Advanced Liver Cancer Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Advanced Liver Cancer Market is segmented By Clinical Trials (Phase III, Phase II, Phase I), By Route of Administration (Oral, Intravenous), By Molecu....

Advanced Liver Cancer Market Size

Market Size in USD Bn

CAGR7.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.2% |

| Market Concentration | Medium |

| Major Players | Can-Fite BioPharma, Polaris Pharmaceuticals, Surface Oncology, Chia Tai Tianqing Pharmaceutical Group Co., Ltd., Exelixis and Among Others. |

please let us know !

Advanced Liver Cancer Market Analysis

The Global Advanced Liver Cancer Market is estimated to be valued at USD 3.4 Bn in 2024 and is expected to reach USD 9.8 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2031. Major factors such as rising incidence of liver cancer worldwide along with growing geriatric population are expected to boost the growth of this market during the forecast period. Furthermore, increased R&D investments by key pharmaceutical players for the development of novel targeted drug therapies for advanced liver cancer will also contribute to market growth.

The market trend for Advanced Liver Cancer suggests high growth potential during the forecast period. Significant unmet needs exist in treating advanced liver cancer as the disease has a poor prognosis. Currently, only a few targeted drug options are available, thus leaving scope for various pharmaceutical companies to develop new drugs. Emerging areas such as immuno-oncology also provide opportunities for development of immunotherapies and combination therapies for advanced liver cancer. This will enable patients to benefit from novel treatment options and contribute to an increasing demand.

