Chronic Refractory Cough Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Chronic Refractory Cough Market is segmented By Treatment (Antitussives, Expectorants, Combination Medications), By Route of Administration (Oral, Inh....

Chronic Refractory Cough Market Size

Market Size in USD Bn

CAGR8.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.2% |

| Market Concentration | Medium |

| Major Players | Merck & Co., Inc., Bellus Health Inc., Bayer AG, AstraZeneca plc, GlaxoSmithKline plc and Among Others. |

please let us know !

Chronic Refractory Cough Market Analysis

The chronic refractory cough market is estimated to be valued at USD 1.62 Bn in 2024 and is expected to reach USD 2.82 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2031. The increasing prevalence of chronic respiratory diseases and growing demand for non-codeine medications are major factors contributing to the growth of this market.

Chronic Refractory Cough Market Trends

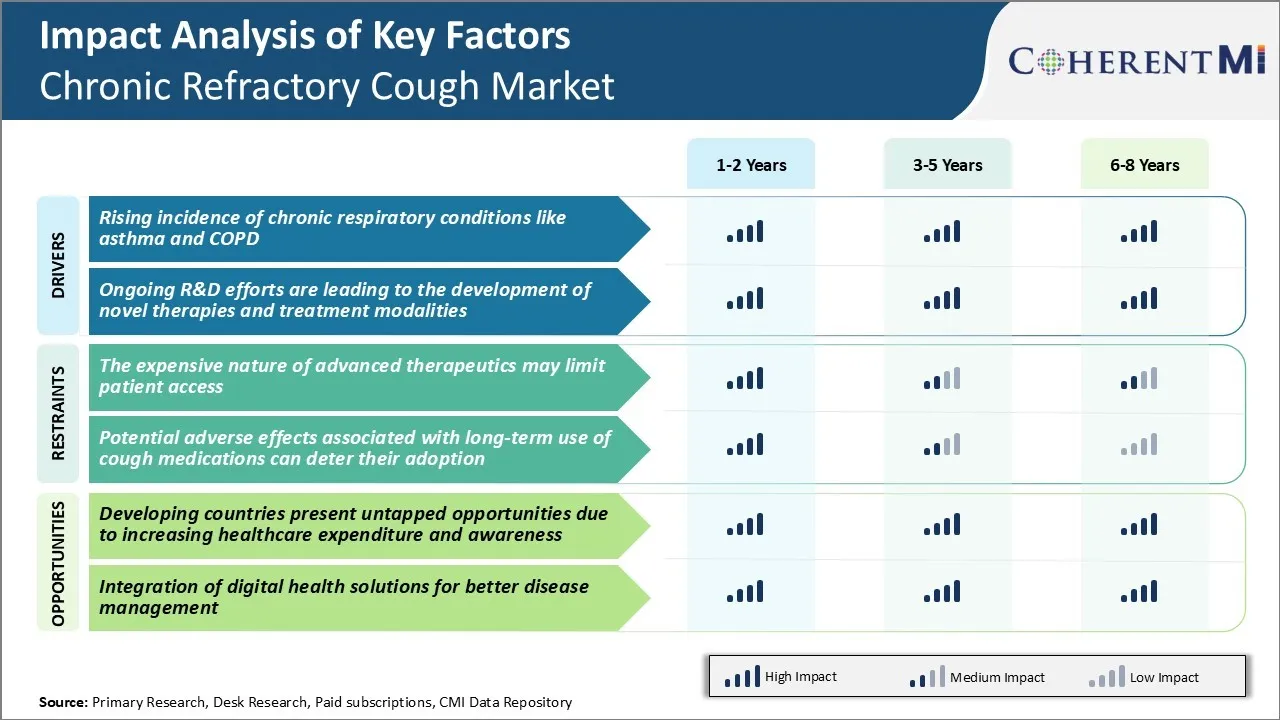

Market Driver - Rising Incidence of Chronic Respiratory Conditions like Asthma and COPD

The chronic refractory cough market is witnessing significant growth opportunities owing to the rising prevalence of chronic respiratory conditions across the globe. As per our analysis, chronic respiratory diseases like asthma and chronic obstructive pulmonary disease (COPD) have emerged as leading causes of morbidity and mortality worldwide. Figures show that over 300 million people worldwide suffer from asthma whereas over 200 million people are diagnosed with COPD. The conditions are more ubiquitous in developing nations, aided by air pollution, smoking habits and lack of medical awareness.

