Internal Combustion Engine Market Size - Analysis

The Global Internal Combustion Engine Market is estimated to be valued at USD 273.13 Bn in 2025 and is expected to reach USD 421.66 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032.

The market has been witnessing few trends affecting its growth over the years. With growing concerns around increasing pollution levels worldwide and push for cleaner and greener alternatives, governments across regions have been enforcing stringent emission norms for vehicles. This has been driving automakers to increasingly invest in developing electric powertrains and shifting their focus from internal combustion engines. However, internal combustion engines still have considerable demand, especially in developing markets where electric vehicle infrastructure is yet to be established widely. Nevertheless, with continuous technological advancements, falling battery prices and growing consumer awareness, the electric vehicles market is expected to steadily eat into the share of internal combustion engine vehicles in the coming years. This may limit the growth potential of the internal combustion engine market globally during the forecast period.

Market Size in USD Bn

CAGR6.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.4% |

| Market Concentration | Medium |

| Major Players | Volkswagen AG, Toyota Industries Corporation, Robert Bosch GmbH, Cummins Inc., Caterpillar Incorporated, BMW and Among Others |

please let us know !

Internal Combustion Engine Market Trends

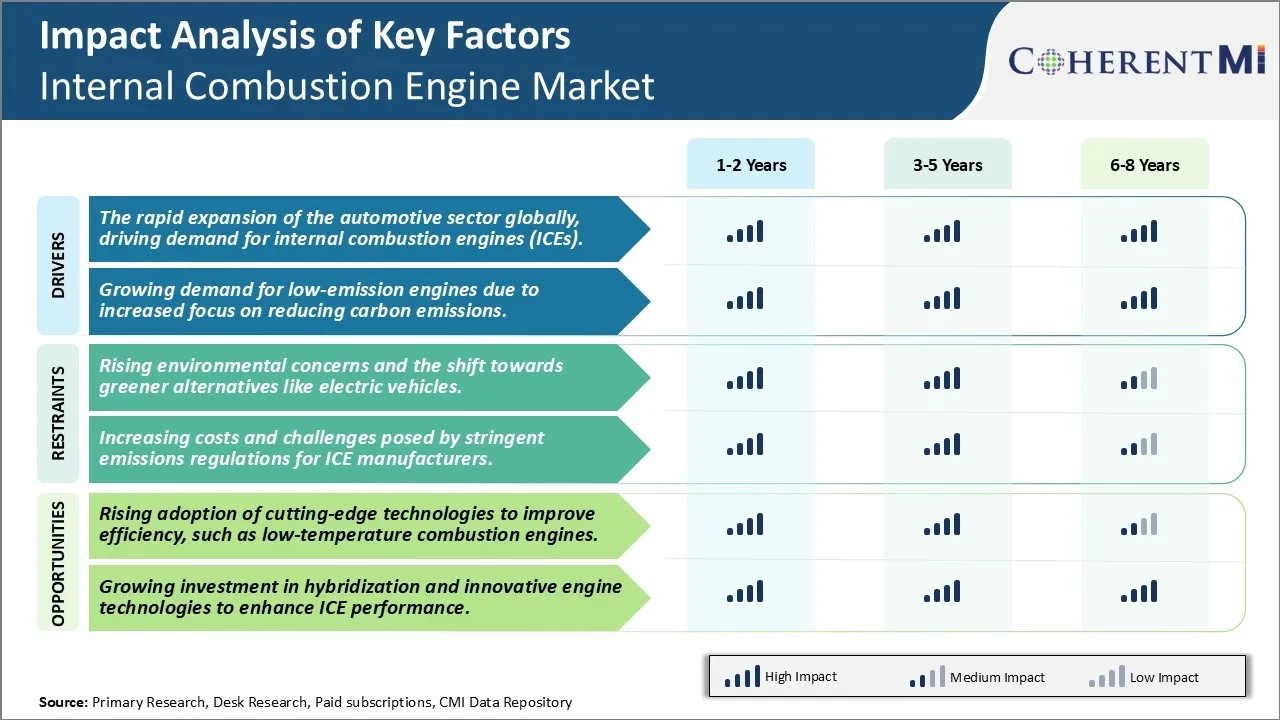

Market Driver - The Rapid Expansion of the Automotive Sector Globally, Driving Demand for Internal Combustion Engines (ICEs)

With the rapid rise in automobile production and vehicle fleet expansion witnessed across both developed and emerging economies worldwide, there has been a significant increase in the demand for internal combustion engines that power these vehicles. The automotive industry has seen exponential growth over the past few decades, especially in the large developing nations of Asia, South America and Central/Eastern Europe.

