Marché de la rétinopathie diabétique proliférative ANALYSE DE LA TAILLE ET DU PARTAGE - TENDANCES DE CROISSANCE ET PRÉVISIONS (2024 - 2031)

Le marché de la rétinopathie diabétique proliférative est segmenté par traitement (anti-VEGF, chirurgie laser, vitrectomie), Par type de drogue (médic....

Marché de la rétinopathie diabétique proliférative Taille

Taille du marché en USD Bn

TCAC11.55%

| Période d'étude | 2024 - 2031 |

| Année de base de l'estimation | 2023 |

| TCAC | 11.55% |

| Concentration du marché | Medium |

| Principaux acteurs | Novartis, Roche, Bayer, Regeneron Pharmaceutiques, Allergan et parmi d'autres |

Merci de nous le faire savoir !

Marché de la rétinopathie diabétique proliférative Analyse

Le marché de la rétinopathie diabétique proliférative est estimé à USD 2,42 Bn en 2024 et devrait atteindre USD 5.2 Bn d'ici 2031, en croissance à un taux de croissance annuel composé (CAGR) de 11,55% de 2024 à 2031. Le marché est principalement motivé par l'augmentation des cas de diabète dans le monde entier. Une forte gamme de produits et la disponibilité accrue de diverses options de traitement se révèlent propices à la croissance du marché.

Marché de la rétinopathie diabétique proliférative Tendances

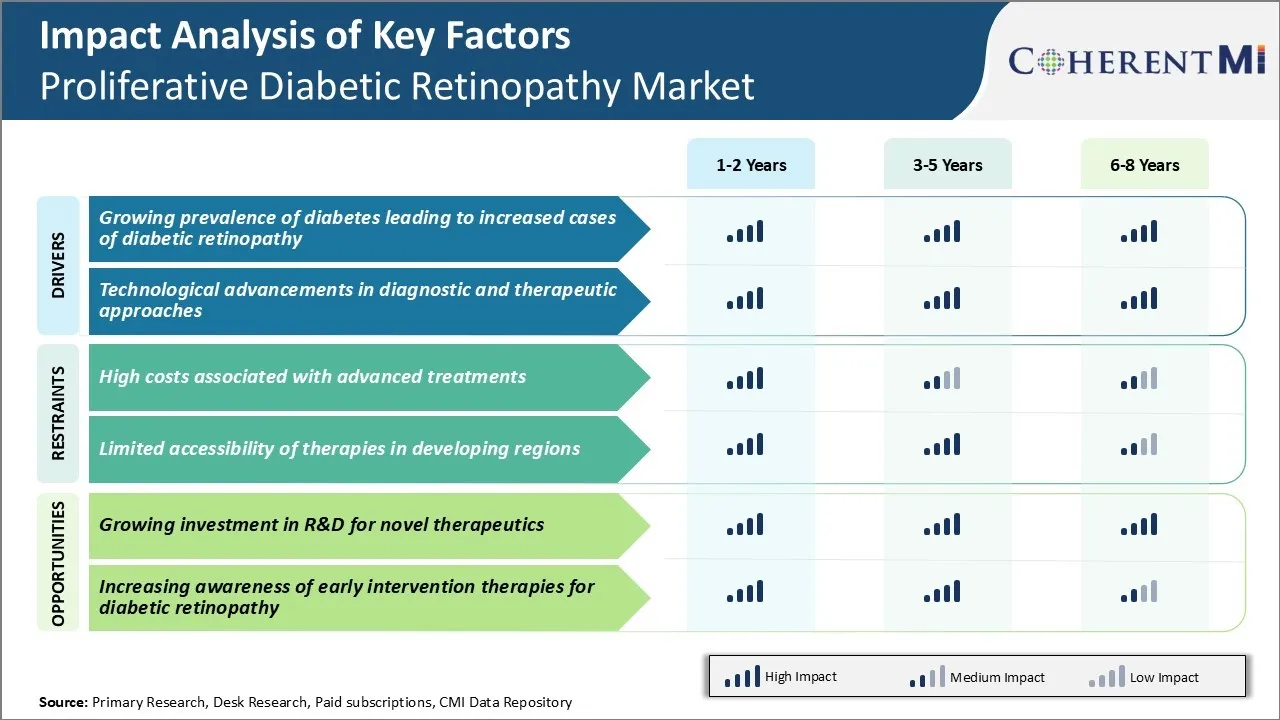

Facteurs du marché - Prévalence croissante du diabète entraînant une augmentation des cas de rétinopathie diabétique

