Europe Radiology Services Market Size - Analysis

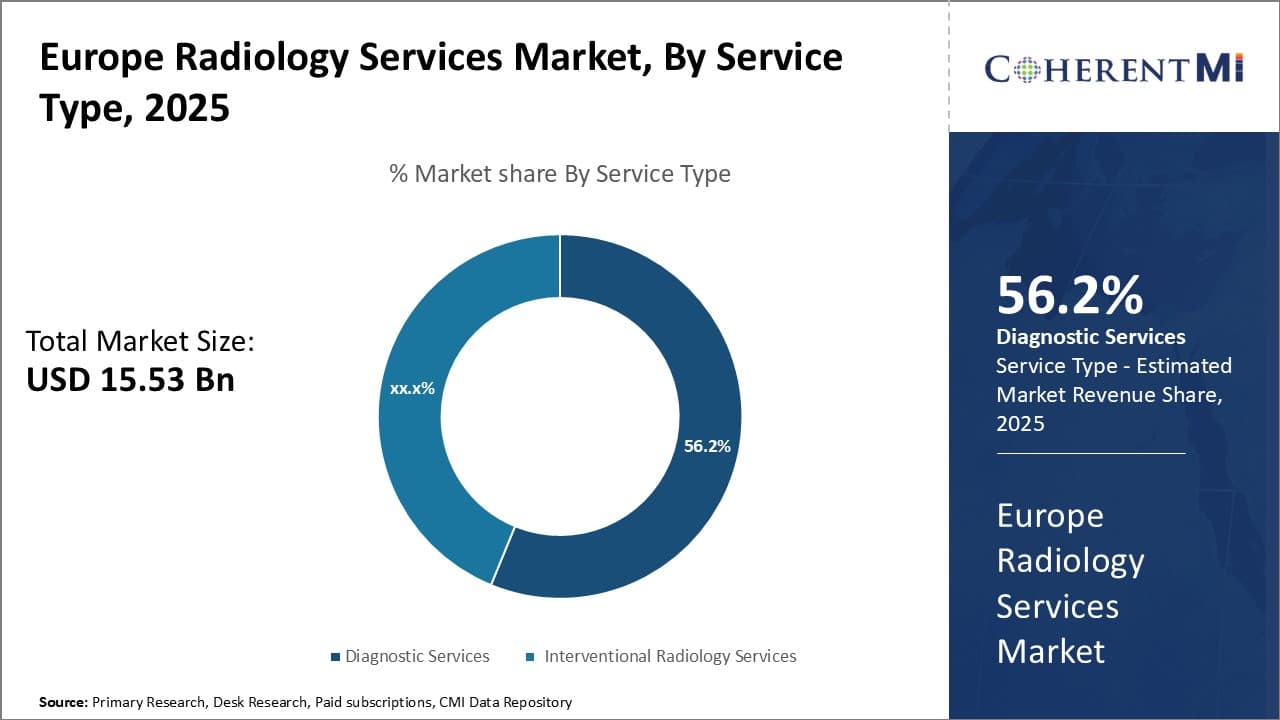

The Europe Radiology Services Market size to be valued at US$ 15.53 billion in 2025 and is expected to reach US$ 35.64 billion by 2032, grow at a compound annual growth rate (CAGR) of 12.6% from 2025 to 2032. Radiology is a medical specialty that utilizes various imaging techniques, such as X-rays, CT scans, MRIs, fluoroscopy, and ultrasound, to diagnose and treat diseases. Some key radiology products and services include diagnostic imaging, interventional radiology, and radiation oncology. Diagnostic imaging involves the use of medical imaging to diagnose medical conditions and includes modalities like X-rays, ultrasounds, MRIs, CTs, and PET scans. Interventional radiology combines imaging guidance with minimally invasive procedures to treat diseases or diagnose problems without the need for open surgery.

The growth in Europe radiology Services Market is driven by rising prevalence of chronic diseases, growing geriatric population, advancements in diagnostic imaging technologies and increasing awareness regarding early diagnosis.

The Europe radiology Services Market is segmented by service type, modality, application, end-user, and region. By modality, the market is segmented into X-ray Radiology, MRI Radiology, CT Scan Radiology, Ultrasound Radiology, Nuclear Imaging Radiology, Mammography Radiology, and Others (Fluoroscopy, Angiography etc.)