Advanced Liver Cancer Market Trends

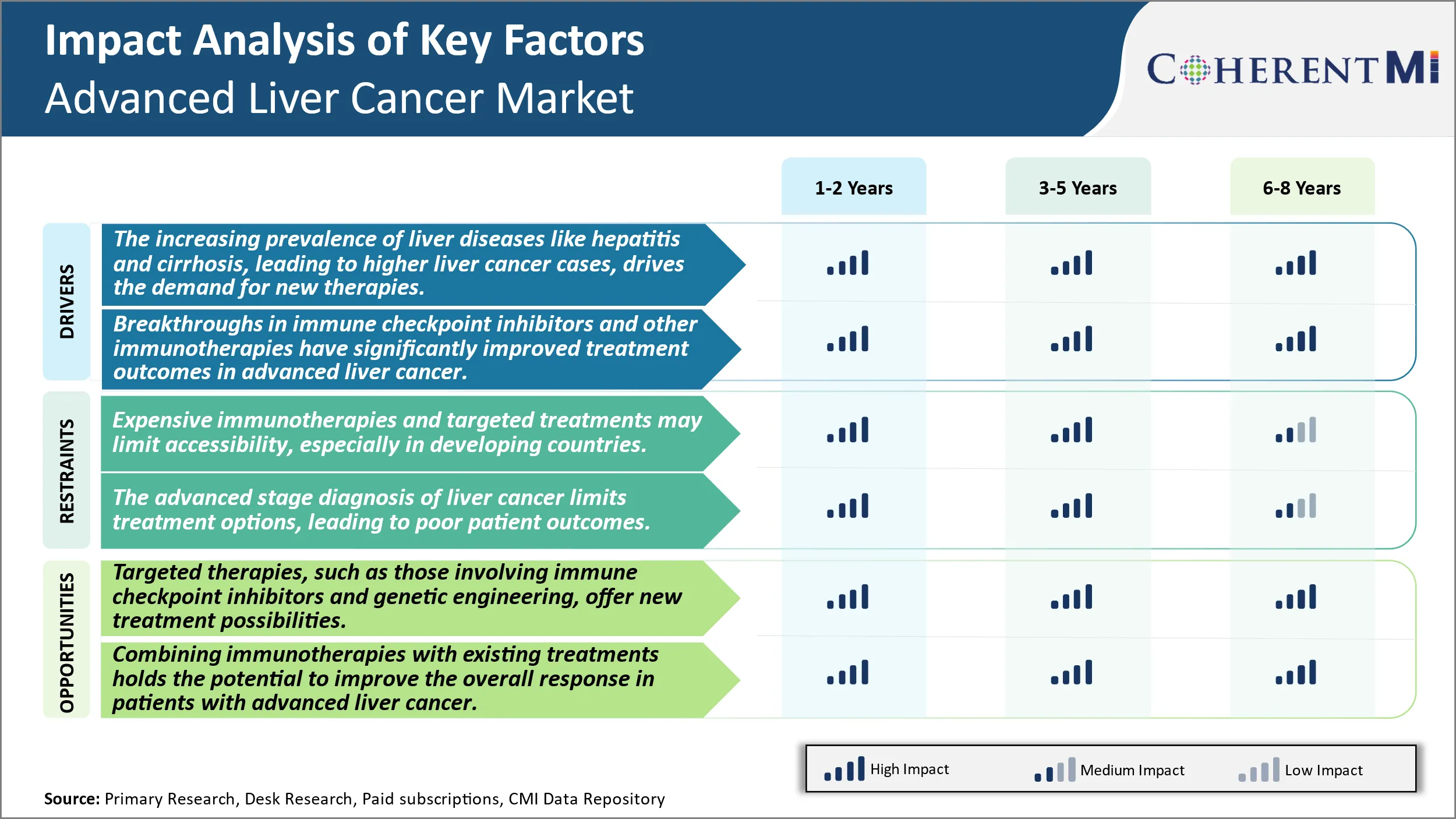

Market Driver - The Increasing Prevalence of Liver Diseases Like Hepatitis and Cirrhosis, Leading to Higher Liver Cancer Cases, Drives the Demand for New Therapies.

The incidence rates of primary liver cancer, also known as hepatocellular carcinoma (HCC), have been increasing steadily over the past few decades. HCC accounts for 80-90% of all liver cancer cases and its incidence has nearly tripled in the United States from 1980 to 2020, making it the fastest rising cause of cancer-related deaths. The majority of liver cancers develop due to chronic inflammation caused by underlying liver diseases. Chronic infections with hepatitis B virus (HBV) and hepatitis C virus (HCV) have emerged as the leading risk factors for HCC globally. It is estimated that more than 50% of all HCC cases are attributable to HBV while HCV infections account for approximately 25% of liver cancer cases worldwide. Both chronic HBV and HCV infections cause hepatic cirrhosis which leads to the development of HCC over prolonged periods of time. Other risk factors that are associated with increasing rates of HCC include non-alcoholic fatty liver disease (NAFLD), alcohol consumption, genetics, environmental toxins and certain metabolic conditions. With more people developing chronic liver diseases and cirrhosis due to these risk factors, there has been a concerning rise in the absolute number of liver cancer diagnoses year after year. This upward trajectory of liver cancer incidence has significant implications for the healthcare systems and is posing substantial economic burden. It is also driving the demand for innovative treatment approaches and development of new therapeutic agents for advanced liver cancer.

Market Driver - Advances in Immunotherapy Encourages Industry Developments.

Immunotherapy has revolutionized cancer treatment over the past decade and is now beginning to make remarkable strides against previously difficult-to-treat cancers as well. Significant progress is being seen with immune checkpoint inhibitors in advanced liver cancer due to recent insights into tumor microenvironment and mechanisms of immunosuppression in HCC. Checkpoint proteins like programmed cell death-1 (PD-1) and its ligand PD-L1 have emerged as important immune resistance pathways exploited by HCC to evade elimination by T cells. Drugs targeting the PD-1/PD-L1 axis have demonstrated favorable responses and better overall survival compared to conventional regimens in clinical trials involving HCC patients. Other forms of immunotherapy currently under investigation for liver cancer include oncolytic viruses, tumor-infiltrating lymphocytes, dendritic cell vaccines and therapeutic monoclonal antibodies. Combination approaches utilizing checkpoint inhibitors along with angiogenesis inhibitors are also being evaluated. Researchers are continually enhancing understanding of tumor immunology and discovering novel targets, which is helping expand the immunotherapeutic options for advanced HCC. This is significantly improving outcomes for patients with fewer treatment alternatives. Promising results with immunotherapy agents are bolstering optimism around their long-term effectiveness and potential as a backbone for future combination regimens in liver cancer.

Market Challenge - Expensive Immunotherapies and Targeted Treatments May Limit Accessibility, Especially in Developing Countries.

One of the major challenges facing the Advanced Liver Cancer market is the high cost of available treatments. Immunotherapies and targeted drug therapies that have been approved in recent years come with significant price tags, often over USD 100,000 for a full course of treatment. This pricing puts these life-extending and potentially curative options out of reach for many patients, especially those in developing nations with limited healthcare budgets. The costs burden both individuals and national healthcare systems. Without mechanisms in place to lower drug prices or increase funding for treatment, many patients globally will still not have access to the latest therapies despite their approval. This challenges the ability of pharmaceutical companies to achieve the full market potential of new drugs and limits overall survival gains that could be achieved.

