Chronic Wounds Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Chronic Wounds Treatment Market is segmented By Type of Disease (Diabetic Ulcers, Venous Leg Ulcers, Pressure Ulcers), By Wound-Care Therapies (Tradit....

Chronic Wounds Treatment Market Size

Market Size in USD Bn

CAGR7.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.1% |

| Market Concentration | Medium |

| Major Players | PolarityTE, Smith & Nephew, Mölnlycke Health Care, 3M Health Care, Medline Industries and Among Others. |

please let us know !

Chronic Wounds Treatment Market Analysis

The Global Chronic Wounds Treatment Market is estimated to be valued at USD 15.50 billion in 2024 and is expected to reach USD 25.61 billion by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. Chronic wounds affect a considerable proportion of the population worldwide resulting from numerous conditions like diabetes, peripheral arterial disease (PAD) among others. This widespread prevalence has driven significant focus on advanced wound care products development.

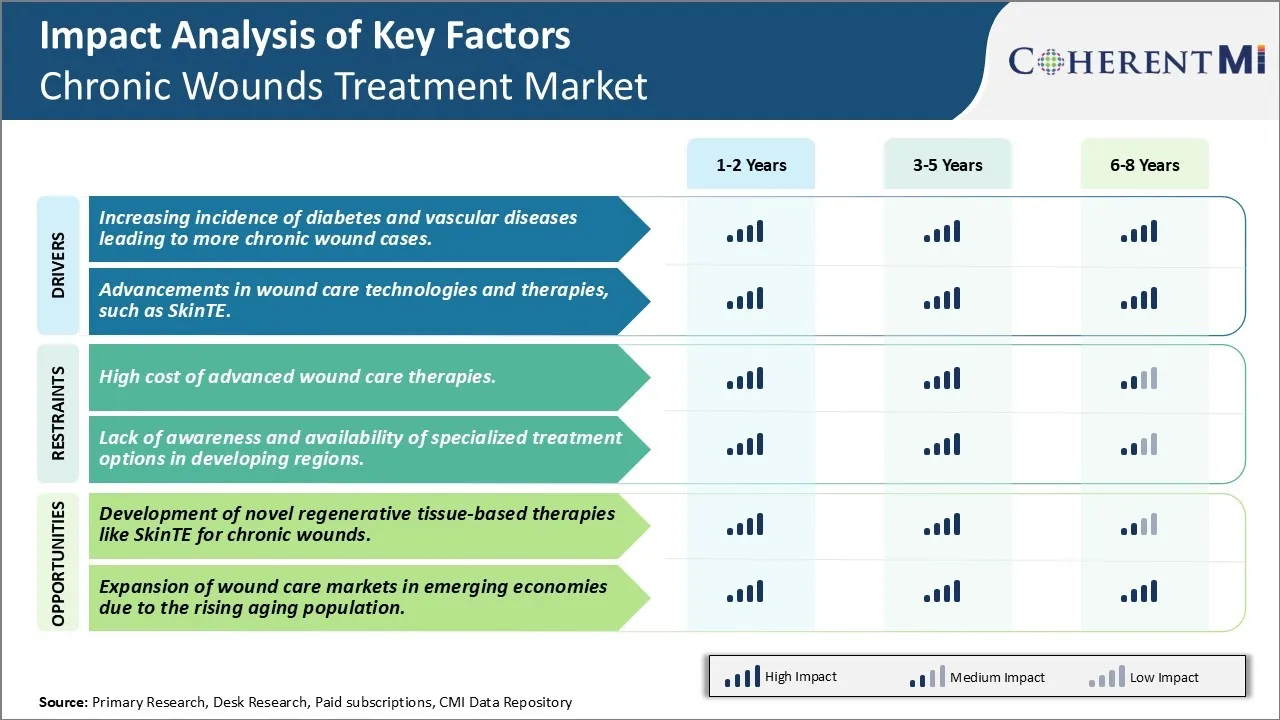

The chronic wounds treatment market is expected to witness a positive growth trend over the forecast period. Rising geriatric population prone to diabetes and other chronic conditions is a key factor. Additionally, growing awareness programs by governments worldwide for chronic wound management is anticipated to boost market revenues. However, high costs associated with advanced wound care products is a challenge. Technological advancements bringing more efficacious and cost-effective products could unlock new opportunities in the coming years.