The robust economic growth and rising disposable incomes in these regions have translated to more individuals being able to purchase personal vehicles. This has not only lifted the sales figures of automakers but has also fueled the production of ICEs that are installed in millions of new cars, buses, trucks and two-wheelers manufactured annually. Developing countries like China, Brazil and India today represent the biggest automotive markets globally and their continued motorization and infrastructure growth will ensure steady requirements for gasoline and diesel engines in the foreseeable future.

Even in prosperous nations where vehicle penetration levels are already quite high, automakers are continuously trying to expand their market share by refreshing their model lineups frequently and introducing new products to attract both new and existing customers. While there is increased focus on electric vehicles in developed markets, traditional ICE technology still accounts for the bulk of automotive production currently. The thriving pre-owned car industry in developed economies too depends largely on the internal combustion engine, extending its lifecycle impact.

With urban population growing rapidly, mass public transportation systems are struggling to cope. This has led to more personalized mobility solutions being adopted, augmenting the demand for motor vehicles. Commercial transportation activities related to freight movement and logistics have also intensified worldwide. All of these trends portend lasting momentum for the internal combustion engine industry as the mobility needs across the world continue their positive trajectory.

Market Driver - Growing Demand for Low-Emission Engines Due to Increased Focus on Reducing Carbon Emissions

Fueled by rising environmental consciousness and the threat of climate change, there is a palpable policy push globally towards lowering vehicular emissions and improving fuel efficiency standards. Various governments have implemented stringent regulations for carbon dioxide, nitrogen oxide and particulate matter emissions from internal combustion engines used in automobiles in a phased manner. This has compelled automakers to engineer their gasoline and diesel powertrains to meet the tightening emission norms within given timeframes.

Original Equipment Manufacturers (OEMs) have invested heavily in developing advanced emission control technologies like gasoline particulate filters, selective catalytic reduction systems, exhaust gas recirculation valves and lean NOx traps to help engines comply with the regulatory emissions thresholds. They have also optimized engine calibration, turbocharging and introduced mild- and full-hybrid powertrain derivatives to enhance efficiency and reduce consumption. Moreover, the proliferation of low-sulfur fuels to facilitate advanced after-treatment devices has encouraged automakers to design innovative low-emission engines.

While transitioning to electric and other alternative fuel-powered vehicles will take time, refining the internal combustion engine still remains pivotal in the short-to-medium term to lower the road transport sector's carbon footprint. Growing public discourse around climate issues has made driver preferences evolve, where emissions and ‘eco’ credentials carry higher significance while purchasing decisions. This translates to robust opportunities for engine manufacturers focusing on rapid development and large-scale production of cleaner and greener combustion technology compatible options. The impetus on decarbonization will hence sustain the need for low-emission engines compliant with evolving emissions norms across geographical markets in the foreseeable future.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Rising Environmental Concerns and the Shift Towards Greener Alternatives Like Electric Vehicles.

One of the major challenges facing the internal combustion engine market is the rising environmental concerns and the shift towards greener alternatives like electric vehicles. There is growing awareness among consumers about the role of vehicular emissions in air pollution and climate change. Strict emission norms implemented by various governments are also putting pressure on automakers to reduce emissions from gasoline and diesel engines. At the same time, support for electric vehicles is increasing through subsidies and policy push in many countries as they offer a cleaner alternative with zero-tailpipe emissions. The traditional dominance of internal combustion engines is facing a serious threat as customers are willing to pay more for electric vehicles to do their bit for the environment. While efforts are on to develop more efficient engines, they may not be enough to match up to the eco-friendliness of battery-powered electric vehicles. This changing landscape poses a long-term challenge for combustion engine manufacturers to adapt their technologies and business models or see their market share erode gradually.