Market Opportunity - Expansion of Targeted Therapy Creates New Avenues for Further Market Growth.

The continued growth of targeted therapy research and development presents a significant opportunity for the Advanced Liver Cancer market. New areas of focus like immune checkpoint inhibitors that help unleash the immune system's anticancer effects and genetic engineering approaches targeting specific mutations are generating positive results. As these therapies move further into late-stage trials and regulatory approval, it signals the potential for new treatment options to become available. This expands both the number of eligible patients who may benefit as well as the lines of treatment that can be offered. If safety and efficacy can be confirmed at scale, targeted therapies may even replace some existing chemotherapy options. The expansion of targeted options has the potential to improve outcomes for more subsets of patients and prolong survival rates. It also offers pharmaceutical companies’ the opportunities for premium pricing of innovative new therapies.

Prescribers preferences of Advanced Liver Cancer Market

Liver cancer treatment is typically dictated by the stage of disease. In early-stage localized disease, surgery to remove the tumor offers the best chance of cure. For patients who are not candidates for surgery, ablation techniques like radiofrequency ablation (RFA) are preferred to destroy the tumor.

In later stages where the cancer has spread locally within the liver, transarterial chemoembolization (TACE) is commonly used. TACE involves injecting chemotherapy drugs like doxorubicin or cisplatin directly into the liver artery, along with embolic substances to restrict blood flow to the tumors. Brands used include Doxil for doxorubicin and Platinol for cisplatin.

For metastatic disease spread beyond the liver, systemic therapy is adopted. First-line treatment involves oral multi-kinase inhibitors like Lenvima (lenvatinib) or Stivarga (regorafenib). Second-line options include clinical trial enrollment, single-agent chemotherapy with fluorouracil or platinum drugs, or targeted therapy with Nexavar (sorafenib).

Additional factors influencing prescriber preferences include side effect profiles, insurance coverage, pretreatment liver function, and the presence of extrahepatic disease. Age and performance status also guide treatment selection between more aggressive versus palliative options. Close monitoring is needed due to risks of liver damage, bleeding, and hand-foot skin reaction from anti-angiogenic therapies.

Treatment Option Analysis of Advanced Liver Cancer Market

There are several treatment options for liver cancer depending on the stage of the disease. Liver cancer is typically staged from 0-4, with Stage 0 being very early cancer and Stage 4 being advanced cancer that has spread.

For early-stage disease (Stage 0-A), treatment options may include surgical resection to remove the tumor. For tumors responding well, ablation techniques such as radiofequency ablation (RFA) or microwave ablation can be used to destroy the cancer cells. These local therapies aim to cure early-stage cancers.

For more advanced localized disease (Stage B-C), options include transarterial chemoembolization (TACE) which is a minimally invasive procedure to deliver high doses of chemotherapy to the liver tumor via the hepatic artery and block the blood flow. Combination therapies using TACE along with radio or immunotherapy are becoming more common.

For metastatic liver cancer (Stage D1-D2), systemic treatments are generally recommended. First line systemic therapy typically involves oral targeted drug regimens such as Lenvima (lenvatinib) plus Lartruvo (olaratumab) or Brivanib plus Lartruvo. For those who progress, second line options include oral multi-kinase inhibitors Nexavar (sorafenib) or Stivarga (regorafenib). Clinical trials should also be considered to access newer immunotherapy and combination therapies.

Selection of treatment depends on various factors like tumor size, location, underlying liver function, performance status, and patient preferences. An integrated care team is crucial to determine the best treatment approach personalized for each liver cancer case.

Key winning strategies adopted by key players of Advanced Liver Cancer Market

Focus on Development of Novel Drugs and Therapies: One of the main strategies adopted by leading players has been investing heavily in R&D to develop novel drugs and treatment options for advanced liver cancer. For example, Bristol-Myers Squibb spent over USD 7.10 bn on an acquisition that brought Opdivo (nivolumab), which received FDA approval for liver cancer in 2017. Other big pharma companies like Merck & Co. and Johnson & Johnson have ongoing late-stage clinical trials evaluating new immunotherapies and targeted therapies. These novel treatment options have shown improved survival benefits over existing therapies, capturing more market share.

