NAMPT Inhibitors Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

NAMPT Inhibitors Market is segmented By Application (Oncology, Hematology), By Mechanism of Action (NAMPT Inhibition, NAD+ Modulation), By Geography (....

NAMPT Inhibitors Market Size

Market Size in USD Bn

CAGR12.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 12.5% |

| Market Concentration | Medium |

| Major Players | Pfizer Inc., Novartis AG, Johnson & Johnson, Merck & Co., Inc., AbbVie Inc. and Among Others. |

please let us know !

NAMPT Inhibitors Market Analysis

The NAMPT inhibitors market is estimated to be valued at USD 1.5 Bn in 2024 and is expected to reach USD 3.5 Bn by 2031, growing at a compound annual growth rate (CAGR) of 12.5% from 2024 to 2031. The growing prevalence of diseases like cancer and inflammatory conditions is expected to drive the demand for NAMPT inhibitors during the forecast period. These drugs have shown promising results in lowering inflammation and inducing cell death in tumor cells during clinical trials.

The NAMPT inhibitors market is expected to witness high growth owing to rising investments in developing novel and targeted therapies. Major pharmaceutical companies have started developing more potent and selective NAMPT inhibitors to tap into the potential opportunities. Furthermore, the successful completion of late stage clinical trials and regulatory approvals of candidates will further aid the market size expansion in the coming years.

