ATTR Amyloidosis Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

ATTR Amyloidosis Treatment Market is segmented By Type (Hereditary ATTR Amyloidosis, Wild-type ATTR Amyloidosis), By Treatment (Pharmacological Therap....

ATTR Amyloidosis Treatment Market Size

Market Size in USD Bn

CAGR8.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.7% |

| Market Concentration | High |

| Major Players | Pfizer Inc., Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Eidos Therapeutics, Inc., Akcea Therapeutics, Inc. and Among Others. |

please let us know !

ATTR Amyloidosis Treatment Market Analysis

The ATTR amyloidosis treatment market is estimated to be valued at USD 3.8 Bn in 2024 and is expected to reach USD 6.82 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2031. ATTR amyloidosis is a rare genetic disease with deposition of abnormal protein called amyloid in organs and tissues. Several treatment options and novel drug pipeline is expected to drive the growth of this market during the forecast period.

ATTR Amyloidosis Treatment Market Trends

Market Driver - Increased Diagnosis Rates are Propelling Market Growth

Previously, ATTR amyloidosis was often misdiagnosed as other conditions like heart failure or carpal tunnel syndrome due to overlapping symptoms. This led to delays in initiating appropriate treatment. However, the introduction of non-invasive diagnostic techniques has streamlined the diagnostic process.

Diagnosing ATTR amyloidosis at an early stage is important as it allows physicians to monitor patients closely and start treatment as soon as signs of organ damage appear. Early intervention can help slow down disease progression and reduce complications in the long run. This has motivated physicians to have a higher index of suspicion for ATTR amyloidosis in patients presenting with heart failure or neuropathy.

As diagnostic accuracy improves, the number of ATTR amyloidosis patients identified is rising steadily. In fact, some studies indicate that increased application of genetic testing and biopsy has led to nearly five-fold increase in newly diagnosed ATTR amyloidosis cases over the past few years.

With more patients getting appropriately diagnosed, the demand for disease modifying therapies is also growing. Pharmaceutical companies have responded by expanding their product portfolios to cater to the different sub-types of ATTR amyloidosis. This has given doctors alternative treatment options based on individual patient characteristics and disease stage.

Market Driver - Novel Therapies Enhancing Market Demand

Significant advances have been made in the therapeutic landscape for ATTR amyloidosis treatment. The approval of tafamidis and inotersen brought much needed options for treating transthyretin-mediated amyloidosis. These therapies demonstrated ability to stabilize the disease and provide symptomatic relief. More recently, the FDA granted accelerated approval to patisiran and pegsilimab for hereditary transthyretin-mediated amyloidosis. Both drugs employ novel mechanisms like RNA interference to selectively silence disease-causing mutant genes. This offers a targeted approach with fewer off-target side effects.

In clinical trials, patisiran and pegsilimab led to remarkable reductions in amyloid deposits and neuropathies. Physicians are hopeful that these first-in-class therapies can potentially modify ATTR amyloidosis progression when used early. Their good safety-efficacy profiles also make them suitable for long-term administration. The robust clinical data has created excitement in the medical community regarding prospects of achieving a true disease-modifying effect with continued use. Pharmaceutical sponsors as well as patient advocacy groups are ramping up efforts to spread awareness about these breakthrough treatments.

As real-world evidence further validates their promise of impacting long-term outcomes, utilization rates will keep growing. This flourishing innovation pipeline ensures robust growth opportunities for ATTR amyloidosis treatment providers in the foreseeable future.

Market Challenge - Expensive Nature of Novel Therapies Limits Accessibility for Some Patients

The expensive nature of novel therapies limits accessibility for some patients in the ATTR amyloidosis treatment market. The current generation of ATTR amyloidosis therapies, such as inotersen and patisiran, are priced at over $300,000 USD for an average course of treatment.

While these novel drugs have shown promise in improving outcomes for ATTR amyloidosis patients, their high list prices create a significant financial burden for patients and healthcare systems. Many payers deny coverage for these therapies citing lack of long-term efficacy and safety data to justify such high costs.

