Genetically Modified Feed Market Size - Analysis

The genetically modified feed market is estimated to be valued at USD 106.03 Bn in 2025 and is expected to reach USD 154.24 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.5% from 2025 to 2032. The genetically modified feed market has seen steady growth over the past decade. It driven by increasing demand for genetically modified soy and corn which are used as key feed ingredients globally.

Market Size in USD Bn

CAGR5.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.5% |

| Market Concentration | Medium |

| Major Players | Bayer AG, Syngenta AG, Corteva Agriscience, BASF SE, KWS SAAT SE and Among Others |

please let us know !

Genetically Modified Feed Market Trends

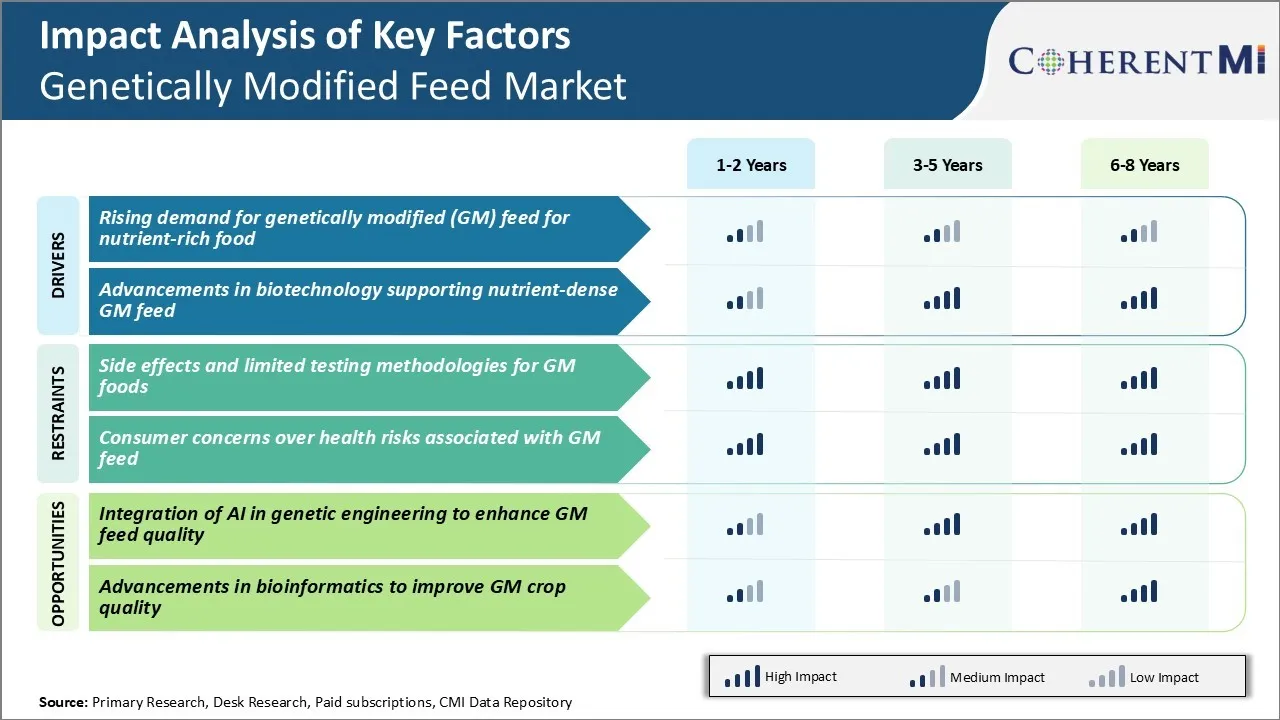

Market Driver - Rising Demand for Genetically Modified for Nutrient-rich Food

The demand for meat and dairy products has grown substantially in the past few decades due to rising incomes and changing dietary patterns around the world. However, conventional animal farming practices are struggling to keep up with this growing demand in a sustainable manner. This is where genetically modified plays a crucial role by enhancing the nutrient profile of animal feed.