Europe Radiology Services Market Drivers:

- Increasing prevalence of chronic diseases: The increasing prevalence of chronic diseases such as heart disease, cancer, and others is a key factor driving the growth of Europe radiology service market. Chronic diseases, which are long-lasting health issues that require ongoing management, like cardiovascular diseases, cancer, respiratory diseases, etc., are becoming highly common in European countries. For instance, according to the data published on December 12, 2025, by the European Commission, a government body, in 2025, about 36.1%, of European citizens reported having a chronic health issue.

- Technological advancements in medical imaging: Technological advancements in the field of radiology are steadily driving the growth of the radiology service market in Europe. Advanced modalities like MRIs, CT scans, and ultrasound imaging are providing more precise diagnosis and treatment planning compared to conventional X-rays. MRIs can produce high-quality images of soft tissues without using ionizing radiation. This has increased the preference for MRI scans over CT for various applications like brain imaging and musculoskeletal issues. Similarly, CT scans provide highly detailed images of bones, blood vessels, and soft tissues with its 360-degree scans. These scans have revolutionized the diagnosis of conditions like cancer, cardiovascular diseases, and injuries.

- The Europe radiology service market is also benefiting from the miniaturization of imaging devices. Portable ultrasound machines and point-of-care CT and MRI devices are making advanced imaging accessible even in small clinics and hospitals. This is helping in the early detection of diseases. For example, handheld ultrasound machines are increasingly being used by paramedics to diagnose internal injuries and pneumonia at accident sites.

- AI and machine learning technologies are further augmenting the capabilities of radiology equipment. Advanced software can now detect subtle abnormalities, perform automated measurements, and generate diagnostic reports from radiology images. This significantly improves workflow and allows radiologists to focus more on complex cases. Studies show AI assisted readings can reduce diagnostic errors by over 10% compared to standalone radiologist reports. Going forward, wide adoption of teleradiology and AI is expected to make quality radiology services accessible even in remote areas and boost the future growth prospects of this industry in Europe.

- Growing geriatric population: The growing geriatric population in Europe is one of the key drivers propelling the growth of the radiology Services Market in the region. For instance, according to the data published by Population Reference Bureau, a nonprofit organization, Europe has one of the oldest populations in the world, with over 20% of people being aged 65 years and older and this percentage is projected to increase even further in the coming years. As individuals grow older, they become more susceptible to chronic diseases like cancer, cardiovascular diseases, neurological disorders, etc.

Europe Radiology Services Market Opportunities:

- Integration of artificial intelligence in radiology: The integration of artificial intelligence in radiology provides a great opportunity to Europe radiology Services Market. AI has the potential to augment radiologists capabilities and help tackle workload issues. Deep learning algorithms trained on huge anonymized datasets can help detect diseases more accurately. This reduces diagnostic errors and improves productivity. For example, a study conducted by the National Institutes of Health in 2021 showed AI-assisted detection of pneumonia on chest x-rays had 5% fewer false negatives compared to radiologists alone.

- AI tools can prioritize urgent cases by analyzing metadata like patient history and symptoms. This enables radiologists to better triage patients and optimize their time. Certain routine tasks, like normal imaging scans, can be pre-screened and flagged by AI. This frees up radiologists to focus more on complex cases that require human expertise. AI transcription of radiology reports is also getting more advanced. IBM, a Technology corporation, claimed its Watson Natural Language Processing detected 33% more clinical findings compared to human transcriptionists in a study done in association with the NIH in 2025.

- Emerging markets in developing countries: Emerging markets in developing countries present a huge untapped potential for growth in the Europe radiology Services Market. As healthcare infrastructure and accessibility expand in nations with large patient pools, it opens up a massive customer base for radiology service providers globally.

- Regions like South Asia, Latin America, and parts of Africa are experiencing rapid economic development and rising income levels. This has increased the affordability and demand for advanced medical diagnostic facilities like MRIs, CT scans, and X-rays among local populations. As per the World Economic Forum, the global healthcare sector experienced unprecedented growth; overall healthcare spending reached to US$ 12 trillion in 2025, up from US$ 8.5 trillion in 2018. A sizable portion of this spending will go towards imaging diagnostics if an adequate supply becomes available to cater to growing needs.

- Growing investments in radiology: The development of teleradiology has been a boon for the Europe radiology Services Market as it has enabled accurate diagnoses even in remote locations. Teleradiology involves the electronic transmission of radiological images like CTs, MRIs, or X-rays from one location to another for diagnostic or consultative interpretation. This allows round-the-clock access to specialist radiologists regardless of location.