Affected individuals often face problems like coughing, wheezing, chest tightness and breathlessness throughout the year. For many patients, symptoms do not subside despite treatment with bronchodilators and steroids. This has led to increased demand for drugs targeting refractory cough associated with respiratory diseases. Leading players are targeting this patient segment through innovations in drug delivery and medical technologies. Mucolytic agents, antitussives and bronchodilators specific for refractory cough symptoms are gaining widespread adoption.

Market Driver - Ongoing R&D Efforts are Leading to the Development of Novel Therapies and Treatment Modalities

With chronic cough proving difficult to treat, pharmaceutical companies and research institutes are investing heavily in this domain. Several drug candidates targeting specific receptors and pathways are in various stages of clinical testing. For instance, the P2X3 receptor has emerged as a viable target, with companies developing oral and inhaled small molecules for modulating it. Phase 3 trials of one such candidate have shown positive outcomes in reducing cough frequency and severity. Other molecules focused on neural pathways and cough reflex hypersensitivity are also witnessing progress.

Similarly, ongoing research in mucociliary clearance and cough hypersensitivity mechanisms have augmented the pipeline. Agents from novel classes like ion channel modulators, PAR2 antagonists and TRPV1 inhibitors are now being evaluated for chronic cough management. The translational efforts have enabled repurposing of some failed drugs as well. The innovation has extended to medical device segment too, with new handheld cough recorders, humidifiers and speech analysis tools facilitating objective assessment of cough. Market players are positioning these diagnostics to support drug development and improve treatment response tracking.

Overall, continuous development of unique propositions aligned to underlying pathophysiology is crucial for serving the complex refractory cough market over the long term.

Market Challenge - The Expensive Nature of Advanced Therapeutics May Limit Patient Access

The chronic refractory cough market faces significant challenges owing to the cost of providing advanced therapeutic options to patients suffering from chronic and difficult-to-treat cough conditions. Developing highly specialized drug formulations and clinical trial protocols to evaluate treatment effectiveness involves massive research and development investments by pharmaceutical companies. This pushes up the overall drug prices significantly.

As a result, many existing as well as new disease-modifying drug therapies for refractory cough indications come with exorbitant price tags, putting them out of reach for most patients, especially those in underdeveloped or developing nations with weaker economic conditions and limited medical insurance coverage.

The high costs impose a huge financial burden and often force patients to resort to generic or alternative therapies that may not be as effective. This could negatively impact treatment outcomes and disease management. Addressing the affordability challenge is critical to improve patient access to better medication and care for chronic refractory cough.

Market Opportunities - Developing Countries Present Untapped Opportunities due to Increasing Healthcare Expenditure and Awareness

The chronic refractory cough market appears highly promising in developing regions of the world due to increasing healthcare spending capabilities and growing health consciousness among consumers. Rapid economic growth and rising per capita income in emerging nations have bolstered the demand for modern medical services over the past decade.

While chronic cough was previously regarded as an inevitable condition owing to lack of proper diagnosis and treatment options, greater health awareness driven by digital transformation and higher spending on pharmaceuticals and medicines are transforming market scenarios.

As developing country markets continue to demonstrate high patient population growth and enhance access to advanced drugs and therapies through expanded insurance coverage or public health programs, they offer lucrative opportunities for chronic refractory cough drug developers and manufacturers to increase sales revenues.

A strategic focus on providing affordable medication choices tailored to suit the needs of developing world consumers could help unlock the market potential in still untapped growth territories.

Prescribers preferences of Chronic Refractory Cough Market

Chronic refractory cough is a persistent cough lasting 8 weeks or more that fails to respond to first-line treatment options. Prescribers typically follow a stepwise approach when treating CRC.

For initial treatment at mild stages of CRC, prescribers commonly prescribe over-the-counter cough suppressants containing dextromethorphan or codeine. If the cough fails to subside, the next line of treatment involves prescription-strength cough suppressants. Brands like Tessalon® (benzonatate) and Hydromet® (dihydrocodeine) are prescribed at this stage.

For moderate to severe CRC that does not respond to cough suppressants, inhaled bronchodilators are tried. Short-acting beta2-agonists like Ventolin® (albuterol) and Spiriva® (tiotropium bromide) are prescribed. If these do not provide relief, the next line involves inhaled corticosteroidslike Pulmicort® (budesonide) to reduce airway inflammation.

For severe CRC persisting over 12 weeks, prescribers may try off-label treatments lacking FDA approval for CRC. Gabapentin or pregabalin are sometimes prescribed to reduce cough reflex sensitivity. Low-dose tricyclic antidepressants like amitriptyline may be tried due to their anticholinergic effects.

