Animal Feed Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Animal Feed Market is Segmented By Animal Type (Poultry, Swine, Ruminants, Aquaculture, Others), By Ingredient (Cereals, Oilseeds, Molasses, Supplemen....

Animal Feed Market Size

Market Size in USD Bn

CAGR4.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.5% |

| Market Concentration | Medium |

| Major Players | Cargill, Inc., Archer Daniels Midland Company (ADM), Charoen Pokphand Group (CP Group), Nutreco N.V., New Hope Group and Among Others. |

please let us know !

Animal Feed Market Analysis

The animal feed market is estimated to be valued at USD 468.8 Bn in 2024 and is expected to reach USD 638.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2031. The animal feed market is expected to witness positive trends over the next few years. Increasing consumption of meat and dairy products along with rising disposable income levels in developing countries is likely to drive uptake of animal feed.

Animal Feed Market Trends

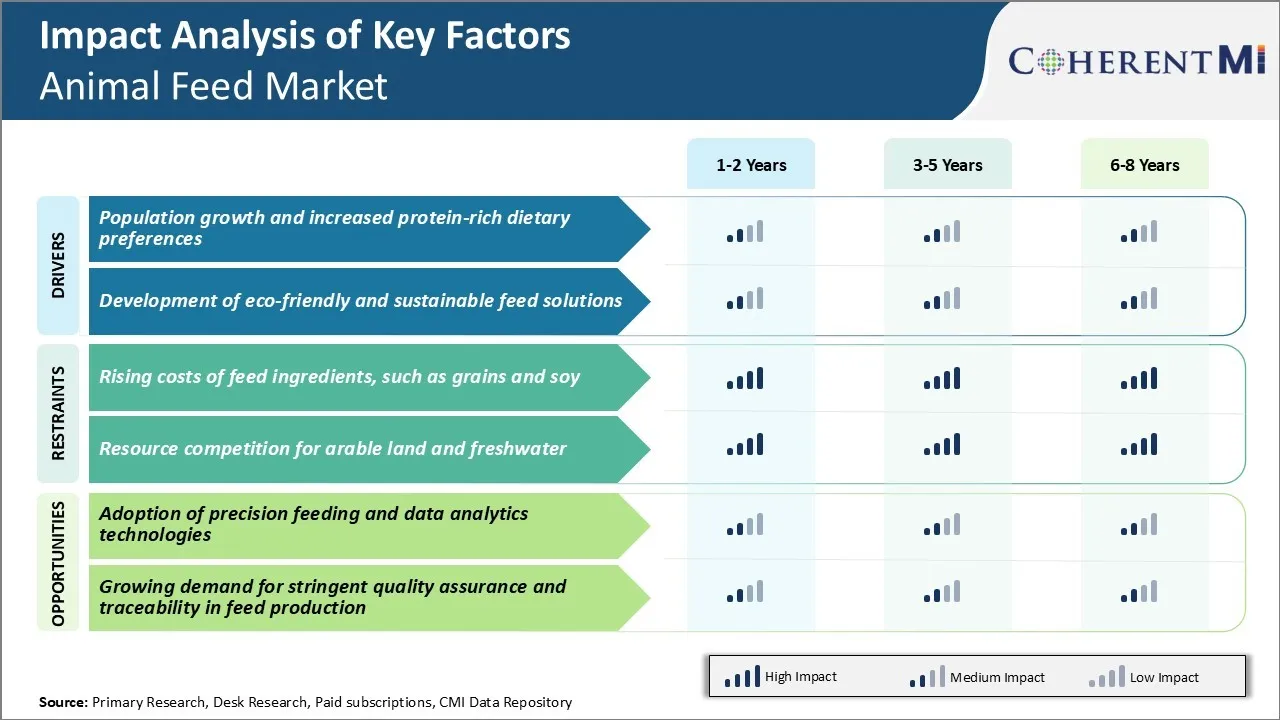

Market Driver - Population Growth and Increased Protein-Rich Dietary Preferences

Over 7 billion people now inhabit the planet and estimates suggesting there may be close to 10 billion people by 2050. Thereby, overall demand for food and nutrition has also swelled dramatically. While various plant-based options provide viable sources of protein, cultural preferences in many developing regions still favor animal meat products in their diets. This represents a massive untapped market potential for feed producers to help meet the nutritional needs.

