Australia Training Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Australia Training Market is Segmented By Training Type (Online, Offline), By Industry (Government, Pulp & Paper, Oil & Gas, Manufacturing, Healthcare....

Australia Training Market Size

Market Size in USD Bn

CAGR8.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.6% |

| Market Concentration | Medium |

| Major Players | 360training.com, Inc, Cornerstone on Demand, DuPont Sustainable Solutions, Euro Petroleum Consultants Ltd [EPC], Global Training Solutions, Inc and Among Others. |

please let us know !

Australia Training Market Analysis

The Australia Training Market is estimated to be valued at USD 1.38 Bn in 2024 and is expected to reach USD 2451.8 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2031. The job market demands in technical skills and chronic skills shortages in Australia has been driving increased spending on vocational and educational training by both individuals and organizations looking to bridge this skills gap.

The market has been witnessing rapid digital transformation with growing adoption of online and blended learning models. This has pushed many training providers to introduce online learning platforms, immersive technologies like augmented and virtual reality and incorporate adaptive learning and gamification elements in their course offerings. Rising internet and smartphone penetration along with the flexibility and cost benefits of e-learning are some key factors fueling the increased preference for technology driven online training programs.

Australia Training Market Trends

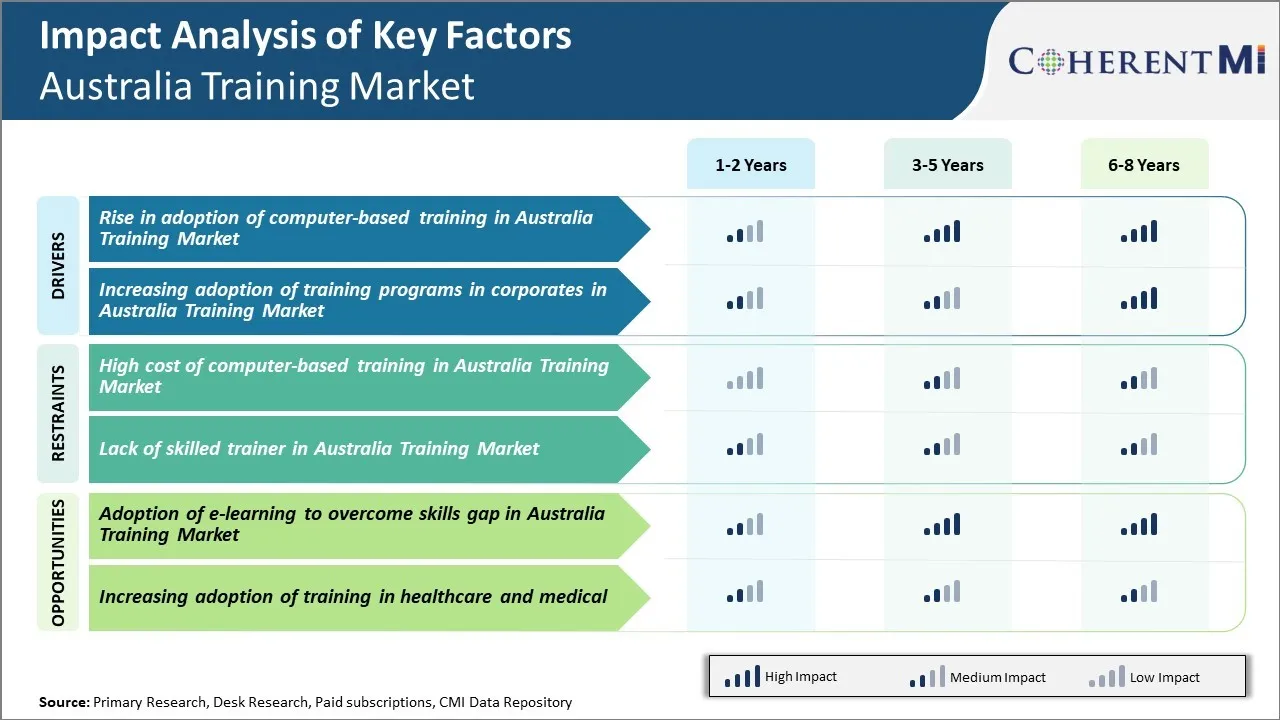

Market Driver – Rise in adoption of computer-based training in Australia Training Market

The Australian training landscape has seen a notable shift in recent years towards more technology-enabled and flexible learning options. As businesses and individuals alike have become increasingly tech-savvy, the demand for computer-based and online training solutions has risen sharply.

