Krabbe Disease Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Krabbe Disease Market is segmented By Therapeutics (Gene Therapy (PBKR03, etc.), Stem Cell Transplants), By Diagnostics (Newborn Screening, Genetic Testing), By Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa). The report offers the value (in USD million) for the above-mentioned.

Krabbe Disease Market Size

Market Size in USD Mn

CAGR8.51%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.51% |

| Market Concentration | High |

| Major Players | Magenta Therapeutics, Passage Bio, Forge Biologics, Krystal Biotech, Orchard Therapeutics and Among Others. |

please let us know !

Krabbe Disease Market Analysis

The Krabbe disease market is estimated to be valued at USD 488.3 Mn in 2024 and is expected to reach USD 864.7 Mn by 2031, growing at a compound annual growth rate (CAGR) of 8.51% from 2024 to 2031. The increased research and development of therapies for the treatment of the rare genetic disorder Krabbe disease is driving the growth of this market.

Krabbe Disease Market Trends

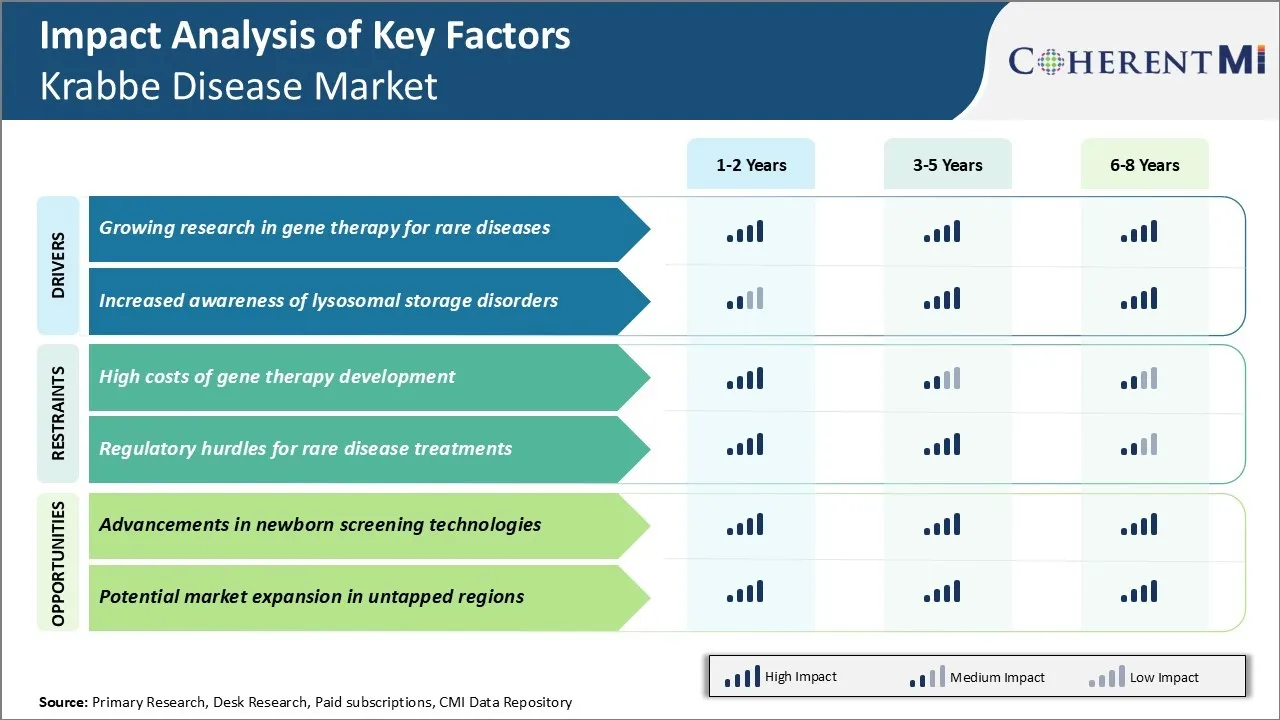

Market Driver - Growing Research in Gene Therapy for Rare Diseases

Gene therapy is showing promising results for several rare genetic disorders and continued progress is fueling hope for conditions like Krabbe disease as well. Initial clinical trials of gene therapy for other lysosomal storage disorders like mucopolysaccharidosis have demonstrated impressive outcomes, with patients experiencing meaningful improvements in neurological function, organ and tissue health, mobility, and quality of life.

