Aplastic Anemia Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Aplastic Anemia Market is segmented By Disease Type (Inherited Anemia, Acquired Anemia), By Mode of Therapy (Immunosuppressive therapies, Promacta/Rev....

Aplastic Anemia Market Size

Market Size in USD Bn

CAGR5.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.2% |

| Market Concentration | High |

| Major Players | Novartis, Pfizer, Teva Pharmaceuticals, Kyowa Kirin, Sanofi and Among Others. |

please let us know !

Aplastic Anemia Market Analysis

The Global Aplastic Anemia Market is estimated to be valued at USD 7.23 bn in 2024 and is expected to reach USD 10.29 bn by 2031, growing at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2031. Aplastic anemia is a rare blood disorder in which the bone marrow does not produce enough new blood cells. The increasing prevalence of aplastic anemia, rising funding for research on rare diseases, and growing pipeline of treatment drugs are some of the key factors expected to drive the growth of the aplastic anemia market during the forecast period.

The market is witnessing positive trends which are expected to support the growth of the market during the forecast years. There is a rise in the number of treatment options available and an increase in awareness regarding aplastic anemia which is supporting early diagnosis and treatment. Additionally, strategic collaborations between key market players to develop new and improved treatment solutions will further aid market expansion. However, high treatment costs and lack of definitive treatment methods are some of the challenges hampering the further growth of the aplastic anemia market.

