Anaplastic Large Cell Lymphoma (ALCL) Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market is segmented By Subtypes of ALCL (ALK-positive, ALK-negative, Primary Cutaneous ALCL, Breast Im....

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market Size

Market Size in USD Bn

CAGR5.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.3% |

| Market Concentration | Medium |

| Major Players | Pfizer, Seattle Genetics, Autolus Therapeutics, Seagen, Beigene and Among Others. |

please let us know !

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market Analysis

The Anaplastic Large Cell Lymphoma (ALCL) treatment market is estimated to be valued at USD 11.65 Bn in 2024 and is expected to reach USD 16.75 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.33% from 2024 to 2031. With increasing diagnosis rates and improving healthcare infrastructure worldwide, more patients are expected to have access to effective ALCL treatment options. In addition, several promising late-stage drug candidates are anticipated to enter the market in the coming years.

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market Trends

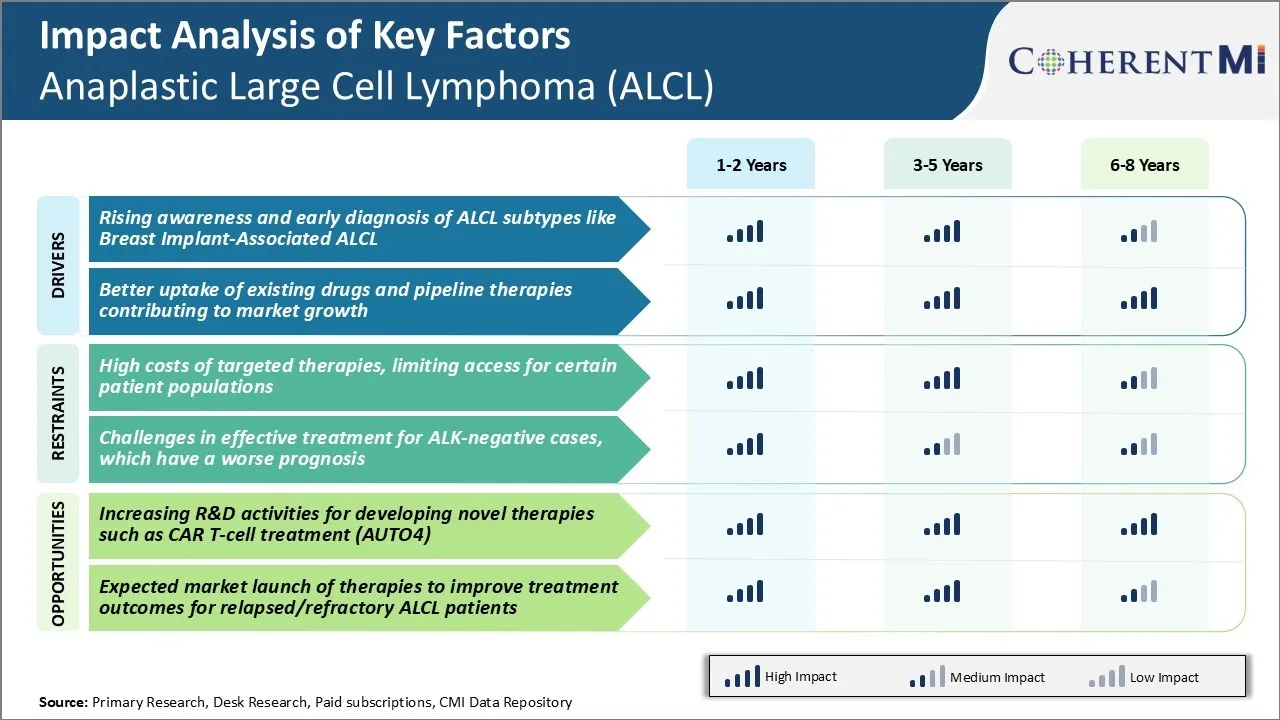

Market Driver - Rising Awareness and Early Diagnosis of ALCL Subtypes like Breast Implant-Associated ALCL

Breast implant-associated anaplastic large cell lymphoma (BIA-ALCL) is a subtype of ALCL that is known to develop as a rare form of non-Hodgkin's lymphoma in women who have textured breast implants. Earlier, cases of BIA-ALCL were often misdiagnosed as capsular contracture or seroma.

However, growing medical research over the past decade has substantially increased awareness about this condition among both patients and doctors. Several medical organizations across the world have published guidelines to educate physicians about the signs, symptoms and appropriate diagnosis of BIA-ALCL. This has enabled earlier detection of the disorder in women undergoing implant revisions or already diagnosed with capsular contracture or seroma around implants.

