Video Management System Market Size - Analysis

Market Size in USD Bn

CAGR12.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 12.3% |

| Market Concentration | High |

| Major Players | Bosch, Hanwha Techwin, Honeywell, Schneider Electric, Avigilon Corporation and Among Others |

please let us know !

Video Management System Market Trends

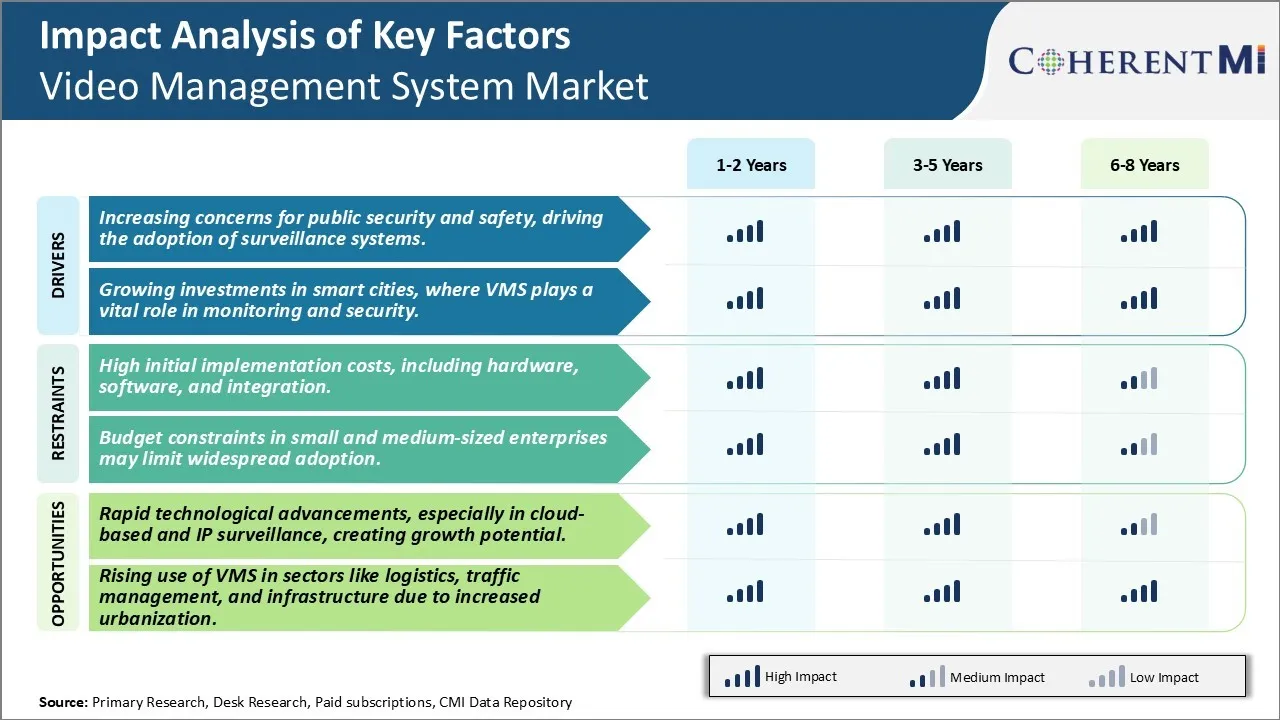

With growing security threats across the world, ensuring public safety has become one of the top priorities for governments as well as private sectors worldwide. Rising crime rates, terrorist activities and geopolitical tensions have heightened security risks in public places. Continuous monitoring through surveillance systems has emerged as an effective measure to deter criminal plans and activities. Video management systems play a pivotal role in modern surveillance networks by efficiently integrating and managing footage from multiple cameras.

Rising installation of surveillance cameras across cities, public transport systems, commercial complexes, educational institutes and other crowded premises is driving the need for centralized video management. Integrating footage from thousands of cameras across a wide geographical area poses technical as well operational challenges. A robust VMS addresses these challenges through features like failover recording, automatic camera discovery, video compression and advanced search capabilities. This makes surveillance networks more reliable, scalable and easier to administer. With an aim to ensure safety of citizens through continuous monitoring, governments globally are making increased investments in upgrading existing video analytics systems as well as setting up new Smart CCTV infrastructure. This growing focus on public security through intelligent surveillance promotes the usage of VMS.

