Conveying Equipment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Conveying Equipment Market is segmented By Type (Belt, Roller, Pallet, Overhead, Chain Conveyors, Others), By Product (Unit Handling, Bulk Handling, P....

Conveying Equipment Market Size

Market Size in USD Bn

CAGR3.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3.8% |

| Market Concentration | High |

| Major Players | Daifuku Co., Ltd., Siemens AG, Honeywell Intelligrated, TGW Logistics Group, BEUMER Group and Among Others. |

please let us know !

Conveying Equipment Market Analysis

The conveying equipment market is estimated to be valued at USD 52.12 Bn in 2024 and is expected to reach USD 67.66 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2031. This steady growth of the conveying equipment market can be attributed to factors like increasing automation across industries and rising adoption of advanced conveying technologies that improve efficiency.

Conveying Equipment Market Trends

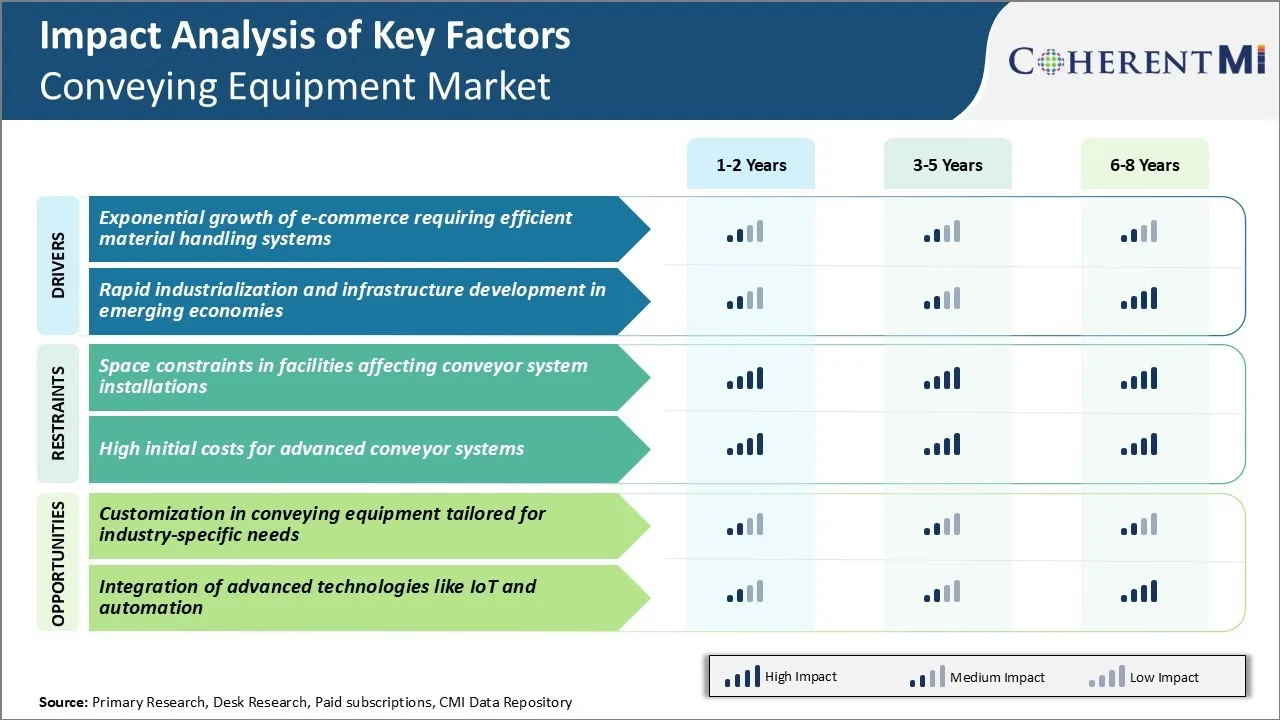

Market Driver - Efficient Material Handling for e-Commerce Growth

The rapid expansion of e-commerce across the globe has put tremendous pressure on logistics and supply chain networks. Exponential growth in online retail is fueling demand for conveying equipment that can efficiently sort, route, and transport packages and products within facilities.

Modern facilities are leveraging conveying equipment like belt conveyors, roller conveyors, slat conveyors, and floor conveyors along with automated guided vehicles to uniformly distribute workload. This ensures streamlined movement of goods right from receiving docks to sorting stations, inventory shelves, and packing areas.

The rise of online grocery and food delivery in particular is accelerating the requirement for hygienic and responsive conveying equipment. Stainless steel variants able to seamlessly integrate with picking applications are being widely adopted. Moreover, with customer expectations of transparency into order status, manufacturers are embedding sensors and IoT enablement into these machines. This will continue to create new growth avenues for players in the conveying equipment market.

Market Driver - Infrastructural Growth Powers Industrial Automation

Major economies are investing heavily in expanding their industrial and logistic infrastructure to sustain long term economic growth. This creates a highly conducive environment for conveyor system providers in the conveying equipment market.

