Fiberglass Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Fiberglass Market is segmented By Material (E Glass, ECR Glass, H Glass, AR Glass, S Glass), By Product Type (Glass Wool, Chopped Strand, Yarn, Roving....

Fiberglass Market Size

Market Size in USD Bn

CAGR6.53%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.53% |

| Market Concentration | High |

| Major Players | Owens Corning, Jushi Group Co., Ltd., PPG Industries, Inc., Saint-Gobain S.A., Nippon Electric Glass Co., Ltd. and Among Others. |

please let us know !

Fiberglass Market Analysis

The fiberglass market is estimated to be valued at USD 29.01 Bn in 2024 and is expected to reach USD 45.16 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.53% from 2024 to 2031. The fiberglass market trend shows increasing demand driven by building renovations and requirements for energy-efficient materials.

Fiberglass Market Trends

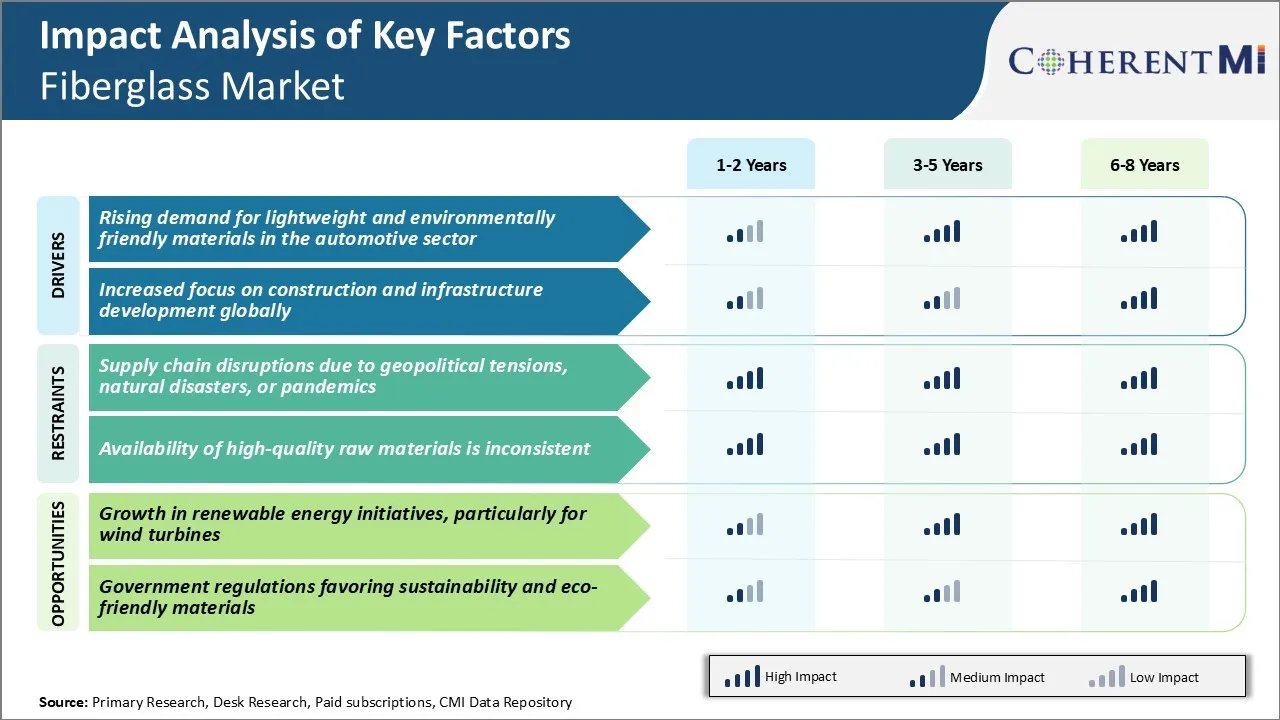

Market Driver - Rising Demand for Lightweight Materials in the Automotive Sector

The automotive sector has been putting increased emphasis on developing lightweight vehicles in order to improve fuel efficiency and reduce emissions. Fiberglass composites are gaining popularity among automakers as they offer substantial weight savings compared to conventional materials like steel. Fiberglass is approximately 30% lighter than steel but provides equivalent strength, due to which players in the fiberglass market are eyeing opportunities in the automotive industry.

Many automakers have started utilizing fiberglass in exterior body panels, roofs, hoods and other non-structural parts to shed kilograms off their vehicles without compromising on performance. Premium manufacturers especially are focusing their efforts on deploying advanced composites to gain an edge in the competitive luxury vehicle segment. Their customers are willing to pay more for vehicles with improved mileage.

Some models have successfully reduced weight by up to 20% through strategic use of fiberglass. This helps them meet stringent fuel efficiency and emission norms without having to downsize engines or make other sacrifices. With regulations getting tighter every year, demand for lightweighting solutions from the auto industry is growing steadily.

Market Driver - Increased Focus on Construction and Infrastructure Development Globally

There is growing recognition among governments worldwide about the critical role that infrastructure plays in long-term economic growth and sustainability. Projects ranging from roads, bridges, rail networks to energy, water and transportation facilities are lining up to be built or modernized.