Market Opportunity- Rising Adoption of Cutting-Edge Technologies Creates Novel Opportunities for Further Market Developments

One important opportunity in the internal combustion engine market is the rising adoption of cutting-edge technologies to improve efficiency, such as low-temperature combustion engines. Automakers and technology companies are continuously investing in research and development to enhance the performance as well as reduce emissions and improve fuel efficiency of gasoline and diesel engines. This includes development of more sophisticated direct injection, turbocharging and downsizing technologies. In addition, there is a lot of focus on novel combustion concepts such as homogeneous charge compression ignition and premixed charge compression ignition which help achieve ultra-low nitrogen oxide and particulate matter emissions while improving thermal efficiency. Wider commercialization of these technologies in the coming years can boost engine efficiency significantly and help internal combustion engines meet stringent emission norms across major markets. Their successful implementation will support continued strong demand for combustion engine vehicles.

Key winning strategies adopted by key players of Internal Combustion Engine Market

R&D Investment: Consistent investment in R&D has helped companies develop more efficient and environment-friendly engine technologies. For example, in 2010 Volkswagen invested over USD 10 Bn in clean diesel technology which helped them dominate the European diesel passenger car market for many years. This allowed them to gain an early mover advantage.

Strategic Partnerships & Collaborations: Partnerships with players across the value chain helps companies access new technologies, customers and geographic markets.

Product Innovation: Introduction of new and innovative products aligned with market needs has driven sales.

Mergers & Acquisitions: Acquiring complementary companies has enabled players to enhance capabilities and offerings.

Focus on Emerging Markets: Identifying high growth markets and customizing products for them has boosted revenues. In the last five years, Chinese automakers like Geely and Great Wall entered Brazilian market with affordable SUVs and pickup trucks tailor made for local needs. This helped them capture significant market share.

The above examples demonstrate how strategic investments, partnerships, new products, M&A activity and market expansion helped global automakers gain a competitive edge in the internal combustion engine industry. Their long-term vision and focus on innovation have enabled leadership positions.

Segmental Analysis of Internal Combustion Engine Market

To learn more about this report, Download Free Sample Copy

Insights, By Fuel Type, Rising Consumption of Gasoline Propels the Petroleum Segment

To learn more about this report, Download Free Sample Copy

Insights, By Fuel Type, Rising Consumption of Gasoline Propels the Petroleum Segment