As economies grow and personal incomes rise across middle and developing markets, consumers are able to diversify their diets beyond basic carbohydrate needs. Protein intake becomes a priority, with animal foods like meat, poultry, fish, eggs and dairy serving as preferred choices. Social trends also play a role where animal protein is seen as a symbol of status and wealth. When supplemented by shifting preferences towards animal proteins, it magnifies the imperative for the global animal feed market.

Market Driver - Development of Eco-Friendly and Sustainable Feed Solutions

There is increasing pressure on players in the feed industry to adopt greener practices and develop innovative solutions that are environmentally sustainable. With agricultural activities and intensive livestock production facing scrutiny for their carbon footprint and emissions levels, feed companies must proactively respond to these challenges. Those leveraging organic byproducts and waste streams through closed-loop systems also align with circular economy goals.

Government regulations in major regions are also incentivizing feed formulations with reduced environmental impact. Subsidies and initiatives exist to promote feedstocks like insects and algae that offer planetary benefits like mitigating greenhouse gases. Consumers too are educating themselves and willing to pay premiums for brands demonstrating sustainability commitments through their supply chain practices and solutions.

This emerging market dynamic compels animal feed manufacturers to invest heavily in research capacity driving product innovation. Those delivering nutritious options with verifiably lighter resource usage will gain competitive edge. Overall, sustainability presents a driver not just due to compliance needs but also growing commercial opportunities for companies cognizant of these societal and industry shifts.

Market Challenge - Rising Costs of Feed Ingredients, such as Grains and Soy

The animal feed market is facing significant challenges due to the rising costs of key feed ingredients such as grains and soy. Globally, the prices of corn and soybeans have risen substantially in the past year due to multiple factors. Adverse weather conditions like droughts in major producing regions have led to reduced harvests and lower supply.

Additionally, a large portion of corn and soybean production is being diverted for uses other than feed, such as biofuel production. This has further tightened availability for the animal feed market. The rising feed ingredient costs have squeezed profits for feed producers and livestock farmers. With commodity prices expected to remain volatile, it is challenging for players across the supply chain to plan budgets and pass on higher costs to consumers.

Unpredictable input price fluctuations also make long-term strategic planning difficult. Overall, escalating feed input costs pose a major threat to the profitability and stability of the global animal feed market.

Market Opportunity - Adoption of Precision Feeding and Data Analytics Technologies

The animal feed market is seeing growing opportunities from the adoption of advanced technologies that help improve production efficiency. Livestock farmers and feed producers are increasingly using precision feeding solutions and data analytics to optimize feed usage and animal performance. Precision feeding involves tailoring feed rations based on the unique nutritional needs of different groups of animals. This entails detailed nutritional profiling and adjusting ingredient compositions.

Meanwhile, data analytics technologies are enabling real-time monitoring of herd health, consumption patterns and growth rates. By leveraging sensors, IoT and cloud computing, players can collect vast amounts of farm data. Advanced data models then provide actionable insights into fine-tuning feeding programs. Going forward, the continued uptake of precision feeding and data analytics presents major opportunities for innovative solution providers in the animal feed market to grow revenues.

Key winning strategies adopted by key players of Animal Feed Market

Product Innovation: Continued product innovation to meet evolving customer needs has been a core strategy for market leaders like Cargill and ADM. For example, in 2020, Cargill launched new formulas for poultry and swine feeds containing micro-ingredients to boost immunity and gut health. Such innovations help stay ahead of competition and drive premiumization.

Strategic Acquisitions: Strategic acquisitions have allowed companies to expand geographic footprint, product portfolio and capabilities. For example, in 2021, ForFarmers acquired Reudink, a leading player in the Dutch animal feed market. This expanded ForFarmers' presence and market share in the Netherlands. Similarly, in 2018, ADM acquired Australian company Simplot's portfolio of animal feed and pet food businesses, expanding its presence globally.

Focus on Organic Growth Avenues: Leading players have focused on strong organic growth by expanding production capacities to cater to rising demand.

Efficient Supply Chain Management: Companies like ForFarmers and Land O'Lakes have streamlined supply chain operations to ensure just-in-time inventory management and lower operating costs. This has increased their price competitiveness. For example, ForFarmers integrated acquisitions like Reudink to leverage combined scale benefits and synergies across procurement and distribution network.

