IoT芯片市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

IoT芯片市场由硬件(处理器、传感器、连通性IC、内存设备、逻辑设备)、工业垂直(消费者电子、汽车和运输、保健、工业、其他)、地理(北美、拉丁美洲、亚太、欧洲、中东和非洲)分割。 本报告为上述部分提供了价值(10亿美元)。....

IoT芯片市场 趋势

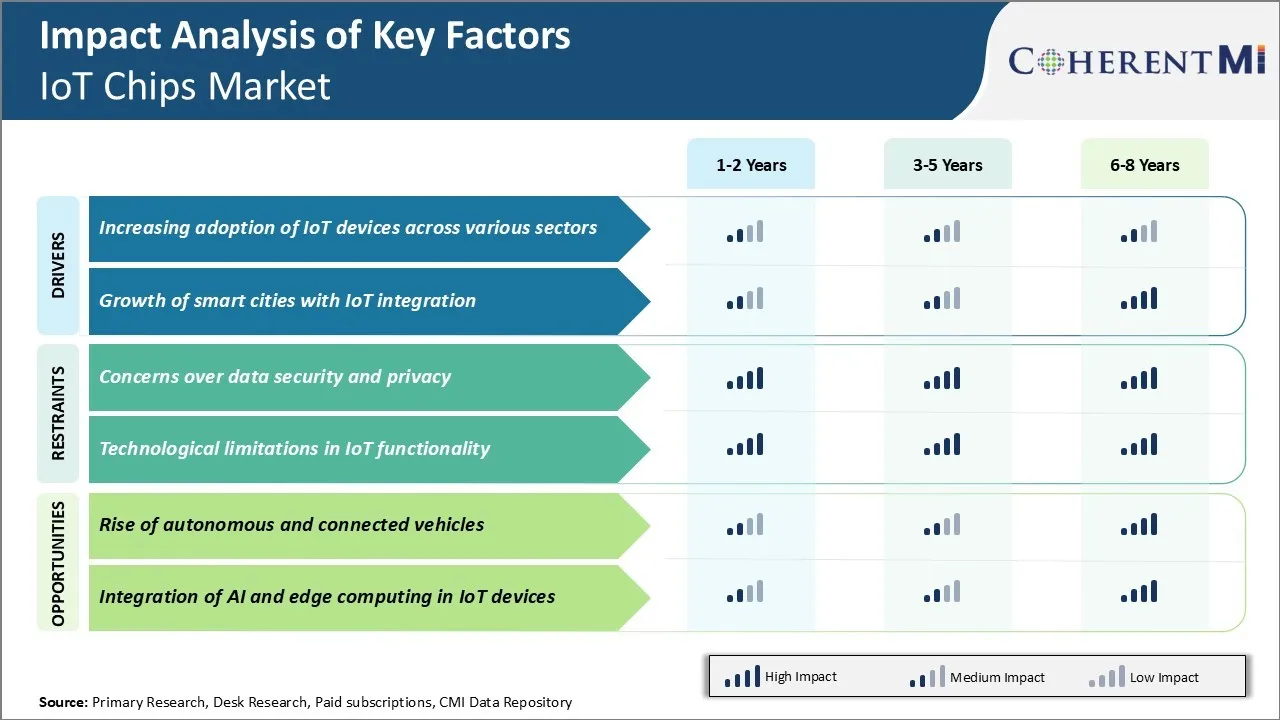

市场驱动力 -- -- 各部门越来越多地采用IOT设备

随着互联互通和传感器技术的进步,IoT设备正在各部门寻找应用。 构成这些连接设备核心的IOT芯片正在见证强劲的需求。

工业和制造业部门是IoT的早期采纳者之一. 在工厂地板上使用IOT启用的传感器、机器和设备提供了实时数据分析能力,以优化生产流程,减少故障时间和浪费。

医疗保健是IOT革命的另一个部门。 通过可穿戴的医疗器械和基于IOT的智能家庭保健解决方案,远程患者监测正在帮助改善患者的生活质量。 这扩大了符合医疗器械规范的IOT芯片市场.

在汽车工业中,与高级驾驶员协助连接的汽车,信息娱乐和远程数据系统依赖于IOT. 诸如超空更新,自主驾驶能力,车辆跟踪和预测维护等功能,正在驱动对强大的汽车级IOT芯片的需求. 汽车行业的所有这些趋势都使IOT芯片市场受益匪浅。

市场驱动力 - 智能城市的增长与IOT一体化

全世界各大城市的智能城市倡议正在利用信息技术作为核心,以改善基础设施、交通、保健、公用事业管理等。 市政府在IOT的帮助下,正在实施停车场管理、污染监测、垃圾收集、街道照明、交通管理和公共交通的智能解决方案。 随后,智能计和传感器的大规模推出为IOT芯片制造商创造了更多机会.

新兴的运输模式,如电动车辆、超小型飞行器、无人驾驶飞机也利用了最新的连接技术。 以智慧城市倡议为后盾,将采用这些办法作为主流运输方案,将需要在整个系统内建立强有力的网络和计算能力。 总体而言,涉及城市生活各个方面的智能城市IoT项目正在刺激对有关组成部分的无情需求。

市场挑战----对数据安全和隐私的关切

由于对数据安全和隐私日益关切,IOT芯片市场面临重大挑战。 许多IOT设备的安全性很弱,因此容易受到网络攻击。 黑客可以潜入IP摄像头,智能家庭助手和连接的汽车的无保障网络,以监视用户甚至劫持控制系统. 这对个人隐私和自主车辆安全构成严重威胁。

大型技术公司最近侵犯隐私的行为削弱了用户对该行业的信任。 诸如GDPR这样的严格的数据隐私条例增加了在欧洲市场运营的公司遵守要求和成本. 解决安全弱点和向用户保证数据管理做法对于广泛采用信息技术至关重要。

技术提供商需要专注于构建强大的安全协议,接入控制和加密到芯片设计中. 除非这些问题得到令人满意的解决,否则隐私和安全方面的担心会严重阻碍IOT芯片市场的发展。

市场机会----自主和连接车辆的崛起

自主和连接车辆的增长为IOT芯片市场提供了重大机遇. 随着车辆的自动化,连接和电动程度的提高,对更先进的汽车芯片的需求正在指数上升.

全程自驾车需要更大的计算功率和数据处理能力,以便处理部署在车辆周围的先进传感器、照相机和雷达的实时输入。 它们还需要可靠的宽带连接和边缘计算能力,以获得频繁的空中更新并与交通基础设施互动。

除高级逻辑IC和微控制器外,自主车辆还将依赖IOT硬件,如系统在芯片(SoC),图形处理单元(GPU),场可编程门阵列(FPGA)和网络处理器上. 自主驱动技术继续找到更广泛的商业用途。 因此,它们预计将产生对专用汽车级半导体前所未有的需求,为IOT芯片销售商今后几年的强劲收入增长火上浇油。