Ebola Fever Therapeutic Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Ebola Fever Therapeutic Market is segemented By Treatment Type (Vaccines, Antiviral Therapies), By Route of Administration (Intravenous, Oral), By Dis....

Ebola Fever Therapeutic Market Size

Market Size in USD Bn

CAGR6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6% |

| Market Concentration | High |

| Major Players | GlaxoSmithKline, Sarepta Therapeutics, Tekmira Pharmaceuticals Corporation, Mapp Biopharmaceutical, Sabin Vaccine Institute and Among Others. |

please let us know !

Ebola Fever Therapeutic Market Analysis

The Ebola fever therapeutic market is estimated to be valued at USD 0.742 bn in 2024 and is expected to reach USD 1.116 bn by 2031, growing at a compound annual growth rate (CAGR) of 6% from 2024 to 2031. The market has been witnessing high growth over the past few years driven by factors such as increased government funding for Ebola research, rising prevalence of Ebola virus diseases globally, and growing product pipeline with many drugs under clinical trials.

Ebola Fever Therapeutic Market Trends

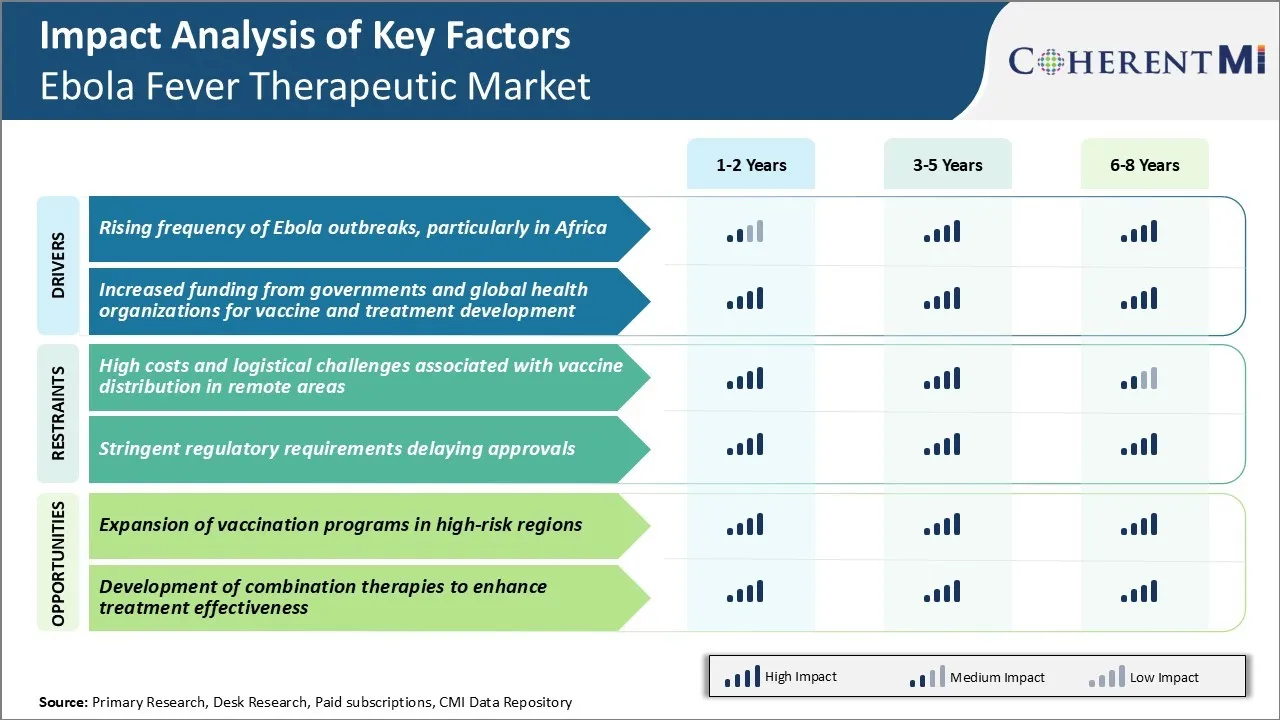

Market Driver - Rising Frequency of Ebola Outbreaks, Particularly in Africa

The Ebola virus disease was first discovered in 1976 has continued to emerge periodically, mostly within Central and Western parts of Africa where public health systems are not adequately equipped to respond quickly. Just between 2014-2016, a devastating epidemic raged in multiple countries including Guinea, Liberia, and Sierra Leone infecting over 28,000 people and claiming more than 11,000 lives.

