Axial Spondyloarthritis (axSpA) Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Axial Spondyloarthritis (axSpA) Treatment Market is segmented By Drug Class (TNF Inhibitors (Infliximab, Etanercept), IL-17 Inhibitors (Secukinumab, I....

Axial Spondyloarthritis (axSpA) Treatment Market Size

Market Size in USD Bn

CAGR7.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.5% |

| Market Concentration | High |

| Major Players | AbbVie Inc., Novartis AG, Pfizer Inc., UCB Pharma, Eli Lilly and Company and Among Others |

please let us know !

Axial Spondyloarthritis (axSpA) Treatment Market Analysis

The axial spondyloarthritis (axSpA) treatment market is estimated to be valued at USD 6.02 billion in 2024 and is expected to reach USD 10 billion by 2031, growing at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2031. Increased prevalence of axSpA and rising population are major drivers responsible for growth of this market. Additionally, development and launch of novel biologic therapies for axSpA treatment such as IL-23 and IL-17 inhibitors have boosted the market growth over the past years.

Axial Spondyloarthritis (axSpA) Treatment Market Trends

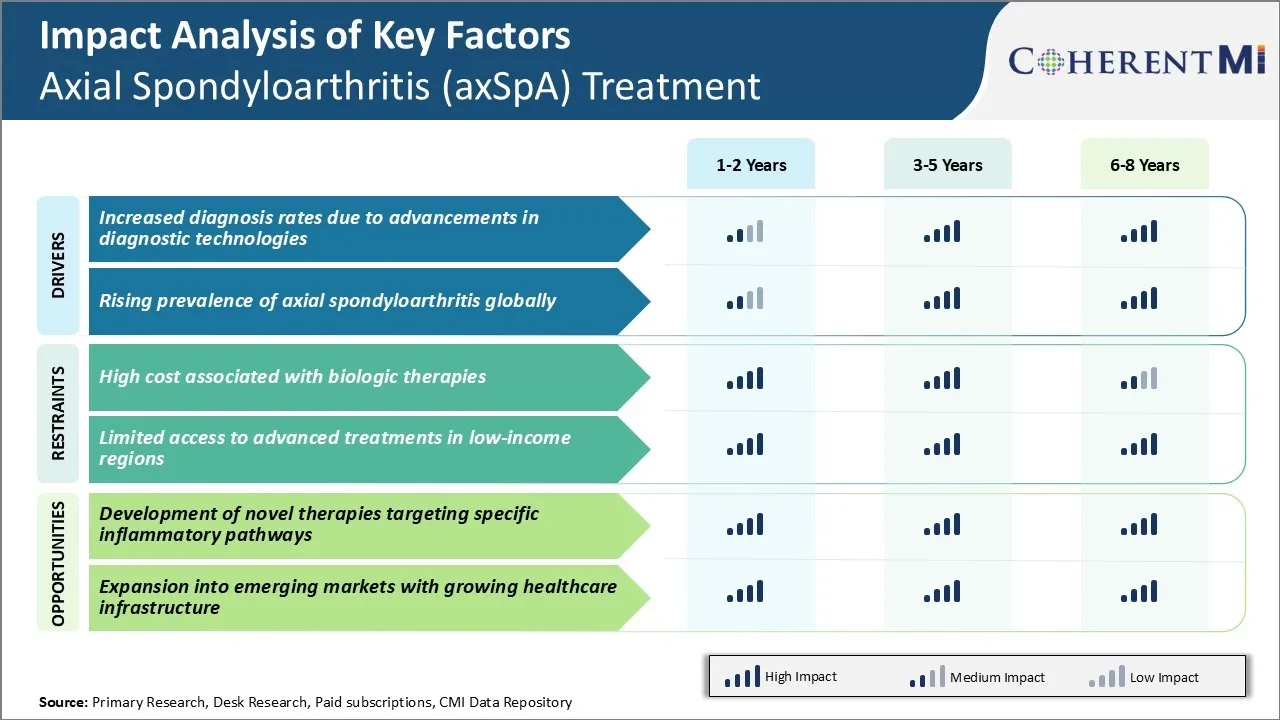

Market Driver - Increased Diagnosis Rates Due to Advancements in Diagnostic Technologies

With the advancements in diagnostic technologies like MRI, more and more cases of axSpA are now being identified at an earlier stage. Earlier, many patients had to suffer for years before getting accurately diagnosed as conventional X-rays could not detect early signs of inflammation and damage in sacroiliac joints and spine.

MRI has been a game changer as it can clearly visualize inflammatory lesions in sacroiliac joints and spine even at a very early or pre-radiographic stage of the disease. As a result, diagnosis rates of axSpA have increased significantly in the past decade.

