Lactose Intolerance Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Lactose Intolerance Market is segmented By Product Type (Lactose-free Dairy Products, Lactase Supplements, Non-dairy Alternatives), By End User (Adult....

Lactose Intolerance Market Size

Market Size in USD Bn

CAGR6.24%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.24% |

| Market Concentration | High |

| Major Players | Labcorp, Quest Diagnostics, Abbott Laboratories, Thermo Fisher Scientific Inc., Alfa Scientific Designs, Inc. and Among Others. |

please let us know !

Lactose Intolerance Market Analysis

The Global Lactose Intolerance Market is estimated to be valued at USD 10.83 Bn in 2024 and is expected to reach USD 16.51 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.24% from 2024 to 2031.

The market is expected to witness significant growth during the forecast period. The rising awareness regarding lactose intolerance and increasing consumption of lactose-free food products are major factors expected to drive the growth of this market. According to recent studies, about 75% of the global population has a reduced ability to digest lactose after infancy. Also, due to growing health concerns and changing dietary preferences, the demand for dairy and bakery alternatives are gaining widespread popularity globally. Most of the leading food companies have launched new lactose-free products catering to this large consumer base which is further supplementing the market growth. However, high prices of premium lactose-free products compared to regular food items may hamper the market expansion to some extent over the forecast period.

Lactose Intolerance Market Trends

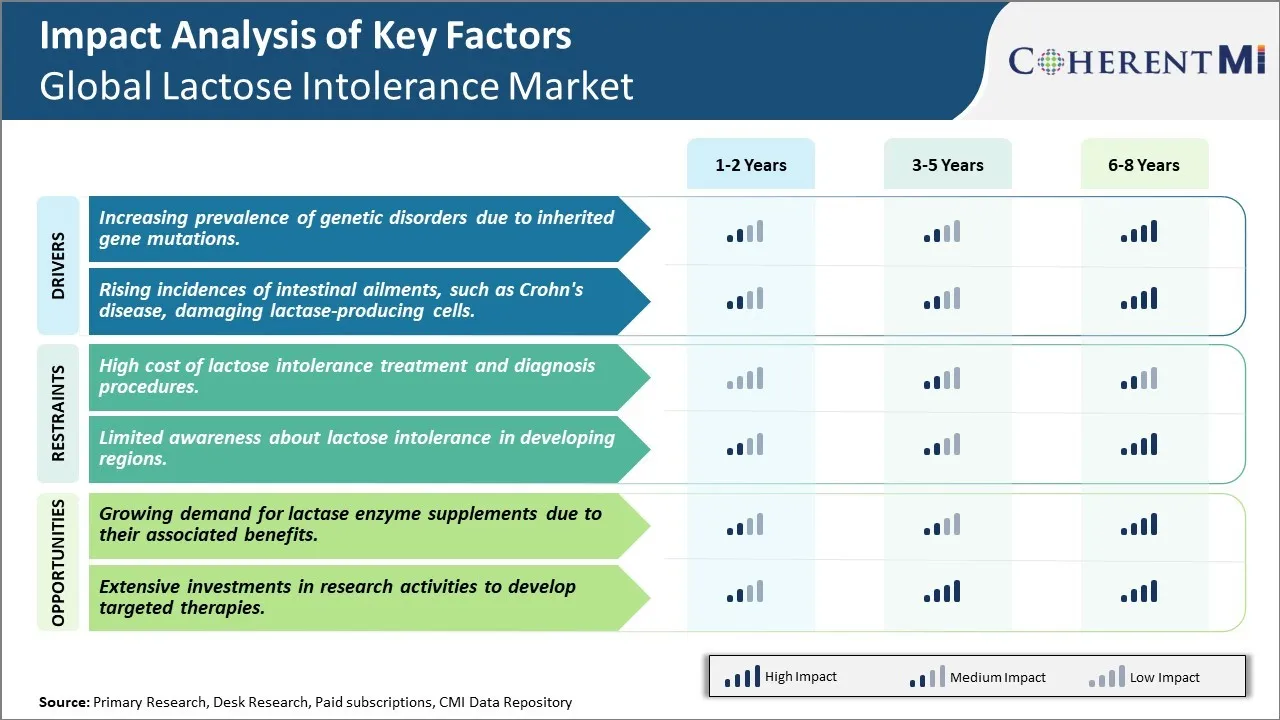

Market Driver - Increasing prevalence of genetic disorders due to inherited gene mutations.

