Non Viral Transfection Reagents Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Non-Viral Transfection Reagents Market is segmented By Non-Viral Transfection Reagents (Lipid-based Carriers, Polymer-based Carriers, Protein-based Ca....

Non Viral Transfection Reagents Market Size

Market Size in USD Mn

CAGR8.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.3% |

| Market Concentration | Medium |

| Major Players | Thermo Fisher Scientific, MaxCyte, MilliporeSigma, Bio-Rad Laboratories, Altogen Biosystems and Among Others. |

please let us know !

Non Viral Transfection Reagents Market Analysis

The non-viral transfection reagents market is estimated to be valued at USD 687 Mn in 2024 and is expected to reach USD 1,200 Mn by 2031, growing at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2031.

The non-viral transfection reagents market is expected to witness a positive growth trend over the forecast period. The demand for non-viral transfection is higher due to various advantages over viral transfection such as reduced cytotoxicity, immunogenicity, and mutagenicity. Moreover, non-viral methods cause less damage to transfected cells. Advancements in transfection technologies and development of novel products are further expected to support the market growth.

Non Viral Transfection Reagents Market Trends

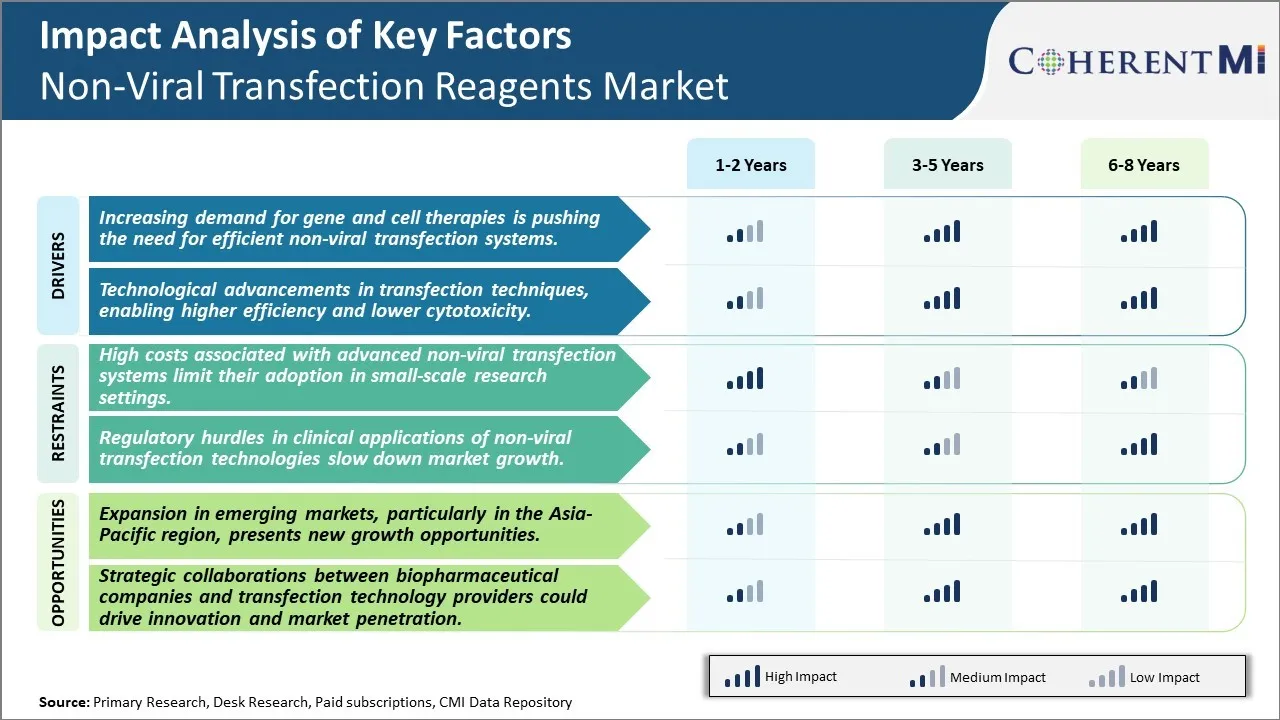

Market Driver - Increasing demand for gene and cell therapies is pushing the need for efficient non-viral transfection systems

The demand for effective gene and cell therapies has been growing exponentially in recent years to treat various genetic disorders, cancer and other life-threatening diseases. As the understanding of molecular pathways involved in diseases improves, there is an increasing focus on developing targeted gene and cell therapies with the ability to modulate gene expression or alter cellular functions. Non-viral transfection reagents play a critical role in enabling the delivery of nucleic acids like DNA, RNA and oligonucleotides into targeted cell types. Compared to viral vectors, non-viral systems offer advantages like better safety profile, unlimited cargo capacity and ease of large scale manufacturing.