By directly modifying the genetic structure of crops scientists are able to develop breeds that are more resilient to diseases and climatic stresses. Furthermore, genetically feed is engineered to have optimal levels of essential nutrients like proteins, vitamins, minerals, and fatty acids that promote healthier growth in animals.

With traditional methods struggling to keep pace, genetically modified feed seems poised to play a vital supporting role in the global food supply chain. As this feed aids our transition towards sustainable intensification of agriculture, it is expected to boost growth of the genetically modified feed market.

Market Driver - Advancements in Biotechnology Supporting Nutrient-dense Genetically modified

Major breakthroughs in plant biotechnology over the past few decades have enabled scientists to improve the innate genetic traits of crops. Advanced gene-editing tools like CRISPR are revolutionizing our ability to select for desirable nutritional qualities during plant breeding. By carefully adding, removing or modifying specific DNA sequences, scientists can now develop customized crop varieties tailored for specific end purposes like animal feed.

Genetic studies have shed light on molecular pathways governing nutrient biosynthesis inside plants. Biotech companies are leveraging this fundamental knowledge to artificially induce enhanced nutrient production without disrupting yield.

As the tools of biotechnology evolve at a rapid pace, greater customization of feed through genetic tailoring will become possible. Advanced gene drives may allow stacking of dozens of nutritional trait genes within a single crop variety. Such advanced “designer feeds” hold promise to revolutionize genetically modified feed market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Side effects and limited testing methodologies for Genetically Modified Feed

One of the key challenges faced by the genetically modified feed market is the lack of comprehensive testing methodologies adopted to evaluate potential side effects of genetically modified feed. While genetic engineering offers promising benefits to enhance crop yields and nutritional value, there are ongoing concerns about its long-term health and environmental impacts.

There is also a lack of quantitative data on aspects like antibiotic resistance and herbicide tolerance that could potentially develop as a result of gene transfers from genetically engineered crops. Absence of long-term epidemiological data on human populations consuming genetically modified feed over generations has led to skepticism among some stakeholders. Addressing such knowledge gaps through improved research protocols and standardized post market surveillance mechanisms can help build greater trust in this technology.

Market Opportunity - Integration of AI in Genetic Engineering to Enhance Genetically Modified Feed Quality

The genetically modified feed market has a significant opportunity to leverage advances in artificial intelligence and machine learning to enhance the genetic engineering process. AI systems powered by vast genomic and phenomics datasets have the ability to revolutionize genome sequencing, gene selection and trait optimization capabilities. This can facilitate development of genetically modified feeds with substantially improved nutritional profiles tailored to the requirements of different livestock.

AI-powered tools also offer opportunities for real-time monitoring of field trials as well as post-marketing surveillance of Genetically modifieds. When integrated with blockchain and IoT, they can provide transparent traceability of feeds from farm to fork.

Such technological upgrades have the potential to address major challenges, accelerate product development cycles and drive faster adoption of higher-value genetically modified feeds with tangible benefits for consumers as well as players in the genetically modified feed market.

Key winning strategies adopted by key players of Genetically Modified Feed Market

Research and development of new genetically modified traits: Bayer's RP-1 trait was launched in 2016 for soybean varieties. It provides increased digestibility for poultry and livestocks. Such innovations help capture market share.

Acquisitions and partnerships: In 2015, Corteva Agriscience (formed after the merger of Dow AgroSciences and DuPont) acquired HyGentechnology to add new genetically modified soybean and corn traits to its portfolio. Partnerships with specialized biotech firms also help source cutting-edge genetically modified technologies.

Strong distribution network: Cargill operates over 140 feed mills across North America to supply genetically modified corn and soy-based feed formulations just-in-time.

Brand visibility and marketing: Big players in genetically modified feed market invest in promotional activities and advertising to increase farmer awareness about benefits of genetically modified attributes in feed like higher nutritional value and economic returns. This enhances market visibility and strengthens brand positioning.

