Automotive Steel Wheels Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Automotive Steel Wheels Market is segmented BBy Vehicle Type (Heavy, Light, Passenger), By Application (OEM, Aftermarket), By Geography (North America....

Automotive Steel Wheels Market Size

Market Size in USD Bn

CAGR3.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3.5% |

| Market Concentration | Medium |

| Major Players | Maxion Wheels, Thyssenkrupp AG, The Carlstar Group, LLC., Central Motor Wheel of America, Inc., Accuride Corporation and Among Others. |

please let us know !

Automotive Steel Wheels Market Analysis

The Global Automotive Steel Wheels Market is estimated to be valued at USD 14.1 Bn in 2024 and is expected to reach USD 20.5 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2031. Steel wheels continue to be the standard for economical vehicle models globally. While aluminum wheel sales are rising for premium vehicles, the mass market is dominated by cheaper and heavier steel wheelsets.

The automotive steel wheels market is expected to witness stable growth over the forecast period. Though facing competition from lightweight aluminum alloy wheels, steel wheels account for the majority of new vehicle production globally. Preference for steel wheels is higher in price-sensitive markets like India, Brazil, China and other developing economies where cost remains a key purchase consideration. OEM fitment of steel wheels particularly in entry and mid-level vehicle segments will drive steady demand through 2031.

Automotive Steel Wheels Market Trends

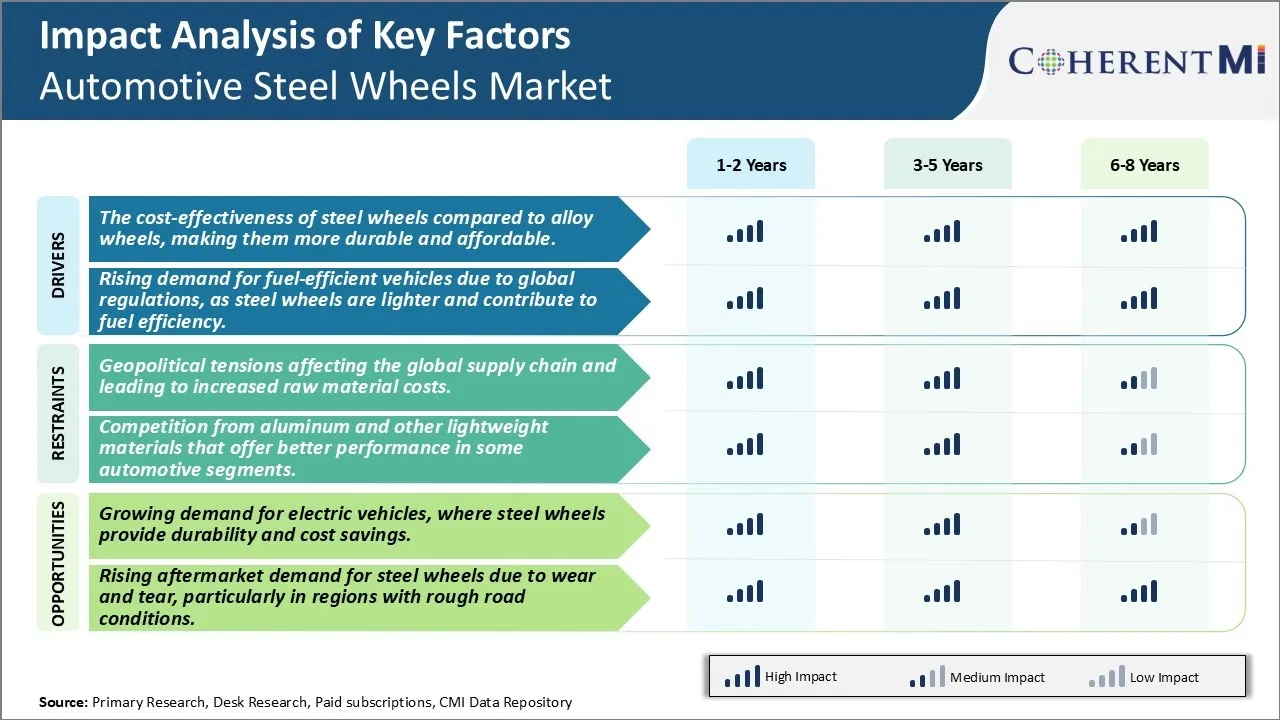

Market Driver - The Cost-Effectiveness of Steel Wheels Compared to Alloy Wheels, Making Them More Durable and Affordable