Combination Therapies: Given the limited success of monotherapies, companies are exploring combination regimens of existing drugs with novel agents. For example, data from 2017 showed Bristol-Myers Squibb's Opdivo in combination with Yervoy outperforming sorafenib as a first-line treatment for advanced liver cancer. This led to its approval as a new standard of care, significantly boosting revenue. Other organizations are also pursuing this strategy of exploring diverse drug combinations in clinical trials.

Geo-Targeted Approaches: Given varying epidemiology and standards of care across regions, leaders are tailoring their approaches to local markets. For example, in China and Japan - which account for over 50% of global liver cancer cases - firms have established R&D collaborations, local manufacturing plants and distribution networks to ensure timely access to new drugs. This geo-targeted strategy has enabled early market entry and leadership position in high potential regions.

Strategic Acquisitions: M&A activity has allowed companies to gain access to promising late-stage assets and expand their product portfolios overnight.

Segmental Analysis of Advanced Liver Cancer Market

Insights, By Clinical Trials: Phase III Clinical Trial Success Drives its Dominance in the Forecast Period.

By Clinical Trials, Phase III is expected to contribute the highest share 48.6% in 2024 owing to its critical role in evaluating drug efficacy and safety. Drugs must successfully complete Phase III trials to gain regulatory approval for commercial use. Given the life-threatening nature of liver cancer, patients often enroll in Phase III trials if no other treatment options are available, driving solid recruitment numbers. Manufacturers also prioritize drugs in Phase III to maximize their chances of approval.

Phase III trials involve hundreds or thousands of patient volunteers across dozens of clinical sites internationally. Their large sample sizes allow researchers to test experimental drugs against current standard treatments or placebo in randomized, controlled trials under clinical research organization oversight. The long duration and extensive data collection of Phase III studies help verify preliminary evidence of effectiveness from Phase I and II trials in much larger and more diverse patient populations that better reflects real-world usage.

Strong Phase III results provide empirical proof that an investigational drug significantly improves clinically meaningful outcomes such as overall survival rates or time to disease progression relative to alternatives. Achieving statistically significant efficacy and safety findings are necessary to convince regulators that the medication has a favorable benefit-risk profile worth approving. This success gives manufacturers valuable IP protection and commercialization confidence that drives investment in manufacturing and marketing the newly approved drug.

Insights, By Route of Administration, Oral is the Leading Segment in the Forecast Period.

By Route of Administration, Oral is expected to contribute the highest share 54.3% in 2024 for its convenient dosing form that boosts patient preference and adherence. Unlike intravenous therapies requiring time-consuming infusions at clinics or hospitals, oral drugs allow patients to take tablets at home on their own schedules. This enhanced flexibility improves quality of life by avoiding continued facility visits that disrupt work and personal life.

Oral dosing also reduces healthcare system burden and costs by shifting treatment administration away from costly inpatient or outpatient infusion settings. Lower associated monitoring and staffing needs of oral drugs lower the financial barriers for both patients and healthcare providers compared to parenteral medications. From a medical standpoint, oral administration also introduces fewer risks of infection or complications from IV insertion sites compared to intravenous therapies.

Patient willingness to choose treatments they can self-administer also drives up demand and utilization of oral drugs approved for liver cancer compared to injectable alternatives. Strong patient preference empowers physicians to confidently prescribe oral options knowing adherence will likely be higher without the dosing inconveniences of infusions. Together, these advantages of oral dosing maximize access and ensure oral drugs represent the highest market share among route of administration segments.

Insights, By Molecule Type, Targeted Small Molecules is the Leading Segment in the Forecast Period.

By Molecule Type, Small Molecule is expected to contribute the highest share in 2024 owing to recent approvals exploiting targeted mechanisms of action. Compared to earlier chemotherapies, modern targeted small molecules benefit from insights into molecular drivers of cancer growth at the cellular signaling pathway level. Leveraging knowledge of deregulated pathways in liver tumors, researchers designed highly targeted small molecules to precisely modulate disease-related protein targets with lower systemic toxicity than chemo drugs.

Examples include Bayer's sorafenib and Lilly's ramucirumab that block angiogenesis promoting VEGF and PDGFR pathways critically involved in liver cancer progression. Their targeted MoAs confer greater efficacy and tolerability than previous chemotherapy standards, fast tracking regulatory approval and paving the way to frontline use. Meanwhile, antibody drugs entering the market face manufacturing complexities and accompanying high costs that limit adoption. Though monoclonal antibodies also exploit targeted MoAs, resource constraints of healthcare systems boost preference for less expensive small molecule options where appropriate.

