Homozygous Familial Hypercholesterolemia Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Homozygous Familial Hypercholesterolemia Market is segmented By Drug Type (PCSK9 Inhibitors, Mipomersen, Lomitapide), By Route of Administration (Subc....

Homozygous Familial Hypercholesterolemia Market Size

Market Size in USD Mn

CAGR8.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.2% |

| Market Concentration | High |

| Major Players | Amgen Inc., Sanofi S.A., Regeneron Pharmaceuticals, Inc., Novartis AG, Ionis Pharmaceuticals, Inc. and Among Others. |

please let us know !

Homozygous Familial Hypercholesterolemia Market Analysis

The homozygous familial hypercholesterolemia market is estimated to be valued at USD 541.1 Mn in 2024 and is expected to reach USD 868.9 Mn by 2031, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2031. Innovation in treatment drugs coupled with increasing adoption of lipid apheresis procedures are estimated to drive the market during the forecast period.

Homozygous Familial Hypercholesterolemia Market Trends

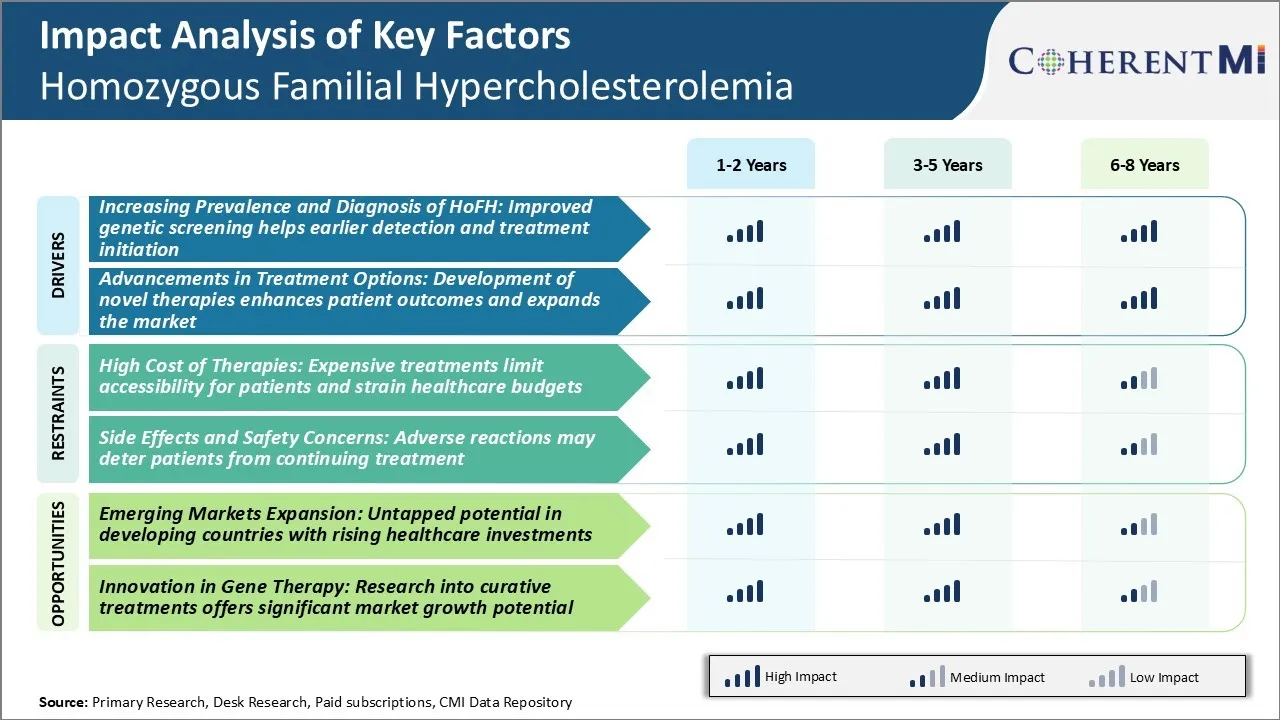

Market Driver - Improved Genetic Screening Helps Earlier Detection and Treatment Initiation

With advancements in genetic screening and diagnostic techniques, the prevalence of Homozygous Familial Hypercholesterolemia (HoFH) is being recognized more commonly. While it was considered an extremely rare disease, we are now able to identify affected individuals at a much earlier stage.

This is allowing for timely interventions that can help slow disease progression and reduce complications. Genetic testing plays a pivotal role here, as it allows for confirmation of diagnoses even in the absence of a family history. Population screening programs and newborn screening initiatives have further fueled the rise in prevalence figures.

