Glioblastoma Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Glioblastoma Market is segmented By Glioblastoma Epidemiology (Total Incident Cases of Glioblastoma, Gender-specific Incidence, Type-specific Incidenc....

Glioblastoma Market Size

Market Size in USD Bn

CAGR13.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 13.1% |

| Market Concentration | High |

| Major Players | Bayer, Chimerix, Aivita Biomedical, Denovo Biopharma, Northwest Therapeutics and Among Others |

please let us know !

Glioblastoma Market Analysis

The glioblastoma market is estimated to be valued at USD 1.15 Bn in 2024 and is expected to reach USD 2.74 Bn by 2031, growing at a compound annual growth rate (CAGR) of 13.1% from 2024 to 2031. With growing geriatric population and rising incidence rates of brain cancer, the market is poised to witness significant growth over the forecast period.

The market is driven by rising research into innovative treatment options and increasing approval of pipeline drugs. Major pharmaceutical players have ramped up R&D investments to develop targeted therapies and immunotherapies to treat Glioblastoma. Furthermore, growing awareness about the disease and better diagnosis is also contributing to the market growth. However, high cost of treatment continues to hinder widespread adoption.

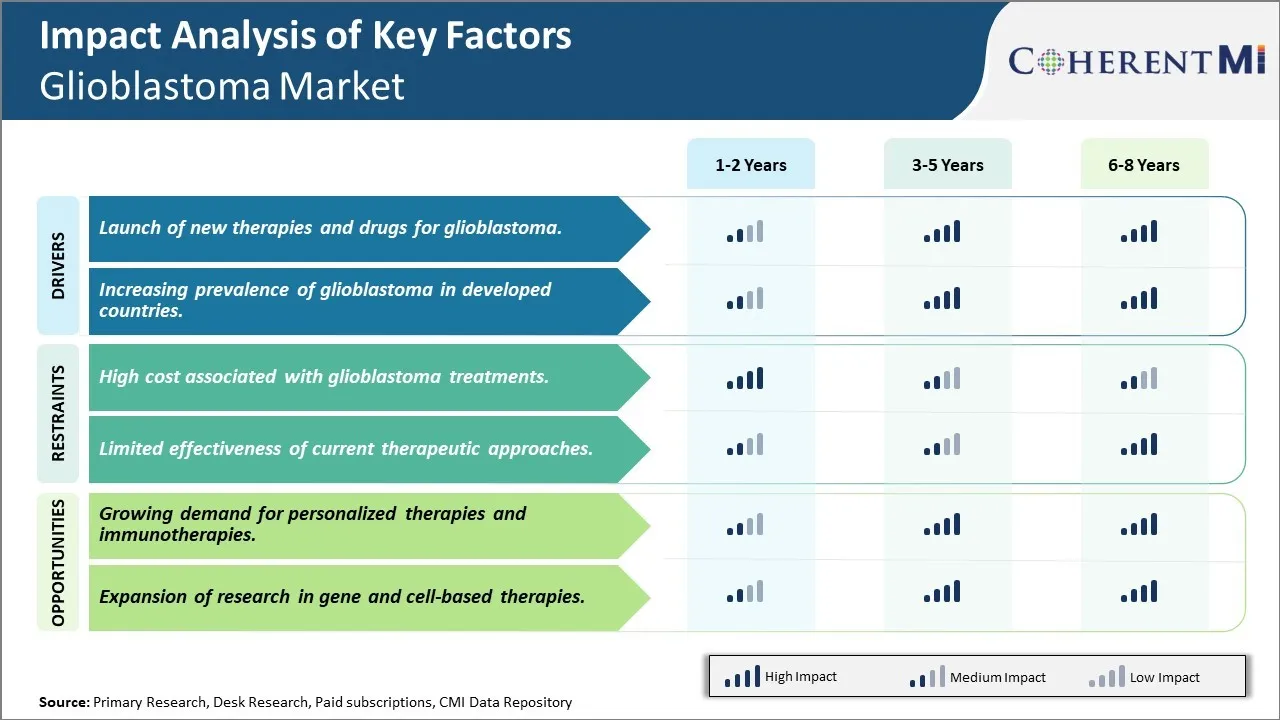

Glioblastoma Market Trends

Market Driver - Launch of new therapies and drugs for glioblastoma

The glioblastoma market has been witnessing significant developments over the past few years due to rising focus on development of novel and innovative treatment options. Pharmaceutical companies and biotech firms have ramped up efforts to identify new drug candidates and therapy procedures that can help improve patient outcomes. A key focus has been on developing targeted therapies against specific molecular alterations associated with glioblastoma tumors. This is a critical area of research as it holds potential to offer more personalized and effective treatment strategies.

