Neurotrophic Keratitis Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Neurotrophic Keratitis Market is segmented By Treatment (Drugs, Surgical Procedures, Other Therapies), By Stage of Disease (Early Stage, Late Stage), ....

Neurotrophic Keratitis Market Size

Market Size in USD Mn

CAGR9.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.2% |

| Market Concentration | High |

| Major Players | RegeneRx Biopharmaceuticals, Inc., Dompé Farmaceutici S.p.A, Aldeyra Therapeutics, ReGenTree LLC, Oxurion NV and Among Others. |

please let us know !

Neurotrophic Keratitis Market Analysis

The neurotrophic keratitis market is estimated to be valued at USD 185.6 Mn in 2024 and is expected to reach USD 343.3 Mn by 2031, growing at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2031. The neurotrophic keratitis market is witnessing significant growth owing to rising incidence of ocular disorders, growing geriatric population, and technological advancements in drug delivery methods.

Neurotrophic Keratitis Market Trends

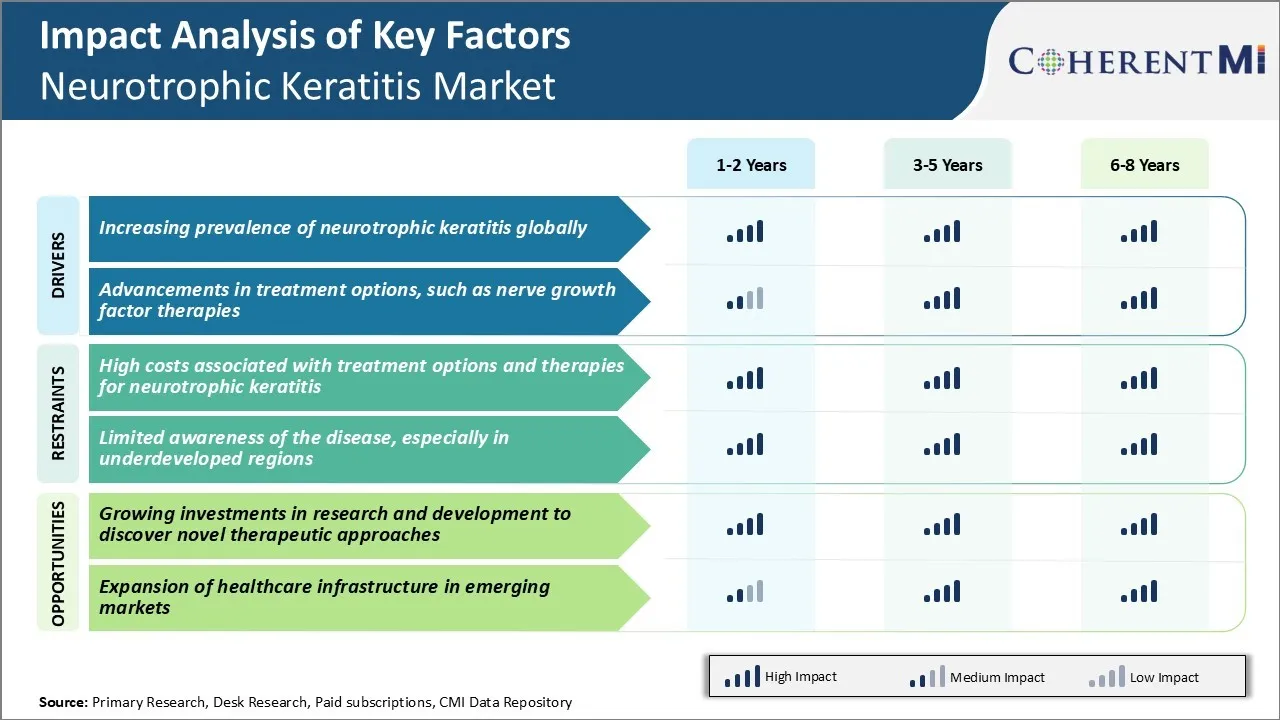

Market Driver - Increasing Prevalence of Neurotrophic Keratitis Globally

People with pre-existing medical conditions such as diabetes, facial nerve palsy, retinal detachment surgery, herpes zoster ophthalmicus and chemical or thermal burns have a much higher risk of developing neurotrophic keratitis. The prevalence of these predisposing factors has risen considerably worldwide due to aging populations and growing rates of lifestyle diseases.

