Micronutrient fertilizers Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Micronutrient fertilizers Market is segmented By Nutrient (Zinc, Manganese, Copper, Boron, Molybdenum, Iron), By Form, Chelated, Non-Chelated), By Cro....

Micronutrient fertilizers Market Size

Market Size in USD Bn

CAGR6.74%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.74% |

| Market Concentration | High |

| Major Players | CF Industries Holdings, Inc., CHS Inc., Coromandel International Ltd, Haifa Group, ICL GROUP LTD and Among Others. |

please let us know !

Micronutrient fertilizers Market Analysis

The micronutrient fertilizers market is estimated to be valued at USD 5.1 Bn in 2024 and is expected to reach USD 8.05 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.74% from 2024 to 2031. The micronutrient fertilizers market is expected to witness significant growth due to rising awareness among farmers about deficiencies in soil and benefits of micronutrients in improving crop health.

Micronutrient fertilizers Market Trends

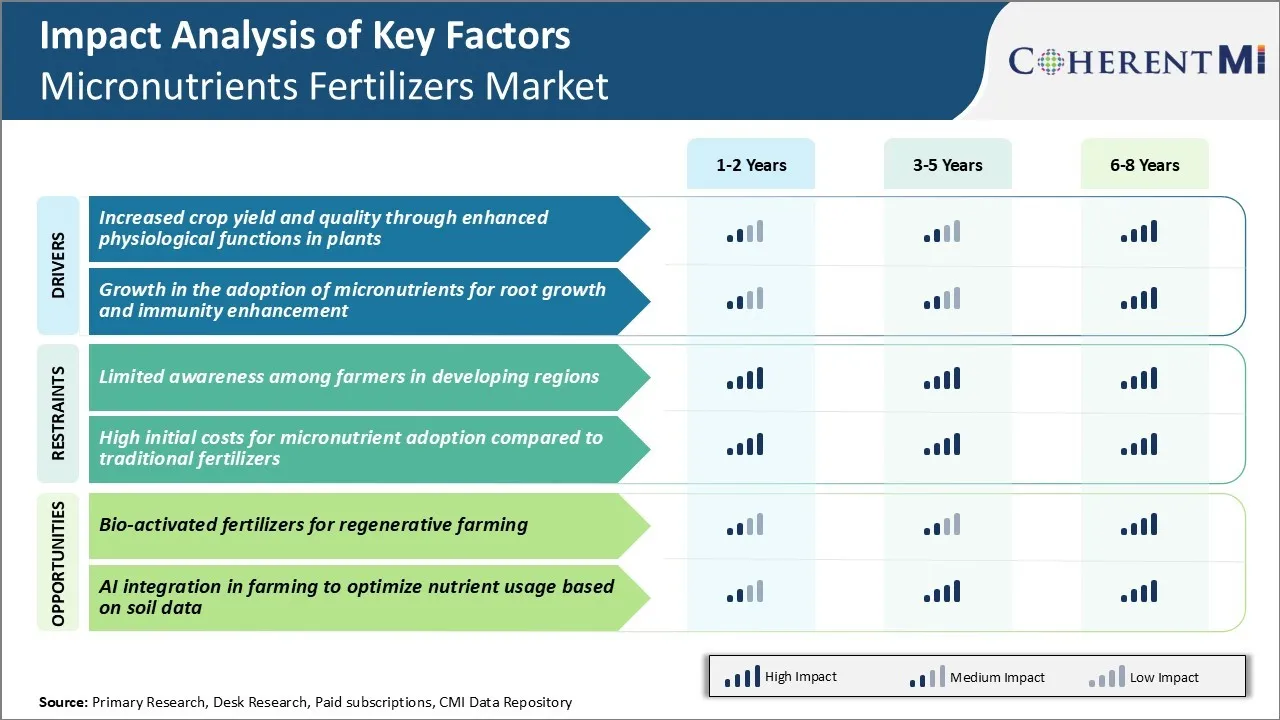

Market Driver - Increased Crop Yield and Quality Through Enhanced Physiological Functions in Plants

Micronutrients play a vital role in improving the physiological functions of plants which directly impact crop yields and quality. Lack of essential micronutrients like zinc, iron, and manganese can adversely affect photosynthesis, nitrogen fixation, and metabolism in plants.