Researchers are eager to apply the lessons learned to develop safer and more effective gene therapies for other rare conditions. Several academic research teams and biotech companies are working on various gene therapy strategies like using viral vectors to ferry the corrected gene into cells and stem cell transplants combined with gene editing.

Early research in animal models of Krabbe disease has shown promise, with treated newborn pups displaying substantially delayed symptoms and extended survival compared to untreated pups. This provides proof of concept that gene therapy may be able to halt or slow the progression of the devastating demyelination seen in patients if administered early.

The successful development of a gene therapy for other ultra-rare diseases like spinal muscular atrophy has demonstrated that achieving this goal for Krabbe disease may now be possible, which may driver the market in the coming years.

Market Driver - Increased Awareness of Lysosomal Storage Disorders

A key driver of the Krabbe disease market is the rising awareness about lysosomal storage disorders as a group of conditions. Efforts by patient organizations play an important role in educating doctors, new parents and the general public about these often misunderstood and frequently misdiagnosed conditions.

Enhanced newborn screening allows for earlier diagnosis when treatment has the best potential to alter the course of the disease. Several states have now mandated that babies be screened for a panel of lysosomal disorders. Earlier diagnosis allows for quicker initiation of available supportive therapies and enrollment in novel treatment trials. It also means parents can make informed medical decisions and life plans having known their child's condition from the start.

Overall, growing recognition among physicians and increased public support has stimulated more research funding and drug development activity. Biopharma companies are more inclined to develop therapies when they have a clearer picture of patient numbers and the market potential. This cycle of increased awareness feeding back into greater research and improved diagnosis/treatment options will likely continue to drive the Krabbe disease market in the coming years.

Market Challenge - High Costs of Gene Therapy Development

One of the major challenges in the Krabbe disease market is the extremely high costs associated with researching and developing effective gene therapies for this rare disease. Developing a gene therapy is an expensive, complex and lengthy process that requires significant financial investments. Extensive pre-clinical testing needs to be conducted on animal models to evaluate efficacy and safety before human clinical trials can begin.

Even after getting regulatory approval to start clinical trials, multiple phases of trials involving human subjects need to be run, which adds to the overall costs substantially. Furthermore, since Krabbe disease has a very low prevalence, the potential patient pool for effective therapies will be small, making it difficult for companies to generate sufficient returns on their huge R&D investments.

The orphan drug designation and incentives provided by regulatory agencies help offset some costs but are not enough to encourage large pharmaceutical companies to actively pursue new gene therapy programs. Unless effective solutions like cost-sharing consortiums between companies and research institutions are promoted, or public funding is increased significantly, high costs will continue to pose a serious challenge for progress in this market.

Market Opportunity - Advancements in Newborn Screening Technologies

One major opportunity area for growth in the Krabbe disease market is the advancement of newborn screening technologies. Early diagnosis of Krabbe disease through newborn screening before symptoms appear can significantly improve treatment outcomes. While several states in the US currently screen newborns for this condition, technologies with higher sensitivity and specificity are needed for widespread universal screening.

Development of more advanced multiplex screening methods that can test for Krabbe disease along with other lysosomal storage disorders using a single blood spot sample has potential to make population-level screening more affordable and feasible.

Adoption of new screening technologies by additional states and other countries could help identify many more asymptomatic infants eligible for emerging therapies. This will expand the patient pool and drive higher treatment uptake, benefiting patients as well as pharmaceutical companies investing in new treatment options. Overall, continuous improvements in newborn screening hold promise to transform patient outcomes and positively impact the Krabbe disease market in the long run.

Prescribers preferences of Krabbe Disease Market

Krabbe Disease is a rare and often fatal genetic disorder. Treatment preferences are dictated by the stage and severity of the disease.

For early-onset Krabbe Disease, hematopoietic stem cell transplantation (HSCT) is the standard first-line treatment option. HSCT works best when performed early, before symptoms appear. Umbilical cord blood is commonly used given its availability. Brands like CordBlood Registry and ViaCord are popular sources.