As more gene and cell therapy candidates enter clinical trials and move towards regulatory approvals and commercialization, the need for efficient and reliable non-viral delivery systems is surging. Several biopharma companies and research labs are investing heavily in developing novel non-viral vectors and engineering cell lines with stable expression of therapeutic genes. The demand is further fueled by the approval of first gene and cell therapies in recent years for indications like cancer, genetic disorders. However, one of the main limitations of non-viral systems that has slowed progress is their relatively lower transfection efficiencies compared to viral vectors. Addressing this issue through innovations will be crucial to enable more widespread clinical and commercial applications of gene and cell therapies.

Market Driver - Technological advancements driving efficiency and safety gains

The past decade has witnessed significant advancements in transfection techniques that have improved the efficiency, safety and functionality of non-viral systems. Continuous engineering of vectors and development of novel chemical and physical methods of transfection have enabled consistent intracellular delivery of nucleic acids. For instance, the use of lipid and polymeric nanoparticles tailored with cell-targeting ligands have shown promise to selectively transfect specific cell types with minimal cytotoxicity in vitro and in vivo models. These next-gen non-viral vectors often demonstrate transfection rates at par or better than early viral vectors.

Several physical methods for intracellular delivery like electroporation, magnetofection and acoustic transfection have also emerged as potent transfection tools with wide applicability in basic research and translational applications. These techniques temporarily permeabilize cell membranes using physical stimuli without significantly impacting viability. Combined with optimized vector formulations, they have resulted in transfection efficiencies sufficient for many gene and cell therapy applications. Moreover, novel polymer-based and mineralo-lipid vectors have simplified vector engineering while enhancing biocompatibility. Their translation-focused design also supports scalable manufacturing critical for clinical and commercial needs.

Market Challenge - High costs associated with advanced non-viral transfection systems limit their adoption in small-scale research settings

The high costs associated with advanced non-viral transfection systems is one of the major challenges currently limiting their adoption in small-scale research settings such as academic laboratories and startup biotech firms. These advanced transfection technologies often require specialized equipment and reagents that can be quite expensive for laboratories operating on limited budgets. For example, some proprietary non-viral vectors and instruments for delivering genetic material into cells routinely cost thousands of dollars, making them prohibitive for small research groups. Additionally, maintaining steady supplies of critical reagents like transfection-enhancing polymers or nucleic acids can add up over time. The high financial investment required has led many smaller research efforts to favor older, cheaper methods like lipofection or electroporation that are not always as effective. This lack of adoption is hindering the advancement of non-viral technologies and applications. In order to increase accessibility and foster further innovation, suppliers will need to explore new pricing structures and technology designs that lower the costs for resource-constrained settings without compromising efficacy.

Market Opportunity - Expansion in emerging markets, particularly in the Asia-Pacific region, presents new growth opportunities.

The non-viral transfection reagents market is poised for significant expansion in emerging economies across Asia and the Pacific region over the coming years. Several countries in this area have rapidly growing life sciences industries and are investing heavily in biomedical research and development. For example, China and India now perform some of the largest amounts of genetic and cellular engineering research globally and have seen huge increases in the number of research universities and pharmaceutical companies established within their borders. As bioscience capabilities expand in these nations, demand is also surging for cutting-edge tools to enable genetic studies like non-viral transfection methods. Moreover, economic development has bolstered purchasing power among laboratories that previously could not afford such advanced technologies. To capitalize on the opportunity, savvy vendors of non-viral reagents and equipment are prioritizing these emerging markets through targeted distribution and sales efforts. They are localizing marketing, adapting product offerings to regional needs, and improving access to support.

Key winning strategies adopted by key players of Non Viral Transfection Reagents Market

Companies have been investing heavily in R&D to develop more effective and safer non-viral transfection reagents. For example, Thermo Fisher Scientific spent over $1 billion on R&D in 2020 to introduce new products in this space. In 2018, they launched Lipofectamine MessengerMAX, an mRNA transfection reagent optimized for high transfection efficiency of mRNA. This product was well received in the market and helped Thermo Fisher gain market share.

Players make strategic acquisitions to enhance their research capabilities and product portfolio. In 2020, Qiagen acquired INGS, a leader in cell and gene therapy tools, to strengthen its position in non-viral gene delivery. This augmented Qiagen's portfolio of non-viral reagents. Similarly, Roche acquired Spark Therapeutics in 2019 known for its investigational gene therapies. Such acquisitions strengthened players' foothold in this high growth market.