Similarly, the incidence of herpes zoster infections including herpes zoster ophthalmicus has been on the rise particularly in developed countries with aging populations. Reactivation of the varicella zoster virus causes shingles which may directly infect and injure the trigeminal nerve leading to neurotrophic keratitis in severe cases.

Workers involved in welding, glass manufacturing and other industries dealing with molten materials are prone to serious ocular surface burns which frequently develop into neurotrophic keratitis if not properly treated. Additionally, combat veterans engaged in warfare have elevated chances of blast injuries, shrapnel wounds or infection exposures that damage ocular nerves.

Overall, the confluence of these macro trends relating to lifestyle, medical, occupational as well as demographic factors have driven up the global patient base suffering from neurotrophic keratitis over time.

Market Driver - Advancements in Treatment Options, such as Nerve Growth Factor Therapies

Significant research efforts from both public and private sector organizations have centered upon developing more effective treatment approaches for neurotrophic keratitis in recent years. A major breakthrough emerged with the advent of recombinant human nerve growth factor therapies targeted at corneal neuroregeneration.

This provided impetus for clinical evaluation in humans. Early phase trials found nerve growth factor eye drops promoted significant corneal re-innervation and healing even among longstanding neurotrophic keratitis non-responders to conventional therapies.

Larger subsequent trials established nerve growth factor eye drops as a safe and well tolerated treatment delivering substantive improvements in symptoms, wound resolution and visual recovery. Its approval for clinical use marked the first ever pharmacologic agent capable of reversing trigeminal nerve damage and restoring corneal sensation lost to neurotrophic keratitis.

Availability of nerve growth factor eye drops have considerably enhanced neurotrophic keratitis management protocols today. No longer reliant purely on symptomatic approaches, clinicians can now offer patients a disease modifying treatment aimed at the root cause nerve injury pathology itself. This has fuelled growth for the neurotrophic keratitis market.

Market Challenge - High Costs Associated with Treatment Options and Therapies for Neurotrophic Keratitis

One of the major challenges faced by the neurotrophic keratitis market is the high costs associated with treatment options and therapies available for patients suffering from this condition. Neurotrophic keratitis is a rare disease and treatments available are also limited.

The existing drugs and therapies including topical antibiotics, lubricants, bandage contact lenses, therapeutic botulinum toxin A injection, corneal neurotization procedures and corneal transplantation surgery have high costs associated with them. These high costs make these treatments inaccessible to a large population of patients globally.

Many patients in developing parts of the world cannot afford such expensive treatment options. This limits the penetration of existing treatment options in worldwide neurotrophic keratitis market. The high costs also restrict further research and development in this therapeutic area as potential profits for pharmaceutical companies and researchers are limited due to low patient volumes and treatment costs. This becomes a major challenge for market growth. Unless more affordable treatment alternatives are identified, a large patient pool will remain untapped.

Market Opportunity - Growing Investments in Research and Development to Discover Novel Therapeutic Approaches

One of the key opportunities for growth in the neurotrophic keratitis market is the increasing investments being made in research and development to find new therapeutic approaches for the treatment of this condition. With growing awareness about this rare disease, healthcare organizations and private companies are allocating increased funds for R&D activities.

Researchers are exploring options like blood-derived products, recombinant growth factors, nerve grafting, gene and stem cell therapies to replace or regenerate damaged corneal nerves. Novel drug delivery methods are also being evaluated. The focus on identification of new targets and development of advanced medications can help address the current unmet needs.

Such innovative treatment strategies have the potential to reduce costs associated with management of neurotrophic keratitis in the long run and make therapies accessible to more patients. This will expand the market scope and open up new avenues for growth over the coming years.

Prescribers preferences of Neurotrophic Keratitis Market

Neurotrophic Keratitis is a degenerative disease that damages the cornea's nerves and epithelia. Treatment follows a stepwise approach based on disease severity.

Initial mild cases are typically managed with lubricating eye drops to relieve symptoms. Common brands include Systane, Refresh, and GenTeal. As the disease progresses to the moderate stage, prescribers may recommend antibiotic eyedrops such as TobraDex or Moxeza to prevent infections of the damaged cornea. For more significant cases with compromised epithelial integrity, autologous serum tears are frequently prescribed. Compounded by pharmacies, these provide essential growth factors to promote epithelial healing.