NAMPT Inhibitors Market Trends

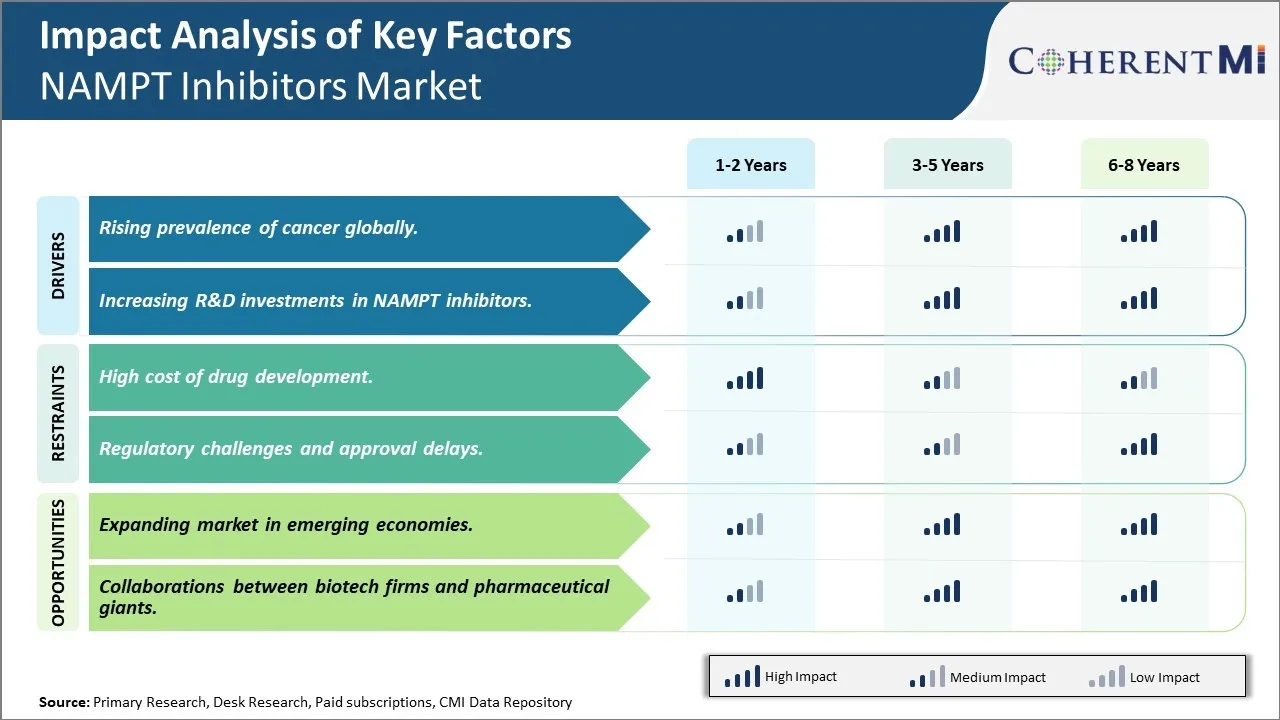

Market Driver - Rising prevalence of cancer globally

Cancer has become one of the leading causes of death worldwide in today's era. As per the recent estimations by World Health Organization, the global burden of cancer is expected to reach almost 30 million new cancer cases by 2040 due to several reasons such as aging population, changing lifestyle habits, and increasing exposure to risk factors. Especially in developing countries, the number of cancer incidences is rising rapidly mainly due to adoption of western lifestyle and lack of awareness regarding risk factors. The growing cancer patient pool worldwide has become one of the major public health problems faced by healthcare systems globally.

The rising prevalence of cancer indicates a growing need for more advanced and effective treatment options with improved efficacies and safer side effect profiles. Currently, chemotherapy remains one of the major treatment approaches for several types of cancers. However, the traditional cytotoxic chemotherapies are associated with serious side effects and limitations in terms of response rate. This has increased the focus on developing more targeted therapeutic agents acting through novel mechanisms of action. NAMPT inhibitors have emerged as a promising class of drugs which may offer an innovative mode of treatment for various cancers. These inhibitors target NAMPT enzyme which plays a key role in cellular metabolism and is overexpressed in many cancer cells. Blocking this enzyme is expected to selectively kill cancer cells through metabolic disruption while sparing normal cells.

The increasing incidence rates of cancer present a huge patient population requiring effective therapeutic interventions. This represents a massive global market opportunity for novel targeted therapies like NAMPT inhibitors which can potentially address the unmet needs in cancer treatment. Pharmaceutical companies are actively investing in clinical research to evaluate NAMPT inhibitors for different cancer indications. A drug approval in a major market can prove to be highly lucrative given the vast addressable patient pool suffering from cancer worldwide. Overall, the staggering rise in cancer burden is anticipated to be a major driver propelling the clinical research and commercialization efforts for NAMPT inhibitors in the coming years.

Market Driver - Increasing R&D investments in NAMPT inhibitors

There has been a continuous rise in global R&D spending on cancer drug development by pharmaceutical companies in response to growing commercial potential of oncology therapeutics. As per industry estimates, the global oncology drug market is projected to reach over $200 billion by 2023 due to increasing cancer prevalence, biomarker-driven drug development, and emergence of novel targeted therapies. This rising commercial attractiveness of cancer drugs is encouraging more investment flows into innovative early-stage research. NAMPT being a novel and clinically unexplored target, it has garnered significant interest from industry and academia worldwide.

Major pharmaceutical firms have recognized NAMPT inhibitors as a breakthrough candidate with blockbuster drug potential. Several big pharma companies such as Roche, Bayer, AstraZeneca etc. have been actively investing in developing internally discovered NAMPT inhibitor programs over the past decade. This includes funding advanced clinical trials and licensing novel preclinical candidates. Moreover, many smaller biotechs are solely focused on progressing NAMPT projects through early clinical evaluation seeking potential buyouts from large players. Critical publications validating the role of NAMPT pathway in cancer metabolism have also boosted its attractiveness as a target. Total funding from both private and public sources into NAMPT inhibitor R&D has increased manifold in the recent past.

With growing capital support, clinical studies of NAMPT inhibitors have advanced rapidly. Currently many candidates are under Phase 1/2 testing across different tumor types to demonstrate safety, efficacy signals and recommended Phase 2 dosing. Positive results from ongoing trials are expected to entice further co-development collaborations between industry partners and additional late stage studies. Continued success in clinical testing can reinforce increasing investment aspirations to maximize the blockbuster market scope of NAMPT inhibitors. Hence rising R&D commitment is identified as a major factor that will drive both preclinical and clinical progress, supporting the growth.

