Flying Taxis Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Flying Taxis Market is segmented By Propulsion (Electric, Parallel Hybrid, Turboshaft, Turboelectric), By Aircraft Type (Multicopter, Quadcopter, Othe....

Flying Taxis Market Size

Market Size in USD Bn

CAGR28.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 28.9% |

| Market Concentration | High |

| Major Players | Joby Aviation, Volocopter GmbH, Lilium GmbH, EHang Holdings Limited, Airbus Group and Among Others. |

please let us know !

Flying Taxis Market Analysis

The flying taxis market is estimated to be valued at USD 4.89 Bn in 2024 and is expected to reach USD 28.91 Bn by 2031, growing at a compound annual growth rate (CAGR) of 28.9% from 2024 to 2031. The flying taxis market is expected to witness significant growth over the forecast period owing to ongoing technology advancements in unmanned and autonomous aviation.

Flying Taxis Market Trends

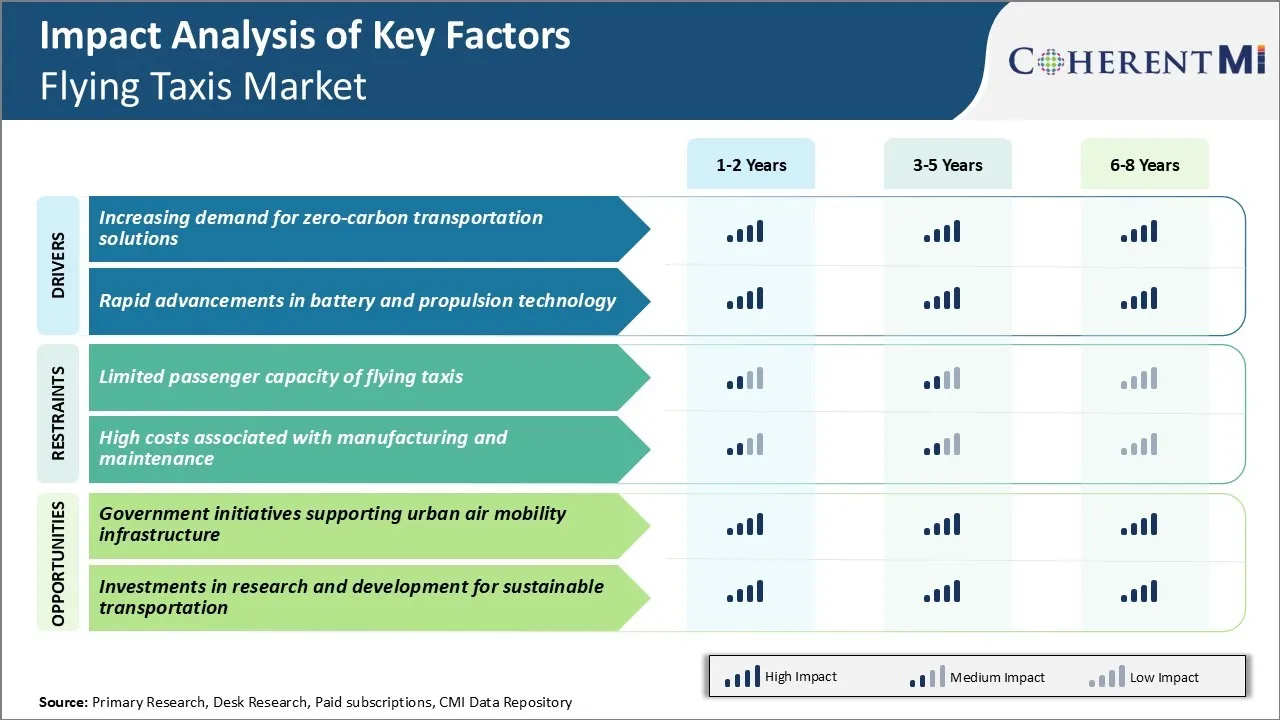

Market Driver - Demand for Zero-Carbon Transportation

The growing effects of climate change have put carbon emissions from transportation sector under immense scrutiny. Flying taxis have potential to make a significant dent in carbon output as they are fully electric aircrafts powered by batteries or hybrid systems. Flying taxis can take traffic off already crowded roads and help shorten commute times, all while producing zero direct emissions.

