Global Space Economy Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2023 - 2030)

Global Space Economy Market is Segmented By Type (Satellite Manufacturing & Launching, Ground Stations & Equipment, Space Launch Services, Satellite S....

Global Space Economy Market Size

Market Size in USD Bn

CAGR11.5%

| Study Period | 2023 - 2030 |

| Base Year of Estimation | 2022 |

| CAGR | 11.5% |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | North America |

| Market Concentration | High |

| Major Players | SpaceX, Boeing, Lockheed Martin , Northrop Grumman , Airbus and Among Others. |

please let us know !

Global Space Economy Market Analysis

The Space Economy Market size is expected to be valued at US$ US$ 518.48 billion in 2023 and is expected to reach US$ 1,110.84 billion by 2030, grow at a compound annual growth rate (CAGR) of 11.5% from 2023 to 2030.

Global Space Economy Market Analysis

The space economy encompasses a wide range of space-enabled products and services including satellite manufacturing and launching, ground stations, space launch services, satellite services, space insurance, space tourism, space mining and more. The increasing adoption of space-based services like broadband internet, real-time earth observation, and satellite navigation is driving the growth of the global space economy.

Key drivers include Declining Cost of Space Access, Growth in Commercial Space Industry, Satellite Mega-Constellations,The Space Economy Market is segmented by by type, orbit, end-user, application, payload, and region By Type, the satellite manufacturing & launching segment accounted for the largest share. The increasing deployment of small satellites for remote sensing, communication, and other applications is driving the growth of this segment.

- Declining Cost of Space Access: The cost of accessing space has been declining steadily over the past decade thanks to innovations in rocket and launch technologies. The introduction of reusable rocket systems by private companies has been a game changer, bringing down launch costs by over 50% compared to expendable systems. Reusable systems such as SpaceX's Falcon 9 and Blue Origin's New Shepard have enabled more frequent and affordable launches. The lower launch costs are catalyzing growth across downstream segments of the space economy like satellite manufacturing, space-based services, space tourism etc.

- Growth in Commercial Space Industry: The space sector has witnessed surging private investments and emergence of commercial space companies providing launch vehicles, satellites and space-based services. Companies like SpaceX, Blue Origin, RocketLab, Planet Labs, OneWeb have driven innovation and expanded capabilities in the commercial space domain. The NewSpace companies have increased launch cadence and fostered competition. More companies are now accessing space driven by its potential commercial benefits, further propelling growth of the space economy.

- Satellite Mega-Constellations: Companies have begun deploying large networks of hundreds to thousands of satellites in low and medium earth orbits, called satellite mega-constellations. Examples include SpaceX's Starlink, OneWeb, Amazon's Project Kuiper. These constellations can provide cost-effective global services like high-speed broadband internet connectivity, IoT connectivity and real-time earth observation. The satellite mega-constellations represent a multi-billion dollar revenue opportunity and are a significant driver for the space economy.

- Applications of Space Technology: Advancements in space technology have enabled new applications on earth across sectors like communications, agriculture, maritime, environment monitoring etc. Other applications like space tourism, in-space manufacturing, space resource utilization are also gaining traction. The expanding practical utility of space-based assets across public and commercial domains is a key driver. Integration of space technology into broader economic activities will continue to drive market growth.

Global Space Economy Market Trends

- Private Sector Partnerships: Space agencies like NASA, ESA, JAXA are increasingly entering partnerships with private space companies for missions and technology development. For instance, SpaceX and Boeing were contracted for providing commercial crew transportation to ISS under NASA's CCP program. Such public-private partnerships leverage the capabilities of both entities and foster greater innovation in the space sector. More partnerships models will emerge, benefitting space economy players.

- Space Startups: The space industry has witnessed a surge in new startups in recent years developing new technologies, launch vehicles, satellite constellations and space-based services. The startups are attracting significant venture capital, private equity funding given the strong growth prospects. Space infrastructure and transportation have been key startup focus areas. According to Bryce Tech, space startups raised $25 billion in funding from 2020-2022 reflecting the sector potential.