Strategic pricing: Pricing strategies play a key role given cost-sensitivity in the genetically modified feed market. Leaders price genetically modified products competitively while capturing value from novel traits to gain volumes at scale.

Segmental Analysis of Genetically Modified Feed Market

To learn more about this report, Download Free Sample Copy

Insights, By Crop Type: Growing Demand for Animal Feed and Biofuel Production Drives Corn Segment

To learn more about this report, Download Free Sample Copy

Insights, By Crop Type: Growing Demand for Animal Feed and Biofuel Production Drives Corn Segment

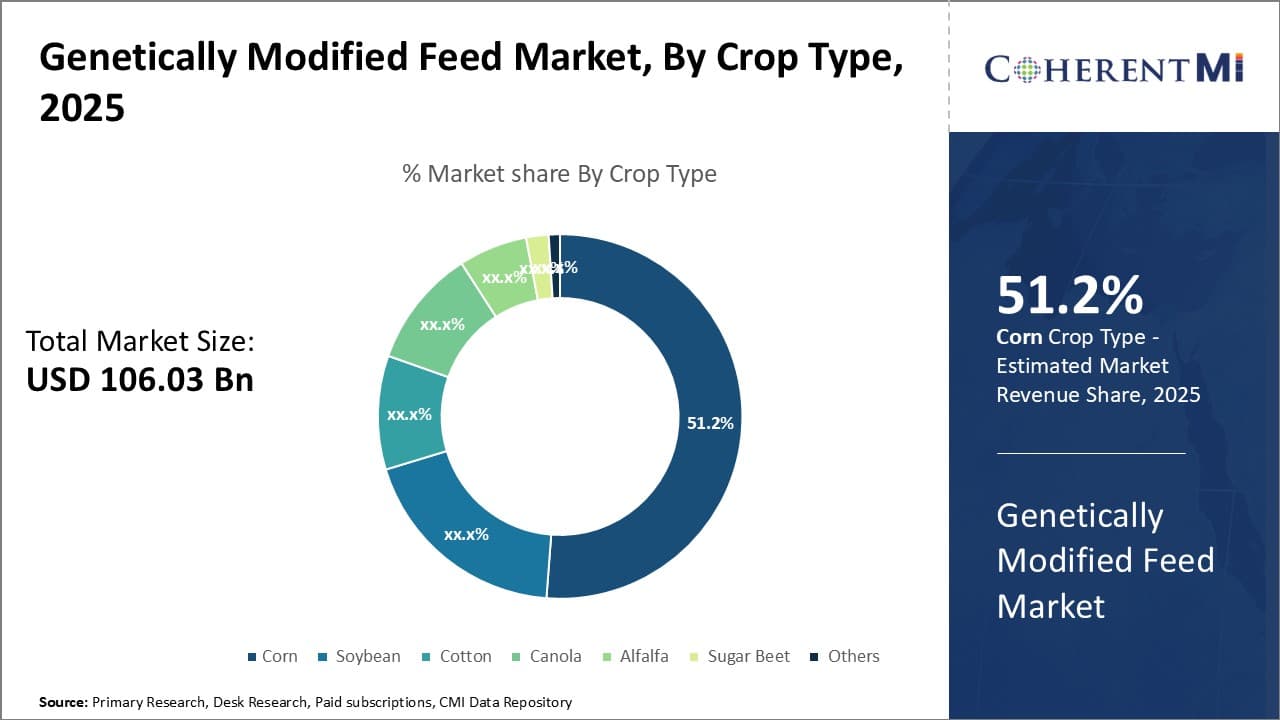

In terms of crop type, corn contributes 51.2% share of the genetically modified feed market owing to its widespread cultivation and diversified usage. Corn is one of the most important crops cultivated globally and the demand for corn has been steadily rising over the years.

The growing meat consumption and rapidly expanding animal feed industry have significantly increased the demand for corn as a primary ingredient in animal feed formulations. Corn is a highly preferred feed ingredient for poultry and swine due to its energy-dense nutritional profile and availability throughout the year.