When symptoms emerge, prescribing shifts to symptom management. For excessive muscle tone, botox (Allergan) injections may be used. Anti-seizure drugs like clobazam (Onfi) help control seizures. Antibiotics treat frequent infections.

As the disease progresses, nutritional support becomes important. Feeding tubes and thickened liquids help prevent choking. Prescribers may recommend dietary supplements like Ensure (Abbott) or Pediasure (Abbott).

For later stages, comfort becomes a priority. Opiates like morphine alleviate pain as the body progressively breaks down. Antidepressants can relieve distress. Having care strategies in place and palliative options discussed aids prescribers in decision making.

Overall, treatment approaches are multi-faceted depending on disease phase. Beyond medications, coordinating supportive therapies affects patient outcomes and is a key consideration for prescribers.

Treatment Option Analysis of Krabbe Disease Market

Krabbe disease has four main stages - early infantile, late infantile, juvenile, and adult. The most common and severe form is early infantile Krabbe disease, which begins before 6 months of age.

For early infantile patients, hematopoietic stem cell transplantation (HSCT) from a matched family or unrelated donor is the standard first-line treatment and offers the best chance of improving outcomes if performed early in the presymptomatic or early symptomatic stage. HSCT works to replace the defective galactocerebrosidase enzyme in the brain. However, a matched donor is not always available, and HSCT also carries risks of transplant-related mortality and morbidity.

When HSCT is not an option, therapeutic options include enzyme replacement therapy (ERT) using agents like cerliponase alfa (Brineura). Brineura is administered directly into the cerebrospinal fluid through an intrathecal route. It aims to slow disease progression by supplementing the missing enzyme. While Brineura has shown some efficacy especially for slowing motor deterioration, its long-term benefits are still being studied.

For later-onset forms like juvenile Krabbe disease, HSCT may also be considered but is generally less effective than in early infantile patients. Symptomatic treatments targeting specific neurological or psychiatric issues are also given depending on the patient's presentation and disease stage.

Key winning strategies adopted by key players of Krabbe Disease Market

Leading drug developer Sanofi Genzyme has undertaken various strategic initiatives focused on research and development to develop treatments for Krabbe disease. In 2018, the company initiated a global phase 3 clinical trial evaluating the safety and efficacy of its investigational enzyme replacement therapy cerliponase alfa for infantile Krabbe disease. The VELoCE study is the largest interventional study ever conducted for this rare and devastating disease.

Another major player, Pfizer, acquired start-up Biohaven Pharmaceutical in 2019 for $11.6 billion. Biohaven was developing Trofinetide, a novel treatment for Rett syndrome and other neurological disorders including Krabbe disease. By acquiring Biohaven, Pfizer gained access to Trofinetide which was under a phase 3 clinical trial for Krabbe disease at the time. This allowed Pfizer to strengthen its rare disease portfolio. The acquisition proved strategic as in 2021, Trofinetide received an orphan drug designation from the FDA for the treatment of Krabbe disease based on positive phase 3 data.

In 2016, leading CRO Catalent Biologics partnered with axovant gene therapies (now Passage Bio) to provide process development, manufacturing and analytical services for their adeno-associated virus (AAV) gene therapy candidate, PBKR03, to potentially treat late infantile neuronal ceroid lipofuscinosis (CLN2) disease and infantile Krabbe disease.

