Gastrointestinal Stromal Tumor (GIST) Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Gastrointestinal Stromal Tumor (GIST) Market is segmented By Product (Marketed Drugs, Phase III Pipeline Drugs), By Drug Category (Tyrosine Kinase Inh....

Gastrointestinal Stromal Tumor (GIST) Market Size

Market Size in USD Bn

CAGR9.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.6% |

| Market Concentration | High |

| Major Players | Novartis AG, Pfizer Inc., Bayer AG, Roche Holding AG, Eli Lilly and Company and Among Others. |

please let us know !

Gastrointestinal Stromal Tumor (GIST) Market Analysis

The gastrointestinal stromal tumor (GIST) market is estimated to be valued at USD 1.2 Bn in 2024 and is expected to reach USD 2.28 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.6% from 2024 to 2031. Major factors such as rising incidence of gastrointestinal cancers, increasing adoption of targeted therapies and growing population aware about the available treatment options for GIST cancers will boost the demand.

Gastrointestinal Stromal Tumor (GIST) Market Trends

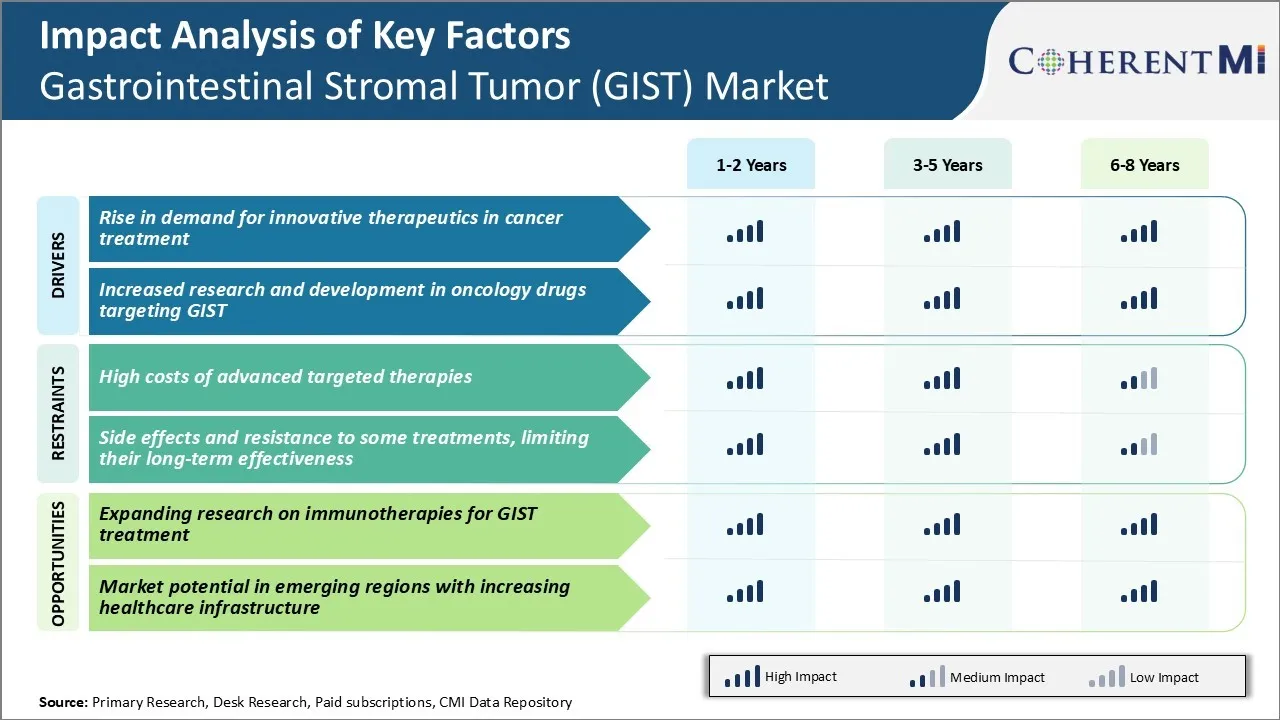

Market Driver - Rise in Demand for Innovative Therapeutics in Cancer Treatment

As the prevalence of cancer continues rising globally, patients and their families look for advanced treatment options that can effectively defeat their disease. GIST is no exception, with several cases diagnosed each year worldwide. Traditional chemotherapy and radiation have significant side effects and are not always successful. People affected by GIST greatly desire novel pharmaceuticals developed through cutting-edge research that can precisely target the cancer and eliminate it from the body with minimal toxicity.

In recent times, many innovative drugs specific to GIST have entered the gastrointestinal stromal tumor (GIST) market after rigorous clinical testing. These new drugs are more tolerable and often significantly improve patient outcomes compared to existing alternatives. They work through refined mechanisms focused on GIST's unique molecular characteristics.

The entry and success of pioneering GIST drugs have boosted hopes in the medical community as well as those suffering from the condition. Advancements in biopharmaceutical innovation directly enhance patient care, strengthening the demand for novel therapeutic options. Drug makers continue prioritizing GIST-centered R&D to develop next-generation solutions addressing unmet needs. This momentum plays a vital role in the gastrointestinal stromal tumor (GIST) market’s positive trend.

Market Driver - Increased Research and Development in Oncology Drugs Targeting GIST

Oncology has been one of the major therapeutic areas attracting pharmaceutical investments over the last few decades. Cancer remains a leading public health concern affecting millions worldwide. Continuous efforts to understand and defeat various malignancies including GIST have never slowed down. Today's cancer research has expanded knowledge about the complex molecular drivers of the disease. Ongoing exploration aims to leverage these insights for developing highly effective treatments.