Micronutrient fertilizers help address these deficiencies by supplying precisely balanced compositions of micro elements required by crops. They facilitate optimum photosynthesis by taking part in formation of chlorophyll pigments. It enables plants to produce more carbohydrates through enhanced absorption of sunlight.

As a key component of enzymes related to transfer of electrons in photosynthesis, manganese deficiency severely limits this process. Provision of manganese through fertilizers restores normal photosynthetic capacity. Similarly, iron is integral to formation of proteins involved in nitrogen fixation by leguminous crops. Its deficiency causes disruption in nitrogen fixation causing legumes to become nitrogen deficient and less productive.

Thereby, fertilization with micronutrients consistently results in higher crop yields and superior quality produce with improved nutrient contents meeting international standards. This is expected to drive growth of micronutrient fertilizers market globally.

Market Driver - Growth in the Adoption of Micronutrients for Root Growth and Immunity Enhancement

Lack of micronutrients like zinc severely inhibits root initiation and development processes by disturbing biosynthesis of growth hormones regulating these functions. Application of balanced micronutrient mixes addresses such deficiencies by providing essential micronutrients to roots. It supports formation of root primordia, elongation of root hairs and proliferation of lateral roots. This augments the rooting volume and ability to extract soil nutrients efficiently.

Strong roots also play a major role in strengthening plant immunity. Micronutrients like zinc and manganese strengthen plant cell walls making them less permeable to toxins and pathogen attacks. Well-developed roots aided by micronutrients also help plants withstand abiotic stressors like drought, flooding and temperature variations through regulated hormonal responses.

Enhanced root growth offers resilience against lodging and other stress-induced damages. These multifaceted benefits of micronutrients in promoting root functions and overall immunity of crops are a key driver spurring greater adoption of micronutrient fertilizers globally.

Market Challenge - Limited Awareness Among Farmers in Developing Regions

One of the key challenges being faced by the micronutrient fertilizers market is the limited awareness among farmers, especially in developing regions. Many smallholder and resource-poor farmers in these regions have low levels of education and lack access to information regarding the importance and benefits of applying balanced micronutrients in soils.

Due to poverty and financial constraints, these farmers tend to focus only on major nutrients like nitrogen, phosphorus and potassium in their fertilization practices. They are often not aware about the gradual depletion of secondary and micronutrients from intensive cereal cropping and how it impacts long term soil health and crop productivity.

Overcoming this awareness gap requires increased investments in rural outreach programs, simplifying technical concepts for ease of understanding and leveraging local agencies and communities to raise awareness at the grassroots level in local languages. This remains a major bottleneck that needs to be addressed to stimulate demand and uptake of micronutrient fertilizers in developing country markets.

Market Opportunity - Bio-activated Fertilizers for Regenerative Farming

One of the major opportunities for the micronutrient fertilizers market is the rising global interest in regenerative agricultural practices. Regenerative farming aims to improve soil health through techniques like minimum tillage, cover cropping, and application of organic soil amendments and biofertilizers.

Bio-activated or bio-stimulant fertilizers containing beneficial microbes are increasingly being used by regenerative farmers to foster nutrient cycling processes in soil. These next generation micronutrient fertilizers have been shown to improve soil structure and fertility while enhancing crop yields in a sustainable manner.

As consumers demand for chemical-residue free foods continue to rise, many farmers are transitioning to regenerative models. This growing shift provides a massive market potential for innovative bio-activated micronutrient fertilizers tailored for different soil and crop needs.

Leading companies in the micronutrient fertilizers market can capitalize on this opportunity by developing tailored product portfolios. They can also focus on conducting extensive on-farm trials and promoting the multiple agronomic and environmental benefits of regenerative micronutrient fertilizers programs.

Key winning strategies adopted by key players of Micronutrient fertilizers Market

Strategy 1: Product innovation and expansion

The micronutrient fertilizers market has seen many new product launches catering to specific crop and soil needs. For example, in 2022, Yara International launched YaraVita Boron 4%, a water-soluble fertilizer specifically designed for boron deficient crops like apples, almonds, and grapes.