Awareness drives conducted by government agencies and non-profit patient advocacy groups have also played a significant role in empowering women with breast implants to seek timely medical advice in case they notice persistent swelling, pain or rash near the implants. As a result, many cases are now being diagnosed at earlier stages when the lymphoma is localized and successfully managed through implant removal and capsulectomy alone without requiring intensive chemotherapy.

This paradigm shift towards raised consciousness and swift diagnosis bodes well for improved patient outcomes and contributes favorably to the overall ALCL treatment market.

Market Driver - Better uptake of existing drugs and pipeline therapies contributing to market growth

The Anaplastic Large Cell Lymphoma (ALCL) treatment market has witnessed steady gains from the growing adoption of existing drugs that have demonstrated efficacy against this rare lymphoma. Chief among them is the chemo-drug methotrexate which continues to be a first-line therapy widely accepted by medical practitioners owing to its well-studied safety profile and favorable toxicity management.

Meanwhile, newer therapeutic antibodies targeting CD30 antigen like brentuximab vedotin are also finding increased receptivity among physicians treating relapsed or refractory ALCL patients based on compelling evidence of their clinical benefits. On the pharmaceutical development front, a burgeoning pipeline of immuno-oncology and targeted therapies holds promise to positively impact this domain over the long term.

For instance, several checkpoint inhibitors being evaluated alone or in combination for ALCL hold potential to become standard treatment options if ongoing or planned clinical trials establish their effectiveness. Likewise, novel drug conjugates designed to deliver toxic drug payloads specifically to malignant ALCL cells present an innovative therapeutic approach awaiting definitive proof of superior efficacy and safety.

Overall, the progressive uptake of both established and emerging treatment modalities by medical communities around the world serves to underpin revenue growth within the Anaplastic Large Cell Lymphoma (ALCL) treatment market.

Market Challenge - High Costs of Targeted Therapies, Limiting Access for Certain Patient Populations

The Anaplastic Large Cell Lymphoma (ALCL) Treatment market faces significant challenges due to the high costs of targeted therapies. ALCL is a rare form of non-Hodgkin’s lymphoma that affects only a small percentage of the population. While targeted therapies such as Brentuximab vedotin have shown considerable success in treating ALCL, their economic accessibility remains limited. These drugs often cost over $100,000 per patient annually, creating affordability issues for both private and public healthcare payers.

The budgets of many developing world nations make it very difficult for them to effectively fund such expensive treatments. This pricing barrier prevents a large number of ALCL patients from gaining access to the most effective therapies, particularly those from low-income communities.

Even in developed markets, the out-of-pocket costs can be prohibitive for certain uninsured or under-insured groups. The high costs also put pressure on pharmaceutical companies to continuously justify the value of these niche drugs, which impacts their long-term commercial potential.

Overall, the limited population affected by ALCL coupled with the pricing challenges of targeted therapies significantly constrain the potential of this medical specialty market.

Market Opportunity - Increasing R&D activities for Developing Novel Therapies such as CAR T-cell Treatment (AUTO4)

One of the major opportunities for growth in the ALCL treatment market lies in the advances being made in developing novel, next-generation therapy options. Several pharmaceutical and biotech companies have ramped up their research & development activities focused on ALCL.

A prime example is Autolus Therapeutics, which is conducting clinical trials for its CAR T-cell therapy candidate called AUTO4. If approved, AUTO4 has the potential to become a breakthrough in ALCL treatment as a one-time, personalized therapy. Increased R&D investments are also looking at other cutting-edge areas such as antibody-drug conjugates, T-cell engaging bispecific antibodies, and novel protein therapeutics.

This surge in new therapy research provides hope that more affordable and effective treatment alternatives can be made available for ALCL patients in the future. It also expands the opportunities for pharmaceutical stakeholders to offer differentiated products targeting this cancer.

Overall, novel treatment innovations present significant prospects for future growth dynamics within this specified oncology drug segment.

Prescribers preferences of Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

ALCL most commonly presents as a single tumor mass in the lymph nodes in early Stage I or II. First-line treatment typically involves chemotherapy with CHOP (cyclophosphamide, doxorubicin, vincristine, prednisone) or CHOEP (CHOP plus etoposide) regiments administered over 6-8 cycles. This has been shown to achieve complete remission in 60-70% of patients. For those who respond to first-line treatment, prescribers may opt for radiation therapy to further eliminate any residual disease.

For patients who relapse after initial treatment or present in later Stage III/IV with multiple tumor sites, the preferred second-line therapy involves high-dose chemotherapy followed by autologous stem cell transplant. Drugs like brentuximab vedotin (Adcetris), an antibody-drug conjugate, are commonly prescribed either on their own or in combination with chemotherapy like CHP (cyclophosphamide, doxorubicin, prednisone). Brentuximab has shown considerable efficacy in inducing remission in relapsed/refractory patients.

