Clinical Trial Services Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Clinical Trial Services Market is segmented By Therapeutic Areas (Cardiovascular Disorders, Infectious Disorders, Metabolic Disorders, Neurological Di....

Clinical Trial Services Market Size

Market Size in USD Bn

CAGR14.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 14.1% |

| Market Concentration | High |

| Major Players | Center Point Clinical Services, eClinicalHealth, Mytrus (Medidata Solutions), Science 37, Berry Consultants and Among Others. |

please let us know !

Clinical Trial Services Market Analysis

The clinical trial services market is estimated to be valued at USD 1.09 billion in 2024 and is expected to reach USD 2.75 billion by 2031, growing at a compound annual growth rate (CAGR) of 14.1% from 2024 to 2031. The increasing R&D expenditure of pharmaceutical and biotechnology companies and the rising number of clinical trial studies are propelling the demand for clinical trial services.

Clinical Trial Services Market Trends

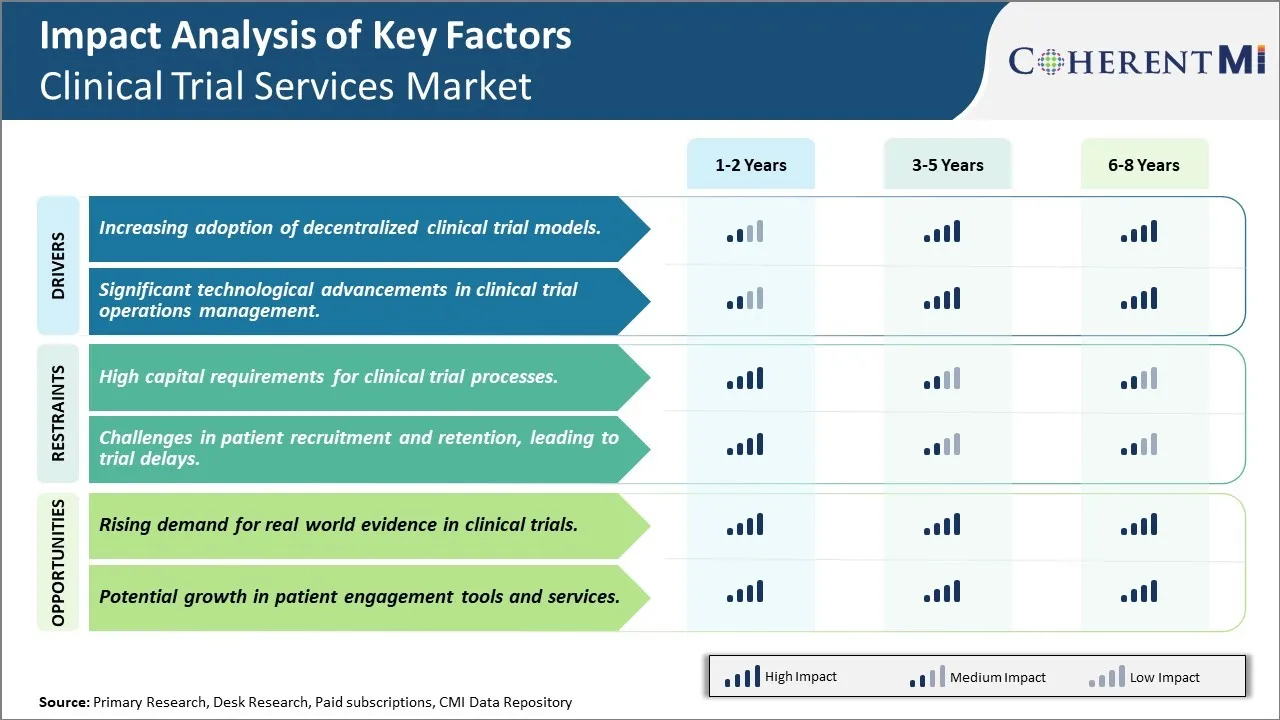

Market Driver - Increasing Adoption of Decentralized Clinical Trial Models

The traditional clinical trial model involving centralized clinical sites has certain limitations in terms of their scalability and ability to reach diverse patient populations. This has been driving the adoption of decentralized clinical trial models which rely on virtual environments instead of physical sites. Decentralized trials allow participation from a wider geographic area and help address challenges involved in recruiting specific patient cohorts.

