Advanced Cancer Pain Management Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Advanced Cancer Pain Management Market is segmented By Drug Class (Monoclonal Antibody, Cannabinoid, Aminoindane), By Route of Administration (Intrave....

Advanced Cancer Pain Management Market Size

Market Size in USD Bn

CAGR5.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.6% |

| Market Concentration | High |

| Major Players | Tetra Bio-Pharma, Medlab Clinical Ltd, GW Pharmaceuticals, Pharmascience Inc., PharmaCielo and Among Others. |

please let us know !

Advanced Cancer Pain Management Market Analysis

The Global Advanced Cancer Pain Management Market is estimated to be valued at USD 8.1 Bn in 2024 and is expected to reach USD 12.9 billion by 2031, growing at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2031. The rising prevalence of cancer across the world coupled with increasing demand for effective pain management drugs and therapies for advanced cancer patients are the key factors driving the growth of this market. Advanced pain management options have significantly improved the quality of life of cancer patients.

The Advanced Cancer Pain Management market is expected to grow steadily over the forecast period owing to rising incidences of cancer and increasing adoption of advanced pain therapies. The market is witnessing introduction of novel drug delivery methods and combination therapies that help provide better pain relief with lesser side effects. Moreover, increased awareness among patients, healthcare providers as well as government support are also expected to boost the demand for effective pain management in advanced cancer treatment.

Advanced Cancer Pain Management Market Trends

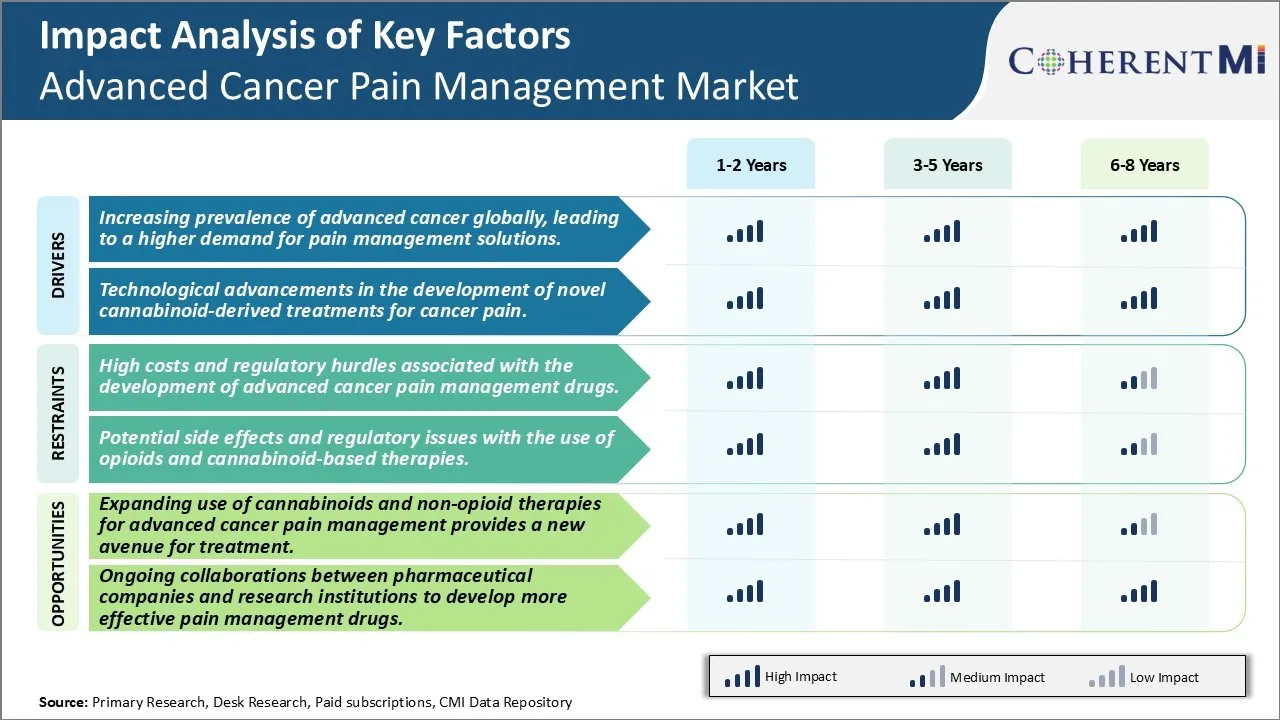

Market Driver - Increasing Prevalence of Advanced Cancer Globally, Leading to a Higher Demand for Pain Management Solutions.

