Electric Actuator Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Electric Actuator Market is segmented By Product Type (Linear Actuator, Hybrid Actuator, Rotary Actuator), By End-use Industry (Oil & Gas Industry, Po....

Electric Actuator Market Size

Market Size in USD Bn

CAGR6.11%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.11% |

| Market Concentration | High |

| Major Players | Rotork PLC, Emerson Electric Co., AUMA Riester GmbH & Co. KG, Honeywell International Inc., ABB Ltd. and Among Others. |

please let us know !

Electric Actuator Market Analysis

The electric actuator market is estimated to be valued at USD 13.96 Bn in 2024 and is expected to reach USD 21.15 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.11% from 2024 to 2031. The growth of the industrial automation sector and increasing adoption of electric actuators across industries such as oil & gas, energy & power, mining, and aerospace is contributing to growth of the electric actuator market.

Electric Actuator Market Trends

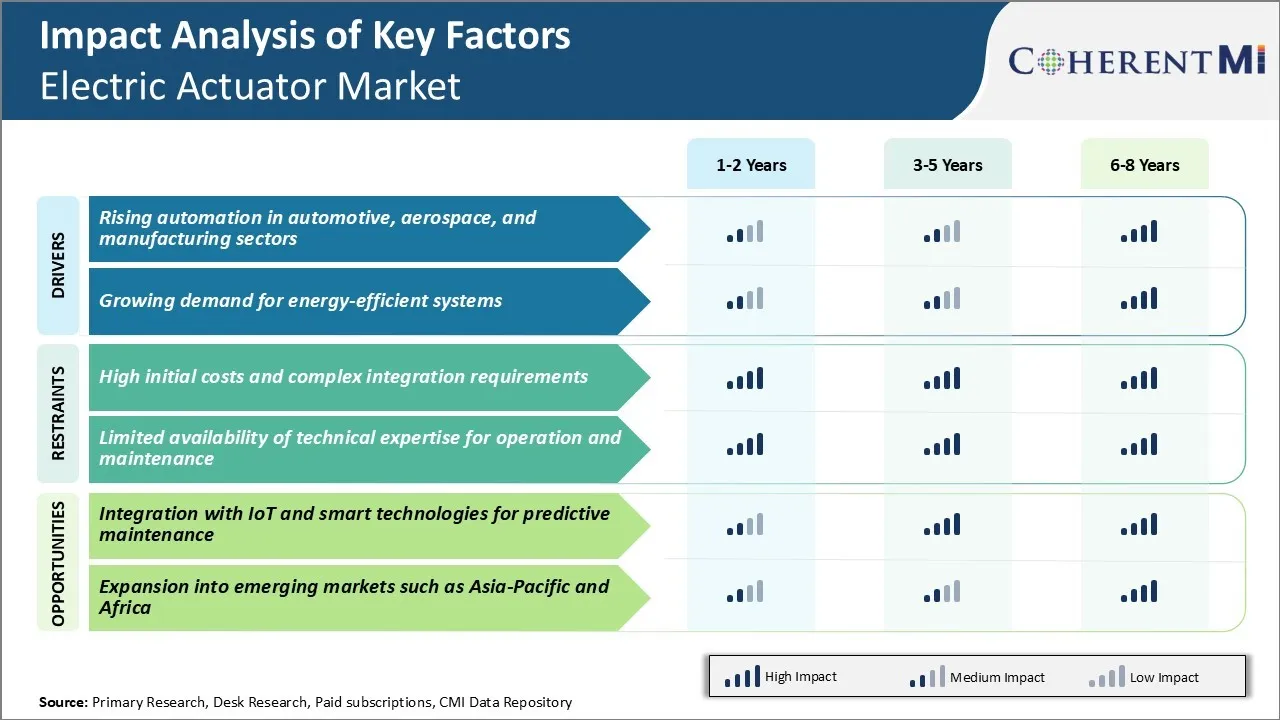

Market Driver - Rising Automation in Automotive, Aerospace, and Manufacturing Sectors

The electric actuator market has been witnessing prominent growth owing to rising automation across various sectors such as automotive, aerospace, and manufacturing. In the automotive industry, electric actuators are extensively used across the assembly lines for numerous operations like welding, painting, and packaging. Leading automakers are increasingly automating their production facilities to improve productivity and meet rising global vehicle demand.

The aerospace industry is also automating various aircraft and engine assembly procedures which involves accurate positioning and movement of large components. Advanced electric actuators ensure repeatability and reliability in critical aerospace applications.

On the manufacturing front, industries such as electronics, semiconductors, food and beverages are automating their production lines and processes with the help of electric actuators. This helps achieve mass production of components and products in a unified, synchronized, and cost-efficient manner.