According to World Health Organization reports, this latest outbreak which infected over 3,000 individuals and caused over 2,000 casualties was the worst in the country's history and the second largest globally only after the 2014-2016 West Africa epidemic. The frequent and continuous emergence of the disease in the same impoverished regions indicates that risks of Ebola outbreaks have been amplified in these parts of Africa due to a mixture of reasons.

For one, the lack of adequate sanitation and healthcare infrastructures have allowed the virus to persist in bat and animal populations acting as reservoirs. Secondly, conflict zones and political instability in countries like DRC, South Sudan etc. have disrupted long-standing surveillance systems. As communities remain highly vulnerable to such introduced infections, chances of Ebola resurfacing time and again continue to loom large casting a shadow over public health in the continent.

Market Driver - Increased Funding from Governments and Global Health Organizations for Vaccine and Treatment Development

Spurred by the scale and impact of the 2014 West Africa Ebola outbreak, governments and international institutions have stepped up commitments towards expediting the development of countermeasures against the Ebola virus. Several new vaccine candidates received initial clinical approvals and prequalification between 2015-2020 backed by financing from Coalition for Epidemic Preparedness Innovations, WHO, World Bank and others.

Amono-vaccine rVSV-ZEBOV developed by Merck obtained regulatory green light as the first-ever vaccine to be approved by both European Medicines Agency and U.S FDA for preventing Ebola virus disease. Similarly, another candidate developed by Johnson & Johnson received an approval nod and has since aided response efforts during Congo outbreaks through comprehensive vaccination programs.

Beyond new product development, fund allocations have supported logistical requirements of stockpiling, deployment and capacity building activities especially within worst-affected regions. The WHO has further strengthened its emergency response departments and established protocols for early detection and rapid containment with the help of generous contributions.

Overall, collective aid through coordinated partnerships seeking treatment solutions for Ebola has grown substantially thereby enabling the health ecosystem to combat future flare-ups in a far more effective manner.

Market Challenge - High Costs and Logistical Challenges Associated with Vaccine Distribution in Remote Areas

One of the major challenges facing the Ebola fever therapeutic market is the high costs and logistical difficulties involved in distributing vaccines and therapeutics to remote areas affected by outbreaks. Ebola often strikes in parts of Central and West Africa that have poor infrastructure and limited transportation networks.

Getting medical supplies to isolated villages, tribal areas, and border regions in a timely manner requires establishing complex distribution chains. This involves transporting materials vast distances by road on unpaved routes that may be unusable during certain weather conditions, as well as potentially flying supplies by small aircraft to make deliveries to more remote communities.

The climate in many areas also poses difficulties, as extremes of heat and rain can damage vital medical products if not properly stored and transported. Additionally, storage and cold chain requirements for certain Ebola vaccines and therapies add further complications for distribution in territory that lacks reliable electricity.

All these factors drive up costs significantly. With funding often limited during outbreak response, high distribution expenses can hamper efforts to fully protect at-risk populations.

Market Opportunity - Expansion of Vaccination Programs in High-Risk Regions

One substantial market opportunity for players in the Ebola fever therapeutic sphere concerns the expansion of preventative vaccination programs across regions deemed highly vulnerable to future outbreaks. International organizations like the WHO have rightly identified certain parts of Central and West Africa as being at consistently elevated risk due to political instability, cultural practices, and interaction between human and animal populations.

However, vaccination rates in these danger zones currently remain too low. Were programs to be strengthened with support from national governments and NGO partners, protecting larger segments of communities through pre-emptive vaccination could help curtail future outbreaks earlier. This would not only save lives, but also reduce economic impacts.

