Gardening Equipment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Gardening Equipment Market is segmented By Product (Lawn Mowers, Handheld Power Tools, Hand Tools & Wheeled Implements, Water Equipment), By Sales Cha....

Gardening Equipment Market Size

Market Size in USD Bn

CAGR13.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 13.7% |

| Market Concentration | High |

| Major Players | Husqvarna Group, Deere & Company, American Honda Motor Co. Inc., Briggs Stratton, Ariens Company and Among Others. |

please let us know !

Gardening Equipment Market Analysis

The Global Gardening Equipment Market is estimated to be valued at USD 67.9 Bn in 2024 and is expected to reach USD 129.2 Bn by 2031, growing at a compound annual growth rate (CAGR) of 13.7% from 2024 to 2031. The market has been experiencing steady growth over the past few years driven by the increasing interest of people in gardening and doing yard work amid the Covid-19 pandemic. The gardening equipment market is expected to witness positive growth trends in the coming years. More people are adopting gardening as a hobby and for relaxation purposes during their free time which is increasing the demand for various gardening tools and equipment. Furthermore, the rising environmental awareness and increasing focus on organic farming will also contribute to the further growth of this market going forward.

Gardening Equipment Market Trends

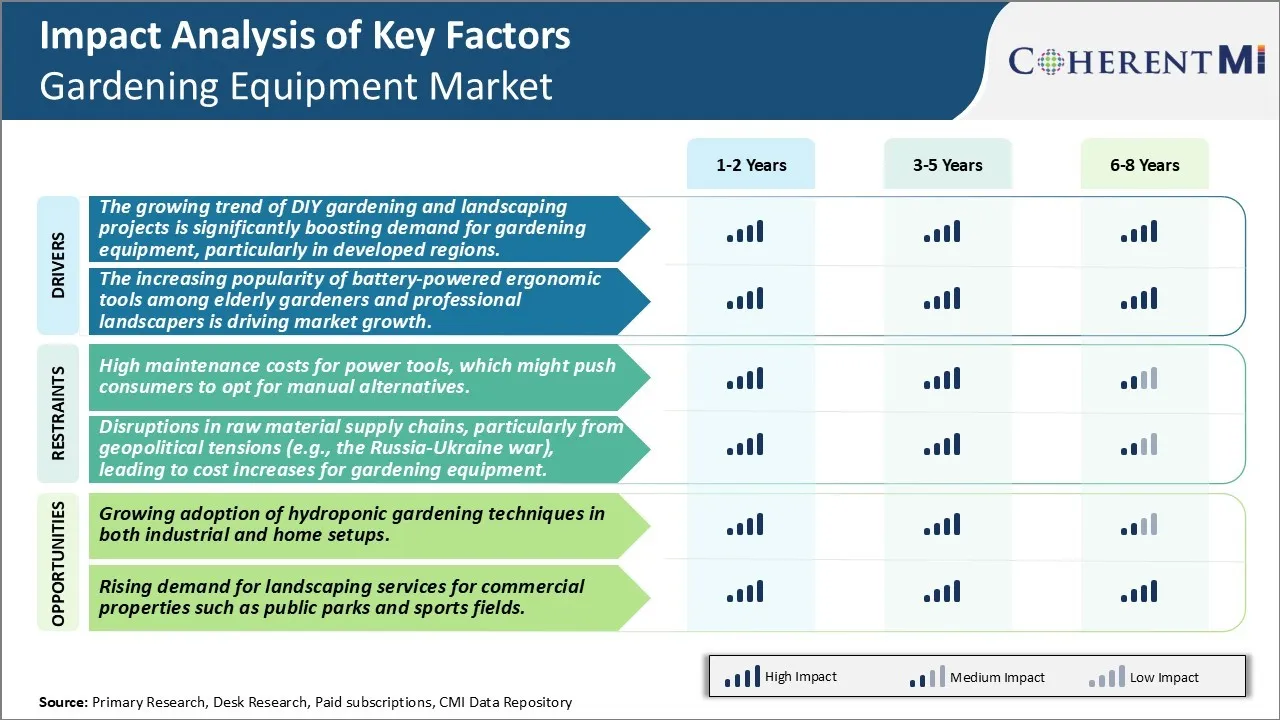

Market Driver - The Growing Trend of DIY Gardening and Landscaping Projects are Significantly Boosting Demand for Gardening Equipment, Particularly in Developed Regions

