排尿器械市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

压力尿道器械市场按产品(Sling Systems、阴道器械、人工尿道器械、 Urethral Bulking Agent)、类型(外部器械、内部器械)、终端用户(医院、救护车中心、专科诊所)、地理(北美、拉丁美洲、亚太、欧洲、中东和非洲)。 本报告为上述各部分提供了价值(百万美元)。 ....

排尿器械市场 规模

市场规模(美元) Mn

复合年增长率6.9%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 6.9% |

| 市场集中度 | High |

| 主要参与者 | 波士顿科学公司, AscentX医疗公司, 科洛普拉斯公司, 贝克顿、迪金森和公司, ConvaTec集团 以及其他 |

请告诉我们!

排尿器械市场 分析

全球应激尿道失禁设备市场估计价值 2024年780.1百万美元 预计将达到 1130.3美元 2031年时 以复合年增长率增长 (CAGR)从2024年到2031年占6.9%. 老年人口中尿道失禁的流行日益普遍,加上对压力尿道失禁治疗程序的认识和采用不断提高,这些都推动了这个市场的增长。

市场正出现积极趋势,例如对最低侵入性治疗程序和先进技术产品的需求日益增加。 制造商正在集中力量开发新颖的丝袜、植入装置和其他治疗装置,以便更有效地满足病人的需要。 然而,发展中国家缺乏对治疗办法的认识,以及复杂的设备成本高昂,可能在一定程度上限制了预测期间的市场增长。