Companies partner with leading research institutes and biotech firms to gain access to cutting-edge technologies. For example, Miltenyi Biotec collaborated with PolyPid to develop a non-viral transfection reagent for more effective delivery of therapeutic genes. This assisted both companies to make progress in drug development. Such partnerships play a key role in advancing non-viral vector technologies.

Segmental Analysis of Non Viral Transfection Reagents Market

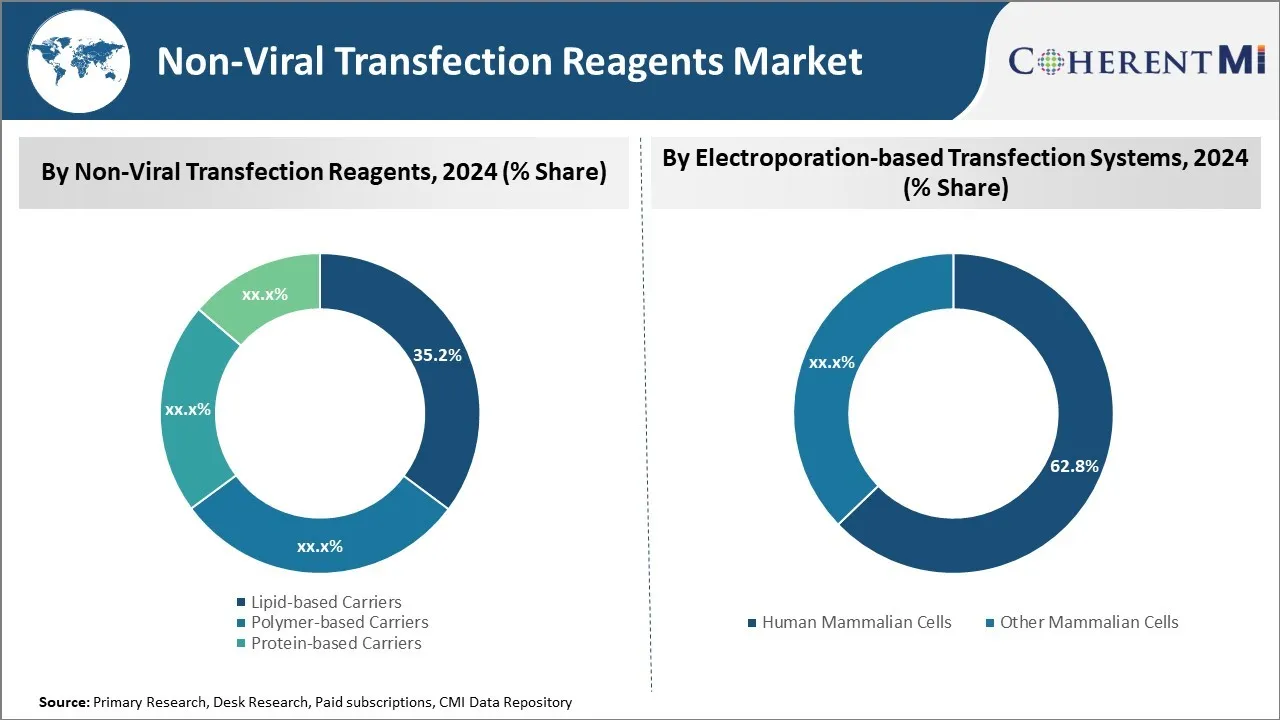

Insights, By Non-Viral Transfection Reagents: Effectiveness and versatility of lipid-based carriers

In terms of non-viral transfection reagents, lipid-based carriers sub-segment contributes the highest share of 35.2% in the market owing to its effectiveness and versatility. Lipid-based carriers dominate the non-viral transfection reagents market due to their high transfection efficiency and low cytotoxicity. Lipids can spontaneously combine with nucleic acids to form liposomes or lipid nanoparticles that efficiently ferry genetic material into cells. The cell-like lipid bilayer membrane of liposomes mimics cell membranes, facilitating interaction and uptake by cells. A wide variety of cationic and neutral lipids are available for customizing properties like surface charge and size to suit different cell types.

Lipid-based carriers demonstrate consistently high transfection rates across diverse cell lines without significantly impacting cellular viability or function. They transfect both dividing and non-dividing cells, expanding their applications beyond traditional laboratory research. Their flexibility has led to successful in vitro delivery of genes, antisense oligonucleotides, and RNAi triggers to model diseases. Clinically, they show promise for therapies involving gene editing, protein replacement, and vaccination.

Relative ease of preparation and excellent shelf life further increase lipid reagents' value proposition. Off-the-shelf kits containing pre-mixed lipids are convenient for standardized experiments. Formulations can be easily synthesized, purified, and characterized using well-established methods. Stable storage as lyophilized powders permits just-in-time reconstitution without loss of activity.