The gardening equipment market has been witnessing steady growth over the past few years mainly attributed to the thriving trend of do-it-yourself gardening and landscaping projects among homeowners. Gardening has evolved from being just a pastime activity to a much sought-after hobby with increasing number of people taking up gardening and landscaping works in their leisure time. Busy lifestyles and hectic schedules have prompted people to spend quality time in their backyard gardens and outdoor spaces to relax and rejuvenate. Meanwhile, rising environmental concerns have motivated individuals to grow their own organic fruits and vegetables and reduce their carbon footprint. This growing inclination towards self-managed green spaces has considerably boosted demand for various gardening tools and equipment that assist in landscape maintenance and gardening tasks.

The convenience and cost-effectiveness of DIY projects compared to professional landscaping services has further augmented the DIY movement. Advancements in gardening technologies with user-friendly tools have made gardening tasks more efficient and easier for amateur gardeners to handle. A wide assortment of lawn mowers, trimmers, edgers and other yard care equipment is now easily available online as well as in retail outlets, encouraging more homeowners to landscape their properties independently. Growing availability of DIY gardening tutorials and information over the internet has also empowered individuals to successfully execute gardening works without relying on experts. Meanwhile, the flexibility of pursuing gardening according to one's convenience and preference works as a major motivation.

Market Driver - Popularity of Battery-Powered Ergonomic Tools Encourages Demand

The gardening equipment landscape is undergoing changes with increasing popularity of battery-powered tools attributed to their ease of use and convenience. Battery technology innovations have enabled development of tools that are lightweight, cordless and offer long runtimes on a single charge, making them preferential among users who wish to minimize effort. Battery power prevents issues related to gas fumes and troublesome starting procedure of fuel-powered variants thereby lending user-friendliness. With rising focus on comfort and reduced muscle strain, ergonomic designs of battery tools are gaining widespread acceptance especially among elderly and professional gardeners who have to undertake gardening works for extended durations.

Ageing population demographics indicate growing percentage of elderly population inclined to gardening for leisure, exercise and mental well-being. However, traditional heavy-duty gas tools involve strenuous operation that causes fatigue and exerts pressure. Battery tools address such issues through lightweight designs, ergonomic handles and efficient transmission of power with less vibrations. This has increased adoption among elderly gardeners looking for low maintenance options that allow independent gardening at own pace. Ergonomic designs also help senior citizens avoid exertion-related injuries while carrying out gardening activities.

Professional landscapers and lawn care service providers are another key segment driving significance of battery-powered tools. They require equipment facilitating quick and effortless completion of jobs across multiple locations every day over long seasons. Heavy tools limit productivity through time wastage during refueling, start-up issues and transportation inconvenience. In contrast, cordless battery tools enable unmatched mobility and allow non-stop usage.

Market Challenge - High Maintenance Costs For Power Tools, Might Push Consumers to Opt for Manual Alternatives

One of the key challenges currently being faced by the gardening equipment market is the high maintenance costs associated with power tools. Power tools such as lawnmowers, trimmers and chainsaws require frequent servicing and repairs to keep them in good working condition. Small issues such as a blunt blade or worn out engine part, if not addressed on time, can significantly escalate repair costs over time. Additionally, power tools also have scheduled maintenance requirements such as oil changes and tune-ups that need to be performed periodically as per the manufacturer's guidelines. All of these maintenance activities involve time and money invested by consumers. With evolving farming practices and smaller residential spaces, gardening tasks are becoming more fragmented requiring tools to be used only occasionally. In such cases, the high owning and maintenance costs of power tools may not justify their benefits. As a result, some consumers are opting for manual gardening tools that have lower upfront costs and do not require any servicing. This trend poses a challenge for manufacturers of power tools to make their products more cost-effective over the long run and provide total cost of ownership advantages over manual alternatives.