Market Driver: Growing Investments in Smart Cities, Where VMS Plays a Vital Role in Monitoring and Security

Smart city projects usually involve setting up large networks of thousands of IP cameras to cover all the important areas and thoroughfares in a city. These include streets, public parks, transport hubs, administrative buildings and other civic amenities. Footage gathered from such widespread camera installations runs into petabytes of data which needs to be ingested, stored and organized efficiently for retrieval and analysis purposes. This is where a proficient VMS takes centerstage by handling live streaming, recording, archiving and mining of colossal volumes of unstructured video data generated across the smart city infrastructure on a daily basis.

Market Challenge - High Initial Implementation Costs, Including Hardware, Software, and Integration.

One of the key opportunities in the video management system market is the rapid technological advances that are lowering adoption barriers. Specifically, the growth of cloud-based and IP surveillance solutions is making video security systems more accessible for cost-conscious organizations. Cloud-hosted video management platforms allow organizations to avoid upfront server purchase and maintenance costs. All infrastructure, storage and analytics are managed by the vendor on their own servers hosted on the cloud. For IP cameras as well, the availability of affordable IP cameras with improved features is reducing hardware costs. This has enabled more small business and even residential users to leverage video security. Furthermore, with IP cameras, not only is there no need for expensive analog cabling infrastructure but video recordings can also be accessed from anywhere through internet connectivity. These technological shifts towards more affordable, scalable and flexible solutions are helping drive greater adoption across various customer segments and verticals, creating new growth avenues for video management system vendors.

Key winning strategies adopted by key players of Video Management System Market

Focus on innovation and product development - Leading VMS providers like Genetec, Milestone Systems and Avigilon have invested heavily in R&D to continually enhance their platforms with cutting-edge features. For example, in 2019 Milestone introduced its XProtect Essential+ VMS specifically tailored for SMB customers. Its user-friendly interface and scalability helped it gain popularity rapidly.

Expand product portfolio – The large players have widened their portfolio beyond core VMS to offer integrated security platforms. For example, in 2018 Genetec launched Security Center - an open architecture platform that unifies access control, command and emergency systems along with video. Its one-stop solution appealed to many enterprise customers.

Partner ecosystem development - All top vendors have built robust partnerships with camera OEMs, system integrators, managed service providers and technology alliances. For instance, Avigilon's technology partnerships with AWS and Dell helped it gain traction in cloud-based surveillance projects.

Segmental Analysis of Video Management System Market

Insights, By Component, the Growth of Video Surveillance and Analytics Drives Demand for Solutions in the Video Management System Market