Accordingly, lipid carriers dominate as the primary choice for non-viral gene delivery. Constant refinement of lipid chemistry and formulations continues to drive higher efficiencies approaching viral levels. Their effectiveness and versatility have established lipid-based reagents as the leading technology in the non-viral transfection reagents market.

Insights, By Electroporation-based Transfection Systems: Human mammalian cells sees highest usage due to significant research into human diseases

Among electroporation-based transfection systems, human mammalian cells sub-segment holds the largest market share of 62.8% due to significant research into human diseases. Within electroporation-based transfection systems, cells derived from humans account for the bulk of the market. The overwhelming focus of biomedical research is to understand and treat diseases that afflict people. As a result, there is substantial effort directed towards developing cell-based models utilizing human cells to study disease pathogenesis, drug toxicity and efficacy.

A plethora of immortalized human cell lines are available representing different tissue types and disease states. Primary human cells can also be obtained from clinical samples and biopsies. These human-derived cells allow investigations that are clinically relevant and predictive of human responses. As such, electroporation is widely employed to deliver DNA, RNA and proteins into both established and primary lines of human cells.

Furthermore, there is immense interest in developing personalized or precision medicine approaches using patient-specific induced pluripotent stem cells or stem cell-derived lineages. Electroporation plays a key role in reprogramming and genome editing of these important cell types. Advancements in stem cell biology also rely on electroporation-based methods to study human development, model genetic disorders and screen therapeutic compounds.

Given the preponderance of research employing human cells and tissues, electroporation instruments and reagents are heavily optimized to transfect this cell category. Thus, within electroporation transfection, human mammalian cells garner the bulk of usage, driving their prominence in the market segment. Novel applications of human cells in regenerative medicine and personalized therapeutics are likely to further cement this trend.

Additional Insights of Non Viral Transfection Reagents Market

- The non-viral transfection market is expected to witness a substantial growth rate due to the increasing use of these technologies in gene editing, gene therapy, and biopharmaceutical production. The adoption is particularly high in North America, which holds the largest market share, followed by Europe and the Asia-Pacific region. The integration of advanced nanotechnology in transfection methods is anticipated to revolutionize the efficiency of gene delivery, reducing cytotoxicity and increasing transfection success rates.

Competitive overview of Non Viral Transfection Reagents Market

The major players operating in the non-viral transfection reagents market include Thermo Fisher Scientific, MilliporeSigma, MaxCyte, Bio-Rad Laboratories, Altogen Biosystems, Inovio Pharmaceuticals, Nepa Gene, OZ Biosciences, Celsion and Genprex.

Non Viral Transfection Reagents Market Leaders

- Thermo Fisher Scientific

- MaxCyte

- MilliporeSigma

- Bio-Rad Laboratories

- Altogen Biosystems

Non Viral Transfection Reagents Market - Competitive Rivalry, 2024

Non Viral Transfection Reagents Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Non Viral Transfection Reagents Market

- In April 2023, Sartorius acquired Polyplus for $ 2.6 Bn to strengthen its portfolio in transfection reagents, specifically targeting DNA/RNA delivery for viral vector production.

- In 2024, Thermo Fisher Scientific announced a partnership with MaxCyte to enhance the scalability of gene therapy manufacturing using non-viral transfection technologies.

Non Viral Transfection Reagents Market Segmentation

- By Non-Viral Transfection Reagents

- Lipid-based Carriers

- Polymer-based Carriers

- Protein-based Carriers

- Nanotechnology-based Carriers

- By Electroporation-based Transfection Systems

- Human Mammalian Cells

- Other Mammalian Cells

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the non-viral transfection reagents market?

The high costs associated with advanced non-viral transfection systems limit their adoption in small-scale research settings and regulatory hurdles in clinical applications of non-viral transfection technologies slow down market growth are the major factors hampering the growth of the non-viral transfection reagents market.

What are the major factors driving the non-viral transfection reagents market growth?

The increasing demand for gene and cell therapies is pushing the need for efficient non-viral transfection systems and technological advancements in transfection techniques, enabling higher efficiency and lower cytotoxicity are the major factors driving the non-viral transfection reagents market.

Which is the leading non-viral transfection reagents in the non-viral transfection reagents market?

The leading non-viral transfection reagents segment is lipid-based carriers.

Which are the major players operating in the non-viral transfection reagents market?

Thermo Fisher Scientific, MilliporeSigma, MaxCyte, Bio-Rad Laboratories, Altogen Biosystems, Inovio Pharmaceuticals, Nepa Gene, OZ Biosciences, Celsion, and Genprex are the major players.

What will be the CAGR of the non-viral transfection reagents market?

The CAGR of the non-viral transfection reagents market is projected to be 8.3% from 2024-2031.