Even when approved, patients may be required to pay large co-pays that they cannot afford. As a result, many ATTR amyloidosis patients who could benefit from the new generation of treatments do not have access to them. High drug prices also put pressure on healthcare budgets and could hamper broader uptake of novel ATTR amyloidosis therapies.

Addressing issues of drug pricing and accessibility will be key to realizing the full market potential of new treatments in this space.

Market Opportunity - Untapped Markets in Developing Countries

Untapped markets in developing countries offer significant growth potential for the ATTR amyloidosis treatment market. Currently, the market is dominated by North America and Western Europe where awareness of ATTR amyloidosis is higher and patients have better access to diagnostic techniques and novel therapies.

However, ATTR amyloidosis has a global prevalence and an increasing number of cases are being identified in developing regions of Latin America, Asia Pacific and Africa as diagnostic capabilities expand to these markets. The large patient populations in countries like Brazil, India and across Africa present lucrative commercial opportunities.

Penetration of existing and emerging therapies into developing country healthcare systems could drive a substantial increase in the number of treated patients globally. Multinational pharmaceutical companies need to devise innovative pricing, access programs and partnerships with local stakeholders to successfully tap into these emerging markets and ensure long-term sustainability of novel ATTR amyloidosis treatments worldwide.

Prescribers preferences of ATTR Amyloidosis Treatment Market

ATTR Amyloidosis typically progresses through three stages - early, middle, and late stage disease. In early stage, prescribers commonly start treatment with tafamidis (Vyndaqel) or diflunisal for patients with polyneuropathy symptoms. These medications aim to slow neurological decline by stabilizing transthyretin.

As the disease transitions to middle stage with more severe polyneuropathy and/or cardiomyopathy, prescribers may switch therapy to inotersen (Tegsedi). Inotersen is administered through weekly subcutaneous injections and targets neurological symptoms by reducing production of problematic transthyretin protein. For patients experiencing heart failure in middle stage, prescribers have also begun to use tafamidis or experimental gene silencing drugs like patisiran (Onpattro) to prevent further transthyretin aggregation in cardiac tissues.

In late stage ATTR Amyloidosis, dominant symptoms involve severe neuropathy, inability to perform daily tasks, and refractory heart failure. Currently, the only treatments at this advanced point involve manageable care through medications like diuretics and ACE inhibitors. Prescribers note supportive care is prioritized once neurologic and cardiac damage becomes irreversible. Overall treatment approach is also influenced by patient outcomes on previous therapies, insurance coverage, and new drugs in late-stage trials.

Treatment Option Analysis of ATTR Amyloidosis Treatment Market

In early-stage disease, where amyloid deposits are minimal and organ dysfunction is not severe, the preferred line of treatment involves the use of tafamidis. Tafamidis, sold under the brand name Vyndaqel, is a Pfizer drug that works by stabilizing the tetrameric form of transthyretin, thus preventing amyloid formation. As damage is largely reversible at this stage, tafamidis helps halt disease progression and preserve organ function.

Once organ damage becomes significant and/or amyloid deposits cross a certain threshold, the disease enters the late stage. For late-stage ATTR patients with cardiomyopathy, inhibitors like Pfizer's Vyndaqel or Alnylam/Akcea's Onpattro are used. Onpattro (patisiran) is an RNA interference therapeutic that promotes clearance of toxic transthyretin. It offers an advantage over tafamidis by not just halting amyloid buildup but actively removing existing deposits. However, tafamidis continues to be the preferred choice for patients with contraindications to Onpattro or those unable to maintain steady infusion schedules.

For late-stage neuropathic patients, Onpattro is usually the treatment of choice due to its ability to remove amyloid fibrils from nerves and reduce pain levels. Overall, inhibitors like tafamidis and Onpattro that prevent amyloidogenesis or promote dissolution of amyloid deposits have emerged as the mainstay of ATTR treatment across stages of disease.