Countries are allocating higher healthcare budgets for widespread genetic testing panels. This has significantly improved access to testing and enabled detection of HoFH cases that may have otherwise gone undiagnosed for years. Even minimal delays in diagnosis and treatment can have serious repercussions.

Timely treatment initiation plays a big role in effectively managing cholesterol levels and reducing risks of heart attacks and strokes in patients. With improved understanding of the mutations responsible for HoFH, genetic screening is also aiding researchers develop more personalized treatment plans.

Market Driver - Development of Novel Therapies Enhances Patient Outcomes and Expands the Market

The treatment landscape for HoFH has witnessed dynamic changes over the past few years. Several new drug entities have been approved that provide hitherto unavailable options for patients. These innovative therapies are able to achieve much lower target lipid levels compared to conventional drugs. Some of them even halt progression or induce regression of the condition. They have vastly enhanced long-term prognosis of HoFH patients and lifted the treatment paradigm to a new level.

Pharmaceutical companies have invested heavily in gene therapy research which is bringing promising solutions. These gene-based therapies can address the underlying dysfunction driving cholesterol abnormalities in HoFH. A few candidates have shown immense potential in clinical trials, and subject to regulatory clearances, are expected to be commercially available soon.

Such curative options will be a game changer for patients and possibly reduce dependence on lifelong medications. Development efforts continue at a brisk pace, leading to a robust late-stage pipeline. This indicates the homozygous familial hypercholesterolemia market is likely to be flooded with novel products in the foreseeable future.

Market Challenge - Expensive Treatments Limit Accessibility for Patients and Strain Healthcare Budgets

One of the major challenges currently facing the homozygous familial hypercholesterolemia market is the incredibly high cost of existing therapies. Homozygous FH is an ultra-rare disease, affecting only a few thousand patients globally. However, the lifelong treatments needed to manage the condition and avoid fatal consequences like heart attacks at a young age do not come cheap.

For example, the US list price of the gene therapy recently approved for treatment of HoFH is $2.1 million, making it one of the most expensive drugs in the world. While infusion therapies like PCSK9 inhibitors have annual costs in the range of $250,000-300,000 as well. Such high costs place an enormous strain on healthcare budgets and limit the accessibility of these potentially life-saving treatments for many patients.

Insurers often balk at paying for them due to budgetary constraints. This leaves many HoFH patients without access to optimal care and at risk of early morbidity or mortality. High list prices and lack of affordability thus remain a key obstacle to improving clinical outcomes for HoFH worldwide.

Market Opportunity – Untapped Potential in Developing Countries with Rising Healthcare Investments

Among the opportunities in the homozygous familial hypercholesterolemia market is the potential for expansion into emerging economies. While currently the homozygous familial hypercholesterolemia market is dominated by developed nations in Western Europe and North America, there is huge untapped potential in developing countries.

An estimate from the Global Burden of Disease study projects over 98% of people with FH live in countries with low or middle income. As the economies of nations like China, India, Brazil and others continue to rapidly grow, their healthcare sectors are also receiving higher investments.

This will enhance accessibility and affordability of specialty drugs over time. savvy companies operating in the HoFH space need to have a strategy for these emerging regions. Those who are first to gain approvals and set up availability through innovative access programs will be best placed to tap into future growth opportunities as awareness and standards of care improve globally.

Prescribers preferences of Homozygous Familial Hypercholesterolemia Market

Homozygous Familial Hypercholesterolemia (HoFH) is a rare and severe genetic disorder characterized by extremely high levels of LDL cholesterol from birth. Treatment is focused on aggressively lowering LDL cholesterol through a combination of lifestyle changes and medication.

In early stages, doctors typically prescribe high-intensity statins like atorvastatin (Lipitor) or rosuvastatin (Crestor). However, statins alone often do not lower LDL cholesterol sufficiently in HoFH patients. The next line of treatment involves adding ezetimibe (Zetia) to enhance the LDL-lowering effect of statins.

For patients who fail to achieve adequate response with maximally tolerated statin+ezetimibe therapy, prescribers shift to monoclonal antibody PCSK9 inhibitors. Alirocumab (Praluent) and evolocumab (Repatha) target PCSK9 protein and can reduce LDL cholesterol by 50-70% when used with other drugs.

The final treatment option consists of LDL apheresis and lomitapide (Juxtapid). LDL apheresis is a medical procedure that filters LDL cholesterol from the blood. Lomitapide inhibits production of triglycerides and VLDL, thereby decreasing circulating levels of LDL. Both are typically reserved for severe cases where other options fail or are not tolerated.

