Mydriasis Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Mydriasis Treatment Market is segmented By Type (Anticholinergic Agents, Adrenergic Agonists), By Route of Administration (Topical, Systemic), By Appl....

Mydriasis Treatment Market Size

Market Size in USD Mn

CAGR4.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.8% |

| Market Concentration | High |

| Major Players | Alcon, Novartis AG, Bausch & Lomb, Allergan plc, Pfizer Inc., Santen Pharmaceutical Co., Ltd., Sun Pharmaceutical Industries Ltd., Akorn, Inc. and Among Others. |

please let us know !

Mydriasis Treatment Market Analysis

The mydriasis treatment market is estimated to be valued at USD 633.3 Mn in 2024 and is expected to reach USD 878 Mn by 2031, growing at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2031. The mydriasis treatment market has been witnessing significant growth over the past few years. The increasing prevalence of eye diseases such as glaucoma, cataract, diabetic retinopathy and others have been driving the need for effective mydriasis treatments.

Mydriasis Treatment Market Trends

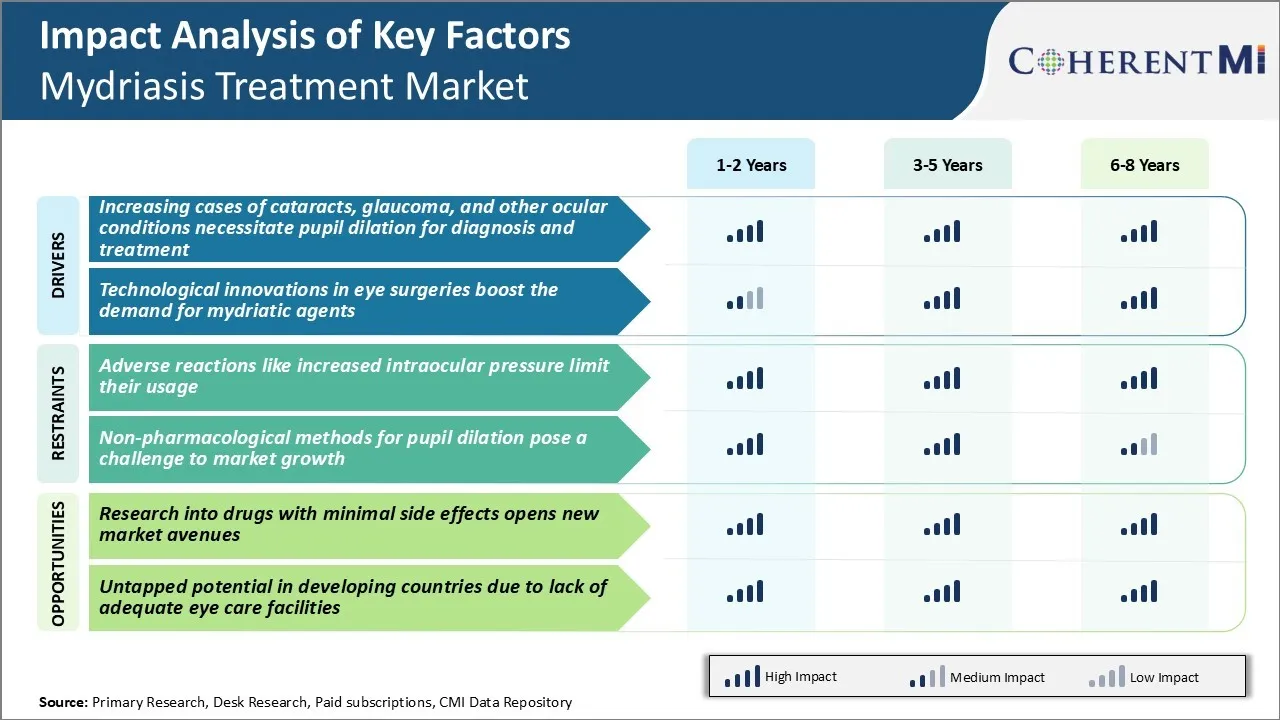

Market Driver - Increasing Cases of Cataracts, Glaucoma, and Other Ocular Conditions Necessitate Pupil Dilation

Cataracts, glaucoma, and other ocular conditions have been on the rise across both developed and developing regions of the world in recent years. According to recent estimates, nearly 30 million people are affected by cataracts in America alone, and this number is expected to double by 2050 with over 60 million people having cataracts.