Key winning strategies adopted by key players of ATTR Amyloidosis Treatment Market

Pfizer has been a dominant player in the ATTR amyloidosis treatment market with its drug Vyndaqel (tafamidis meglumine). It gained approval for ATTR cardiac amyloidosis in 2019. A key strategy Pfizer adopted was conducting robust clinical trials to demonstrate efficacy and safety of tafamidis. Its landmark ATTR-ACT trial showed tafamidis reduced all-cause mortality and cardiovascular related hospitalizations in ATTR-cardiac patients vs placebo. This clinical evidence helped gain regulatory approvals and physician acceptance globally.

Another strategy was aggressive marketing campaigns post approval to educate clinicians and patients. Pfizer deployed a large sales force for outreach and conducted educational seminars highlighting trial results. As a result, tafamidis garnered a 72% market share within a year of launch for ATTR-cardiac in the US. Its sales grew from $429 million in 2019 to $881 million in 2021 demonstrating the commercial success of this strategy.

Alnylam emerged as a strong competitor with its RNAi based drug Onpattro approved in 2019 for ATTR-PN. It adopted a patient-centric strategy by providing financial assistance programs and raising ATTR awareness among neurologists. Over 80% of eligible patients were able to access Onpattro through their patient support programs. This strategy helped establish Onpattro as a principal treatment for ATTR-PN patients.

Segmental Analysis of ATTR Amyloidosis Treatment Market

Insights, By Type: Genetic Factors Drive the High Prevalence of Hereditary ATTR Amyloidosis

In terms of type, hereditary ATTR amyloidosis contributes the highest share of the market owning to genetic factors. Hereditary ATTR amyloidosis is an inherited condition caused due to mutations in the TTR gene which produces abnormal transthyretin protein that misfolds and accumulates in tissues and organs.

About 100 mutations in the TTR gene have been identified so far, with the most common mutations occurring at positions 30, 60, and 84. These genetic mutations have a dominant inheritance pattern, meaning if one parent passes on a mutated gene then there is a 50% chance that each child will inherit the condition.

Populations with genetic ancestry linked to endemic foci in Portugal, Japan and Sweden have a higher incidence of hereditary ATTR amyloidosis due to ancestral founder mutations. The high prevalence of specific gene mutations in these geographic regions significantly contributes to the dominant market share of hereditary ATTR amyloidosis segment.

Insights, By Treatment: Established Treatment Paradigm Boosts Pharmacological Therapies Segment

In terms of treatment, pharmacological therapies contribute the highest share of the market owing to an established treatment paradigm. Transthyretin stabilizers such as Tafamidis and Patisiran which prevent transthyretin protein dissociation and amyloid fibril formation have become the standard of care for hereditary ATTR amyloidosis patients. Due to proven efficacy and safety demonstrated in clinical trials, they have rapidly gained regulatory approvals and reimbursements globally.

Moreover, non-invasive oral administration of these pharmacological therapies makes long-term adherence and management convenient for patients. Established clinical guidelines recommend early initiation of disease-modifying therapy to delay disease progression, creating a strong clinical demand for pharmacological drugs in theATTR amyloidosis treatment landscape.

Insights, By Route of Administration: Favorable Dosage Form Drives Oral Route of Administration Segment

In terms of route of administration, oral administration contributes the highest share of the market owing to a favorable dosage form. Available pharmacological therapies such as Tafamidis and Patisiran offer oral capsules and tablets as the route of drug delivery.

The oral route allows outpatient administration with less patient discomfort and risks associated with intravenous or subcutaneous injections. Higher acceptance of oral medications leads to more prescriptions and adherence to therapy.

Additionally, oral drugs have economic benefits with reduced administration costs and healthcare resource utilization compared to parenteral routes. These advantages of oral routes of delivery establish it as the most widely used form of administration among ATTR amyloidosis patients.

Additional Insights of ATTR Amyloidosis Treatment Market

- ATTR amyloidosis affects approximately 50,000 people worldwide, but it's often underdiagnosed due to nonspecific symptoms.

- The disease predominantly affects individuals over the age of 60, with wild-type ATTR amyloidosis more common in males.

- The high cost of therapies can exceed $225,000 per patient annually, placing a significant burden on healthcare systems and patients.