Other factors influencing prescriber decisions include patient comorbidities, lifestyle factors, insurance coverage, and long-term adherence/safety data for newer treatment options.

Treatment Option Analysis of Homozygous Familial Hypercholesterolemia Market

Homozygous familial hypercholesterolemia (HoFH) presents in three stages based on severity of symptoms and LDL cholesterol levels.

Stage I occurs in early childhood with LDL levels over 500 mg/dL. Lipid-lowering drugs alone cannot control LDL, so first-line treatment involves LDL apheresis every 2 weeks along with high-intensity statins. This offers the best chance of removing excess LDL from blood before irreversible damage occurs.

Stage II presenting in adolescence sees LDL rise to 800+ mg/dL despite apheresis and maximum statins. Adding ezetimibe helps reduce absorption of dietary cholesterol further. For those with genetic defects inhibiting LDL receptors, PCSK9 inhibitors like evolocumab or alirocumab are life-extenders by preventing PCSK9 from binding LDL receptors.

Stage III is the most severe seen in adults, with pathological changes in arteries and organs. LDL levels exceed 1000 mg/dL despite multiple drug combinations. Adding lomitapide, an oral microsomal triglyceride transfer protein inhibitor, to existing treatment lowers production of LDL and VLDL from the liver. For those with continued high cholesterol and disease progression, liver transplantation may offer the only solution by replacing the organ incapable of clearing LDL from blood. Early and aggressive treatment at each stage aims to prevent cardiovascular events associated with untreated HoFH.

Key winning strategies adopted by key players of Homozygous Familial Hypercholesterolemia Market

Amgen's Repatha:

Amgen launched Repatha (evolocumab) in 2015 as the first PCSK9 inhibitor to treat patients with Homozygous Familial Hypercholesterolemia (HoFH). Repatha led to significantly greater reductions in LDL-C levels compared to standard therapies alone. In pivotal Phase 3 studies, Repatha reduced LDL-C by 51% on average when added to other lipid-lowering therapies in HoFH patients. This meaningful improvement in cholesterol control provided clinicians an important new therapy option, allowing Amgen to capture a sizable share of the HoFH market.

Regulatory Approval for Younger Patients:

In 2019, the FDA approved expanding the label for Repatha to include pediatric patients aged 10 and older with HoFH. This marked the first cholesterol-lowering therapy approved to treat this young patient population. It helped address an important unmet need and strengthen Repatha's leadership position, since achieving good cholesterol control from a young age can have significant long-term health benefits for HoFH patients.

Expanded Access Programs:

Amgen launched multiple expanded access programs that provided Repatha at no cost to eligible patients without insurance or adequate coverage. Such programs helped more HoFH patients access this innovative therapy, establishing Amgen as a leader committed to patient access.