Segmental Analysis of Animal Feed Market

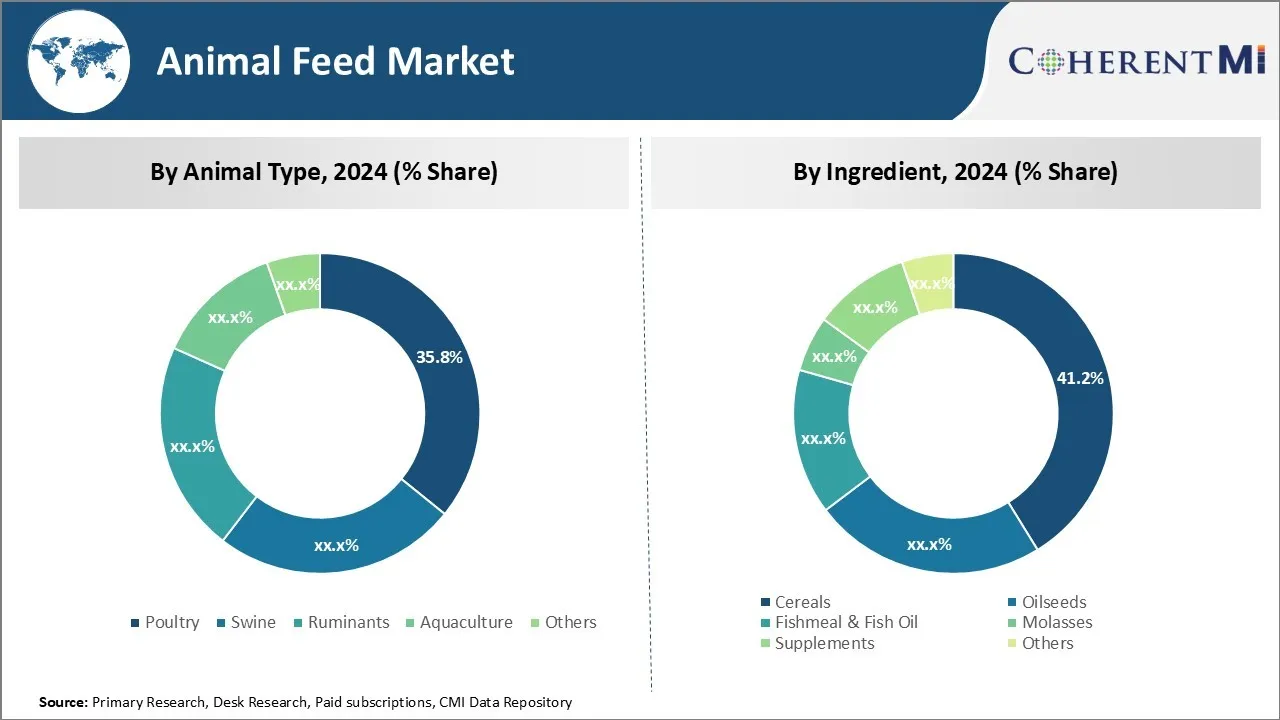

Insights, By Animal Type: Population Growth and Income Rise Drive Poultry Demand

In terms of animal type, poultry contributes 35.8% share of the animal feed market owning to rising demand for chicken and egg products across the world. Robust population growth in developing nations is translating to higher food demand, especially for affordable sources of protein like chicken and eggs. Poultry farming helps meet the nutritional needs of the growing masses in a cost-effective manner.

Furthermore, economic development in these markets is improving household incomes and lifting more people out of poverty each year. The expanding middle class has greater disposable earnings to spend on protein-rich animal foods. This bodes well for poultry producers as demand for broiler chicken and commercial laying hens increases. Investments to boost egg and poultry meat production would be crucial to keep up with dietary requirements of the surging population.

Insights, By Ingredient: Cereal Dominance Driven by Balanced Nutrition

In terms of ingredient, cereals contributes 41.2% share of the animal feed market owing to their balanced nutritional profile suiting key livestock types. Corn, wheat, and barley are among the most widely grown grains worldwide and offer abundant energy through carbohydrates. They are also reasonable sources of proteins, vitamins, minerals, and fiber required for health and growth.

Due to this balanced composition, cereals serve as a staple calorie provider in feed formulations for poultry, ruminants and pig farms. While soybean meal delivers additional protein value, cereal ingredients make up the bulk volume and energy fraction in cattle, swine, and poultry diets. The ready availability of these crops and affordability make cereals an indispensable nutrient base for livestock production around the globe.

Insights, By Additive: Antibiotics Lead due to Disease Control Function

In terms of additive, antibiotics contributes the highest share of animal feed market owing to their ability to prevent infectious diseases in farm animals. Bacterial illnesses can lead to heavy economic losses by reducing growth and impairing health in livestock operations. As animals are raised in high-density quarters, pathogens quickly spread without proper preventive measures.