Competitive overview of ATTR Amyloidosis Treatment Market

The major players operating in the ATTR Amyloidosis Treatment Market include Pfizer Inc., Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Eidos Therapeutics, Inc., Akcea Therapeutics, Inc., Prothena Corporation plc, Corino Therapeutics, Inc., and AstraZeneca plc.

ATTR Amyloidosis Treatment Market Leaders

- Pfizer Inc.

- Alnylam Pharmaceuticals, Inc.

- Ionis Pharmaceuticals, Inc.

- Eidos Therapeutics, Inc.

- Akcea Therapeutics, Inc.

ATTR Amyloidosis Treatment Market - Competitive Rivalry, 2024

ATTR Amyloidosis Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in ATTR Amyloidosis Treatment Market

- In August 20222, Alnylam Pharmaceuticals Announced positive results from the Phase III APOLLO-B trial for Patisiran, demonstrating efficacy in ATTR amyloidosis patients with cardiomyopathy. This could expand its label to include cardiac manifestations, impacting patient care positively. The trial demonstrated that patisiran improved functional capacity in patients with ATTR amyloidosis with cardiomyopathy.

- In June 2023, Eidos Therapeutics Reported promising Phase III data for Acoramidis in treating ATTR-CM, showing improvement in functional capacity and quality of life, potentially offering a new oral therapeutic option. Acoramidis, developed by Eidos Therapeutics (a subsidiary of BridgeBio), showed significant improvements in treating transthyretin amyloid cardiomyopathy (ATTR-CM) during the ATTRibute-CM Phase III trial.

- Pfizer's Vyndaqel (tafamidis) received expanded FDA approval to treat both hereditary and wild-type transthyretin amyloid cardiomyopathy (ATTR-CM). This approval covers two forms of the disease: hereditary ATTR-CM, which results from genetic mutations, and wild-type ATTR-CM, which occurs with aging. Vyndaqel and its alternative formulation, Vyndamax, are the first and only FDA-approved treatments for ATTR-CM. Clinical trials demonstrated that Vyndaqel significantly reduces all-cause mortality and cardiovascular-related hospitalizations in patients with both types of ATTR-CM.

- Ionis Pharmaceuticals' eplontersen, an investigational ligand-conjugated antisense oligonucleotide, is currently undergoing Phase III clinical trials aimed at reducing transthyretin (TTR) protein production. This treatment is being developed for conditions like hereditary transthyretin-mediated amyloidosis (ATTR), which includes polyneuropathy and cardiomyopathy forms. The NEURO-TTRansform Phase III trial, targeting polyneuropathy patients, demonstrated consistent and sustained improvements in reducing TTR protein levels, halting disease progression, and improving quality of life over a period of up to 85 weeks.

ATTR Amyloidosis Treatment Market Segmentation

- By Type

- Hereditary ATTR Amyloidosis

- Familial Amyloid Polyneuropathy (FAP)

- Familial Amyloid Cardiomyopathy (FAC)

- Wild-type ATTR Amyloidosis

- Senile Systemic Amyloidosis

- Isolated Atrial Amyloidosis

- Hereditary ATTR Amyloidosis

- By Treatment

- Pharmacological Therapies

- Transthyretin Stabilizers (e.g., Tafamidis)

- RNA Interference Therapies (e.g., Patisiran)

- Antisense Oligonucleotides (e.g., Inotersen)

- Organ Transplantation

- Liver Transplantation

- Heart Transplantation

- Supportive Care

- Symptomatic Treatments

- Rehabilitation Services

- Pharmacological Therapies

- By Route of Administration

- Oral

- Intravenous

- Subcutaneous

- By End User

- Hospitals

- Specialty Clinics

- Homecare Settings

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the ATTR Amyloidosis treatment market?

The ATTR amyloidosis treatment market is estimated to be valued at USD 3.8 Bn in 2024 and is expected to reach USD 6.82 Bn by 2031.