Steel wheels represent a highly cost-effective solution for automakers compared to alloy wheels. Being significantly cheaper to produce than alloy wheels means that automakers are able to offer them as a standard fitment on many entry-level and economy models. This helps keep the initial purchase price of such vehicles low and makes them affordable for many price-sensitive consumers. Steel wheels are often nearly half or even a third of the price of a comparable set of alloy wheels. The lower costs are passed down to the end customer, making steel-wheeled variants of vehicles much more accessible financially.

Additionally, steel wheels are known to withstand daily wear and tear quite well. While they may not look as flashy as alloy wheels, they can endure curb rash, pothole impacts and minor accidents much better without needing replacement. This translates to lower ownership costs over the long run for buyers. Steel also does not corrode or get damaged like cheaper alloys sometimes do. As a result, steel wheels tend to have a longer service life, often lasting the entire lifespan of the vehicle if properly maintained. This minimizes unplanned wheel replacement expenses and helps keep total cost of ownership lower.

Market Driver - Rising Demand for Fuel Efficient Vehicles Boosts Market Growth

Tightening emissions regulations around the world have put immense pressure on automakers to improve the efficiency and reduce the environmental impact of their vehicles. One way they are addressing this is by focusing more on weight savings throughout the vehicle, including the wheels. Steel wheels contribute to this goal as they are significantly lighter than alloy wheels of a similar design. Every extra ounce saved can help boost overall fuel economy marginally. For example, a set of steel wheels may weigh up to 10-20 lbs less than an aluminum alternative. Considering millions of vehicles are sold each year globally, the microscopic improvements add up substantially. Automakers are able to claim better fuel efficiency ratings and meet stringent new testing protocols partly because of the use of steel wheels. This has benefits for both manufacturers and consumers. The industry can avoid hefty fines for being non-compliant, while customers benefit from lower fuel bills. With fuel prices only moving higher, buyers are increasingly factoring running costs into their purchasing decisions. Steel wheels thus improve the value proposition of many mainstream models in light of rising demand for thriftier motoring.

Market Challenge - Geopolitical Tensions Affecting the Global Supply Chain and Leading to Increased Raw Material Costs

Geopolitical tensions between major trading partners have escalated in recent years, disrupting global supply chains for automotive steel wheels. Raw materials like steel and aluminum are facing significant cost pressures as trade disagreements raise tariffs and create non-tariff barriers. Several steel producing nations have become less reliable suppliers due to the prevailing political atmosphere. With steel being a bulk commodity that is difficult to locally source in many markets, wheel manufacturers have limited options for alternatives and must absorb these additional costs. The profit margins for steel wheels, which are highly commoditized, provide little flexibility when input costs surge. Supply chain risks have increased as well from potential conflicts or sanctions that could cut off critical material streams. Unless geopolitical stability can be restored through cooperative trade policies, cost pressures on raw materials will persist and potentially force wheel producers to raise prices.

Market Opportunity- Growing Demand for Electric Vehicles Presents an Opportunity

The rapid electrification of the automotive industry presents a major opportunity for steel wheel suppliers. As electric vehicles continue to gain broader market acceptance, steel wheels provide durability and cost savings advantages over more expensive alloy wheels. With their inherent weight benefits over alternatives, steel wheels allow EV manufacturers to extend vehicle range at a relatively low price point. Given battery costs and infrastructure challenges, getting the most possible distance per charge remains a key selling feature. Furthermore, the heavier electric powertrains require more robust suspension components, an area where steel excels. Suppliers that can demonstrate the energy efficiency and value proposition of pairing steel wheels with EVs may capture market share as this ambitious sector booms. Technological solutions maximizing these attributes open the door for expanded use of steel wheels in tomorrow's automobiles.