Genetically modified corns have higher yield potential and resistance to pests and diseases, making them attractive for large-scale farming to meet the rising requirements. Ongoing R&D focusing on developing genetically modified corns with enhanced nutritional traits has further strengthened its position in the genetically modified feed market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

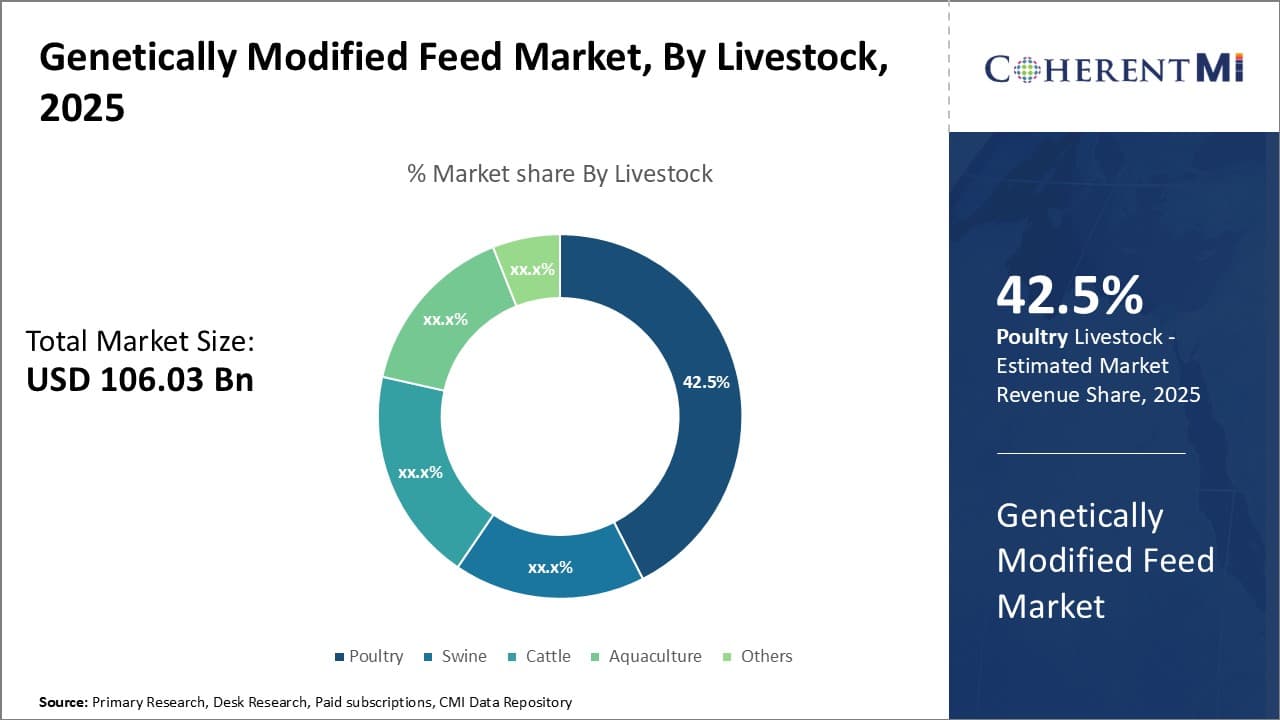

Insights, By Livestock: Growing Meat Consumption Drives Poultry Segment

In terms of livestock, poultry contributes the highest share of the genetically modified feed market owing to the robust growth in demand for poultry meat and eggs globally. Poultry meat has emerged as one of the most affordable and preferred sources of animal protein.

Additionally, poultry farming requires low capital investment and offers high returns, encouraging many small-scale farmers to enter the business. These factors have accelerated the growth of the commercial poultry industry. Given its high growth rates and feed conversion efficiency, poultry is one of the most ideal livestock reared globally. Genetically modified feed containing balanced nutrients specially tailored for poultry helps farmers to improve productivity and meet the growing demand for poultry meat and eggs.