Several biotech have shown promising results from early clinical trials of targeted drugs against genetic mutations seen in a subset of glioblastoma patients. A few recent examples include a phase II trial of a BRAF inhibitor that demonstrated encouraging response rates in patients with BRAF V600E mutated glioblastoma. Another ongoing phase I/II study is evaluating a MEK inhibitor in combination with standard chemotherapy for MEK mutated glioblastomas. Results so far have been quite positive in slowing tumor growth. Large pharmaceutical companies are also exploring uses of existing oncology drugs for glioblastoma indications through biomarker-guided clinical trials.

Immunotherapy is another therapy category attracting heavy investments as a treatment approach for glioblastoma. Multiple cell therapy developers are conducting trials of engineered T-cell therapies and immune checkpoint inhibitors either as monotherapies or in combination with other treatments. Experts remain cautiously optimistic about the potential of immunotherapies to provide durable responses for at least a subset of glioblastoma patients, based on early data. The launch of newer immunotherapies targeting glioblastoma-specific tumor antigens could expand the market opportunities significantly in the coming years.

Advancements are also being made in gene therapy with several clinical studies ongoing to evaluate the safety and efficacy of various viral vector-mediated approaches. These include attempts to deliver tumor suppressor genes like p53 or suicide genes selectively to glioblastoma cells. The gene therapy research pipeline remains active with more candidates expected to enter human testing in the near future.

Market Driver - Increasing prevalence of glioblastoma in developed countries

Another important factor influencing the glioblastoma market landscape is the rising prevalence rates seen in developed countries primarily attributed to aging populations. Glioblastoma incidence is known to increase with age, with the average age of diagnosis being around 64 years. With significant improvements in life expectancy and medical advancements extending the human life span, the number of elderly individuals has swelled rapidly in North America and Western Europe in particular over the past few decades.

Research studies have established that the risk of glioblastoma almost doubles for every 10-year increase beyond the age of 50 years. Therefore, with larger proportions of the population classifying as geriatric, this age group is expected to fuel greater demand for glioblastoma therapeutics. Additionally, greater access to advanced diagnostics like MRI scans has led to more glioblastoma cases being accurately identified and reported now compared to the past. All these elements have contributed to the growing prevalence numbers seen widely across developed markets.

According to some estimates, over the next 20 years, the geriatric demographic constituting individuals aged 65 years and above will grow by over 50% in the United States alone. This impending surge in the aging population base of major pharmaceutical markets is poised to significantly impact brain tumor incidence rates in the long run. With glioblastoma exhibiting a strong predilection towards affecting the older population, its prevalence is expected to rise in parallel, heightening the need for improved screening and treatment protocols. The mounting disease burden resulting from shifting demographics certainly promotes prospects within the glioblastoma therapeutics area.

Market Challenge - High cost associated with glioblastoma treatments

One of the major challenges being faced in the glioblastoma market is the high cost associated with glioblastoma treatments. Glioblastoma is one of the most aggressive forms of brain cancer and the available treatment options such as chemotherapy, radiation therapy and targeted therapy are often very costly. The prices of drugs used in chemotherapy can range from tens of thousands to hundred thousands of dollars for a course of treatment. Additionally, glioblastoma treatment often requires longer hospital stays, repeated imaging and surgical procedures which collectively contribute to heightened medical costs. This financial burden is difficult to bear for many patients and their families. The exorbitant cost of treatment is also challenging for public and private health insurers to cover. As a result, only a limited number of high-income patients are able to afford the high-end treatment options. This inevitably poses barriers to access and puts several low-income patients at high risk of non-adherence to therapy due to cost factors. Pharmaceutical manufacturers need to focus on reducing drug prices to enhance affordability without compromising treatment efficacy. Insurers and governments also need to explore mechanisms to subsidize costs for needy patients. If the financial barriers to treatment are not addressed proactively, it may negatively impact the overall market potential for glioblastoma drugs and diagnostics.

