Kenya Carbon Credit Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Kenya Carbon Credit Market is Segmented By Sector (Energy, Transportation, Residential and Commercial Buildings, Industrial, Agriculture, Forestry, Wa....

Kenya Carbon Credit Market Size

Market Size in USD Mn

CAGR32.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 32.2% |

| Market Concentration | Medium |

| Major Players | WGL Holdings, Inc, Enking International, Green Mountain Energy, Native Energy, Cool Effect, Inc. and Among Others. |

please let us know !

Kenya Carbon Credit Market Analysis

The Kenya Carbon Credit Market is estimated to be valued at USD 475.7 Mn in 2024 and is expected to reach USD 3,448.6 Mn by 2031, growing at a CAGR of 32.2% from 2024 to 2031. This is mainly due to support from the government in incentivizing carbon reduction programs and growing international demand for carbon offsets.

Kenya Carbon Credit Market Trends

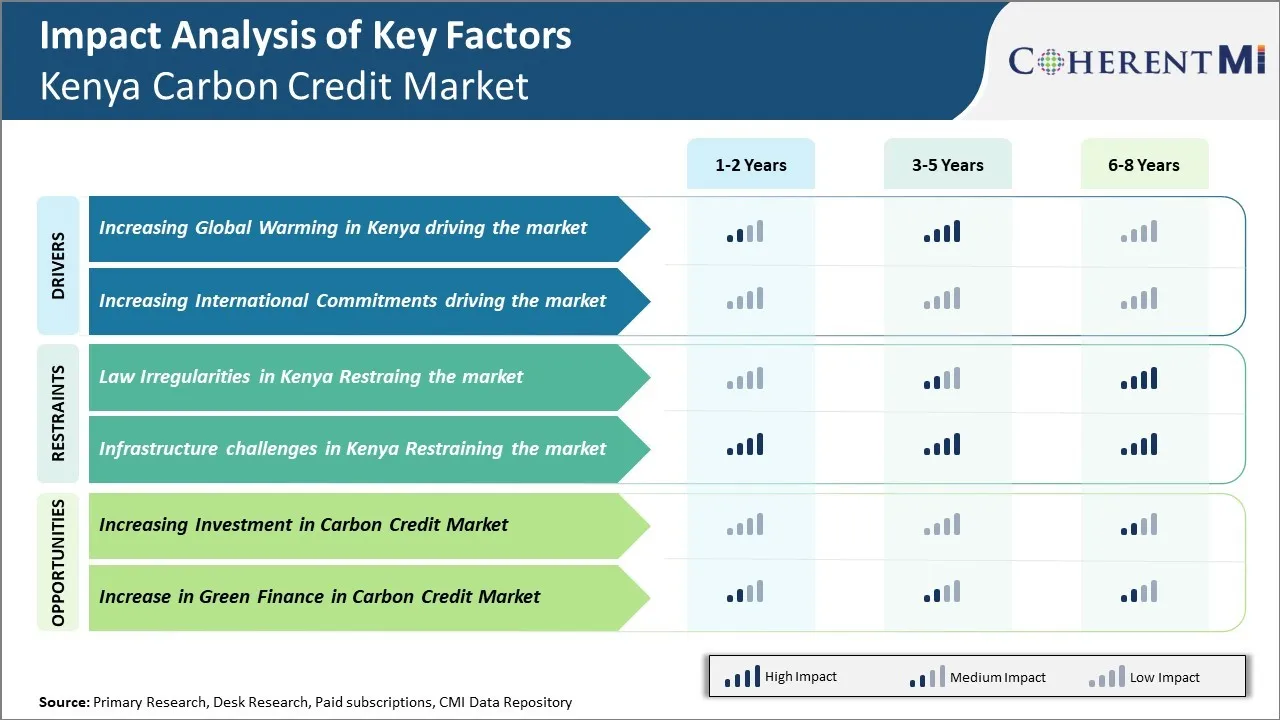

Market Driver – Increasing Global Warming in Kenya

Increasing temperatures and changing precipitation patterns due to global warming are severely impacting Kenya's economy and environment. As per the Kenya National Climate Change Action Plan 2018-2022, the average temperature in Kenya has increased by 1°C over the past few decades and is projected to increase by an additional 0.5-1.5°C by 2050. This warming climate has led to increased intensity and frequency of droughts and reduced agricultural yields across the country.

The impacts of climate change threaten Kenya's development goals as the economy is highly dependent on climate sensitive sectors like agriculture, tourism and forestry. As reported in the United Nations Environment Programme's 2021 Adaptation Gap Report, crop failure due to droughts cost Kenya about $2.2 billion each year which is equivalent to over 2% of the country's GDP. With devastation set to worsen in the coming decades, the government of Kenya is looking to reduce emissions and boost resilience through innovative policies and projects.

Carbon credits from emission reduction initiatives present an effective way to cut carbon footprint as well as generate additional income.

Market Driver – Increasing International Commitments

Kenya has seen significant growth in its carbon credit market over the past few years due to rising global commitments to reduce greenhouse gas emissions. As many developed nations pledge to become carbon neutral by 2050, there is growing demand for high-quality carbon offsets that support climate projects in Africa. Kenya is well-positioned to capitalize on this demand thanks to its high potential for renewable energy and forestation initiatives that remove carbon from the atmosphere.