Market stakeholders are pumping substantial funds into GIST drug R&D programs annually based on promising indications from early trials. Multiple compounds at different stages target specific aberrations driving rapid tumor growth or inhibiting metastasis. Some work to enhance the body's natural defenses against the cancer or combine specialized mechanisms for stronger effect. Early results point to considerable potential to improve upon approved standards. This motivates intensified efforts to advance candidates up the drug development pipeline.

Meanwhile, various research institutions worldwide are expanding understanding of obscure clinical and cellular aspects of GIST which could open new avenues. Overall R&D activity centered on GIST drug innovations builds positive sentiment around future therapeutic capacity and market expansion. Stakeholders remain committed to defeating the disease through unrelenting scientific endeavor.

Market Challenge - High Costs of Advanced Targeted Therapies

One of the major challenges faced in the Gastrointestinal Stromal Tumor (GIST) market is the high costs of advanced targeted therapies. GIST tumors often require lifelong treatment with targeted therapies such as imatinib (Gleevec) or regorafenib (Stivarga) which are associated with significant costs. These targeted therapies have significantly improved patient outcomes and survival rates for GIST.

However, they are also very expensive often costing over $100,000 per year of treatment. Due to the high costs, patient access to these life-saving medications remains a challenge particularly in developing countries with limited healthcare budgets. The high therapy costs also put significant financial burden on patients requiring them to pay high insurance premiums and co-pays. This financial toxicity associated with the treatments can negatively impact treatment adherence over time.

Pharmaceutical companies need to explore new pricing strategies and patient assistance programs to improve global access to modern GIST treatments. Governments and healthcare systems also need to allocate additional funding to support greater use of cost-effective targeted therapies. If left unaddressed, the issue of affordability can limit overall uptake of innovative GIST treatments and clinical outcomes over the long run.

Market Opportunity - Expanding Research on Immunotherapies for GIST Treatment

One significant opportunity in the GIST market lies in further expanding research on immunotherapies for GIST treatment. While targeted therapies have revolutionized GIST treatment, resistance to these drugs remains a challenge in the longer run. There is an urgent need to explore novel treatment approaches to combat drug-resistant GIST.

