UAE 颜料市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

阿联酋颜料市场按产品类型(无机颜料、有机颜料、特制颜料)、应用(油漆和化妆品、印墨、塑料、皮革和纺织品、化妆品等)。 本报告为上述各部分提供了价值(百万美元)。....

UAE 颜料市场 规模

市场规模(美元) Mn

复合年增长率3.1%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 3.1% |

| 市场集中度 | Medium |

| 主要参与者 | 感官化妆技术, 巴斯夫·菲兹, 化学公司, 语文 公司, PPG工业股份有限公司 以及其他 |

请告诉我们!

UAE 颜料市场 分析

阿联酋颜料市场估计价值为: 2024年48.4百万美元 预计将达到 59.7美元 2031年时 以复合年增长率增长 (CAGR)从2024年到2031年占3.1%.

不断增长的建筑业和可支配收入不断增长,促使人们需要各种颜色和颜料,如油漆、涂层、塑料、建筑材料等。

UAE 颜料市场 趋势

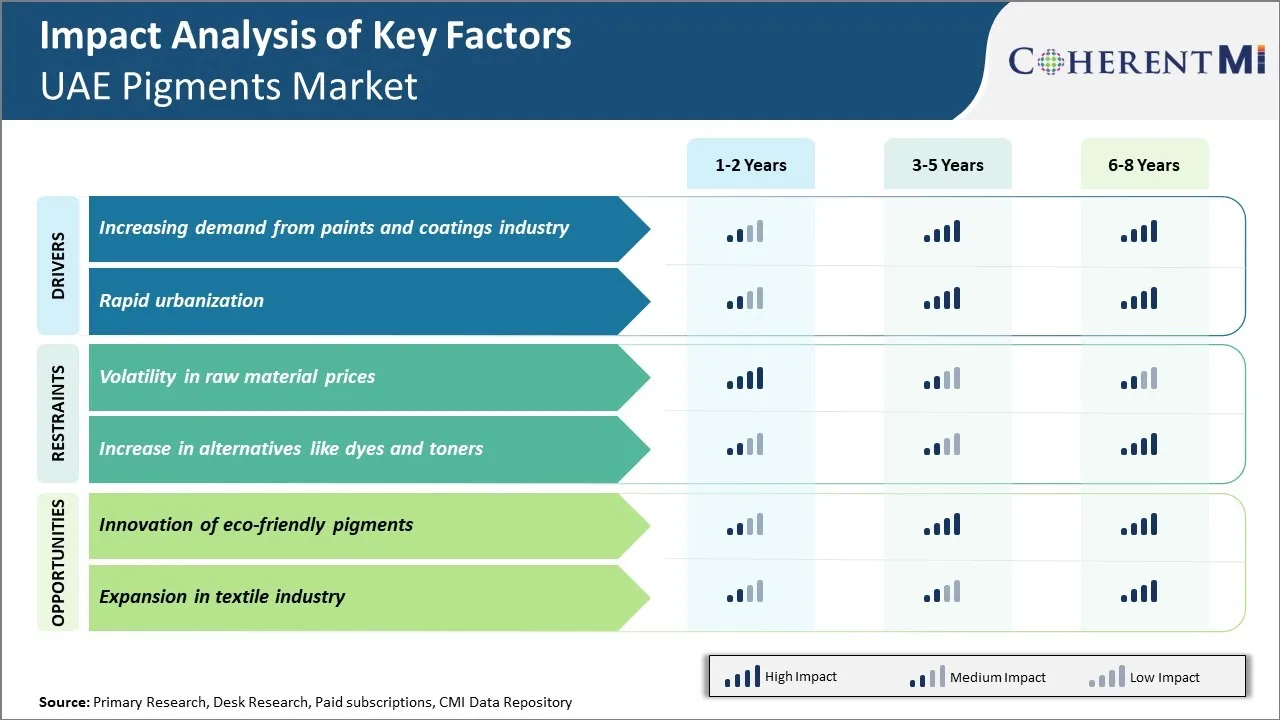

市场驱动器 - 油漆和服装业需求增加

近年来,阿联酋的油漆和涂料业由于该国基础设施的开发活动和迅速城市化而大幅增长。 政府大力投资新建项目,商业建筑,住宅建筑,道路,机场等,以适应日益增长的人口,发展世界级基础设施. 这对建筑和建筑部门的各种油漆和涂料产生了强烈的需求。

颜料在制造建筑物、汽车和各种工业应用中使用的不同种类的油漆和涂料方面发挥着至关重要的作用。 在油漆和涂层中添加颜料,以提供颜色、不透明、耐久性、防腐蚀和其他损害等特性。 随着建筑活动的兴旺,阿联酋对墙面油漆、纳梅尔油漆、水泥油漆、粉末涂料和其他建筑涂料的需求增加了一倍。 汽车工业也在稳步增长,可支配收入不断增加,这助长了对汽车油漆和涂料的需求。

政府的各种举措正在推动整个油漆业的增长。 例如,关于在建筑中使用更环保的低VOC涂料的指示,正在促使涂料制造商投资于先进的颜料技术.