Industries across segments like automobile, electronics, pharmaceuticals, chemicals, and heavy engineering are automating their plants by incorporating automated guided vehicles and integrated conveyor lines. Industries want to enhance throughput, reduce manual labor requirements and minimize ergonomic risks through mechanized movement of goods and tools within their premises. At the same time, adoption of Industry 4.0 principles is raising the bar for visualization, data connectivity and customizability of these systems.

Overall, the surge in manufacturing capacity additions coupled with worldwide emphasis on supply chain optimization is a core driver propelling the adoption of different product types in the conveying equipment market.

Market Challenge - Space Constraints in Facilities Affecting Conveyor System Installations

One of the major challenges faced by the conveying equipment market is the lack of available space in manufacturing facilities and warehouses for installing conveyor systems. As operations expand and throughput needs to increase, finding space to add more conveyors is becoming a struggle for many companies.

The constrained layout leaves little room for error during installation and commissioning of new conveyor segments. Specialized low-clearance conveyors need to be used in facilities with height restrictions. Space limitations also reduce routing options for conveyors and flexibility in layout design. This can sub-optimally increase travel distances and handling times.

The high costs involved in structural modifications or new construction deter companies from large-scale conveyor system upgrades. This acts as a barrier for the conveying equipment market to capitalize on the growing material handling needs within existing manufacturing footprints. Conveying equipment market players are challenged to innovate compact conveyor designs that maximize throughput within minimal footprints.

Market Opportunity - Customization in Conveying Equipment Tailored for Industry-specific Needs

A major opportunity for the conveying equipment market lies in customizing products to suit the unique material handling requirements of specific industries. No two manufacturing or warehouse processes are identical and a one-size-fits-all approach is rarely optimal.

Semiconductor fabrication requires ultra-clean conveyance in controlled environments. Developing modular, customizable conveyor platforms that can be configured as per industry application opens up new revenue streams. Partnerships with system integrators help roll out ready-to-install, customized conveyor packages for clients across industry verticals. This ensures a perfect fit within the client's existing workflow and optimized performance for their specific material types, throughput needs, and environmental conditions.

It also creates customer lock-in through a seamlessly integrated customized solution rather than off-the-shelf parts. A focus on customization allows the conveying equipment market to expand beyond commoditized standard products and command premium pricing supported by specialized values.

Key winning strategies adopted by key players of Conveying Equipment Market

Product Innovation: Innovation has been a key strategy for conveying equipment players to gain market share. For example, in 2017, Daifuku introduced its column-type automatic sorter which can handle up to 3000 parcels per hour, 30% higher than previous models.

Strategic Acquisitions: Acquisitions have enabled companies to expand their product portfolio and geographic reach. In 2019, Swisslog acquired GreyOrange to add robotics, AI, and material handling automation capabilities.

Focus on niche segments: Leading players like Murata Machinery have found success by focusing on specific industry niches like electronics manufacturing. They worked closely with customers to build application-specific solutions.

Adopting Industry 4.0 Practices: Global players in the conveying equipment market implemented advanced technologies like IoT, data analytics, and simulation software quite early. For example, BEUMER's BoxLogiX WMS solution launched in 2015 uses predictive analytics to optimize system performance.

Focus on quality and service: Key to long term success has been continual focus on product/service quality. For instance, systems from Interroll enjoy high reliability due to their decades long commitment to engineering excellence.

Segmental Analysis of Conveying Equipment Market

Insights, By Type: Belt Conveyors Gain Leadership in Conveying Equipment Space

In terms of type, belt contributes 35.5% share of the conveying equipment market due to its expansive functional scope. Belt conveyors effectively transport materials over both long and short distances either horizontally, inclined, or vertically. They are highly scalable and adaptable to myriad industrial needs given varied belt types, widths and structures. Manufacturers extensively customize belt conveyors for specific throughput levels and payload handling requirements.

Their operational flexibility has enabled belt conveyors to ably support high-volume, continuity-driven operations across industries. Food and beverage facilities widely leverage them for moving product batches seamlessly between processing lines and storage areas. Distribution centers rely on belt conveyors to efficiently sort inventories and expedite order fulfillment. Similarly, their compatibility with automation has augmented uptake in electronics factories where precision and throughput assume high importance.

Self-tracking functions minimize misalignment issues to deliver reliable performance over lengthy duty cycles. Together, these advantages have propelled belt conveyors to the forefront of handling diverse materials across industries.

Insights, By Product: Unit Handling Solutions Lead Wheeled Equipment Space on Back of Dynamic Functionality

In terms of product, unit handling contributes 47.3% share to the conveying equipment market given its dynamic functionality. Unlike bulk handling systems focused on mass loads, unit handlers facilitate discrete item movement with precision. They ably serve diversifying packaging, order configuration and tracking needs of end-use sectors.

Unit handlers capitalize on flexible conveying solutions like belt, roller, overhead and pallet varieties to independently transport inventory in totes, trays and cartons. Conveying equipment like lifts and turntables further augment three-dimensional movement of loads within confined spaces.