More pharma companies and Contract Research Organizations (CROs) are now exploring hybrid models where certain trial procedures are conducted virtually while others still occur in person. For example, informed consent processes and routine safety assessments can take place remotely through telemedicine tools whereas laboratory sample collection may need to happen at sites. This gives patients more flexibility in terms of their location and schedule while lightening the logistical burdens on sponsors. It also opens up opportunities to recruit from rural areas and developing markets which were previously hard to reach.

Going fully virtual has also been made possible due to advancement of technologies like eConsent, eCOA, mobile health apps, connected devices, and at-home sample collection kits. The preference for hybrid and fully decentralized approaches is expected to persist long-term across therapeutic areas.

Market Driver - Significant Technological Advancements in Clinical Trial Operations Management

The clinical trial landscape is getting transformed significantly due to the rapid evolution of technologies that aid in various Clinical Trail Management System (CTMS) functions. Advanced cloud-based platforms are enabling end-to-end integration of activities from planning and budgeting to patient recruitment and monitoring. This is streamlining workflows and removing data silos across departments and vendors. Technologies like artificial intelligence (AI) and machine learning (ML) are also being applied to areas such as protocol design, site feasibility assessment, and monitoring.

Automation solutions powered by Robotic Process Automation (RPA) are taking over mundane administrative tasks and manual document handling from clinical trial coordinators. The use of blockchain for transparent drug serialization and result archival is another emerging area. Advanced analytics platforms on the other hand are facilitating real-time decision making through predictive monitoring of trial progress against objectives. Emerging areas like genomics, digital biomarkers and decentralized methods are also propelling the development of specialized technological solutions.

The resulting increase in operational efficiencies is expected to drive higher volumes of clinical research and more complex trial designs going forward. This will sustain the demand for advanced CTMS platforms, generating significant new opportunities for clinical trial technology providers.

Market Challenge - High Capital Requirements for Clinical Trial Processes

One of the key challenges faced by the clinical trial services market is the high capital requirements associated with clinical trial processes. Conducting clinical trials is a highly expensive process that requires significant investments at various stages. From setting up clinical trial sites and recruiting patients to monitoring trials and collecting and analyzing large amounts of data, every step in the clinical trial process demands substantial financial resources. This intense capital intensity acts as a barrier for small- and mid-sized pharmaceutical companies with limited budgets.

The costs of clinical trials have been rising continuously over the years due to factors such as increasing complexities of trials, stringent regulatory compliance requirements and growing operational expenses. Meeting the hefty financial obligations for advanced stage trials can put immense financial strain even on large pharmaceutical firms. The steep capital needs thus pose a considerable challenge for the market by restricting entry and limiting research and development activities of industry players with constrained access to capital.

Market Opportunity - Rising Demand for Real-world Evidence in Clinical Trials

One major opportunity for the clinical trial services market is the growing demand for real-world evidence generation in clinical trials. There is an increasing emphasis on supplementing conventional randomized controlled trial data with real-world clinical evidence derived from electronic health records, patient registries, and claims databases. This shift is being driven by factors such as longer treatment cycles of many drugs requiring extensive post-approval monitoring, need to evaluate drug performance in real practice settings, and desire to optimize personalized medical approaches.

The increasing preference for real-world evidence is creating significant demand for clinical trial services that can leverage real-world data sources and advanced analytics capabilities to design and execute more flexible and pragmatic clinical trials. This presents lucrative opportunities for clinical trial service providers to develop capabilities around real-world data integration, analytics and trial protocol design. It also allows pharmaceutical companies to cut costs and reduce timelines using real world evidence-based trials. The growing significance of real-world data in clinical development thus offers immense potential for increased market adoption of associated services.