Market Challenge - High cost of drug development

The high cost associated with drug development poses a major challenge for the NAMPT inhibitors market. Developing a new drug and bringing it to market requires significant investment of time and resources. On an average, it takes over $2 billion and upwards of 10 years to develop a new drug and complete the clinical trial and approval process. A large portion of this expense goes into clinical trials where drugs have a high failure rate. For NAMPT inhibitors in particular, conducting late stage clinical trials involving thousands of patients to test efficacy and safety in indication areas like oncology is extremely expensive. Any failures or delays in clinical development can significantly increase costs and considerably extend time to profitability. The risk of drug development failure also makes investors and big pharmaceutical companies wary of pouring money into early stage research for new NAMPT inhibitor therapies. High attrition rates and development costs make it difficult for smaller biotech companies to independently finance entire drug development programs.

Market Opportunity - Expanding market in emerging economies

The expanding healthcare markets in emerging economies present a major opportunity for future growth of the NAMPT inhibitors market. While developed markets in North America and Europe currently dominate drug sales, an increasing number of patients in developing Asian, Latin American and African countries are gaining access to modern medicines. It is estimated that healthcare spending in emerging economies will grow at nearly twice the rate of mature markets in the coming years. As per capita income rises in these regions, more patients will be able to afford high-priced specialty therapies like cancer drugs. At the same time, governments are allocating larger healthcare budgets to address growing disease burden. This rising demand and improved affordability in emerging nations can be leveraged by pharmaceutical companies to accelerate patient uptake of new NAMPT inhibitor drugs once they are approved and commercialized. In particular, oncology represents a therapeutic area of high unmet need and market potential in developing countries. Early entry into these high growth markets will allow companies to maximize returns on their drug development investments.

Key winning strategies adopted by key players of NAMPT Inhibitors Market

In 2021, Eiger BioPharmaceuticals received Breakthrough Therapy Designation from the FDA for its NAMPT inhibitor lonafarnib in combination with ritonavir for treatment of Hutchinson-Gilford Progeria Syndrome (HGPS) and progeroid laminopathies. This marked the first drug candidate granted this status in progeria. Such innovations help companies dominate indications and capture larger market share.

In 2018, BerGenBio expanded its oncology portfolio by initiating Phase II clinical trials of Bemcentinib for lung cancer in combination with KEYTRUDA. This helped supplement its existing focus on acute lung injury and cancer. Portfolio diversity mitigates risks from setbacks in individual programs.

In 2020, Eucharex entered a partnership with Daiichi Sankyo to develop a novel long-acting NAMPT inhibitor for oncology. The partnership leveraged Daiichi Sankyo's development expertise and commercial infrastructure while providing funding to accelerate Eucharex's program. Such collaborations de-risk programs for companies.

In 2017, Gilead acquired Kite Pharma for $11.9 billion to gain access to its NAMPT inhibitor yescarta and expertise in CAR T-cell therapy, strengthening its position in immuno-oncology. This major deal demonstrated Gilead's commitment to dominate the space.

Segmental Analysis of NAMPT Inhibitors Market

Insights, By Application: Oncology drives the demand in the NAMPT inhibitors market

In terms of application, oncology sub-segment contributes the highest share of 55.35 in the NAMPT Inhibitors market owning to the increasing prevalence of different types of cancers worldwide. NAMPT inhibitors are proving to be highly effective in the treatment of various cancers such as lung cancer, breast cancer, prostate cancer and more. These inhibitors help in reducing tumor growth and size by inhibiting the Nampt enzyme which is pivotal for NAD+ synthesis in cancer cells. Cancer cells depend on NAD+ biosynthesis for cell proliferation and survival. By blocking the NAD+ biosynthesis pathway in cancer cells, NAMPT inhibitors can kill cancer cells effectively or make them more susceptible to chemotherapy.