排尿器械市场 趋势

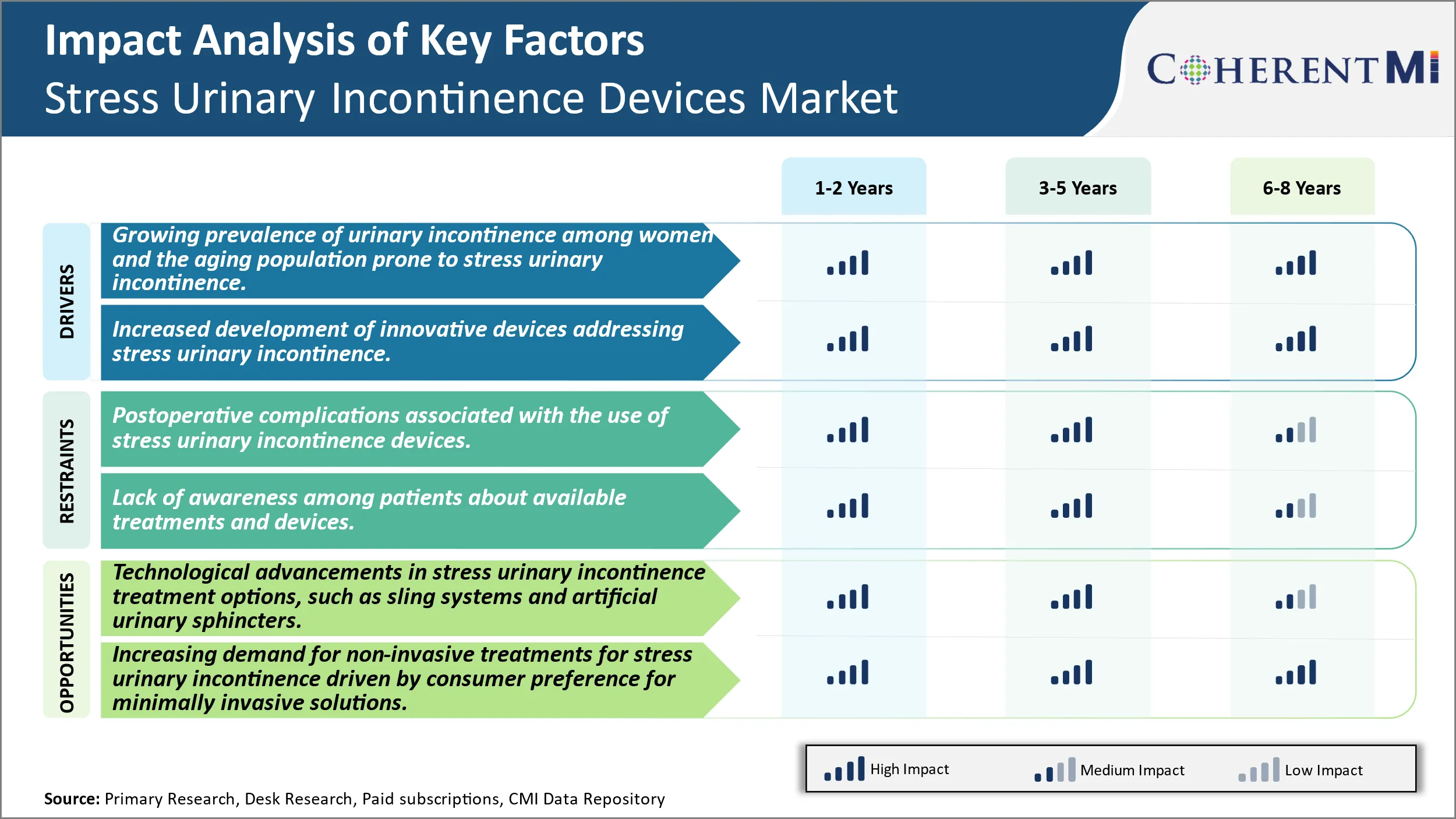

市场驱动器 -- -- 妇女尿道失禁的流行率不断提高,以及老年人对尿道失禁装置的压力。

尿失禁是影响全球数百万人的非常普遍的情况,妇女比男子更容易感染。 紧张性尿失禁装置是常见的失禁类型之一,其原因是骨盆底部肌肉衰弱,导致在咳嗽、打喷嚏或运动等体育活动中意外渗漏。 研究表明,泌尿失禁与年龄的增长密切相关,近50%的老年妇女受到某种形式的失禁的影响。 全世界人口正在迅速老龄化,从现在到2050年,65岁以上的老年患者的比例将从7%增至16%。 因此,随着预期寿命的延长,易患与年龄有关的病症,包括应激尿失禁装置的情况也会增加。

此外,由于怀孕和分娩期间的身体变化削弱了骨盆底部肌肉,与男子相比,妇女患上压力尿道失禁装置的可能性是男子的四倍。 分娩是妇女失禁的主要风险因素之一,因为阴道分娩给这些肌肉带来巨大压力。 随着全球女性劳动力参与的增加和妇女推迟分娩,在许多国家,每名妇女的生育数量已经减少。 然而,选择怀孕的妇女现在更有可能在晚年阶段发生泌尿失禁。 由于肥胖和吸烟与风险增加有关,生活方式的变化因素也助长了这一保健问题。

市场驱动 - 加大创新装置研发力度,应对排尿压力.

为应对巨大的临床需求,医疗技术公司加大了研发工作力度,为抗压尿失禁装置开发新的治疗方案,这些装置的入侵性较小,并比传统方法产生更好的效果。 一个经历重大创新的领域是中尿道支架,这已成为金本位非手术治疗。 使用更轻、更舒适的胶片和工具,允许通过较小的切口进行安插的先进螺旋设计使这些程序得到更好的容忍。 同样,进一步减少创伤的单刀切口和小刀也越来越受欢迎。 诸如神经调节系统等通过电刺激在神经层面解决失禁问题的可移植设备,也在临床试验和扩展治疗算法中表现出与手术等效.

3D打印可以使解剖形状的植入物适合个体患者解剖学. 正在研究可吸收的甲壳虫和脚手架,这些甲壳虫在愈合后降解,以防止长期外来的身体反应. 通过最低侵入性手段插入的非甲状腺中层植入处于发育阶段。 正在评价的替代疗法除螺旋外,还包括可注射散装剂以扩大弱小的组织、旨在组织再生的干细胞疗法以及用于保守管理的一线设备以推迟或避免手术。 创业者们正在用一些破坏性的想法来做贡献,比如一个小小的植入物来强化尿道封闭. 近年来对几种高级失禁装置的营销批准,突出了监管部门对新技术的认可,这些新技术比现有解决方案有明显优势。

围绕新技术应用的兴奋,有可能从根本上改变治疗环境和临床指南,提供更安全、更容易使用、更能容忍、更快恢复的解决方案。

市场挑战 - 与使用应激尿失禁设备相关的手术后并发症.