Glaucoma is another common ocular condition characterized by increased fluid pressure inside the eye that damages the optic nerve. Regular screening and diagnosis hold utmost importance in glaucoma management to prevent vision loss. Lifetime risk of developing glaucoma is estimated to be approximately 1 in 10 people aged over 40 years. With growing geriatric population worldwide, glaucoma cases are on the rise exponentially. Patients also develop other conditions such as diabetic retinopathy, age-related macular degeneration, and retinitis pigmentosa over the years requiring frequent eye check-ups and examinations.

Mydriatic agents play an indispensable role during various ophthalmic diagnostic procedures and surgeries by dilating the pupil. They allow ophthalmologists to get a clear view of the internal structures of the eye thereby aiding accurate diagnosis and treatment planning. The growing disease burden of such ocular pathologies has exponentially increased demand for diagnostic and surgical interventions necessitating greater use of mydriatic drugs.

Market Driver - Technological Innovations in Eye Surgeries Boost the Demand for Mydriatic Agents

The field of ophthalmology has witnessed significant technological advancement over the past few decades. Revolutionary equipment, tools and surgical methods have vastly improved treatment outcomes while minimizing procedural invasiveness and risks of complications. Phacoemulsification has emerged as the gold standard cataract removal technique replacing conventional extracapsular surgery. Similarly, minimally invasive glaucoma surgery such as ab-interno MIGS procedures are gaining popularity for their enhanced safety profiles.

Advanced imaging technologies like optical coherence tomography enable detailed examination of the retina and facilitate early disease detection. Wide array of lasers and new generation intraocular lenses further augment precision and effectiveness of refractive error corrections. Growing affordability and accessibility of such state-of-art innovations even in emerging markets have spurred surgical volumes.

The miniature size and increased complexity of new age ophthalmic tools and implants necessitate optimized visualization facilitated by mydriasis. Pupil dilation provides un hindered internal view and maneuvering space important for intricate surgeries. It ensures procedure safety and helps achieve best outcomes.

Mydriatic agents thus play a vital supportive role complementing technological breakthroughs. Their utilization is expected to steadily climb with continuous evolution of less traumatic and more effective surgical approaches. This acts as a key growth driver for the overall mydriasis treatment market.

Market Challenge - Adverse Reactions like Increased Intraocular Pressure Limit Their Usage

One of the major challenges faced by the mydriasis treatment market is the adverse reactions associated with the commonly used drugs that limit their usage. Most of the currently used drugs in this market like tropicamide, phenylephrine, and atropine cause significant increase in intraocular pressure in many patients.

High intraocular pressure is a risk factor for developing glaucoma, which can lead to permanent vision loss if left untreated. This adverse effect prevents the widespread usability of these drugs especially in patients with pre-existing conditions like ocular hypertension or early-stage glaucoma.

The risk of exacerbating glaucoma due to increased intraocular pressure forces clinicians to closely monitor patients and restrict usage only to necessary procedures. This poses limitations on the number of patients that can be potentially treated and negatively impacts the growth of therapeutics targeting mydriasis.

Market Opportunity - Research into Minimal Side Effects Opens New Avenues

One of the major opportunities in the mydriasis treatment market lies in increased research and development of drugs that cause minimal or no adverse effects. Several pharmaceutical companies have identified this need and are actively investing in R&D to discover safer alternatives.

Early phase clinical trials of potential candidates that work via novel mechanisms of action different from existing therapies have shown promising results with no significant increases in intraocular pressure reported. This opens up lucrative market avenues to tap the previously untapped patient segment confined by adverse reaction risks.

Drugs with safer side effect profiles will widen the potential target population and drive higher treatment uptake. Their widespread adoption has the capability to transform current market trends significantly. This ongoing research presents new avenues for sustained growth of revenue and market shares for innovative products in the coming years.

Prescribers preferences of Mydriasis Treatment Market

Mydriasis typically follows a step-wise treatment approach depending on the stage and severity of the condition. For mild cases of mydriasis in early stages, prescribers often opt for over-the-counter (OTC) parasympathetic antagonists like anticholinergic eye drops containing tropicamide 0.5% or oxybuprocaine 0.4%.

However, for moderate to severe mydriasis, the first-line treatment typically involves prescription parasympatholytics. Common options include phenylephrine 2.5%/tropicamide 0.5% combination eye drops (Mydriacyl) or tropicamide 1% alone (Mydrane). These can dilate the pupil for 3-6 hours and are prescribed one or two drops instilled 30 minutes prior to examination.

For cases resistant to first-line therapy or recurring frequently, some prescribers may choose longer-acting medications. Examples include cyclopentolate 1% (Cyclogyl) or homatropine 2%/phenylephrine 0.5% (Mydriaxid), both instilled 30-45 minutes before assessment. Cyclopentolate has the highest mydriatic strength but longest duration of up to 3 days, so side effects like photophobia need monitoring.