Market Opportunity - Growing Adoption of Hydroponic Gardening Techniques

One significant opportunity being presented in the gardening equipment market is the growing adoption of hydroponic gardening techniques. Hydroponics is a soilless method of cultivating plants where mineral nutrient solutions are used in an aqueous solvent instead of soil. With increasing urbanization and smaller residential spaces, hydroponics is gaining popularity as it enables year-round cultivation of herbs, vegetables and flowers using minimal space. Both commercial greenhouse set-ups as well as home hydroponic systems are witnessing higher demand. This trend is creating opportunities for manufacturers of hydroponic growing systems, mineral nutrient solutions, accessories such as growing mediums, lighting equipment and irrigation components. Furthermore, as hydroponics eliminates the need for pesticides and fertilizers, it is perceived as a more environmentally sustainable way of gardening. The growing consumer preference for fresh, chemical-free produce is further propelling the adoption of hydroponics worldwide. The market is expected to showcase significant gains as innovative and affordable hydroponic solutions become more mainstream.

Key winning strategies adopted by key players of Gardening Equipment Market

Focus on product innovation - Players like Husqvarna, Honda, and MTD focused heavily on R&D to develop innovative new products that help gardeners work more efficiently. For example, in 2018 Husqvarna launched their first robot lawnmower that can map and mow lawns autonomously. Such innovative products capture consumer interest and help companies gain market share.

Expand product range - Many players have found success expanding their range of gardening tools offered. For example, in 2015, Stanley Black & Decker acquired the Gardena brand and product line, allowing it to offer a more comprehensive portfolio of products under one roof including pruners, shears, hoses, nozzles and watering systems. This one-stop-shop approach is convenient for customers.

Target new demographics - Younger consumers and urban gardeners represent growing demographics. Companies like Bosch innovated compact electric garden tools that are suitable for small urban spaces. Their GTC range launched in 2020 has been popular among younger city gardeners. Similarly, product customization and trendy colors/designs attract younger consumers interested in gardening as a hobby.

Build private label brands - Retailers like Home Depot, Lowe's and Bunnings have found success launching their own private label gardening equipment brands which are more affordable. For example, Home Depot's Orion brand is among its best selling tool labels. Private labels help retailers scale their tool offerings and gain buyer loyalty while boosting margins.

Pursue strategic acquisitions - M&A allows companies to quickly gain expertise, expand globally and broaden product lines. For example, in 2015 Techtronic Industries acquired US-based Milwukee Electric Tools, positioning it strongly in the North American power tool sector. Such acquisitions strengthen competitive positioning.

Segmental Analysis of Gardening Equipment Market

Insights, By Product, Consumer Preference Drives Lawn Mower Demand

By Product, Lawn Mowers are expected to contribute 37.6% market share in 2024 owing to strong consumer preference. Lawn mowers have become integral for lawn and garden upkeep tasks due to their efficiency and cost effectiveness compared to manual alternatives. Shifting consumer lifestyles have resulted in less time available for manual lawn care chores, fueling demand for power lawn mowers. Younger consumers especially appreciate the labor savings of a lawn mower. Product innovation is also a key factor, with new variants like robotic lawn mowers gaining popularity among those seeking low maintenance options. Yard work was traditionally a chore but is now seen more as a hobby or form of leisure by many homeowners. This mindset shift has made lawn quality an indicator of pride of ownership, benefiting lawn mowers. The urbanization trend bringing more people into smaller living spaces with lawns has concentrated demand. Warm weather regions naturally require more frequent mowing, centering consumption in the Southern U.S. Overall the priority given to neat, manicured lawns by consumers looking for a quality outdoor space to spend time ensures ongoing demand growth for lawn mowers.

Insights, By Sales Channel, In-Store Experience Boosts Home Centers' Share

By Sales Channel, Home Centers are expected to contribute 33.8% market share in 2024 owing to the benefits of an in-person shopping experience. Homeowners prefer to examine gardening equipment up close before purchase since quality, features and suitability for the intended task are important criteria. Touch and feel allows for better product evaluation compared to online. Home centers provide knowledgeable staff on hand to answer questions or demonstrate equipment use. Being able to see all options side by side within one location creates an efficient shopping process appreciated by busy consumers. Many home centers stock extensive inventories with variations to suit any budget or application. Testing equipment in the store before committing to buy provides confidence in the decision. Complementary items can also be purchased together conveniently under one roof. For large, bulky items, the ability to drive equipment straight home from the point of purchase holds appeal. Loyalty programs and installation services offered by major chains build customer retention in this space as well.