In severe cases with perforation risk, therapeutic contact lenses and bandage soft contact lenses are usually fitted to protect the cornea. Daily or weekly lenses by manufacturers like Bausch+Lomb and Alcon are common choices. For cases with persistent epithelial defects or perforation, amniotic membrane transplants are often considered. Promoting rapid re-epithelialization, ProKera and AmbioDisk are two amniotic membrane products frequently used.

Additional factors influencing prescribers include patient adherence, insurance coverage, cost of medications, and availability of specialized treatments or surgical options. For example, off-label use of neurotrophic growth factor treatments may be recommended for advanced cases despite their high costs.

Treatment Option Analysis of Neurotrophic Keratitis Market

Neurotrophic keratitis has four main stages - mild, moderate, severe, and end-stage. Treatment is focused on the stage and severity of the disease.

For mild cases, preservative-free artificial tears are usually the first-line treatment to relieve symptoms and protect the eye. This helps improve symptoms with low risk.

Moderate cases may require prescription eye drops containing antibiotics and corticosteroids to reduce inflammation and prevent infection risks. Cyclosporine ophthalmic emulsion 0.05% (Restasis) is also commonly used at this stage due to its effectiveness in suppressing inflammation.

Severe neurotrophic keratitis often requires more aggressive interventions. Autologous serum tears involving patient's blood are frequently prescribed. These special eye drops help stimulate corneal healing. Amniotic membrane grafts are also used to protect the damaged cornea and support its regeneration.

For end-stage disease, tissue transplants may be the only option to prevent vision loss. Corneal transplantation involving donated corneal tissue is the standard of care. Stem cell therapy using cultured limbal epithelial cells is gaining popularity due to its ability to regenerate damaged ocular surface tissue from stem cells.

A multidisciplinary team of ophthalmologists, optometrists and corneal specialists works closely to determine the most appropriate line of care to manage the condition and improve clinical outcomes at each disease stage.

Key winning strategies adopted by key players of Neurotrophic Keratitis Market

Product innovation: One of the most successful strategies adopted by leading players like Allergan and Dompé Farmaceutici has been continuous investment in R&D to develop innovative and effective products. Allergan's Restasis, launched in 2002, was the first FDA-approved prescription eye drop treatment for neurotrophic keratitis. It helped Allergan gain a sizable market share initially. More recently in 2019, Dompé launched Oxervate, a recombinant human nerve growth factor eye drop, after positive Phase III clinical trials showed its superiority over conventional treatments.

Strategic partnerships: Companies have partnered with leading research institutes and companies to gain access to new products and technologies. For example, in 2018, Dompé partnered with Senju Pharmaceutical to commercialize and co-develop Oxervate in Japan, China and other Asian countries. This expanded their market reach. Similarly, other players like QOL Medical have collaborated with universities and research organizations to develop novel therapies.

Aggressive marketing: Given the limited treatment options and seriousness of the condition, players aggressively market products to clinicians and patients. Allergan and Dompé spend heavily on promotions to doctors to increase prescriptions for Restasis and Oxervate respectively. They conduct special educational programs and sponsorship activities.

