Food Service Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Food Service Packaging Market is segmented By Material Type (Plastic, Paper & Paperboard, Metal, Others), By Packaging Type (Flexible Packaging, Rigid....

Food Service Packaging Market Size

Market Size in USD Bn

CAGR5.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.5% |

| Market Concentration | High |

| Major Players | Pactiv Evergreen Inc., Dart Container Corporation, Huhtamaki Oyj, Amcor PLC, Genpak LLC and Among Others |

please let us know !

Food Service Packaging Market Analysis

The food service packaging market is estimated to be valued at USD 90.2 Bn in 2024 and is expected to reach USD 131.2 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2031. The food service packaging market is expected to witness significant growth over the next few years. There is a rising demand for sustainable and eco-friendly packaging materials to curb plastic wastage.

Food Service Packaging Market Trends

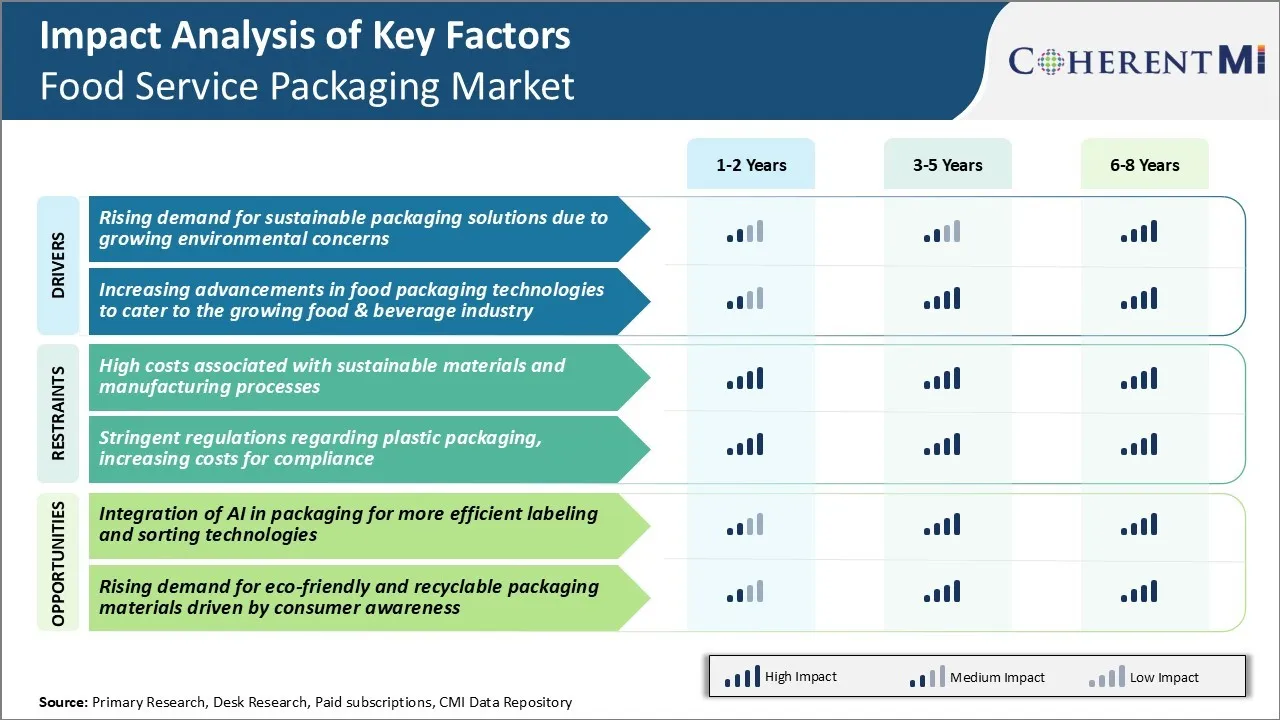

Market Driver - Rising Demand for Sustainable Packaging Solutions due to Growing Environmental Concerns

Environment sustainability has become a major concern globally in recent years. There is increasing awareness about reducing, reusing and recycling of plastic packaging materials. This has prompted food service packaging manufacturers to invest more in developing sustainable packaging solutions made from eco-friendly materials.