Furthermore, various discrete and process manufacturing sectors are implementing industrial internet of things (IIoT) and industry 4.0 technologies. This is expected to continue creating new opportunities in the electric actuator market.

Market Driver - Growing Demand for Energy-efficient Systems

Another key factor promoting the demand for electric actuators is the increasing emphasis on energy efficiency across various industries. With growing environmental awareness and stringent regulations regarding carbon emissions, companies are actively pursuing initiatives to enhance energy efficiency of their facilities and operations. Electric actuators offer distinct energy savings benefits over traditional pneumatic and hydraulic actuators through reduced operating costs.

They also offer lower life cycle costs since electric actuators have fewer moving parts and require lower maintenance. Regulatory push for greener buildings and sustainable manufacturing is acting as a driver as electric actuators help lower carbon footprint of facilities through energy-efficient operations.

Rising oil and gas prices worldwide are also prompting industries to focus on minimizing energy consumption from processes. With growing environmental stewardship, industries are proactively investing in energy-efficient technologies including electric actuators to reduce their operational costs and comply with stringent sustainability targets. This growing emphasis on energy efficiency is a key driver bolstering prospects of the global electric actuator market.

Market Challenge - High Initial Costs and Complex Integration Requirements

One of the major challenges faced by the electric actuator market is their high initial costs and complex integration requirements. Electric actuators tend to have higher unit costs than conventional hydraulic or pneumatic actuators due to the use of more advanced electronic components and control mechanisms.

Additionally, integrating electric actuators into existing industrial machinery and systems often requires extensive custom engineering and programming work. This drives up costs and makes simple retrofitting difficult. The complex integration process also means electric actuators typically have longer commissioning times.

For cost-sensitive industrial customers, these higher costs and involved integration process pose a significant barrier to large-scale adoption of electric actuators. However, with falling technology costs and improvements in modular designs, some electric actuator manufacturers are striving to make their products more cost-competitive and user-friendly to integrate.

Market Opportunity - Integration with IoT and Smart Technologies for Predictive Maintenance

One of the major opportunities for growth in the electric actuator market is through greater integration with IoT and smart technologies. With the increasing connectivity of industrial equipment and machinery, electric actuators that are embedded with sensors and intelligent controls could easily connect to IoT platforms. This allows for predictive maintenance capabilities where data from the actuator can be monitored remotely.

Manufacturers can schedule maintenance during planned shutdowns to optimize uptime. For customers, the predictive maintenance enabled by smart electric actuators with IoT connectivity could significantly reduce unexpected downtime and repairs. This presents an attractive value proposition that OEMs may leverage to increase adoption rates of electric actuators across diverse industries.

Key winning strategies adopted by key players of Electric Actuator Market

Focus on Product Development - Companies have extensively focused on developing innovative electric actuators to meet emerging needs across industries.

Partnerships and Acquisitions - Players have partnered with or acquired companies to enhance their product portfolio and expand into new markets.

Leveraging IoT and Digital Technologies - Leading players are equipping actuators with IoT and analytics capabilities to deliver predictive maintenance and remote monitoring solutions.

Focus on Asia Pacific and Emerging Markets - With growing infrastructure development and industrialization in APAC and emerging markets, companies have increased focus on these regions through partnerships and local manufacturing.

Segmental Analysis of Electric Actuator Market

Insights, By Product Type: Fit for Purpose Drives Demand

In terms of product type, linear actuator contributes 45.3% share of the electric actuator market in 2024, owing to its suitability across a wide range of applications. Linear actuators provide straightforward linear motion making them an ideal solution for applications requiring precision positioning, such as industrial automation equipment. Their simple motion profile allows for cost-effective implementation compared to alternative actuator types.

Furthermore, improvements in linear actuator technology have enhanced their functionality. Advanced models now offer features such as built-in limit switches, adjustable speed and force control, and homing capabilities. These additions have expanded the capabilities of linear actuators, satisfying the emerging needs of automation environments. The compatibility of linear actuators with varied manufacturing processes cements their prominent position in the electric actuator market.

Insights, By End-use Industry: Core Application Drives Segment

In terms of end-use industry, oil & gas industry contributes 25.5% share of the electric actuator market in 2024, owing to reliance on electric actuators. The industry mandates reliable remote operation within hazardous environments such as oil rigs and refineries. Electric actuators fulfill this need through intrinsically safe enclosed motors that eliminate the risk of explosion from sparks. Their ability to effectively automate valve movements and position sensors at all stages of the production cycle makes them instrumental to smooth operations.

Linear actuators especially see wide use for pipe manipulation. Overall, strict safety regulations within oil and gas increase the importance of intrinsically safe actuators like electric models. This supports the oil and gas industry as the core end user and primary driver of electric actuator market.