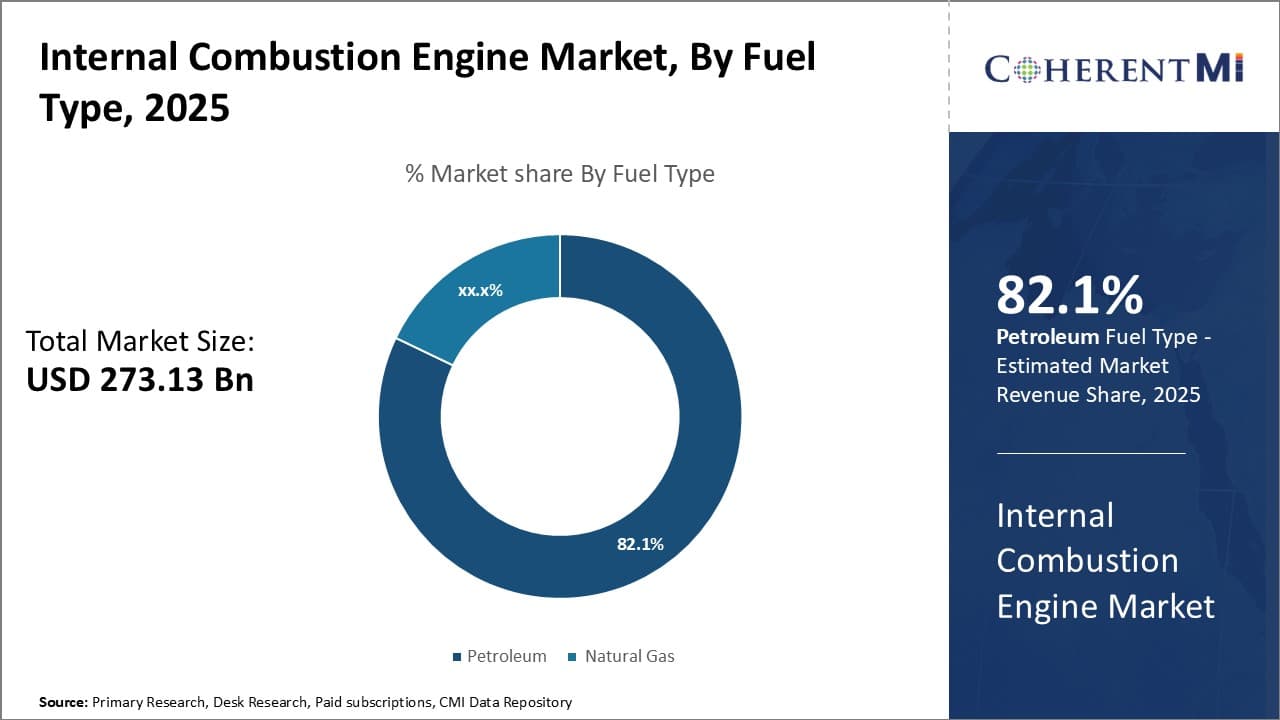

By Fuel Type, the petroleum segment dominates and is projected to register 82.1% in 2025 owing to extensive usage of gasoline in automobiles. Petroleum in the form of gasoline and diesel is used as fuel for running Internal Combustion Engines in most vehicles globally. With rapid urbanization and growing preference for personal modes of transport, the number of vehicles on road has increased substantially over the past few decades. This has directly translated to higher demand for gasoline as a fuel.

Gasoline continues to be the prominent fuel for light duty vehicles and passenger cars due to their relatively lower costs and widespread availability of gas stations. Most automakers also design their engines to optimally run on gasoline. Established gasoline infrastructure and technological familiarity have further solidified gasoline's popularity. Going forward as well, gasoline is expected to remain the primary fuel for Internal Combustion Engines in small passenger vehicles and motorcycles across major markets.

Transitioning to electric vehicles will gradually reduce dependence on petroleum fuels over the long-run. However, the sizable existing fleet of gasoline vehicles ensures steady requirement for petroleum in the coming years. Coupled with rising vehicle ownership in developing nations, total consumption of gasoline as a transport fuel is set to keep increasing steadily. This will keep the petroleum segment firmly in the leading position within the Internal Combustion Engine market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Industry, Massive Automotive Production Boosts the Industry Segment