Key winning strategies adopted by key players of Automotive Steel Wheels Market

Strategic Focus on Emerging Economies: Many automotive steel wheel manufacturers have strategically focused on emerging economies in Asia Pacific and Latin America to boost their sales volumes. For example, Iochpe-Maxion, one of the largest manufacturers, increased its presence in Brazil, China, and India between 2015 and 2020. This helped the company gain significant market share as vehicle production rapidly increased in these regions.

Product Innovation: Leading players like ALCAR, Superior Industries, and Accuride Corporation have invested heavily in R&D to develop steel wheels that are 20-30% lighter than conventional ones. Lightweighting improves fuel efficiency, a big focus area. Additionally, Magnesium alloy embedded steel wheels were introduced for superior styling and curb weight reduction.

Mergers and Acquisitions: Consolidation through M&A's has been a top strategy. In the recent past, Titan International acquired Italy based Jwo Company, a leader in off-highway wheel manufacturing. This expanded Titan's expertise beyond agricultural wheels into construction and mining segments.

Strong Distribution Networks: Wider availability through extensive distribution networks in core regions provides an edge. For example, Hitachi Metals of Japan has partnered with over 700 distributors globally to supply wheels for popular vehicle brands like Honda, Toyota, GM, and Ford. This strong chain maximizes market coverage and aftersales support for fleets.

Segmental Analysis of Automotive Steel Wheels Market

Insights, By Vehicle Type: Heavy Commercial Vehicle is Projected to Account for a Significant Market Share in the Forecast Period

By Vehicle Type, heavy vehicles are projected to account for 46.2% in 2024 owing to increased infrastructure development. The heavy vehicle type segment within the automotive steel wheels market holds the largest share primarily owing to increased infrastructure development activities across the globe. Heavy vehicles such as trucks, buses and trailers see substantial demand from the construction as well as mining industries. Mega infrastructure projects pertaining to roads, tunnels, bridges and commercial buildings require robust material movement, thereby driving the need for heavy vehicles.

Several countries are heavily investing in their infrastructure to boost economic growth. For instance, the Belt and Road initiative by China aims to connect Asia with Africa and Europe through land and maritime networks. This involves massive roadway construction which benefits the heavy vehicle industry. Similarly, industrialization of developing nations also spurs demand. The rental and resale market for used heavy vehicles is also experiencing an upswing, thereby increasing aftermarket opportunities for steel wheel replacement and repairs.

Insights, By Application, OEM is Expected to Account for a Leading Share in the Forecast Period

By Application, OEMs are expected to account for 61.3% in 2024 due to the rise in vehicle production. Within the automotive steel wheels market segmented by application, the OEM segment currently holds dominance over the aftermarket. This is largely attributed to continual growth in the global vehicle manufacturing industry in recent years. Automakers are launching new vehicle models and line extensions at a rapid pace to cater to evolving customer preferences worldwide. Steel wheels are an essential original equipment provided by OEMs across various vehicle classes. While aluminum wheel sales are on the rise, bulk steel wheel demand still stems from OEM shipments. Production numbers of car, commercial vehicle and two-wheeler manufacturers have remained on an upward trajectory particularly in China, India and other developing auto hubs. This has secured a consistent revenue stream for steel wheel OEMs. In contrast, the aftermarket is impacted more by macroeconomic cycles and dependent on vehicle parc on roads for replacement parts procurement. Nevertheless, both OEM and aftermarket segments are anticipated to move in tandem with the rising motorization trend globally.

Additional Insights of Automotive Steel Wheels Market

Demand for automotive steel wheels is highly projected in the coming years mainly for their cost efficiency and durability. The steel wheels are known for their resilience and robustness that make them ideal for all extreme environments. Globally, the push towards lightweight materials is driving the trend. While the demand for steel wheel remains prevalent, the market is witnessing competition from aluminum products that are light in weight and improves the fuel consumption. Moreover, the growing focus on sustainability and recyclability contributes to green initiatives alongside stringent regulations on emissions.