As the prevalence of advanced stage cancers continues to rise across major regions of the world, the need for effective pain management options has become increasingly important. Various statistics indicate that globally, cancer incidence and related mortality have been growing at an alarming pace over the past few decades. According to estimates by health experts, there will be a significant rise in the number of new cancer cases every year until 2030. A bulk of these new cases are expected to be diagnosed at later or advanced stages when the disease has often already metastasized.

With advanced stage cancers come severe complications that greatly impact a patient's quality of life. One of the most troubling symptoms experienced is pain - whether it is caused due to the primary tumor, involvement of surrounding tissues and organs, or as a result of metastatic lesions in other parts of the body. Left untreated or managed inappropriately, such pain can become chronic and even unbearable at times. It leads to worsening morbidity and disability in advanced cancer patients. Thankfully, considerable progress has been made in recent years to better understand cancer pain and develop more effective treatment approaches. Still, as the prevalence of advanced disease continues to rise worldwide, managing associated pain remains a massive clinical challenge as well as an area of high unmet need.

Market Driver - Technological Advancements in Cannabinoid-derived Treatments Drives Advanced Cancer Pain Management Market.

Scientists have long been investigating the therapeutic potential of cannabinoids, the active chemical components in cannabis, for pain management. This interest has spiked in recent years following the legalization of medical marijuana in many regions across the globe. A notable area of focus has been on developing cannabinoid-based treatments for cancer pain which has proven very difficult to control using conventional analgesics alone. Various technological advancements are now allowing researchers to better understand the binding mechanisms of specific phytocannabinoids to endogenous cannabinoid receptors in the body as well as their downstream signaling effects.

This has enabled formulation of precisely engineered botanical drug substances that can target the endocannabinoid system more selectively and with fewer side effects compared to whole plant preparations. Manufacturers have additionally come up with novel drug delivery designs like sublingual films and oral dissolving tablets that help improve bioavailability and pharmacokinetic profiles of cannabinoid compounds. Some formulations are even beginning to combine cannabinoids with other pain medications to develop multi-target synergistic therapies. Overall, continued improvements in cannabinoid extraction techniques and pharmacy are expanding options for clinicians as an adjunct or alternative method within the advanced cancer pain management landscape.

Market Challenge - High Costs and Regulatory Hurdles Associated with the Development of Advanced Cancer Pain Management Drugs.

The development of new and innovative drugs for advanced cancer pain management faces significant challenges due to the high costs and stringent regulatory requirements involved. Bringing a new drug to market typically costs over USD 2.6 billion and takes 10-15 years due to the extensive research and clinical trial process required to prove a drug’s safety and efficacy according to regulatory standards. For advanced cancer pain drugs in particular, large and complex clinical trials are needed to demonstrate effectiveness in managing various types of pain experienced by late-stage cancer patients. These trials require significant funding and time to recruit thousands of patients to achieve statistically meaningful results. Any delays or failures during the clinical trial phases can force drug developers to incur more costs or abandon the program altogether. Additionally, regulatory agencies like the FDA impose very strict rules for approving new cancer pain medications due to the vulnerable patient population involved and risk of side effects from powerful analgesics. Drug sponsors must meet all of the FDA’s clinical, manufacturing, and labeling requirements, which involve additional studies and investments, before obtaining approval to market their drug. These intensive research and regulatory compliance costs serve as major barriers that limit the number of organizations pursuing the development of new treatments for advanced cancer pain management.