Market Opportunity - Growing demand for personalized therapies and immunotherapies

One key opportunity being witnessed in the glioblastoma market is the growing demand for personalized therapies and immunotherapies. Research efforts in the domain of precision medicine and immunotherapy are unlocking new scientific avenues for more effective glioblastoma treatment. The adoption of genomic profiling and biomarker screening enables tailored therapeutic strategies customized to an individual patient's molecular profile and disease characteristics. This personalized approach holds promise to maximize treatment response while limiting toxicities. Similarly, immunotherapy is emerging as a game-changing approach that leverages the body's immune system to fight cancer. Drugs targeting immune checkpoints like CTLA-4 and PD-1 pathways have demonstrated survival benefits in clinical trials for glioblastoma patients. The success of novel therapies like CAR T-cell therapy has also stimulated interest. As healthcare enters an era of individualized care, products enabling personalized precision therapies and immunotherapies are likely witness increased demand. This presents lucrative opportunities for innovative drug makers to gain market share through cutting-edge treatments tailored for glioblastoma patients.

Key winning strategies adopted by key players of Glioblastoma Market

Major players like Merck & Co., Roche, and Amgen have focused their R&D efforts on developing targeted therapy drugs that interfere with specific molecular pathways involved in glioblastoma tumor growth. For example, in 2015 Roche received FDA approval for Avastin (bevacizumab), which targets VEGF to limit tumor blood supply. In clinical trials, Avastin helped prolong progression-free survival when added to standard chemo. This targeted approach helped establish Roche as a leader in the glioblastoma treatment space.

Given the rare nature and complexity of glioblastoma, no single company can tackle it alone. Players like Amgen and Roche have partnered with smaller biotechs to gain access to novel drug candidates and pool resources for expensive clinical trials. For instance, in 2012 Amgen partnered with Cavion to develop inhibitor AC102. Through partnership, Amgen was able to advance the drug from preclinical to phase 1 trials, mitigating risks.

Companies also acquire other firms to quickly gain a promising drug or technology platform. In 2018, Merck acquired Peloton Therapeutics for $1 billion to obtain access to their hypoxia-targeting drug PT2977, which was showing potential in glioblastoma in early trials. This bolstered Merck's late-stage pipeline. Such strategic acquisitions have helped larger firms continue dominating the market.

Most companies identify gaps remaining in existing glioblastoma treatment approaches and focus their R&D on addressing those unmet needs. For example, after standard chemo stopped offering meaningful benefits, Roche focused Avastin on improving progression-free survival, filling an important unmet need and achieving regulatory approval.

