Marché des caméras à grande vitesse ANALYSE DE LA TAILLE ET DU PARTAGE - TENDANCES DE CROISSANCE ET PRÉVISIONS (2024 - 2031)

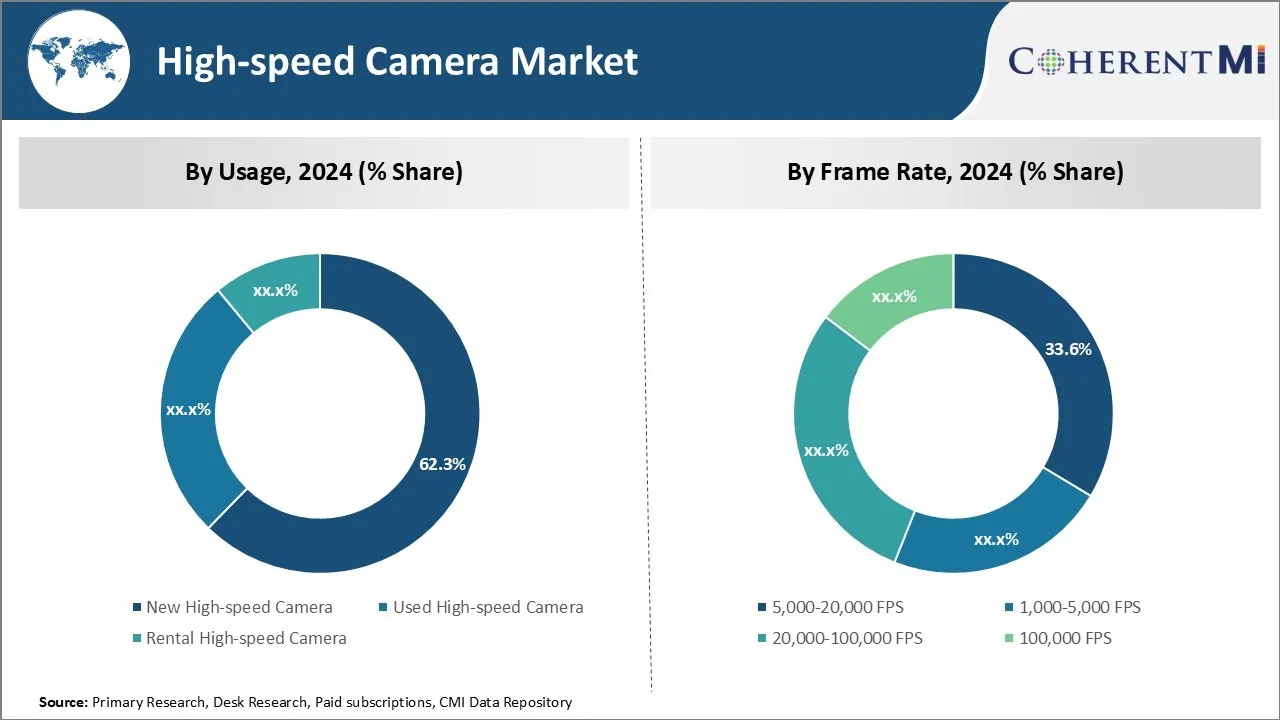

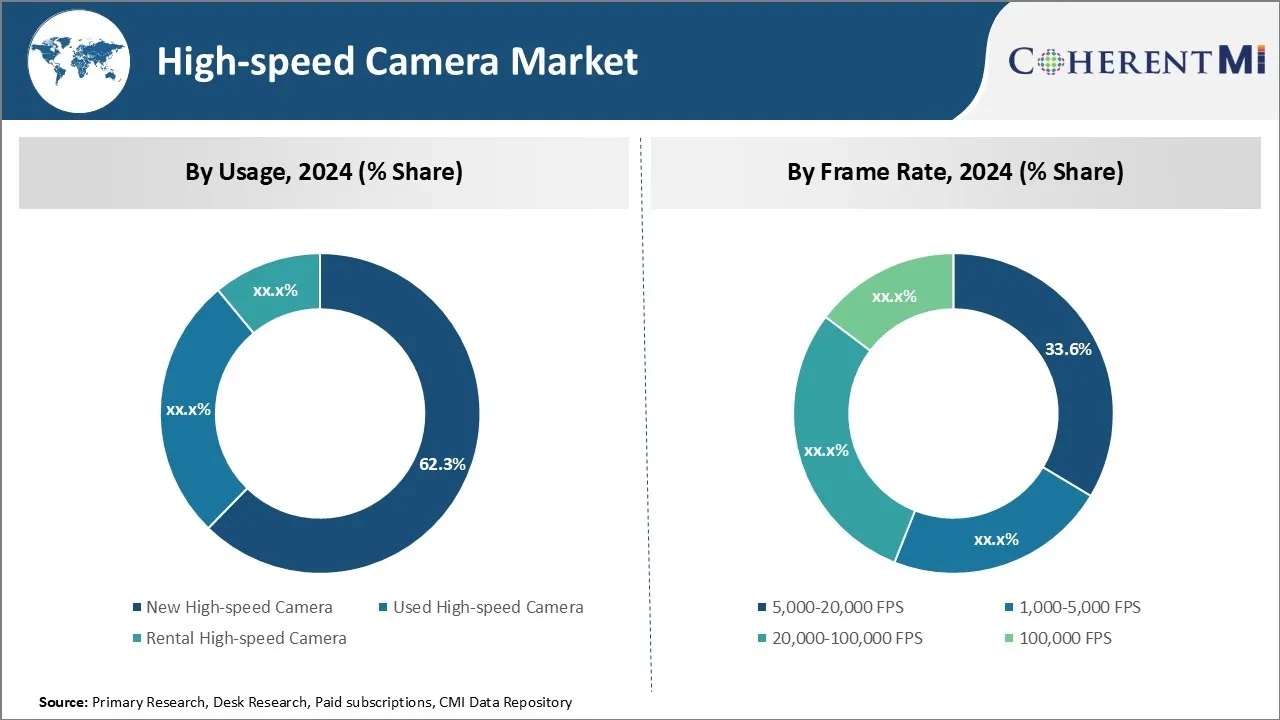

Le marché des caméras à grande vitesse est segmenté par utilisation (nouvelle caméra à grande vitesse, caméra à grande vitesse d'occasion, caméra à gr....

Marché des caméras à grande vitesse Taille

Taille du marché en USD Mn

TCAC12.65%

| Période d'étude | 2024 - 2031 |

| Année de base de l'estimation | 2023 |

| TCAC | 12.65% |

| Concentration du marché | Medium |

| Principaux acteurs | Recherche sur la vision, Inc., Société Olympus, AOS Technologies AG, NAC Technologie de l'image, Mikrotron GMBH et parmi d'autres |

Merci de nous le faire savoir !

Marché des caméras à grande vitesse Analyse

Le marché des caméras à grande vitesse est estimé à USD 666,81 Mn en 2024 et devrait atteindre USD 1 535,1 Mn par 2031, en croissance à un taux de croissance annuel composé (CAGR) de 12,65 % de 2024 à 2031. On s'attend à ce que le marché des caméras à grande vitesse enregistre une croissance significative, ce qui est attribuable à des facteurs tels que l'adoption croissante de caméras à grande vitesse dans l'analyse sportive et l'augmentation des investissements dans les activités de recherche et de développement scientifiques.

Marché des caméras à grande vitesse Tendances

Pilote du marché - Demande croissante de précision dans les applications industrielles

Avec la concurrence croissante dans les industries manufacturières, le besoin de précision et de précision s'est considérablement accru au fil des ans. Les caméras à grande vitesse permettent de capturer des séquences de mouvements rapides image par image, ce qui aide à analyser les processus et les problèmes de dépannage qui se produisent en fractions de seconde. Ce niveau de précision permet de minimiser les déchets et d'améliorer le contrôle de la qualité. Cela aide à optimiser les processus pour les industries comme l'électronique, les produits pharmaceutiques, la transformation des aliments, etc.

Les caméras à grande vitesse sont de plus en plus déployées sur les lignes de production pour inspecter les pièces à grande vitesse. Ils jouent un rôle vital dans la détection même la plus subtile des défauts ou des déviations par rapport aux spécifications. Cela permet de prendre des mesures correctives en temps réel avant que les défauts à grande échelle n'affectent les produits finis. Les industries sont en mesure de réduire les coûts de retravail et de renforcer l'efficacité opérationnelle.