Segmental Analysis of Krabbe Disease Market

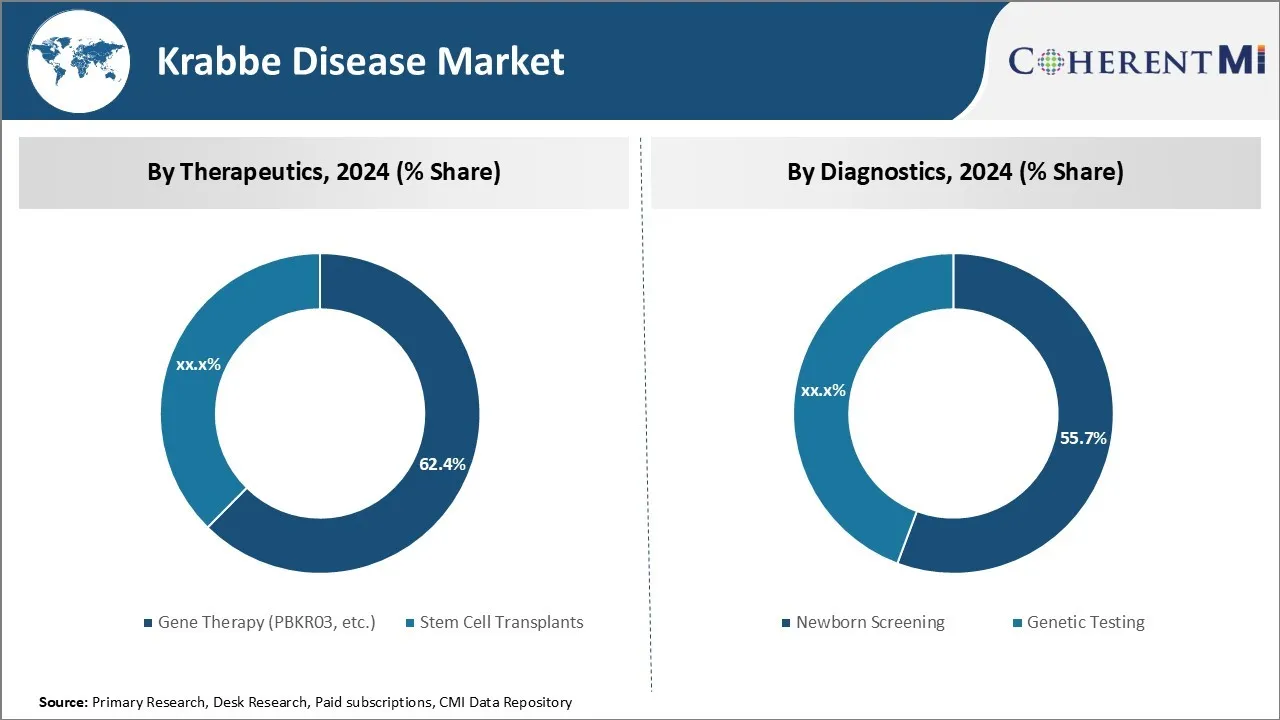

Insights, By Therapeutics: Gene Therapy (PBKR03, etc.) Remains High in Demand with its Promising Therapeutic Potential

In 2024, gene therapy segment is expected to account for 62.4% share of the Krabbe disease market. Gene therapy holds significant promise for the effective treatment of Krabbe disease by addressing the underlying genetic cause. Various gene therapy approaches are currently under investigation, with PBKR03 being the most clinically advanced.

PBKR03 aims to deliver the missing GALC gene directly into the brain using an adeno-associated viral vector. Early clinical trials have shown PBKR03 to be well-tolerated with no significant safety issues reported.

More importantly, PBKR03 has demonstrated therapeutic benefit by slowing disease progression in infant patients. The improvements seen on standards assessments of neurodevelopment are highly encouraging for the future of PBKR03 and gene therapy in general for Krabbe disease.

What gives PBKR03 its current market leadership is its targeting of the central nervous system through intravenous administration. This overcomes many of the challenges that had hindered previous gene therapy attempts. By delivering the therapeutic gene to brain cells systemically, invasive procedures are avoided.

Compliance is also increased as patients receive a simple intravenous infusion rather than more complex administration regimens. The clinical data establishing proof-of-concept for PBKR03 in halting disease progression further enhances its attractiveness over alternative approaches still in preclinical testing.

Insights, By Diagnostics: Newborn Screening Supports Early Detection and Intervention for Krabbe Disease

Newborn screening segment is also expected to hold 55.7% share of the Krabbe disease market in 2024. Newborn screening is also called newborn metabolic screening, involves testing a newborn's blood sample for several genetic and endocrine disorders within days of birth.

Among the conditions screened for in many public health programs is Krabbe disease. The ability to identify infants affected by Krabbe disease from a simple heel prick test is extremely valuable from a medical and public health perspective.