Segmental Analysis of Neurotrophic Keratitis Market

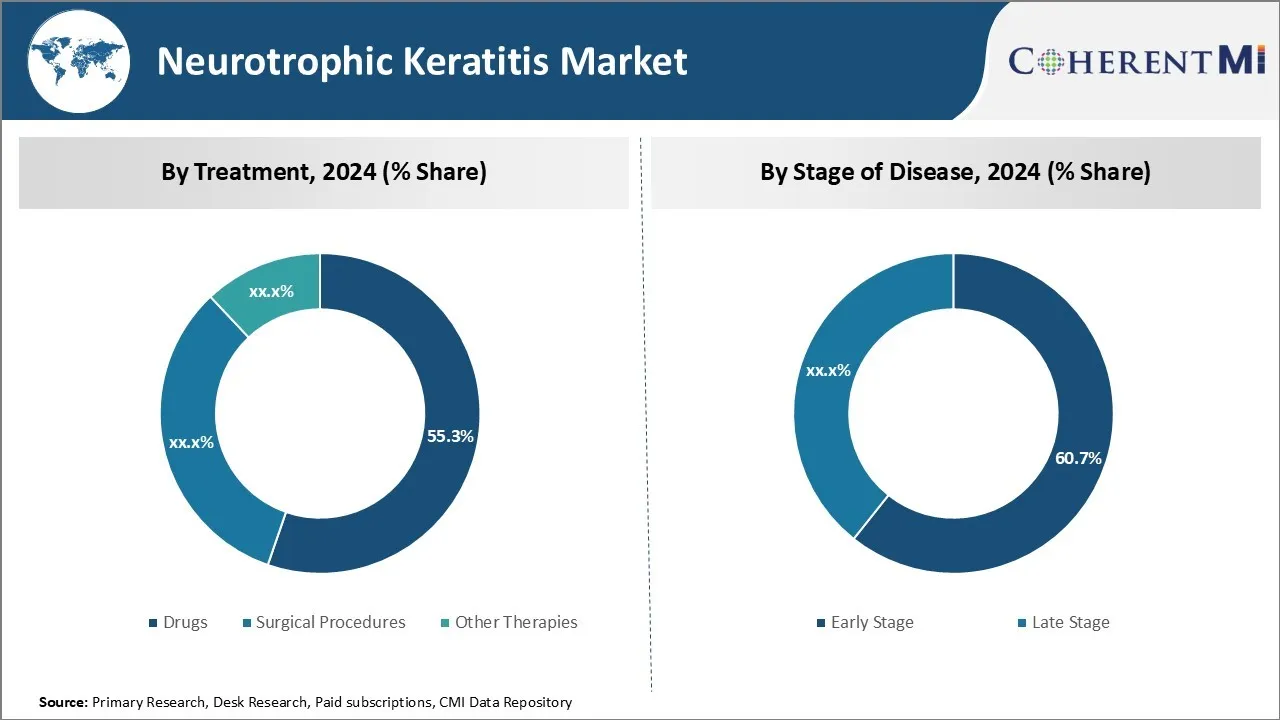

Insights, By Treatment: Clinical Efficacy Drives Dominance of Drug Treatment

Within the neurotrophic keratitis market, the drug treatment segment is expected to hold 55.3% share in 2024, owing to demonstrated clinical efficacy. Several pharmaceutical options have been developed to address the underlying pathophysiology and support wound healing in affected patients.

Topical cyclosporine formulations are widely utilized due to their ability to suppress inflammation and normalize tear function. Applied regularly, cyclosporine drops can effectively treat mild to moderate cases while also preventing disease progression. Oral doxycycline possesses matrix metalloproteinase inhibitory properties helpful for reducing corneal degradation.

Multicenter clinical trials have evidenced doxycycline's capacity to improve epithelial defect closure when used adjunctively with other measures. Autologous serum tears have risen in popularity due to their nutrient-rich composition mimicking natural tears.

Consisting of serum diluted in saline, this approach replenishes growth factors lost in dysfunctional neurotrophic corneas. Studies indicate autologous serum accelerates re-epithelialization compared to traditional artificial tears. As demonstrated success establishes drugs as the gold standard first-line approach, patients will continue to rely heavily on pharmaceutical options for neurological keratitis care.

Insights, By Stages of Disease: Greater Clinical Awareness Boosts Early-stage Disease Management

Of the disease staging segments within the neurotrophic keratitis market, early-stage is expected to garner 60.7% share in 2024. This is due to enhanced clinician acuity and swifter intervention. Raising healthcare provider knowledge regarding subtle initial symptoms like punctate erosions or foreign body sensation has facilitated more prompt diagnoses. Education initiatives stress the value of expeditious evaluation and treatment initiation prior to extensive epithelial defects.

Once early signs are recognized, topical cyclosporine or doxycycline frequently suffices to reverse damage at the mild stage. Should defects persist or worsen despite medical therapy, amniotic membrane transplantation offers an effective surgical option for arresting deterioration.

Close follow up allows for close monitoring of treatment response and modification if needed to curb progression. As awareness of subtle cues increases detection of early-stage cases, focus will remain on defending the cornea through speedy and conservative care strategies before complications ensue.

Insights, By Route of Administration: Convenience Drives Popularity of Topical Administration Route

The topical administration route dominates usage within the Neurotrophic Keratitis market due to its non-invasive nature and convenience. Drop formulations appeal to both patients and providers as the easiest and most comfortable method.

Topical cyclosporine and doxycycline enjoy widespread preference given their availability as eye drop formulations. Only requiring instillation into the affected eye per the prescribed regimen, topical treatment imposes minimal patient burden compared to other modalities.

Oral medications necessitate strict adherence to a pill-taking schedule, while injectables entail visits for professional administration. Amniotic membrane transplantation as a surgical procedure carries risks of infection, rejection and higher costs.