Beyond drug therapy, prescribers also consider non-pharmacological options like speech therapy and physiotherapy involving breathing and relaxation techniques.

Treatment Option Analysis of Chronic Refractory Cough Market

In the early stage, lifestyle modifications and over-the-counter medications are recommended. Cough suppressants containing dextromethorphan or codeine can help suppress symptoms temporarily.

If cough persists for more than 8 weeks, it is considered refractory. At this stage, physicians may prescribe low-dose tricyclic antidepressants like amitriptyline. These act on the brainstem cough center and are shown to be effective with few side effects.

For patients in the advanced stage with debilitating symptoms despite above treatments, biologics are preferred. Dupixent (dupilumab), an interleukin-4 and interleukin-13 inhibitor, reduces inflammation and is highly effective for treating refractory cough. It is administered as monthly subcutaneous injections with consistent response rates seen across clinical trials.

For those who fail biologics, an off-label option includes the gepant class of drugs designed for chronic cough. Dousen (revefenacin) is a nebulized bronchodilator that targets P2X3 purinoceptors involved in cough reflex hypersensitivity. As it is inhaled locally, it provides relief with very few systemic side effects compared to other alternatives.

In summary, treatment progresses from OTC to prescription-only drugs to biologics based on symptom severity and response to prior treatments.

Key winning strategies adopted by key players of Chronic Refractory Cough Market

Product innovation - Developing novel products that can effectively treat chronic refractory cough is one of the major strategies adopted by companies. For example, in 2020, Merck & Co. launched Reyvow (lasmiditan), which is the first FDA-approved oral treatment for acute treatment of migraine with or without aura in adults.

License agreements and partnerships - Partnering with smaller biotech companies engaged in developing promising drug candidates is a strategy used by large pharmaceutical companies. For example, in 2018, Bayer partnered with Marinomed Biotech to develop an anticholinergic drug candidate for treating chronic refractory cough. This allowed Bayer to access a novel therapeutic approach and strengthen its product pipeline.

Expanded indications - Applying for regulatory approval to expand existing products' label to include chronic refractory cough as an additional indication. In 2015, Mylan received FDA approval to expand the label of its Benzonatate capsule to include treatment of chronic cough.

Acquisitions - Major companies acquire smaller drug developers to obtain their clinical stage product candidates and research capabilities. For example, in 2017, AstraZeneca acquired Amplyx Pharmaceuticals primarily to gain access to fosmanogepix (APX001), a first-in-class antifungal drug in phase 2 testing that also showed potential in treating refractory chronic cough.

Segmental Analysis of Chronic Refractory Cough Market

Insights, By Treatment: Antitussives Lead the Treatment Segment Due to Strong Efficacy Against Dry Cough Symptoms

Within the treatment segment of the chronic refractory cough market, antitussives is likely contribute the greatest share of 47.3% in 2024. This is primarily due to antitussives' proven effectiveness in suppressing dry, nonproductive coughs, which are a hallmark symptom of chronic refractory cough.

Antitussives work directly on the cough center located in the medulla oblongata part of the brain to suppress the urge to cough. Compared to alternative treatment options, antitussives provide faster and more reliable cough relief for patients experiencing dry coughs that are unresolved by other measures. This strong performance has helped antitussives become the go-to first-line treatment recommended by medical guidelines for chronic refractory cough associated with dry cough symptoms.

The ability of antitussives to deliversimmediate, targeted relief of dry coughs without causing unwanted side effects like drowsiness has supported their widespread adoption among both patients and physicians. New research into more selective antitussives with improved safety profiles is also expanding clinical application and driving greater utilization. The combination of proven efficacy, fast onset of action, and growing innovation in the class solidifies antitussives as the leading treatment segment.

By Route of Administration - Oral Administration Dominates due to Convenience and Compliance

Within the administration route segment of the chronic refractory cough market, oral options such as tablets and syrups will contribute the greatest share of approximately 54.2% in 2024. This is largely due to the convenience and compliance benefits associated with oral administration.

For patients suffering from chronic refractory cough, consistent treatment is important but not always easy. Oral medications are simple for patients to take accurately as prescribed without help from a caregiver. This ease of use supports reliable compliance with long-term treatment regimens. It also allows patients to conveniently administer medication as needed in response to cough symptoms wherever they may be.

The noninvasiveness of oral administration also improves the tolerance and preference of patients compared to alternatives like nebulizers or injections. This enhances adherence to therapy. With the chronic nature of the condition, characteristics like simplicity, discretion, and comfort are paramount drivers of segment leadership for oral options over other administration routes in the refractory cough market. Innovation into new oral formulations may further build on these advantages over time.