Traditional classroom-style training, while still relevant in some contexts, no longer best serves the needs of modern learners. Many professionals juggle demanding work schedules with family commitments, making it difficult to attend in-person programs that require time out of the office. Computer-based training has gained favor as it allows learning to fit around busy lifestyles. Courses can be accessed anywhere via laptop, tablet or smartphone, and paced according to the trainee's availability.

Government initiatives to boost digital skills and connectivity across Australia have supported this shift. As a result of COVID-19, there has also been accelerated adoption of online tools to support learning continuity during lockdowns and social distancing periods. This rapid change has familiarised Australians with virtual classrooms and e-learning platforms to a degree that was unimaginable just a few years ago.

Businesses have taken note of employee demand for flexible options and the potential for cost savings versus traditional training. Self-paced online modules eliminate travel expenses and lost productivity from time out of the workplace. High-quality training can now be securely delivered to staff regardless of their physical location. Vendors have responded with sophisticated learning management systems incorporating blended models of online and offline delivery.

The rise of computer-based training is set to continue as younger generations enter the workforce already comfortable with digital methods. Its benefits for work-life balance and cost-effectiveness make it a highly appealing proposition for Australian companies and learners in the years to come. While in-person programs still have value in building connections, computer-based training looks primed to dominate the training landscape.

Market Driver – Increasing adoption of training programs in corporates in Australia Training Market

As the nature of work evolves rapidly, the need for continuous skills development has never been greater for businesses. Forward-thinking companies recognise that investing in staff through ongoing training delivers both individual and organisational benefits. It drives motivation and retention by demonstrating a commitment to employees' career growth. Regular training also ensures teams have the latest technical expertise and soft skills needed to excel in their roles and tackle new challenges.

Adoption of formal training programs has grown significantly across Australian corporations of all sizes. Rather than occasional one-off events, a strategic approach involving thorough skills gap analysis and tailored multi-year plans has become the norm. Top firms schedule cohort-based programs throughout the year to maintain momentum, with topic selections informed by frequent workforce surveys and feedback.

Departmental budgets that once only accommodated mandatory compliance courses now include broader professional development allowances. Brands seeking to differentiate their employment proposition actively promote training opportunities both internally and to candidates. Subscription partnerships with multiple external providers give companies on-demand access to a rich library of courses tailored for the business environment.

Progress has been helped by the realisation that training yields tangible results. Leading firms rigorously evaluate program impact using metrics like productivity gains, error reduction, customer satisfaction scores and recurring evaluation surveys. Return on investment data strengthens the case for ongoing investment at budget planning time each year. As corporate Australia adopts more data-driven methodologies, training will maintain its role as a key performance lever into the future.

Market Challenges - High Cost of Computer-Based Training in Australia Training Market

One of the major challenges currently being faced by the Australia training market is the high cost of computer-based training programs. Developing effective e-learning courses and content requires a significant investment of time and resources from training providers. Content needs to be developed from scratch and kept up to date with the latest technologies and workforce needs. This involves hiring instructional designers, subject matter experts, multimedia developers and other professionals. Furthermore, there are ongoing costs associated with hosting the content on learning management systems, updating it regularly, and providing technical support to users. All of these factors contribute to the overall high costs of developing and delivering computer-based training programs. This cost challenge makes it difficult for some training providers, especially smaller ones, to offer extensive catalogs of online courses. It also puts pressure on course fees, potentially pricing some individuals and organizations out of the market. Unless costs can be reduced through processes like outsourcing development or leveraging open education resources, high e-learning costs may inhibit the growth and adoption of technology-driven training in Australia.

Market Opportunity – Adoption of E-Learning to Overcome Skills Gap in Australia Training Market

One opportunity for the Australia training market is boosting the adoption of e-learning to help address skills gaps. Recent research has shown there are workforce shortages in many industry sectors across technologies, healthcare and trades. E-learning provides a flexible way to reskill and upskill employees through online and blended programs they can access anywhere, anytime from mobile devices. This overcomes issues like lack of time, costs of travel and accommodation for face-to-face courses. If training providers promote the benefits of e-learning more strongly to organizations and market innovative micro credentialing solutions, it could help reskill many existing workers from home or work environments. Greater use of online simulations and virtual reality could also engage learners in experiential skills development. With skills shortages a pressing issue, promoting adoption of technology-driven e-learning stands to benefit both training providers and industries across Australia in need of qualified talent.