Au fur et à mesure que les processus de fabrication deviennent plus automatisés grâce à la robotique avancée, la nécessité de surveiller la vitesse et les mouvements des lignes de production à un niveau très granulaire conduit le marché des caméras à grande vitesse. Leur adoption garantit la compétitivité de la fabrication en éliminant les défauts et en minimisant les temps d'arrêt grâce à un entretien prédictif.

Opportunité de marché - Adoption de caméras haute vitesse dans les essais de sécurité automobile

Les essais et la conformité en matière de sécurité automobile sont devenus très réglementés au fil des ans. Le développement de systèmes avancés d'assistance au conducteur et de fonctions de conduite automatisées nécessite une validation approfondie. Les caméras à grande vitesse offrent un moyen objectif d'évaluer scientifiquement les composants automobiles, les intérieurs et les véhicules complets dans les essais de choc ou dans d'autres conditions réelles simulées.

Les organismes de réglementation s'appuient également sur des preuves vidéo recueillies par des caméras à grande vitesse pour certifier la conformité des nouveaux véhicules. D'autres applications incluent la validation et l'étalonnage des systèmes d'assistance avancés au conducteur dans diverses conditions. Les systèmes de caméras installés à l'intérieur des conducteurs fictifs enregistrent les données visuelles pour optimiser les interfaces et les réponses.

En attendant, les caméras à grande vitesse montées à l'extérieur permettent d'optimiser les systèmes de sécurité actifs grâce à des scénarios de cas de bord dans des conditions contrôlées. À mesure que les véhicules autonomes continuent à se développer, les caméras à grande vitesse jouent un rôle clé dans l'essai de la robustesse des logiciels et du matériel grâce à une collecte méticuleuse des données. Cela devrait jouer un rôle important dans la croissance du marché des caméras à grande vitesse dans les années à venir.

Défi du marché - Coûts élevés des systèmes de caméras à grande vitesse

Les coûts élevés associés aux systèmes de caméras à grande vitesse posent un défi important pour l'adoption généralisée dans diverses industries. Ces caméras disposent de capteurs d'image et d'optique avancés qui permettent de capturer des objets et des événements en mouvement rapide, mais cette technologie de pointe vient à une prime.

Pour de nombreuses petites organisations et laboratoires de recherche, des prix aussi élevés constituent un obstacle à l'expérimentation de la photographie à grande vitesse. De plus, le coût des accessoires et du matériel de soutien comme les lentilles, l'équipement d'éclairage augmentent encore le total des dépenses. Bien que les systèmes haut de gamme offrent un rendement inégalé, leurs points de prix inaccessibles limitent leur utilisation aux grands ministères de R-D ou à la recherche scientifique avec un financement suffisant.

Opportunités de marché - Demande croissante dans le développement de véhicules autonomes

L'industrie automobile autonome en plein essor offre une opportunité majeure pour le marché des caméras à grande vitesse. Les voitures auto-conduites comptent sur des caméras et des capteurs avancés pour capturer les détails de l'environnement environnant à la vitesse de la foudre pour naviguer en toute sécurité dans les conditions de circulation. Pour évaluer comment les systèmes perçoivent et réagissent à différents scénarios routiers, il faut des caméras à grande vitesse capables d'analyser les séquences de mouvement image par image. Les principaux constructeurs automobiles et les entreprises technologiques investissent activement dans le développement autonome des véhicules par le biais de programmes de recherche et d'essais.

Au fur et à mesure que les activités dans le domaine de la technologie autonome des véhicules s'étendent à l'échelle et à la portée, la demande de caméras industrielles de haute performance connaîtra une croissance exponentielle. Étant donné que les véhicules autonomes devraient devenir plus courants au cours de la prochaine décennie, les fournisseurs de caméras à grande vitesse peuvent s'attendre à ce que les vents arrière du marché soient soutenus pour soutenir leurs activités.

Stratégies gagnantes clés adoptées par les principaux acteurs de Marché des caméras à grande vitesse

Mettre l'accent sur l'innovation technologique continue: En 2020, Phortron a lancé le FASTCAM Mini AX100 qui permet de capturer des vidéos ultra-rapides à 1 million d'images par seconde (fps) en pleine résolution. Cette innovation permet aux acteurs de rester en avance sur la concurrence et d'attirer de nouveaux clients.

Élargir le portefeuille de produits entre les points de prix: Des leaders comme Phoron et Olympus offrent une large gamme de caméras haute vitesse pour différents budgets et cas d'utilisation.