Segmental Analysis of Glioblastoma Market

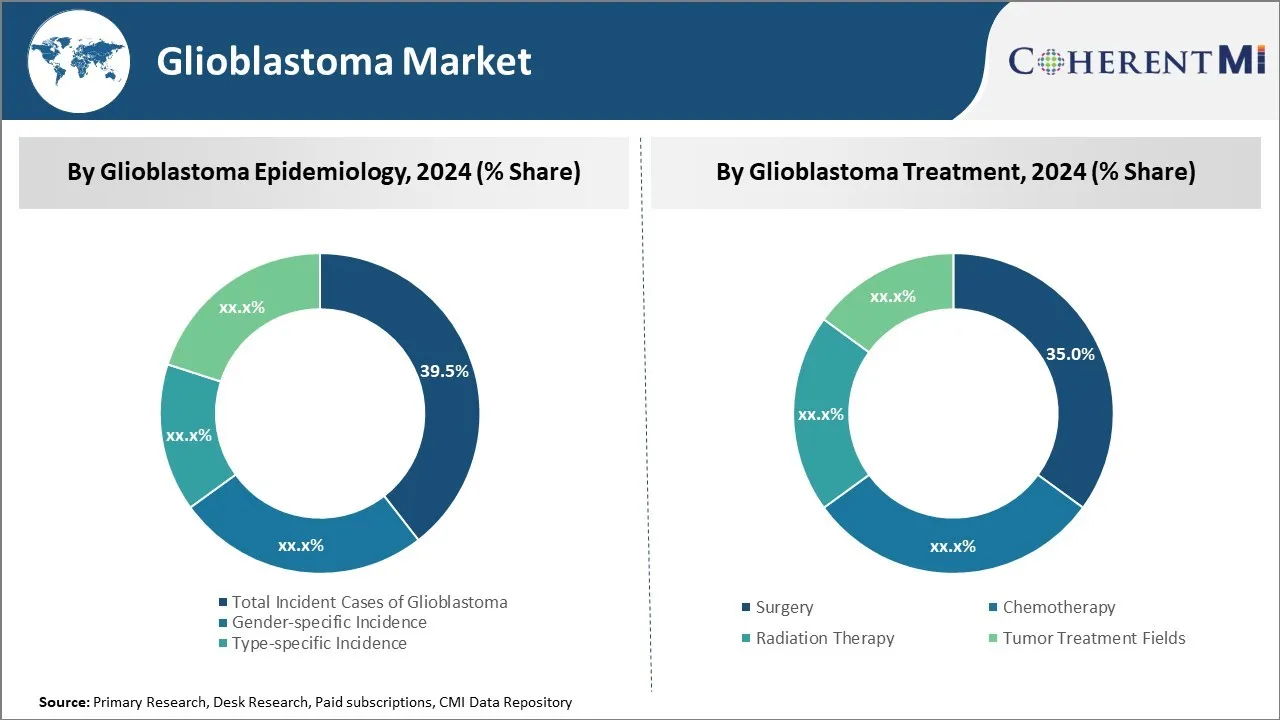

Insights, By Glioblastoma Epidemiology: Increased incidence and prevalence fuel growth in total glioblastoma cases

In terms of glioblastoma epidemiology, total incident cases of glioblastoma sub-segment contributes the highest share of 39.5% in the market owing to rising incidence and prevalence of the disease. Glioblastoma is one of the most common and aggressive forms of brain cancer, with new cases being diagnosed worldwide each year. Several factors have contributed to higher glioblastoma rates in recent decades. Improved diagnostic techniques such as MRI and specialized brain scans have enabled more accurate detection and diagnosis of tumors. Additionally, the global population is aging significantly as life expectancies increase. Glioblastoma occurs predominantly in older adults, with the average age at diagnosis being around 64 years. A growing elderly demographic means a larger pool of individuals are entering the high-risk age groups. Environmental and lifestyle changes over time may also play a role in higher glioblastoma risks. Further research is still needed to fully understand influencing factors.

With current treatments not yet enabling a cure, glioblastoma typically remains a chronic condition patients battle long-term. Even with treatment, the disease often recurs or progresses within months or a few years. This translates to a growing prevalence of glioblastoma patients worldwide who have been diagnosed and are living with the disease. Both rising new diagnoses as well as a sustained prevalence pool fuel ongoing demand for diagnosis and long-term management of the condition, driving the total incident cases segment in the glioblastoma market. As risk factors remain and the population continues aging, total glioblastoma cases are expected to keep rising in the coming years unless scientific breakthroughs change outcomes and alleviate disease burden.

Insights, By Glioblastoma Treatment: Surgery sub-segment dominates treatment due to importance of maximizing resection

In terms of glioblastoma treatment, surgery sub-segment contributes the highest share of 35.2% in the market owing to its vital importance in optimizing patient outcomes and quality of life. Despite the highly invasive nature of glioblastoma, surgical resection with the goal of maximum safe tumor removal remains the standard front-line approach for newly diagnosed patients. More extensive resections that leave only very small residual tumor amounts have been definitively linked to significantly prolonged survival times compared to partial or biopsy-only surgeries. With aggressive tumor behavior, even marginal improvements in controlling the disease through optimized resection can meaningfully extend the time before recurrence or progression. In particular for elderly or frail patients who may not tolerate aggressive chemotherapy or radiation, achieving maximum safe resection takes on heightened significance. Given the current focus of treatment remains palliative rather than curative, surgeons aim to debulk tumors as fully as possible to postpone regrowth and symptom development. The front-line status of surgery reflects its critical role in attaining the best outcomes and quality of life extensions possible for glioblastoma patients through anatomy-preserving yet maximally exhaustive resection.