Majority of population in congested cities now prefer environment friendly options for their daily commutes. Flying taxis are poised to capture this segment as they provide an elevated commute with negligible carbon footprint. Governments also see potential in flying taxis for congestion control as well as green credentials.

Strict emission regulations being introduced in many cities further strengthens the business case for electric flying vehicles. With growing societal pressure and policy push, transition to carbon-free flying taxis seems imminent in not-too-distant future. Their potential to cause paradigm shift in green transportation is expected to drive growth of the flying taxis market.

Market Driver - Advances in Battery Technology

Rapid progress in battery technology has been critical for making electric flying machines a possibility. Lithium-ion batteries used in various gadgets and electric vehicles have served as a starting point, but energy densities needed substantial improvement for powering aircrafts. Meanwhile, nanotechnology aided tweaks to existing lithium-ion formulation has augmented capacities by small yet significant margins.

Such relentless effort on battery front gives confidence that flying taxis can achieve requisite flight times and trip ranges within this decade. Major companies like Boeing, Airbus have been conducting extensive flight tests to gather performance data. Flying taxis are also optimizing energy usage through leaner airframe designs, efficient propulsion systems and intelligent flight control computers.

Energy density breakthrough could soon make flying taxis practical for intercity commute as well. That will open whole new markets and much higher revenue streams for operators. Some predict battery technologies to possibly progress at even faster pace due to renewed interests and abundant investment flowing in. If so, flying taxis may establish themselves sooner than generally envisioned.

Market Challenge - Limited Passenger Capacity of Flying Taxis

One of the key challenges the flying taxis market faces is the limited passenger capacity of these vehicles. Currently, most flying taxi prototypes and models in development stages are designed to carry only 1-3 passengers including the pilot. Transporting a small number of passengers per flight will not be financially viable for operators and difficult to achieve expected scale in operations.

It will also not be practical for daily commuting needs and last-mile connectivity within cities where there is demand for group transportation. Unless flying taxis can accommodate 4-6 passengers per vehicle similar to small buses and vans, it will be difficult to effectively compete with existing ground-based transportation options and achieve expected ridership numbers.

Manufacturers and developers in the flying taxis market need to focus on designing models that offer higher passenger capacities without compromising heavily on power ratios and engineering complexities involved in VTOL flights. This remains a major technical challenge for the flying taxis market.

Market Opportunity - Government Initiatives Supporting Urban Air Mobility Infrastructure

A key opportunity for the flying taxis market lies in various government initiatives worldwide that aim to develop infrastructure and regulatory frameworks for urban air mobility. Several cities and national governments have announced plans to invest in building vertiports, air traffic management, UAM technologies, and formulating safety and operational standards.

For instance, initiatives like the Urban Air Mobility Roadmap 2030 by US DOT aim to integrate advanced air vehicles into urban settings by 2030. Similarly, countries like Singapore and UAE are aggressively working towards enabling air taxis and drones for commercial passenger transport by mid-2020s. Such initiatives are helping flying taxis market players collaborate with local authorities to test vehicles, gain operational experience, and fast-track certification.

It is also encouraging more investors to fund UAM infrastructure development. Established infrastructure will help boost consumer acceptance and commercial adoption of flying taxis once they become available. Thus, government support for UAM ecosystems holds significant potential for faster market realization of this transformative technology.

Key winning strategies adopted by key players of Flying Taxis Market

Strategic Partnerships and Collaborations: One of the most effective strategies adopted by leading flying taxi companies like Joby Aviation, Lilium, and Volocopter is strategic partnerships with other players. For example, Joby Aviation partnered with Toyota in 2020 to jointly develop scalable commercial manufacturing for flying taxis.