The global lactose intolerance market is expected to grow significantly owing to the rising incidences of genetic disorders that damage lactase production. Lactase, an enzyme produced by the small intestine, is responsible for breaking down lactose found in dairy products. However, several genetic mutations can impair the production of lactase which eventually leads to lactose malabsorption and eventually lactose intolerance. Primary lactose intolerance, which usually develops in late childhood or adolescence, is a hereditary condition wherein the body does not produce enough lactase after weaning. Such genetic mutations are commonly found in populations with roots in Asia, Africa, the Mediterranean, and South America. As more people from these regions migrate to new locations, there is an increasing chance of such genetic mutations getting passed on to newer generations, thus raising the overall prevalence of lactose intolerance. Besides, modern lifestyle changes like increased consumption of processed foods high in sugar and carbohydrates are also putting more people at the risk of type 2 diabetes, non-alcoholic fatty liver disease and obesity—conditions that may worsen the symptoms of lactose intolerance. Hence, the growing incidence of genetic disorders attributable to various gene mutations is significantly fuelling demand for lactose-free dairy products and supplements.

Market Driver- Rising Incidences of Intestinal Ailments

Another key factor propelling the global lactose intolerance market is the surging cases of intestinal disorders like Crohn's disease. Crohn's disease is a type of inflammatory bowel disease (IBD) that can cause irritation and damage the small intestine. The inflammatory episodes associated with Crohn's disease may chronically affect the villi containing lactase-producing cells in the small intestine. This continual damage to the lining of the small intestine over time can impair or reduce the production of lactase enzyme. The precise cause of Crohn's disease is still unknown but it is believed to have genetic and environmental components. With changing lifestyles and diets, there has been a notable rise in the incidences of Crohn's disease worldwide in the last few decades. The rise has been more prominent in developed nations due to widespread adoption of Western diets typically high in refined carbohydrates and sugar. As more people develop Crohn's disease or other intestinal disorders damaging the lactase cells, their ability to digest lactose gets hampered, thereby increasing the risk of lactose intolerance. This rising prevalence of intestinal ailments is expected to drive significant demand for lactose-free products among affected consumers. Dieticians also often recommend low-lactose or lactose-free diets to Crohn's disease patients experiencing lactose intolerance symptoms post-flare in order to minimize abdominal discomfort.

Market Challenge - High cost of lactose intolerance treatment and diagnosis procedures.

One of the major challenges faced by the global lactose intolerance market is the high cost associated with treatment and diagnosis procedures. Many people suffering from lactose intolerance abstains from seeking medical help due to the steep costs involved. Diagnosing lactose intolerance requires tests like the hydrogen breath test or genetic testing, both of which are expensive. Similarly, treatment options like enzyme replacement therapy require lifelong medication intake which adds to the overall treatment cost. This poses affordability challenges, especially in developing regions where access to healthcare is limited. Moreover, lack of proper diagnosis prevents people from following an appropriate diet change or medication regimen on time. This results in worsening of symptoms and can even cause serious complications in rare cases. The high costs associated with lactose intolerance management limits its overall demand and impact the market's growth potential negatively.

Market Opportunity- Growing Demand for Lactase Enzyme Supplements

One major opportunity for the global lactose intolerance market lies in the growing demand for lactase enzyme supplements. These supplements are gaining popularity due to their associated benefits such as allowing consumption of dairy products, addressing digestive issues and enabling a balanced diet. Intake of lactase enzyme supplements before consuming lactose-containing foods helps break down the lactose into simpler sugars, thereby preventing symptoms. This makes them a convenient treatment option for lactose intolerant individuals. With rising health awareness, more people are opting for enzyme supplements as a safe and effective means to manage their condition. Manufacturers are launching diverse product ranges of lactase enzyme supplements including chewable tablets and liquids to suit various consumer needs. The market is witnessing increasing sales of such supplements, aided by strong online distribution networks. This growing demand can drive higher revenues for players in the global lactose intolerance market.

Prescribers preferences of Lactose Intolerance Market

Lactose intolerance is typically treated via a step-wise approach depending on the severity of symptoms. For mild cases, lifestyle modifications are usually the first line of treatment. This involves reducing or eliminating dairy from the diet. If symptoms persist, an over-the-counter (OTC) lactase enzyme supplement may be recommended to help digest lactose in dairy products. Popular brand names include Lactaid and Dairy Ease.

For moderate symptoms, prescribers may suggest a prescription-strength lactase enzyme drug. Prescribers commonly prescribe Lactase-S (lactase) by Novartis, available as delayed-release capsules in 3000/5ml unit doses. Taking it before meals can help manage occasional indulgences in dairy. For severe cases where symptoms are debilitating, a lactose-free diet may be necessary long-term. Soy, almond, oat, or coconut milk alternatives can replace dairy.

