Netherlands Bitumen Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Netherlands Bitumen Market is Segmented By Product Grade (Paving Grade, Hard Grade, Oxidized Grade, Bitumen Emulsion, Polymer Modified Bitumen), By En....

Netherlands Bitumen Market Size

Market Size in USD Bn

CAGR4.60%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.60% |

| Market Concentration | Medium |

| Major Players | Royal Dutch Shell, Koninklijke Wegenbouw Stevin B.V., Ooms Producten B.V., Latexfalt B.V., Bitufa Bitumen B.V. and Among Others. |

please let us know !

Netherlands Bitumen Market Analysis

The Netherlands Bitumen Market is estimated to be valued at USD 13.81 Bn in 2024 and is expected to reach USD 20.43 Bn by 2031, growing at a CAGR of 4.60% from 2024 to 2031.

The market growth is driven by the increase in infrastructural projects related to road construction and development of transportation facilities.

Netherlands Bitumen Market Trends

Market Driver - Growing Demand for Road Construction

The Netherlands has witnessed significant growth in road construction activities over the past few years which has driven the demand for bitumen in the country. With increasing urbanization and industrialization, the need for better road infrastructure to support the growing transportation needs has risen steadily. The government has recognized the need to expand and upgrade the road networks and has allocated sizable funds towards various road construction projects.

As per the estimates from the Dutch Ministry of Infrastructure and Water Management, the government had earmarked about €6.5 billion annually between 2020-2023 for the construction and maintenance of road networks across the Netherlands. A major portion of these funds has been utilized for flagship projects such as the construction of the A12 motorway connecting Utrecht and Arnhem which opened in 2021. The ongoing expansion and renovation of the road connecting Schiphol airport and Amsterdam has also contributed towards higher bitumen usage.

The future trends also remain positive as the vision of the Dutch government is to develop a robust inter-city transportation grid along with upgrading existing roads to reduce traffic congestion.

Market Driver – Increasing Use of Bitumen in Waterproofing

The use of bitumen in waterproofing applications has been growing rapidly in the Netherlands in recent years. Bitumen is increasingly being used for waterproofing roofs, basements, terraces and other structures due to its excellent waterproofing and corrosion resistant properties. It adheres well to various building materials like concrete, wood, metal etc. and forms an effective barrier against water seepage and moisture ingress.

Some of the key factors driving the higher use of bitumen for waterproofing include growth in construction activities in the country as well as rising awareness about the need for effective waterproofing solutions to protect infrastructure from damage. The Netherlands has witnessed steady growth in new residential and commercial construction post pandemic in 2022 according to the Dutch Central Bureau of Statistics.

Government regulations stipulating the use of certified waterproofing products on infrastructure projects has further propelled the demand. According to a report by Rijkwaterstaat, the executive agency of the Dutch Ministry of Infrastructure and Water Management, over 75% of the large infrastructure projects in 2022 incorporated certified bitumen membranes for waterproofing critical areas such as tunnels, bridges and hydraulic structures.

Market Challenge – Environmental Concerns

Environmental concerns surrounding bitumen are significantly restraining the growth of Netherlands Bitumen Market. One of the major concerns is the emission of greenhouse gases from bitumen extraction and production processes. Bitumen production requires a lot of energy and heat which leads to high carbon emissions. According to the report published by Netherlands Environmental Assessment Agency in 2022, the emission from bitumen production facilities alone accounted for over 5% of the country's total industrial greenhouse gas emissions in 2021. The agency has recommended switching to more sustainable materials and processes to meet the country's climate targets under Paris Agreement.

Additionally, the extraction and mining of bitumen poses threat to local biodiversity. The areas surrounding the bitumen mines often contain fragile ecosystems and extraction damages the natural habits. As per the data from Netherlands Environmental Protection Agency published in 2021, over 10,000 hectares of forest land was cleared for bitumen mining in the last decade. This destruction of green cover adversely impacts local flora and fauna. Several environmental groups are protesting against proposed expansion of bitumen mines citing ecological degradation.

Market Opportunity – Growing Demand for Sustainable Construction

The growing demand for sustainable construction presents a great opportunity for the Netherlands bitumen market. In recent years, there has been a strong push towards more environmentally friendly construction practices in the Netherlands. The Dutch government has implemented strict regulations and policies to reduce emissions from buildings and infrastructure. All new residential and commercial projects are now required to meet minimum energy efficiency standards and make use of renewable materials where possible.