Le diabète est une maladie chronique qui a touché des millions de personnes dans le monde au cours des dernières décennies. Le diabète de type 1 et 2 altère les petits vaisseaux sanguins de la rétine, entraînant une rétinopathie diabétique. On estime que presque tous les diabétiques de type 1 et plus de 60% des diabétiques de type 2 développent une forme de rétinopathie après 20 ans de vie avec cette maladie métabolique.

Comme un plus grand nombre de personnes sont diagnostiquées chaque année en raison de l'évolution des modes de vie et des niveaux d'activité physique inadéquats, le bassin de patients à risque pour développer des complications rétiniennes continue de croître rapidement.

Selon les dernières estimations de l'OMS, près d'un demi-milliard d'adultes vivaient avec le diabète dans le monde en 2019. Ce nombre a doublé depuis 1980 et devrait encore augmenter au cours des prochaines années en raison du vieillissement des populations et de la prévalence croissante de l'obésité. Les pays en développement, en particulier, ont connu des hausses massives des taux d'incidence du diabète dues à l'occidentalisation croissante des régimes alimentaires et à la réduction de l'effort physique dans la vie quotidienne.

Tous ces cas de diabète nouvellement diagnostiqués alimenteront la demande de dépistage et de traitement de la rétinopathie à long terme, car des dommages rétiniens surviennent des années après le début de la maladie métabolique et sa prise en charge inadéquate.

Pilote du marché - Progrès technologiques dans les approches diagnostiques et thérapeutiques

Les progrès technologiques importants sont un autre facteur important qui stimule le marché de la rétinopathie diabétique proliférative. Divers nouveaux systèmes d'imagerie diagnostique et médicaments/dispositifs thérapeutiques ont amélioré la capacité de détecter la rétinopathie au début et d'offrir des interventions thérapeutiques plus ciblées.

L'imagerie numérique à large champ comme Optos et Heidelberg rétina angiographie ont remplacé les caméras mydriatiques classiques pour le dépistage non mydriatique et ultra-large champ rétinien. Elles offrent des avantages d'un plus grand champ de vision pour détecter les lésions périphériques, une résolution plus élevée et une portabilité plus facile. Sur le plan thérapeutique, les injections d'anti-VEGF par des innovations telles que les systèmes d'implants Ozurdex et les systèmes d'administration portuaires ont rendu les procédures d'ablation vasculaire moins invasives et plus efficaces.

Les progrès de la photocoagulation au laser, y compris le laser à balayage de motifs (PASCAL), le laser navigué et la taille automatisée de points variables permettent également une photocoagulation plus précise avec moins de dommages collatéraux. Les technologies chirurgicales ont également progressé, comme les systèmes de vitrectomie de petite jauge et la vitrectomie épargnante des lentilles. Ils permettent une chirurgie plus rapide, une fermeture sans suture et une réadaptation visuelle précoce.

Les chercheurs étudient en outre les pharmacothérapies au-delà des anti-VEGF et des nouvelles technologies de revêtement pour la livraison contrôlée de médicaments par des implants insérés dans les yeux. De tels développements continus dans l'imagerie de la rétinopathie, le dépistage et les traitements permettent une détection plus précoce ainsi que des approches de traitement personnalisées adaptées aux besoins de chaque patient.

Défi du marché - Coûts élevés associés aux traitements avancés

L'un des principaux défis à relever par le marché de la rétinopathie diabétique proliférative est le coût élevé associé aux options de traitement avancées telles que les injections anti-VEGF et la chirurgie au laser. Ces méthodes de traitement nécessitent un équipement spécialisé, des rendez-vous de suivi et une surveillance réguliers, et une réadministration fréquente de médicaments dans certains cas. Cela rend le coût global du traitement assez élevé.

