы, влияющие на рост рынка конвейерного оборудования?

Экспоненциальный рост электронной коммерции, требующий эффективных систем обработки материалов и быстрой индустриализации и развития инфраструктуры в странах с развивающейся экономикой, являются основными факторами, определяющими рынок транспортирующего оборудования.

Какой тип является ведущим на рынке конвейерного оборудования?

Ведущим сегментом типа является ленточный конвейер.

Какие основные игроки работают на рынке конвейерного оборудования?

Daifuku Co., Ltd., Siemens AG, Honeywell Intelligrated, TGW Logistics Group, BEUMER Group, Vanderlande Industries, Murata Machinery, Ltd., Fives Group, Dematic, Swisslog Holding AG, Interroll Group, Viastore Systems GmbH, KNAPP AG, Hytrol Conveyor Company, Inc. и Jervis B. Webb Компании являются основными игроками.

Каким будет CAGR рынка перевозочного оборудования?

Прогнозируется, что CAGR рынка конвейерного оборудования составит 3,8% с 2024 по 31 год.