Lupus Nephritis Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Lupus Nephritis Treatment Market is segmented By Treatment Type (Immunosuppressants, Biologics), By Route of Administration (Intravenous, Oral, Subcut....

Lupus Nephritis Treatment Market Size

Market Size in USD Bn

CAGR8.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.4% |

| Market Concentration | Medium |

| Major Players | Roche, AstraZeneca, Novartis, Aurinia Pharmaceuticals, GlaxoSmithKline and Among Others. |

please let us know !

Lupus Nephritis Treatment Market Analysis

The lupus nephritis treatment market is estimated to be valued at USD 1.95 billion in 2024 and is expected to reach USD 3.42 billion by 2031, growing at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2031. The increasing prevalence of systemic lupus erythematosus and growing awareness about the availability of various treatment options are expected to drive the growth of the market during the forecast period.

Lupus Nephritis Treatment Market Trends

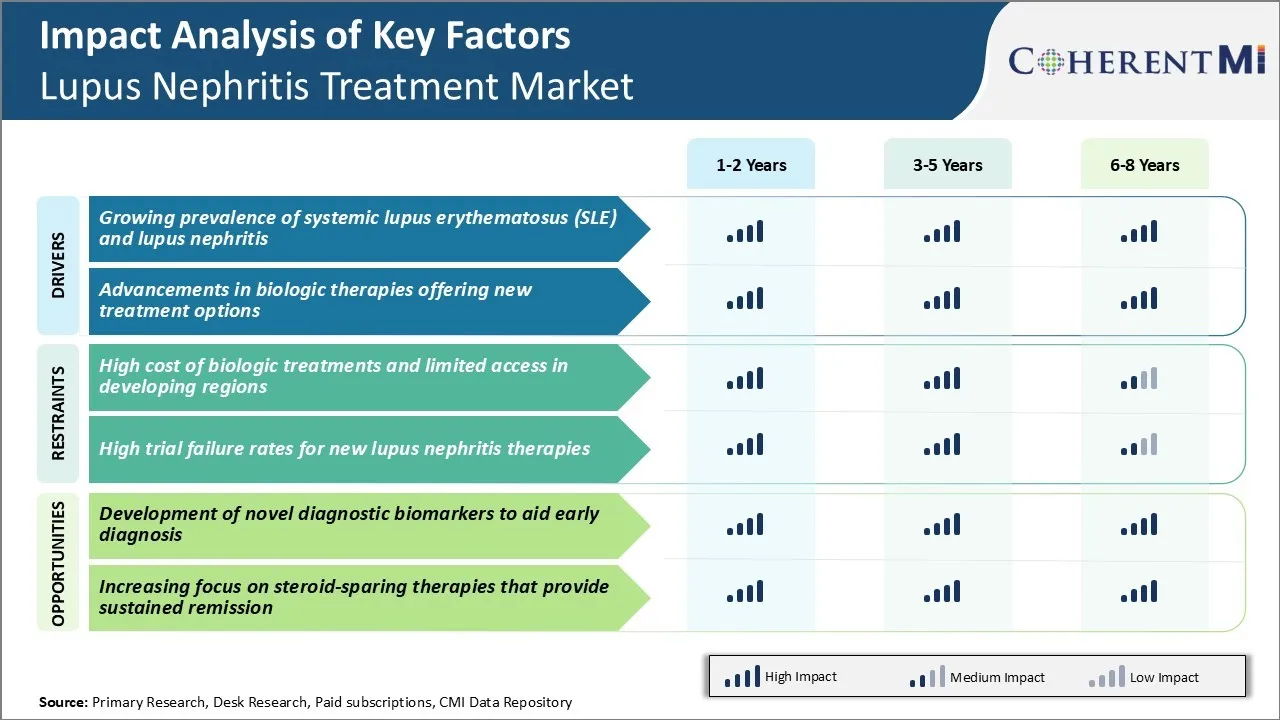

Market Driver - Growing Prevalence of Systemic Lupus Erythematosus (SLE) and Lupus Nephritis

As per estimates, up to 60% of patients with SLE will eventually develop lupus nephritis at some point in their lifetime making it a major public health concern. The exact causes are yet unknown but genetics, environment and hormonal factors all play a role.

It predominantly affects women of childbearing age with estimates suggesting a female to male ratio of 8-10:1. In the United States alone, it is estimated that around 322,000 new cases of SLE are diagnosed annually with rates especially high among Hispanic, African and Asian populations.

As the underlying SLE condition remains uncontrolled and untreated for long periods, it often manifests into inflammation of kidneys known as lupus nephritis. Uncontrolled nephritis leads to permanent kidney damage over time and even failure requiring dialysis or transplant.