- With the onset of the COVID-19 pandemic, the need for contactless healthcare has increased manifold. Teleradiology has helped address this need by enabling radiology services to continue without exposure to potential infection. Radiologists could easily interpret scans from isolated Covid-19 wards or from patients’ homes virtually. This has ensured that radiology departments remain functional during lockdowns and emergencies. The pandemic has accelerated digital transformations across healthcare and raised awareness about telemedicine. As per the World Health Organization (WHO), over 100 countries adopted telehealth and telemedicine practices for the first time due to COVID-19. This widespread exposure to and experience of virtual care alternatives like teleradiology is likely to continue post-pandemic as well.

Europe Radiology Services Market Restraints:

High cost of diagnostic imaging modalities:

The high cost of diagnostic imaging modalities is presenting a major challenge for the growth of the Europe radiology Services Market. Modern imaging techniques such as MRI, CT scans, and ultrasound have greatly enhanced the ability of radiologists to accurately diagnose medical conditions. However, these advanced modalities require huge investments in high-end equipment and come with high maintenance costs. Setting up MRI machines or CT scanners typically requires a capital expenditure of several million dollars. Additionally, running these machines involves significant recurring costs associated with staffing, technology upgrades, supplies, and power consumption. All of these expenses have to be passed on to the patients through higher medical bills.

The rising healthcare costs have made advanced diagnostic scans unaffordable for large sections of the population globally. As per estimates by the World Health Organization in 2020, over 800 million people worldwide spend at least 10% of their household budgets on health expenses, and over 100 million people are pushed into extreme poverty each year due to out-of-pocket healthcare costs. In many developing nations, the high prices of CT or MRI tests mean that they remain out of reach for common citizens. Even in developed countries, a sizable portion of the populace is either uninsured or possesses inadequate health coverage. This leaves them with no option but to forgo important diagnostic procedures when facing health issues. The lack of access to advanced radiology services could potentially delay the detection of critical illnesses.

Shortage of skilled radiologists:

The shortage of skilled radiologists is posing a significant challenge for the growth of the Europe radiology Services Market. While the demand for advanced radiology diagnostics and imaging services is growing steadily due to rising disease prevalence and an aging population worldwide, a lack of qualified radiology professionals is limiting supply-side capabilities.

With the introduction of newer and more advanced diagnostic medical imaging technologies like MRI, CT, PET, etc., the workflow and skillset requirements of radiologists have increased multifold in recent years. However, radiology training programs have struggled to keep up with this technological advancement. On average, it takes anywhere between 10 and 12 years for a medical student to complete all stages of radiology specialization, which includes 4 years of medical school, 1 year of internship, 4 years of diagnostic radiology residency, and an additional 1-2 years of fellowship training in sub-specialized areas. This long training cycle coupled with the limited enrollment capacity of radiology programs in medical colleges, has made it difficult to fulfill the growing talent requirements.

As per estimates by the Radiological Society of North America, in Europe, there are 13 radiologists for every 100,000 people, whereas there are only 8.5 in the U.K. A number of variables are coming together to exacerbate the global radiology deficit, one of which is the rising demand for imaging tests. This major gap between demand and supply of radiologists will restrain radiology clinics and hospitals from enhancing their service volumes and capabilities to cater to rising patient needs. It will negatively impact their revenue growth potential over the coming years unless collaborative efforts are made by all stakeholders to strengthen radiology education infrastructure and incentivize medical students to pursue radiology specializations.

Analyst Views

The radiology Services Market in Europe has tremendous growth potential over the next few years. Some of the key drivers for market growth include rising geriatric population, increasing prevalence of chronic diseases such as cancer, cardiovascular diseases and others. Moreover, advancing diagnostic technologies and adoption of minimally invasive procedures is also expected to propel the demand for radiology services across the region.

However, stringent regulations related to medical device approval and healthcare reforms in various European countries may hamper market growth to some extent. Data privacy laws are also very strict which poses challenges. Finding and retaining skilled radiologists remains a challenge due to tough training requirements and workload pressure. Reimbursement policies vary widely across countries which introduces uncertainty.

The market sees immense opportunities from growing medical tourism industry. Many Europeans are opting for less costly treatments in other European countries. Emerging technologies such as artificial intelligence, cloud solutions, and tele-radiology are bringing structural changes. These new-age solutions are enhancing accuracy, shortening diagnosis time and improving access in remote areas. AI also has potential to automate routine tasks and reduce radiologist’s workload.