Early diagnosis allows for rapid initiation of available disease-modifying treatments, which clinical studies have shown work best when started presymptomatically. The therapies currently being utilized mostly aim to slow disease progression rather than provide a cure. Nevertheless, even a short delay in symptom onset can substantially improve long-term outcomes.

Newborn screening's dominance of the diagnostics segment for Krabbe disease arises from its role in facilitating early detection. Identifying affected newborns before clinical presentation occurs optimizes therapeutic options and prognosis. It is often the only means to an early diagnosis given nonspecific early symptoms.

While newer screening technologies may be adopted over time, newborn screening's mass population reach ensures it remains the front-line strategy for identifying those at-risk for this rare but devastating condition. Wider geographic newborn screening programs along with increased public health resources invested should help sustain newborn screening's market position.

Additional Insights of Krabbe Disease Market

- The incidence of Krabbe Disease is about 1 in 100,000 births globally, with higher rates in certain isolated populations due to genetic predispositions.

- Early diagnosis through newborn screening is critical for effective intervention, highlighting the importance of expanding screening programs in developing regions.

- Orchard Therapeutics has made strides in delivering gene therapies via intrathecal routes, offering hope to patients with neurodegenerative disorders like Krabbe.

Competitive overview of Krabbe Disease Market

The major players operating in the Krabbe disease market include Magenta Therapeutics, Passage Bio, Forge Biologics, Krystal Biotech, and Orchard Therapeutics.

Krabbe Disease Market Leaders

- Magenta Therapeutics

- Passage Bio

- Forge Biologics

- Krystal Biotech

- Orchard Therapeutics

Krabbe Disease Market - Competitive Rivalry, 2023

Krabbe Disease Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Krabbe Disease Market

- In May 2024, Passage Bio advanced its PBKR03 therapy into Phase II trials, targeting improved neurological outcomes in infants diagnosed with Krabbe Disease. Passage Bio's advancements in Krabbe Disease treatment have shown promising results in preclinical models. This trial began earlier and was designed as a dose-escalation study aimed at evaluating safety, tolerability, and initial efficacy.

- In February 2024, Magenta Therapeutics launched a stem cell transplant program, which showed promising results in early trials. Magenta Therapeutics is focused on stem cell therapies and has had several key developments, including programs like MGTA-117 and MGTA-145 for targeted conditioning and stem cell mobilization. Magenta has shown promising results in stem cell mobilization trials and is continuing to advance its pipeline, especially in areas like blood cancers and autoimmune diseases.

- In January 2024, Forge Biologics announced positive results from their preclinical studies involving FBX-101, a gene therapy designed to address GALC enzyme deficiency, which is the root cause of Krabbe Disease. This therapy uses an adeno-associated viral (AAV) vector to deliver the GALC gene. The preclinical data showed promising results in addressing peripheral nerve issues not corrected by traditional treatments. Following this success, Forge Biologics plans to transition to clinical trials.

Krabbe Disease Market Segmentation

- By Therapeutics

- Gene Therapy (PBKR03, etc.)

- Stem Cell Transplants

- By Diagnostics

- Newborn Screening

- Genetic Testing

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the Krabbe disease market?

The Krabbe disease market is estimated to be valued at USD 488.3 Mn in 2024 and is expected to reach USD 864.7 Mn by 2031.

What are the key factors hampering the growth of the Krabbe disease market?

High costs of gene therapy development and regulatory hurdles for rare disease treatments are the major factors hampering the growth of the Krabbe disease market.

What are the major factors driving the Krabbe disease market growth?

Growing research in gene therapy for rare diseases and increased awareness of lysosomal storage disorders are the major factors driving the Krabbe disease market.

Which are the leading therapeutics in the Krabbe Disease Market?

The leading therapeutics segment is gene therapy (PBKR03, etc.).

Which are the major players operating in the Krabbe disease market?

Magenta Therapeutics, Passage Bio, Forge Biologics, Krystal Biotech, and Orchard Therapeutics are the major players.

What will be the CAGR of the Krabbe disease market?

The CAGR of the Krabbe disease market is projected to be 8.51% from 2024-2031.