Many quick service restaurants and food brands are announcing goals to use packaging made from recyclable or compostable materials. Some brands have even started testing reusable containers and encourage consumers to return them after use. Compostable food service packaging made from renewable plant-based materials like bagasse, bamboo, and corn starch are finding more acceptance.

Government regulations banning certain single-use plastic items have accelerated the urgency for the industry to switch to alternative food service packaging types. Packaging manufacturers have ramped up their R&D efforts to engineer innovative designs utilizing recycled content plastic, paper, and bio-plastics. Close collaboration across the value chain from brand owners to retailers will be key to optimize transition in the food service packaging market.

Market Driver - Increasing Advancements in Food Packaging Technologies to Cater to Food & Beverage Industry

The food and beverage industry has been experiencing steady growth globally, led by changing consumer demands, growing disposable incomes, and on-the-go lifestyles. Advancements in active and intelligent food service packaging technologies have enabled real-time monitoring of food quality parameters like moisture, gases, pathogens, etc.

Such smart packaging integrated with sensors, RFID tags, and interactive displays are gaining popularity among quick service brands. Digital printing coupled with functional inks allows for customized graphics, variable information, and traceability codes on packages, driving a new trend in the food service packaging market.

New formats like flexible pouches, skin packages, and fanny packs endorsed by leading brands have boosted availability of portion-controlled ready-to-consume snacks and meals. Popularity of healthy cuisine segments like fruits, salads, sandwiches and juices is driving demand for aseptic cartons, bottles, and stand-up pouches. 3D printing and robotics applications are increasingly redefining shapes, sizes, and forming procedures of food service packaging products.

Market Challenge - High Costs Associated with Sustainable Materials and Manufacturing Processes

One of the major challenges faced by the food service packaging market is the high costs involved in adopting more sustainable materials and manufacturing processes. Transitioning to renewable and recyclable substrates requires significant investment in R&D to develop new packaging formats.

Additional considerations like the need for specialized machinery, different production workflows, separate waste handling also increase the per-unit manufacturing costs. The lack of economies of scale in the early stages of commercializing new sustainable packages further compounds these cost disadvantages. Passing on the full incremental costs to customers also risks losing price-sensitive customers to competitors in the food service packaging market providing conventional packages at lower price points.

Overall, the current cost differentials pose major adoption barriers for industry players and slow down the transition towards a circular economy for food service packaging. Addressing these economic challenges is critical in the food service packaging market to accelerate the large-scale development and deployment of truly sustainable alternatives.

Market Opportunity - Integration of AI in Packaging for More Efficient Labeling and Sorting Technologies

Integration of artificial intelligence (AI) and machine learning technologies present opportunities to make food service packaging smarter and more efficient. AI-based labeling solutions can automate the production process, reduce errors and drive significant cost savings compared to manual labeling.

AI is also improving sorting and segregation of used food packaging at recycling facilities. Optical character recognition and defect detection models using computer vision algorithms can rapidly and accurately sort different types of recyclable materials like plastics, papers, metals at high speeds with minimal human intervention.

This level of precision and automation boosts recovery rates and improves the quality of sorted streams for later reprocessing. Overall, AI is making packaging and recovery systems smarter, more data-driven and efficient which can help advance sustainability efforts across the food service value chain in the food service packaging market.

Key winning strategies adopted by key players of Food Service Packaging Market

Sustainability-focused innovations

- Major players like Amcor, Sealed Air, and Berry Global have focused on developing eco-friendly and sustainable food packaging solutions made from recyclable or compostable materials. For example, Amcor launched new fiber-based food packaging made from sustainable wood sources or recycled content in 2022.

Customization

- Players are offering customizable packaging solutions to help food brands stand out on shelves. For example, Sealed Air introduced custom shapes, sizes, prints and tamper-evident features for foodservice packaging in 2020.