Par exemple, une seule injection intravitréenne de médicaments anti-VEGF comme le ranibizumab ou l'aflibercept peut coûter des milliers de dollars. Les patients doivent souvent recevoir des injections multiples périodiquement pour gérer leur état. De même, les procédures comme la photocoagulation au laser panrétinienne nécessitent des lasers spécialisés et des installations chirurgicales qui contribuent de façon significative aux coûts globaux.

La charge économique des traitements fréquents et coûteux pose des problèmes d'accès et d'adhésion aux traitements, en particulier dans les pays en développement et pour la population non assurée des marchés développés. Ce coût élevé des soins est un facteur limitant majeur de la croissance globale de ce marché.

Opportunités de marché - Investissement croissant dans la R-D pour les produits thérapeutiques nouveaux

L'un des principaux débouchés pour le marché de la rétinopathie diabétique proliférative est l'investissement croissant dans la R-D pour les nouveaux médicaments et technologies thérapeutiques. Plusieurs sociétés biopharmaceutiques et fonds de capital-risque investissent massivement dans la mise au point de nouvelles approches de livraison de médicaments, de biomarqueurs et de cibles moléculaires pour traiter le DR prolifératif.

Par exemple, d'importants travaux de recherche sont en cours pour mettre au point des implants intraoculaires à libération prolongée qui peuvent fournir continuellement des médicaments anti-VEGF sur de longues périodes, réduisant ainsi la fréquence des injections. D'autres pistes nouvelles sont explorées : thérapie génique, thérapie des cellules souches et thérapies ciblant de nouvelles molécules comme le facteur de croissance des tissus conjonctifs.

Le succès de ces efforts de développement peut aider à surmonter certaines des limites actuelles et à introduire des options de traitement plus efficaces et plus rentables. Ce pipeline croissant de thérapies innovatrices et l'approbation prévue de nouveaux médicaments dans un avenir proche perspectives de croissance lucrative pour les intervenants sur le marché des DR prolifératifs.

Préférences des prescripteurs de Marché de la rétinopathie diabétique proliférative

La rétinopathie diabétique proliférative est un stade avancé de la maladie des yeux diabétiques où les vaisseaux sanguins anormaux se transforment en gel vitré. Ces nouveaux vaisseaux fragiles peuvent saigner ou s'infiltrer dans la cavité vitrée, causant une perte de vision rapide.

La première ligne de traitement de la PDR consiste à contrôler la glycémie et à utiliser des injections d'anti-VEGF (facteur de croissance endothéliale vasculaire) directement dans l'œil. Les médicaments anti-VEGF couramment prescrits sont le ranibizumab (Lucentis) et l'aflibercept (Eylea). Ces thérapies sont efficaces pour arrêter le développement de vaisseaux sanguins anormaux, mais nécessitent une surveillance et des injections fréquentes par un ophtalmologiste.

Si la maladie progresse malgré un traitement anti-VEGF, la photocoagulation panrétinienne (PRP) est la prochaine ligne de traitement recommandée. Pendant le PRP, un ophtalmologiste utilise un laser pour appliquer de petites brûlures à la rétine périphérique. Cela rétrécit et scelle les nouveaux vaisseaux sanguins en déclenchant des cicatrices. Un PRP étendu sur plusieurs séances est habituellement nécessaire pour traiter toute la rétine.

Dans le PDR avancé et non contrôlé, les chirurgiens peuvent recommander une chirurgie de la vitrectomie pour enlever le sang et les tissus cicatriciels de la cavité vitrée. Cela aide à soulager les symptômes de saignement, de traction et améliore les chances de rétablissement de la vision. Après la chirurgie, des médicaments comme les anti-VEGF continuent de prévenir la prolifération des vaisseaux.

Analyse des options de traitement de Marché de la rétinopathie diabétique proliférative

La rétinopathie diabétique proliférative est un stade avancé de la maladie des yeux diabétique caractérisé par la croissance de nouveaux vaisseaux sanguins dans la rétine. Il y a trois étapes de la PDR - légère, modérée et sévère.