The construction industry has taken notice of this opportunity and ramped up planning to take on large-scale projects. Fiberglass finds extensive applications in construction from pipes, ducts, panels to architectural structures due to its corrosion resistance, strength, and relatively lighter weight. Its non-conductive properties make it suitable for housing electrical components as well. Fiberglass reinforced plastic (FRP) materials are now commonly used in sanitary applications like bathtubs, sinks etc. where light weight delivers ergonomic benefits.

Developing countries especially in regions like South Asia, Middle East and Africa will see massive investments in building new cities, roads and utilities. Even in developed nations, upgrades to existing infrastructure will open new avenues alongside opportunities from mega project announcements. All factors considered, the global fiberglass market is positioned for sizable gains with increased construction and infrastructure development worldwide forming a structural driver.

Market Challenge - Supply Chain Disruptions due to Geopolitical Tensions, Natural Disasters, or Pandemics

Being a globalized industry, the fiberglass market faces challenges in maintaining an undisrupted supply chain. Geopolitical tensions between major trading nations have disrupted trade routes and availability of raw materials in the past few years. The ongoing Russia-Ukraine conflict is one such example where European nations dependent on Russian natural gas supplies are exploring alternative solutions.

Natural disasters like hurricanes also damage manufacturing and transport infrastructure periodically. The COVID-19 pandemic further highlighted how entire economies can come to a standstill due to public health crises. International border closures and lockdowns stalled movement of goods and people globally. This disrupted Just-In-Time inventory management practices of fiberglass manufacturers.

Sourcing alternative suppliers at short notice to meet production demands is a big challenge in the fiberglass market. Maintaining business continuity and customer satisfaction during such supply chain disturbances requires agile contingency planning and strategizing by market players. Geographical diversification of manufacturing footprints and supplier networks can help mitigate over-dependence on any single region.

Market Opportunity - Growth in Renewable Energy Initiatives

The global transition towards renewable and clean energy solutions presents significant opportunities for the fiberglass market. In particular, the wind energy segment is one of the fastest growing renewable industries. As per industry estimates, annual installations of new wind turbines will need to increase five-fold by 2050 to meet worldwide emissions reduction targets.

Fiberglass features extensively in wind turbine blades for properties like high strength-to-weight ratio, corrosion resistance and longevity under harsh outdoor conditions. As renewable capacity addition gains momentum, the demand for larger wind turbine blades using advanced fiberglass composites will see a proportional rise.

Market leaders are ramping up investments in specialized manufacturing infrastructure to cater to the evolving blade designs. Government subsidies and corporate sourcing commitments are additionally accelerating the adoption of wind power worldwide. The fiberglass market is well-positioned to benefit from this renewable growth momentum in the coming decades.

Key winning strategies adopted by key players of Fiberglass Market

Focus on product innovation through R&D: Leading players like Owens Corning, Jushi Group, Saint-Gobain, etc. have consistently invested substantial amounts in R&D to develop innovative fiberglass products.

Leverage strategic acquisitions: Acquisitions are a major strategy used by top companies to consolidate market share and expand product portfolios. For example, in 2020 Owens Corning acquired Barrier Technologies, a fiberglass facades manufacturer.

Diversify end-use industries served: Large players have successfully diversified beyond traditional construction markets into new verticals like wind energy, transportation, marine, etc. For instance, Jushi Group strengthened its presence in wind industry by setting up R&D centers focused on developing fiberglass materials for wind blades.

Focus on emerging economies: Top companies increasingly focus on high growth regions like Asia Pacific and Middle East countries.

Segmental Analysis of Fiberglass Market

Insights, By Material: E Glass's Versatility Drives its Market Dominance in Fiberglass Materials

In terms of material, the fiberglass market is dominated by E glass with a 66.3% market share in 2024. This is due to its versatile material properties and wide applicability across end use industries. E glass consists of silica, calcium oxide, borax, and sodium oxide which provides it with key characteristics of high mechanical strength, good electrical properties, and dimension stability at elevated temperatures. Its heat resistance allows it to retain tensile strength even after long exposure to high temperatures up to 650°C.

E glass fibers also demonstrate excellent corrosion resistance against acids, bases, and organic chemicals. This corrosion resistance further extends the lifespan of end products and lowers maintenance costs. Additionally, E glass possesses fair electrical resistivity which makes it suitable for applications involving electrical insulation. It is these properties of high strength, stability, resistance, and versatility that have established E glass as the primary choice for diverse composite applications.

Insights, By Product Type: Glass Wool's Thermal Insulation Capabilities Drive its Market Dominance

In terms of product type, the fiberglass market is led by glass wool with a market share of 43.2% in 2024. This is due to its superior insulation properties. Glass wool consists of fine fibers of E glass that are spun or drawn into a wool-like material. When packed or layered, these fibers trap air within their interstices providing excellent thermal resistance. The fine diameter of glass wool fibers allows them to resist heat transfer through conduction and convection across surfaces.