- Ground Segment Infrastructure: As satellite networks grow, substantial investments are being made to upgrade ground infrastructure including ground stations, data processing facilities and terrestrial connectivity needed to fully leverage space-based capabilities. According to Euroconsult, over $72 billion is forecast to be invested in ground infrastructure over the next decade. The ground segment upgrades provide significant opportunities for a wide range of players from subsystem suppliers to terrestrial network providers.

- Sustainability Practices: With growing debris in orbits from old satellites and rocket bodies posing collision risks, participants across the supply chain are adopting standards and best practices for space sustainability. This includes deorbiting satellites post-mission, avoiding debris release events, limiting deployments in crowded orbits, optimizing satellite designs for demise etc. Adoption of norms like the Space Safety Coalition's Space Sustainability Rating can build confidence among various actors and stakeholders.

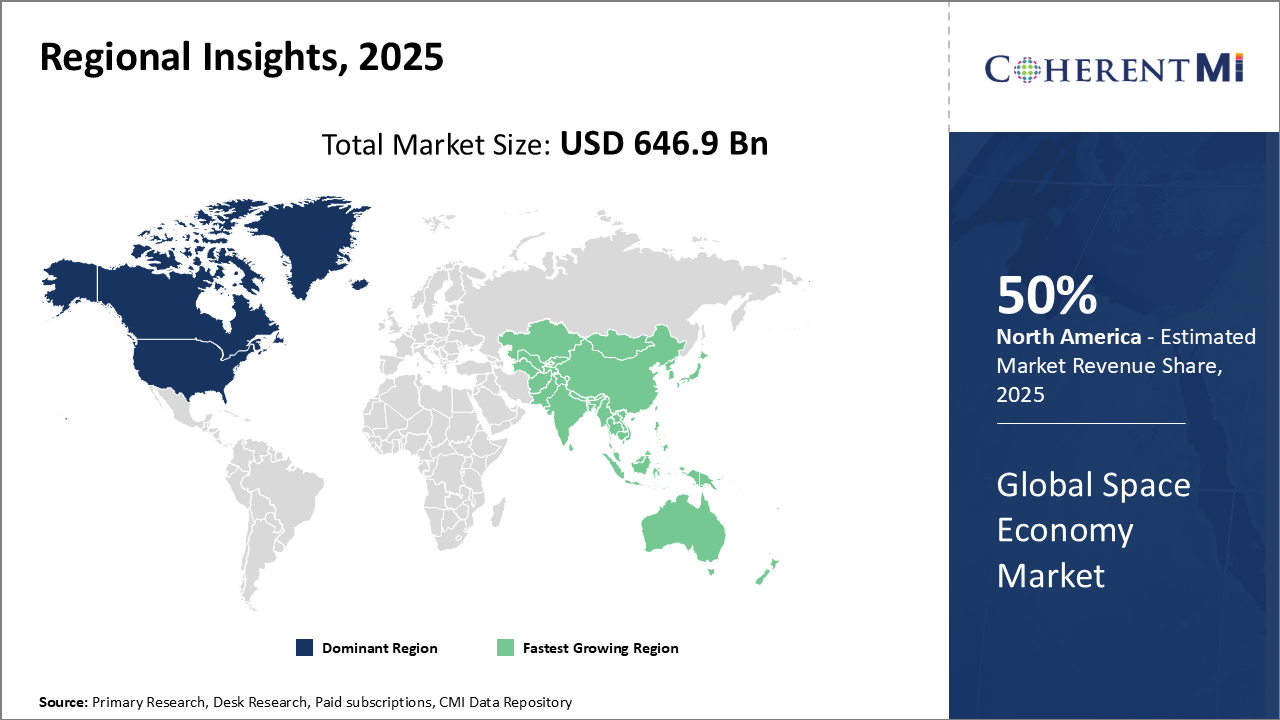

Global Space Economy Market Regional Insights:

- North America: North America is the largest space economy in the world, with a market share of over 50%. This is due to the presence of major space companies such as Boeing, SpaceX, and Lockheed Martin, as well as NASA, the world's leading space agency.