Recent studies suggest up to 50% of SLE patients eventually progress to some form of nephritis within 10 years of diagnosis. With rising SLE prevalence, absolute number of patients developing lupus nephritis has also increased substantially presenting a massive future patient pool. Overall, growing prevalence of the disease and its severe renal complications indicates a growing target population seeking effective treatment and management options for lupus nephritis.

Market Driver - Advancements in Biologic Therapies Offering New Treatment Options

Traditionally, therapy for lupus nephritis has involved use of broad acting immunosuppressants like corticosteroids and azathioprine to bring inflammation under control. However, such non-specific drugs come with a lot of side effects if used long term. In recent years, improved understanding of lupus pathology has enabled development of novel targeted biologic therapies which selectively block specific cytokines, cells or pathways implicated in disease activity.

Notable among the new treatment options are B cell depleting therapies like belimumab which binds to B-lymphocyte stimulator (BLyS) to reduce B cell proliferation. Belimumab was the first biologic approved by FDA in 2011 specifically for treatment of SLE. Several other BLyS inhibitors are in pipeline.

Moreover, several advanced therapies utilizing stem cells, nanocarriers and gene therapies are under investigation which may potentially provide complete remission if proven safe and effective. Growing understanding of disease biology is enabling tailored targeting of specific pathological mechanisms underlying SLE and lupus nephritis.

This recent development of selective biologic response modifiers provides viable treatment alternatives with improved efficacy and safety profiles. The availability of novel targeted therapies is hence expected to further expand treatment options for lupus nephritis patients not adequately controlled on standard of care regimens.

Market Challenge - High Cost of Biologic Treatments and Limited Access in Developing Regions

The high cost of biologic treatments for lupus nephritis poses a notable challenge for the lupus nephritis treatment market growth potential. Biologics such as belimumab have revolutionized lupus treatment but come with a steep price tag. A year of treatment can exceed six figures in cost for many patients. This financial burden means many patients struggle to consistently afford and adhere to their prescribed treatment regimen.

It also puts biologic medications out of reach for healthcare systems in developing countries and low-income regions. Limited access to innovative, targeted biologic treatments will likely continue to hinder market expansion opportunities in those areas.

High drug prices remain a barrier both for patients and for market penetration in less-developed healthcare markets worldwide. Additional resources and efforts are still needed to strengthen economic access to needed lupus nephritis therapies, especially biologics, on a global scale.

Market Opportunity - Development of Novel Diagnostic Biomarkers to Aid Early Diagnosis

The development of novel diagnostic biomarkers that can enable earlier and more accurate diagnosis of lupus nephritis presents a major market opportunity. Currently, diagnosis often occurs late in the progression of kidney damage when treatment is less effective.

More sensitive and specific biomarkers could allow for detecting lupus nephritis at earlier, preclinical stages. This would give physicians a valuable tool to monitor at-risk patients more closely and begin therapies preemptively. Earlier intervention aims to preserve long-term kidney function by slowing or stopping disease progression at its onset. Biomarkers that provide objective measures of renal tissue inflammation and injury could also aid clinical decision making and help evaluate treatment responses over time.

Considerable efforts are underway to identify and validate new biomarkers from easily accessible samples like blood or urine. Successful validation and commercialization of novel diagnostic biomarkers stands to drive earlier detection and improved management of lupus nephritis.

Prescribers preferences of Lupus Nephritis Treatment Market

Lupus nephritis is typically treated via a stepwise approach based on disease severity and response to prior treatment lines. For mild nephritis (class I/II), physicians may choose non-nephrotoxic immunosuppressants like Azathioprine as first-line treatment.

However, for moderate to severe nephritis (class III/IV/V), the standard first-line treatment involves induction therapy with glucocorticoids like Methylprednisolone along with either cyclophosphamide administered intravenously or mycophenolate mofetil given orally. The goal is to achieve remission within 6 months. CellCept (mycophenolate mofetil) is favored by some prescribers due to its tolerability profile compared to cyclophosphamide which carries risks of hemorrhagic cystitis and infertility.

For patients who fail to respond to first-line treatment or experience relapse after remission, second-line options include rituximab or belimumab combined with glucocorticoids and either CellCept or cyclophosphamide. Rituximab, marketed as Rituxan, has gained popularity among nephrologists as it offers comparable efficacy to cyclophosphamide with less toxicity.

Finally, for refractory cases where even second-line options fail, prescribers sometimes turn to investigational drugs under clinical trials or off-label use of TNF inhibitors like infliximab. Overall treatment approach is tailored based on individual patient characteristics, comorbidities, concurrent medications and preference for oral vs intravenous therapies.