Several major international commitments are fueling carbon credit projects across Kenya. The European Union's Green Deal aims to cut EU emissions 55% by 2030, driving European companies to purchase foreign carbon offsets. Similarly, China's pledge to become carbon neutral by 2060 opens up a huge compliance market for credits from countries like Kenya. As the costs of transitioning to greener economies rise in developed nations, the incentives to invest in high-impact projects abroad will only increase. Kenya has also prioritized low-carbon development initiatives through its Climate Change Action Plan, making the country an attractive partner in meeting global climate goals.

Market Challenge – Law Irregularities in Kenya

Kenya has great potential to develop a robust carbon credit market due to its vast natural wealth and commitment to reduce greenhouse gas emissions. However, unclear and inconsistent laws regarding carbon rights and benefit-sharing are significantly hampering the growth of this important market. Currently, there is ambiguity around who legally owns the carbon stored in forests, grasslands, and other natural sinks. Since rural communities depend on these areas, they expect compensation for any carbon credits generated. But large corporations are also interested in investing in conservation projects to generate tradeable credits. Without clear laws establishing carbon rights, long-term deals between local communities and investors cannot materialize, discouraging much-needed private sector funding.

This legal uncertainty is already impacting local livelihoods and conservation efforts. In western Kenya, plans to conserve over 5000 hectares of forest were halted when conflicts arose between nearby communities and the project developer over who had rights over stored carbon. As a result, valuable carbon remained unmonitored and at risk of release into the atmosphere due to logging or land-use change.

Market Opportunity – Increasing Investment in Carbon Credit Market

Increasing investment in carbon credit market presents a huge opportunity for Kenya's market to expand in a sustainable manner. As one of the most vulnerable nations to climate change impacts like prolonged droughts and flooding, Kenya has demonstrated strong leadership in voluntarily committing to reduce its greenhouse gas emissions through sustainable development initiatives. Investing in large-scale forestry projects, efficient cookstoves programs and renewable energy sector can help the country meets its climate targets while benefiting local communities financially.

When investors support such carbon offsetting projects by buying verified carbon credits, it provides crucial capital for further expansion of these green programs. More funding means more people gaining access to clean cooking solutions and electricity from wind and solar. It also allows planting of more indigenous trees which helps carbon sequestration while making the environment more resilient. As per the UN Environment Programme, Kenya managed to mitigate over 1.5 million tons of carbon emissions between 2017-2020 through various offset projects funded by international carbon credit buyers. Some of these projects also improved livelihoods of thousands of smallholder farmers through income from sustainable agricultural practices.

Segmental Analysis of Kenya Carbon Credit Market

Insights, By Sector: Transition Towards Clean Energy Sources

In terms of sector, energy sub-segment contributes the highest share of 25.8% in the market, owing to transition towards clean energy sources. Kenya has ambitious targets to increase its renewable energy capacity and recent policy pushes have accelerated the adoption of solar and wind power across the nation.

A key driver is the need to curb carbon emissions from conventional power plants and reduce Kenya’s dependence on imported fossil fuels. According to the latest national grid expansion plan, over 50% of installed capacity is expected to come from solar, wind, geothermal and small hydro by 2030. This focus on developing indigenous renewable resources has spurred growth in carbon offsetting projects in areas like utility-scale solar parks and wind farms. Financial support through mechanisms like carbon credits provides crucial funding support for these large infrastructure ventures.

Furthermore, measures to promote off-grid renewable solutions have increased carbon credit opportunities in distributed solar projects. The last mile electrification strategy relies heavily on both commercial and domestic solar applications, especially in rural areas not connected to the main inter-connect. Carbon revenues help strengthen the business case for smaller renewable energy installations that power homes, agriculture and local businesses.

Competitive overview of Kenya Carbon Credit Market

The major players operating in the Kenya Carbon Credit Market include WGL Holdings, Inc, Enking International, Green Mountain Energy, Native Energy, Cool Effect, Inc., Sustainable Travel International, 3 Degrees, Terrapass, and Sterling Planet, Inc.

Kenya Carbon Credit Market Leaders

- WGL Holdings, Inc

- Enking International

- Green Mountain Energy

- Native Energy

- Cool Effect, Inc.

Kenya Carbon Credit Market - Competitive Rivalry, 2024

Kenya Carbon Credit Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Kenya Carbon Credit Market

- In April 2021, Cool Effect launched Digital Toolkit, in order to promote adoption of climate change effects during Earth Month (April).

- In September 2020, Arzee International, a U.S.-based clothing manufacturing company entered into a partnership with Cool Effect, in order to contribute Cool Effect's carbon reduction projects across the globe.

Kenya Carbon Credit Market Segmentation

- By Sector

- Energy

- Transportation

- Residential and Commercial Buildings

- Industrial

- Agriculture

- Forestry

- Water and Wastewater

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Kenya Carbon Credit Market?

The law irregularities in Kenya are a major factor hampering the growth of the Kenya Carbon Credit Market.

What are the major factors driving the Kenya Carbon Credit Market growth?

The increasing global warming in Kenya is a major factor driving the Kenya Carbon Credit Market growth.

Which is the leading Sector in the Kenya Carbon Credit Market?

The leading Sector segment is Energy.

Which are the major players operating in the Kenya Carbon Credit Market?

WGL Holdings, Inc, Enking International, Green Mountain Energy, Native Energy, Cool Effect, Inc., Sustainable Travel International, 3 Degrees, Terrapass, and Sterling Planet, Inc. are the major players.

What will be the CAGR of the Kenya Carbon Credit Market?

The CAGR of the Kenya Carbon Credit Market is projected to be 32.2% from 2025-2031.