Insights, By Distribution Channel: Direct Interface Increases Impact

In terms of distribution channel, direct sales contributes the highest share of the electric actuator market owing to the ability to optimize solutions. Direct engagement between electric actuator suppliers and end users facilitates tailored product selection and technical support. It allows customizing actuator specifications to perfectly address unique automation needs. Through direct interaction, customers receive personalized guidance on integrating, operating and servicing electric actuators from experienced experts. This minimizes integration challenges and downtime.

In contrast, indirect channels involve multiple third parties that limit specialized product and integration support. Consequently, industries tending to utilize complex automated systems heavily rely on direct supplier relationships for seamless project execution. This direct interface makes electric actuator suppliers well positioned to better assist core industry clients, reinforcing the lead of the direct sales segment.

Additional Insights of Electric Actuator Market

- The integration of IoT technology in electric actuators has enabled real-time monitoring and control, significantly improving efficiency in industrial processes.

- The shift towards renewable energy sources has increased the demand for electric actuators in solar tracking systems and wind turbine controls.

- The automotive industry's move towards electric vehicles has spurred innovation in compact and energy-efficient electric actuators for various vehicular functions.

- The Asia Pacific region is expected to witness the highest growth rate in the global electric actuator market, due to rapid industrialization and infrastructural development in countries like China and India.

- Electric actuators contribute to a significant reduction in energy consumption, offering up to 30% energy savings compared to traditional actuator systems.

Competitive overview of Electric Actuator Market

The major players operating in the electric actuator market include Rotork PLC, Emerson Electric Co., AUMA Riester GmbH & Co. KG, Honeywell International Inc., ABB Ltd., Flowserve Corporation, Moog Inc., Rockwell Automation, Inc., SMC Corporation, Curtiss-Wright Corporation, General Electric, Actuonix Motion Devices Inc., and Ewellix (SKF Motion Technologies).

Electric Actuator Market Leaders

- Rotork PLC

- Emerson Electric Co.

- AUMA Riester GmbH & Co. KG

- Honeywell International Inc.

- ABB Ltd.

Electric Actuator Market - Competitive Rivalry, 2024

Electric Actuator Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Electric Actuator Market

- In January 2024, Emerson introduced the Fisher™ easy-Drive™ 200R Electric Actuator, designed for use with Fisher butterfly and ball valves. This actuator is engineered to perform accurately and reliably under extreme conditions, particularly in industries like oil and gas installations located in cold, remote areas.

- In November 2023, Flowserve introduced the Limitorque QX Series B (QXb) quarter-turn smart electric actuator, designed to enhance reliability and precision while reducing ownership costs. This next-generation actuator builds upon the proven Limitorque QX and MX platforms, offering user-preferred features in a smart actuator package.

- In August 2023, Rotork PLC launched a new line of smart electric actuators designed for enhanced efficiency and connectivity, aiming to meet the growing demand for automation in industrial applications.

- In July 2023, Emerson Electric Co. acquired a leading actuator manufacturer, expanding its automation solutions portfolio and strengthening its position in the electric actuator market.

Electric Actuator Market Segmentation

- By Product Type

- Linear Actuator

- Hybrid Actuator

- Rotary Actuator

- By End-use Industry

- Oil & Gas Industry

- Power Generation

- Chemical & Petrochemical

- Aerospace & Defence Industry

- Automotive Industry

- Water & Wastewater

- Others

- By Distribution Channel

- Direct Sales

- Indirect Sales

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the electric actuator market?

The electric actuator market is estimated to be valued at USD 13.96 Bn in 2024 and is expected to reach USD 21.15 Bn by 2031.

What are the key factors hampering the growth of the electric actuator market?

High initial costs and complex integration requirements and limited availability of technical expertise for operation and maintenance are the major factors hampering the growth of the electric actuator market.

What are the major factors driving the electric actuator market growth?

Rising automation in automotive, aerospace, and manufacturing sectors and growing demand for energy-efficient systems are the major factors driving the electric actuator market.

Which is the leading product type in the electric actuator market?

The leading product type segment is linear actuator.

Which are the major players operating in the electric actuator market?

Rotork PLC, Emerson Electric Co., AUMA Riester GmbH & Co. KG, Honeywell International Inc., ABB Ltd., Flowserve Corporation, Moog Inc., Rockwell Automation, Inc., SMC Corporation, Curtiss-Wright Corporation, General Electric, Actuonix Motion Devices Inc., and Ewellix (SKF Motion Technologies) are the major players.

What will be the CAGR of the electric actuator market?

The CAGR of the electric actuator market is projected to be 6.11% from 2024-2031.