Immune checkpoint inhibitors and other immunotherapy agents have shown promising results for other tumor types but remain largely unexplored for GIST. Initial research indicates these therapies may help overcome some limitations of targeted therapies by harnessing the power of patient's own immune system. More clinical trials are evaluating various immunotherapies such as anti-PD1 inhibitors alone or in combination with existing targeted therapies.

Positive results from ongoing studies can help establish immunotherapies as an important new treatment option. This will substantially expand the available armamentarium to effectively treat GIST at different stages of the disease. Increased research funding and support from government agencies can help accelerate development of immunotherapies. Their successful integration into clinical practice has the potential to transform long term outcomes for GIST patients worldwide.

Prescribers preferences of Gastrointestinal Stromal Tumor (GIST) Market

GIST is typically treated through a step-wise approach based on the stage of disease. For localized resectable disease, surgery remains the standard first-line treatment with the goal of complete resection. For patients who are not surgical candidates or those with recurrent/metastatic disease, drug therapy is preferred.

The first-line drug treatment includes tyrosine kinase inhibitors (TKIs) such as imatinib (Gleevec). Imatinib works by inhibiting abnormal kinase activity driven by mutations in KIT or PDGFRA proteins which are prevalent in GIST tumors. For early stage recurrent/metastatic GIST, imatinib at 400mg per day is the preferred option. For patients who progress on imatinib, second-line sunitinib (Sutent) at 50mg per day is prescribed. Sunitinib also targets KIT and PDGFRA pathways but has a distinct kinase inhibition profile compared to imatinib.

For patients unsuitable or intolerant to both imatinib and sunitinib, the third-line regimen involves the use of regulatory approved regorafenib (Stivarga). Regorafenib inhibits multiple kinases involved in angiogenesis and oncogenesis and has shown survival benefits in refractory GIST patients. The dosage is typically 160mg taken orally once daily for 3 weeks on/1 week off treatment cycles.

Key influencing factors for prescribers include a patient's medical history, symptoms, tumor stage/subtype, tolerance to side effects, and most importantly, response to previous lines of therapy.

Treatment Option Analysis of Gastrointestinal Stromal Tumor (GIST) Market

GIST has four main stages - localized, locally advanced, metastatic/unresectable, and recurrent/progressive. For localized resectable GIST, surgical removal of the tumor (usually performed laparoscopically) is the primary treatment option.

For locally advanced or metastatic/unresectable GIST, targeted drug therapy is recommended. Imatinib (Gleevec) was the first FDA-approved targeted therapy for GIST and remains the standard first-line treatment. Imatinib works by inhibiting abnormal KIT and PDGFRA proteins driving tumor growth. For patients who cannot tolerate or do not respond to imatinib, sunitinib (Sutent) is recommended as second-line therapy. Sunitinib also targets KIT and PDGFRA along with additional receptors promoting angiogenesis.

For patients progressing on imatinib and sunitinib, regorafenib (Stivarga) is the standard third-line option. Regorafenib fights GIST by blocking several kinases involved in tumor growth and spread. Recent research found combining regorafenib with nintedanib provides a safe and effective fourth-line alternative for patients no longer responding to other targeted therapies.

The sequential use of targeted drugs delays disease progression the longest by inhibiting multiple pathways fueling GIST at different stages. Close monitoring of treatment response and side effects allows doctors to determine the most effective personalized option at each line of therapy.

Key winning strategies adopted by key players of Gastrointestinal Stromal Tumor (GIST) Market

FDA approval and successful drug launches:

One of the most important strategies adopted by players has been obtaining FDA approval and successfully launching new drugs to treat GIST. For example, Novartis gained FDA approval for Stivarga (regorafenib) in 2013 for metastatic GIST after failure of imatinib and sunitinib.