The therapeutic market stands to gain significantly from sale of additional vaccine doses and ancillary medical products and services required to mount broadened preventative public health drives in high-risk locales. With adequate preparation, outbreaks could be nipped in the bud before becoming large-scale crises.

Treatment Option Analysis of Ebola Fever Therapeutic Market

Ebola fever can be categorized into three main stages - early, intermediate, and late stage.

Early stage (days 1-5): The symptoms are non-specific like fever, body aches, headache etc. as the virus is still not widespread in the body. Oral rehydration therapy using WHO ORS solution is the mainstay treatment to prevent dehydration. Symptomatic relief for fever and pain using paracetamol or ibuprofen is also given.

Intermediate stage (days 6-9): The virus starts affecting multiple organs as it spreads. Intravenous fluids and electrolyte supplementation using Ringer's lactate or normal saline becomes important to prevent hypovolemic shock. Antibiotics like doxycycline, levofloxacin are given to prevent secondary infections.

Late stage (after day 10): The virus has caused extensive organ damage leading to complications. At this critical stage, supportive care to regulate vital functions becomes crucial. Blood products are transfused as per requirement. Drugs like Remdesivir, ZMapp are being evaluated but still not approved for treatment. Their use may be considered on case-to-case basis along with best supportive care.

Overall, early detection and intensive supportive care remains the mainstay of Ebola treatment. Timely fluid and electrolyte management can help stabilize vital functions till the immune system recovers on its own.

Key winning strategies adopted by key players of Ebola Fever Therapeutic Market

Early entry and significant R&D investment: When the 2014 Ebola epidemic struck West Africa, very few pharmaceutical companies had programs actively working on Ebola therapies or vaccines. However, Tekmira Pharmaceuticals (now called Arbutus Biopharma) had been researching an RNAi therapeutic against Ebola as early as 2010. Their head start allowed them to be one of the first companies to progress a candidate (TKM-Ebola) into human clinical trials in 2014.

Partnerships and collaborations: No single company could shoulder the enormous costs and risks of developing Ebola therapies alone. Merck entered partnerships with the NIH and DoD in 2014 to expedite development of its VSV-EBOV vaccine candidate. This allowed Merck to leverage government resources and expertise. Similarly, NewLink Genetics collaborated with BioProtection Systems and Sarepta to develop their candidate MLH. Forming partnerships proved crucial for risk-sharing and speeding development.

Manufacturing scale-up: When cures are urgently needed, a successful therapy must be quickly producible at population-scale. In 2016, Merck took the forward-looking step of beginning construction of a dedicated vaccine manufacturing plant in Pennsylvania, well before any regulatory approvals. This allowed them to achieve WHO prequalification and availability of their now-approved ERVEBO vaccine within months of approval. Early manufacturing scale-up enabled timely access.

Segmental Analysis of Ebola Fever Therapeutic Market

Insights, By Treatment Type: Vaccines Continue the Drive Towards Preventive Measures

In terms of treatment type, vaccines contribute the highest share of the market owning to the growing emphasis on preventive healthcare. With the regular outbreaks of Ebola virus, developing effective vaccines has become a top priority to limit the spread and impact of the disease.

ChAd3-ZEBOV and rVSV-ZEBOV are the two most prominent vaccine candidates that have shown positive results in clinical trials and offer safe and reliable protection against Ebola infection. Their emergency use authorization by regulatory bodies like WHO paved the way for widespread vaccination programs in at-risk regions of Africa. Ongoing research is also evaluating newer methods like monoclonal antibody therapies to enhance the efficacy and durability of immune response from vaccines.

Insights, By Route of Administration: Intravenous Superiority in Clinical Settings

In terms of route of administration, intravenous contributes the highest share of the market owing to its reliability and precision in clinical settings. Treatments for advanced Ebola infections mandate rapid onset of action to neutralize the virus quickly before it causes systemic damage.

The intravenous delivery method ensures immediate absorption of drugs into the bloodstream from where they can spread to tissues. This gives clinicians tight control over dosage and timing compared to oral administration. Several experimental antiviral therapies against Ebola like TKM-Ebola have been developed in intravenous form to maximize their therapeutic potential during hospitalized care of infected patients.