Pour le PDR léger à modéré, le traitement de première ligne préféré est la photocoagulation au laser. Au cours de cette procédure, un laser est utilisé pour générer des brûlures sur la rétine afin de sceller les vaisseaux sanguins et empêcher la croissance de nouveaux vaisseaux sanguins. Cela aide à réduire le risque de perte de vision.

Pour les patients qui ne répondent pas au traitement par laser ou qui présentent un RDP sévère/à haut risque, des injections anti-VEGF sont recommandées. Ces injections contiennent des médicaments comme le ranibizumab (Lucentis) ou l'aflibercept (Eylea) qui inhibent le facteur de croissance vasculaire endothélial (VEGF), une protéine qui déclenche la croissance de vaisseaux sanguins anormaux dans la rétine. Le traitement anti-VEGF est efficace pour arrêter la progression de la maladie et stabiliser la vision en supprimant la croissance de nouveaux vaisseaux sanguins.

Dans les cas où la PDR a entraîné la formation d'une hémorragie prérétinienne ou vitréeuse, une chirurgie de la vitrectomie peut être nécessaire pour éliminer l'hémorragie et prévenir une perte de vision supplémentaire. Pendant la vitrectomie, le gel vitré à l'intérieur de l'œil est enlevé et remplacé par du sel ou du gaz. Cela permet une meilleure visibilité de la rétine et l'élimination des détachements rétiniens tractionnels.

Stratégies gagnantes clés adoptées par les principaux acteurs de Marché de la rétinopathie diabétique proliférative

Mettre l'accent sur la thérapie avancée - Plusieurs entreprises de premier plan se concentrent sur le développement de méthodes plus avancées pour la fourniture d'anti-VEGF aux patients. Par exemple, AbbVie a reçu l'approbation de la FDA en 2018 pour son traitement par Susvimo (système d'administration de port avec ranibizumab), ce qui permet une libération prolongée des médicaments sur plusieurs mois avec moins d'injections nécessaires.

Acquisitions stratégiques et partenariats - Les principaux acteurs acquièrent et s'associent à de petites biotechnologies pour accéder à des candidats nouveaux et prometteurs. Par exemple, Novartis a acquis le programme de thérapie génique de Roche en 2020 pour accélérer son développement et sa commercialisation potentielle.

Élargissement géographique vers les marchés émergents - Comme les pays en développement signalent une prévalence croissante du diabète, les entreprises développent activement les réseaux de vente et de distribution en Asie, en Amérique latine, au Moyen-Orient et en Afrique. Par exemple, Regeneron a triplé ses ventes internationales d'Eylea de 2016 à 2020 en commercialisant dans plus de 50 pays.

Investissement accru en R-D dans les nouvelles technologies - Les dirigeants consacrent davantage de fonds au développement de thérapies génétiques, de thérapies à cellules souches et d'autres traitements de pointe. Par exemple, Allergan a investi 625 millions de dollars en 2020 pour soutenir les essais de phase 3 d'Abicipar, le plus important pour un candidat anti-VEGF.

Analyse segmentaire de Marché de la rétinopathie diabétique proliférative

Perspectives, par traitement : Prévalence de la rétinopathie diabétique toujours croissante

En ce qui concerne le traitement, le traitement anti-VEGF devrait détenir 58,2 % du marché en 2024, étant propriétaire de son efficacité dans le traitement de la croissance anormale des vaisseaux sanguins associée à la rétinopathie diabétique proliférative. Les médicaments anti-VEGF agissent en inhibant le facteur de croissance endothéliale vasculaire, une protéine qui stimule la croissance des vaisseaux sanguins anormaux dans la rétine.

L'augmentation de la prévalence du diabète due à l'obésité, à l'inactivité physique et à la mauvaise alimentation a entraîné une augmentation correspondante des cas de rétinopathie diabétique dans le monde. Cela a considérablement stimulé la demande de médicaments anti-VEGF qui sont considérés comme la première ligne de traitement des stades prolifératifs de la maladie.