Market Opportunity: Expanding Use of Cannabinoids and Non-Opioid Therapies for Advanced Cancer Pain Management Provides a New Avenue For Treatment.

An emerging opportunity lies in the growing acceptance and exploration of alternative approaches to treating advanced cancer pain that avoid the dangers of opioid addiction and side effects. Cannabinoids derived from marijuana, namely THC and CBD, are demonstrating potential as natural remedies. Studies show they may help reduce pain, nausea and other symptoms. Their non-addictive nature relative to opioids also alleviates risks. More clinical evidence on dosage and formulations is needed, but research interest is rising given the demand for non-opioid options. In parallel, non-opioid pharmacological therapies are in development. These include lidocaine patches, antidepressants, and nerve blockers that relieve pain via non-opioid mechanisms. As understanding of cancer pain pathophysiology expands, more targeted non-opioid treatments may be identified. With greater societal support for medical cannabis and focus on the opioid crisis, cannabinoids and complementary non-narcotic therapies represent a largely untapped market segment. Growth looks promising as awareness of these alternative spreads within oncology and palliative care provider circles and cancer patients seek solutions beyond conventional opioids. Both pharmaceutical companies and cannabis product firms see gains to be made by establishing innovative offerings in this burgeoning niche.

Prescribers preferences of Advanced Cancer Pain Management Market

For late-stage cancers, treatment follows several lines as the disease progresses and adapts. For first-line treatment of metastatic cancers, chemotherapy remains standard due to favorable risk-benefit ratios. Combination regimens including platinum drugs like carboplatin (Paraplatin) paired with taxanes like paclitaxel (Taxol) are commonly prescribed.

If the cancer becomes resistant or stops responding, immunotherapy has emerged as an important second-line option. Checkpoint inhibitors targeting PD-1/PD-L1 pathways like pembrolizumab (Keytruda) and atezolizumab (Tecentriq) are frequently chosen due to durable responses observed, even if minimal toxicity allows further lines of therapy.

For patients progressing on immunotherapy or with tumor types less amenable, targeted therapies offer an alternative second-line approach if specific mutations are present. For example, osimertinib (Tagrisso) is prescribed for EGFR+ non-small cell lung cancer after earlier EGFR inhibitors fail.

Beyond second-line, treatment choices aim to maximize control of symptoms and quality of life with lowest toxicity. Taxane monotherapy, hormonal therapies, or investigational drugs in clinical trials may be considered depending on patient suitability and recent treatments. Prescriber preferences at later stages incorporate patient performance status and tolerance in addition to efficacy data.

Overall treatment costs also exert influence, especially in the community setting where out-of-pocket costs impact patient access and adherence. This drives physicians to carefully assess therapeutic value at each line of therapy.

Treatment Option Analysis of Advanced Cancer Pain Management Market

Advanced cancer refers to cancer that has spread beyond the original site to other parts of the body. Treatment depends on the type and stage of cancer, as well as the patient's overall health and preferences. For many advanced solid tumor cancers, the standard of care involves chemotherapy.

First-line chemotherapy typically involves a platinum-based doublet such as cisplatin or carboplatin combined with paclitaxel, docetaxel, gemcitabine or pemetrexed. These combinations are aimed at controlling tumor growth and prolonging survival. For cancers like lung or colorectal cancer responding poorly to first-line therapy, second-line options include monotherapies like docetaxel, paclitaxel, pemetrexed, or targeted drugs like cetuximab, panitumumab or bevacizumab depending on the biomarker status.

For cancers still progressing on second-line therapy, third-line options are limited and often involve clinical trials of newer regimens or drugs. Immunotherapy has also emerged as an important treatment approach, with checkpoint inhibitors like nivolumab, pembrolizumab and atezolizumab approved for various tumor types. These are generally used after chemotherapy fails due to their favorable side effect profile. For select tumor mutations, targeted therapies blocking specific cancer-driving genes are also options when available. aggressive tumor removal surgery or radiation therapy may provide local control and improve quality of life when appropriate.