Additionally, glass wool demonstrates good absorption of sound vibrations which makes it a preferred material for acoustic insulation in building walls and floors. Its moisture resistance protects insulation integrity in damp environments. Glass wool also exhibits flexibility to accommodate complex shaping and packing into narrow spaces. These characteristics of high insulation, sound absorption, and physical versatility have ensured glass wool's widespread adoption in residential, commercial and industrial insulation applications.

Insights, By Application: Composites Leverage Fiberglass's Strength-to-Weight Advantages

In terms of application, fiberglass finds highest usage in composites due to the inherent strength-to-weight advantages provided by the material. The high tensile strength of fiberglass filaments, as high as four times that of steel per unit weight, substantially improves the mechanical characteristics of the composite structure.

Composites also demonstrate superior corrosion resistance to harsh chemicals and moisture. The non-conductive nature of fiberglass further benefits electrical insulation applications. Overall, the lightweight and high strength properties of fiberglass composites have led to their extensive deployment across transportation, marine, pipe and construction end use segments.

Additional Insights of Fiberglass Market

- Strategic Partnerships: Companies in the global fiberglass market are forming alliances to enhance their product portfolios and expand their global reach. For example, Saint-Gobain S.A. partnered with local distributors in emerging markets to strengthen its presence.

- Acquisitions: PPG Industries, Inc. acquired smaller fiberglass manufacturers to increase its share in the fiberglass market and access new technologies.

- Regional Growth: The Asia-Pacific region holds the largest share in global fiberglass market due to rapid industrialization and growth in the construction sector, particularly in China and India.

- Demand in Aerospace: The aerospace industry's need for lightweight and durable materials is contributing to the increased use of fiberglass composites in aircraft manufacturing.

Competitive overview of Fiberglass Market

The major players operating in the Fiberglass Market include Owens Corning, Jushi Group Co., Ltd., PPG Industries, Inc., Saint-Gobain S.A., Nippon Electric Glass Co., Ltd., Chongqing Polycomp International Corporation (CPIC), Taishan Fiberglass Inc., Johns Manville Corporation, Nitto Boseki Co., Ltd., Binani 3B-The Fibreglass Company, Asahi Fiber Glass Co., Ltd., Fibre Glast Developments Corp., PFG Fiber Glass (Kunshan) Co. Ltd., Fiberglass Fabricators, and Glassfibre & Allied Industries.

Fiberglass Market Leaders

- Owens Corning

- Jushi Group Co., Ltd.

- PPG Industries, Inc.

- Saint-Gobain S.A.

- Nippon Electric Glass Co., Ltd.

Fiberglass Market - Competitive Rivalry, 2024

Fiberglass Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Fiberglass Market

- In March 2024, EDOTCO Bangladesh and Huawei Technologies (Bangladesh) Limited signed a Memorandum of Understanding (MoU) to introduce an eco-friendly telecommunications tower made of Fiberglass Reinforced Plastics (FRP). The signing occurred during the Mobile World Congress in Barcelona.

- In February 2023, China Jushi Co., Ltd. initiated the construction of the Huai'an Lianshui Glass Fiber Zero-Carbon Intelligent Manufacturing Base, aiming to produce glass fibers with zero carbon emissions.

- In February 2023, Owens Corning announced plans to build a new 150,000-square-foot facility in Russellville, Arkansas, expected to create 50 jobs over two years.

Fiberglass Market Segmentation

- By Material

- E Glass

- ECR Glass

- H Glass

- AR Glass

- S Glass

- By Product Type

- Glass Wool

- Chopped Strand

- Yarn

- Rovings

- Fabrics

- By Application

- Composites

- Insulation

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the fiberglass market?

The fiberglass market is estimated to be valued at USD 29.01 Bn in 2024 and is expected to reach USD 45.16 Bn by 2031.

What are the key factors hampering the growth of the fiberglass market?

Supply chain disruptions due to geopolitical tensions, natural disasters, or pandemics and inconsistent availability of high-quality raw materials are the major factors hampering the growth of the fiberglass market.

What are the major factors driving the fiberglass market growth?

Rising demand for lightweight and environmentally friendly materials in the automotive sector and increased focus on construction and infrastructure development are the majors factor driving the fiberglass market.

Which is the leading material in the fiberglass market?

The leading material segment is E Glass.

Which are the major players operating in the fiberglass market?

Owens Corning, Jushi Group Co., Ltd., PPG Industries, Inc., Saint-Gobain S.A., Nippon Electric Glass Co., Ltd., Chongqing Polycomp International Corporation (CPIC), Taishan Fiberglass Inc., Johns Manville Corporation, Nitto Boseki Co., Ltd., Binani 3B-The Fibreglass Company, Asahi Fiber Glass Co., Ltd., Fibre Glast Developments Corp., PFG Fiber Glass (Kunshan) Co. Ltd., Fiberglass Fabricators, and Glassfibre & Allied Industries are the major players.

What will be the CAGR of the fiberglass market?

The CAGR of the fiberglass market is projected to be 6.53% from 2024-2031.