Early Mover Advantage: Pioneering the technology and being amongst the first to launch flying taxi services has provided significant competitive edge to some players.

Focus on Regulatory Approvals: Proactively engaging with regulators and obtaining necessary certifications has helped frontrunners gain legitimacy and set industry standards. For example, after completing a successful public demonstration flight in 2019, Volocopter became the first eVTOL company to receive design organization approval from EASA.

Targeted Acquisitions: Strategic takeovers of complimentary startups have enabled flying taxi majors to diversify and expand their offerings. For instance, Joby Aviation acquired Uber Elevate in 2020 to enhance its aviation expertise.

Segmental Analysis of Flying Taxis Market

Insights, By Propulsion: Electric Flying Taxis Highlight the Rise of Electrification

In terms of propulsion, electric contributes 38.8% share of the flying taxis market in 2024, owning to several key advantages over other propulsion types. Electric motors allow for near silent operation of flying taxis, which is crucial for gaining public acceptance of these aircraft operating in and around urban areas. The lack of noisy combustion engines means electric flying taxis can take off and land without disturbing people on the ground.

Electric propulsion also offers significantly lower operating costs compared to gas-powered alternatives. Maintenance is cheaper since electric motors have far fewer moving parts. Also, the price of electricity continues to decline steadily, helping lower costs per flight hour over the lifespan of the aircraft.

Importantly, concerns around sustainability are a major driver for the electric segment. For both fleet operators and urban governments, electric propulsion aligns well with environmental goals. Major players in the flying taxis market are committing large R&D budgets towards electric aircraft to capitalize on this powerful sustainability-driven trend.

Insights, By Aircraft Type: Multicopters Lead the Way

In terms of aircraft type, multicopters contribute 47.1% share of the flying taxis market in 2024, due to their design advantages for passenger transport missions. Multicopters have multiple horizontally-mounted rotors positioned around the aircraft frame, giving them intrinsic redundancy. If one rotor fails, the remaining rotors can keep the aircraft airborne and return it safely.

The distributed electric motor configuration of multicopters also provides benefits like VTOL capability and efficient hover performance. Being able to take off and land vertically from any suitable location gives multicopters an edge in exploiting limited urban infrastructure like rooftop pads.

Perhaps most importantly, the simple yet proven multirotor platform lends itself well to full aircraft autonomy. This capability to fly entirely without an onboard pilot and land precisely is pivotal to scaling autonomous taxi services profitably using multicopters.

Insights, By Passenger Capacity: Micro-Mobility Concepts Target 1-2 Passengers

In terms of passenger capacity, the 1-2 passenger segment commands the highest share in the flying taxis market by addressing mobility at the most local scale. Flying taxis with room for just one or two people are optimized for short point-to-point intracity trips replacing solo car trips or short public transit journeys.

Smaller aircraft also take up less parking space at congested vertiports and helipads dotted around dense urban centers. With limited infrastructure, high throughput is important - small 1-2-seater designs allow for more landing slots per hour.

From a customer perspective, single passenger aircraft provide an on-demand private mode of transport competing directly with taxis and ride-hailing services popular in cities. On solo trips or with one companion, flying direct avoids time spent navigating traffic or queues for buses and trains. This will drive important trends in the flying taxis market in the coming decade.

Additional Insights of Flying Taxis Market

- Uber Elevate Acquisition by Joby Aviation: In December 2020, Joby Aviation acquired Uber's air taxi division, Uber Elevate. This strategic move allowed Joby to integrate Uber's technology and expertise in ride-sharing platforms, enhancing their service model. The acquisition accelerates the commercialization of flying taxis by combining aviation technology with ride-sharing networks.