Additional Insights of Chronic Refractory Cough Market

- Economic Burden: Chronic refractory cough leads to increased healthcare utilization, accounting for over $1 billion in annual medical costs in the U.S. alone.

- Quality of Life Impact: Patients with chronic refractory cough experience a reduction in quality of life scores by up to 30%, affecting daily activities and mental health.

- Rising Incidence of Chronic Cough: Studies indicate that approximately 5-10% of the global population suffers from chronic cough, highlighting the significant patient population requiring effective treatments.

- Regulatory Approvals: The FDA's fast-track designation for certain chronic cough medications underscores the urgent need for new therapies and accelerates market entry for innovative drugs.

- The United States accounted for nearly 42% of the 12-month prevalent cases of chronic cough in 2023, with projections of an increase by 2034.

Competitive overview of Chronic Refractory Cough Market

The major players operating in the chronic refractory cough market include Merck & Co., Inc., Bellus Health Inc., Bayer AG, AstraZeneca plc, GlaxoSmithKline plc, Sanofi S.A., Pfizer Inc., Novartis AG, Johnson & Johnson, and Teva Pharmaceutical Industries Ltd.

Chronic Refractory Cough Market Leaders

- Merck & Co., Inc.

- Bellus Health Inc.

- Bayer AG

- AstraZeneca plc

- GlaxoSmithKline plc

Chronic Refractory Cough Market - Competitive Rivalry, 2024

Chronic Refractory Cough Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Chronic Refractory Cough Market

- In September 2023, AstraZeneca plc initiated a global Phase II clinical trial for a novel monoclonal antibody targeting chronic cough, indicating the company's commitment to expanding its respiratory portfolio.

- In July 2023, Merck & Co., Inc. acquired a biotech startup specializing in cough reflex modulation. Merck's recent acquisitions in 2023 primarily focused on companies specializing in immunology and neuroscience rather than specifically in cough reflex modulation. This strategic move aims to enhance Merck's pipeline and strengthen its market share in the chronic cough segment.

- In March 2023, Bellus Health Inc. announced positive Phase III trial results for their investigational drug BLU-5937. The medication showed significant efficacy in reducing cough frequency, potentially positioning Bellus Health as a leader in refractory cough treatment. Bellus Health had been actively progressing with their clinical trials, particularly with the Phase 2b SOOTHE trial showing promising results for BLU-5937 in reducing cough frequency.

- In 2023, GSK acquired Bellus Health for approximately USD 2.0 billion, enhancing its respiratory pipeline with camlipixant, a P2X3 antagonist in Phase III for CRC. The acquisition includes camlipixant, a highly selective P2X3 antagonist currently in Phase III development, aimed at treating refractory chronic cough (RCC).

Chronic Refractory Cough Market Segmentation

- By Treatment

- Antitussives

- Opioid Antitussives

- Non-Opioid Antitussives

- Expectorants

- Guaifenesin

- Hypertonic Saline

- Combination Medications

- Antitussive and Expectorant Combinations

- Antitussives

- By Route of Administration

- Oral

- Tablets

- Syrups

- Inhalation

- Nebulizers

- Inhalers

- Injectable

- Subcutaneous

- Intravenous

- Oral

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the chronic refractory cough market?

The chronic refractory cough market is estimated to be valued at USD 1.62 Bn in 2024 and is expected to reach USD 2.82 Bn by 2031.

What are the key factors hampering the growth of the chronic refractory cough market?

The expensive nature of advanced therapeutics may limit patient access. Furthermore, the potential adverse effects associated with long-term use of cough medications can deter their adoption. These are the major factors hampering the growth of the chronic refractory cough market.

What are the major factors driving the chronic refractory cough market growth?

The rising incidence of chronic respiratory conditions like asthma and COPD and ongoing R&D efforts are leading to the development of novel therapies and treatment modalities. These are the major factors driving the chronic refractory cough market.

Which is the leading treatment in the chronic refractory cough market?

The leading treatment segment is antitussives.

Which are the major players operating in the chronic refractory cough market?

Merck & Co., Inc., Bellus Health Inc., Bayer AG, AstraZeneca plc, GlaxoSmithKline plc, Sanofi S.A., Pfizer Inc., Novartis AG, Johnson & Johnson, and Teva Pharmaceutical Industries Ltd. are the major players.

What will be the CAGR of the chronic refractory cough market?

The CAGR of the chronic refractory cough market is projected to be 8.2% from 2024-2031.