Pharmaceutical companies have also supported initiatives to spread awareness about early signs and symptoms of axSpA among rheumatologists as well as primary care physicians and orthopedics. As a result, more and more rheumatology practices are adopting the pragmatic approach of using MRI to diagnostic axial spondyloarthritis, rather than relying solely on conventional radiography.

All these factors, including awareness drives and diagnostic guideline changes are cumulatively leading to substantially higher diagnosis rates for axSpA compared to a decade back. This changing disease landscape can be considered as a major driver propelling the axial spondyloarthritis treatment market forward in the coming years.

Market Driver – Rising Prevalence of Axial Spondyloarthritis Globally

Many factors like improved awareness and diagnostic accuracy are resulting in increasing prevalence estimates being reported from retrospective as well as prospective population-based studies. Genetic and environmental influences also play a role in varying disease frequencies between ethnicities and geographical locations. While more work is still required, it is becoming apparent that axial SpA prevalence has been underestimated in the past especially in developing nations with limited research.

Rising disease prevalence naturally translates to an expanding patient population seeking medical attention and therapy over time. This sustained increase in the number of patients with axial SpA will drive sustained demand for approved treatments options worldwide. Given the often-debilitating symptoms of active axial inflammation if left uncontrolled, patients are increasingly willing to adhere to lifelong pharmacological therapy targeting IL-17 and TNF. All top pharmaceutical companies have added axial SpA to their rheumatology pipelines recognizing this growing market potential.

The axial spondyloarthritis (axSpA) treatment market is particularly primed for growth in Asia Pacific and Latin American regions. With rising incomes and implementation of universal healthcare in emerging nations, access to diagnosis and treatment is improving steadily. This will allow more prevalent cases to receive standardized care conforming to ASAS classification criteria.

Market Challenge - High Cost Associated with Biologic Therapies

One of the major challenges in the axSpA Treatment Market is the high cost associated with biologic therapies. Biologics such as anti-TNF drugs are the standard of care for treating axSpA in patients with inadequate response to NSAIDs. However, these biologics are unusually expensive compared to generic alternatives. The list prices of anti-TNF biologics typically range from $20,000 to $50,000 per patient annually in the United States.

Additionally, the costs of treatment are rising as new high-cost specialty biologics enter the axial spondyloarthritis (axSpA) treatment market frequently. The economic burden caused by these high drug prices often poses difficulties for public and private payers to provide affordable treatments for patients. It could potentially reduce access to life-changing medications and worsen the overall healthcare outcomes.

Manufacturers will need to explore strategies to make these vital treatments more affordable and cost-effective without compromising quality. This remains a major challenge hampering overall market growth.

Market Opportunity - Development of Novel Therapies Targeting Specific Inflammatory Pathways

One of the key opportunities in the axSpA Treatment Market lies in the development of novel therapies targeting specific inflammatory pathways for which unmet needs exist. Currently, anti-TNF therapy is the standard treatment but not all patients respond to it. Moreover, there are safety concerns with long-term use of anti-TNF agents. This necessitates research into new therapeutic approaches.

Projects are ongoing to develop next-generation biologics inhibiting cytokines like IL-17, IL-23, as well as small molecules targeting JAK and other pathways. A promising pipeline with diversified mechanisms has potential to address primary as well as secondary non-response to existing therapies.

Successful introduction of innovative medications with better safety profiles and new targets will offer patients more effective treatment options. It could also capture a larger share of the axial spondyloarthritis (axSpA) treatment market and drive stronger revenue growth for pharmaceutical companies in the long run.

Prescribers preferences of Axial Spondyloarthritis (axSpA) Treatment Market

Axial spondyloarthritis (axSpA) treatment follows a step-care approach involving different lines of therapy based on disease stage and symptom severity. For mild symptomatic patients, prescribers typically recommend nonsteroidal anti-inflammatory drugs (NSAIDs) like ibuprofen as first-line treatment.

If symptoms are inadequately controlled or patients experience progression to ankylosing spondylitis (AS), biologics are often prescribed as second-line treatment options. The most commonly used biologics for patients with active AS include tumor necrosis factor (TNF) inhibitors. Examples are adalimumab (Humira), certolizumab pegol (Cimzia), etanercept (Enbrel), golimumab (Simponi), and infliximab (Remicade).

For patients who have active axSpA but do not meet imaging criteria for AS, or those who show inadequate response to first TNF inhibitor therapy, an interleukin-17A (IL-17A) inhibitor may be prescribed. Secukinumab (Cosentyx) is a preferred IL-17A inhibitor treatment.