La nature non invasive et moins d'effets secondaires des injections intravitréennes de médicaments anti-VEGF en font un choix privilégié par rapport aux autres options chirurgicales. Le développement continu de formulations améliorées anti-VEGF avec une durée d'action plus longue et une biocompatibilité élevée alimente également leur absorption.

Points de vue, selon le type de drogue : préférence pour la livraison ciblée de drogues

En termes de type de médicament, les médicaments biologiques devraient représenter 67,5 % du marché en 2024, en raison de leur capacité à cibler précisément les voies de la maladie. Contrairement aux médicaments à petites molécules, les produits biologiques offrent une plus grande sélectivité en mimant les protéines, anticorps, enzymes ou récepteurs naturels humains. Ils peuvent ainsi bloquer plus spécifiquement les récepteurs VEGF et d'autres facteurs de croissance qui augmentent la formation anormale de vaisseaux sanguins dans la rétine.

Les produits biologiques démontrent également une amélioration de la pharmacocinétique des petites molécules, étant donné leur grande structure moléculaire limitant la distribution non spécifique. De plus, les médicaments biologiques ont généralement une affinité de liaison élevée et de longues demi-vies permettant des intervalles de dosage plus longs et une gestion supérieure des complications de la vision menaçant la rétinopathie diabétique proliférative.

Les progrès dans les technologies des anticorps monoclonaux et des protéines de fusion ont augmenté le développement de nouveaux médicaments biologiques avec des profils d'efficacité et d'innocuité améliorés.

Perspectives, par mécanisme de livraison: Commodité et conformité avec la livraison intraoculaire

En termes de mécanisme d'administration, les injections intravitréennes contribuent la plus forte part en raison de l'administration directe de médicaments à l'œil. Les injections intravitréennes garantissent des concentrations élevées de médicaments dans les tissus rétiniens ciblés, avec une exposition systémique minimale et des effets secondaires.

L'administration intraoculaire unique entraîne une réponse thérapeutique immédiate sans nécessité d'administrations orales fréquentes associées à une faible adhérence du patient. Il élimine les problèmes impliquant la dégradation gastro-intestinale et le premier passage métabolisme du foie vu avec d'autres voies de livraison.

De plus, les injections intravitréennes sont généralement bien tolérées avec un bon profil de sécurité. De tels facteurs de commodité et de fiabilité ont fait des injections intravitréennes le mode privilégié pour l'administration de produits biologiques pour traiter la rétinopathie diabétique proliférative.

Informations supplémentaires sur Marché de la rétinopathie diabétique proliférative

- La rétinopathie diabétique proliférative touche près du tiers des personnes atteintes de rétinopathie diabétique, et l'incidence devrait augmenter avec l'augmentation de la population diabétique mondiale, en particulier dans les sociétés vieillissantes.

- La rétinopathie diabétique proliférative est une complication sévère du diabète, qui entraîne une néovascularisation de la rétine et du vitré, entraînant une perte de vision ou une cécité. Les traitements sont axés sur l'inhibition de la production de VEGF, comme les injections anti-VEGF et la thérapie laser.

- Les traitements anti-VEGF deviennent la norme de soins pour prévenir la progression de la rétinopathie diabétique au stade prolifératif. Des joueurs comme Roche et Novartis mènent ce virage avec de nouvelles formulations de médicaments plus efficaces.

Aperçu concurrentiel de Marché de la rétinopathie diabétique proliférative

Les principaux acteurs du marché de la rétinopathie diabétique proliférative sont Novartis, Roche, Bayer, Regeneron Pharmaceuticals, Allergan, Ocuphire Pharma, Inc. et OcuTerra Therapeutics, Inc.

Marché de la rétinopathie diabétique proliférative Leaders

- Novartis

- Roche

- Bayer

- Regeneron Pharmaceutiques

- Allergan

Marché de la rétinopathie diabétique proliférative - Rivalité concurrentielle

Marché de la rétinopathie diabétique proliférative

(Dominé par des acteurs majeurs)

(Très compétitif avec de nombreux acteurs.)