Among regions, Germany dominates currently due to large and developed healthcare sector. The country is adopting advanced techniques rapidly which is a big plus. France and the United Kingdom also have sizeable markets and steady growth patterns. Nordic nations will emerge as high potential markets led

Market Size in USD Bn

CAGR12.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 12.6% |

| Larget Market | Europe |

| Market Concentration | High |

| Major Players | Siemens Healthineers, GE Healthcare, Canon Medical Systems, Carestream Health, Hitachi Medical and Among Others |

please let us know !

Europe Radiology Services Market Trends

Cloud-based radiology solutions:

The radiology services industry has witnessed a massive shift towards cloud-based solutions over the past few years. Radiologists and hospitals are rapidly adopting cloud-based picture archiving and communication systems (PACS) and radiology information systems (RIS) solutions as it allows seamless access to medical images and patient data from anywhere.

This has enabled improved collaboration between radiologists and clinicians. With patient data and images stored in the cloud, specialist radiologists can easily provide second opinions and consultations remotely without having to access in-person facilities. This trend has proven critical during the COVID-19 pandemic where medical professionals needed to minimize in-person exposure while continuing to provide critical care.

The move to cloud solutions has also supported improved accessibility of services for patients in remote and rural areas that previously faced challenges reaching radiology centers or specialists. For example, a 2021 study by the World Health Organization found tele-radiology solutions improved access to CT and MRI scans for stroke patients in remote villages in parts of Latin America. Patients no longer had to travel long distances or wait longer for test reports. Cloud technologies have thus enabled a wider and more equitable delivery of radiology care globally.

For healthcare providers, cloud solutions allow radiology departments to invest less in hardware and IT infrastructure while gaining access to advanced tools and resources. This has significantly reduced operational costs while improving efficiency. The near-universal shift to cloud-based systems will continue to reshape how radiology services are provided in the coming years, with an increased focus on virtual and remote care models supported by digital technologies.

Hybrid imaging modalities:

The use of hybrid imaging modalities is influencing the Europe radiology Services Market significantly. Hybrid imaging combines anatomical and functional imaging modalities to provide comprehensive information about the human body.

An example is PET/CT, which combines positron emission tomography and computed tomography scans. While CT provides detailed anatomical images, PET adds functional insight by tracking radiolabeled tracers inside the body. This hybrid approach allows doctors to better detect and characterize diseases. Because PET/CT can show the precise location and spread of malignancies, it is incredibly useful for cancer screening and staging. According to the National Cancer Institute, PET/CT scans found small tumors or seen if cancer had spread in about half of patients.

Another major hybrid modality is SPECT/CT, which combines single photon emission computed tomography with CT. Similarly, it provides co-registered functional-anatomical images which offer greater diagnostic accuracy compared to the individual modalities alone. SPECT/CT is especially effective for examining heart disease, infections and neurological disorders. For example, a study of 500 patients by the Society of Nuclear Medicine found that SPECT/CT altered initial diagnoses in 20% of neurology cases compared to SPECT alone.

Personalized diagnostic and treatment planning:

The growing trend of personalized diagnostic and treatment planning is having a profound influence on the Europe radiology Services Market. With advancements in technology like artificial intelligence and machine learning, radiologists are now able to provide highly customized care to each patient.

This personalized approach starts with gathering detailed medical history and demographic information of the patient. Then advanced imaging techniques like CT, MRIs and PET scans are utilized to generate comprehensive imaging data sets. This vast amount of imaging information is then analyzed with the help of AI and ML algorithms. Radiologists can now study minute details in the scans and prepare customized diagnostic reports highlighting unique traits for each individual.

This personalized analysis further helps in crafting a tailored treatment plan for the patient. By detecting subtle abnormalities or variations in scans, doctors can make an accurate prognosis and recommend procedures specialized for that particular case.

For example, if imaging detects genetic susceptibility or lifestyle risks unique to a patient, doctors may suggest lifestyle modifications along with focused radiation therapy targeting only the affected regions. This level of customization improves clinical outcomes for patients. It also increases patient satisfaction as they receive care designed specifically for their own biology and medical history.