Going forward, expanding understanding of tumor genetics will continue fueling development of novel targeted small molecules selectively interfering with newly discovered cancer vulnerabilities. Their targeted MoAs, oral dosing convenience, and affordable costs position small molecules to displace earlier chemotherapies and antibodies as leading therapy classes in the advanced liver cancer treatment landscape.

Additional Insights of Advanced Liver Cancer Market

Advanced liver cancer poses significant challenges due to its aggressive nature and late-stage diagnosis. By the time the disease reaches advanced stages, it has often metastasized to other organs, making treatment more difficult. Treatment options include immunotherapy, targeted therapies, and in some cases, palliative care aimed at improving quality of life. The landscape of advanced liver cancer treatment is evolving rapidly with the development of drugs like Namodenoson and ADI-PEG20, which offer new hope for patients. Namodenoson, an adenosine receptor agonist, has shown promise in inducing tumor cell apoptosis and reducing inflammation. ADI-PEG20 works by depriving cancer cells of arginine, a key amino acid necessary for tumor growth. Despite these advances, high treatment costs and limited accessibility in certain regions remain challenges. Combination therapies involving immune checkpoint inhibitors and targeted therapies are emerging as the next frontier in treating advanced liver cancer, offering a more comprehensive approach to managing the disease.

Competitive overview of Advanced Liver Cancer Market

The major players operating in the Advanced Liver Cancer Market include Can-Fite BioPharma, Polaris Pharmaceuticals, Surface Oncology, Chia Tai Tianqing Pharmaceutical Group Co., Ltd., Exelixis, Eli Lily and Company, Genetech, Merck & Co., Qurient Co. Ltd, Teclison, Eureka Therapeutics, Bristol Myers Squibb and Ono Pharmaceuticals.

Advanced Liver Cancer Market Leaders

- Can-Fite BioPharma

- Polaris Pharmaceuticals

- Surface Oncology

- Chia Tai Tianqing Pharmaceutical Group Co., Ltd.

- Exelixis

Advanced Liver Cancer Market - Competitive Rivalry, 2024

Advanced Liver Cancer Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Advanced Liver Cancer Market

- In May 2024, Can-Fite BioPharma reported positive Phase III trial results for Namodenoson, demonstrating efficacy in treating advanced hepatocellular carcinoma.

- In April 2024, Polaris Pharmaceuticals announced the completion of Phase III trials for ADI-PEG20, showing significant improvements in survival rates for advanced liver cancer patients.

Advanced Liver Cancer Market Segmentation

- By Clinical Trials

- Phase III

- Phase II

- Phase I

- By Route of Administration

- Oral

- Intravenous

- By Molecule Type

- Small Molecule

- Monoclonal Antibody

- By Mechanism of Action

- Adenosine Receptor Agonist

- Immune Modulator

- Arginine Deprivation

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Advanced Liver Cancer Market?

The Global Advanced Liver Cancer Market is estimated to be valued at USD 3.4 Bn in 2024 and is expected to reach USD 9.8 Bn by 2031.

What will be the CAGR of the Advanced Liver Cancer Market?

The CAGR of the Advanced Liver Cancer Market is projected to be 7.2% from 2024 to 2031.

What are the major factors driving the Advanced Liver Cancer Market growth?

The increasing prevalence of liver diseases like hepatitis and cirrhosis, leading to higher liver cancer cases, drives the demand for new therapies and advances in immunotherapy. Breakthroughs in immune checkpoint inhibitors and other immunotherapies have significantly improved treatment outcomes in advanced liver cancer are the major factor driving the market growth.

What are the key factors hampering the growth of the Advanced Liver Cancer Market?

The high cost of treatment such as expensive immunotherapies and targeted treatments may limit accessibility, especially in developing countries. The advanced stage diagnosis of liver cancer limits treatment options, leading to poor patient outcomes are the major factor hampering the growth of the Advanced Liver Cancer Market.

Which is the leading Clinical Trials in the Advanced Liver Cancer Market?

Phase III is the leading clinical trials segment in the advanced liver cancer market.

Which are the major players operating in the Advanced Liver Cancer Market?

Can-Fite BioPharma, Polaris Pharmaceuticals, Surface Oncology, Chia Tai Tianqing Pharmaceutical Group Co., Ltd, Exelixis, Eli Lily and Company, Genetech, Merck & Co., Qurient Co. Ltd, Teclison, Eureka Therapeutics, Bristol Myers Squibb, Ono Pharmaceuticals are the major players.