Antibiotics play a crucial role in maintaining a disease-free environment and optimal productivity levels. They control clinical infections and inhibit subclinical diseases which may not outwardly manifest but still compromise production efficiency. Due to prophylactic and growth-promoting properties, antibiotics represent an important tool to maximize output from animal agriculture systems. Their unmatched disease control functionality makes them a staple additive in animal feed formulations around the world.

Additional Insights of Animal Feed Market

- Asia-Pacific Region Dominance: The region holds the largest share in animal feed market due to increasing livestock production and consumption of animal products.

- Shift Towards Plant-Based Animal Feed Ingredients: A trend driven by sustainability concerns and the high cost of traditional ingredients like fishmeal.

- The integration of blockchain technology in the supply chain to ensure traceability and transparency of feed ingredients, enhancing food safety and consumer trust.

- Mergers and acquisitions among key players to consolidate position in animal feed market and expand product portfolios, such as Nutreco's acquisition of animal nutrition companies in emerging markets.

Competitive overview of Animal Feed Market

The major players operating in the animal feed market include Cargill, Inc., Archer Daniels Midland Company (ADM), Charoen Pokphand Group (CP Group), Nutreco N.V., New Hope Group, Land O'Lakes, Inc., ForFarmers N.V., Alltech, Inc., Wen's Food Group, J.D. Heiskell & Co., Dabaco Group, De Heus Animal Nutrition, Ridley Corporation Limited, Kemin Industries, Inc., Biomin Holding GmbH, Evonik Industries AG, and BASF SE.

Animal Feed Market Leaders

- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- Charoen Pokphand Group (CP Group)

- Nutreco N.V.

- New Hope Group

Animal Feed Market - Competitive Rivalry, 2024

Animal Feed Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Animal Feed Market

- In January 2023, De Heus Animal Nutrition inaugurated its first animal feed factory in Ivory Coast. Located in the new industrial zone of PK 24 in Attinguié, the greenfield facility has an initial production capacity of 120,000 metric tons per annum. The factory produces complete feeds and concentrates, providing farmers in Ivory Coast and neighboring regions with a comprehensive product portfolio tailored to their specific conditions and goals.

- In 2022, Cargill announced a $50 million investment to upgrade its Global Animal Nutrition Innovation Center in Elk River, Minnesota, with completion expected in spring 2023.

Animal Feed Market Segmentation

- By Animal Type

- Poultry

- Broilers

- Layers

- Turkeys

- Swine

- Piglets

- Mature Pigs

- Ruminants

- Dairy Cattle

- Beef Cattle

- Sheep

- Aquaculture

- Fish

- Crustaceans

- Others

- Horses

- Pets

- Poultry

- By Ingredient

- Cereals

- Corn

- Wheat

- Barley

- Oilseeds

- Soybean Meal

- Canola Meal

- Fishmeal & Fish Oil

- Molasses

- Supplements

- Vitamins

- Minerals

- Amino Acids

- Enzymes

- Others

- Fats & Oils

- Antioxidants

- Cereals

- By Additive

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

- By Mode of Delivery

- Premixes

- Oral Powder

- Oral Solutions

- By End User

- Feed Manufacturers

- Contract Manufacturers

- Livestock Producers

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the animal feed market?

The animal feed market is estimated to be valued at USD 468.8 Bn in 2024 and is expected to reach USD 638.1 Bn by 2031.

What are the key factors hampering the growth of the animal feed market?

Rising costs of feed ingredients, such as grains and soy and resource competition for arable land and freshwater are the major factors hampering the growth of the animal feed market.

What are the major factors driving the animal feed market growth?

The population growth and increased protein-rich dietary preferences and development of eco-friendly and sustainable feed solutions are the major factor driving the animal feed market.

Which is the leading animal type in the animal feed market?

The leading animal type segment is poultry.

Which are the major players operating in the animal feed market?

Cargill, Inc., Archer Daniels Midland Company (ADM), Charoen Pokphand Group (CP Group), Nutreco N.V., New Hope Group, Land O'Lakes, Inc., ForFarmers N.V., Alltech, Inc., Wen's Food Group, J.D. Heiskell & Co., Dabaco Group, De Heus Animal Nutrition, Ridley Corporation Limited, Kemin Industries, Inc., Biomin Holding GmbH, Evonik Industries AG, and BASF SE are the major players.

What will be the CAGR of the animal feed market?

The CAGR of the animal feed market is projected to be 4.5% from 2024-2031.