Regional Insight:

The automotive steel wheels market is expected to grow steadily, driven by their cost-effectiveness and durability. While steel wheels are losing market share to alloy wheels in certain high-performance segments, they remain dominant in commercial and budget vehicles, particularly in emerging markets. The Asia Pacific region leads the market, fueled by economic growth in countries like China and India. The growing demand for electric vehicles and the adoption of fuel-efficient technologies in the automotive sector provide significant growth opportunities for steel wheels, especially in the aftermarket segment. However, geopolitical tensions and supply chain disruptions present challenges for the industry. Companies that adopt AI and innovative manufacturing processes are likely to gain a competitive edge in the evolving market.

Competitive overview of Automotive Steel Wheels Market

The major players operating in the Automotive Steel Wheels Market include Maxion Wheels, Thyssenkrupp AG, The Carlstar Group, LLC., Central Motor Wheel of America, Inc., Accuride Corporation, ALCAR Wheels GmbH, Automotive Wheels Ltd., Steel Strips Group, U.S. Wheel Corp., Topy America, Inc., Klassic Wheels Limited and CLN Coils Lamiere Nastri SpA.

Automotive Steel Wheels Market Leaders

- Maxion Wheels

- Thyssenkrupp AG

- The Carlstar Group, LLC.

- Central Motor Wheel of America, Inc.

- Accuride Corporation

Automotive Steel Wheels Market - Competitive Rivalry, 2024

Automotive Steel Wheels Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Automotive Steel Wheels Market

- In June 2024, Hilton Metal Forging Ltd. entered the wagon axle manufacturing sector in India, reducing import dependency under the "Make in India" initiative, aimed at bolstering domestic production in critical industrial sectors.

- In September 2023, Maxion Wheels introduced its new product, Maxion BIONIC, a lightweight, eco-friendly steel wheel for light vehicles, designed by teams from Brazil, Mexico, the U.S., and Germany.

- In March 2024, Hyundai Motor India integrated AI, ML, and VR technology in its global passenger vehicle manufacturing center to transform its operations.

Automotive Steel Wheels Market Segmentation

- By Vehicle Type

- Heavy

- Light

- Passenger

- By Application

- OEM

- Aftermarket

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Automotive Steel Wheels Market?

The Global Automotive Steel Wheels Market is estimated to be valued at USD 14.1 bn in 2024 and is expected to reach USD 20.5 Bn by 2031.

What will be the CAGR of the Automotive Steel Wheels Market?

The CAGR of the Automotive Steel Wheels Market is projected to be 3.5% from 2024 to 2031.

What are the key factors hampering the growth of the Automotive Steel Wheels Market?

The geopolitical tensions affecting the global supply chain and leading to increased raw material costs and competition from aluminum and other lightweight materials that offer better performance in some automotive segments are the major factor hampering the growth of the Automotive Steel Wheels Market.

What are the major factors driving the Automotive Steel Wheels Market growth?

The cost-effectiveness of steel wheels compared to alloy wheels, making them more durable and affordable and rising demand for fuel-efficient vehicles due to global regulations, as steel wheels are lighter and contribute to fuel efficiency. are the major factors driving the Automotive Steel Wheels Market.

Which is the leading Vehicle Type in the Automotive Steel Wheels Market?

Heavy vehicle type is the leading Vehicle Type segment.

Which are the major players operating in the Automotive Steel Wheels Market?

Maxion Wheels, Thyssenkrupp AG, The Carlstar Group, LLC., Central Motor Wheel of America, Inc., Accuride Corporation, ALCAR Wheels GmbH, Automotive Wheels Ltd., Steel Strips Group, U.S. Wheel Corp., Topy America, Inc., Klassic Wheels Limited, CLN Coils Lamiere Nastri SpA are the major players.