- Europe: Europe is the second-largest space economy in the world, with a market share of around 20%. The European Space Agency (ESA) is a major player in the European space sector, and European companies such as Airbus and Thales are also leading players in the global space industry.

- Asia-Pacific: The Asia-Pacific region is the fastest-growing space economy in the world, with a CAGR of over 10%. This growth is being driven by China, which is rapidly developing its space capabilities. Other countries in the region, such as India, Japan, and South Korea, are also investing heavily in the space sector.

Figure 1. Global Space Economy Market Share (%), By Region, 2023

Competitive overview of Global Space Economy Market

Major Players operating in the Global Space Economy Market SpaceX, Boeing, Lockheed Martin, Northrop Grumman, Airbus, Maxar Technologies, Planet Labs, OneWeb, Rocket Lab, Virgin Orbit, Relativity Space, Blue Origin, Sierra Nevada Corporation, AST & Science, Spire Global, Momentus Space, Firefly Aerospace, Astranis, Redwire, Made in Space

Global Space Economy Market Leaders

- SpaceX

- Boeing

- Lockheed Martin

- Northrop Grumman

- Airbus

Global Space Economy Market - Competitive Rivalry, 2023

Global Space Economy Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Space Economy Market

The space economy, also known as the space industry, refers to all the economic activity related to outer space. This includes a wide range of sectors such as satellite communication, earth observation, space exploration, space tourism, and the manufacturing of spacecraft and related equipment.

This includes the manufacturing of satellites, ground equipment, and launch services, as well as satellite services such as broadcasting, earth observation, and telecommunications.Space exploration and space tourism are also emerging sectors in the space economy. Companies like SpaceX, Blue Origin, and Virgin Galactic are pioneering efforts in these areas, offering commercial space travel and launching missions to explore the moon, Mars, and beyond.

The space economy is expected to continue its growth in the coming years, driven by advancements in technology, increasing investments in space exploration, and the growing commercialization of space activities.

- In September 2022, SpaceX launched its Falcon Heavy rocket carrying satellites for the US Space Force. Falcon Heavy is currently the world’s most powerful operational rocket.

- In March 2022, Rocket Lab successfully launched its Electron rocket carrying a satellite for Hawk Eye 360’s space-based radio frequency monitoring constellation.

Global Space Economy Market Segmentation

- By Type

- Satellite Manufacturing & Launching

- Ground Stations & Equipment

- Space Launch Services

- Satellite Services

- Space Insurance

- Others

- By Orbit

- LEO (Low Earth Orbit)

- MEO (Medium Earth Orbit)

- GEO (Geosynchronous Orbit)

- Beyond GEO

- By End User

- Commercial

- Government & Military

- Consumer

- Others

- By Application

- Communications

- Earth Observation & Remote Sensing

- Technology Development

- Navigation & Space Science

- Others

- By Payload

- Communication

- Imaging

- Navigation

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is Space Economy Market?

The Space Economy market size is expected to be valued at US$ 518.48 Bn in 2023.

What are the key factors hampering growth of the Market?

The regulatory environment and legal considerations related to copyright and intellectual property rights pose challenges for content creators and platforms alike.

What are the major factors driving the growth?

Declining Cost of Space Access, Growth in Commercial Space Industry, Satellite Mega-Constellations, Applications of Space Technology.

Which is the leading component segment in the Market?

The Communication segment accounted for the largest share in 2022.

Which are the major players operating in the Market?

SpaceX, Boeing, Lockheed Martin, Airbus, Northrop Grumman, Maxar Technologies, Planet Labs, OneWeb, Rocket Lab, and Virgin Orbit.

What will be the CAGR of Market?

The CAGR of Market is expected to be 11.5% from 2023-2030.