Key winning strategies adopted by key players of Australia Training Market

Focus on customised and niche training programs:

Workskills, one of the largest private RTOs in Australia, adopted a strategy of focusing on providing customised and niche training programs from 2006 onwards. They identified gaps in the market for specialty skills training and launched programs in areas like crane operation, confined spaces, dogging etc. This helped them attract professionals working in specific industries. By 2010, over 60% of their revenues came from these specialized programs.

Leverage online and blended learning:

TAFE Queensland adopted a strategy to heavily invest in online and blended learning platforms from 2012. They developed robust LMS platforms, video content for online courses and invested in technologies to enable virtual classrooms. By 2015, over 30% of their training was delivered online or through blended modes. This helped them reach new geographic markets and increased enrollments by 25% between 2012-15.

Form industry partnerships for skills development:

Training providers like William Angliss Institute partnered directly with industry bodies and large employers from 2010 onwards to understand their future skills needs and design training programs accordingly. They partnered with industries like hospitality, food processing, logistics to deliver customised and job-relevant training. By 2015, over 50% of their programs were designed and delivered in collaboration with industry partners. This ensured high employability rates of over 90% for their students.

Segmental Analysis of Australia Training Market

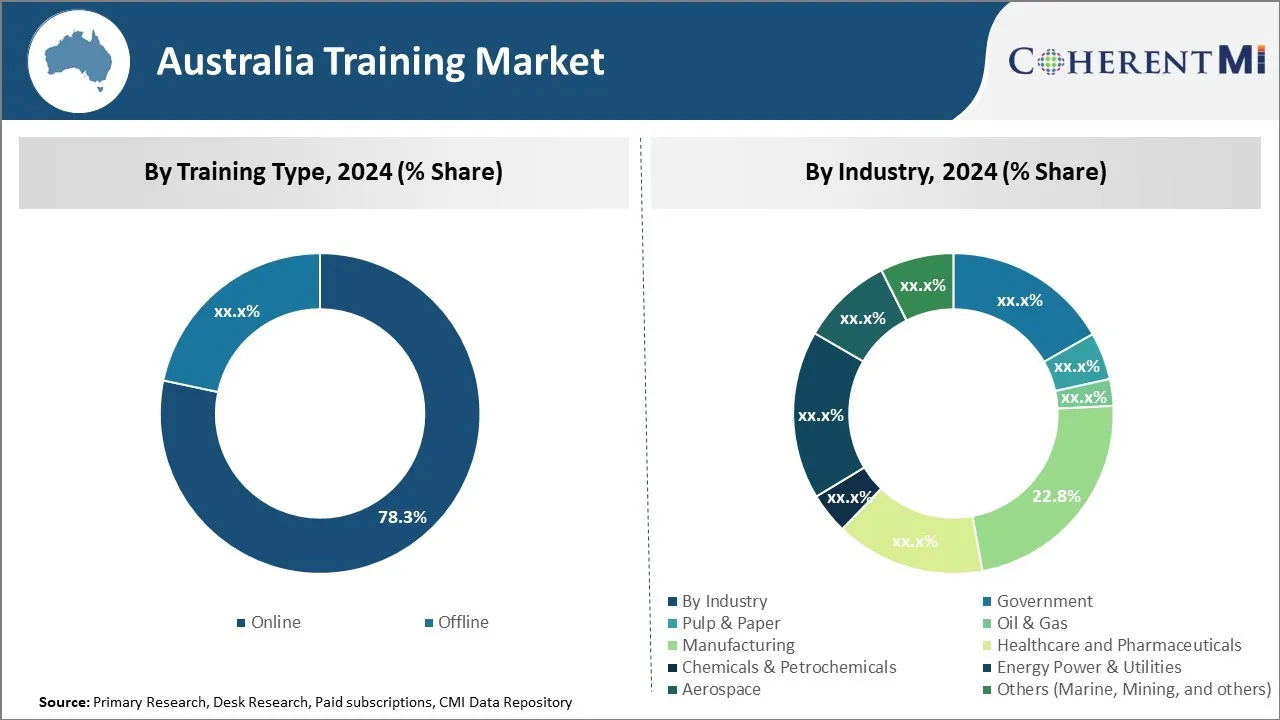

Insights By Training Type - Online dominates the market by owning to increased digitalization and flexibility in learning

The online training segment has emerged as the dominant segment in the Australia training market with 78.3% share in 2024 owing to increased adoption of digital technologies across all industries and domains. The digital transformation of education systems has enabled anytime, anywhere access to learning opportunities which has significantly boosted the prospects of online training courses. Learners today prefer the flexibility offered by online programs where they can learn at their own pace and convenience without having to commute to a physical classroom.