Key winning strategies adopted by key players of Advanced Cancer Pain Management Market

Product Innovation: Pain therapies and technologies for cancer pain management are rapidly evolving. One of the most effective strategies adopted by leading players has been continuous investment and focus on R&D to develop novel and more effective products.

Partnerships and Acquisitions: Companies have partnered with or acquired other players offering complementary portfolios to expand their product lines.

Targeted Marketing Strategies: Given the heterogeneity of cancer pain and the need for customized treatments, players have launched aggressive promotion efforts towards both patients and physicians. They conduct extensive market research to understand specialty groups and tailor educational campaigns accordingly.

These evidence-backed strategic moves around investment in R&D, tactical mergers/partnerships, and targeted promotional activities have helped leading companies in the advanced cancer pain management space gain significant traction in terms of revenues, market share and brand perception. A holistic approach to product, portfolio and marketing appears crucial for success.

Segmental Analysis of Advanced Cancer Pain Management Market

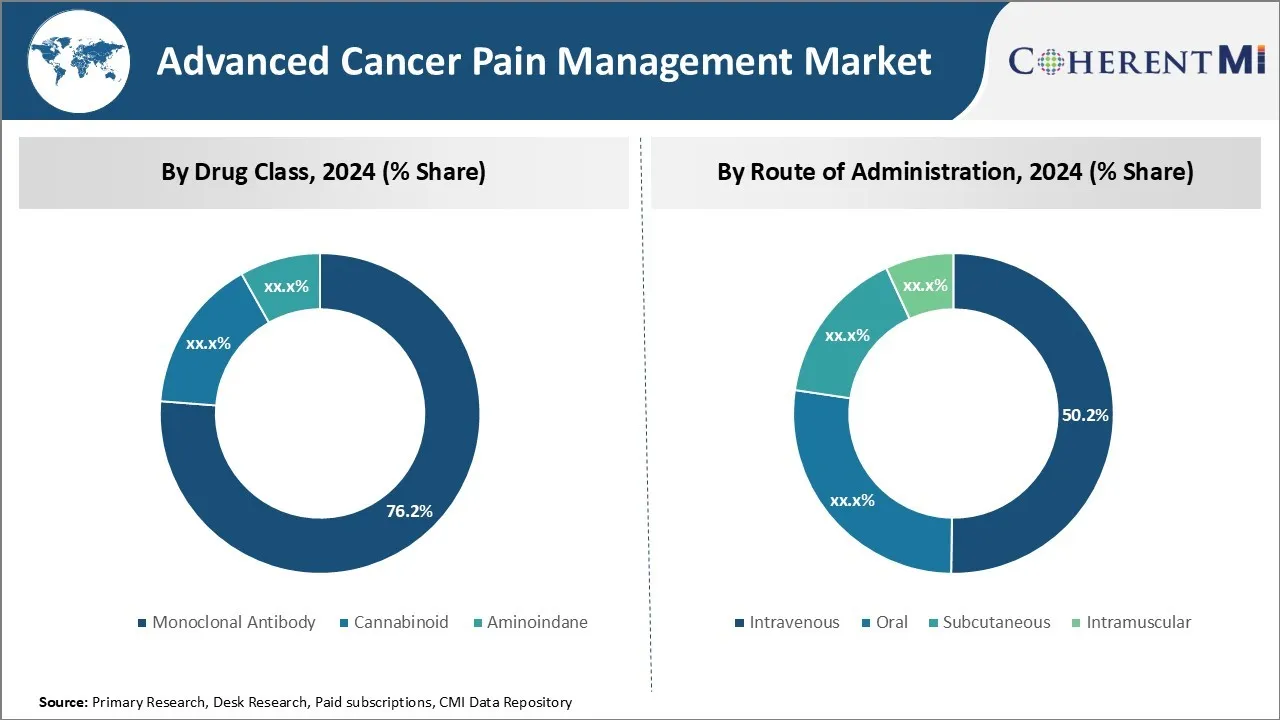

Insights, By Drug Class, Advanced Treatment Options Drive Monoclonal Antibody Dominance.