Segmental Analysis of Homozygous Familial Hypercholesterolemia Market

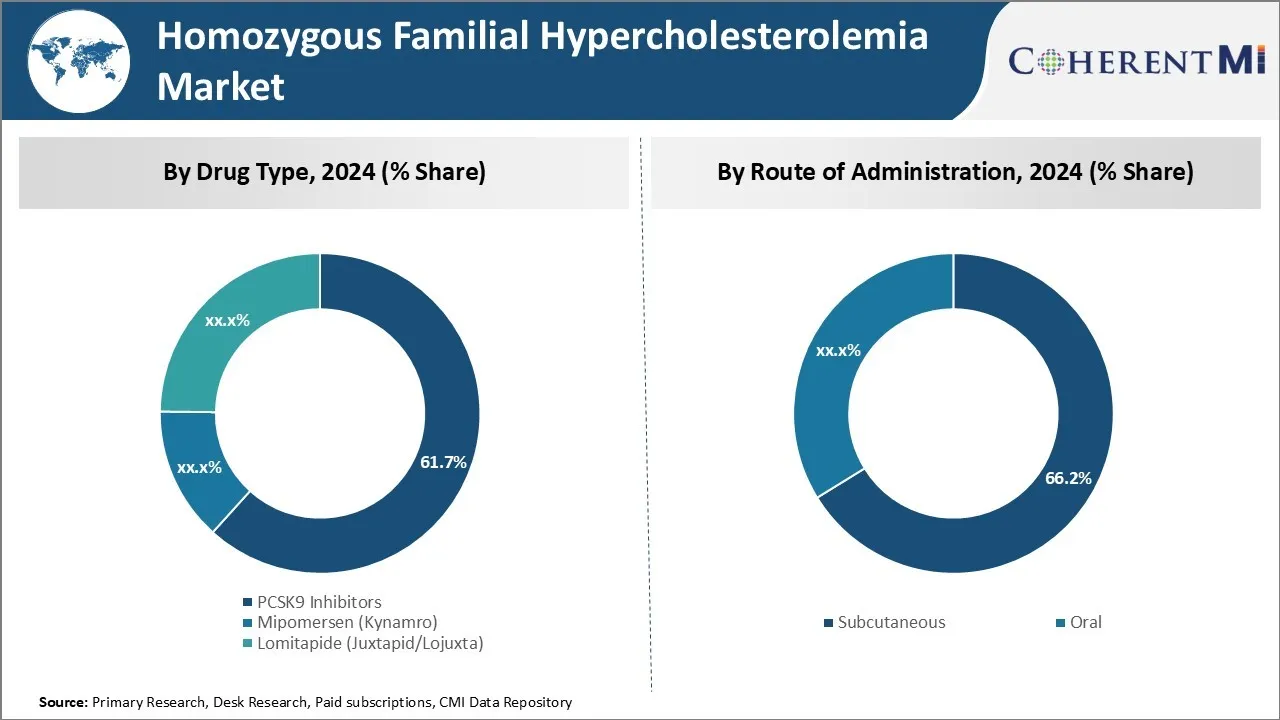

Insights, By Drug Type: Strong Efficacy Drives Dominance of PCSK9 Inhibitors

In terms of drug type, PCSK9 inhibitors are estimated to account for 61.7% share of the homozygous familial hypercholesterolemia market in 2024, owning to their strong efficacy in significantly reducing LDL cholesterol levels. Evolocumab and alirocumab are monoclonal antibody therapies that work by inhibiting PCSK9, a protein that reduces the liver's ability to remove LDL-C from the bloodstream. Clinical trials have found PCSK9 inhibitors can reduce LDL-C by up to 60% when used alone or in combination with other lipid-lowering therapies. This level of LDL-C lowering far exceeds that of other treatment options and leads to a reduced risk of cardiovascular events in patients.

The strong efficacy demonstrated by PCSK9 inhibitors has made them the preferred therapeutic choice for patients with HoFH who struggle to achieve LDL-C goals even when maximizing other lipid-lowering medications and lifestyle changes alone. Physicians are more likely to prescribe PCSK9 inhibitors first-line compared to other options given their superior LDL-C lowering abilities. The typically monthly dosing of subcutaneous injections is also more convenient for patients than daily oral medications. However, the high acquisition costs of PCSK9 inhibitors remain a challenge which has led to reimbursement and access issues in some healthcare systems.

Insights, By Route of Administration: Dominance of Subcutaneous Route Reflects Convenience

In terms of route of administration, subcutaneous routes of administration are projected to hold 66.2% share of the market in 2024, driven by its convenience compared to other options. All currently approved PCSK9 inhibitors are administered as subcutaneous injections on a monthly basis.

The subcutaneous route avoids the challenges of daily oral dosing required by some other lipid-lowering therapies. It is more convenient for patients to receive treatment via monthly injections rather than having to remember to take a pill every day. This convenience increases patient adherence to the prescribed treatment regimen.

Physicians also prefer to prescribe subcutaneous therapies because the route makes it easy to monitor treatment response and assess patient compliance. Missing an occasional dose of an injection is less likely to negatively impact treatment compared to missing oral pills.

Self-administration or administration by a friend/family member is usually straightforward for subcutaneous injections as well. The dominance of Subcutaneous is therefore expected to continue as a result of its convenience advantage over other administration routes like oral medications in the HoFH market.

Insights, By Distribution Channel: Hospital Pharmacies Dominate Distribution

In terms of distribution channel, hospital pharmacies contribute the highest share of the market. Patients with HoFH have severe cases that require specialized care management often provided in hospital settings. Most physicians will centrally coordinate a HoFH patient's lipid-lowering treatment through a hospital pharmacy due to the complexity of the condition and its treatment. Hospital pharmacies have the expertise and resources to properly store, handle, and dispense complex biologic therapies like PCSK9 inhibitors that dominate the HoFH market.

Many private insurers and public drug plans also have policies that require or incentivize HoFH patients to obtain their prescribed medications from hospital pharmacies rather than retail. This helps improve medication access and adherence through integrated care. Retail pharmacies and online pharmacies have more limited involvement in HoFH given the severe nature of the patient population and specialized treatment approach commonly occurring in hospitals. As a result, hospital pharmacies maintain the highest share in the distribution of therapies for this rare condition.

Additional Insights of Homozygous Familial Hypercholesterolemia Market

- Global Prevalence: HoFH affects approximately 1 in 300,000 individuals worldwide, but prevalence may be higher due to underdiagnosis.