Focus sur les applications de nicheEn 2018, Vision Research a lancé Phantom v2512 pour les camps d'essais d'accident automobile qui les ont aidés à gagner plus de 15% de part de marché dans cette verticale.

Construire un réseau de distribution solide: Les leaders comme Phortron et Olympus disposent d'une vaste distribution mondiale et de réseaux de soutien après-vente sur les grands marchés. Par exemple, Phoron compte plus de 50 distributeurs dans le monde. Un réseau de distribution solide augmente la portée des produits, facilite le soutien à la clientèle et entraîne des cycles d'achat continus.

Analyse segmentaire de Marché des caméras à grande vitesse

Insights, par utilisation: Demande du client pour les lecteurs d'images ultra-rapides

En termes d'utilisation, la nouvelle caméra haute vitesse contribue à la part la plus élevée du marché qui possède à la demande croissante de clients nécessitant des images ultra-rapides. Plusieurs facteurs contribuent à cette demande forte et cohérente. Les activités de recherche-développement continuent de repousser les frontières de la science et de la technologie, exigeant des caméras à grande vitesse de plus en plus sophistiquées pour capter les phénomènes fugaces.

De plus, l'industrie du divertissement compte fortement sur des caméras de pointe pour filmer des séquences spectaculaires d'effets spéciaux pour des films, des publicités et des émissions de télévision. Les franchises sportives utilisent également de nouvelles caméras pour analyser les performances sportives et améliorer les techniques de coaching.

À mesure que la demande des clients augmente pour des applications dans plusieurs secteurs, les fabricants introduisent régulièrement de nouveaux modèles de caméra innovants optimisés pour les dernières exigences. Cette traction soutenue du client est le principal conducteur satisfaisant la plus grande part du marché des caméras à grande vitesse grâce à de nouveaux achats de caméras.

Perspectives, par utilisation : progrès technologiques continus Demande d'appareils photo usagés

En termes d'utilisation, la caméra haute vitesse utilisée capture également 33,6 % du marché de la caméra haute vitesse en 2024, en raison des améliorations technologiques en cours. Bien que les besoins de la recherche, de l'analyse sportive et de la création d'effets visuels évoluent constamment, de nombreuses applications établies ont maintenu leur utilisation pendant plusieurs années.

Cependant, l'industrie de la caméra à grande vitesse innove à un rythme rapide en introduisant de nouveaux modèles avec des spécifications améliorées sur une base annuelle. Les laboratoires, les écoles et les petites maisons de production achètent des caméras d'occasion qui offrent des spécifications adéquates à des prix inférieurs à ceux des nouveaux équivalents.

De plus, les amateurs et les créateurs indépendants alimentent la demande de caméras d'occasion abordables pour explorer la photographie à grande vitesse sans grands investissements initiaux. Dans l'ensemble, un marché prospère de la rénovation et de la location émerge pour engager des clients sensibles aux coûts et recycler les anciens stocks de caméras pour répondre à la demande continue sur le marché de la caméra haute vitesse.

Insights, selon le taux de cadre : les caméras spécialisées à haut taux de cadre servent les besoins de niche

En termes de taux d'encadrement, le segment de 5 000 à 20 000 FPS représente la part la plus élevée du marché des caméras à grande vitesse. Cependant, la demande existe aussi pour les caméras plus spécialisées à haut débit de cadre. Appareils photo offrant 20 000 à 100 000 FPS et plus de 100 000 FPS répondent à des applications critiques mais étroites. Le développement de domaines comme la recherche sur la combustion et les études sur la dynamique des fluides repose sur ces caméras ultra-rapides pour visualiser des événements transitoires extraordinairement rapides.

De même, les essais avancés d'accident automobile et l'analyse des composants aérospatiaux exigent la capture d'incidents à l'échelle de millisecondes avec des détails précis seulement grâce à des taux de cadre très élevés. Alors que les prix de ces caméras spécialisées exigent des primes élevées, les clients stratégiques justifient les coûts des applications centrales pour progresser dans diverses industries. Les fabricants de caméras réduisent continuellement la taille des caméras et stimulent les taux pour répondre aux besoins de longue distance de la recherche et du développement de pointe grâce à des modèles spécialisés à taux d'encadrement élevé.

Informations supplémentaires sur Marché des caméras à grande vitesse

- Crash automobile Essais : Les caméras à grande vitesse sont essentielles pour recueillir des données détaillées lors des essais de choc, aidant ainsi les constructeurs à améliorer les caractéristiques de sécurité des véhicules.