市场驱动力-快速城市化

阿联酋在过去几十年里实现了巨大的经济增长和发展,从一个卑微的贸易前哨转变为现代的大都会. 由于强有力的领导和对城市规划的远见卓识,这是可能的。 政府进行了广泛的城市规划,以发展与世界一流基础设施和设施紧密相连的城市和社区。 诸如迪拜2020年计划、阿布扎比2030年经济愿景和其他城市发展蓝图等雄心勃勃的项目表明,在可预见的未来将继续快速城市化。

年增长率超过2%的不断增加的人口更多地集中在城市就业和生计中心。 这导致对住房、办公室、商场、医院和其他社会经济基础设施的需求惊人。 迪拜郊区、阿布扎比和其他主要城市明显可见扩大的城镇、居民区和卫星城市。 长期金质签证的引入正在吸引更多有技能的外籍人士和企业家来到阿联酋,进一步推动城市化趋势.

房地产业蓬勃发展是建筑活动的主要动力,涉及大量消费油漆、涂层和相关颜料。 高级建筑的完成和美学要求需要专门的色素配方.

市场挑战-原材料价格波动

阿拉伯联合酋长国颜料市场面临的主要挑战之一是原材料价格的波动。 颜料生产高度依赖氧化铁,铬化合物,镉化合物,二氧化钛等原料. 这些原材料的价格取决于全球商品价格波动和地缘政治问题。 原材料价格的任何上涨都会导致颜料制造商的总生产成本上升。 由于这一商品化学品部门的利润率已经很低,生产商无法将全部成本负担转嫁给客户。 这挤压了他们的利润。

制造商通常与原材料供应商签署年度供应合同,但无法完全避免价格冲击。 价格波动给色素生产商带来了财政规划困难,使其经营利润较低.

市场机会 -- -- 生态友好色素的创新

阿联酋颜料市场的一大机遇是生态友好颜料的创新. 随着环境意识的不断提高,监管者正在执行关于使用危险物质的严格法律。 含有铅、铬和镉等重金属的颜料正面临禁令或限制。 这为制造商开发基于无毒矿物和化合物的绿色颜料开辟了途径。

采用可持续技术的生产者将享有竞争优势。 投资于天然、生物降解和可回收色素配方的研发,有助于公司利用涂料、涂料、塑料和印刷墨水等整个终端使用行业对环境友好产品日益增长的需求。 这也是企业提高品牌价值和区别其供货的机会。

竞争概览 UAE 颜料市场

在阿联酋颜料市场运营的主要角色包括感知化妆技术,BASF FZE,Chemours公司,LANXESS公司,PPG Industries,Inc. BROOSOLUTIONS,福尔图阿联酋通用贸易有限责任公司,以及Al Lamaan贸易有限责任公司.

UAE 颜料市场 领导者

- 感官化妆技术

- 巴斯夫·菲兹

- 化学公司

- 语文 公司

- PPG工业股份有限公司

UAE 颜料市场 - 竞争对手

UAE 颜料市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 UAE 颜料市场

- 2023年1月26日,全球化学公司The Chemours Company为Ti-Pure TS-1510揭幕,这是一款高效的二氧化钛(TiO2)颜料,旨在增强塑料应用中的加工性能.

- 2022年1月3日,Clariant作为一家重点突出,可持续和创新的特产化公司,完成了其颜料业务向Heubach集团(“Heubach”)和SK Capital Partners(“SK Capital”)联合体的销售.

UAE 颜料市场 细分

- 按产品类型

- 无机颜料

- 有机颜料

- 特殊颜料

- 通过应用程序

- 绘画和装饰

- 打印墨水

- 塑料

- 皮革和纺织品

- 化妆品

- 其他人员

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

阻碍阿联酋颜料市场增长的关键因素是什么?

原材料价格的波动和染料和罐头等替代品的增加是阻碍阿联酋颜料市场增长的主要因素。

驱动阿联酋颜料市场增长的主要因素是什么?

油漆和涂料业和快速城市化的需求不断增加,是推动阿联酋颜料市场的主要因素。

谁是阿联酋颜料市场的主要产品类型?

主要产品类型段为无机颜料.

谁是在阿联酋颜料市场运营的主要角色?

BASF FZE、Chemours公司、LANXESS公司、PPG Industries、BOSOLUTIONS、Fortune Amirates总贸易有限责任公司和Al Lamaan贸易有限责任公司是主要参与者。

阿联酋颜料市场的CAGR是什么?

阿联酋颜料市场CAGR预计从2024年-2031年达到3.1%.