Treatment Option Analysis of Lupus Nephritis Treatment Market

Lupus nephritis can be classified into classes based on the severity of kidney involvement. Class I and II involve minimal mesangial abnormalities, Class III and IV involve various degrees of glomerulonephritis, Class V involves minimal mesangial abnormalities with glomerular sclerosis/atrophy, and Class VI involves asymptomatic proteinuria.

For Class III/IV (proliferative) disease, the first-line treatment typically involves induction therapy with mycophenolate mofetil (CellCept) or intravenous cyclophosphamide. CellCept is preferred for less severe Class III/IV disease due to its milder side effect profile compared to cyclophosphamide. It works by suppressing lymphocyte proliferation. Cyclophosphamide is preferred for severe, high-risk Class III/IV disease as it is better at achieving remission, but it is associated with higher infertility risks.

Following induction, maintenance therapy is needed. The preferred options are CellCept and azathioprine (Imuran), as they have proven efficacy in maintaining remission. For patients who fail or relapse after the first line, rituximab (Rituxan) can be used as an alternative induction agent. It targets B lymphocytes and depletes them from tissues. For refractory or relapsing disease, belimumab (Benlysta) may be added to standard therapy. It inhibits B lymphocyte stimulating activity to suppress autoantibody production.

Key winning strategies adopted by key players of Lupus Nephritis Treatment Market

One of the key strategies adopted by major players in the lupus nephritis treatment market has been focus on innovative drug development through extensive research and clinical trials. For instance, Roche received FDA approval for its drug Benlysta (belimumab) in 2011, which was the first biologic therapy approved for lupus in over 50 years. This was a major breakthrough in treatment of lupus nephritis.

Another strategy undertaken by GlaxoSmithKline and Aurinia Pharmaceuticals was to focus on voclosporin, a novel calcineurin inhibitor. In 2019, voclosporin received FDA approval for treating lupus nephritis, post positive results from the pivotal phase 3 study (AURORA 1 and AURORA 2). The study demonstrated that addition of voclosporin to standard of care resulted in statistically superior renal response rates compared to standard of care alone.

Bristol-Myers Squibb adopted the strategy of acquiring leading biotech Celgene Corporation in 2019 for $74 billion. This provided BMS access to investigational assets from Celgene’s pipeline including ozanimod and CC-220. Ozanimod is a novel S1P receptor modulator being evaluated in a phase 3 trial for lupus nephritis, with promising phase 2b efficacy and safety data. CC-220 is also an investigational oral therapy targeting Bruton's tyrosine kinase pathway.

Segmental Analysis of Lupus Nephritis Treatment Market

Insights, By Treatment Type: Patient Compliance Drives Immunosuppressants’ Share

In terms of treatment type, immunosuppressants contributes the highest share of the lupus nephritis treatment market owning to their widespread acceptance among patients and doctors. Being oral drugs, immunosuppressants offer unmatched convenience and compliance compared to other options. The oral route of administration allows patients to easily incorporate treatment into their daily routines without disrupting lifestyle much. This high level of treatment compliance ensures optimal management of lupus nephritis symptoms.

Moreover, immunosuppressants are the mainstay first-line treatment prescribed by nephrologists for mild to moderate cases of lupus nephritis. Their well-established efficacy and safety profiles, accumulated over decades of clinical use, make them a trusted option for front-line therapy. Furthermore, low-cost generic versions of many major immunosuppressants have made them accessible for large patient segments. Their widespread insurance coverage and relative affordability compared to biologics boosts adoption.

The non-specific nature of immunosuppressants also works in their favor. By broadly suppressing the immune system, they provide comprehensive suppression of autoimmune response behind lupus nephritis compared to targeted therapies. This holistic treatment approach reassures both patients and physicians to some extent. Overall, the unmatched convenience, compliance, and clinical reputation of oral immunosuppressants have cemented their leadership position in the treatment type segment.

Insights, By Route of Administration: Safety Benefits Drive Intravenous Dominance

In terms of by route of administration, intravenous administration contributes the highest share of the lupus nephritis treatment market owing to its safety benefits over other routes. Being an in-hospital procedure, intravenous administration allows for close patient monitoring and management of infusion-related reactions. This mitigates safety concerns frequently associated with self-administered drugs taken at home.

Intravenous therapy also ensures accurate dosing of concentration-sensitive drugs since patient non-compliance is not a factor. Drugs bypass gastrointestinal absorption issues and reach therapeutic levels in the bloodstream quicker via direct intravenous entry. This fast acting and predictable nature of intravenous drugs makes them preferable for serious, refractory cases requiring urgent control of nephritis symptoms and inflammation.

Furthermore, for biologics that are too large to be absorbed orally or degraded in the digestive system, intravenous remains the only feasible administration route. Since biologics now represent a major share of novel lupus nephritis treatments in the pipeline, their expected market launch will further boost intravenous prevalence going forward. Overall, intravenous administration provides reassuring safety and reliable efficacy that clinicians seek for complex lupus nephritis cases.