- The US accounts for 47% of diagnosed cases of HoFH in the 7MM.

- Statins account for a major portion of the first-line treatment for HoFH, but many patients remain at risk of cardiovascular events despite treatment.

- Impact of Early Treatment: Initiating therapy at a young age can reduce the risk of cardiovascular events by up to 80%, highlighting the importance of early detection.

- Regulatory Approvals: The FDA granted Breakthrough Therapy Designation to a novel gene therapy for HoFH, expediting its development and review process.

Competitive overview of Homozygous Familial Hypercholesterolemia Market

The major players operating in the Homozygous Familial Hypercholesterolemia Market include Amgen Inc., Sanofi S.A., Regeneron Pharmaceuticals, Inc., Novartis AG, and Ionis Pharmaceuticals, Inc.

Homozygous Familial Hypercholesterolemia Market Leaders

- Amgen Inc.

- Sanofi S.A.

- Regeneron Pharmaceuticals, Inc.

- Novartis AG

- Ionis Pharmaceuticals, Inc.

Homozygous Familial Hypercholesterolemia Market - Competitive Rivalry, 2024

Homozygous Familial Hypercholesterolemia Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Homozygous Familial Hypercholesterolemia Market

- In July 2023, Novartis announced a collaboration with a biotech firm to develop a gene therapy for HoFH. The company also announced several high-profile collaborations related to gene therapies, particularly with Voyager Therapeutics, focusing on neurological diseases like Huntington's disease and spinal muscular atrophy (SMA), leveraging Voyager's TRACER™ capsid discovery platform. These partnerships aimed to advance gene therapies for severe neurologic conditions using innovative delivery technologies.

- In March 2023, Amgen Inc. launched a new formulation of Evolocumab (Repatha) with an easier administration method, improving patient adherence and expanding its market share. Amgen has been actively promoting the existing delivery devices for Repatha, such as the SureClick® autoinjector and the Pushtronex® system. These devices provide convenient methods for administering Repatha, aiming to improve patient adherence. The SureClick® autoinjector allows a single subcutaneous injection every two weeks, while the Pushtronex® system offers once-a-month administration.

- In April 2023, Chiesi Farmaceutici completed the acquisition of Amryt Pharma, expanding its rare disease portfolio. This acquisition includes the integration of JUXTAPID (known as Lojuxta in Europe), a microsomal triglyceride transfer protein (MTP) inhibitor used to treat homozygous familial hypercholesterolemia (HoFH). The deal is valued at up to $1.48 billion and positions Chiesi to strengthen its market presence in the treatment of rare diseases. The addition of JUXTAPID impacts the MTP inhibitor market as it expands Chiesi's offering in lipid management for rare conditions.

Homozygous Familial Hypercholesterolemia Market Segmentation

- By Drug Type

- PCSK9 Inhibitors

- Evolocumab (Repatha)

- Alirocumab (Praluent)

- Mipomersen (Kynamro)

- Lomitapide (Juxtapid/Lojuxta)

- PCSK9 Inhibitors

- By Route of Administration

- Subcutaneous

- Injectable Medications

- Oral

- Capsules

- Tablets

- Subcutaneous

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the homozygous familial hypercholesterolemia market?

The homozygous familial hypercholesterolemia market is estimated to be valued at USD 541.1 Mn in 2024 and is expected to reach USD 868.9 Mn by 2031.

What are the key factors hampering the growth of the homozygous familial hypercholesterolemia market?

Expensive treatments limit accessibility for patients and strain healthcare budgets. Furthermore, side effects and safety concerns associated with adverse reactions may deter patients from continuing treatment. These are the major factors hampering the growth of the homozygous familial hypercholesterolemia market.

What are the major factors driving the homozygous familial hypercholesterolemia market growth?

Improved genetic screening helps earlier detection and treatment initiation for HoFH. Also, advancements in treatment options and development of novel therapies enhance patient outcomes and expands the market. These are the major factors driving the homozygous familial hypercholesterolemia market.

Which is the leading drug type in the homozygous familial hypercholesterolemia market?

The leading drug type segment is PCSK9 inhibitors.

Which are the major players operating in the homozygous familial hypercholesterolemia market?

Amgen Inc., Sanofi S.A., Regeneron Pharmaceuticals, Inc., Novartis AG, and Ionis Pharmaceuticals, Inc. are the major players.

What will be the CAGR of the homozygous familial hypercholesterolemia market?

The CAGR of the homozygous familial hypercholesterolemia market is projected to be 8.2% from 2024-2031.