Segmental Analysis of Europe Radiology Services Market

To learn more about this report,Request Sample Copy

To learn more about this report,Request Sample CopyCompetitive overview of Europe Radiology Services Market

Canon Medical Systems, Carestream Health, Hitachi Medical, Siemens Healthineers, GE Healthcare, Hologic, Shimadzu, Fujifilm Holdings, Samsung Medison, Philips Healthcare

Europe Radiology Services Market Leaders

- Siemens Healthineers

- GE Healthcare

- Canon Medical Systems

- Carestream Health

- Hitachi Medical

Europe Radiology Services Market - Competitive Rivalry

Europe Radiology Services Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Europe Radiology Services Market

- On December 12, 2023, Bracco, a medical device company, announced that the European Commission has granted market authorization to Imaging’s Vueway (gadopiclenol), a gadolinium-based contrast agent (GBCA) used in magnetic resonance imaging (MRI). Vueway is delivered via intravenous injection to increase the contrast of structures or fluids within the body in contrast-enhanced MRI (CE-MRI) scans. The agent has half the dose of gadolinium as that of standard agents.

- On November 26, 2023, Koninklijke Philips N.V., a multinational conglomerate corporation, showcases the world’s first mobile MRI system with helium-free operations at the Radiology Conference & Annual Meeting 2023. BlueSeal MR Mobile, the industry’s first and only 1.5T fully sealed magnet, delivers patient-centric MRI services where and whenever needed. Unlike other mobile MRI scanners, the BlueSeal MR Mobile is more agile and lightweight, so it can be located in more convenient places for patients, like near a hospital’s main entrance.

- On March 22, 2023, Otto von Guericke University Magdeburg launched Europe’s 7-Tesla magnetic resonance imaging (MRI) machine.

- On April 27, 2023, GE HealthCare, a medical device company, announced the launch of Pixxoscan (gadobutrol), its macrocyclic, non-ionic Magnetic Resonance Imaging (MRI) gadolinium-based contrast agent (GBCA). Pixxoscan has been reviewed using a regulatory decentralized procedure (DCP) with marketing authorization already in place in Austria and pending approval, will be introduced to a number of European countries in 2023.

Acquisition and Collaboration

- On September 17, 2023, The International Atomic Energy Agency (IAEA) and the European Society of Radiology (ESR) have extended a collaboration agreement until 2026. The first agreement between the IAEA and an international medical imaging association was signed in 2017. Consequently, throughout the past six years, the IAEA and the ESR have worked well together to enhance medical imaging quality and safety, conduct educational initiatives, and build capacity in low- and middle-income nations.

- On January 18, 2023, Bayer AG, a Germany based pharmaceutics company, announced the acquisition of Blackford Analysis Ltd., a global imaging AI platform and solutions provider. The acquisition is part of Bayer's strategy to drive innovation in radiology, including the development and adoption of AI within the clinical workflow, with the goal to ultimately improve patient care and advance Bayer’s position in digital medical imaging.

Europe Radiology Services Market Segmentation

- By Service Type

-

- Diagnostic Services

- Interventional Radiology Services

- By Modality

-

- X-ray Radiology

- MRI Radiology

- CT Scan Radiology

- Ultrasound Radiology

- Nuclear Imaging Radiology

- Mammography Radiology

- Others (Fluoroscopy, Angiography etc.)

- By Application

-

- Cardiovascular

- Neurological

- Musculoskeletal

- Oncology

- Urology

- Pelvic and Abdominal

- Others (Obstetrics & Gynecology etc.)

- By End-User

-

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Ambulatory Surgical Centers

- Others (Public Health agencies etc.)

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the Europe Radiology Services Market?

The Europe Radiology Services Market is estimated to be valued at USD 15.5 in 2025 and is expected to reach USD 35.6 Billion by 2032.

What are the major factors driving the Europe radiology Services Market growth?

The major factors driving Europe radiology Services Market growth are the increasing prevalence of chronic diseases, technological advancements in medical imaging, and a growing geriatric population.

Which is the leading modality segment in the Europe radiology Services Market?

The leading modality segment in the Europe radiology Services Market is the X-ray radiology segment owing to its wide availability, cost-effectiveness and utility in initial disease diagnosis.

Which are the major players operating in the Europe radiology Services Market?

The major players operating in Europe radiology Services Market are Siemens Healthineers, GE Healthcare, Canon Medical Systems, Carestream Health, Hitachi Medical, Hologic, Shimadzu, Fujifilm Holdings, Samsung Medison, Philips Healthcare.

What will be the CAGR of Europe radiology Services Market?

The CAGR of Europe Radiology Services Market is expected to be 12.6% from 2025-2032.