By drug class, monoclonal antibody is expected to contribute the highest market share 76.2% in 2024 owing to their targeted mechanism of action and improved efficacy and safety profiles over other traditional drug classes. Monoclonal antibodies have revolutionized cancer treatment in recent years by providing more precise targeting of cancer cells while limiting systemic exposure and off-target effects. These antibodies work by binding to specific proteins on cancer and immune cells, such as receptors, and disrupting the signaling pathways that allow tumors to grow and spread.

Compared to other drug classes like opioids which provide broad systemic pain relief but carry significant safety risks, monoclonal antibodies offer a more targeted approach of blocking pain signals directly at their source. This superior mechanism of action has resulted in monoclonal antibodies demonstrating robust pain reduction in clinical trials with fewer side effects than alternative options. Their development has also been driven by the need for more durable and advanced therapies to manage cancer pain as patients live longer with metastatic disease.

Major pharmaceutical companies have invested heavily in developing novel monoclonal antibodies to treat various cancer types as well as their associated pain. Blockbuster drugs like bevacizumab and rituximab have set the stage for a new generation of antibody therapies with refined targeting abilities. The trend towards precision medicines has elevated monoclonal antibodies as the preferred treatment choice among oncologists and patients. With their differentiated safety profiles and high effectiveness against cancer pain, monoclonal antibodies are expected to continue dominating this segment of the Advanced Cancer Pain Management market.

Insights, By Route of Administration, Increasing Administration Options Fuel Intravenous Segment Dominance.

By route of administration, intravenous is expected to contribute 50.2% share in 2024 owing to advantages over other administration routes. While oral administration provides patient convenience, many cancer pain therapies have poor oral bioavailability or require high doses to achieve therapeutic levels systemically. This can lead to inconsistent absorption and side effects from high drug levels in the liver and gastrointestinal tract.

In contrast, intravenous delivery enables precise dosing of medications directly into the bloodstream, maximizing availability at the site of action and avoiding issues around gastrointestinal and first-pass metabolism. For cancer pain drugs that must achieve rapid and high systemic concentrations like opioids, the intravenous route allows for titratable dosing in medical settings to carefully manage pain levels. Certain therapies are also designed specifically for intravenous use due to their short half-lives and need for frequent redosing.

Furthermore, many patients with advanced cancer experience issues like nausea, vomiting or difficulty swallowing that limit oral intake as the disease progresses. The intravenous route circumvents these problems and ensures medications are delivered effectively regardless of performance status. Self-administered options like subcutaneous or intramuscular injections also require stable physical and mental conditions. Thus, for critically ill cancer patients with severe pain, intravenous therapy remains the gold standard administration method.

Insights, By Distribution Channel, Prevalence of Hospital Based Care Boosts Hospital Pharmacies Segment.

In terms of By Distribution Channel, Hospital Pharmacies contributes the highest share of the market owing to many cancer patients receiving treatment in hospitals. For individuals diagnosed with advanced or metastatic cancer, aggressive therapies like surgery, chemotherapy or radiation are often required. These procedures are predominantly performed in inpatient hospitals by medical oncologists and surgeons.

During active treatment phases involving complex regimens and frequent monitoring, most cancer pain medications are also initiated and titrated under medical supervision in hospitals. This allows for closer observation of patients for adverse reactions or complications from high-risk drugs like opioids. It also guarantees consistent supply of medications tailored to rapidly changing care plans as a patient’s condition and pain levels fluctuate through therapy.

Once treatment wraps up, many cancer survivors still face months to years of follow up appointments and potential palliative care if pain persists. This continued engagement with hospital-based care providers sustains the demand for obtaining pain medicines through hospital pharmacies. The specialized compounding, storage and documentation services provided also make hospitals a one-stop-shop for complex cancer pain treatment regimens.

With the majority of cancer management still centered around hospitals, it follows that hospital pharmacies would dominate the distribution of affiliated pain management drugs. Their integration within healthcare systems allows for seamless fulfilment of prescriptions compared to external retail sources. This positions hospital pharmacies as the core supply channel for the Advanced Cancer Pain Management market.