压力尿道失禁设备市场面临若干挑战,与使用各种可用设备治疗该病症引起的术后并发症有关。 中尿道支架等装置是最常用的选择之一,然而,在相当大比例的患者中可能会发生不良事件. 各种并发症,从尿道感染到侵蚀和穿孔,均造成邻近组织受损。 处理由此引起的疾病会增加保健费用,并对病人的福祉和结果产生不利影响。 这些风险还影响到设备的吸收,限制了某些产品线的扩展性。 制造商不断努力通过设计和材料改进降低复杂率,并确保遵循正确的外科技术。 然而,鉴于程序的性质,不可能完全消除并发症。 对病人进行关于潜在副作用的教育也至关重要,但并不能消除公布病例的负面宣传挑战。 总体而言,在效力与安全之间保持平衡仍然是一个关键优先事项,各种复杂情况对市场扩张构成威胁。

市场机会-压力尿道设备处理方案的技术进展,如Sling Systems和人工尿道螺旋桨。

压力尿失禁装置市场因治疗组合的不断技术进步而出现大量机会。 过去几十年中,中尿道螺旋系统和人工尿道螺旋管等设备发生了显著变化。 新的环形设计、网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网式网状网状网状网状网状网式网状网状网状网状网状网状网状网状网状网状网式网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状网状 同样,人工泌尿器现在提供强化的设计、控制、材料和定制,使更多的病人受益。 这种创新为制造商提供了重新激活现有产品线的机会,并推出了以临床证据为基础的较新的格式。 数字革命还支持开发最低侵入性和机器人辅助解决方案,创造收入流。 展望未来,生物吸收植入物、干细胞疗法或神经调节选择的到来将彻底改变市场格局。 总体而言,关于装置功能、生物材料和交付平台的持续研发确保了由优越临床命题驱动的市场增长的不断空间。

关键参与者采用的关键制胜策略 排尿器械市场

产品创新: 玩家专注于开发小说和改良产品来治疗SUI. 2017年,波士顿科学公司推出了Solyx单切切片支架系统,这是一种经过改进的中尿道支架系统,其特征是预型的Trocar尖端和自选送货系统. 临床研究发现,它的治愈率与术后疼痛较少且恢复时间更快的传统 s相似. 这有助于波士顿科学公司获得更大的市场份额.

战略采购: 公司通过战略性合并和收购加强了其SUI组合和能力。 2018年,科洛普拉斯特收购了Innovatec Medical,增加了他们的可调节性静脉疗法(ProACT)植入治疗应激,混合和轻度过度活动膀胱失禁. 这个新颖的非手术选择扩展了科洛普拉斯的治疗服务.

侵略性营销: 玩家投入大量资源,通过各种营销渠道对医生和病人进行关于SUI流行情况和可用解决方案的教育. 2014-2018年间,波士顿科学公司和Ethicon公司将其医疗销售代表翻了一番,使得医生更频繁的接触和更快的采用其纺丝制品. 结果,其市场份额从35%增至50%以上。

伙伴关系: 公司与外科医生合作开发和验证新技术,提高临床接受程度。 例如,Caldera Medical的Contour Transendermal AntiStress 尿道失禁装置(英语:Urinary Intunition Devices Implant)是与外科医生合作开发的. 2019年NEJM公布的5年临床试验结果呈阳性,导致FDA批准,医生迅速采纳.

这一分析突出了成功的战略,如创新、并购、营销投资和伙伴关系,这些战略通过扩大治疗选择和医生关系,帮助参与者在竞争性SUI市场上取得领导地位。 数据支持的实例提供了这些战略对业务的可衡量影响的背景。