Other factors like a patient's dietary habits and preferences also guide treatment selections. Younger patients may preferTrying OTC options first to maintain social interactions. Older individuals with metabolic disorders tend to opt for prescription medications to minimize complications. Overall, prescribers tailor their recommendations to each patient's profile and priorities to effectively relieve lactose intolerance.

Treatment Option Analysis of Lactose Intolerance Market

Lactose intolerance is a digestive disorder caused by a lactase deficiency, leading to symptoms like bloating, gas, and diarrhea when consuming dairy. Treatment varies based on the severity of the condition. For mild cases, small amounts of dairy can be consumed with the help of lactase supplements and lactose-reduced products. Moderate intolerance requires further limiting dairy intake, opting for lactose-free alternatives, and using enzyme supplements. In severe cases, strict avoidance of dairy, reliance on lactose-free products, and high-dose lactase supplements are necessary to manage symptoms effectively. The appropriate treatment plan depends on the individual's level of intolerance.

Key winning strategies adopted by key players of Lactose Intolerance Market

Innovation of lactose-free and low-lactose products- Major dairy players have introduced extensive lines of lactose-free and low-lactose dairy products to cater to the growing number of lactose intolerant consumers. For example, in 2015, Lactalis launched its first lactose-free milk under the President brand in the US market. Around the same time, Danone launched Activia dairy drinks with low levels of lactose.

Acquisitions to expand product portfolio- Players have made strategic acquisitions of companies with established lactose-free products. For example, in 2018, Lactalis acquired Erber Group's dairy business which included well-known lactose-free brands like Provamel and Pharmaton. This strengthened Lactalis' position in the lactose-free space. Similarly, in 2013 Dean Foods acquired Alpro, a Belgian producer of plant-based foods including soy, rice, almond and oat drinks.

Diversification into non-dairy alternatives- Given the rise of veganism and plant-based trends, large players like Danone, Chobani and Kite Hill have introduced dairy-free milk made from almonds, coconuts and oats. For example, Danone's Alpro brand is a market leader in plant-based products across Europe. Their early entry and wide range of alternatives has helped capture a large consumer base.

The above strategies have worked well for major players. Innovation helped expand addressable market and cater to new consumers. Acquisitions strengthened product portfolios, while diversification has further driven growth.

Segmental Analysis of Lactose Intolerance Market

Insights, By Product Type - "Changing Consumer Preferences towards Lactose-free Food Products"

In terms of By Product Type, Lactose-free Dairy Products contributes the highest share of the market with 41.2% in 2024 owning to changing consumer preferences towards lactose-free food products. As the number of people suffering from lactose intolerance is rising globally, consumers are increasingly demanding dairy products that are easy to digest. Lactose-free dairy items allow consumers to enjoy the nutritional benefits of dairy without suffering from symptoms of lactose intolerance such as stomach cramps, bloating and diarrhea. Besides taste and convenience factors, rising health awareness about the advantages of lactose-free dairy in managing lactose intolerance is driving up their popularity. Growing vegan and flexitarian trends have also boosted demand for lactose-free milk, cheese and yogurt in recent years. Manufacturers are responding to these consumer needs by regularly introducing new lactose-free innovations in traditional as well as exotic dairy flavors. Increased product availability in mainstream supermarkets and online retail channels have further enhanced accessibility.

Insights By End User - "High Occurrence Rate Among Adult Population"

In terms of By End User, Adults contributes the highest share of the market with 42.9% in 2024 owing to the high occurrence rate of lactose intolerance among the adult population. As people grow older, the ability to digest lactose decreases due to a decline in lactase enzyme levels. Nearly 70% of the global population is estimated to have low levels of lactase after childhood. Symptoms are also known to worsen with age. This makes lactose-containing foods tough to tolerate for most adults. Furthermore, health issues like irritable bowel syndrome and inflammatory bowel diseases that often coincide with lactose malabsorption are more prevalent in adults. As a result, there is heightened awareness and need for lactose avoidance alternatives among working professionals and older consumers. This drives their higher consumption of lactose-free products designed to suit the dietary requirements of adult end users.

Insights By Distribution Channel - "Growing Retailer Focus on Specialty Health Products"

In terms of By Distribution Channel, Supermarkets/Hypermarkets contributes the highest share with 43.1% in 2024 owing to the growing focus of retailers on stocking specialty health products. With wider medical acceptance of the link between diet and gastrointestinal disorders, major retail chains are dedicating more shelf space to customized gut health products. Supermarkets find it lucrative to house comprehensive selections of lactose-free items under one roof to attract customers looking for specific solutions. Their widespread store presence enables convenient access for consumers across geographical locations. Furthermore, the ability to offer competitive pricing, promotions and private labels have made supermarkets a preferred shopping destination over specialty stores. Rising health-conscious demographics are also frequent superstore shoppers, driving greater sales volumes through their distribution channels. This retailing dominance is anticipated to continue reinforcing consumer reliance on supermarkets for all their lactose intolerance needs.