- Projected Urban Population Growth: By 2030, it is estimated that over 60% of the world's population will live in urban areas. Increased urbanization intensifies traffic congestion, highlighting the need for alternative transportation solutions like flying taxis.

- Investment Trends: Since 2015, over $1 billion has been invested in the development of eVTOL aircraft. Significant financial backing indicates strong confidence in the future of the flying taxis market.

Competitive overview of Flying Taxis Market

The major players operating in the flying taxis market include Joby Aviation, Volocopter GmbH, Lilium GmbH, EHang Holdings Limited, Airbus Group, Bell Textron Inc., EmbraerX, Kitty Hawk Corporation, Vertical Aerospace, Uber Elevate, Boeing Airplane Company, Dassault Aviation SA, Gulfstream Aerospace Corporation, Textron Aviation, Beechcraft Corporation, Uber's VTOL, Aero Mobil's, OPENER.aero or Opener, and LLC and Zhejiang Geely Holding Group.

Flying Taxis Market Leaders

- Joby Aviation

- Volocopter GmbH

- Lilium GmbH

- EHang Holdings Limited

- Airbus Group

Flying Taxis Market - Competitive Rivalry, 2024

Flying Taxis Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Flying Taxis Market

- In June 2023, Joby Aviation received a Special Airworthiness Certificate from the Federal Aviation Administration (FAA) for the first aircraft built at its Pilot Production Line in Marina, California. This certification authorized Joby to commence flight testing of its initial production prototype.

- In April 2023, Volocopter GmbH partnered with Japan Airlines (JAL) to conduct public test flights in Osaka, Japan. This collaboration aimed to demonstrate the practicality of air taxis in urban environments, potentially accelerating their adoption in Asian markets.

- In May 2023, The ePlane Company received Design Organisation Approval (DOA) from the Directorate General of Civil Aviation (DGCA), becoming India's first certified electric aircraft company.

- In May 2023, Volocopter entered into a multi-year agreement with Swiss Aviation Software (Swiss-AS) to integrate AMOS, Swiss-AS's maintenance, repair, and overhaul (MRO) software, into its operations. This collaboration aims to manage Volocopter's global fleet of electric vertical takeoff and landing (eVTOL) aircraft, ensuring continued airworthiness and efficient fleet management.

Flying Taxis Market Segmentation

- By Propulsion

- Electric

- Parallel Hybrid

- Turboshaft

- Turboelectric

- By Aircraft Type

- Multicopter

- Quadcopter

- Others

- By Passenger Capacity

- 1-2 Passengers

- 3-5 Passengers

- More than 5 Passengers

- By Application

- Passenger Transportation

- Cargo Transportation

- Emergency Medical Services

- Military and Defense

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the flying taxis market?

The market is estimated to be valued at USD 4.89 Bn in 2024 and is expected to reach USD 28.91 Bn by 2031.

What are the key factors hampering the growth of the flying taxis market?

Limited passenger capacity of flying taxis and high costs associated with manufacturing and maintenance are the major factors hampering the growth of the flying taxis market.

What are the major factors driving the flying taxis market growth?

Increasing demand for zero-carbon transportation solutions and rapid advancements in battery and propulsion technology are the major factors driving the flying taxis market.

Which is the leading propulsion in the flying taxis market?

The leading propulsion segment is electric.

Which are the major players operating in the flying taxis market?

Joby Aviation, Volocopter GmbH, Lilium GmbH, EHang Holdings Limited, Airbus Group, Bell Textron Inc., EmbraerX, Kitty Hawk Corporation, Vertical Aerospace, Uber Elevate, Boeing Airplane Company, Dassault Aviation SA, Gulfstream Aerospace Corporation, Textron Aviation, Beechcraft Corporation, Uber's VTOL, Aero Mobil's, OPENER.aero or Opener LLC, and Zhejiang Geely Holding Group are the major players.

What will be the CAGR of the flying taxis market?

The CAGR of the flying taxis market is projected to be 28.9% from 2024-2031.