分段分析 排尿器械市场

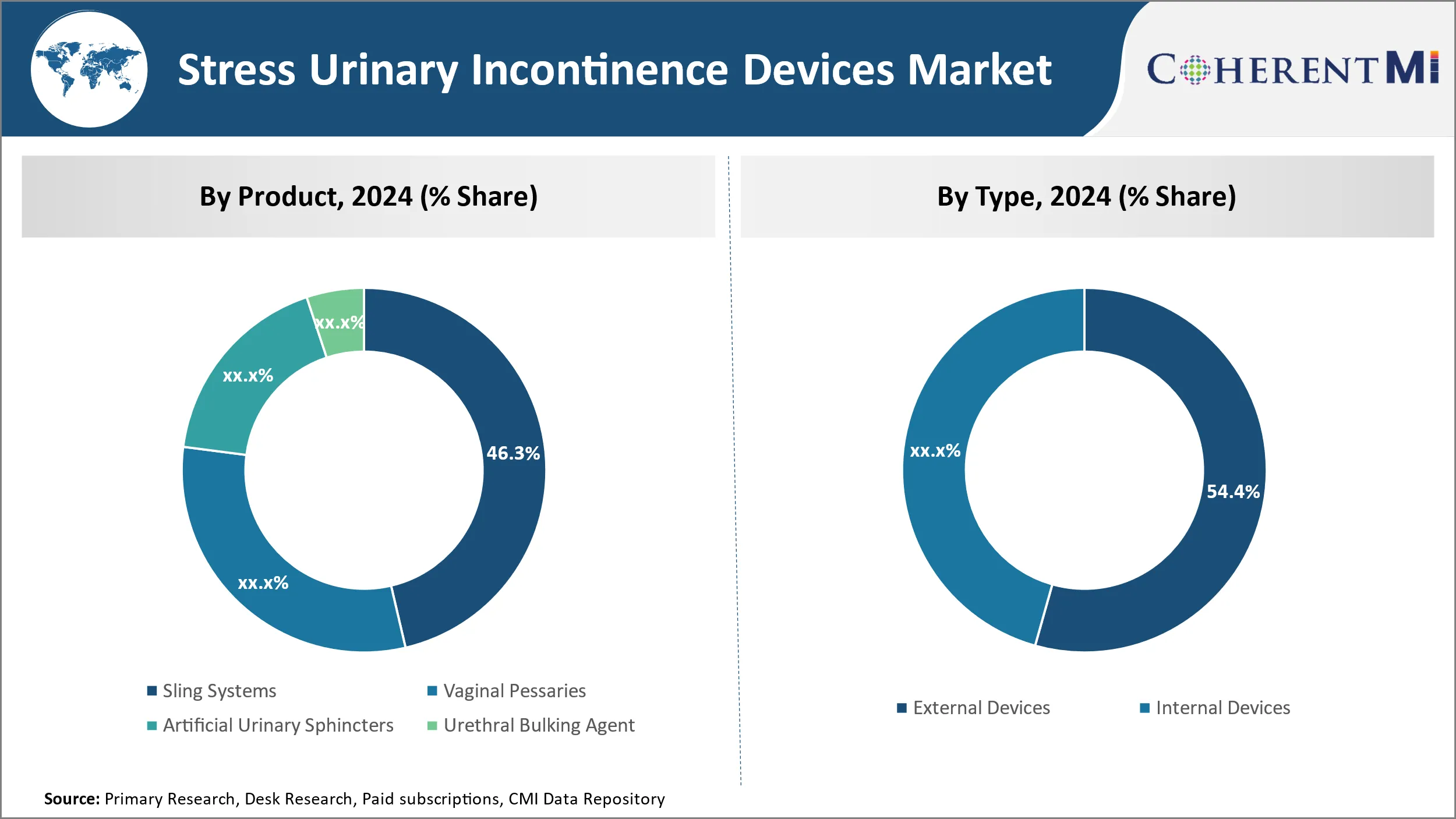

按产品、方便性和有效性来看,预测期间的Sling系统占据主导地位。

就按产品分类而言,Sling Systems为压力尿道失禁装置市场提供了最大份额的便利和效力。 螺旋系统是最低侵入性程序,不需要切割或破坏阴道或尿道等组织. 由于与替代治疗相比,康复时间缩短,出现并发症的风险减少,因此对病人和医生都具有吸引力。

滑翔系统通过从下方向尿道提供温和,恒定的支持来工作. 这种支持可以提升和改善尿道的对齐性,帮助防止在咳嗽,打喷嚏或运动等腹部压力增加时发生意外泄漏. 螺旋体模仿身体的自然支撑结构,一旦植入,不需要不断调整. 合成网状或病人自己的组织等不同的丝状材料提供了适合每个病人情况的定制选择.

方便的同日安置和迅速康复也意味着远离正常活动和工作的时间减少。 摇摆手术往往是在门诊进行,这进一步增加了他们对住院手术的吸引力。 最小的入侵和快速愈合帮助了螺旋系统成为了医生推荐的标准一线治疗. 不断创新线程设计、布置方法和网状技术,还有助于提高患者的满意度和对替代产品的流行程度。

透视(Insights),按类型,外部设备 DOMINTINTE 由于易感. 该部分预计在预测期间会增加。

按类型划分,由于非侵入性质和使用简便,预计2024年外部设备所占份额将达到54.4%。 吸收垫和防护内衣等外部装置在外穿戴,提供即时保护,无需手术或永久附着.

与通常需要植入体内的内部装置相比,外部选项避免了与医疗程序和长期不适或并发症有关的任何风险。 因此,患者倾向于选择外部解决方案作为第一防线,特别是对于温和到中度的病例. 其临时和可移动性质还意味着外部装置为尚未准备好或希望避免入侵性疗法的人提供安全求助。

简单地滑入防护服和携带额外垫子的方便,使外部管理变得离散和无麻烦。 这种在繁忙的每日日程安排上容易使用的做法,是促使人们偏爱需要调整、导管化或持续医疗监督的内部装置的一个关键因素。 不断的产品改进进一步加强了外垫,内衣和卫士的吸附,裁量和舒适程度,巩固了他们的受欢迎程度.