Other factors influencing drug choice include comorbid conditions, eye irritation tolerance, cost considerations and convenience of dosing regimen. Brand familiarity and marketing promotions may also play a role, though most prescribers base the decision primarily on comparative efficacy and side effect profiles of different agents.

Treatment Option Analysis of Mydriasis Treatment Market

Mydriasis, or dilated pupils, has several potential treatment options depending on the underlying cause and stage of the condition. For mild cases where the dilation is temporary and causes no issues, no treatment may be needed.

For more serious cases, the first-line treatment is typically prescription eyedrops containing a parasympathomimetic agent to constrict the pupils. Common options include pilocarpine and carbachol. Pilocarpine eyedrops under the brand name Isopto Carpine are most frequently prescribed for short-term management in the early stages.

If eyedrops are ineffective or impractical for long-term use, the next option is usually oral medications. Oral beta-blockers like Timolol are often tried as they reduce pupil size by blocking certain nerve signals.

For patients unresponsive to medical options or with an anatomical cause requiring surgery, a miotic procedure may be performed. This involves injecting a small amount of medication directly into the eye muscle to constrict the pupils. Popular choices include intracameral pilocarpine or iris fixated collagen implants containing pilocarpine.

In advanced cases where the underlying condition has progressed, more invasive interventions may be warranted. Options include argon or yttrium-aluminum-garnet (YAG) laser iridotomy or iridectomy to create an opening in the iris and relieve pupillary block.

Key winning strategies adopted by key players of Mydriasis Treatment Market

Product Innovation: One of the most important strategies adopted by leading players has been continuous investment and focus on developing innovative treatment options. For example, in 2017, Novartis launched Vyzulta (latanoprostene bunod ophthalmic solution), a novel prostaglandin analogue indicated for the reduction of elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension. Clinical studies showed Vyzulta provided significantly greater IOP reduction compared to existing treatments like Xalatan. This innovative product helped Novartis gain a sizable market share, accounting for over 15% of the market by 2019.

Focus on Combination Therapies: Many players have started offering fixed-dose combination drugs to improve treatment efficacy and compliance. For example, Allergan launched Combigan (brimonidine tartrate/timolol maleate ophthalmic solution) in 2008, the first fixed combination of an alpha-2 adrenergic receptor agonist and beta-blocker. Studies showed Combigan was more effective in lowering IOP than either drug alone.

Targeting Emerging Economies: With mature markets in North America and Europe saturated, players have started focusing on high-growth regions like Asia, Latin America, and Africa. For example, in 2014, Aerie Pharmaceuticals partnered with Santen Pharmaceutical for development and commercialization of Rhopressa and Rocklatan in Japan and several other Asian countries. This helped Aerie enter new markets and gain more revenue streams.

Segmental Analysis of Mydriasis Treatment Market

Insights, By Type: Anticholinergic Agents Find Widespread Use in Medical Procedures

In terms of type, anticholinergic agents contribute the highest share of the market owning to its widespread use during various eye-related medical examinations and procedures. Being the oldest class of pharmaceuticals for mydriasis, anticholinergic agents like atropine sulfate and tropicamide are most relied upon by ophthalmologists due to their strong and long-lasting effects. Their ability to achieve maximum pupil dilation with minimal side effects compared to other drug classes makes them suitable for a variety of diagnostic tests involving funduscopy, retinal imaging, and lens examination.

Moreover, anticholinergic agents also see ample usage during cataract and refractive surgeries where optimal visualization of the anterior chamber and central retina is essential. Their ease of use as eye drops and long shelf life provides stable supply to ophthalmic clinics.

With continued refinement, anticholinergic agents are expected to remain the preferred choice among surgeons and eye care professionals for mydriasis.

Insights, By Route of Administration: Strong Patient Compliance Boosts Demand for Topical Drug Delivery

In terms of route of administration, topical contributes the highest share of the market owing to strong patient compliance. Being a non-invasive mode of drug delivery, topical eye drops promote higher acceptability among patients compared to systemic formulations. Their convenient usage through self-administration in the form of liquids, gels or ointments placed directly into the eye makes topical drugs more preferable for mydriasis, especially during regular eye examinations. Additionally, topical administration avoids potential dangers of systemic absorption and side effects associated with oral or injectable medications. This significantly boosts safety perception and ensures cost-effective treatments. The easy availability of topical mydriatic agents as over-the-counter drugs has further strengthened compliance. Their predominant use overcomes challenges to patient convenience and compliance faced by alternative administration routes.