Growing e-commerce activities and personalized product options have amplified the role of unit handlers in quick order fulfilment. Unitization of shipments facilitates automated tracking and real-time inventory updates as well. Such advanced functionality and compatibility with Industry 4.0 needs have fueled unit handlers’ widespread acceptance.

Insights, By Application: Food Processing Sector Stimulates Conveying Gear Uptake Led by Safety and Quality Imperatives

Considering application, food & beverage generates the highest demand in conveying equipment market owing to stringent industry regulations. Food manufacturing adheres to elaborate safety, hygiene, and traceability standards to ensure quality and build consumer trust. Conveying equipment play a vital role in maintaining these quality imperatives.

Conveying equipment designed with hygienic finishes like polished stainless-steel surfaces offer contamination-free transport. Sealed motors and enclosed designs further prevent infiltration of extraneous matter. Certain variants with modular, cleanable construction ably support Clean-In-Place applications.

Collectively, such safety and quality characteristics have increased conveyor acceptance among food processors aiming to satisfy regulatory protocols and customer assurance. Their hassle-free scaling also supports expanding production capacities and new product line additions.

Additional Insights of Conveying Equipment Market

Asia-Pacific Market Share: In 2023, Asia-Pacific held a 42% share of the conveying equipment market, attributed to robust industrialization, burgeoning manufacturing activities, and the rapid expansion of e-commerce. Countries like China and India witness substantial demand for conveying systems across diverse industries, including automotive, electronics, and logistics.

Competitive overview of Conveying Equipment Market

The major players operating in the conveying equipment market include Daifuku Co., Ltd., Siemens AG, Honeywell Intelligrated, TGW Logistics Group, BEUMER Group, Vanderlande Industries, Murata Machinery, Ltd., Fives Group, Dematic, Swisslog Holding AG, Interroll Group, Viastore Systems GmbH, KNAPP AG, Hytrol Conveyor Company Inc., and Jervis B. Webb Company.

Conveying Equipment Market Leaders

- Daifuku Co., Ltd.

- Siemens AG

- Honeywell Intelligrated

- TGW Logistics Group

- BEUMER Group

Conveying Equipment Market - Competitive Rivalry, 2024

Conveying Equipment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Conveying Equipment Market

- In July 2023, Jungheinrich AG announced plans to construct a fully automated high-bay warehouse for Hawle Armaturen GmbH at their headquarters in Freilassing, Germany. The facility is designed to include advanced conveyor systems that will connect production lines to storage areas, facilitating efficient and ergonomic order picking.

- In June 2023, TGW Logistics Group announced the development of a high-performance e-commerce system for Skechers in Taicang, China. This system features an 8-mile (approximately 13-kilometer) network of energy-efficient KingDrive® conveyors, connecting various areas within the facility and linking to the existing fulfillment center.

- In April 2023, TGW Logistics Group introduced FullPick, an innovative system designed for fully automated mixed pallet picking. This solution enables grocery producers, retailers, and foodservice distributors to load both pallets and roll cages automatically in a store-friendly manner.

- In October 2022, Daifuku North America inaugurated a new manufacturing plant in Boyne City, Michigan. The 225,000-square-foot facility, representing a $26 million investment, consolidates operations from previous plants in Boyne City, Harbor Springs, and Pellston into a single location.

Conveying Equipment Market Segmentation

- By Type

- Belt

- Roller

- Pallet

- Overhead

- Chain Conveyors

- Others

- By Product

- Unit Handling

- Bulk Handling

- Parts & Attachments

- By Application

- Food & Beverage

- Warehouse & Distribution

- Automotive

- Airport

- Mining

- Electronics

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the conveying equipment market?

The conveying equipment market is estimated to be valued at USD 52.12 Bn in 2024 and is expected to reach USD 67.66 Bn by 2031.

What are the key factors hampering the growth of the conveying equipment market?

Space constraints in facilities affecting conveyor system installations and high initial costs for advanced conveyor systems are the major factors hampering the growth of the conveying equipment market.

What are the major factors driving the conveying equipment market growth?

Exponential growth of e-commerce requiring efficient material handling systems and rapid industrialization and infrastructure development in emerging economies are the major factors driving the conveying equipment market.

Which is the leading type in the conveying equipment market?

The leading type segment is belt conveyer.

Which are the major players operating in the conveying equipment market?

Daifuku Co., Ltd., Siemens AG, Honeywell Intelligrated, TGW Logistics Group, BEUMER Group, Vanderlande Industries, Murata Machinery, Ltd., Fives Group, Dematic, Swisslog Holding AG, Interroll Group, Viastore Systems GmbH, KNAPP AG, Hytrol Conveyor Company, Inc., and Jervis B. Webb Company are the major players.

What will be the CAGR of the Conveying Equipment Market?

The CAGR of the conveying equipment market is projected to be 3.8% from 2024-2031.