由最终用户判断,医院预计在预测期间会停产。

在最终用户看来,医院可望在其拥有的压力尿道失禁装置市场中贡献最高份额,使其能够在一个屋顶下提供综合治疗。 作为医疗机构,医院拥有所有必要的专门知识、基础设施和技术,能够满足失禁病人的全部护理需要。

它们提供由泌尿科医生、护士、理疗师和心理学家等多学科专家组成的团队,提供综合评价、定制治疗规划以及不同部门的协调治疗。 单一地点提供的诊断测试、外科手术选择、治疗会和后续服务多种多样,为单独咨询不同护理人员而畏缩的病人提供了方便,提高了遵守规定的程度。

此外,医院还配备了对准确诊断至关重要的高级设备,如空气动力学机器,以及创新的失禁程序所需的复杂手术设施。 住院护理通过监测药物的服用和难以在家中持续实现的强化物理治疗制度,在主要治疗后进一步帮助康复。

世界级护理的集中化甚至吸引了复杂和高风险的患者,使医院能够积累专门知识,巩固其在压力尿失禁装置管理中的领导能力. 政府方案还将公共资金输送到医院,加强医院对市场的巨大贡献。

附加见解 排尿器械市场

压力尿道失禁装置市场预计将显著增长,因为老年人和女性人口的发病率不断上升。 越来越重视非侵入性治疗和最低侵入性治疗,因此引入了诸如螺旋系统和阴道吸管等创新产品. 世界各地的老龄化人口,特别是41岁及41岁以上的妇女,由于盆腔地板变弱,患上排尿压力装置的风险更高。 波士顿科学和Coloplast等公司正在不断开发新技术和装置,这些技术和装置可望获得更大的市场渗透。 此外,改进补偿政策和提高对泌尿卫生的认识运动正在促进这些装置的采用。 病人不断增长的需求、不断进行的产品创新和有利的管理环境,使这一市场在未来十年内稳定增长。 然而,某些区域的认识有限和手术后并发症等挑战可能阻碍更广泛的采用。

竞争概览 排尿器械市场

在压力尿道器械市场经营的主要角色包括波士顿科学公司,AscentX医学公司,科洛普拉斯特公司,贝克顿,迪金森和公司,康瓦泰克集团PLC,Ethicon US, LLC(Johnson & Johnson),库克医学公司,Teleflex Incormation, Caldera医学公司,Prosurg, Inc., Labroie and Incontrol Medical.

排尿器械市场 领导者

- 波士顿科学公司

- AscentX医疗公司

- 科洛普拉斯公司

- 贝克顿、迪金森和公司

- ConvaTec集团

排尿器械市场 - 竞争对手

排尿器械市场

(主要参与者主导)

(竞争激烈,参与者众多。)

排尿器械市场 细分

- 按产品分列

- 悬挂系统

- 阴道

- 人工泌尿器

- 排泄剂

- 按类型

- 外部设备

- 内部设备

- 按最终用户

- 医院

- 救护车中心

- 专科诊所

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

排尿器械市场有多大?

全球应激尿失禁装置市场估计价值为780美元。 Mn在2024年,预计达到1130.3美元。 Mn在2031年之前完成.

压力排尿器械市场的CAGR是什么?

压力排尿器械市场的CAGR预计从2024年到2031年占6.9%.

哪些主要因素推动了压力尿失禁装置市场的增长?

尿道失禁症在妇女中日益普遍,以及容易发生紧张尿道失禁症的老年人口。 并增加开发应对精神紧张尿失禁装置的创新装置。 压力排尿器械市场的主要因素

哪些关键因素阻碍了压力尿道失禁设备市场的发展?

术后并发症与使用应激尿失禁装置有关,患者对可用的治疗和装置缺乏认识. 这些是妨碍压力尿道失禁设备市场发展的主要因素。

压力尿道失禁设备市场的主要产品是什么?

滑翔系统是主要的产品部分。

哪些主要角色在压力尿道失禁设备市场运营?

波士顿科学公司、AscentX医学公司、Coloplast公司、Becton、Dickinson and Company、ConvaTec Group PLC、Ethicon US、LLC(Johnson & Johnson)、Cook医学公司、Teleflex Incaded、Caldera医学公司、Prosurg、Labroie、InControl医学公司是主要参与者。