Focus on novel targeted therapies:

Players like Bayer and Deciphera Pharmaceuticals are conducting late-stage clinical trials for novel targeted therapies like ripretinib and rebastinib respectively. If approved, these drugs will be the only approved therapies for 4th line or later treatment.

Strategic acquisitions:

Bayer strengthened its oncology portfolio through the acquisition of BluePrint Medicines in 2020 for $1.5 billion. This added a pipeline of precision medicine programs including the investigational drug, pralsetinib, for the treatment of RET-altered solid tumors including GIST.

Lifecycle management of blockbusters:

Novartis has extended the commercial potential of Gleevec through various strategies like new indications and formulations. This includes getting approval for pediatric GIST in 2009.

Collaborations for expedited drug development:

Deciphera formed a collaboration with Zai Lab in 2020 to accelerate development and commercialization of rebastinib in Greater China. Such partnerships help companies access newer markets and patients more quickly.

Segmental Analysis of Gastrointestinal Stromal Tumor (GIST) Market

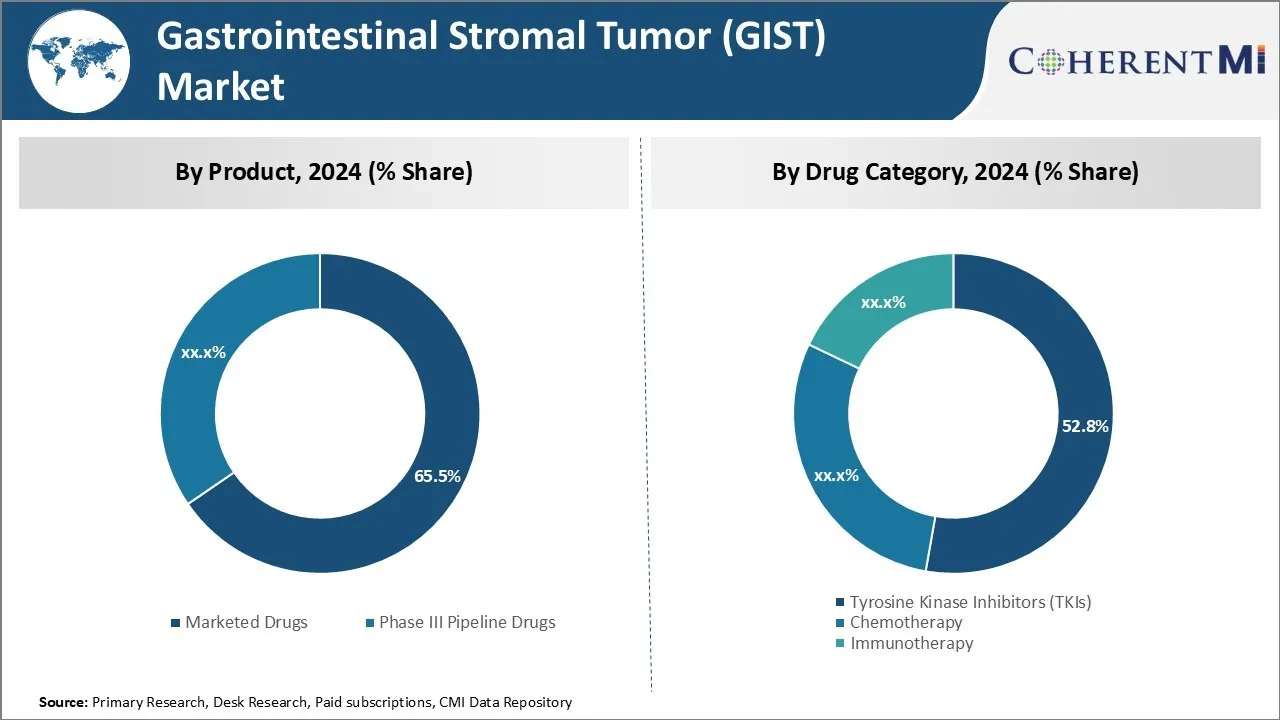

Insights, By Product: Growth of Targeted Therapies with Marketed Drugs

In terms of product, marketed drugs are estimated to account for 65.5% share of the gastrointestinal stromal tumor (GIST) market in 2024, owning to the availability of innovative targeted therapies. Significant research efforts over the past decade have led to development of targeted drugs with novel mechanisms of action that specifically inhibit cancer growth. Imatinib revolutionized GIST treatment by becoming the first approved targeted therapy. It demonstrated remarkable response rates and improved survival outcomes.