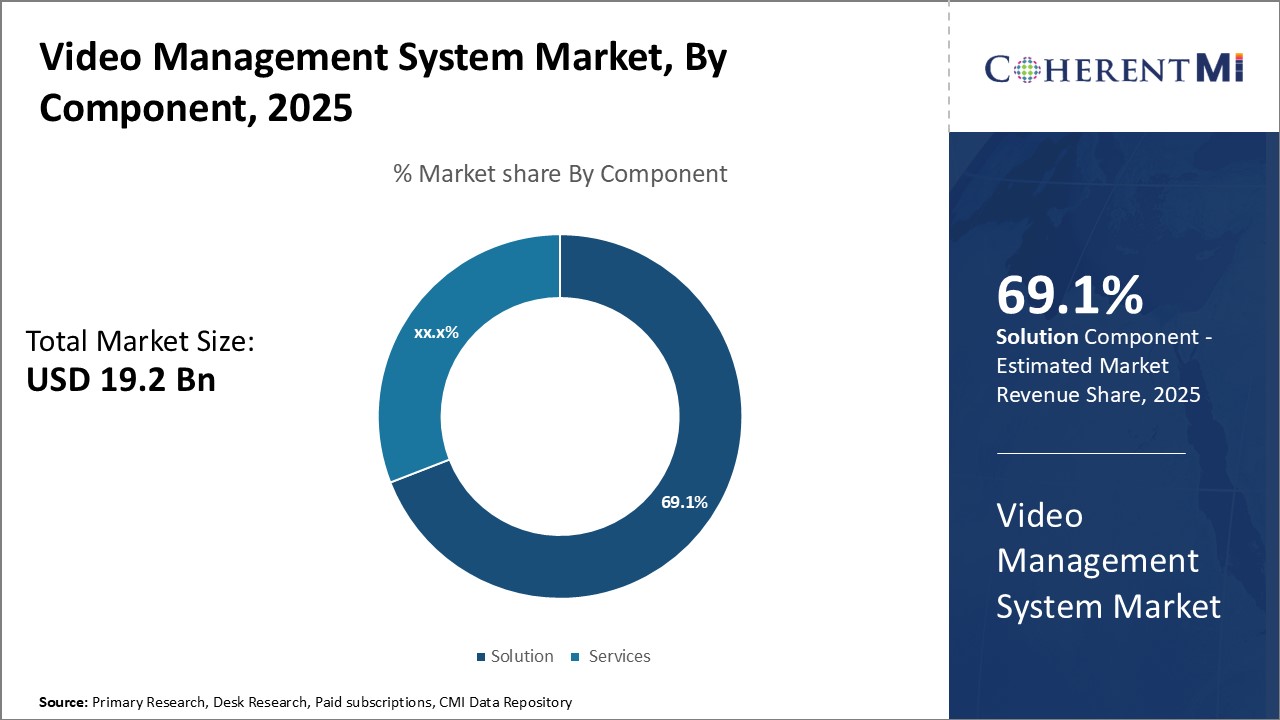

Insights, By Component, the Growth of Video Surveillance and Analytics Drives Demand for Solutions in the Video Management System MarketBy Component, Solution is expected to contribute 69.1% market share owing to the constant evolution and advancement of video surveillance technology. There is a growing need among organizations across industry verticals to leverage video footage for various security and business intelligence purposes. This has fueled the adoption of IP camera systems, network video recorders, video analytics and other solutions that provide high quality live and recorded video along with advanced features. Various solution vendors are focusing on developing easy to use platforms and offering open architecture systems that allow for customization and integration with other solutions. The use of video analytics in particular has increased exponentially in recent years. Technologies such as facial recognition, license plate recognition and behavioral analysis are helping organizations across retail, transportation and other sectors gain valuable insight from video data. The rising deployment of video surveillance systems coupled with the growing capability of solutions is expected to continue driving the solutions segment at a strong pace.