Chronic Wounds Treatment Market Trends

Market Driver - Increasing incidence of diabetes and vascular diseases leading to more chronic wound cases.

As per the available medical studies and research, it has been witnessed that there is a significant rise in the number of people suffering from diabetes and vascular diseases globally. Diabetes is one of the leading causes of chronic wounds as high blood sugar levels in diabetes can damage nerves and reduce blood flow - both of which put people at higher risk of slow-healing wounds. Poorly controlled diabetes over long period can also lead to peripheral artery disease, or PAD which is narrowing of arteries supplying blood to the body's extremities. This obstruction in blood vessels reduces blood flow and oxygen to the tissues, ultimately delaying natural wound healing process.

According to World Health Organization's recent report, the prevalence of diabetes among adults over 18 years of age has risen from 6.7% in 2000 to 10.5% in 2020. It is projected that around 642 million people or one in 10 adults will have diabetes by 2040. Most of the increase will occur in developing countries and emerging nations where lifestyle is changing rapidly leading to more obesity and lesser physical activities. Similar trends have been seen for vascular conditions as well according to various epidemiological studies. This substantial growing patient pool of diabetes and vascular diseases will significantly drive the demand for advanced chronic wound care management options as healing of wounds formed in these patients require much more time and intervention. Treatment expenditures per case also increases manifold for chronic wounds. All these factors directly translate to continuous increase in chronic wounds treatment market worldwide to handle this growing patient caseload across various healthcare settings.

Market Driver- Advancements in Wound Care Technologies and Therapies, such as SkinTE

The chronic wounds treatment landscape has transformed considerably over past few years with progressive innovations focusing on faster healing through tissue regeneration approach. Introduction of novel wound dressings, devices, skin and nerve substitutes has provided clinicians and patients with much improved options compared to traditional treatment modifications. Continuous research is also bringing more refined solutions to address various wound etiologies more effectively.

A prime example is SkinTE, a first-of-its-kind bioengineered skin substitute made from a patient's own cells. This latest advancement uses an innovative manufacturing process involving gentle harvesting of skin cells non-invasively through a small skin biopsy. The cells are then multiplied in the laboratory to create an intact and living sheet mimicking natural skin structure and function. During application, SkinTE helps regenerate all layers of the skin by promoting tissue growth, blood vessel formation and re-epithelialization. Successful clinical outcomes have been shown even for recalcitrant chronic wounds that failed to respond to standard care over long durations. The chances of infection, pain and need for dressing changes are also lower compared to alternative available grafts or flaps.

Market Challenge - High Cost of Advanced Wound Care Therapies Limits the Market Growth.

One of the major challenges faced by the chronic wounds treatment market is the high cost of advanced wound care therapies. Chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers often require expensive treatment options such as skin substitutes, growth factors, and topical antibiotics to heal. These advanced therapy products generally cost between USD 500 to USD 3000 per application with most patients requiring multiple applications. This steep financial burden makes such cutting-edge treatments inaccessible to a large portion of patients, especially those in the developing world. The soaring costs have also put immense pressure on the healthcare systems and medical reimbursements cover only a part of the total expenses in many countries. Additionally, long and recurrent hospitalization further increases the economic burden on patients as well as payers. This prohibitively high cost of care poses a significant barrier to the widespread adoption of evidence-based regenerative therapies for chronic wounds.