Aplastic Anemia Market Trends

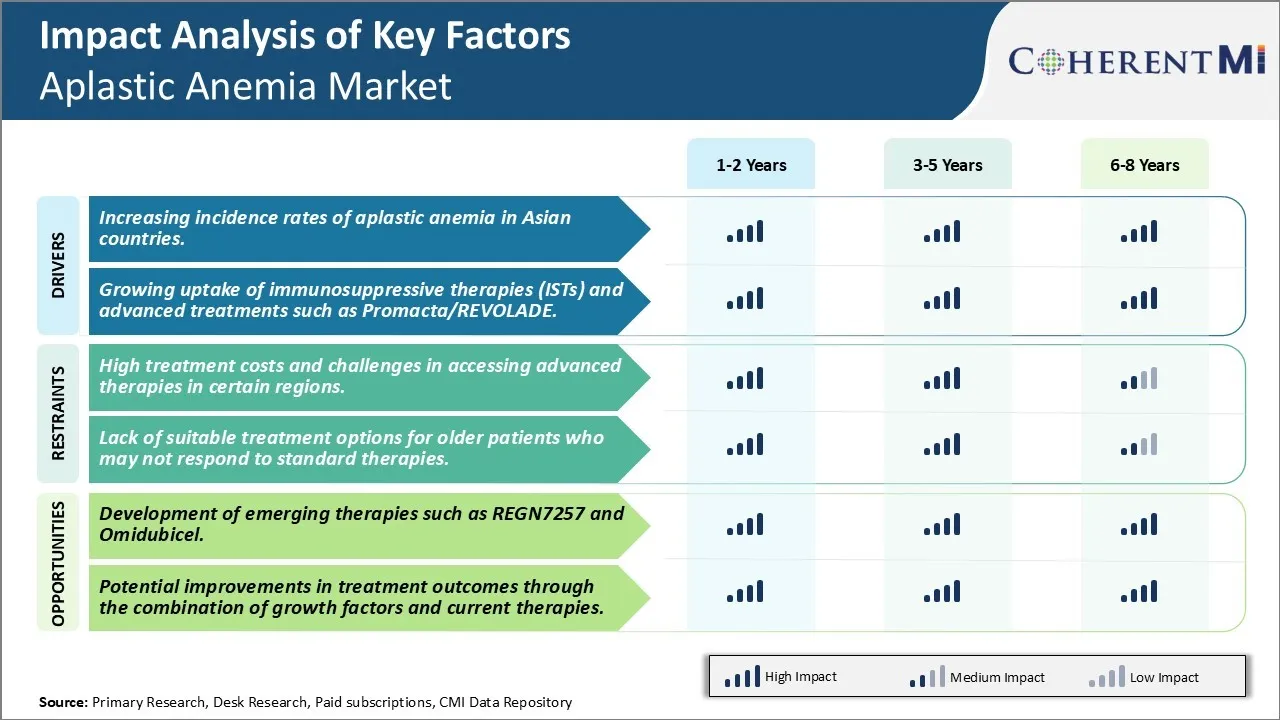

Market Driver - Increasing Incidence Rates of Aplastic Anemia in Asian Countries.

With increasing globalization and industrialization taking place rapidly across Asia, the rates of aplastic anemia have seen a noticeable rise in the region in recent years. Countries such as India, China, Japan and several Southeast Asian nations have reported higher detection of aplastic anemia cases among their population. This has mainly been attributed to rising pollution levels, higher exposure to toxins and chemicals at workplaces and changes occurring in lifestyles and food habits.

India in particular has emerged as a nation with high occurrence of aplastic anemia, with estimates suggesting incidences have doubled over the past decade. Environmental pollutants released by numerous factories combined with poor emission standards have negatively impacted public health. Across Southeast Asia as well, the scenario is alarming with nations experiencing epidemiological transition undergoing a ‘disease burden shift’. Countries which hitherto had lower risks are now encountering non-communicable diseases in abundance. This is primarily due to changing dietary patterns, sedentary jobs and contamination of natural resources from irresponsible waste disposal. All these factors have contributed to rising susceptibility to aplastic anemia in Asia’s population.

With awareness and diagnostic capabilities improving simultaneously, more cases are being reported officially which were previously undocumented. The rising incidence rates particularly in the high growth regions of Asia signifies growing market potential. As these nations look to provide effective treatment options to their citizens, demand is expected to increase substantially for drugs, therapies and services catering to aplastic anemia management. The brewing healthcare crisis unfolding demands immediate attention of stakeholders to curb risk factors and ensure access to advanced care for those impacted.

Market Driver - Growing Uptake of Immunosuppressive Therapies (ISTs) and Advanced Treatments such as Promacta/REVOLADE

Over the past decade, the treatment landscape for aplastic anemia has evolved significantly with new lines of therapies gaining prominence. While conventional first line treatment involving immunosuppressive drugs like Anti-thymocyte globulin and Cyclosporine A still remain popular, they are increasingly being supplemented or substituted with newer tailored options. One such class of drugs receiving increased uptake are JAK inhibitors approved specifically for aplastic anemia. A prime example is Promacta/Revolade developed by Novartis which works by inhibiting JAK pathway and stimulating platelets production. Since gaining regulatory approvals starting 2015, it has fast emerged as an alternative or add-on to ISTs, especially for patients not responding fully or facing side effects. Its oral administration, minimal adverse reactions and definitive action on symptoms have made it a preferred choice. Regular reviews have also found Promacta improving long term outcomes and survival rates compared to traditional ISTs alone.

Market Challenge - High Treatment Costs and Challenges in Accessing Advanced Therapies In Certain Regions.

One of the key challenges for the Aplastic Anemia market is the high treatment costs associated with advanced therapies for the disease. Aplastic Anemia is a rare disease with a small patient pool globally. Developing advanced therapies such as stem cell transplants and gene therapies require massive investments in R&D. The costs of these new therapies are considerably high to recoup investments. This makes advanced aplastic anemia treatments unaffordable for many patients.

Similarly, certain regions have limited access to advanced care centers that can provide complex treatments like stem cell transplant and gene therapy. Most developing countries have very few transplant centers with necessary infrastructure and trained medical staff. Even developed markets outside of US and Europe have inadequate number of advanced care providers. The disproportionately uneven spread of healthcare resources poses treatment access challenges for aplastic anemia patients in these regions. Overall, the high costs of new therapies and inadequate healthcare infrastructure in certain parts of the world restrict larger access to life-saving aplastic anemia treatments.