Additional Insights of Glioblastoma Market

The glioblastoma market is poised for significant growth during the forecast period, driven by the introduction of novel therapies and increasing awareness of the disease's epidemiology. The market is characterized by high unmet needs, especially in terms of treatment effectiveness, as many existing therapies show limited long-term success in managing glioblastoma. New treatment options, such as gene therapy, immunotherapy, and targeted drugs, are being developed to address these challenges.

Competitive overview of Glioblastoma Market

The major players operating in the glioblastoma market include Bayer, Chimerix, Aivita Biomedical, Denovo Biopharma, Northwest Therapeutics, VBL Therapeutics, Laminar Pharmaceuticals, MedImmune, DNAtrix, Immunomic Therapeutics, Imvax, MimiVax, CNS Pharmaceuticals, Epitopoietic Research Corporation (ERC), Istari Oncology, SonALAsense, Kintara Therapeutics, Bristol Myers Squibb, Medicenna Therapeutics, BioMimetix, Eisai, Merck Sharp & Dohme, Kazia Therapeutics, Oblato, Genenta Science, Enterome, Inovio Pharmaceuticals, Karyopharm Therapeutics, Forma Therapeutics, VBI Vaccines, and TME Pharma.

Glioblastoma Market Leaders

- Bayer

- Chimerix

- Aivita Biomedical

- Denovo Biopharma

- Northwest Therapeutics

Glioblastoma Market - Competitive Rivalry

Glioblastoma Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Glioblastoma Market

- In January 2023, VBI Vaccines initiated a Phase I/II clinical trial for its glioblastoma vaccine (VBI-1901), designed to enhance immune response against tumor cells.

- In July 2022, VBL Therapeutics reported promising Phase III trial results for Ofranergene Obadenovec, targeting solid tumors like glioblastoma.

- In August 2021, Diffusion Pharmaceuticals advanced Trans Sodium Crocetinate, showing potential in reoxygenating tumor tissue during treatment.

Glioblastoma Market Segmentation

- By Glioblastoma Epidemiology

- Total Incident Cases of Glioblastoma

- Gender-specific Incidence

- Type-specific Incidence

- Age-specific Incidence

- By Glioblastoma Treatment

- Surgery

- Chemotherapy

- Radiation Therapy

- Tumor Treatment Fields

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How big is the Glioblastoma Market?

The glioblastoma market is estimated to be valued at USD 1.15 Bn in 2024 and is expected to reach USD 27.4 Bn by 2031.

What are the major factors driving the glioblastoma market growth?

The launch of new therapies and drugs for glioblastoma and increasing prevalence of glioblastoma in developed countries are the major factors driving the glioblastoma market.

Which is the leading glioblastoma epidemiology in the glioblastoma market?

The leading glioblastoma epidemiology segment is total incident cases of glioblastoma.

Which are the major players operating in the glioblastoma market?

Bayer, Chimerix, Aivita Biomedical, Denovo Biopharma, Northwest Therapeutics, VBL Therapeutics, Laminar Pharmaceuticals, MedImmune, DNAtrix, Immunomic Therapeutics, Imvax, MimiVax, CNS Pharmaceuticals, Epitopoietic Research Corporation (ERC), Istari Oncology, SonALAsense, Kintara Therapeutics, Bristol Myers Squibb, Medicenna Therapeutics, BioMimetix, Eisai, Merck Sharp & Dohme, Kazia Therapeutics, Oblato, Genenta Science, Enterome, Inovio Pharmaceuticals, Karyopharm Therapeutics, Forma Therapeutics, VBI Vaccines, and TME Pharma are the major players.

What will be the CAGR of the glioblastoma market?

The CAGR of the glioblastoma market is projected to be 13.1% from 2024-2031.

What are the key factors hampering the growth of the glioblastoma market?

The high cost associated with glioblastoma treatments and limited effectiveness of current therapeutic approaches are the major factors hampering the growth of the glioblastoma market.