As topical medications maintain the cornea’s surface while avoiding disruptions to daily life, this administration path offers a practical solution fitting most clinical scenarios. Convenience will continue propelling the lead of topical options in neurotrophic keratitis management.

Additional Insights of Neurotrophic Keratitis Market

- Neurotrophic keratitis is a rare and degenerative eye disease that affects less than five in 10,000 people. The most advanced treatments, such as those based on nerve growth factors, have proven highly effective in repairing corneal damage and improving patient quality of life.

- The prevalence of neurotrophic keratitis is rising due to an aging global population and increasing rates of conditions such as diabetes, which can lead to corneal nerve damage.

- The U.S. accounts for the highest number of neurotrophic keratitis cases, followed by major European markets.

Competitive overview of Neurotrophic Keratitis Market

The major players operating in the neurotrophic keratitis market include RegeneRx Biopharmaceuticals, Inc., Dompé Farmaceutici S.p.A, Aldeyra Therapeutics, ReGenTree LLC, Oxurion NV, Johnson & Johnson Vision Care, Inc., Allergan (AbbVie Inc.), and Senju Pharmaceutical Co., Ltd.

Neurotrophic Keratitis Market Leaders

- RegeneRx Biopharmaceuticals, Inc.

- Dompé Farmaceutici S.p.A

- Aldeyra Therapeutics

- ReGenTree LLC

- Oxurion NV

Neurotrophic Keratitis Market - Competitive Rivalry, 2024

Neurotrophic Keratitis Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Neurotrophic Keratitis Market

- In March 2024, Johnson & Johnson introduced a new line of innovative eye-care products designed specifically for neurotrophic keratitis patients. This development aims to enhance patient care and strengthen the company's foothold in the neurotrophic keratitis market. Johnson & Johnson Vision is actively involved in developing and launching innovative products for eye health, as seen in their recent advancements in intraocular lenses (IOLs) and other eye-care solutions.

- In July 2023, Dompé Farmaceutici S.p.A expanded its clinical trials for Oxervate, a therapy for neurotrophic keratitis, to additional countries. This expansion is expected to significantly boost global access to advanced treatments for the condition, potentially increasing market share for Dompé. It has been actively working on expanding the reach of Oxervate. Oxervate is a significant product in their portfolio, and expanding clinical trials to additional countries would align with the goal of increasing global access and market share.

- In March 2023, RegeneRx announced the completion of Phase III clinical trials for its RGN-259 therapy, demonstrating significant healing potential for patients with neurotrophic keratitis. The company, in collaboration with its U.S. joint venture ReGenTree, has been conducting clinical trials for its RGN-259 therapy. In the trial, six out of ten patients treated with RGN-259 experienced complete corneal healing after four weeks, compared to only one out of eight in the placebo group. The treatment was well-tolerated, with no major safety concerns noted.

Neurotrophic Keratitis Market Segmentation

- By Treatment

- Drugs

- Surgical Procedures

- Other Therapies

- By Stage of Disease

- Early Stage

- Late Stage

- By Route of Administration

- Oral

- Injectable

- Topical

- By End User

- Hospitals

- Specialty Clinics

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the neurotrophic keratitis market?

The neurotrophic keratitis market is estimated to be valued at USD 185.6 Mn in 2024 and is expected to reach USD 343.3 Mn by 2031.

What are the key factors hampering the growth of the neurotrophic keratitis market?

High costs associated with treatment options and therapies for neurotrophic keratitis and limited awareness of the disease, especially in underdeveloped regions, are the major factors hampering the growth of the neurotrophic keratitis market.

What are the major factors driving the neurotrophic keratitis market growth?

Increasing prevalence of neurotrophic keratitis globally and advancements in treatment options, such as nerve growth factor therapies, are the major factors driving the neurotrophic keratitis market.

Which is the leading treatment in the neurotrophic keratitis market?

The leading treatment segment is drugs.

Which are the major players operating in the neurotrophic keratitis market?

RegeneRx Biopharmaceuticals, Inc., Dompé Farmaceutici S.p.A, Aldeyra Therapeutics, ReGenTree LLC, Oxurion NV, Johnson & Johnson Vision Care, Inc., Allergan (AbbVie Inc.), and Senju Pharmaceutical Co., Ltd. are the major players.

What will be the CAGR of the neurotrophic keratitis market?

The CAGR of the neurotrophic keratitis market is projected to be 9.2% from 2024-2031.