Additional Insights of Advanced Cancer Pain Management Market

Advanced cancer pain management remains a critical area of need in oncology care. Patients with advanced cancer often experience severe pain that can affect their quality of life and adherence to treatment. Traditional pain management approaches, such as opioids, while effective, pose significant risks, including addiction and adverse side effects. The emerging pipeline of drugs, such as Tetra Bio-Pharma's QIXLEEF and Medlab Clinical Ltd's NanaBis, represents a shift towards cannabinoid-based therapies that offer potential benefits with fewer risks compared to opioids. These cannabinoid-derived drugs target specific pain pathways and offer a natural alternative for patients suffering from uncontrolled cancer pain. Additionally, ongoing collaborations between pharmaceutical companies, such as the partnership between Medlab Clinical Ltd and Pharmascience Inc., are expected to enhance the availability of these innovative treatments globally. The future of advanced cancer pain management is likely to focus on personalized, non-opioid treatments that improve both pain relief and patient outcomes.

Competitive overview of Advanced Cancer Pain Management Market

The major players operating in the Advanced Cancer Pain Management Market include Tetra Bio-Pharma, Medlab Clinical Ltd, GW Pharmaceuticals, Pharmascience Inc., PharmaCielo, Tilray Pharmaceuticals, WEX Pharmaceuticals, Pfizer, eurofins, Sigma-Aldrich, GSK plc and Recipharm.

Advanced Cancer Pain Management Market Leaders

- Tetra Bio-Pharma

- Medlab Clinical Ltd

- GW Pharmaceuticals

- Pharmascience Inc.

- PharmaCielo

Advanced Cancer Pain Management Market - Competitive Rivalry, 2024

Advanced Cancer Pain Management Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Advanced Cancer Pain Management Market

- In May 2024, Tetra Bio-Pharma advanced its QIXLEEF drug to Phase II trials, targeting cannabinoid-based pain relief for advanced cancer patients. The drug aims to provide a non-opioid option for pain management and improve quality of life for patients.

- In March 2024, Medlab Clinical Ltd partnered with Pharmascience Inc. to further develop and distribute its NanaBis drug globally, expanding access to non-opioid treatments for advanced cancer pain management.

Advanced Cancer Pain Management Market Segmentation

- By Drug Class

- Monoclonal Antibody

- Cannabinoid

- Aminoindane

- By Route of Administration

- Intravenous

- Oral

- Subcutaneous

- Intramuscular

- By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Advanced Cancer Pain Management Market?

The Global Advanced Cancer Pain Management Market is estimated to be valued at USD 8.1 Bn in 2024 and is expected to reach USD 12.9 Bn by 2031.

What will be the CAGR of the Advanced Cancer Pain Management Market?

The CAGR of the Advanced Cancer Pain Management Market is projected to be 5.6% from 2024 to 2031.

What are the major factors driving the Advanced Cancer Pain Management Market growth?

The increasing prevalence of advanced cancer globally, leading to a higher demand for pain management solutions and technological advancements in the development of novel cannabinoid-derived treatments for cancer pain. These are the major factors driving the Advanced Cancer Pain Management Market.

What are the key factors hampering the growth of the Advanced Cancer Pain Management Market?

The high costs and regulatory hurdles associated with the development of advanced cancer pain management drugs and potential side effects and regulatory issues with the use of opioids and cannabinoid-based therapies. These are the major factors hampering the growth of the Advanced Cancer Pain Management Market.

Which is the leading Drug Class in the Advanced Cancer Pain Management Market?

Monoclonal Antibody is the leading Drug Class segment.

Which are the major players operating in the Advanced Cancer Pain Management Market?

Tetra Bio-Pharma, Medlab Clinical Ltd, GW Pharmaceuticals, Pharmascience Inc., PharmaCielo, Tilray Pharmaceuticals, WEX Pharmaceuticals, Pfizer, eurofins, Sigma-Aldrich, GSK plc, Recipharm are the major players.