Insights, By Form: Expanding Commercial Livestock Farming Boosts Pellet Segment

In terms of form, pellets contribute the highest share of the genetically modified feed market owing to its widely favored format in commercial livestock farming operations. Pellets are increasingly preferred over other feed forms due to advantages such as improved nutritional delivery, consistency in size and shape, higher digestibility, and prevention of feed wastage.

Pellets enable uniform blending and density packing of various feed ingredients in the right proportions. This ensures standardized nutrient intake for animals. Their uniform shape and size allow for precise mechanized feeding with no sorting or selection by animals. The sturdy nature of pellets also prevents separating, floating and wastage during transport and feeding.

With ongoing industrialization and expansion of commercial livestock farms, pelleted feeds have become fundamental to achieve maximum production efficiency. Their numerous advantages over other forms continue to augment growth of the genetically modified feed market globally.

Additional Insights of Genetically Modified Feed Market

- The adoption of genetically modified feed - corn in the United States has significantly increased due to its pest-resistant traits, leading to higher yields and reduced pesticide usage.

- In Brazil, the expansion of genetically modified soybean cultivation has positioned the country as one of the leading exporters of Genetically modified crops globally.

- The approval of genetically modified feed varieties in China aligns with the nation’s agricultural modernization goals, aiming to meet food security demands through biotech advancements.

- North America held the largest share in genetically modified feed market in 2023 due to increased government investment and a robust biotech sector.

- Asia-Pacific expected to see the highest growth in the global genetically modified feed market, driven by increased demand for genetically modified dairy products and chicken.

Competitive overview of Genetically Modified Feed Market

The major players operating in the genetically modified feed market include Bayer AG, Syngenta AG, Corteva Agriscience, BASF SE, KWS SAAT SE, DuPont de Nemours, Inc., Dow Chemical Company, Syngenta Group, R.Simplot Company, Okanagan Specialty Fruits Inc., and J.R. Simplot Company.

Genetically Modified Feed Market Leaders

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- BASF SE

- KWS SAAT SE

Recent Developments in Genetically Modified Feed Market

- In October 2023, China's National Crop Variety Registration Committee (CNCVRC) published its inaugural list of genetically modified feed as corn and soybean varieties approved for commercial planting. This list includes 37 genetically modified corn varieties and 14 genetically modified soybean varieties, marking a significant step toward the commercialization of genetically modified food crops in China.

- In September 2023, BASF, through its vegetable seed brand Nunhems, introduced three tomato hybrid varieties in Brazil that are resistant to the Tomato Brown Rugose Fruit Virus (ToBRFV). These hybrids include Blindon, Strongton, Azoviam, and Brovian, all of which are salad-type tomatoes.

- In August 2023, Syngenta AG acquired a biotechnology firm specializing in drought-resistant traits, enhancing its portfolio of genetically modified crops suitable for arid regions. This strategic move is anticipated to open new markets and address challenges posed by climate change.

- In April 2023, Bayer AG introduced the Asgrow® AG27XF3 brand, a 2.7 relative maturity (RM) XtendFlex® soybean variety. This genetically modified soybean offers enhanced herbicide tolerance, allowing for the use of multiple herbicides, including glyphosate, dicamba, and glufosinate.

- In March 2023, Corteva Agriscience announced the advancement of a novel gene-editing technology aimed at enhancing disease resistance in elite corn hybrids. This technology utilizes CRISPR to consolidate multiple native disease-resistant traits into a single genomic location.

Genetically Modified Feed Market Segmentation

- By Crop Type

- Corn

- Soybean

- Cotton

- Canola

- Alfalfa

- Sugar Beet

- Others

- By Livestock

- Poultry

- Swine

- Cattle

- Aquaculture

- Others

- By Form

- Pellets

- Crumbles

- Mash

- Meal/Cake

Would you like to explore the option of buying individual sections of this report?

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.