Prescribers also consider other factors like comorbidities, lifestyle needs, insurance coverage and cost when choosing between biologic therapies. For example, patients with cardiac issues may be prescribed etanercept over other options due to its favorable safety profile. Adalimumab's convenient dosing benefits busy patients. This comprehensive understanding of disease stages and tailored treatment pathways is critical for addressing axSpA.

Treatment Option Analysis of Axial Spondyloarthritis (axSpA) Treatment Market

Axial Spondyloarthritis can be broadly classified into two stages - non-radiographic and radiographic.

In the non-radiographic stage (nr-axSpA), when x-rays do not show definite damage of the sacroiliac joints, treatment primarily involves non-steroidal anti-inflammatory drugs (NSAIDs) to manage pain and inflammation. Disease-modifying anti-rheumatic drugs (DMARDs) like sulfasalazine may also be used.

As the disease progresses to the radiographic stage (r-axSpA), where x-rays exhibit structural damage, biologics become the preferred treatment option. TNF-alpha inhibitors like infliximab (Remicade), adalimumab (Humira), golimumab (Simponi), and certolizumab pegol (Cimzia) are frequently prescribed. These biologics work by blocking tumor necrosis factor-alpha, a protein involved in inflammatory and immune responses. They are highly effective at reducing symptoms, improving function and spinal mobility, while also inhibiting further structural damage to the spine and sacroiliac joints.

For patients who show inadequate response or intolerance to one TNF blocker, switching to an alternative TNF inhibitor is recommended as the first line of treatment. However, for patients unresponsive to multiple TNF-alpha inhibitors, switching to a new class of biologics like interleukin-17 inhibitors secukinumab (Cosentyx) or ixekizumab (Taltz), which work via a different mechanism, becomes the preferred treatment approach.

Key winning strategies adopted by key players of Axial Spondyloarthritis (axSpA) Treatment Market

Focus on Biologics: Leading companies like AbbVie, UCB, Janssen (Johnson & Johnson), and Novartis have focused their strategies on developing and marketing biologic drugs to treat axSpA. Biologics that target tumor necrosis factor (TNF)-α such as Humira, Cimzia, and Simponi have revolutionized axSpA treatment. For example, AbbVie captured over 50% of the market share with Humira which was the first biologic approved specifically for axSpA in 2016. Its effectiveness and long-term safety data have made Humira the standard of care.

Life Cycle Management: As biologics go off patent, companies implement strategies to extend their lifecycles. For example, when Humira's patents expired in Europe in 2018, AbbVie launched adalimumab biosimilars and transitioned patients to maintain their market share. Janssen similarly introduced subcutaneous infliximab to expand treatment options and life cycle of Remicade before biosimilar entry.

Real-World Evidence Generation: Companies invest in developing extensive real-world evidence on treatment effectiveness, safety, and health economics outcomes through long-term axSpA registries and studies. This helps physicians optimize therapy management and demonstrates value to payers.

Payer Partnerships: Commercial success depends on reimbursement. Companies form payer partnerships through value-based contracts that tie prices to outcomes data. Novartis' performance-based contract for Cosentyx in the US ties payment to ASDAS response.

Segmental Analysis of Axial Spondyloarthritis (axSpA) Treatment Market

Insights, By Drug Class: TNF Inhibitors High Demand Due to Growing Prevalence of Ankylosing Spondylitis and Psoriatic Arthritis

In terms of drug class, TNF inhibitors contribute the highest share of the axial spondyloarthritis (axSpA) treatment market owning to its efficacy and early approval for treating active axial spondyloarthritis including ankylosing spondylitis and non-radiographic axial spondyloarthritis.

Drugs like infliximab and etanercept have provided durable clinical response and allowed many patients to experience symptoms relief and improve mobility. Their well-established long-term safety profile have positioned TNF inhibitors as frontline treatment options for patients failing NSAIDs.

Additionally, increasing diagnosis rates of axial spondyloarthritis driven by advancements in disease classification criteria and imaging modalities like magnetic resonance imaging have contributed to growing sales of TNF inhibitors over years.

Insights, By Route of Administration: Convenience of Administration Drives Preference for Injectable Drugs

In terms of route of administration, injectable contributes the highest share of the market owing to convenience of self-administration by pre filled syringes and autoinjector pens at home or work. This allows patients to easily adhere to prescribed treatment regimen and helps overcome barriers to oral drugs requiring multiple daily pills.

Subcutaneous administration also offers faster absorption and more reliable drug levels in blood compared to oral drugs which are dependent on gastrointestinal absorption. These attributes have made injectable biologics and biosimilars the preferred mode of treatment delivery among rheumatologists and axSpA patients.