Furthermore, online learning platforms have made high-quality training programs more affordable and accessible to even remote regions of the country. Individuals and working professionals can upskill themselves on new technologies or soft skills from the comfort of their homes through online self-paced courses or live webinars. Various government initiatives are also promoting online education to improve digital literacy. Leading companies have also embraced virtual learning options for continuous employee development that is not disrupted by location constraints. The widespread availability of internet and proliferation of smart devices have strengthened the infrastructure support for digital education delivery. With its diverse benefits, online training segment will continue to grow at a healthy rate in the coming years.

Insights By Industry - Manufacturing leading the market due to intensive skill requirements for Industry 4.0 transformation

The manufacturing industry contributes the 22.8% share to the Australia training market in 2024 owing to its urgent reskilling and upskilling needs to adapt to Industry 4.0 technologies. Advanced manufacturing processes integrated with robotics, automation, IoT, and data analytics require a highly skilled workforce that can handle computer-controlled machinery and smart factories. There is also a growing emphasis on sustainability practices, product innovation, and quality standards that necessitate continuous workforce learning and development.

Moreover, the implementation of advanced technologies like additive manufacturing, cognitive computing, and artificial intelligence is reshaping manufacturing jobs at an unprecedented rate. While some roles will be replaced, new types of high-skilled jobs focused on technology usage, problem-solving, and systems thinking will emerge. Companies are investing heavily in training programs to impart the required technical and soft skills to employees. Sectors like automotive, electronics, and medical devices manufacturing that adopt cutting-edge Industry 4.0 solutions have the greatest training needs currently. The dynamic skill requirements from the manufacturing segment will ensure its dominance in the Australia training industry.

Competitive overview of Australia Training Market

360training.com, Inc, Cornerstone on Demand, DuPont Sustainable Solutions, Euro Petroleum Consultants Ltd [EPC], Global Training Solutions, Inc

Australia Training Market Leaders

- 360training.com, Inc

- Cornerstone on Demand

- DuPont Sustainable Solutions

- Euro Petroleum Consultants Ltd [EPC]

- Global Training Solutions, Inc

Australia Training Market - Competitive Rivalry, 2024

Australia Training Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Australia Training Market

- In September 2023, GPStrategies Corp., a global leader in workforce transformation and learning solutions, introduced "Compliance Fundamentals," a comprehensive training solution designed to address critical training needs within organizations. This initiative aims to enhance compliance training by providing a range of off-the-shelf courses focused on financial crime and corporate conduct, thereby supporting compliance, human resources, and learning and development teams.

- In October 2023, Vector Solutions, a leading provider of training and software solutions dedicated to enhancing safety and performance in educational settings, acquired PATHWAYos, a platform that connects K-12 schools and students to work-based learning opportunities. This acquisition allows school districts, states, and career centers to collaborate with businesses, thereby expanding work-based learning programs and bridging the gap between education and workforce readiness.

Australia Training Market Segmentation

- By Training Type

- Online

- Offline

- By Industry

- Government

- Pulp & Paper

- Oil & Gas

- Manufacturing

- Healthcare and Pharmaceuticals

- Chemicals & Petrochemicals

- Energy Power & Utilities

- Aerospace

- Others (Marine, Mining, and others)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Australia Training Market?

The high cost of computer-based training in australia training market and lack of skilled trainer in australia training market are the major factor hampering the growth of the Australia Training Market.

What are the major factors driving the Australia Training Market growth?

The rise in adoption of computer-based training in australia training market and increasing adoption of training programs in corporates in australia training market are the major factor driving the Australia Training Market.

Which is the leading Training Type in the Australia Training Market?

The leading Training Type segment is Online.

Which are the major players operating in the Australia Training Market?

360training.com, Inc, Cornerstone on Demand, DuPont Sustainable Solutions, Euro Petroleum Consultants Ltd [EPC], Global Training Solutions, Inc, GP Strategies Corp., Petroskills, PRYOR Learning Solutions, Raytheon Company, Safety Media are the major players.

What will be the CAGR of the Australia Training Market?

The CAGR of the Australia Training Market is projected to be 8.6% from 2024-2031.