Market Opportunity: Development of Novel Regenerative Tissue-Based Therapies like SkinTE for Chronic Wounds

One major opportunity for the chronic wounds treatment market lies in the development of novel regenerative tissue-based therapies. SkinTE by PolarityTE is a promising tissue-based regenerative therapy currently being investigated for chronic wound applications. It uses a patient's own skin cells to grow new tissue in the wound, mimicking the body's natural wound healing process. This engineered skin graft aims to overcome key limitations of existing products by potentially providing a permanent solution with a single application. Preliminary clinical data has demonstrated SkinTE’s ability to facilitate wound closure and regeneration of natural skin tissue in chronic wound patients. With its off-the-shelf availability and relatively low cost of around USD 3000 per application, SkinTE has the potential to significantly increase access to advanced care, especially in developing countries. Its tissue regenerative approach could also minimize need for repeat treatments and long hospital stays. This novel regenerative technology holds immense potential to transform chronic wound management if proven effective and economical through further clinical research.

Key winning strategies adopted by key players of Chronic Wounds Treatment Market

Product Innovation: One of the most successful strategies adopted by players has been continuous product innovation to address unmet needs. For example, in 2018, Smith & Nephew launched PICO Single Use NPWT system, the smallest portable NPWT device, which facilitates early mobility and activity. In 2015, KCI introduced the V.A.C. Therapy system with Prevena, the only NPWT device approved for in-patient use. These innovative products helped the companies capture significant market share by addressing limitations in existing therapies.

Partnerships & Acquisitions: Players have entered strategic partnerships and acquisitions to expand their product portfolio and market reach. For example, in 2017, Acelity acquired Spiracur to enhance its advanced wound care offerings with Spiracur Negative Pressure Wound Therapy devices and therapy systems. Similarly, in 2014, ConvaTec partnered with 3M to leverage 3M's composites and adhesives technology for advanced wound care products. These strategic moves enabled the companies to offer more comprehensive wound care solutions.

Awareness Programs: Players conduct various awareness and educational programs to increase adoption of evidence-based therapies. For instance, Smith & Nephew supports Wound Care Education Institute which provides advanced wound care training programs for healthcare professionals. Between 2012-17, it trained over 230,000 clinicians globally. Such initiatives have raised clinician knowledge and familiarized them with new treatment options, thereby driving market revenues.

Segmental Analysis of Chronic Wounds Treatment Market

Insights, By Type of Disease, Population Aging and Increased Diabetes Prevalence Drive Growth in Diabetic Ulcers Segment.

By Type of Disease, Diabetic Ulcers contributes the highest market share 57.7% in 2024 due to aging population and increasing rates of diabetes globally. Older patients are more prone to diabetic complications like poor blood circulation that can delay wound healing. The rise in diabetes prevalence worldwide is a consequence of growing obesity and sedentary lifestyles. Countries with developing economies are seeing the fastest growth in diabetes cases. This translates to a bigger pool of at-risk patients and greater clinical burden of diabetic foot ulcers and other chronic wounds. Another factor is that many patients have poorly managed blood glucose levels over a long period of time before the diagnosis of a diabetic ulcer. Sustained hyperglycemia causes microvascular damage and neuropathic complications, impairing the body's natural wound repair mechanisms. Early intervention and diabetes self-management can help reduce the risk of ulcers and boost treatment outcomes.

Insights, By Wound-Care Therapies, Rising Life Expectancy Fuels Venous Leg Ulcer Incidence.

By Wound-Care Therapies, Traditional Wound Care contributes the highest market share 52.7% in 2024. This is largely due to venous leg ulcers which make use of compression bandaging and dressings as first-line treatment modalities. Venous leg ulcers comprise a substantial portion of chronic wounds managed in community and long-term care settings. Their incidence rate tracks closely with an aging population worldwide. As life expectancy increases, more people are living with co-morbidities and mobility issues in their older years which can worsen venous hypertension in the legs over time. This leads to higher pressures in the veins making them more susceptible to damage and ulcer formation, especially if there is a history of deep vein thrombosis or injury. Traditional wound care approaches continue to be relied upon for effective compression therapy and dressing of venous stasis ulcers.