Strategy 2: Strategic acquisitions

Leading players in micronutrient fertilizer market have strengthened their portfolio and geographic presence through strategic acquisitions. For example, in 2021, Nutrien acquired the Brazilian agricultural retailer Agrosema Comercio de Insumos Agricolas for $38 million.

Strategy 3: Focus on emerging markets

With maturity in developed markets, companies have focused on high growth developing regions. For example, between 2015-2020, ICL Fertilizers expanded its production capacity in Latin America, India and Africa to cater to rising micronutrient demand.

Strategy 4: Digital innovations

Leading players have leveraged precision farming and big data tools to improve outreach. For example, in 2020, Yara's digital farming platform Yara Grower became one of Europe's largest agriculture networks with over 50,000 farmers.

Segmental Analysis of Micronutrient fertilizers Market

Insights, By Nutrient: Rising Demand for Micronutrients Boosts Zinc Segment

In terms of nutrient, zinc contributes 34% share of the micronutrient fertilizers market in 2024, owing to the crucial role it plays in plant growth and immunity. Zinc is essential for various metabolic functions in crops including protein synthesis, DNA synthesis, and cell division.

The demand for zinc fertilizers is gaining traction as farmers globally realize the importance of zinc in obtaining higher yields. Cereals such as wheat and rice remove considerable amounts of zinc from soil each season through harvesting. Thus, periodic zinc supplementation through fertilizers is necessary to replace depleted levels.

Additionally, the emergence of precision farming enables precise and targeted application of zinc fertilizers only to zinc-deficient fields or parts of a field. This cost-effective approach is further catalyzing the sales of zinc-based micronutrient fertilizers, and ultimately, growth of the micronutrient fertilizer market.

Insights, By Form: Chelated Form Emerges as a Favorite Due to High Bioavailability

In terms of form, chelated micronutrient fertilizers account for 65% share of the micronutrient fertilizers market in 2024, owing to its superior agronomic qualities. Chelated micronutrients such as zinc, manganese, and iron form stable molecules with organic acids that protect the micronutrient from being tied up or rendered unavailable in soil. This high stability allows chelated micronutrients to remain in soluble and plant-available forms for extended periods in different soil pH levels.

Non-chelated forms are often rapidly converted into insoluble forms in soil by processes like adsorption, precipitation, and formation of insoluble complexes. Moreover, the elemental analysis of chelated products ensures an exact and balanced supply of the target micronutrient to crops. This precision feeding through reliable chelated micronutrient fertilizers earns the preference of agriculturists.

Insights, By Crop Type: Grains and Cereals Dominate Micronutrient Usage Attributed to Vast Cultivation

In terms of crop type, grains and cereals contribute the highest share of the micronutrient fertilizers market owing to the scale at which they are grown globally. Wheat, rice, maize, and other cereal crops collectively dominate the world's cropland area and agricultural production volumes. Recognizing yield constraints due to hidden hunger, farmers are increasingly adopting soil and foliar applications of micronutrient fertilizers for cereals.

Additionally, cereals extract sizable amounts of micronutrients during each harvest, necessitating timely replenishment through fertilizers. Pulses and oilseeds follow cereals in utilizing micronutrients, though their overall cultivation footprint remains smaller than staple grains. Vegetables and commercial horticultural crops also present a rising opportunity for micronutrient fertilizers’ usage supported by growing health awareness and changing diets worldwide.

Additional Insights of Micronutrient fertilizers Market

- The significant adoption of AI in micronutrient fertilizer application to reduce environmental impact by predicting nutrient levels and optimizing fertilization cycles.

- Asia Pacific, particularly China and India, has seen strong growth in micronutrient fertilizer consumption due to the region's large population and agricultural needs.

- North America held the largest share of 39% in micronutrient fertilizers market in 2023, largely due to established agricultural practices and government recommendations.

- Precision Agriculture Adoption: The increasing use of precision agriculture technologies is optimizing micronutrient fertilizer application, leading to better crop performance and reduced waste.