Insights, By Patient Type: Extensive Disease Burden Drives Adult Patient Dominance

Among patient types, Adult Patients contribute the highest market share due to having a significantly larger population and disease burden compared to pediatric patients. Lupus predominantly affects women of childbearing age, with onset typically between ages 15-44. Moreover, lifetime prevalence of lupus is 70 per 100,000 for adults but only 10-15 per 100,000 for children below 18 years of age.

Kidney involvement from lupus nephritis also has a higher frequency in adult patients, manifesting in 30-50% of adult cases versus only 10-15% of pediatric patients. Additionally, the course of nephritis tends to be milder in children whereas adult patients often experience multiple organ involvement complicating nephritis management.

The longer life expectancy of adults compared to children further increases the patient pool over time as those with early-onset lupus and nephritis age into adulthood requiring long-term treatment. Overall, the older age demographics struck most by lupus, higher prevalence of kidney disease, and long-term treatment needs combine to make adult patients the core driver of market demand over pediatrics.

Additional Insights of Lupus Nephritis Treatment Market

- Prevalence: About 40-50% of adult SLE patients develop lupus nephritis, with even higher rates in juvenile-onset cases.

- Unmet Needs: The market is characterized by a high unmet need for new therapies, particularly for steroid-sparing options.

Competitive overview of Lupus Nephritis Treatment Market

The major players operating in the Lupus Nephritis Treatment Market include Roche, AstraZeneca, Novartis, Aurinia Pharmaceuticals, GlaxoSmithKline, Johnson & Johnson, Boehringer Ingelheim, Biocon/Equillium, Omeros Corporation, and Kezar Life Sciences.

Lupus Nephritis Treatment Market Leaders

- Roche

- AstraZeneca

- Novartis

- Aurinia Pharmaceuticals

- GlaxoSmithKline

Lupus Nephritis Treatment Market - Competitive Rivalry, 2024

Lupus Nephritis Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Lupus Nephritis Treatment Market

- In July 2023, Roche received Breakthrough Therapy Designation from the FDA for Obinutuzumab (Gazyva) for the treatment of lupus nephritis. This designation highlights its potential in managing refractory patients with this condition. The FDA granted this status based on positive results from the Phase II NOBILITY trial, which demonstrated enhanced efficacy of Gazyva, in combination with standard care, compared to placebo in achieving complete renal responses in patients with lupus nephritis. No new safety signals were reported during the study.

- In March 2024, Novartis advanced its monoclonal antibody Ianalumab (VAY736) into Phase III clinical trials, specifically targeting patients with proliferative lupus nephritis. The trials aim to evaluate the safety, efficacy, and tolerability of Ianalumab as an additional therapy on top of standard care for systemic lupus erythematosus (SLE) and lupus nephritis. The trials involve randomized, double-blind, placebo-controlled studies, with participants receiving either Ianalumab or a placebo alongside their current standard treatments.

Lupus Nephritis Treatment Market Segmentation

- By Treatment Type

- Immunosuppressants

- Calcineurin Inhibitors

- Mycophenolate Mofetil

- Biologics

- Monoclonal Antibodies

- Cytokine Inhibitors

- Immunosuppressants

- By Route of Administration

- Intravenous

- Oral

- Subcutaneous

- By Patient Type

- Adult Patients

- Pediatric Patients

- By Stage of Lupus Nephritis

- Class I/II LN

- Class III/IV ± V LN

- Class VI LN

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the lupus nephritis treatment market?

The lupus nephritis treatment market is estimated to be valued at USD 1.95 billion in 2024 and is expected to reach USD 3.42 billion by 2031.

What are the key factors hampering the growth of the lupus nephritis treatment market?

The high cost of biologic treatments, limited access in developing regions, and high trial failure rates for new lupus nephritis therapies are the major factors hampering the growth of the lupus nephritis treatment market.

What are the major factors driving the lupus nephritis treatment market growth?

The growing prevalence of systemic lupus erythematosus (SLE) and lupus nephritis, and advancements in biologic therapies offering new treatment options are the major factors driving the lupus nephritis treatment market.

Which is the leading treatment type in the lupus nephritis treatment market?

The leading treatment type segment is immunosuppressants.

Which are the major players operating in the lupus nephritis treatment market?

Roche, AstraZeneca, Novartis, Aurinia Pharmaceuticals, GlaxoSmithKline, Johnson & Johnson, Boehringer Ingelheim, Biocon/Equillium, Omeros Corporation, and Kezar Life Sciences are the major players.

What will be the CAGR of the lupus nephritis treatment market?

The CAGR of the lupus nephritis treatment market is projected to be 8.4% from 2024-2031.