Key winning strategies adopted by key players of Clinical Trial Services Market

Strategy #1: Focus on niche therapeutic areas

CROs have found success by focusing on niche therapeutic areas that are underserved rather than attempting to be experts in all areas. For example, PRA Health Sciences focuses heavily on oncology while PPD focuses on central nervous system disorders.

Strategy #2: Pursue strategic acquisitions and partnerships

Leading CROs have strengthened their service offerings and geographic footprints through selective acquisitions and partnerships. For example, in 2018 LabCorp acquired contract research organization Covance for $6.1 billion, creating an industry giant. This expanded LabCorp's global clinical trial capabilities.

Strategy #3: Invest in advanced technologies

Top CROs have invested heavily in technologies like artificial intelligence, robotic process automation, and virtual/decentralized trial platforms to enhance efficiency and remain competitive. For instance, in 2018 PRA launched Populytics, an AI-based platform using real-world data to accelerate clinical development.

Strategy #4: Expand in emerging markets

As operations in countries like China, India, and Eastern Europe continue growing rapidly, leading CROs have established a physical presence in high-potential emerging markets. For example, PPD expanded its footprint in China over the past decade to capitalize on the region's clinical trial activity. Today it has over 5,000 employees in China.

Segmental Analysis of Clinical Trial Services Market

Insights, By Therapeutic Areas - The Growing Threat of Cardiovascular Disease

In terms of therapeutic areas, cardiovascular disorders contribute the highest share of the market owning to the growing threat posed by conditions like heart attacks, strokes, and heart disease. Cardiovascular disorders remain the leading cause of death globally, despite advancements in treatment options. Several factors contribute to the high prevalence of these conditions.

Lifestyle changes over recent decades have led to more sedentary habits and unhealthy diets heavy in fat, salt, and sugar. Obesity, hypertension, diabetes, and other metabolic disorders associated with poor lifestyle choices significantly increase the risk of heart disease and strokes. An aging global population has also amplified this public health threat. Additionally, the development of novel cardiovascular drugs and devices undergoing clinical trials ensures a steady stream of study opportunities in this segment.

Conditions like coronary artery disease, congenital heart defects, arrhythmias and peripheral artery disease all fall under the cardiovascular disorders category. Clinical trials evaluating everything from new interventional cardiology devices and pharmaceuticals to lifestyle modification programs targeting cardiovascular risk factors are regularly recruiting. The strong relationships formed between sponsors, CROs and sites with cardiovascular expertise makes this therapeutic area particularly productive for trial recruitment. Addressing cardiovascular disease remains a top research priority given its enormous disease burden and economic toll, driving significant investment into related clinical research.

Insight, By End User - Small Players Dominate Due to Flexibility

In terms of end user, small-sized players contribute the highest share of the market due to their ability to cater to specific customer needs with a higher degree of flexibility. Small CROs and sites comprise the majority of players in the highly fragmented clinical trial industry. They appeal to smaller biotech companies and startups conducting early phase proof-of-concept studies due to lower costs and more personalized service.

With lean structures and specialist teams, small entities can often design and implement niche protocols more efficiently than their larger counterparts. Their localized footprints also allow for proximity to specific patient populations and expert investigators. Administrative burdens tend to be lighter than at large global organizations. This nimble, focused approach is well-suited to the fast timelines of early research.

Relationships between sponsor coordinators and small provider staff remain personal. Close cooperation streamlines operations as protocols evolve flexibly. Small players further capitalize on serving local sponsors who prefer dealing directly with domestic resources. While limited in their scope and capabilities compared to large multinationals, these dynamics give smaller end users and sites an edge in capturing a sizeable share of early phase work.