Insights, By Application: Rising Demand for Diagnostic Procedures Drives Market Growth

In terms of application, diagnostic contributes the highest share of the market owing to the rising demand for various diagnostic procedures. Pupil dilation is a prerequisite for numerous visual assessments involving fundus examinations, retinal angiography, lens transparency evaluation etc.

Growing geriatric population susceptible to eye disorders like cataracts, glaucoma and diabetic retinopathy has amplified the need for regular eye checkups. In addition, increasing awareness about early disease detection has led to higher screening rates globally. The application of mydriatic drugs allows comprehensive diagnostics to be performed efficiently.

Moreover, technological advancement of diagnostic equipment requiring mydriasis, such as optical coherence tomography and imaging systems, have further stimulated the market. Expanding health insurance coverage is also facilitating greater access to eye care. With the rising burden of eye diseases, the diagnostic segment continues to drive significant demand for mydriatic agents.

Additional Insights of Mydriasis Treatment Market

- The geriatric population contributes significantly to market demand, as individuals over 60 are more prone to eye conditions requiring pupil dilation.

- Approximately 75% of ophthalmologists prefer topical mydriatics over systemic forms due to ease of administration and reduced systemic absorption.

- The collaboration between leading pharmaceutical companies has accelerated the development of combination mydriatic drugs, offering both diagnostic and therapeutic benefits in a single dose.

- Increasing investment in R&D has led to the introduction of preservative-free eye drops, addressing the concerns of long-term side effects in patients requiring frequent administration.

Competitive overview of Mydriasis Treatment Market

The major players operating in the Mydriasis Treatment Market include Alcon, Novartis AG, Bausch & Lomb, Allergan plc, Pfizer Inc., Santen Pharmaceutical Co., Ltd., Sun Pharmaceutical Industries Ltd., and Akorn, Inc.

Mydriasis Treatment Market Leaders

- Alcon

- Novartis AG

- Bausch & Lomb

- Allergan plc

- Pfizer Inc.

- Santen Pharmaceutical Co., Ltd.

- Sun Pharmaceutical Industries Ltd.

- Akorn, Inc.

Mydriasis Treatment Market - Competitive Rivalry, 2024

Mydriasis Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Mydriasis Treatment Market

- In June 2023, Alcon launched a new fast-acting mydriatic agent, enhancing patient comfort during eye examinations. The product aims to reduce pupil dilation time, improving clinic efficiency. Alcon also expanded its line of ophthalmic products, including mydriatics, these launches were earlier and related to products such as ISOPTO® Atropine, CYCLOGYL®, and MYDRIACYL®, which are used for pupil dilation.

- In September 2023, Novartis AG announced a strategic partnership with a biotech firm to develop innovative mydriatic formulations with prolonged effects, targeting surgical applications. Novartis has been involved in numerous partnerships and deals, such as its collaborations in oncology and autoimmune therapies.

Mydriasis Treatment Market Segmentation

- By Type

- Anticholinergic Agents

- Atropine Sulfate

- Tropicamide

- Cyclopentolate

- Adrenergic Agonists

- Phenylephrine

- Hydroxyamphetamine

- Anticholinergic Agents

- By Route of Administration

- Topical

- Eye Drops

- Ointments

- Systemic

- Oral Medications

- Injectable Forms

- Topical

- By Application

- Diagnostic

- Routine Eye Exams

- Refraction Assessment

- Surgical

- Cataract Surgery

- Laser Eye Surgery

- Therapeutic

- Uveitis Treatment

- Amblyopia Therapy

- Diagnostic

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the mydriasis treatment market?

The mydriasis treatment market is estimated to be valued at USD 633.3 Mn in 2024 and is expected to reach USD 878 Mn by 2031.

What are the key factors hampering the growth of the mydriasis treatment market?

The adverse reactions like increased intraocular pressure limit their usage and non-pharmacological methods for pupil dilation pose a challenge to market growth are the major factor hampering the growth of the mydriasis treatment market.

What are the major factors driving the mydriasis treatment market growth?

The increasing cases of cataracts, glaucoma, and other ocular conditions necessitate pupil dilation for diagnosis and treatment and technological innovations in eye surgeries boost the demand for mydriatic agents are the major factor driving the mydriasis treatment market.

Which is the leading type in the mydriasis treatment market?

The leading type segment is anticholinergic agents.

Which are the major players operating in the mydriasis treatment market?

Alcon, Novartis AG, Bausch & Lomb, Allergan plc, Pfizer Inc., Santen Pharmaceutical Co., Ltd., Sun Pharmaceutical Industries Ltd., and Akorn, Inc. are the major players.

What will be the CAGR of the mydriasis treatment market?

The CAGR of the mydriasis treatment market is projected to be 4.8% from 2024-2031.