Additional Insights of Lactose Intolerance Market

The lactose intolerance market is poised for significant growth due to rising genetic disorders and intestinal diseases leading to lactose malabsorption. The increasing awareness and adoption of lactase enzyme supplements, coupled with innovations in treatment options, are driving market expansion. Furthermore, the market's growth is supported by advancements in diagnostic techniques, enabling early detection and management of lactose intolerance. However, challenges such as high treatment costs and limited awareness in developing regions may hinder market growth. Despite these challenges, opportunities abound, particularly in research and development of personalized therapies and expanding access to lactose intolerance treatments in emerging markets. The market is expected to remain dynamic, with continuous evolution in treatment protocols and product offerings to cater to the diverse needs of lactose-intolerant individuals.

Competitive overview of Lactose Intolerance Market

The major players operating in the Global Lactose Intolerance Market include OraSure Technologies Inc., Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, MPD Inc., Shimadzu Corporation, Lifeloc Technologies, Inc., Drägerwerk AG & Co. KGaA, Premier Biotech, Inc., Omega Laboratories, Inc., Psychemedics Corporation, Clinical Reference Laboratory, Inc., American Bio Medica Corporation, ACM Global Laboratories, CareHealth America Corp and Intoximeters, Inc.

Lactose Intolerance Market Leaders

- Labcorp

- Quest Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Alfa Scientific Designs, Inc.

Lactose Intolerance Market - Competitive Rivalry, 2024

Lactose Intolerance Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Lactose Intolerance Market

- On April 2024, Prairie Farms Dairy has launched four new lactose-free dairy products, including whole and 2% milk in gallon sizes, along with cottage cheese and sour cream in 16-ounce tubs. CEO Matt McClelland emphasized that this launch aims to normalize the lactose-free category by making it more affordable and accessible, particularly with the introduction of family-size gallon options—a first in the industry.

- On February 2024 Novartis announced that Xolair (omalizumab) was approved by the US FDA to reduce allergic reactions in patients with IgE-mediated food allergies. This development significantly impacts the market by providing a new treatment option for managing lactose intolerance symptoms associated with food allergies.

- On February 2024, Perfect Day, a leader in precision fermentation, has teamed up with Unilever's Breyers to launch Breyers Lact,ose-Free Chocolate. Made with Perfect Day's dairy protein created through precision fermentation, this new product offers the same classic taste without lactose and with a reduced environmental impact. The 48-ounce tub is now available nationwide.

- On November 2022, Cerrato Cheeses has introduced Cerrato Provita Lactose Free, a new cheese designed for health-conscious consumers, particularly those who are lactose-intolerant. Developed by their R&D&I department, this cheese features a high probiotic content, reduced fat and salt, and advanced lactobacilli and natural ferments.

Lactose Intolerance Market Segmentation

- By Product Type

- Lactose-free Dairy Products

- Lactase Supplements

- Non-dairy Alternatives

- By End User

- Adults

- Children

- Infants

- By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail

- Health Food Stores

- Pharmacies

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Global Lactose Intolerance Market?

The high cost of lactose intolerance treatment and diagnosis procedures. and limited awareness about lactose intolerance in developing regions. are the major factor hampering the growth of the Global Lactose Intolerance Market.

What are the major factors driving the Global Lactose Intolerance Market growth?

The increasing prevalence of genetic disorders due to inherited gene mutations. and rising incidences of intestinal ailments, such as crohn's disease, damaging lactase-producing cells. are the major factor driving the Global Lactose Intolerance Market.

Which is the leading Product Type in the Global Lactose Intolerance Market?

The leading Product Type segment is Lactose-free Dairy Products.

Which are the major players operating in the Global Lactose Intolerance Market?

OraSure Technologies Inc., Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, MPD Inc., Shimadzu Corporation, Lifeloc Technologies, Inc., Drägerwerk AG & Co. KGaA, Premier Biotech, Inc., Omega Laboratories, Inc., Psychemedics Corporation, Clinical Reference Laboratory, Inc., American Bio Medica Corporation, ACM Global Laboratories, CareHealth America Corp, Intoximeters, Inc. are the major players.

What will be the CAGR of the Global Lactose Intolerance Market?

The CAGR of the Global Lactose Intolerance Market is projected to be 6.24% from 2024-2031.