Market Opportunity - Development of emerging therapies such as REGN7257 and Omidubicel.

A major opportunity for the Aplastic Anemia market lies in the development of emerging treatment candidates that are more effective yet affordable. Drugs like REGN7257 and Omidubicel have demonstrated promising results in clinical trials and hold potential to transform the treatment landscape. REGN7257 is an investigational IL-15 cytokine developed by Regeneron to boost T-cell counts in aplastic anemia. In a phase 1 trial, it showed positive early signs of increasing T-cell counts and neutrophil levels in patients. Omidubicel, developed by Gamida Cell, is an investigational advanced cell therapy using umbilical cord blood. Phase 3 trials found Omidubicel helped over 70% of aplastic anemia patients avoid the need for disease treatments like blood transfusions and immunosuppressive drugs for at least a year. The development of new therapies like these could offer more effective and affordable options to address aplastic anemia compared to existing treatments like immunosuppression and stem cell transplants. This will help in improving outcomes and further expanding access to care, thus opening up potential growth avenues for the market.

Prescribers preferences of Aplastic Anemia Market

Aplastic anemia is a rare disease where bone marrow fails to produce sufficient new blood cells. Treatment varies depending on severity and patient factors. For mild cases, first-line therapy involves blood transfusions and immunosuppressive drugs. Brands like Rezurock (ruxolitinib) and Promacta (eltrombopag) are often prescribed to stimulate platelet production.

For moderate to severe cases, the standard first-line treatment is immunosuppressive therapy using a combination of horse antithymocyte globulin (ATGAM) and cyclosporine A (Gengraf, Neoral). This aims to restore normal blood cell production in around 70% of patients. When immunosuppression fails or relapse occurs, the next line of treatment involves bone marrow transplantation. Prescribers prefer bone marrow from a matched sibling donor if possible. Otherwise, they consider bone marrow or peripheral blood stem cells from an unrelated donor.

Factors influencing prescriber preferences include patient health status, complication risk, insurance coverage, and treatment availability. They also monitor patients closely for side effects from immunosuppression like infections. The stage and severity of disease determines whether close monitoring, maintenance therapy, or moving quickly to transplant is most appropriate. Overall, prescribers aim to restore natural blood production through the least intensive means possible.

Treatment Option Analysis of Aplastic Anemia Market

Aplastic Anemia has three main stages - mild, moderate, and severe - determined by blood cell counts. Treatment varies based on severity and patient health factors.

For mild cases, the first line treatment is usually blood transfusions to address low red blood cell and platelet counts. This helps manage symptoms until the body can recover on its own.

More severe cases require immunosuppressive drugs or stem cell transplants. A common first-line treatment is a combination of horse antithymocyte globulin (ATGAM) and cyclosporine. ATGAM works to suppress the immune system's destruction of bone marrow stem cells. Cyclosporine helps prevent their rejection. This drug regimen allows stem cells to regrow the blood-forming tissues in over 70% of patients.

For those who do not respond to immunosuppression or relapse, the next line of treatment is a stem cell transplant. The stem cells can come from either bone marrow or circulating blood. The preferred donor is a matched sibling, but unrelated and cord blood donors are also used. Before the transplant, high-dose immunosuppressants like busulfan are given to prevent rejection. This offers the best chance of cure by restoring the bone marrow's blood production capabilities.

Transfusions and growth factors may be used as supportive care during/after transplants. The treatment goal is always to stimulate recovery of the bone marrow through immune modulation or stem cell replacement.

Key winning strategies adopted by key players of Aplastic Anemia Market

Product Innovation: Developing new and improved treatment options has been a winning strategy for key players. In 2019, Pfizer received FDA approval for Reblozyl (luspatercept-aamt) as the first ever erythroid maturation agent indicated for aplastic anemia. This novel treatment represented a significant advancement and expanded treatment options for patients.