Développements récents dans Marché de la rétinopathie diabétique proliférative

- Roche a rapporté des résultats d'essais prometteurs pour son traitement anti-VEGF ciblant la rétinopathie diabétique, y compris la rétinopathie diabétique proliférative. Plus précisément, des essais comme PAVILION évaluent le Système de livraison portuaire (SDP) avec le ranibizumab, conçu pour assurer une libération prolongée des médicaments au fil du temps. Les premiers résultats montrent que ce traitement pourrait réduire significativement la progression de la rétinopathie diabétique en fournissant systématiquement le ranibizumab à la rétine. Le système innovant de livraison de Roche est toujours dans les essais cliniques, et si les résultats continuent d'être favorables, la disponibilité commerciale pourrait effectivement se produire vers la fin de 2025.

- En juin 2024, Ocuphire Pharma a terminé l'essai de phase II de son médicament oral APX3330, qui cible la rétinopathie diabétique en inhibant la VEGF et les cytokines inflammatoires. Ce médicament offre une nouvelle approche en visant à réduire l'angiogenèse et l'inflammation dans les yeux. L'essai, appelé l'essai de phase II de ZETA-1, a évalué l'efficacité du médicament pour ralentir la progression de la rétinopathie diabétique (DR).

- OcuTerra Therapeutics a avancé sa formulation de gouttes oculaires, OTT166, pour le traitement de la rétinopathie diabétique dans les essais cliniques de phase II dans le cadre de l'étude DR. Cet essai, qui met l'accent sur l'innocuité et l'efficacité des gouttes oculaires, a atteint la pleine inscription au milieu de 2023, et les résultats topline sont attendus au début de 2024. Le traitement, conçu comme une solution non invasive, a montré des chances d'inhiber l'angiogenèse en ciblant les intégrins de la DGR, une voie clé dans la progression de la rétinopathie diabétique.

- En mars 2024, Novartis a lancé son essai clinique pour un traitement biologique novateur ciblant le PDR, visant à réduire le besoin de chirurgies invasives. Novartis a été actif dans le développement de traitements biologiques dans divers domaines médicaux, y compris les maladies oculaires, en utilisant des thérapies anti-VEGF et d'autres innovations dans la rétinopathie diabétique.

Marché de la rétinopathie diabétique proliférative Segmentation

- Par traitement

- Anti-VEGF Thérapie

- Chirurgie au laser

- Vitrectomie

- Par type de drogue

- Médicaments biologiques

- Petites molécules

- Par mécanisme d'exécution

- Injections intravitréennes

- Médicaments systémiques

Souhaitez-vous explorer l'option d'achat sections individuelles de ce rapport ?

Questions fréquemment posées :

Quelle est la taille du marché de la rétinopathie diabétique proliférative?

Le marché de la rétinopathie diabétique proliférative est évalué à 2,42 milliards de dollars en 2024 et devrait atteindre 5,2 milliards de dollars en 2031.

Quels sont les principaux facteurs qui entravent la croissance du marché de la rétinopathie diabétique proliférative?

Les coûts élevés associés aux traitements avancés et l'accessibilité limitée des thérapies dans les régions en développement sont les principaux facteurs qui entravent la croissance du marché de la rétinopathie diabétique proliférative.

Quels sont les principaux facteurs de croissance du marché de la rétinopathie diabétique proliférative?

La prévalence croissante du diabète entraînant une augmentation des cas de rétinopathie diabétique et les progrès technologiques dans les approches diagnostiques et thérapeutiques sont les principaux facteurs à l'origine du marché de la rétinopathie diabétique proliférative.

Quel est le principal traitement sur le marché de la rétinopathie diabétique proliférative?

Le principal segment de traitement est le traitement anti-VEGF.

Quels sont les principaux acteurs du marché de la rétinopathie diabétique proliférative?

Novartis, Roche, Bayer, Regeneron Pharmaceuticals, Allergan, Ocuphire Pharma, Inc. et OcuTerra Therapeutics, Inc. sont les principaux acteurs.

Quel sera le TCAC du marché de la rétinopathie diabétique proliférative?

Le TCAC du marché de la rétinopathie diabétique proliférative devrait être de 11,55% par rapport à 2024-2031.