This shift towards sustainable construction is driving increased demand for products that can help builders construct greener and more resilient buildings and roads. Bitumen, being a widely used binder in asphalt production and waterproofing, has the potential to play a crucial role in sustainable construction when derived from recycled materials. Using recycled bitumen extracted from existing road surfaces and post-consumer waste reduces the need to mine for new bitumen resources. It also lowers greenhouse gas emissions since less refined bitumen needs processing. As environmental regulations tighten, builders will seek out such climate-friendly bitumen alternatives to remain compliant.

The Netherlands government data shows the percentage of construction and demolition waste being recycled rose from 60% in 2015 to almost 70% in 2020.

Segmental Analysis of Netherlands Bitumen Market

Insights, By Product Grade: Rise in Infrastructure Development Drives Demand for Paving Grade Bitumen

The paving grade sub-segment contributes the highest share of 58.3% in the Netherlands bitumen market owing to its widespread applications in road construction activities. Paving grade bitumen serves as a key binder and waterproofing agent in asphalt mixtures used for paving surfaces of highways, streets, and other heavy-duty roads. Rapid infrastructure development across the country in recent years has fueled the demand for paving works.

The Netherlands government has earmarked large investments to expand and upgrade the national highway network. Several multi-billion-euro projects are currently underway to construct new motorways as well as widen existing roads. This is aimed at improving connectivity between major cities and facilitating freight transportation. Sustained focus on bridging the infrastructure gap between densely populated western regions and relatively underdeveloped northern areas boosts the consumption of paving-grade bitumen.

Furthermore, the large presence of logistics and warehousing facilities near major ports necessitates frequent repairs and resurfacing of heavy-traffic roads. Port cities like Rotterdam and Amsterdam witness intensive movement of heavy cargo vehicles on a daily basis, taking a toll on road quality over time. Paving grade bitumen plays a critical role in maintenance, repair and overlay activities carried out by provincial authorities to extend the lifespan of commercial roads.

Insights, By End Use Industry: Road Construction Dominates Bitumen Consumption in the Netherlands

In terms of end use industry, the road construction sub-segment accounts for the major share of 83.8% in terms of bitumen demand. Asphalt mixtures containing bitumen are extensively used in the construction and maintenance of highways, streets and pavements across the Netherlands.

With one of the highest road network densities globally, the country has placed strong emphasis on expanding and upgrading its road infrastructure over the past decade. Mega projects like the A6 Motorway extension and the A15/A16 Rotterdam highway construction have stimulated bitumen consumption substantially. Meanwhile, routine maintenance activities such as resealing, microsurfacing and crack seal repair works involve periodic recoating of aged asphalt surfaces, driving continuous need for bitumen.

Growing transportation requirements are also propelling roadway developments. Freight movement between the Port of Rotterdam and the hinterland regions relies heavily on an efficient road-based logistics network. Similarly, high private vehicle ownership levels necessitate addition of new lanes as well as rehabilitation projects across existing highways each year.

Provincial government outlays on connecting agricultural zones with urban distribution centers translate into numerous rural road construction contracts. Spending on municipal-level street resurfacing and pothole repairs additionally augments consumption in the Netherlands' dominant road construction end-use industry.

Competitive overview of Netherlands Bitumen Market

The major players operating in the Netherlands Bitumen Market include Royal Dutch Shell, Koninklijke Wegenbouw Stevin B.V., Ooms Producten B.V., Latexfalt B.V., Bitufa Bitumen B.V., Bitunova B.V., Bitumen Handelsmaatschappij B.V., Bitumen Produkten B.V., Bitumen Specialiteiten B.V., and Bitumen Trading B.V.

Netherlands Bitumen Market Leaders

- Royal Dutch Shell

- Koninklijke Wegenbouw Stevin B.V.

- Ooms Producten B.V.

- Latexfalt B.V.

- Bitufa Bitumen B.V.

Netherlands Bitumen Market - Competitive Rivalry, 2024

Netherlands Bitumen Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Netherlands Bitumen Market

- In March 2019, Royal Dutch Shell Introduced a new bitumen solution called Rids Bitumen Fresh Air to reduce the harmful effects of paving and asphalt production on local air quality.

- In November 2022, NYNAS AB Introduced a novel polymer-modified bitumen called Nypol RE. This product contains biogenic elements that enhance service life while having a low environmental impact.