Targeted Acquisitions: Strategic acquisitions of smaller biotech companies have helped large players gain access to promising drug candidates and pipelines. For example, in 2018, Bristol-Myers Squibb acquired Celgene for USD 74 billion, gaining rights to Celgene's investigational drug, luspatercept, which was in late-stage trials for aplastic anemia. This acquisition accelerated Bristol-Myers Squibb's entry into the market.

Expanded Indications: Existing drugs have demonstrated success when granted approval for new indications. In 2014, Roche received approval to expand the use of Rituxan for treating aplastic anemia patients who had an insufficient response to immunosuppressive therapy. This helped increase Rituxan's market share in the aplastic anemia segment.

Partnerships for Clinical Trials: Collaborating with research institutions has helped advance experimental therapies. In 2018, Omidubicel received Breakthrough Therapy Designation from the FDA after Mustang Bio partnered with City of Hope for Phase 3 clinical trials. Such partnerships de-risk development and speed therapies to market.

Aggressive Commercialization: Players have aggressively promoted newly approved drugs through marketing campaigns targeting physicians and patients. Pfizer invested heavily in promotions for Reblozyl, resulting in USD100 million in sales in its first year. These promotion efforts have been important for establishing market presence and share for new treatment options.

Segmental Analysis of Aplastic Anemia Market

Insights, By Disease Type, Inherited Anemia Dominates Due to Lack of Prevention Options.

Inherited anemia is expected to contribute 65.4% in 2024 owing to limited prevention options. Aplastic anemia caused by inherited genetic mutations and disorders cannot be avoided, as the conditions are passed down from generation to generation. While acquired anemia may be avoidable through lifestyle changes or reducing exposure to toxic triggers, inherited forms have no such prevention pathways. Genetic flaws that inhibit the body's normal blood cell production inevitably leads to aplastic anemia over time. Conditions like Fanconi anemia and dyskeratosis congenita slowly degrade the bone marrow's ability to regenerate blood supply. As long as the defective genes remain in a person's DNA, the decline cannot be stopped. Raising awareness of family histories and facilitating genetic testing can identify high-risk individuals, but it does not eliminate the underlying cause driving their anemia.

Even with early detection, management of inherited anemia primarily relies on lifelong treatment to address symptoms rather than a cure. Bone marrow transplant presents risks and is not an option for all patients. Immunosuppressive drugs and growth factors can boost blood counts temporarily but do not repair the flawed hematopoietic stem cells. Unless gene therapy or advanced regenerative approaches emerge, inherited patients have little choice but to endure iterative treatment courses.

The unavoidable nature of genetic predisposition means inherited anemia accounts for the majority of the total aplastic anemia cases seen in clinics each year. While acquired causes maydecline with improved understanding of toxic triggers, inherited forms will remain a persistent condition marketplace as long as the defective genes themselves cannot be altered or replaced.

Insights, By Mode of Therapy, Immunosuppressive Therapies Dominate Initial Treatment.

Within aplastic anemia therapy modes, immunosuppressive drugs hold the largest share 41.6% in 2024 due to being the standard first-line treatment option. Most patients initially attempt immunosuppression to stimulate dormant bone marrow function before considering costlier or riskier alternatives.

Doctors commonly prescribe antithymocyte globulin (ATG) and cyclosporine A due to their proven efficacy in spurring hematopoietic recovery in over 70% of acquired aplastic anemia patients. As the least invasive treatment path, immunosuppression provides a low-risk starting point that can eliminate the need for further intervention in many cases. This appealing risk-benefit profile solidifies its popularity compared to other therapy classes.

Moreover, orally dosed cyclosporine A enables outpatient treatment, avoiding hospitalization. Its gradual taper schedule to mitigate rejection risk allows sustained treatment periods for maximum response opportunity. ATG administration usually requires only brief hospitalization for infusion management. Convenient administration further drives preference for immunosuppressive selection as initial aplastic anemia therapy.