Since then, second generation drugs like regorafenib and ripretinib have further expanded treatment options. Their improved selectivity, safety profile and convenience of oral administration have made them preferred treatments over chemotherapy. Continuous advancement in understanding tumor biology also helps identify new targets, driving the launch of newer targeted agents in the gastrointestinal stromal tumor (GIST) market. Wider recognition of benefits of targeted therapies among physicians and patients further boosts uptake of these marketed drugs.

Insights, By Drug Category: Prevalence of Kinase Inhibition

In terms of drug category, tyrosine kinase inhibitors (TKIs) are projected to account for 52.8% share of the gastrointestinal stromal tumor (GIST) market in 2024, owing to their established efficacy and safety in GIST. Tyrosine kinases play a central role in oncogenic signaling pathways driving proliferation of GIST tumors. TKIs emerged as the mainstay of therapy by specifically inhibiting abnormal kinase activity. Imatinib was the first approved TKI and remains the standard-of-care first line treatment.

Second generation multi-targeted TKIs like regorafenib and ripretinib offer additional benefits over imatinib. Their flexible dosing schedules and manageable toxicity profiles have improved patient outcomes and compliance. Continued research to discover novel kinase targets will likely see launch of newer TKIs in the future as well. Widespread clinical evidence validating benefits of kinase inhibition makes it the preferred treatment modality amongst medical professionals.

Insights, By Route of Administration: Convenience of Oral Administration

In terms of route of administration, oral contributes the highest share owing to supreme convenience and flexibility it offers patients and caregivers. Given the typically long-term nature of GIST treatment, oral administration provides a less invasive alternative to intravenous therapy.

It allows convenient self-administration of drugs at home or alongside daily routines. This improves adherence and compliance to therapy. Oral drugs also offer freedom from hospital/clinic visits for infusion administration. Their ease of use promotes superior quality of life for GIST patients.

Nearly all approved targeted therapies are available in oral formulations, including front-line options like imatinib. Market preference is thus skewed towards convenient oral drugs that patients can seamlessly integrate into their lifestyle without much disruption.

Additional Insights of Gastrointestinal Stromal Tumor (GIST) Market

- Prevalence: GIST affects approximately 10-15 per million people annually worldwide.

- Mutation Breakdown: About 80% of GIST cases have KIT mutations, 10% have PDGFRA mutations, and the remaining 10% are wild-type or have other rare mutations.

- The integration of genomic testing in clinical practice has enabled more precise targeting of GIST mutations, improving treatment efficacy and patient survival rates.

- GIST remains a challenging malignancy to treat due to its resistance to some therapies, and the limited availability of targeted therapies, leading companies to focus on developing advanced treatments that can overcome these hurdles.

Competitive overview of Gastrointestinal Stromal Tumor (GIST) Market

The major players operating in the gastrointestinal stromal tumor (GIST) market include Novartis AG, Pfizer Inc., Bayer AG, Roche Holding AG, Eli Lilly and Company, Daiichi Sankyo, Astellas Pharma, Blueprint Medicines Corporation, Merck & Co., and Amgen Inc.

Gastrointestinal Stromal Tumor (GIST) Market Leaders

- Novartis AG

- Pfizer Inc.