- Biomécanique Recherche : En sciences du sport et en études médicales, ces caméras analysent les mouvements humains pour améliorer les performances et prévenir les blessures.

- Dépannage industriel : L'imagerie à grande vitesse identifie les défauts dans les processus de fabrication en enregistrant les machines à des taux de trame élevés pour détecter les dysfonctionnements.

- Le secteur de l'automobile et du transport représente environ 30 % du marché des caméras à grande vitesse, sous l'effet de règlements de sécurité rigoureux.

- La région de l ' Asie et du Pacifique devrait connaître le taux de croissance le plus élevé du marché mondial des caméras à grande vitesse en raison de l ' industrialisation croissante et des investissements dans la recherche-développement.

Aperçu concurrentiel de Marché des caméras à grande vitesse

Les principaux acteurs du marché des caméras à grande vitesse sont Vision Research, Inc., Olympus Corporation, AOS Technologies AG, NAC Image Technology, Mikrotron GMBH, Fastec Imaging Corporation, Weisscam GmbH, Del Imaging Systems, Phortron Limited, Optronics GmbH et Motion Capture Technologies.

Marché des caméras à grande vitesse Leaders

- Recherche sur la vision, Inc.

- Société Olympus

- AOS Technologies AG

- NAC Technologie de l'image

- Mikrotron GMBH

Marché des caméras à grande vitesse - Rivalité concurrentielle

Marché des caméras à grande vitesse

(Dominé par des acteurs majeurs)

(Très compétitif avec de nombreux acteurs.)

Développements récents dans Marché des caméras à grande vitesse

- En mars 2024, Vision Research a présenté Phantom Miro C321 Air, une caméra à grande vitesse adaptée aux essais en vol. Cette innovation devrait améliorer les applications des systèmes aériens habités et non habités.

- En mars 2022, Phoron Ltd. sort le Fastcam Nova R5, une caméra haute vitesse offrant jusqu'à 12 800 images par seconde à la résolution mégapixel. Ce développement renforce les capacités d'essais industriels et de recherche scientifique, permettant une meilleure analyse des phénomènes transitoires rapides.

Marché des caméras à grande vitesse Segmentation

- Par utilisation

- Nouvelle caméra haute vitesse

- Caméra haute vitesse usagée

- Caméra haute vitesse de location

- Par taux d'encadrement

- 5 000 à 20 000 FPS

- 1 000 à 5 000 FPS

- 20 000 à 100 000 FPS

- 100 000 FPS

- Par demande

- Automobile et transports

- Aéronautique et défense

- Recherche et conception

- Médias et divertissements

- Sports

- Santé

- Autres

Souhaitez-vous explorer l'option d'achat sections individuelles de ce rapport ?

Questions fréquemment posées :

Quelle est la taille du marché des caméras à grande vitesse ?

Le marché des caméras à grande vitesse est estimé à USD 666,81 Mn en 2024 et devrait atteindre USD 1535.1 D'ici 2031.

Quels sont les facteurs clés qui entravent la croissance du marché des caméras à grande vitesse?

Les coûts élevés des systèmes de caméras à grande vitesse et les défis de maintenance et d'étalonnage sont les principaux facteurs qui entravent la croissance du marché des caméras à grande vitesse.

Quels sont les principaux facteurs de la croissance du marché des caméras à grande vitesse?

La demande croissante de précision dans les applications industrielles et l'adoption de caméras à grande vitesse dans les essais de sécurité automobile sont les principaux facteurs à l'origine du marché des caméras à grande vitesse.

Quelle est l'utilisation principale dans le marché de la caméra haute vitesse?

Le segment d'utilisation leader est la nouvelle caméra à grande vitesse.

Quels sont les principaux acteurs du marché de la caméra haute vitesse ?

Vision Research, Inc., Olympus Corporation, AOS Technologies AG, NAC Image Technology, Mikrotron GMBH, Fastec Imaging Corporation, Weisscam GmbH, Del Imaging Systems, Phortron Limited, Optronics GmbH et Motion Capture Technologies sont les principaux acteurs.

Quel sera le CAGR du marché des caméras haute vitesse?

Le TCAC du marché des caméras à grande vitesse devrait atteindre 12,65 % entre 2024 et 2031.