- Government Initiatives: Various governments are implementing policies and subsidies to promote the use of micronutrient fertilizers, recognizing their role in improving food security and agricultural sustainability.

Competitive overview of Micronutrient fertilizers Market

The major players operating in the micronutrient fertilizers market include CF Industries Holdings, Inc., CHS Inc., Coromandel International Ltd, Haifa Group, ICL GROUP LTD, Indian Farmers Fertiliser Cooperative Limited, Rashtriya Chemicals and Fertilizers Limited, Nouryon, SABIC Agri-Nutrients, Sociedad Quimica Y Minera De Chile SA, The Mosaic Company, Unikeyterra Chemical, Yara International ASA, Nutrien Ltd., BASF SE, Compass Minerals International, Inc., AkzoNobel N.V., Helena Agri-Enterprises, LLC, and Valagro.

Micronutrient fertilizers Market Leaders

- CF Industries Holdings, Inc.

- CHS Inc.

- Coromandel International Ltd

- Haifa Group

- ICL GROUP LTD

Micronutrient fertilizers Market - Competitive Rivalry, 2024

Micronutrient fertilizers Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Micronutrient fertilizers Market

- In October 2024, BASF announced a strategic partnership with AgroSpheres to co-develop and commercialize a novel bioinsecticide, demonstrating BASF's commitment to sustainable crop protection solutions. Additionally, BASF participated in the World Agri-Tech Innovation Summit in London in September 2023, where industry leaders discussed accelerating the transition towards sustainable and resilient agri-food systems.

- In June 2024, Coromandel International Ltd inaugurated a state-of-the-art nano fertilizer plant at its Kakinada facility in Andhra Pradesh. This fully automated plant, designed with energy-efficient technologies, has an annual production capacity of one crore bottles.

- In November 2023, Rashtriya Chemicals and Fertilizers Limited (RCF Ltd.), a leading Navratna company, actively participated in the 'Viksit Bharat Sankalp Yatra' (VBSY) campaign. This nationwide initiative aimed to disseminate the benefits of the Government of India's flagship schemes to target beneficiaries.

- In July 2023, Yara International ASA launched a new line of environmentally friendly micronutrient fertilizers designed to improve nutrient use efficiency and reduce environmental impact, reinforcing their commitment to sustainable agriculture.

Micronutrient fertilizers Market Segmentation

- By Nutrient

- Zinc

- Manganese

- Copper

- Boron

- Molybdenum

- Iron

- By Form

- Chelated

- Non-Chelated

- By Crop Type

- Grains & Cereals

- Pulses & Oilseeds

- Commercial Crops

- Fruits & Vegetables

- Other Crop Types

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the micronutrient fertilizers market size?

The micronutrient fertilizers market is estimated to be valued at USD 5.1 Bn in 2024 and is expected to reach USD 8.05 Bn by 2031.

What are the key factors hampering the growth of the micronutrient fertilizers market?

Limited awareness among farmers in developing regions and high initial costs for micronutrient adoption compared to traditional fertilizers are the major factors hampering the growth of the micronutrient fertilizers market.

What are the major factors driving the micronutrient fertilizers market growth?

Increased crop yield and quality through enhanced physiological functions in plants and growth in the adoption of micronutrients for root growth and immunity enhancement are the major factors driving the micronutrient fertilizers market.

Which is the leading nutrient in the micronutrient fertilizers market?

The leading nutrient segment is zinc.

Which are the major players operating in the micronutrient fertilizers market?

CF Industries Holdings, Inc., CHS Inc., Coromandel International Ltd, Haifa Group, ICL GROUP LTD, Indian Farmers Fertiliser Cooperative Limited, Rashtriya Chemicals and Fertilizers Limited, Nouryon, SABIC Agri-Nutrients, Sociedad Quimica Y Minera De Chile SA, The Mosaic Company, Unikeyterra Chemical, Yara International ASA, Nutrien Ltd., BASF SE, Compass Minerals International, Inc., AkzoNobel N.V., Helena Agri-Enterprises, LLC, Valagro are the major players.