Insights, By Advanced Therapies, Necessity of Wound Closure Drives Demand for Skin Substitutes

In terms of By Advanced Therapies, Skin Substitutes contributes the highest share of the market. For non-healing or large chronic wounds, closure of the epithelial layer is critical for progress towards full recovery. Conventional treatment methods sometimes fail to promote timely wound closure. This gap has been increasingly filled by the use of skin substitutes and tissue engineered products that can expedite re-epithelialization. Skin substitutes seek to emulate the structure and function of natural skin in order to facilitate wound closure. Their importance has grown for managing difficult wound cases, minimizing scarring and accelerating patient recovery. The need for faster healing solutions, coupled with their demonstrated clinical efficacy on most wound types, will continue supporting demand for advanced skin substitutes over other regenerative approaches.

Additional Insights of Chronic Wounds Treatment Market

Chronic wounds represent a significant healthcare burden, especially among populations with diabetes, vascular diseases, and limited mobility. Chronic wounds are defined by their failure to heal within a standard timeframe (typically three months) and often require advanced treatments like debridement, compression, and regenerative therapies. Emerging therapies such as PolarityTE’s SkinTE offer promising advances by leveraging patient-derived tissue to repair and regenerate damaged skin, offering new hope for patients with non-healing wounds. These developments could shift the chronic wound care market, particularly as the prevalence of diabetes and other chronic diseases continues to rise globally. The adoption of such therapies, however, may be limited by high costs and accessibility issues in developing markets. Advances in wound care technologies, such as regenerative medicine, are anticipated to increase the success rate of chronic wound healing and reduce the associated complications.

Competitive overview of Chronic Wounds Treatment Market

The major players operating in the Chronic Wounds Treatment Market include PolarityTE, Smith & Nephew, Mölnlycke Health Care, 3M Health Care, Medline Industries, Tissue Regenix, ConvaTec Group, B.Braun Melsungen AG, Coloplast Group, Cardinal Health and MiMedx.

Chronic Wounds Treatment Market Leaders

- PolarityTE

- Smith & Nephew

- Mölnlycke Health Care

- 3M Health Care

- Medline Industries

Chronic Wounds Treatment Market - Competitive Rivalry, 2024

Chronic Wounds Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Chronic Wounds Treatment Market

- In August 2024, PolarityTE’s SkinTE is progressing through Phase III clinical trials. This human tissue-based product is designed to aid in skin tissue repair for patients with chronic wounds, offering an alternative to traditional skin grafts. This development could transform chronic wound care by offering a more effective and patient-derived solution.

- In a published medical study in 2022, the research emphasized the significance of nanotherapeutics, 3D bio-printing based therapies, stem cell therapies, and bioprinting-based therapies to enhance the outcomes on skin regeneration with least side effects.

Chronic Wounds Treatment Market Segmentation

- By Type of Disease

- Diabetic Ulcers

- Venous Leg Ulcers

- Pressure Ulcers

- By Wound-Care Therapies

- Traditional Wound Care

- Advanced Wound Care

- By Advanced Therapies

- Skin Substitutes

- Regenerative Therapies

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Chronic Wounds Treatment Market?

The Global Chronic Wounds Treatment Market is estimated to be valued at USD 15.50 billion in 2024 and is expected to reach USD 25.61 billion by 2031.

What will be the CAGR of the Chronic Wounds Treatment Market?

The CAGR of the Chronic Wounds Treatment Market is projected to be 7.1% from 2024-2031.

What are the major factors driving the Chronic Wounds Treatment Market growth?

The increasing incidence of diabetes and vascular diseases leading to more chronic wound cases and advancements in wound care technologies and therapies, such as SkinTe are the major factor driving the Chronic Wounds Treatment Market.

What are the key factors hampering the growth of the Chronic Wounds Treatment Market?

The high cost of advanced wound care therapies and lack of awareness and availability of specialized treatment options in developing regions are the major factor hampering the growth of the Chronic Wounds Treatment Market.

Which is the leading Type of Disease in the Chronic Wounds Treatment Market?

Diabetic ulcers is the leading type of disease.

Which are the major players operating in the Chronic Wounds Treatment Market?

PolarityTE, Smith & Nephew, Mölnlycke Health Care, 3M Health Care, Medline Industries, Tissue Regenix, ConvaTec Group, B.Braun Melsungen AG, Coloplast Grsoup, Cardinal Health, MiMedx are the major players.