- In March 2022, DL Chemical Co., Ltd acquired Kraton Corporation for $2.5 billion, expanding its presence in the bitumen market.

Netherlands Bitumen Market Segmentation

- By Product Grade

- Paving Grade

- Hard Grade

- Oxidized Grade

- Bitumen Emulsion

- Polymer Modified Bitumen

- By End Use Industry

- Road Construction

- Waterproofing

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Netherlands Bitumen Market?

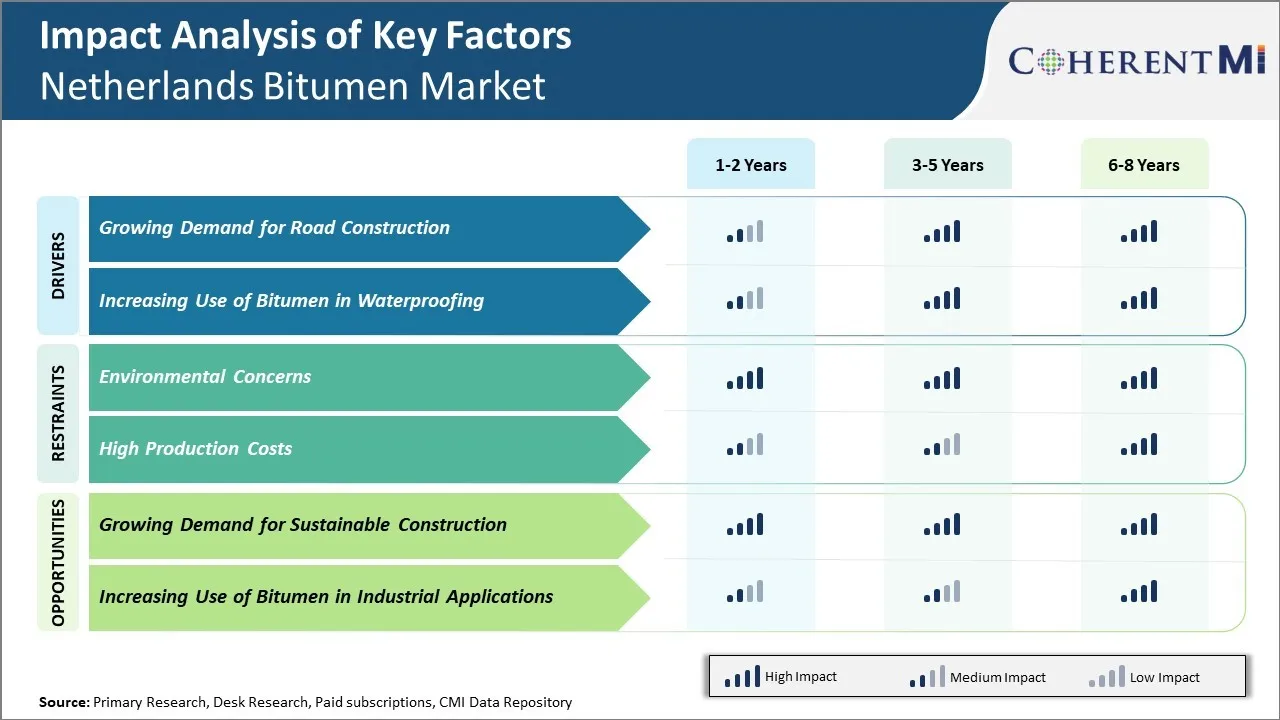

The environmental concerns and high production costs are the major factors hampering the growth of the Netherlands Bitumen Market.

What are the major factors driving the Netherlands Bitumen Market growth?

The growing demand for road construction and increasing use of bitumen in waterproofing are the major factors driving the Netherlands Bitumen Market.

Which is the leading Product Grade in the Netherlands Bitumen Market?

The leading Product Grade segment is Paving Grade.

Which are the major players operating in the Netherlands Bitumen Market?

Royal Dutch Shell, Koninklijke Wegenbouw Stevin B.V., Ooms Producten B.V., Latexfalt B.V., Bitufa Bitumen B.V., Bitunova B.V., Bitumen Handelsmaatschappij B.V., Bitumen Produkten B.V., Bitumen Specialiteiten B.V., and Bitumen Trading B.V. are the major players.

What will be the CAGR of the Netherlands Bitumen Market?

The CAGR of the Netherlands Bitumen Market is projected to be 4.60% from 2024-2031.