Insights, By Phase of Development - Phase I Studies Pioneer New Treatments

In terms of phase of development, Phase I contributes the highest share of the market owing to the critical importance of safety testing in pioneering new therapies. Phase I represents the initial moment of truth for any experimental drug, biologic or device when it first enters the human body. Safety pharmacology and dose escalation studies conducted in small healthy volunteer populations serve as the first line of defense.

Identifying maximum tolerated doses, pharmacokinetic profiles and early signs of toxicity are the key goals of Phase I trials, which typically enroll fewer than 100 subjects. However, the risk of finding serious adverse effects that halt development makes these earliest trials particularly consequential, as well as often lengthy and costly. Close monitoring in specialized Phase I units is required to rapidly identify and mitigate potential safety issues.

Given their role in de-risking candidates so later development may proceed, Phase I offerings will remain in high demand from biotech companies and pharmaceutical firms advancing early assets. Demographic testing of healthy cohorts also provides key insights to inform subsequent therapeutic investigations. With investments pouring into novel modalities like gene and cell therapies, monitoring innovative technologies safely at the initial human dose represents an area of expanding importance.

Additional Insights of Clinical Trial Services Market

- Pharma Industry's R&D Budget: Estimated that 40% of the US pharma industry’s R&D budget is spent on clinical trials, highlighting the financial intensity of the sector.

- Clinical Trials Failures: Nearly 85% of clinical trials fail to retain enough patients, causing significant delays and financial losses, estimated at USD 8 million per day for blockbuster drugs.

Competitive overview of Clinical Trial Services Market

The major players operating in the Clinical Trial Services Market include Center Point Clinical Services, eClinicalHealth, Mytrus (Medidata Solutions), Science 37, Berry Consultants, CRF Bracket, Cytel, Evidera, Clinerion, Medpace, NorthWest EHealth, TriNetX, endpoint Clinical, Greenphire, International Drug Development Institute (IDDI), and ThoughtSphere.

Clinical Trial Services Market Leaders

- Center Point Clinical Services

- eClinicalHealth

- Mytrus (Medidata Solutions)

- Science 37

- Berry Consultants

Clinical Trial Services Market - Competitive Rivalry, 2024

Clinical Trial Services Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Clinical Trial Services Market

- In August 2023, Texas Tech University Health Sciences Center collaborated with Deep 6 AI to launch an AI program for clinical trials, aiming to streamline data management and patient recruitment processes.

- In June 2023, Medable launched a decentralized trials tool kit in collaboration with MRCT Center to establish a common framework for ethical conduct in clinical trials.

Clinical Trial Services Market Segmentation

- By Therapeutic Areas

- Cardiovascular Disorders

- Infectious Disorders

- Metabolic Disorders

- Neurological Disorders

- Oncological Disorders

- Others

- By End User

- Small-sized Players

- Mid-sized Players

- Large Players

- Academia/Others

- By Phase of Development

- Phase I

- Phase II

- Phase III

- Phase IV

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the clinical trial services market?

The high capital requirements for clinical trial processes and challenges in patient recruitment and retention, leading to trial delays are the major factor hampering the growth of the clinical trial services market.

What are the major factors driving the clinical trial services market growth?

The increasing adoption of decentralized clinical trial models and significant technological advancements in clinical trial operations management are the major factor driving the clinical trial services market.

Which is the leading therapeutic area in the clinical trial services market?

The leading therapeutic area in the clinical trial services market is cardiovascular disorders.

Which are the major players operating in the clinical trial services market?

Center Point Clinical Services, eClinicalHealth, Mytrus (Medidata Solutions), Science 37, Berry Consultants, CRF Bracket, Cytel, Evidera, Clinerion, Medpace, NorthWest EHealth, TriNetX, endpoint Clinical, Greenphire, International Drug Development Institute (IDDI), ThoughtSphere are the major players.

What will be the CAGR of the clinical trial services market?

The CAGR of the clinical trial services market is projected to be 14.1% from 2024-2031.