Insights, By Disease Type: Focus on Containing the Deadliest Strain

In terms of disease type, Ebola Zaire contributes the highest share of the market as it is considered the most lethal strain. Since its discovery during a simultaneous outbreak in Zaire (now DR Congo) and Sudan, Ebola Zaire has caused major epidemics with mortality rates exceeding 80-90%.

Though Ebola Sudan also results in high fatalities, Ebola Zaire infections are associated with severe hemorrhagic symptoms and organ failure. This has spurred intensive R&D efforts towards developing strain-specific treatment options for Ebola Zaire. Vaccines like rVSV-ZEBOV and experimental drugs such as AVI-7537 targeting the glycoprotein of Ebola Zaire have advanced the clinical landscape, aiming to curb transmission and reduce casualties from this deadly variant of the virus.

Additional Insights of Ebola Fever Therapeutic Market

- The largest Ebola outbreak recorded was in 2014, significantly increasing awareness and funding for vaccine development.

- Despite declining cases, continued investment in Ebola therapies is essential due to the virus's high fatality rate of up to 90%.

Competitive overview of Ebola Fever Therapeutic Market

The major players operating in the Ebola Fever Therapeutic Market include GSK, Sarepta Therapeutics, Tekmira Pharmaceuticals Corporation, Mapp Biopharmaceutical, Sabin Vaccine Institute, Johnson & Johnson, and Merck & Co.

Ebola Fever Therapeutic Market Leaders

- GlaxoSmithKline

- Sarepta Therapeutics

- Tekmira Pharmaceuticals Corporation

- Mapp Biopharmaceutical

- Sabin Vaccine Institute

Ebola Fever Therapeutic Market - Competitive Rivalry, 2024

Ebola Fever Therapeutic Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Ebola Fever Therapeutic Market

- In August 2023, GSK halted the clinical trials of its Ebola vaccine primarily due to the declining number of cases, which made it challenging to justify the continued investment in the vaccine's development. As part of this decision, GSK transferred the rights to its Ebola and Marburg virus vaccine candidates to the Sabin Vaccine Institute. This transfer aims to allow Sabin to continue the development of the vaccines for potential use in future outbreaks. The decision aligns with GSK's broader approach to global health, where they support partners to carry forward innovations that may not be immediately profitable but hold significant public health value.

- In March 2024, Tekmira Pharmaceuticals commenced Phase I clinical trials of TKM-Ebola, assessing its safety and effectiveness in healthy adults.

Ebola Fever Therapeutic Market Segmentation

- By Treatment Type

- Vaccines

- ChAd3 Ebola

- rVSV-ZEBOV

- Antiviral Therapies

- TKM-Ebola

- AVI-7537

- Vaccines

- By Route of Administration

- Intravenous

- Oral

- By Disease Type

- Ebola Zaire

- Ebola Sudan

- Marburg Virus

- By End User

- Hospitals

- Specialty Clinics

- Rehabilitation Centers

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the Ebola fever therapeutic market?

The Ebola fever therapeutic market is estimated to be valued at USD 0.742 bn in 2024 and is expected to reach USD 1.116 bn by 2031.

What are the key factors hampering the growth of the Ebola fever therapeutic market?

The high costs and logistical challenges associated with vaccine distribution in remote areas, and stringent regulatory requirements delaying approvals are the major factors hampering the growth of the Ebola Fever Therapeutic Market.

What are the major factors driving the Ebola fever therapeutic market growth?

The rising frequency of Ebola outbreaks, particularly in Africa, and increased funding from governments and global health organizations for vaccine and treatment development are the major factors driving the Ebola fever therapeutic market.

Which is the leading treatment type in the Ebola fever therapeutic market?

The leading treatment type segment is vaccines.

Which are the major players operating in the Ebola fever therapeutic market?

GSK, Sarepta Therapeutics, Tekmira Pharmaceuticals Corporation, Mapp Biopharmaceutical, Sabin Vaccine Institute, Johnson & Johnson, and Merck & Co. are the major players.

What will be the CAGR of the Ebola fever therapeutic market?

The CAGR of the Ebola fever therapeutic market is projected to be 6% from 2024-2031.