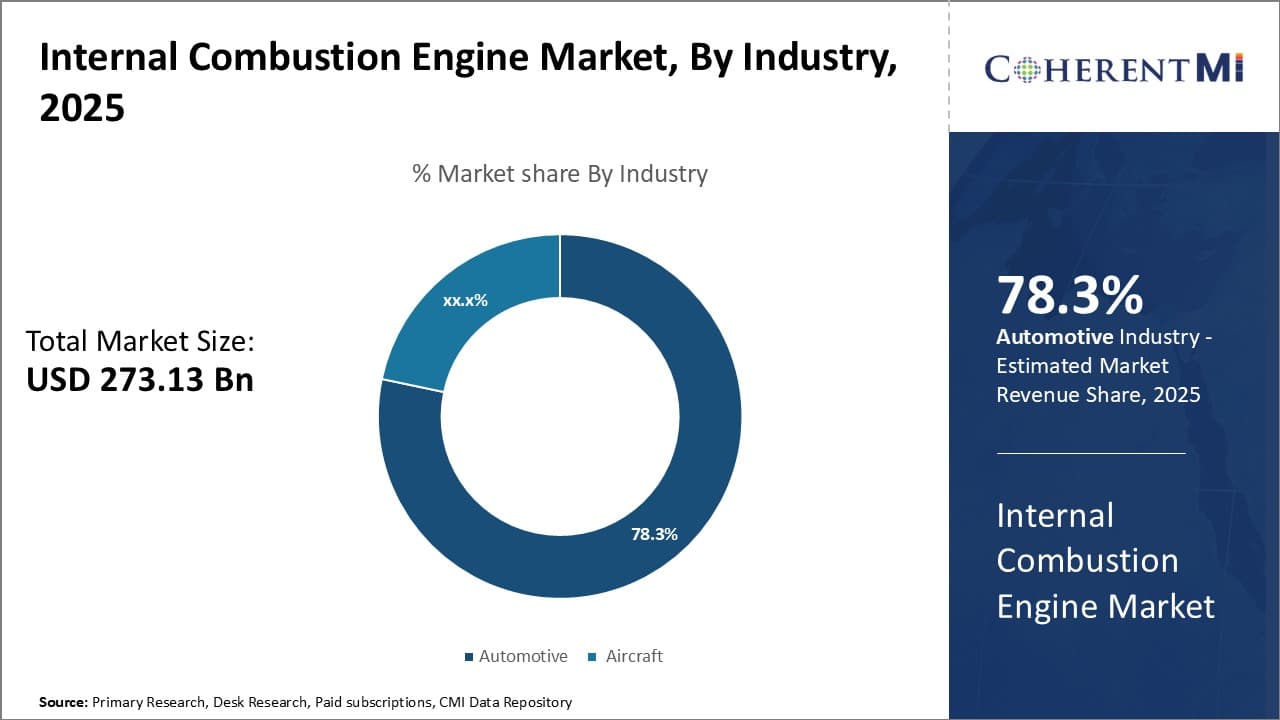

The automotive segment holds the largest share and is projected to account for 78.3% in 2025 owing to extensive use of engines in motor vehicles. Internal Combustion Engines have been the prime movers for automobiles since the inception of automotive industry. They effectively harness the chemical energy in fuels to generate torque or power for mobility applications.

Passenger cars, commercial vehicles, motorcycles and three-wheelers extensively rely on Internal Combustion Engines for their operations. Global automotive production has increased manifold in the last few decades with growing personal income levels and availability of vehicle financing options. Major automotive manufacturing hubs in Asia, North America and Europe rolled out millions of new vehicles annually powered by engines.

Even with rising electrification, conventional Internal Combustion Engine vehicles will account for the bulk of automotive sales over the next 10-15 years. Electrics are yet to achieve price parity and widespread charging infrastructure remains a limitation. Engines therefore continue enjoying robust demand from OEMs for automotive applications. Their mechanical design has also been refined for delivering higher performance with lower emissions. Steady growth in global vehicle parc along with replacement demand for engines from the sizable in-use fleet ensures healthy industry appetite. This will allow the automotive segment to retain its lead position in consumption within the overarching Internal Combustion Engine market.

Additional Insights of Internal Combustion Engine Market

The internal combustion engine (ICE) market continues to grow despite the increasing focus on green technologies like electric vehicles. ICEs remain essential across multiple sectors, including automotive, marine, and aerospace, due to their versatility, reliability, and ability to power a wide range of applications. The market is driven by technological advancements aimed at reducing emissions and improving efficiency, such as low-emission engines and hybridization technologies. The growth in the automotive sector, particularly in developing regions, has also bolstered demand for ICE-powered vehicles. However, the market faces challenges from environmental regulations and rising consumer preference for electric vehicles. Nevertheless, innovation in engine design, particularly for cleaner fuel options like natural gas and hydrogen, provides growth opportunities. The Asia Pacific region leads the market due to high automotive production, while North America shows notable growth in ICE adoption, driven by industrial applications and hybrid technology.

Competitive overview of Internal Combustion Engine Market

The major players operating in the Internal Combustion Engine Market include Volkswagen AG, Toyota Industries Corporation, Robert Bosch GmbH, Cummins Inc., Caterpillar Incorporated, BMW, Navistar International Corporation, MAN SE, General Motors, Ford Motor Company, Rolls-Royce, AGCO Corporation, Renault Group, Mitsubishi Heavy Industries, Ltd. and Kirloskar Oil Engines Ltd.

Internal Combustion Engine Market Leaders

- Volkswagen AG

- Toyota Industries Corporation

- Robert Bosch GmbH

- Cummins Inc.

- Caterpillar Incorporated

- BMW

Recent Developments in Internal Combustion Engine Market

- In May 2024, Toyota collaborated with Mazda and Subaru to develop next-generation ICEs with enhanced efficiency and performance, compatible with alternative fuels.

- In July 2024, Toyota unveiled its “game-changer” ICE engines, with new 1.5-liter and 2.0-liter four-cylinder engines that boast improved efficiency compared to current models.

- In June 2023, General Motors invested USD 632 million in its Fort Wayne Assembly to prepare for the production of next-generation ICE full-volume light-duty trucks.

- In June 2023, Rolls-Royce opened an assembly plant for MTU Series 2000 engines featuring green energy systems and smart building control to maximize energy efficiency.

Internal Combustion Engine Market Segmentation

- By Fuel Type

- Petroleum

- Natural Gas

- By Industry

- Automotive

- Aircraft

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.