Insights, By End-use, Residential Maintenance Drives Growth for End-use Segment

By End-use, Residential contributes the highest share of the market owing to widespread gardening and lawn care activities at homes. Yardwork forms an intrinsic part of average home maintenance and beautification tasks, necessitating equipment purchases. North American cultural norms emphasize neat, well-kept residential landscapes, keeping homeowners engaged in regular outdoor jobs. With more people living in single family houses that include lawns and gardens instead of higher density housing, outdoor space is commonly seen as an extension of the living area - hence worth investing time and money to maintain properly. Additionally, many homeowners tackle lawn and garden tasks themselves rather than outsource for cost savings. Busy schedules still require tools and equipment for timely, convenient care. Finally, gardening is a popular leisure activity and point of pride for homeowners, driving steady equipment replacement and seasonal purchases to improve outdoor areas. The residential nature of most neighborhoods translates this participative mindset into consistent equipment demand over the long term.

Additional Insights of Gardening Equipment Market

The gardening equipment market is set to grow significantly due to various factors, including the rise of DIY gardening projects, increasing adoption of eco-friendly tools, and advancements in battery-powered ergonomic products. The market’s expansion is being accelerated by the growing interest in gardening for leisure and landscaping in residential and commercial properties. Moreover, the market is responding to challenges such as supply chain disruptions and raw material price fluctuations by investing in innovative solutions like electric and battery-powered tools. North America continues to dominate the market, but rapid growth is expected in the Asia-Pacific region due to infrastructural development and a rise in disposable income. The surge in online sales of gardening equipment has also reshaped the retail landscape, providing new opportunities for manufacturers to expand their reach globally.

Competitive overview of Gardening Equipment Market

The major players operating in the Gardening Equipment Market include Husqvarna Group, Deere & Company, American Honda Motor Co. Inc., Briggs Stratton, Ariens Company, The Toro Company, Falcon Garden Tools, Fiskars, Robert Bosch GmbH and Robomow Friendly House.

Gardening Equipment Market Leaders

- Husqvarna Group

- Deere & Company

- American Honda Motor Co. Inc.

- Briggs Stratton

- Ariens Company

Gardening Equipment Market - Competitive Rivalry, 2024

Gardening Equipment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Gardening Equipment Market

- In March 2021, ZAMA Corporation, a subsidiary of STIHL, collaborated with Elrad International Group to form a joint venture for electronic assemblies. This partnership is set to enhance the production of electronic components, impacting the efficiency and innovation of power tools in the market.

- In January 2021, DEWALT introduced two new self-propelled and push mowers powered by high-efficiency brushless motors, offering high-voltage cutting power. This innovation is expected to meet the growing demand for battery-powered, eco-friendly equipment in gardening.

Gardening Equipment Market Segmentation

- BY Product

- Lawn Mowers

- Handheld Power Tools

- Hand Tools & Wheeled Implements

- Water Equipment

- By Sales Channel

- Home Centers

- Lawn & Garden Specialty Stores

- National Retailers & Discount Stores

- Hardware Stores

- E-commerce

- By End-use

- Residential

- Commercial

- Government

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Gardening Equipment Market?

The Global Gardening Equipment Market is estimated to be valued at USD 67.9 Bn in 2024 and is expected to reach USD 129.2 Bn by 2031.

What are the major factors driving the Gardening Equipment Market growth?

The growing trend of DIY gardening and landscaping projects is significantly boosting demand for gardening equipment, particularly in developed regions. and the increasing popularity of battery-powered ergonomic tools among elderly gardeners and professional landscapers is driving market growth. are the major factor driving the Gardening Equipment Market.

What are the key factors hampering the growth of the Gardening Equipment Market?

The high maintenance costs for power tools, which might push consumers to opt for manual alternatives. Disruptions in raw material supply chains, particularly from geopolitical tensions (e.g., the Russia-Ukraine war), leading to cost increases for gardening equipment are the major factors hampering the growth of the Gardening Equipment Market.

Which is the leading Product in the Gardening Equipment Market?

Lawn Mowers is the leading Product segment.

Which are the major players operating in the Gardening Equipment Market?

Husqvarna Group, Deere & Company, American Honda Motor Co. Inc., Briggs Stratton, Ariens Company, The Toro Company, Falcon Garden Tools, Fiskars, Robert Bosch GmbH, Robomow Friendly House are the major players.

What will be the CAGR of the gardening equipment market?

The CAGR of the gardening equipment market is projected to be 13.7% from 2024-2031.