Value-added features

- Companies are adding features like freshness seals, temperature control properties and easier accessibility to enhance value proposition. For example, Berry Global launched a paperboard food tray with easy-open lid and steam-release vents in 2021.

Strategic acquisitions

- Major players are acquiring innovative firms to expand capabilities. For example, Sealed Air acquired Automated Packaging Systems in 2021 to bolster automated solutions portfolio.

Segmental Analysis of Food Service Packaging Market

Insights, By Material Type: Versatility and Cost-Effectiveness Drive Plastic's Dominance

In terms of material type, plastic is expected to account for 54.7% share of the market in 2024, owing to its versatility and cost-effectiveness. Plastic remains the most widely used material for food service packaging due to its ability to be molded into various shapes and sizes.

This versatility allows plastic to be used across a variety of packaging formats from bags and pouches to trays, clamshells, and other rigid containers. Plastics like polyethylene, polypropylene, and polystyrene are favored for their moisture and vapor resistance properties which help preserve the quality and freshness of packaged food items.

Additionally, plastic offers strength and durability qualities needed for distribution and transportation of packaged foods. The material is also lightweight which reduces costs associated with transportation and logistics. From a cost perspective, plastic remains one of the most affordable packaging materials per unit. Its low manufacturing costs combined with versatility and strength have cemented plastic's dominant position in the food service packaging market.

Insights, By Packaging Type: Convenience Drives Flexible Packaging Demand

In terms of packaging type, flexible packaging segment is projected to hold 49.2% share of the market in 2024, driven by convenience. Flexible packaging such as pouches, bags, and wraps have seen widespread adoption in the food service industry owing to their portable and user-friendly nature.

Items like snacks, confectionaries, processed foods, sandwiches, and salads are commonly packaged using flexible formats due to their lightweight and compact qualities. These allow packaged food items to be easily transported, stored, displayed and consumed on-the-go. Flexible packaging collapses to minimal space when empty, making them ideal from a logistics and storage perspective.

Pouches and bags are also considered more hygienic than other loose formats as they help prevent spillage and contamination. Their user-friendly peelable seals and re-closable features are attractive from a consumer perspective. Overall, the convenience offered by flexible packaging has made them the packaging of choice, driving their increased usage in the food service packaging market.

Insights, By Application: On-the-Go Consumption Boosts Food Packaging Demand

In terms of application, food contributes the highest share driven by on-the-go consumption trends. Consumers today lead increasingly busy lifestyles with little time for home-cooked meals. This has boosted the demand for ready-to-eat packaged foods that can be consumed anywhere, anytime.

A wide variety of food items ranging from snacks, meals to fresh produce are now commonly available in packaged ready-to-eat formats suitable for on-the-go consumption. Food packaging manufacturers provide convenient, portable and microwavable packaging solutions for foods to cash in on this trend.

Packaging plays a vital role in positioning food brands by communicating important information to today’s savvy, health-conscious consumers. It also helps extend shelf-life and preserve the quality, taste and nutritional value of packaged foods. The ability of food packaging to enable today’s fast-paced consumers to conveniently access their dietary needs on-the-move has been a key driver of its rising prominence in the food service packaging market.

Additional Insights of Food Service Packaging Market

- Asia-Pacific held the largest share of the food service packaging market in 2023, mainly driven by the rapid expansion of food industries in countries like Japan, India, and China.

- Europe is expected to register the fastest growth rate due to increasing corporate offices, food chains, and sustainability initiatives across the region.

- Consumer Preference Shift: Over 60% of consumers are willing to pay more for food packaging that is environmentally friendly, indicating a strong food service packaging market trend toward sustainability.

- E-commerce Impact: The online food delivery sector grew by 25% in 2022, directly influencing the demand for reliable and secure food service packaging.

- The rise of ghost kitchens, which operate exclusively through delivery and takeout services, has amplified the need for efficient and branding-friendly packaging solutions to enhance customer experience.