For patients who do not respond sufficiently to or tolerate first-line drugs, subsequent options involve weightier considerations. Hematopoietic growth factors may supplement partial responders but do not replace initial therapy. Bone marrow transplant entails substantial preparative regimens and life-long monitoring. Younger patients tend to be selected due to risks. Therefore, immunosuppression therapy dominates as the low-hanging fruit for initial aplastic anemia intervention in the majority of cases.

Additional Insights of Aplastic Anemia Market

Aplastic Anemia is a complex and rare disease affecting hematopoietic cells. The treatment landscape has evolved with immunosuppressive therapies and bone marrow transplantation being the most widely used. However, there is a significant unmet need for treatments in older patients who are not eligible for aggressive therapies. The market is witnessing new developments with the introduction of emerging therapies such as REGN7257 and Omidubicel. The US accounts for the highest market share due to a larger patient pool, and Japan follows closely with a growing incident rate. The market is expected to expand as new treatments gain approval and as research focuses on improving long-term survival for patients, especially those in higher age groups. Given the complexity of the condition, personalized treatment plans and advanced therapies hold promise for better outcomes.

Competitive overview of Aplastic Anemia Market

The major players operating in the Aplastic Anemia Market include Novartis, Pfizer, Teva Pharmaceuticals, Kyowa Kirin, Sanofi, Regeneron Pharmaceuticals (REGN7257), Gamida Cell (Omidubicel), Cellenkos, Hemogenyx Pharmaceuticals and BioLineRx, Ltd.

Aplastic Anemia Market Leaders

- Novartis

- Pfizer

- Teva Pharmaceuticals

- Kyowa Kirin

- Sanofi

Aplastic Anemia Market - Competitive Rivalry, 2024

Aplastic Anemia Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Aplastic Anemia Market

- In June 2024, Gamida Cell announced the approval of Omidubicel for use in umbilical cord blood transplantation, enhancing marrow recovery and improving transplant outcomes.

- In July 2023, Novartis' PROMACTA/REVOLADE continues to drive revenue, primarily benefiting severe aplastic anemia patients. The drug's robust sales are driven by increased adoption in the US and Japan.

- In August 2023, Regeneron Pharmaceuticals' REGN7257 is undergoing Phase I/II trials for refractory or relapsed severe aplastic anemia, offering a new approach to T-cell-mediated conditions.

Aplastic Anemia Market Segmentation

- By Disease Type

- Inherited Anemia

- Acquired Anemia

- By Mode of Therapy

- Immunosuppressive therapies (ISTs)

- Promacta/Revolade

- Bone Marrow Transplantation

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Aplastic Anemia Market?

The Global Aplastic Anemia Market is estimated to be valued at USD 7.23 bn in 2024 and is expected to reach USD 10.29 bn by 2031.

What will be the CAGR of the Aplastic Anemia Market?

The CAGR of the Aplastic Anemia Market is projected to be 5.2% from 2024 to 2031.

What are the major factors driving the Aplastic Anemia Market growth?

The increasing incidence rates of aplastic anemia in Asian countries and growing uptake of immunosuppressive therapies (ists) and advanced treatments such as PROMACTA/REVOLADE are the major factors driving the Aplastic Anemia Market.

What are the key factors hampering the growth of the Aplastic Anemia Market?

The high treatment costs and challenges in accessing advanced therapies in certain regions and lack of suitable treatment options for older patients who may not respond to standard therapies are the major factor hampering the growth of the Aplastic Anemia Market.

Which is the leading Disease Type in the Aplastic Anemia Market?

The leading Disease Type segment is Inherited Anemia.

Which are the major players operating in the Aplastic Anemia Market?

Novartis, Pfizer, Teva Pharmaceuticals, Kyowa Kirin, Sanofi, Regeneron Pharmaceuticals (REGN7257), Gamida Cell (Omidubicel), Cellenkos, Hemogenyx Pharmaceuticals, BioLineRx, Ltd. are the major players.