Another key factor boosting the oncology segment is the ability of NAMPT inhibitors to overcome drug resistance in certain cancers. There is a high unmet need for overcoming drug resistance which allows cancer to become treatment resistant over time. NAMPT inhibitors are able to restore sensitivity to chemotherapy in drug resistant cancers, making them an attractive option for such cases. Furthermore, various pharmaceutical companies have initiated clinical trials of NAMPT inhibitors for cancer treatment which indicates high promise in this application. The successful outcomes of ongoing oncology trials will further propel the demand.

Insights, By Mechanism of Action: NAMPT inhibition dominates the mechanism of action segment

The NAMPT inhibition sub-segment contributes the largest share of 60.7% within the mechanism of action segment of the NAMPT Inhibitors market. This is because directly inhibiting the NAMPT enzyme has shown more effectiveness in preclinical and clinical studies compared to other mechanisms that indirectly target NAD+ levels. NAMPT plays a pivotal role in NAD+ biosynthesis and inhibiting this enzyme can significantly reduce NAD+ levels in cancer or immune cells. Most NAMPT inhibitors in development target the catalytic site of the NAMPT enzyme to prevent its function.

Pharmaceutical companies are primarily focused on molecules that directly inhibit NAMPT rather than modulating NAD+ levels via other approaches considering the clear benefits demonstrated so far. Successful clinical trials of NAMPT inhibitors for conditions like cancer or inflammation further validate this mechanism of action. Additionally, specifically inhibiting NAMPT allows for more targeted therapy with lesser off-target effects compared to broader NAD+ modulators. This makes NAMPT inhibition an attractive proposition for researchers.

Additional Insights of NAMPT Inhibitors Market

- The NAMPT inhibitors market is expected to triple in size, driven by advancements in R&D, increased prevalence of cancer, and strategic collaborations. However, high costs and regulatory hurdles could restrain market growth. Nevertheless, emerging markets present substantial opportunities for expansion, particularly as companies focus on reducing drug development costs and enhancing accessibility.

Competitive overview of NAMPT Inhibitors Market

The major players operating in the NAMPT inhibitors market include Pfizer Inc., Novartis AG, Johnson & Johnson, Merck & Co., Inc., AbbVie Inc., GSK plc, Sanofi S.A., Bayer AG, AstraZeneca plc and Boehringer Ingelheim GmbH.

NAMPT Inhibitors Market Leaders

- Pfizer Inc.

- Novartis AG

- Johnson & Johnson

- Merck & Co., Inc.

- AbbVie Inc.

NAMPT Inhibitors Market - Competitive Rivalry, 2024

NAMPT Inhibitors Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in NAMPT Inhibitors Market

- In November 2023, Pfizer Inc. announced a strategic partnership with a leading biotech firm to develop next-generation NAMPT inhibitors, aiming to enhance efficacy and reduce side effects, potentially broadening their therapeutic application.

- In July 2024, Novartis AG launched a new clinical trial for its NAMPT inhibitor, focusing on hematological malignancies, showing promise in preliminary results for improving patient outcomes.

NAMPT Inhibitors Market Segmentation

- By Application

- Oncology

- Hematology

- By Mechanism of Action

- NAMPT Inhibition

- NAD+ Modulation

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the NAMPT inhibitors market?

The high cost of drug development and regulatory challenges and approval delays are the major factors hampering the growth of the NAMPT inhibitors market.

What are the major factors driving the NAMPT inhibitors market growth?

The rising prevalence of cancer globally and increasing R&D investments in NAMPT inhibitors are the major factors driving the NAMPT inhibitors market.

Which is the leading Application in the NAMPT inhibitors market?

The leading application segment is oncology.

Which are the major players operating in the NAMPT inhibitors market?

Pfizer Inc., Novartis AG, Johnson & Johnson, Merck & Co., Inc., AbbVie Inc., GSK plc, Sanofi S.A., Bayer AG, AstraZeneca plc, and Boehringer Ingelheim GmbH are the major players.

What will be the CAGR of the NAMPT inhibitors market?

The CAGR of the NAMPT inhibitors market is projected to be 12.5% from 2024-2031.