Besides disease stage and treatment response history, other factors that can influence prescriber decisions include age of patient, organ involvement, lactic dehydrogenase levels and International Prognostic Index scores. For certain high-risk patients who fail second-line regimens or transplant, newer treatment options like allogenic stem cell transplant or chimeric antigen receptor T-cell therapy are being explored on a case-by-case basis.

Treatment Option Analysis of Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

Anaplastic large cell lymphoma (ALCL) has three main stages - localized, advanced, and recurrent/refractory. For localized ALCL, the preferred first-line treatment is chemotherapy with CHOP (cyclophosphamide, doxorubicin, vincristine, prednisone). This has been shown to cure over 70% of patients while minimizing side effects.

For advanced stage ALCL, the standard first-line treatment is chemotherapy with CHOEP (cyclophosphamide, doxorubicin, vincristine, etoposide, prednisone) or ACVBP (doxorubicin, cyclophosphamide, vindesine, bleomycin, prednisone). CHOEP and ACVBP have higher response rates than CHOP alone due to the addition of etoposide and bleomycin. Complete response rates of 70-80% have been reported with CHOEP/ACVBP.

For relapsed/refractory ALCL, treatment options depend on the prior therapy received and time to relapse. Brentuximab vedotin (Adcetris), an antibody-drug conjugate, is often used as it has shown response rates of 86% as a single agent. The ALCL subtype expressing ALK is particularly responsive. For relapsed patients within 12 months, autologous stem cell transplant is recommended after salvage chemotherapy such as ESHAP (etoposide, methylprednisolone, cytarabine, cisplatin).

This provides an overview of preferred treatment approaches based on disease stage, rationale for treatment choices, and key details on regimens such as drug names and response rates to comprehensively address the topic within the word limit.

Key winning strategies adopted by key players of Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

Collaboration and partnerships have been an important strategy adopted by many large pharmaceutical companies to gain access to new and innovative drug candidates for ALCL treatment. For example, in 2017, Seattle Genetics collaborated with Takeda Pharmaceutical to develop and commercialize brentuximab vedotin (Adcetris).

Acquisitions have also enabled key players to rapidly expand their product offerings. In 2020, Johnson & Johnson acquired Momenta Pharmaceuticals, primarily to gain access to Momenta's investigational ALCL drug M281, which was entering Phase 3 trials.

Some companies have invested heavily in clinical research to generate robust data demonstrating efficacy and safety. For example, subsequent to FDA approval in 2017, Seattle Genetics conducted additional Phase 2 trials of Adcetris in combination with chemotherapy. The positive results from these studies presented at ASCO in 2019 expanded the approved label and helped establish Adcetris as the front-line standard of care.

Partnering with patient advocacy groups and supporting patient access programs has created goodwill among stakeholders. For example, Takeda supports organizations like The Lymphoma Research Foundation and provides financial assistance to help eligible patients afford Adcetris treatment through its patient support program. This community engagement strategy has enhanced Takeda's reputation as a trusted partner in ALCL research and care.

Segmental Analysis of Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

Insights, By Subtypes of ALCL: >ALK-positive Shows Dominance in Targeted Therapy

In terms of subtypes of ALCL, ALK-positive contributes the highest share of the market owing to the benefits of targeted therapeutic approaches. ALK-positive ALCL is directly fueled by dysregulated ALK signaling, which makes it particularly receptive to ALK inhibitors. Most notably, drugs like XALKORI that selectively block ALK have demonstrated unprecedented response rates and durable remissions in ALK-positive ALCL patients.

The success of targeted ALK inhibitors is driving further research to expand treatment options for ALK-positive ALCL. Newer generations of ALK inhibitors are in development with aims of more potent inhibition, ability to penetrate the blood-brain barrier, and overcoming resistance. Immunotherapies are also showing promise when combined with ALK inhibitors, offering the potential for long-term management without chronic toxicity from chemotherapy.

As understanding increases of the oncogenic drivers in ALK-positive ALCL, targeted therapies tailored to disruption of ALK signaling will continue fueling this segment's market leadership. Relative safety, specificity and effectiveness of ALK inhibitors have established them as the standard of care, benefiting patients and contributing to the sustained growth prospects of this subtype.

Insights, By Diagnosis: Effectiveness of Frontline Regimen Highlights the Importance of XALKORI (Crizotinib)

In terms of By Diagnosis, XALKORI (Crizotinib) contributes the highest share of the market owing to its role as the treatment of choice for frontline treatment of ALK-positive ALCL. Crizotinib achieved unprecedented response rates exceeding 80% when first tested as a single agent in relapsed/refractory ALK-positive ALCL.

