Рынок охлаждающих батарей для электромобилей АНАЛИЗ РАЗМЕРОВ И ДОЛЕЙ - ТЕНДЕНЦИИ РОСТА И ПРОГНОЗЫ (2024 - 2031)

Рынок хладагентов для электромобилей сегментирован по транспортным средствам (батареи для электромобилей, гибридные электромобили), по батареям (литий....

Рынок охлаждающих батарей для электромобилей Тенденции

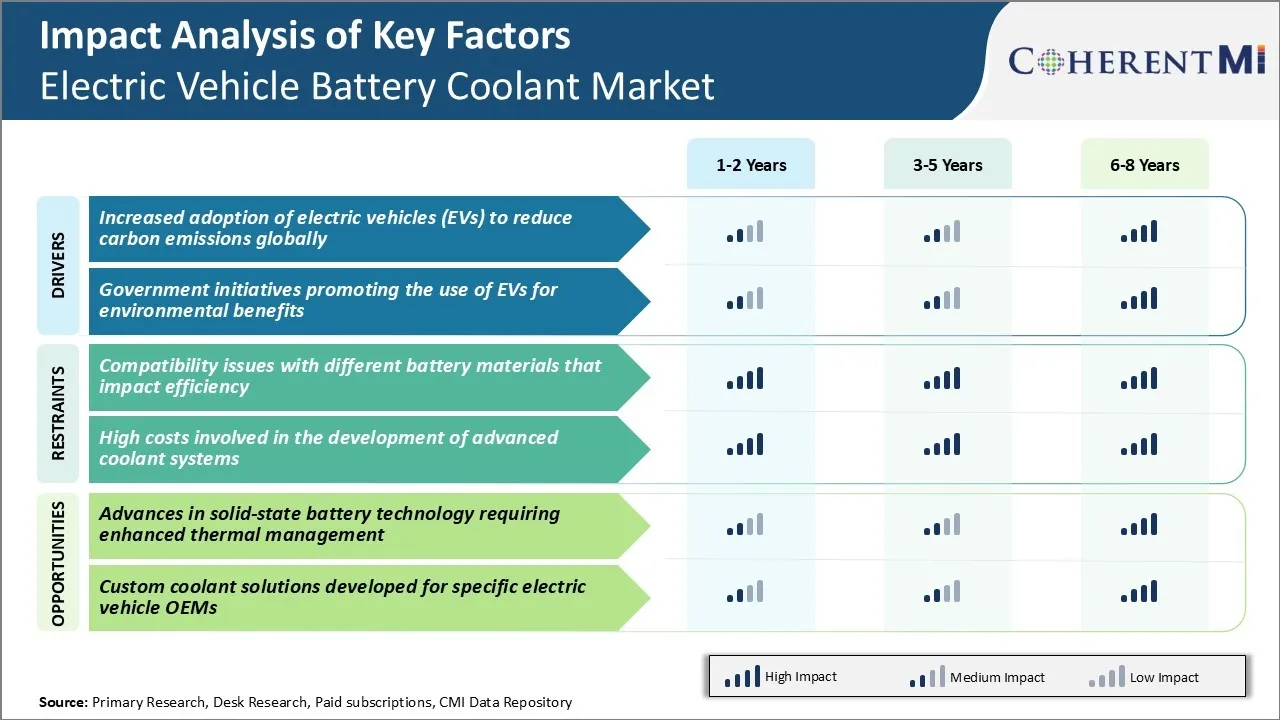

Рыночный драйвер: более широкое внедрение электромобилей для сокращения выбросов углерода во всем мире

Сегодня транспортный сектор признан основным источником выбросов углерода. Это привлекло внимание к электромобилям, которые имеют нулевые прямые выбросы. Страны поставили амбициозные цели по переходу на электрическую мобильность, чтобы уменьшить зависимость от импорта нефти и сократить выбросы парниковых газов от транспортных средств.

С ростом парка электромобилей на дорогах, установленная база литий-ионных батарей, питающих эти транспортные средства, будет продолжать расширяться в ближайшие годы. С батареями, составляющими почти половину стоимости электромобиля, эффективное тепловое управление этими большими и энергоемкими аккумуляторными батареями становится критически важным для обеспечения оптимальной производительности и продления срока службы.