Competitive overview of Food Service Packaging Market

The major players operating in the food service packaging market include Pactiv Evergreen Inc., Dart Container Corporation, Huhtamaki Oyj, Amcor PLC, Genpak LLC, Berry Global Inc., Novolex Holdings LLC, Sabert Corporation, Sonoco Products, Winpak Limited, Mondi, WestRock Company, Sealed Air Corporation, DS Smith Plc, and Georgia-Pacific LLC.

Food Service Packaging Market Leaders

- Pactiv Evergreen Inc.

- Dart Container Corporation

- Huhtamaki Oyj

- Amcor PLC

- Genpak LLC

Food Service Packaging Market - Competitive Rivalry

Food Service Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Food Service Packaging Market

- In April 2024, Sabert launched the pulp 2S produce tray designed for serving meat and plant-based alternatives, contributing to the growing demand for sustainable packaging. These trays are designed to cater to both meat and plant-based alternatives, contributing to the growing demand for sustainable packaging solutions.

- In March 2024, IMEX Vision launched Adama, a line of sustainable paper cups targeting the U.S. and Latin American markets, supporting the shift towards eco-friendly food service packaging products. They are made using Asia Pulp & Paper's (APP) Foopak Bio Natura base paper, which is PFAS-free, curbside recyclable, and compostable.

- In February 2024, Berry introduced a reusable tableware range aimed at helping players in the food services packaging market adopt more sustainable practices.

- In January 2024, Genpak launched a new fiber line of containers, promoting the use of biodegradable packaging in restaurants. This line is made from renewable fibers and is designed to be compostable, offering an eco-friendly solution to traditional plastic packaging.

Food Service Packaging Market Segmentation

- By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Paper & Paperboard

- Coated Unbleached Kraft Paperboard

- Bleached Paperboard

- Molded Fiber Pulp

- Metal

- Aluminum

- Steel

- Others

- Glass

- Wood

- Biodegradable Materials

- Plastic

- By Packaging Type

- Flexible Packaging

- Pouches

- Bags

- Wraps

- Rigid Packaging

- Containers

- Clamshells

- Trays

- Paperboard Packaging

- Boxes

- Cartons

- Sleeves

- Flexible Packaging

- By Application

-

- Food

- Ready-to-Eat Meals

- Fresh Products

- Bakery & Confectionery

- Beverages

- Hot Drinks

- Cold Drinks

- Alcoholic Beverages

-

- By End User

- Restaurants

- Quick Service Restaurants

- Full-Service Restaurants

- Catering Services

- Corporate Catering

- Event Catering

- Institutional Food Services

- Schools

- Hospitals

- Military

- Retail & Grocery Stores

- Supermarkets

- Convenience Stores

- Restaurants

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How big is the food service packaging market size?

The food service packaging market is estimated to be valued at USD 90.2 Bn in 2024 and is expected to reach USD 131.2 Bn by 2031.

What are the key factors hampering the growth of the food service packaging market?

High costs associated with sustainable materials and manufacturing processes, stringent regulations regarding plastic packaging, and increasing costs for compliance are the major factors hampering the growth of the food service packaging market.

What are the major factors driving the food service packaging market growth?

Rising demand for sustainable packaging solutions due to growing environmental concerns and increasing advancements in food packaging technologies to cater to the growing food & beverage industry are the major factors driving the food service packaging market.

Which is the leading material type in the food service packaging market?

The leading material type segment is plastic.

Which are the major players operating in the food service packaging market?

Pactiv Evergreen Inc., Dart Container Corporation, Huhtamaki Oyj, Amcor PLC, Genpak LLC, Berry Global Inc., Novolex Holdings LLC, Sabert Corporation, Sonoco Products, Winpak Limited, Mondi, WestRock Company, Sealed Air Corporation, DS Smith Plc, and Georgia-Pacific LLC are the major players.

What will be the CAGR of the food service packaging market?

The CAGR of the food service packaging market is projected to be 5.5% from 2024-2031.