Its success inspired its rapid adoption as the standard frontline therapy, where even higher rates of remission are seen given patients have not already failed other treatments. No other regimen has come close to matching crizotinib's frontline efficacy and safety profile in ALK-positive ALCL. This has made crizotinib the foundational treatment approach in all recent clinical guidelines.

With first line use solidifying over time, and a lack of competitors demonstrating clear advantages, crizotinib will remain the dominant revenue driver within the ALCL treatment diagnosis segment for the foreseeable future. Its sustained first-in-line usage ensures a steady stream of repeat prescriptions, follow-on usage, and reinforcement as the treatment of choice driving this segment's market share leadership.

Additional Insights of Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

- Gender-specific cases show a higher incidence in men compared to women.

- ALCL accounts for about 1% of all non-Hodgkin lymphomas and 16% of T-cell lymphomas.

- ALK-positive ALCL typically affects children and adolescents, with a median age of 30, while ALK-negative cases have a median age of 54.

- Both ALK-positive and negative subtypes present distinct prognoses based on ALK protein expression.

Competitive overview of Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

The major players operating in the Anaplastic Large Cell Lymphoma (ALCL) Treatment Market include Pfizer, Seattle Genetics, Autolus Therapeutics, Seagen, and Beigene.

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market Leaders

- Pfizer

- Seattle Genetics

- Autolus Therapeutics

- Seagen

- Beigene

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market - Competitive Rivalry, 2024

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Anaplastic Large Cell Lymphoma (ALCL) Treatment Market

- In January 2021, Pfizer's XALKORI (crizotinib) was approved by the U.S. Food and Drug Administration (FDA) for the treatment of pediatric and young adult patients (aged 1 year and older) with ALK-positive anaplastic large cell lymphoma (ALCL). XALKORI is a kinase inhibitor and it works by inhibiting the activity of certain proteins, including ALK (anaplastic lymphoma kinase), ROS1, and c-Met, which play roles in the growth and spread of cancer cells.

- In 2021, ADCETRIS (brentuximab vedotin) was approved for the treatment of CD30-positive lymphomas, including refractory or relapsed anaplastic large cell lymphoma (ALCL). It is a CD30-directed antibody-drug conjugate developed by Seattle Genetics (now known as Seagen Inc.). The drug specifically targets the CD30 protein, which is expressed on the surface of certain cancer cells, such as those in Hodgkin lymphoma and ALCL.

- In 2024, Autolus Therapeutics announced that it is conducting a Phase I/II clinical trial (LibrA T1) for AUTO4, a novel CAR T-cell therapy targeting TRBC1 in patients with relapsed or refractory peripheral T-cell lymphoma (PTCL). AUTO4 is designed to selectively target T cells that express the TRBC1 marker, while sparing TRBC2-expressing T cells, which are essential for maintaining immune function.

Anaplastic Large Cell Lymphoma (ALCL) Treatment Market Segmentation

- By Subtypes of ALCL

- ALK-positive

- ALK-negative

- Primary Cutaneous ALCL

- Breast Implant-Associated ALCL

- By Diagnosis

- XALKORI (Crizotinib)

- ADCETRIS (Brentuximab Vedotin)

- AUTO4 (CAR T cell therapy)

- SGN-35T (CD30-directed antibody-drug conjugate)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the Anaplastic Large Cell Lymphoma (ALCL) treatment market?

The Anaplastic Large Cell Lymphoma (ALCL) treatment market is estimated to be valued at USD 11.65 Bn in 2024 and is expected to reach USD 16.75 Bn by 2031.

What are the key factors hampering the growth of the Anaplastic Large Cell Lymphoma (ALCL) treatment market?

The high costs of targeted therapies, limiting access for certain patient populations and challenges in effective treatment for Alk-negative cases, which have a worse prognosis are the major factor hampering the growth of the Anaplastic Large Cell Lymphoma (ALCL) treatment market.

What are the major factors driving the Anaplastic Large Cell Lymphoma (ALCL) treatment market growth?

The rising awareness and early diagnosis of ALCL subtypes like breast implant-associated ALCL and better uptake of existing drugs and pipeline therapies contributing to market growth are the major factor driving the Anaplastic Large Cell Lymphoma (ALCL) treatment market.

Which is the leading subtype Of ALCL in the Anaplastic Large Cell Lymphoma (ALCL) treatment market?

The leading subtype of ALCL segment is ALK-positive.

Which are the major players operating in the Anaplastic Large Cell Lymphoma (ALCL) treatment market?

Pfizer, Seattle Genetics, Autolus Therapeutics, Seagen, Beigene are the major players.

What will be the CAGR of the Anaplastic Large Cell Lymphoma (ALCL) treatment market?

The CAGR of the Anaplastic Large Cell Lymphoma (ALCL) treatment market is projected to be 5.3% from 2024-2031.