Эта растущая революция в области электромобильности, вероятно, будет стимулировать спрос на более сложные и эффективные системы охлаждения аккумуляторов для электромобилей. Передовые решения по охлаждению будут играть жизненно важную роль в поощрении дальнейшего использования транспортных средств с батарейным питанием и более быстрого перехода на энергию во всем мире. Следовательно, ожидается, что это будет стимулировать рост рынка охлаждающей жидкости для электромобилей в ближайшие годы.

Рыночный водитель - Правительственные инициативы, способствующие использованию электрических транспортных средств для экологических выгод

Признавая чрезмерный углеродный след транспорта, страны активизируют политическую поддержку для ускорения внедрения электрической мобильности. Многие страны ввели стимулы для покупок, такие как налоговые льготы и неденежные стимулы. Несколько городов предлагают другие преимущества, такие как бесплатная зарядка на общественных станциях и отсутствие платы за регистрацию или дорожного налога для электромобилей. Многие правительства предоставляют субсидии на производство и маркетинг электромобилей.

Принятие политики согласуется с национальными целями по диверсификации источников энергии, повышению энергетической безопасности и переходу к более экологичной транспортной системе. Развитые страны лидируют в стремлении к электрической мобильности, в то время как развивающиеся страны догоняют благодаря благоприятным политическим экосистемам. Надежная политическая основа ускорила продвижение к транспортным средствам с низким или нулевым уровнем выбросов в странах, приверженных ограничению воздействия транспорта на окружающую среду.

Постоянное внимание к мерам по продвижению электромобилей должно привести к более высоким показателям проникновения и трансформировать глобальный ландшафт транспортных средств. Это свидетельствует о положительных перспективах роста рынка охлаждающей жидкости для электромобилей.

Рыночная проблема - проблемы совместимости с различными аккумуляторными материалами, которые влияют на эффективность

Одной из ключевых проблем, с которыми сталкивается рынок охлаждающей жидкости для электромобилей, являются проблемы совместимости между различными материалами батареи и охлаждающими веществами. Химии аккумуляторов значительно различаются между производителями с различными комбинациями анодов и катодов.

Найти универсальную охлаждающую жидкость, которая может эффективно управлять передачей тепла во всех этих различных материалах батареи, было трудно. Несовместимость может вызвать такие проблемы, как увеличение импеданса между электродами, распад активных материалов и преждевременная потеря емкости по сравнению с циклом батареи.

Необходимы обширные исследования и испытания для анализа того, как конкретный охлаждающий элемент батареи электромобиля взаимодействует на химическом уровне с каждым составом батареи. Выбор подходящих составов охлаждающих веществ для аккумуляторов электромобилей без ущерба для эффективности также остается проблемой, учитывая изменения в технологии и составе аккумуляторов электромобилей, запланированные на будущее. Ожидается, что это создаст значительные проблемы для игроков на рынке охлаждающей жидкости для электромобилей.

Рыночная возможность - Достижения в области твердотельных аккумуляторных технологий, требующие улучшенного термического управления

Одна из основных возможностей для игроков на рынке охлаждающей жидкости для аккумуляторов электромобилей заключается в достижениях в области твердотельных аккумуляторных технологий. Твердотельные батареи предлагают более высокую плотность энергии и лучшую безопасность по сравнению с традиционными литий-ионными батареями. Тем не менее, они также генерируют больше тепла во время работы из-за таких характеристик, как более высокая электронная и ионная проводимость.

Поскольку твердотельные батареи приближаются к коммерциализации, будет расти потребность в разработке инновационных решений для охлаждающей жидкости, которые могут поддерживать идеальные рабочие температуры при более высоких тепловых нагрузках. Ведущие аккумуляторные и автомобильные компании на рынке охлаждающей жидкости для электромобилей вкладывают значительные средства в исследования в области твердотельных технологий. Ожидается, что он удовлетворит растущий спрос на современные охлаждающие жидкости с более высокими возможностями теплопередачи.

С существующими тепловыми решениями производители на рынке охлаждающей жидкости для аккумуляторов электромобилей имеют возможность разрабатывать продукты, адаптированные к новым твердотельным батареям и требованиям.