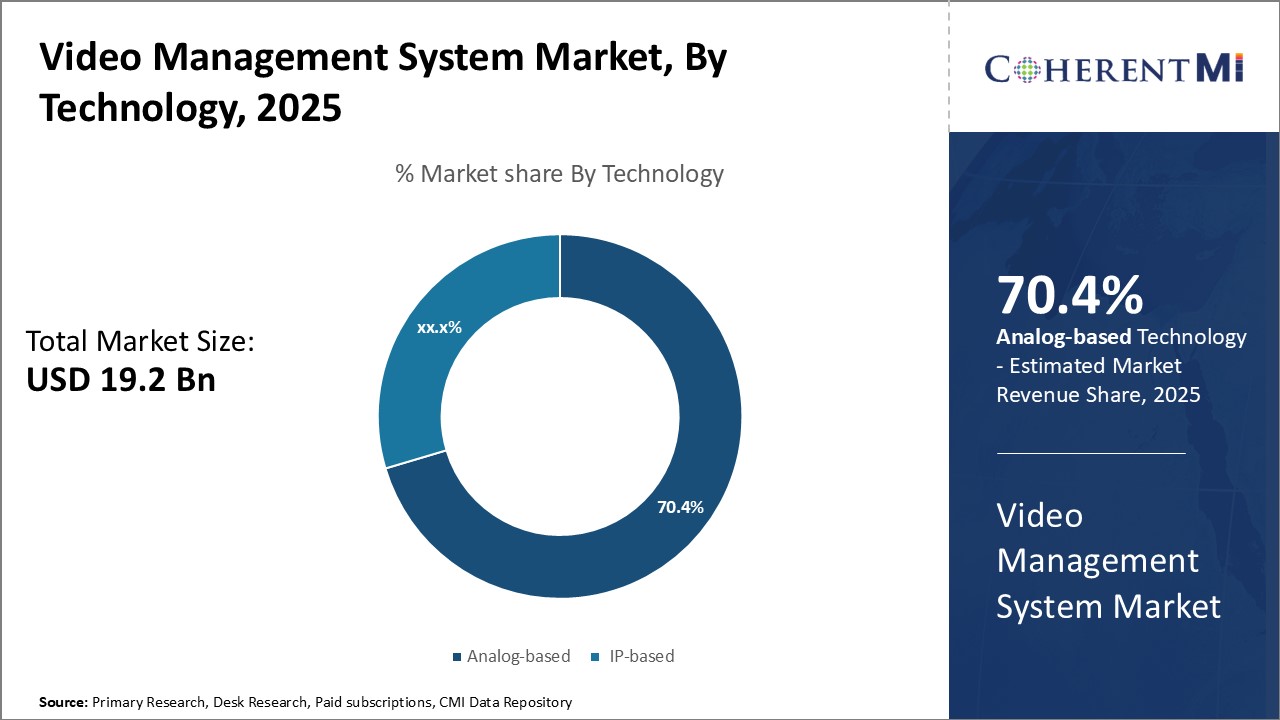

By Technology, IP-based segment is leading and is projected to contribute 70.4% share in 2025 driven by the widespread adoption of IP network infrastructure. Traditional analog video surveillance systems are being replaced by IP camera systems as organizations recognize the advanced capabilities and flexibility provided over traditional approaches. IP cameras offer higher resolution, integrated storage, analytics capabilities and ease of management over networks. They also allow for centralized remote monitoring and longer transmission distances compared to analog alternatives. The ability to seamlessly integrate with network infrastructures as well as combine with other IP-based solutions is fueling the popularity of IP technology in video surveillance deployments. Additionally, IP infrastructures are more cost effective over time as they eliminate the need for costly cabling installations and coaxial cable runs associated with analog systems. Government initiatives toward smart city development and commercial infrastructure upgrades to IP are creating conducive environments for IP camera adoption as well. These factors have prompted many organizations to upgrade existing analog systems or implement IP platforms in new deployments.

Insights, By End-user, Retail Sector Leads Growth in Video Management Adoption Driven by Security and Business Needs

Additional Insights of Video Management System Market

The video management system (VMS) market is on a trajectory of rapid growth, driven by the increasing need for enhanced security solutions across a variety of sectors, including retail, healthcare, and transportation. The surge in urbanization, coupled with rising concerns over public safety, has significantly fueled demand for efficient video surveillance systems. Governments and private organizations are investing heavily in smart infrastructure projects, where VMS plays a crucial role in monitoring and security management. VMS solutions provide real-time access to video feeds from various surveillance devices, enabling businesses to ensure the safety of their employees, customers, and operations. With technological advancements such as cloud-based platforms and AI-driven analytics, VMS is gaining momentum as it offers scalability, automation, and advanced functionalities like real-time threat detection and incident response. As companies shift towards IP-based systems from conventional analog systems, the global adoption of VMS is expected to continue growing at a robust pace, particularly in developing regions.

Competitive overview of Video Management System Market

The major players operating in the Video Management System Market include Bosch, Hanwha Techwin, Honeywell, Schneider Electric, Avigilon Corporation, Axis Communication, Axxonsoft, Inc., Arcules Corporation, Exacq Technologies, Dahua Technology, Senstar and Verint Systems.

Video Management System Market Leaders

- Bosch

- Hanwha Techwin

- Honeywell

- Schneider Electric

- Avigilon Corporation

Video Management System Market - Competitive Rivalry

Video Management System Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Video Management System Market

- In April 2024, Lumana launched its AI-powered video security platform for enhancing operational efficiency and streamlining incident response with hybrid cloud architecture.

- In December 2023, D.C. police launched a real-time crime center at the Metropolitan Police Department headquarters, integrating a vast surveillance system for better crime monitoring.

- In July 2023, Infinova partnered with L&T to install industrial-grade surveillance cameras in Bangalore Metro Rail, enhancing the city's rail safety infrastructure.

Video Management System Market Segmentation

- By Component

- Solution

- Services

- By Technology

- Analog-based

- IP-based

- By End-user

- Retail

- Airports

- Education

- Banking

- Healthcare

Would you like to explore the option of buying individual sections of this report?

Suraj Bhanudas Jagtap is a seasoned Senior Management Consultant with over 7 years of experience. He has served Fortune 500 companies and startups, helping clients with cross broader expansion and market entry access strategies. He has played significant role in offering strategic viewpoints and actionable insights for various client’s projects including demand analysis, and competitive analysis, identifying right channel partner among others.

Frequently Asked Questions :

How Big is the Video Management System Market?

The Global Video Management System Market is estimated to be valued at USD 19.20 Bn in 2025 and is expected to reach USD 43.25 Bn by 2032.

What will be the CAGR of the Video Management System Market?

The CAGR of the Video Management System Market is projected to be 12.1% from 2024 to 2031.

What are the major factors driving the Video Management System Market growth?

The increasing concerns for public security and safety, driving the adoption of surveillance systems. and growing investments in smart cities, where VMS plays a vital role in monitoring and security are the major factors driving the Video Management System Market.

What are the key factors hampering the growth of the Video Management System Market?

The high initial implementation costs, including hardware, software, and integration and budget constraints in small and medium-sized enterprises may limit widespread adoption are the major factors hampering the growth of the Video Management System Market.

Which is the leading Component in the Video Management System Market?

Solution is the leading Component segment.

Which are the major players operating in the Video Management System Market?

Bosch, Hanwha Techwin, Honeywell, Schneider Electric, Avigilon Corporation, Axis Communication, Axxonsoft, Inc., Arcules Corporation, Exacq Technologies, Dahua Technology, Senstar, Verint Systems are the major players.