- Bayer AG

- Roche Holding AG

- Eli Lilly and Company

Gastrointestinal Stromal Tumor (GIST) Market - Competitive Rivalry, 2024

Gastrointestinal Stromal Tumor (GIST) Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Gastrointestinal Stromal Tumor (GIST) Market

- In September 2023, Daiichi Sankyo initiated Phase III clinical trials for a novel TKI aimed at overcoming resistance in GIST patients. Successful results could significantly impact the treatment landscape. Daiichi Sankyo has been actively involved in developing TKI-related therapies, particularly targeting resistance mechanisms in cancers such as non-small cell lung cancer (NSCLC) with trials like HERTHENA-Lung01 and HERTHENA-Lung02, focusing on overcoming resistance to EGFR TKIs.

- In November 2022, Novartis announced the launch of a new Phase III clinical trial focusing on next-generation tyrosine kinase inhibitors to treat advanced GIST, aiming to reduce resistance issues seen with previous therapies. Novartis has been actively involved in the development of various TKIs, including Scemblix® (asciminib), which has been studied in other types of cancers like chronic myeloid leukemia (CML). This drug targets resistance to prior TKIs and shows promising results, but no direct evidence was found for a GIST-specific trial from November 2022.

- In May 2020, Qinlock (ripretinib), a kinase inhibitor, was approved by the FDA for the treatment of advanced GIST after patients had already been treated with at least three other kinase inhibitors. This approval represented an important development in addressing resistance to previous treatments for metastatic GIST

- In April 2022, Roche Holding AG entered into a licensing agreement with Blueprint Medicines Corporation to co-develop a new GIST treatment. This partnership could accelerate drug availability in international markets. Roche and Blueprint Medicines have been collaborating on the development and commercialization of cancer drugs, particularly focusing on pralsetinib, which targets RET-altered cancers such as non-small cell lung cancer (NSCLC) and thyroid cancers.

- In January 2020, Blueprint Medicines received FDA approval for avapritinib under the brand name Ayvakit for the treatment of GISTs with PDGFRA exon 18 mutations (including the D842V mutation), and the drug was already being used for certain Gastrointestinal Stromal Tumors (GIST) cases. In June 2023, Blueprint Medicines received FDA approval for the use of Ayvakit in treating indolent systemic mastocytosis (ISM).

Gastrointestinal Stromal Tumor (GIST) Market Segmentation

- By Product

- Marketed Drugs

- Phase III Pipeline Drugs

- By Drug Category

- Tyrosine Kinase Inhibitors (TKIs)

- Chemotherapy

- Immunotherapy

- By Route of Administration

- Oral

- Intravenous

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the gastrointestinal stromal tumor (GIST) market?

The gastrointestinal stromal tumor (GIST) market is estimated to be valued at USD 1.2 Billion in 2024 and is expected to reach USD 2.28 Billion by 2031.

What are the key factors hampering the growth of the gastrointestinal stromal tumor (GIST) market?

The high costs of advanced targeted therapies, and the side effects and resistance to some treatments, which can limit their long-term effectiveness, are the major factors hampering the growth of the gastrointestinal stromal tumor (GIST) market.

What are the major factors driving the gastrointestinal stromal tumor (GIST) market growth?

The rise in demand for innovative therapeutics in cancer treatment and increased research and development in oncology drugs targeting GIST are the major factors driving the gastrointestinal stromal tumor (GIST) market.

Which is the leading product in the gastrointestinal stromal tumor (GIST) market?

The leading product segment is marketed drugs.

Which are the major players operating in the gastrointestinal stromal tumor (GIST) market?

Novartis AG, Pfizer Inc., Bayer AG, Roche Holding AG, Eli Lilly and Company, Daiichi Sankyo, Astellas Pharma, Blueprint Medicines Corporation, Merck & Co., and Amgen Inc. are the major players.

What will be the CAGR of the gastrointestinal stromal tumor (GIST) market?

The CAGR of the gastrointestinal stromal tumor (GIST) market is projected to be 9.6% from 2024-2031.