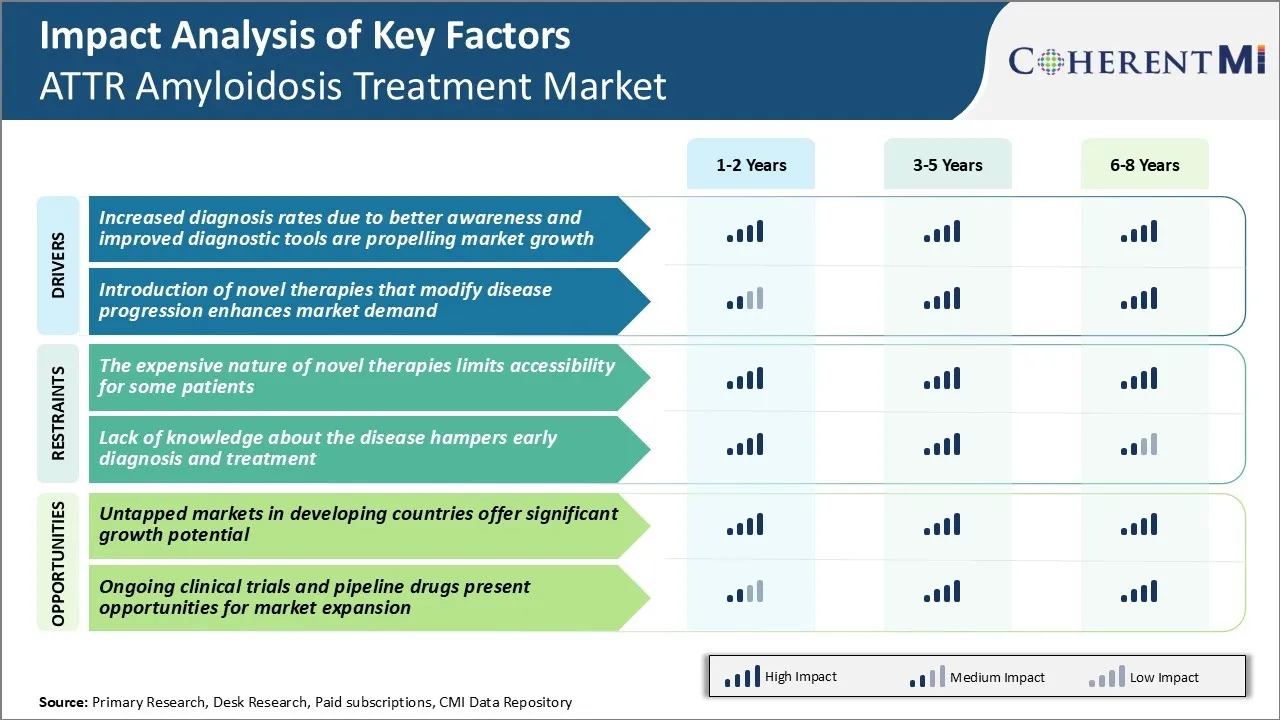

What are the key factors hampering the growth of the ATTR amyloidosis treatment market?

The expensive nature of novel therapies limits accessibility for some patients and lack of knowledge about the disease hampers early diagnosis and treatment are the major factors hampering the growth of the ATTR amyloidosis treatment market.

What are the major factors driving the ATTR amyloidosis treatment market growth?

The increased diagnosis rates due to better awareness and improved diagnostic tools are propelling market growth and introduction of novel therapies that modify disease progression enhances market demand are the major factors driving the ATTR amyloidosis treatment market.

Which is the leading type in the ATTR amyloidosis treatment market?

The leading type segment is hereditary ATTR amyloidosis.

Which are the major players operating in the ATTR amyloidosis treatment market?

Pfizer Inc., Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Eidos Therapeutics, Inc., Akcea Therapeutics, Inc., Prothena Corporation plc, Corino Therapeutics, Inc., and AstraZeneca plc are the major players.

What will be the CAGR of the ATTR amyloidosis treatment market?

The CAGR of the ATTR amyloidosis treatment market is projected to be 8.7% from 2024-2031.