Insights, By Molecule Type: Superior Efficacy Positions Biologic Drugs as Standard of Care

In terms of molecule type, biologics contributes the highest share of the market due to their superior efficacy over other treatment options. Drugs like infliximab, etanercept and secukinumab have shown clinically meaningful improvements not just in symptomatic relief but structural damage progression in ankylosing spondylitis through new bone formation.

In contrast, conventional oral therapies like NSAIDs only provide symptomatic benefit but have little impact on underlying disease course. Biologics' disease modifying ability has positioned them as frontline standard of care treatment recommended in axSpA treatment guidelines internationally. This drives greater market uptake of novel biologics and biosimilars compared to small molecule drugs.

Additional Insights of Axial Spondyloarthritis (axSpA) Treatment Market

- The prevalence of axial spondyloarthritis in the adult population is approximately 0.5-1.4%, making it one of the most common inflammatory back pain conditions.

- The economic burden associated with untreated AxSpA highlights the importance of early intervention and access to effective therapies.

Competitive overview of Axial Spondyloarthritis (axSpA) Treatment Market

The major players operating in the Axial Spondyloarthritis (axSpA) Treatment Market include AbbVie Inc., Novartis AG, Pfizer Inc., UCB Pharma, Eli Lilly and Company, Amgen Inc., Johnson & Johnson, and Biogen Inc.

Axial Spondyloarthritis (axSpA) Treatment Market Leaders

- AbbVie Inc.

- Novartis AG

- Pfizer Inc.

- UCB Pharma

- Eli Lilly and Company

Axial Spondyloarthritis (axSpA) Treatment Market - Competitive Rivalry

Axial Spondyloarthritis (axSpA) Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Axial Spondyloarthritis (axSpA) Treatment Market

- In June 2024, AbbVie Inc. announced positive results from their Phase III SELECT-AXIS 2 study of upadacitinib (RINVOQ®), a novel oral JAK inhibitor, for the treatment of non-radiographic axial spondyloarthritis (nr-axSpA). The trial demonstrated significant improvements in reducing symptoms and enhancing the quality of life for patients with nr-axSpA who had previously shown inadequate responses to TNF blockers. The study successfully met its primary and secondary endpoints, confirming the efficacy and safety of upadacitinib in this patient population.

- February 2024: Novartis AG launched a new clinical study on a combination therapy targeting both TNF and IL-17 pathways, aiming to improve treatment outcomes for patients resistant to existing biologics. Novartis has been actively involved in research on therapies targeting IL-17 and TNF pathways, particularly with their drug Cosentyx (secukinumab), which selectively targets IL-17A. Recent data reinforce its leadership in treating conditions like psoriatic arthritis and spondyloarthritis.

Axial Spondyloarthritis (axSpA) Treatment Market Segmentation

- By Drug Class

- TNF Inhibitors

- Infliximab

- Etanercept

- IL-17 Inhibitors

- Secukinumab

- Ixekizumab

- Other Classes

- TNF Inhibitors

- By Route of Administration

- Injectable

- Oral

- By Molecule Type

- Small Molecules

- Biologics

- By Disease Type

- Radiographic AxSpA (Ankylosing Spondylitis)

- Non-Radiographic AxSpA

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How big is the axial spondyloarthritis (axSpA) treatment market?

The axial spondyloarthritis (axSpA) treatment market is estimated to be valued at USD 6.02 billion in 2024 and is expected to reach USD 10 billion by 2031.

What are the key factors hampering the growth of the axial spondyloarthritis (axSpA) treatment market?

The high cost associated with biologic therapies and limited access to advanced treatments in low-income regions are the major factors hampering the growth of the axial spondyloarthritis (axSpA) treatment market.

What are the major factors driving the axial spondyloarthritis (axSpA) treatment market growth?

The increased diagnosis rates due to advancements in diagnostic technologies and rising prevalence of axial spondyloarthritis globally are the major factors driving the axial spondyloarthritis (axSpA) treatment market.

Which is the leading drug class in the axial spondyloarthritis (axSpA) treatment market?

The leading drug class segment is TNF inhibitors.

Which are the major players operating in the axial spondyloarthritis (axSpA) treatment market?

AbbVie Inc., Novartis AG, Pfizer Inc., UCB Pharma, Eli Lilly and Company, Amgen Inc., Johnson & Johnson, and Biogen Inc. are the major players.

What will be the CAGR of the axial spondyloarthritis (axSpA) treatment market?

The CAGR of the axial spondyloarthritis (axSpA) treatment market is projected to be 7.5% from 2024-2031.